Trustmark National Bank and Commonwealth National Bank enter Strategic Collaboration Agreement

August 23 2021 - 9:15AM

Business Wire

Trustmark National Bank, a wholly-owned subsidiary of Trustmark

Corporation (NASDAQCS:TRMK), is pleased to announce that a

strategic collaboration agreement has been entered with

Commonwealth National Bank as part of the Project REACh Initiative

with the Office of the Comptroller of the Currency.

The Project REACh Initiative, standing for Roundtable for

Economic Access and Change, launched on July 10, 2020, to “create

meaningful partnerships that help Minority Depository Institutions

(MDIs) remain a vibrant part of the economic landscape and

important resources in their communities.”

“Through our shared vision, Trustmark and Commonwealth will be

able to expand economic opportunities in minority and underserved

communities,” said Duane Dewey, Trustmark President and CEO. “With

over 130 years of success in the financial service business, we are

grateful for this new opportunity to demonstrate our core values –

integrity, service, accountability, relationships and

solutions.”

“During my first bank Presidency opportunity in the 1990’s,

Trustmark’s mentorship was instrumental in the success of our

banking operation. I am extremely excited about renewing this

relationship with Trustmark at Commonwealth National Bank,” said

Sidney King, Commonwealth’s President and CEO. “We believe that

this important partnership with Trustmark will allow us to better

serve the needs of our customers and improve the overall health of

the community we serve.”

Trustmark will provide up to $2.5 million in commercial loan

participations as well as advisory services to Commonwealth as a

mentor-bank. In keeping with the five tenets of Project REACh —

investment, technical assistance, business opportunities, executive

training, and commitment of resources — the strategic

relationship provides access to all of Trustmark’s ATMs, and

compliance support, operational, technical and administrative

assistance to Commonwealth as well as access to Trustmark’s

mortgage origination platform.

“Our collaboration with Commonwealth will provide an opportunity

to serve the financial needs of the residents and business

community in the Mobile, Alabama area,” said Michael D. Fitzhugh,

Trustmark Regional President – AL/MS Gulf Coast Region. “We are

honored to be a part of this national initiative that strengthens

minority access to economic resources.”

Commonwealth National Bank, an MDI established in 1976, serves

the community of Mobile, Alabama and surrounding areas.

Commonwealth is a member of the National Bankers Association

(“NBA”), the trade organization founded in 1927 as a voice for

black-owned banks in the United States.

About Trustmark

Trustmark Corporation is a diversified financial services

company headquartered in Jackson, Mississippi, with 180 locations

in Alabama, Florida, Mississippi, Tennessee and Texas. Trustmark

provides banking, wealth management and insurance solutions through

its subsidiaries, including Trustmark National Bank, Trustmark

Investment Advisors, Inc., and Fisher Brown Bottrell Insurance,

Inc. Visit trustmark.com for more information.

About Commonwealth National Bank

Commonwealth National Bank is a full-service nationally

chartered commercial bank. Commonwealth promotes the economic

viability of underserved communities with the goal of expanding

economic opportunity in low-income communities by providing access

to financial products and services for local residents and

businesses. Commonwealth is headquartered in the City of Mobile.

Visit ecommonwealthbank.com for more information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210823005146/en/

Melanie Morgan Director of Corporate Communications &

Marketing 601.208.2979 mmorgan@trustmark.com

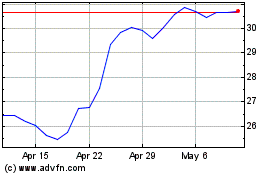

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jun 2024 to Jul 2024

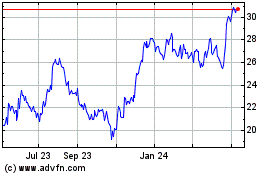

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Jul 2023 to Jul 2024