Current Report Filing (8-k)

October 05 2021 - 4:06PM

Edgar (US Regulatory)

false

0000100378

0000100378

2021-09-30

2021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) October 5, 2021 (September 30, 2021)

TWIN DISC, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Wisconsin

|

001-7635

|

39-0667110

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

1328 Racine Street Racine, Wisconsin 53403

(Address of principal executive offices)

Registrant's telephone number, including area code: (262)638-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (No Par Value)

|

TWIN

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 30, 2021, Twin Disc, Incorporated (the “Company”) entered into a First Amended and Restated Forbearance Agreement and Amendment No. 7 to Credit Agreement (the “Amended and Restated Forbearance Agreement”) that amends the Credit Agreement dated as of June 29, 2018, as amended (the “Credit Agreement”) between the Company and BMO Harris Bank, N.A. (the “Bank”). Capitalized terms in this Current Report that are not otherwise defined herein are defined in the Credit Agreement, as amended.

The Credit Agreement requires the Company to comply with certain minimum EBITDA covenants, including maintaining a minimum EBITDA of $2,500,000 for the three fiscal quarters ended as of December 25, 2020, $6,000,000 for the four fiscal quarters ended as of March 26, 2021, and $10,000,000 for the four fiscal quarters ended as of June 30, 2021. On January 27, 2021, the Company and the Bank had entered into a Forbearance Agreement and Amendment No. 6 to the Credit Agreement (the “Forbearance Agreement”), because the Company was not in compliance with its financial covenant to maintain a minimum EBITDA of $2,500,000 for the three fiscal quarters ended as of December 25, 2020. In the Forbearance Agreement, the Bank agreed to forbear from exercising its rights and remedies against the Company under the Credit Agreement with respect to the Company’s noncompliance with its minimum EBITDA covenants during the period (the “Forbearance Period”) commencing January 27, 2021 and ending on the earlier of (i) September 30, 2021, and (ii) the date on which a default under the Forbearance Agreement or Credit Agreement occurs.

The Amended and Restated Forbearance Agreement extends the Forbearance Period through February 28, 2022, or if earlier, through the date on which a default under the Amended and Restated Forbearance Agreement or Credit Agreement occurs. During the extended Forbearance Period, the Bank will continue to forbear from exercising its rights and remedies against the Company under the Credit Agreement with respect to the Company’s noncompliance with its minimum EBITDA covenants. The Amended and Restated Forbearance Agreement also makes certain adjustments to the Credit Agreement, including:

|

|

●

|

Permitting the Company to sell its manufacturing facility in Novazzano, Switzerland for a gross sales price of approximately $10,000,000, resulting in Net Cash Proceeds of approximately $8.700,000 (the “Rolla Disposition”).

|

|

|

●

|

Requiring the Company to promptly repatriate approximately $7,000,000 of the Net Cash Proceeds from the Rolla Disposition (the “Rolla Repatriation”), and to apply $1,000,000 of such Net Cash Proceeds to the Term Loan and the remainder to the revolving Loans under the Credit Agreement.

|

|

|

●

|

Upon completion of the Rolla Repatriation: (1) reducing the portion of the Borrowing Base that is based on Eligible Inventory from the lesser of $35,000,000 or 50% of the value of Eligible Inventory to the lesser of $30,000,000 or 50% of the value of Eligible Inventory; and (2) reducing the Revolving Credit Commitment from a maximum of $42,500,000 to a maximum of $40,000,000.

|

The above description of the Amended and Restated Forbearance Agreement is qualified in its entirety by reference to the Amended and Restated Forbearance Agreement, a copy of which is filed as Exhibit 1.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01 Other Events

As permitted by the Amended and Restated Forbearance Agreement, the Company sold its manufacturing facility in Novazzano, Switzerland on September 1, 2021, to Impregil SA, a Swiss entity, for a purchase price CHF 9,000,000, which translated to approximately $9,800,000. The Company entered into a two-year lease agreement, with a two-year option to extend, for a portion of the manufacturing facility previously owned by the Company. Through the end of 2021, the lease will be for the entirety of the manufacturing facility, covering 3,075 square meters. Beginning in 2022, the area leased by the Company will be reduced to 1,756 square meters.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

EXHIBIT NUMBER

|

DESCRIPTION

|

|

|

|

|

1.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

|

|

Pursuant to the requirements of section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 5, 2021

|

Twin Disc, Incorporated

|

|

|

|

|

|

/s/ Jeffrey S. Knutson

|

|

|

Jeffrey S. Knutson

|

|

|

Vice President-Finance, Chief Financial

Officer, Treasurer & Secretary

|

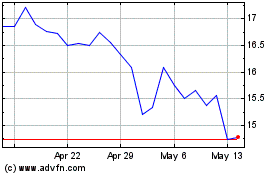

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Jul 2023 to Jul 2024