Additional Proxy Soliciting Materials (definitive) (defa14a)

March 14 2022 - 8:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

| Filed by the Registrant |

|

☒ |

| Filed by a Party other than the Registrant |

|

☐ |

Check the appropriate box:

|

|

|

| ☐ |

|

Preliminary Proxy Statement |

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ☐ |

|

Definitive Proxy Statement |

|

|

| ☒ |

|

Definitive Additional Materials |

|

|

| ☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

Trustmark Corporation

(Name of Registrant as Specified in Its Charter)

(Name of

Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies: |

|

|

(2) |

|

Aggregate number of securities to which transaction applies: |

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

|

Proposed maximum aggregate value of transaction: |

|

|

(5) |

|

Total fee paid: |

|

|

| ☐ |

|

Fee paid previously with preliminary materials |

|

|

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

1) |

|

Amount Previously Paid: |

|

|

2) |

|

Form, Schedule or Registration No.: |

|

|

3) |

|

Filing Party: |

|

|

4) |

|

Date Filed: |

|

|

|

|

|

| Commitment. Perseverance. Dedication.

These words describe the actions of our associates in serving our customers, communities, and shareholders. While the

pandemic continued to impact the ways in which we live, work, and interact with one another, it did not alter our ability to provide the financial solutions our customers have come to expect from Trustmark.

We continued to implement additional health

and safety measures to ensure the well-being of our customers and associates. We utilized technology to facilitate virtual meetings and provided a secure and efficient remote work alternative for our associates. Customers embraced the convenience

and flexibility of our robust digital banking applications, as well as our expanded ATM/ITM network. They also appreciated the ability to meet face-to-face, utilizing

our physical branch network for advice and consultation. Our associates worked tirelessly to secure

funding for businesses to keep their staffs employed, and we remained committed to supporting local economies. Trustmark participated in the Small Business Administration’s Paycheck Protection Program (PPP), funding $376 million in

forgivable loans to over 5,700 small businesses in 2021. We provided $970 million in forgivable loans to more than 9,600 small businesses in 2020. Through PPP, Trustmark assisted small businesses in retaining more than 168,000 jobs in 2020 and

2021. Based upon independent customer satisfaction surveys, we are pleased to have been recognized by

Forbes as the Best-in-State Bank in Mississippi in 2021. Additionally, Trustmark was listed among the Top 10 Best Emerging Regional Banks in “2022 Ranking Banking:

The Best Banks” as prepared by Bank Director magazine. Financial Highlights Trustmark’s net income totaled $147.4 million, representing diluted earnings per share of $2.34. This level of performance produced a return on average tangible equity of 10.81% and a return on average assets of 0.86%.

Despite a challenging environment, our banking, insurance, wealth management, and mortgage banking businesses continued to perform well. |

|

|

|

Loans held

for investment increased $423 million, or 4.3%, totaling $10.2 billion at December 31, 2021. Reflecting the impact of additional liquidity, deposits increased $1.0 billion, or 7.4%, to total $15.1 billion at year-end 2021. Trustmark successfully navigated the challenging interest

rate and economic environment and continued to achieve significant contributions from our fee-income businesses. Total revenue exceeded $640 million in 2021. Net interest income (FTE) totaled

$430 million, resulting in a net interest margin of 2.76%. Excluding the impact of PPP interest and fees and the Federal Reserve Bank balance, the net interest margin was 2.91% in 2021.

Our mortgage banking business continued to post solid performance as loan production totaled $2.8 billion in

2021, following record level production of $3.0 billion during the refinance boom of 2020. Mortgage banking revenue totaled $63.8 million in 2021. We continued our commitment to providing opportunities for affordable housing by utilizing

our team of Community Lending Specialists |

|

|

|

|

|

and expanding product offerings, including the Home Advantage suite of products to meet the needs of low-to-moderate income borrowers and communities. Our insurance business

posted another record year, with revenue exceeding $48.5 million, up 7.4% from the prior year. This performance reflects an expanded producer workforce, as well as the realization of operational efficiencies from investments in technology and

improved processes. Trustmark’s wealth management business also produced record revenue exceeding $35 million, an increase of 11.3% from the prior year. During the year, Trustmark continued to strengthen its competitive positioning and

efficiency of this business and expanded its Private Banking capabilities in key markets.

Credit Quality

We continued to proactively work with customers to provide additional flexibility by granting deferrals and

forbearances, as appropriate. Loans remaining under a COVID-19 related concession declined significantly during the year, representing approximately 0.01% of loans held for investment at year-end 2021. Nonperforming assets declined 10.1% to $67.3 million

at December 31, 2021. Recoveries exceeded charge-offs by $3.7 million. Allocation of Trustmark’s $99.5 million allowance for credit losses (ACL) on loans held for investment represented 1.00% of commercial loans and 0.87% of

consumer and home mortgage loans, resulting in an allowance for credit losses to total loans held for investment of 0.97% and 500.85% of nonperforming loans, excluding individually evaluated loans at year-end

2021. We believe the ACL is appropriate based upon the inherent risk in the loan portfolio.

Capital Strength

Trustmark’s capital position remained solid, reflecting the strength and diversity of our financial services

business. We continued our quarterly cash dividend to shareholders of $0.23 per share, or $0.92 annually. At December 31, 2021, total shareholders’ equity was $1.7 billion, while tangible equity was $1.4 billion, representing

7.86% of tangible assets. During the year, Trustmark repurchased $61.8 million, or approximately 1.9 million shares, of its common stock. Our Board of Directors also authorized a stock repurchase program through which $100 million of

Trustmark’s outstanding shares may be acquired through December 31, 2022.

