Performance Reflects Continued Balance Sheet

Growth and Strong Credit Quality

Trustmark Corporation (Nasdaq:TRMK) reported net income of $52.0

million in the first quarter of 2021, representing diluted earnings

per share of $0.82. Net income in the first quarter produced a

return on average tangible equity of 15.56% and a return on average

assets of 1.26%. Trustmark’s Board of Directors declared a

quarterly cash dividend of $0.23 per share payable June 15, 2021,

to shareholders of record on June 1, 2021.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210427006023/en/

Printer friendly version of earnings release with consolidated

financial statements and notes:

https://www.businesswire.com/news/home/52418458/en

First Quarter Highlights

- Supported local businesses by originating 4,774 loans totaling

$301.5 million (net of $16.5 million in deferred fees and costs)

from the SBA’s Paycheck Protection Program (PPP) during the

quarter

- Mortgage loan production totaled $766.6 million, down 2.8% from

the prior quarter and an increase of 67.7% from levels one year

earlier

- Provision for credit losses totaled a negative $10.5 million

due to improved credit loss expectations

Duane A. Dewey, President and CEO, stated, “Our first quarter

financial performance reflects solid loan and deposit growth, as

well as continued increases in our insurance and wealth management

businesses. Our mortgage banking revenue remained strong following

record-setting levels in the prior quarter. Improvement in the

economic outlook resulted in negative provision and expense for

credit losses, which also contributed to earnings. We continue to

focus on efficiency enhancements throughout the organization,

including investments in technology to better serve customers as

well as rationalization of the branch network. Trustmark remains

well-positioned to serve and expand our customer base and create

long-term value for our shareholders.”

Balance Sheet Management

- Loans held for investment (HFI) totaled $10.0 billion, up 1.6%

from the prior quarter and 4.3% year-over-year

- Deposits totaled $14.4 billion, an increase of 2.4%

linked-quarter and 24.3% year-over-year

- Maintained strong capital position with CET1 ratio of 11.71%

and total risk-based capital ratio of 14.07%

Loans HFI totaled $10.0 billion at March 31, 2021, reflecting an

increase of $159.2 million, or 1.6%, linked-quarter and $415.8

million, or 4.3%, year-over-year. The linked-quarter growth

reflects increases in other real estate secured loans and loans

secured by nonfarm, nonresidential properties, which were

principally the result of the migration of construction loans as

projects were completed. Trustmark’s loan portfolio is

well-diversified by loan type and geography.

Deposits totaled $14.4 billion at March 31, 2021, up $334.7

million, or 2.4%, from the prior quarter and $2.8 billion, or

24.3%, year-over-year. Trustmark maintains a strong liquidity

position as loans HFI represented 69.4% of total deposits at March

31, 2021. Noninterest-bearing deposits represented 32.7% of total

deposits at the end of the first quarter, compared to 31.0% in the

prior quarter. Interest-bearing deposit costs totaled 0.22% for the

first quarter, a decrease of 5 basis points from the prior quarter.

The total cost of interest-bearing liabilities was 0.28% for the

first quarter of 2021, a decrease of 2 basis points from the prior

quarter.

During the first quarter, Trustmark repurchased $4.2 million, or

approximately 145 thousand of its common shares in open market

transactions. At March 31, 2021, Trustmark had $95.8 million in

remaining authority under its existing stock repurchase program,

which expires December 31, 2021. The repurchase program, which is

subject to market conditions and management discretion, will

continue to be implemented through open market repurchases or

privately negotiated transactions. At March 31, 2021, Trustmark’s

tangible equity to tangible assets ratio was 8.30%, while its total

risk-based capital ratio was 14.07%. Tangible book value per share

was $21.59 at March 31, 2021, up 8.4% year-over-year.