Investing for the Future

Trustmark systematically invests in and upgrades our technology platform. In recent years, investments in

state- |

|

|

|

|

|

|

|

| of-the-art technology were

made in Trustmark’s insurance, wealth management and mortgage banking areas, as well as in human resources and accounting systems. We also made significant upgrades to our mobile banking platform, ITM network and digital marketing

platform. In 2021, we introduced redesigned digital channels to enhance the customer experience and

provide expanded sales capabilities, including online account openings. Customers have embraced these offerings, and we look forward to leveraging these new tools to expand relationships and profitably generate additional revenue.

We are progressing toward the implementation of a new core banking system for consumer and commercial loans, deposits

and customer information. This implementation, which we have named Core Optimization for Relationship

Enhancement (CORE), is a

multi-year project, the next phase of which will occur in 2022. These investments will better position Trustmark for continued growth and improved efficiency.

During 2021, Trustmark continued to realign delivery channels and consolidated 15 offices, reflecting changing

customer preferences and the continued migration to mobile and digital banking channels. Additionally, Trustmark opened five new offices: one each in the Birmingham, AL, Jackson, MS, and Memphis, TN MSAs as well as in the Oxford and Greenville, MS

markets. Each of these offices features a design that integrates myTeller® interactive teller machine (ITM) technology that provides enhanced areas for customer interaction.

In addition to branch realignment initiatives, we announced a voluntary early retirement program in 2021 which was

accepted by 98 associates, or 3.6% |

|

|

|

of our workforce. As you may recall, we also had a voluntary early retirement program in the first quarter

of 2020 in which 107 associates, or 3.8% of the workforce at that time, elected to participate. Collectively, these programs have provided additional opportunities to redesign workflows and restructure the organization to leverage investments in

technology and improve efficiency.

Leadership

We greatly value the leadership, counsel, and guidance of our Board. Trustmark’s Directors are engaged in our

governance and strategic direction and work with management to enhance the value of our franchise. During the year, Harry M. Walker retired from the Board after many years of distinguished service as a Director. Harry was a Trustmark associate for

44 years, having served in many capacities in the organization, including as an executive officer. We appreciate his immeasurable contributions and wish him all the best in retirement.

Strategic Focus

Looking forward, Trustmark will focus on

efficiency, growth, and innovation initiatives. We continue to pursue opportunities to redesign workflows and restructure the organization to further leverage investments in technology that will broaden our reach, enhance the customer experience,

and improve efficiency. We remain focused on providing the financial services and advice our customers have come to expect while building long-term value for our shareholders.

We remain grateful to our associates for their commitment, perseverance, and dedication to our customers and

communities. We also appreciate our shareholders for their investment in Trustmark and its future. Finally, we are honored to serve our customers, who have chosen us as their financial partner. Trustmark is “People you trust. Advice that

works.”

Sincerely, |

| |

|

|

|

|

|

| |

|

|

Gerard R. Host |

|

Duane A. Dewey |

| |

|

|

Executive Chairman |

|

President and |

| |

|

|

Trustmark Corporation |

|

Chief Executive Officer |

| |

|

|

|

|

Trustmark Corporation |

|

|

|

|

|

|

Trustmark has a long history of being a dedicated community partner. In 2021, we continued to uphold our commitment

to serve the needs of our communities through outreach initiatives and collaborative partnerships that exemplify our core values of Integrity, Service, Accountability, Relationships and Solutions.

Across our five-state footprint, Trustmark associates regularly volunteered

their time and talents to local organizations and charities to provide meaningful service. Associates volunteered at food banks, organized storm relief efforts, supported local beautification projects, and participated in Backpack Days where

associates helped fill backpacks with school supplies for children in need, to name a few. In addition to

volunteerism, Trustmark provided more than $4.42 million in contributions and sponsorships to organizations in our communities. We also dedicated essential resources to hundreds of organizations to advance economic development, enrichment of

arts and culture, and overall health and social services for youth and families, as well as to promote the conservation of natural resources by sponsoring numerous community Shred-It events to encourage

recycling. During the year, Trustmark prioritized our commitment to financial education by growing

collaborative partnerships and maturing our existing alliances. In partnership with EVERFI, Inc., we provided engaging online courses in approximately 58 schools, educating more than 5,000 students on financial topics through Trustmark’s

Financial Scholars Program. Our growing partnership with EVERFI also allowed Trustmark to conduct virtual and in-person financial education classes directly in our local communities.

Furthermore, Trustmark opened the doors of our first Financial CORE (Center of Resources & Education),

located in Jackson, MS, in partnership with the national non-profit Operation HOPE, where anyone can receive no-cost financial coaching assistance and education. We

strengthened our partnership with Operation HOPE in Memphis, TN, and expanded to a new location in Montgomery, AL, to have an even broader reach for strengthening individuals, families and communities through financial education and

counseling. Trustmark’s commitment to serving and providing superior financial products in our

communities is at the heart of what we do. And, we are excited for the collaborative opportunities that lie ahead in 2022 and beyond.

|

|

|

|

|

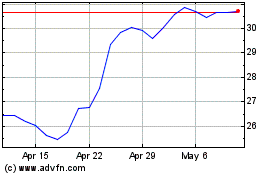

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jun 2024 to Jul 2024

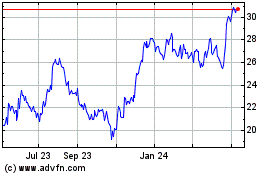

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jul 2023 to Jul 2024