Credit Quality

- Allowance for credit losses (ACL) represented 437.08% of

nonaccrual loans, excluding individually evaluated loans, at March

31, 2021

- Recoveries exceeded charge-offs by $2.4 million in the first

quarter

- Loans remaining under a COVID-19 related concession represented

approximately 28 basis points of loans HFI at March 31, 2021

Nonaccrual loans totaled $63.5 million at March 31, 2021, up

$386 thousand from the prior quarter and $10.5 million

year-over-year. Other real estate totaled $10.7 million, reflecting

a $1.0 million decrease from the prior quarter and a decline of

$14.2 million year-over-year. Collectively, nonperforming assets

totaled $74.2 million at March 31, 2021, reflecting a

linked-quarter decrease of $614 thousand and a year-over-year

decrease of $3.7 million.

The provision for credit losses was a negative $10.5 million in

the first quarter. Negative provisioning was primarily driven by

decreases in quantitative reserves as a result of an improving

economic forecast.

Allocation of Trustmark’s $109.2 million allowance for credit

losses on loans HFI represented 1.13% of commercial loans and 0.95%

of consumer and home mortgage loans, resulting in an allowance to

total loans HFI of 1.09% at March 31, 2021. Management believes the

level of the ACL is commensurate with the present risk in the loan

portfolio.

Revenue Generation

- Mortgage banking revenue totaled $20.8 million in the first

quarter, reflecting tighter spreads and reduced gains on sale of

mortgage loans in the secondary market

- Insurance commissions increased 22.1% from the prior quarter

and wealth management revenue rose 7.4% over the same period

Revenue in the first quarter totaled $162.9 million, down 8.2%

from the prior quarter and 3.7% from the same quarter in the prior

year. The linked-quarter decrease primarily reflects lower interest

income and fees from PPP loans and loans HFI and lower net gains on

sales of mortgage loans.

Net interest income (FTE) in the first quarter totaled $105.2

million, resulting in a net interest margin of 2.81%, down 34 basis

points from the prior quarter. The net interest margin, excluding

PPP loans and Federal Reserve Bank balance, totaled 2.99% for the

first quarter, a decrease of 10 basis points when compared to the

prior quarter. Continued low interest rates decreased the yield on

the loans held for investment and held for sale portfolio as well

as the securities portfolio and were partially offset by lower

costs of interest-bearing deposits.

Noninterest income in the first quarter totaled $60.6 million, a

decrease of $5.5 million from the prior quarter and $4.7 million

year-over-year. The linked-quarter increases in insurance, wealth

management and bank card revenue were more than offset by declines

in mortgage banking revenue and service charges on deposit

accounts. Mortgage loan production in the first quarter totaled

$766.6 million, down 2.8% from the record level in the prior

quarter and an increase of 67.7% year-over-year. Mortgage banking

revenue totaled $20.8 million in the first quarter, a decrease of

$7.4 million from the prior quarter and $6.7 million

year-over-year. The linked-quarter decline is principally

attributable to reduced spreads which resulted in lower net gains

on sales of mortgage loans in the secondary market.

Insurance revenue totaled $12.4 million in the first quarter, up

22.1%, or $2.2 million, from the fourth quarter of 2020 and 7.7%,

or $895 thousand, year-over-year. The linked-quarter increase

primarily reflects growth in property and casualty commissions.

Wealth management revenue in the first quarter totaled $8.4

million, an increase of $578 thousand, or 7.4%, from the prior

quarter and relatively unchanged year-over-year. The linked-quarter

growth reflects both higher trust management fees and brokerage and

investment services revenue.

Bank card and other fees increased $365 thousand, or 4.0%, from

the prior quarter and $4.1 million, or 76.9%, year-over-year,

reflecting higher customer derivative revenue. Service charges on

deposit accounts decreased $927 thousand, or 11.2%, from the prior

quarter and $2.7 million, or 26.7%, year-over-year. The decline is

due largely to reduced NSF/OD occurrences attributable in part to

stimulus programs to address the COVID-19 pandemic.

Noninterest Expense

- Noninterest expense totaled $112.2 million in first quarter,

down 5.6% from the prior quarter

- Adjusted noninterest expense, which excludes amortization of

intangibles, ORE expenses, and credit losses for off-balance sheet

credit exposures, increased $629 thousand, or 0.5%, from the prior

quarter; please refer to the Consolidated Financial Information,

Footnote 8– Non-GAAP Financial Measures

- Continued to realign delivery channels to reflect changing

customer preferences

Adjusted noninterest expense in the first quarter was $120.2

million, up $629 thousand, or 0.5%, from the prior quarter.

Salaries and employee benefits increased $1.5 million

linked-quarter principally due to payroll taxes and increases for

performance-based commissions. Services and fees increased $157

thousand and net occupancy-premises expense grew $179 thousand

during the first quarter compared to the prior quarter.

Credit loss expense related to off-balance sheet credit

exposures was a negative $9.4 million in the first quarter,

reflecting the improvement of the macroeconomic factors used to

determine the necessary reserves for off-balance sheet credit

exposures. Other real estate expense, net totaled $324 thousand for

the first quarter compared to a negative $812 thousand for the

fourth quarter of 2020, reflecting lower net gains on sale of other

real estate.

Trustmark continued to invest in technology to enhance

efficiency. Digital transformation initiatives, including a

completely redesigned, state-of-the-art website to promote

engagement and enhance the customer experience, position Trustmark

for additional growth. During the first quarter, Trustmark

continued to realign delivery channels and closed seven offices,

reflecting changing customer preferences and the continued

migration to mobile and digital banking channels. Additionally, two

new offices were opened, one each in the Memphis, TN MSA and the

Jackson, MS MSA. Each of these offices features a design that

integrates myTeller® interactive teller machine technology as well

as provides enhanced areas for customer interaction.

“Looking forward, Trustmark will continue to focus upon

efficiency, growth and innovation opportunities while building upon

our solid risk management processes, corporate culture and core

values. We will continue to optimize delivery channels and

introduce technology to enhance growth and efficiency

opportunities. We will provide the services and advice our

customers have come to expect while building long-term value for

our shareholders,” said Dewey.

Additional Information

As previously announced, Trustmark will conduct a conference

call with analysts on Wednesday, April 28, 2021 at 8:30 a.m.

Central Time to discuss the Corporation’s financial results.

Interested parties may listen to the conference call by dialing

(877) 317-3051 or by clicking on the link provided under the

Investor Relations section of our website at www.trustmark.com. A

replay of the conference call will also be available through

Wednesday, May 12, 2021, in archived format at the same web address

or by calling (877) 344-7529, passcode 10153927.

Trustmark is a financial services company providing banking and

financial solutions through 181 offices in Alabama, Florida,

Mississippi, Tennessee and Texas.

Forward-Looking Statements

Certain statements contained in this document constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. You can identify

forward-looking statements by words such as “may,” “hope,” “will,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “project,” “potential,” “seek,” “continue,”

“could,” “would,” “future” or the negative of those terms or other

words of similar meaning. You should read statements that contain

these words carefully because they discuss our future expectations

or state other “forward-looking” information. These forward-looking

statements include, but are not limited to, statements relating to

anticipated future operating and financial performance measures,

including net interest margin, credit quality, business

initiatives, growth opportunities and growth rates, among other

things, and encompass any estimate, prediction, expectation,

projection, opinion, anticipation, outlook or statement of belief

included therein as well as the management assumptions underlying

these forward-looking statements. You should be aware that the

occurrence of the events described under the caption “Risk Factors”

in Trustmark’s filings with the Securities and Exchange Commission

could have an adverse effect on our business, results of operations

and financial condition. Should one or more of these risks

materialize, or should any such underlying assumptions prove to be

significantly different, actual results may vary significantly from

those anticipated, estimated, projected or expected.

Risks that could cause actual results to differ materially from

current expectations of Management include, but are not limited to,

changes in the level of nonperforming assets and charge-offs, an

increase in unemployment levels and slowdowns in economic growth,

our ability to manage the impact of the COVID-19 pandemic on our

markets and our customers, as well as the effectiveness of actions

of federal, state and local governments and agencies (including the

Board of Governors of the Federal Reserve System (FRB)) to mitigate

its spread and economic impact, local, state and national economic

and market conditions, conditions in the housing and real estate

markets in the regions in which Trustmark operates and the extent

and duration of the current volatility in the credit and financial

markets, levels of and volatility in crude oil prices, changes in

our ability to measure the fair value of assets in our portfolio,

material changes in the level and/or volatility of market interest

rates, the performance and demand for the products and services we

offer, including the level and timing of withdrawals from our

deposit accounts, the costs and effects of litigation and of

unexpected or adverse outcomes in such litigation, our ability to

attract noninterest-bearing deposits and other low-cost funds,

competition in loan and deposit pricing, as well as the entry of

new competitors into our markets through de novo expansion and

acquisitions, economic conditions, including the potential impact

of issues related to the European financial system and monetary and

other governmental actions designed to address credit, securities,

and/or commodity markets, the enactment of legislation and changes

in existing regulations or enforcement practices or the adoption of

new regulations, changes in accounting standards and practices,

including changes in the interpretation of existing standards, that

affect our consolidated financial statements, changes in consumer

spending, borrowings and savings habits, technological changes,

changes in the financial performance or condition of our borrowers,

changes in our ability to control expenses, greater than expected

costs or difficulties related to the integration of acquisitions or

new products and lines of business, cyber-attacks and other

breaches which could affect our information system security,

natural disasters, environmental disasters, pandemics or other

health crises, acts of war or terrorism, and other risks described

in our filings with the Securities and Exchange Commission

(SEC).

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, we can give no assurance

that such expectations will prove to be correct. Except as required

by law, we undertake no obligation to update or revise any of this

information, whether as the result of new information, future

events or developments or otherwise.

TRUSTMARK CORPORATION AND SUBSIDIARIES

CONSOLIDATED FINANCIAL INFORMATION March 31, 2021

($ in thousands) (unaudited) Linked

Quarter Year over Year QUARTERLY AVERAGE BALANCES 3/31/2021

12/31/2020 3/31/2020 $ Change % Change

$ Change % Change Securities AFS-taxable

$

2,098,089

$

1,902,162

$

1,620,422

$

195,927

10.3

%

$

477,667

29.5

%

Securities AFS-nontaxable

5,190

5,206

22,056

(16

)

-0.3

%

(16,866

)

-76.5

%

Securities HTM-taxable

489,260

550,563

694,740

(61,303

)

-11.1

%

(205,480

)

-29.6

%

Securities HTM-nontaxable

24,070

24,752

25,673

(682

)

-2.8

%

(1,603

)

-6.2

%

Total securities

2,616,609

2,482,683

2,362,891

133,926

5.4

%

253,718

10.7

%

Paycheck protection program loans (PPP)

598,139

875,098

—

(276,959

)

-31.6

%

598,139

n/m

Loans (includes loans held for sale)

10,316,319

10,231,671

9,678,174

84,648

0.8

%

638,145

6.6

%

Fed funds sold and reverse repurchases

136

303

164

(167

)

-55.1

%

(28

)

-17.1

%

Other earning assets

1,667,906

860,540

187,327

807,366

93.8

%

1,480,579

n/m

Total earning assets

15,199,109

14,450,295

12,228,556

748,814

5.2

%

2,970,553

24.3

%

Allowance for credit losses (ACL), loans held for

investment (LHFI)

(119,557

)

(124,088

)

(85,015

)

4,531

3.7

%

(34,542

)

-40.6

%

Other assets

1,601,250

1,620,694

1,498,725

(19,444

)

-1.2

%

102,525

6.8

%

Total assets

$

16,680,802

$

15,946,901

$

13,642,266

$

733,901

4.6

%

$

3,038,536

22.3

%

Interest-bearing demand deposits

$

3,743,651

$

3,649,590

$

3,184,134

$

94,061

2.6

%

$

559,517

17.6

%

Savings deposits

4,659,037

4,350,783

3,646,936

308,254

7.1

%

1,012,101

27.8

%

Time deposits

1,371,830

1,436,677

1,617,307

(64,847

)

-4.5

%

(245,477

)

-15.2

%

Total interest-bearing deposits

9,774,518

9,437,050

8,448,377

337,468

3.6

%

1,326,141

15.7

%

Fed funds purchased and repurchases

166,909

170,474

247,513

(3,565

)

-2.1

%

(80,604

)

-32.6

%

Other borrowings

166,926

173,525

85,279

(6,599

)

-3.8

%

81,647

95.7

%

Subordinated notes

122,875

42,828

—

80,047

n/m

122,875

n/m

Junior subordinated debt securities

61,856

61,856

61,856

—

0.0

%

—

0.0

%

Total interest-bearing liabilities

10,293,084

9,885,733

8,843,025

407,351

4.1

%

1,450,059

16.4

%

Noninterest-bearing deposits

4,363,559

4,100,849

2,910,951

262,710

6.4

%

1,452,608

49.9

%

Other liabilities

264,808

235,284

248,220

29,524

12.5

%

16,588

6.7

%

Total liabilities

14,921,451

14,221,866

12,002,196

699,585

4.9

%

2,919,255

24.3

%

Shareholders' equity

1,759,351

1,725,035

1,640,070

34,316

2.0

%

119,281

7.3

%

Total liabilities and equity

$

16,680,802

$

15,946,901

$

13,642,266

$

733,901

4.6

%

$

3,038,536

22.3

%

n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated

Financials TRUSTMARK CORPORATION AND SUBSIDIARIES

CONSOLIDATED FINANCIAL INFORMATION March 31, 2021

($ in thousands) (unaudited) Linked Quarter

Year over Year PERIOD END

BALANCES 3/31/2021 12/31/2020

3/31/2020 $ Change % Change $ Change

% Change Cash and due from banks

$

1,774,541

$

1,952,504

$

404,341

$

(177,963

)

-9.1

%

$

1,370,200

n/m

Fed funds sold and reverse repurchases

—

50

2,000

(50

)

-100.0

%

(2,000

)

-100.0

%

Securities available for sale

2,337,676

1,991,815

1,833,779

345,861

17.4

%

503,897

27.5

%

Securities held to maturity

493,738

538,072

704,276

(44,334

)

-8.2

%

(210,538

)

-29.9

%

PPP loans

679,725

610,134

—

69,591

11.4

%

679,725

n/m

Loans held for sale (LHFS)

412,999

446,951

325,389

(33,952

)

-7.6

%

87,610

26.9

%

Loans held for investment (LHFI)

9,983,704

9,824,524

9,567,920

159,180

1.6

%

415,784

4.3

%

ACL LHFI

(109,191

)

(117,306

)

(100,564

)

8,115

6.9

%

(8,627

)

-8.6

%

Net LHFI

9,874,513

9,707,218

9,467,356

167,295

1.7

%

407,157

4.3

%

Premises and equipment, net

199,098

194,278

190,179

4,820

2.5

%

8,919

4.7

%

Mortgage servicing rights

83,035

66,464

56,437

16,571

24.9

%

26,598

47.1

%

Goodwill

384,237

385,270

381,717

(1,033

)

-0.3

%

2,520

0.7

%

Identifiable intangible assets

6,724

7,390

7,537

(666

)

-9.0

%

(813

)

-10.8

%

Other real estate

10,651

11,651

24,847

(1,000

)

-8.6

%

(14,196

)

-57.1

%

Operating lease right-of-use assets

33,704

30,901

30,839

2,803

9.1

%

2,865

9.3

%

Other assets

587,672

609,142

591,132

(21,470

)

-3.5

%

(3,460

)

-0.6

%

Total assets

$

16,878,313

$

16,551,840

$

14,019,829

$

326,473

2.0

%

$

2,858,484

20.4

%

Deposits: Noninterest-bearing

$

4,705,991

$

4,349,010

$

2,977,058

$

356,981

8.2

%

$

1,728,933

58.1

%

Interest-bearing

9,677,449

9,699,754

8,598,706

(22,305

)

-0.2

%

1,078,743

12.5

%

Total deposits

14,383,440

14,048,764

11,575,764

334,676

2.4

%

2,807,676

24.3

%

Fed funds purchased and repurchases

160,991

164,519

421,821

(3,528

)

-2.1

%

(260,830

)

-61.8

%

Other borrowings

145,994

168,252

84,230

(22,258

)

-13.2

%

61,764

73.3

%

Subordinated notes

122,877

122,921

—

(44

)

0.0

%

122,877

n/m

Junior subordinated debt securities

61,856

61,856

61,856

—

0.0

%

—

0.0

%

ACL on off-balance sheet credit exposures

29,205

38,572

36,421

(9,367

)

-24.3

%

(7,216

)

-19.8

%

Operating lease liabilities

35,389

32,290

32,055

3,099

9.6

%

3,334

10.4

%

Other liabilities

178,856

173,549

155,283

5,307

3.1

%

23,573

15.2

%

Total liabilities

15,118,608

14,810,723

12,367,430

307,885

2.1

%

2,751,178

22.2

%

Common stock

13,209

13,215

13,209

(6

)

0.0

%

—

0.0

%

Capital surplus

229,892

233,120

229,403

(3,228

)

-1.4

%

489

0.2

%

Retained earnings

1,533,110

1,495,833

1,402,089

37,277

2.5

%

131,021

9.3

%

Accum other comprehensive income (loss), net of tax

(16,506

)

(1,051

)

7,698

(15,455

)

n/m

(24,204

)

n/m

Total shareholders' equity

1,759,705

1,741,117

1,652,399

18,588

1.1

%

107,306

6.5

%

Total liabilities and equity

$

16,878,313

$

16,551,840

$

14,019,829

$

326,473

2.0

%

$

2,858,484

20.4

%

n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated

Financials TRUSTMARK CORPORATION AND SUBSIDIARIES

CONSOLIDATED FINANCIAL INFORMATION March 31, 2021

($ in thousands except per share data) (unaudited)

Quarter Ended Linked Quarter Year over

Year INCOME STATEMENTS

3/31/2021 12/31/2020 3/31/2020 $ Change

% Change $ Change % Change Interest and fees

on LHFS & LHFI-FTE

$

93,394

$

96,453

$

109,357

$

(3,059

)

-3.2

%

$

(15,963

)

-14.6

%

Interest and fees on PPP loans

9,241

14,870

—

(5,629

)

-37.9

%

9,241

n/m

Interest on securities-taxable

8,938

9,998

12,948

(1,060

)

-10.6

%

(4,010

)

-31.0

%

Interest on securities-tax exempt-FTE

290

293

457

(3

)

-1.0

%

(167

)

-36.5

%

Interest on fed funds sold and reverse repurchases

—

—

—

—

n/m

—

n/m

Other interest income

503

249

740

254

n/m

(237

)

-32.0

%

Total interest income-FTE

112,366

121,863

123,502

(9,497

)

-7.8

%

(11,136

)

-9.0

%

Interest on deposits

5,223

6,363

14,957

(1,140

)

-17.9

%

(9,734

)

-65.1

%

Interest on fed funds purchased and repurchases

56

56

625

—

0.0

%

(569

)

-91.0

%

Other interest expense

1,857

1,127

860

730

64.8

%

997

n/m

Total interest expense

7,136

7,546

16,442

(410

)

-5.4

%

(9,306

)

-56.6

%

Net interest income-FTE

105,230

114,317

107,060

(9,087

)

-7.9

%

(1,830

)

-1.7

%

Provision for credit losses, LHFI

(10,501

)

(4,413

)

20,581

(6,088

)

n/m

(31,082

)

n/m

Net interest income after provision-FTE

115,731

118,730

86,479

(2,999

)

-2.5

%

29,252

33.8

%

Service charges on deposit accounts

7,356

8,283

10,032

(927

)

-11.2

%

(2,676

)

-26.7

%

Bank card and other fees

9,472

9,107

5,355

365

4.0

%

4,117

76.9

%

Mortgage banking, net

20,804

28,155

27,483

(7,351

)

-26.1

%

(6,679

)

-24.3

%

Insurance commissions

12,445

10,196

11,550

2,249

22.1

%

895

7.7

%

Wealth management

8,416

7,838

8,537

578

7.4

%

(121

)

-1.4

%

Other, net

2,090

2,538

2,307

(448

)

-17.7

%

(217

)

-9.4

%

Total noninterest income

60,583

66,117

65,264

(5,534

)

-8.4

%

(4,681

)

-7.2

%

Salaries and employee benefits

71,162

69,660

69,148

1,502

2.2

%

2,014

2.9

%

Services and fees

22,484

22,327

19,930

157

0.7

%

2,554

12.8

%

Net occupancy-premises

6,795

6,616

6,286

179

2.7

%

509

8.1

%

Equipment expense

6,244

6,213

5,616

31

0.5

%

628

11.2

%

Other real estate expense, net

324

(812

)

1,294

1,136

n/m

(970

)

-75.0

%

Credit loss expense related to off-balance sheet credit

exposures

(9,367

)

(1,087

)

6,783

(8,280

)

n/m

(16,150

)

n/m

Other expense

14,539

15,890

14,753

(1,351

)

-8.5

%

(214

)

-1.5

%

Total noninterest expense

112,181

118,807

123,810

(6,626

)

-5.6

%

(11,629

)

-9.4

%

Income before income taxes and tax eq adj

64,133

66,040

27,933

(1,907

)

-2.9

%

36,200

n/m

Tax equivalent adjustment

2,894

2,939

3,108

(45

)

-1.5

%

(214

)

-6.9

%

Income before income taxes

61,239

63,101

24,825

(1,862

)

-3.0

%

36,414

n/m

Income taxes

9,277

11,884

2,607

(2,607

)

-21.9

%

6,670

n/m

Net income

$

51,962

$

51,217

$

22,218

$

745

1.5

%

$

29,744

n/m

Per share data Earnings per share - basic

$

0.82

$

0.81

$

0.35

$

0.01

1.2

%

$

0.47

n/m

Earnings per share - diluted

$

0.82

$

0.81

$

0.35

$

0.01

1.2

%

$

0.47

n/m

Dividends per share

$

0.23

$

0.23

$

0.23

—

0.0

%

—

0.0

%

Weighted average shares outstanding Basic

63,395,911

63,424,219

63,756,629

Diluted

63,562,503

63,616,767

63,913,603

Period end shares outstanding

63,394,522

63,424,526

63,396,912

n/m - percentage changes greater than +/- 100% are

considered not meaningful

See Notes to Consolidated

Financials TRUSTMARK CORPORATION AND SUBSIDIARIES

CONSOLIDATED FINANCIAL INFORMATION March 31, 2021

($ in thousands) (unaudited) Quarter

Ended Linked Quarter Year over Year

NONPERFORMING ASSETS (1)

3/31/2021 12/31/2020 3/31/2020 $ Change

% Change $ Change % Change Nonaccrual LHFI

Alabama

$

9,161

$

9,221

$

4,769

$

(60

)

-0.7

%

$

4,392

92.1

%

Florida

607

572

254

35

6.1

%

353

n/m

Mississippi (2)

35,534

35,015

40,815

519

1.5

%

(5,281

)

-12.9

%

Tennessee (3)

12,451

12,572

6,153

(121

)

-1.0

%

6,298

n/m

Texas

5,761

5,748

1,001

13

0.2

%

4,760

n/m

Total nonaccrual LHFI

63,514

63,128

52,992

386

0.6

%

10,522

19.9

%

Other real estate Alabama

3,085

3,271

6,229

(186

)

-5.7

%

(3,144

)

-50.5

%

Florida

—

—

4,835

—

n/m

(4,835

)

-100.0

%

Mississippi (2)

7,566

8,330

13,296

(764

)

-9.2

%

(5,730

)

-43.1

%

Tennessee (3)

—

50

487

(50

)

-100.0

%

(487

)

-100.0

%

Texas

—

—

—

—

n/m

—

n/m

Total other real estate

10,651

11,651

24,847

(1,000

)

-8.6

%

(14,196

)

-57.1

%

Total nonperforming assets

$

74,165

$

74,779

$

77,839

$

(614

)

-0.8

%

$

(3,674

)

-4.7

%

LOANS PAST DUE OVER 90 DAYS

(1) LHFI

$

2,593

$

1,576

$

708

$

1,017

64.5

%

$

1,885

n/m

LHFS-Guaranteed GNMA serviced loans (no obligation to

repurchase)

$

109,566

$

119,409

$

43,564

$

(9,843

)

-8.2

%

$

66,002

n/m

Quarter Ended Linked Quarter Year over

Year ACL LHFI (1)

3/31/2021 12/31/2020 3/31/2020 $ Change

% Change $ Change % Change Beginning Balance

$

117,306

$

122,010

$

84,277

$

(4,704

)

-3.9

%

$

33,029

39.2

%

CECL adoption adjustments: LHFI

—

—

(3,039

)

—

n/m

3,039

100.0

%

Acquired loan transfers

—

—

1,822

—

n/m

(1,822

)

-100.0

%

Provision for credit losses

(10,501

)

(4,413

)

20,581

(6,088

)

n/m

(31,082

)

n/m

Charge-offs

(1,245

)

(2,797

)

(5,545

)

1,552

55.5

%

4,300

77.5

%

Recoveries

3,631

2,506

2,468

1,125

44.9

%

1,163

47.1

%

Net (charge-offs) recoveries

2,386

(291

)

(3,077

)

2,677

n/m

5,463

n/m

Ending Balance

$

109,191

$

117,306

$

100,564

$

(8,115

)

-6.9

%

$

8,627

8.6

%

NET (CHARGE-OFFS) RECOVERIES

(1) Alabama

$

102

$

(1,011

)

$

(1,080

)

$

1,113

n/m

$

1,182

n/m

Florida

30

66

64

(36

)

-54.5

%

(34

)

-53.1

%

Mississippi (2)

2,207

332

126

1,875

n/m

2,081

n/m

Tennessee (3)

47

303

(2,186

)

(256

)

-84.5

%

2,233

n/m

Texas

—

19

(1

)

(19

)

-100.0

%

1

100.0

%

Total net (charge-offs) recoveries

$

2,386

$

(291

)

$

(3,077

)

$

2,677

n/m

$

5,463

n/m

(1) Excludes PPP loans. (2) Mississippi includes Central and

Southern Mississippi Regions. (3) Tennessee includes Memphis,

Tennessee and Northern Mississippi Regions. n/m - percentage

changes greater than +/- 100% are considered not meaningful

See Notes to Consolidated Financials TRUSTMARK

CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL

INFORMATION March 31, 2021 ($ in thousands)

(unaudited) Quarter Ended AVERAGE BALANCES 3/31/2021

12/31/2020 9/30/2020 6/30/2020

3/31/2020 Securities AFS-taxable

$

2,098,089

$

1,902,162

$

1,857,050

$

1,724,320

$

1,620,422

Securities AFS-nontaxable

5,190

5,206

5,973

9,827

22,056

Securities HTM-taxable

489,260

550,563

608,585

655,085

694,740

Securities HTM-nontaxable

24,070

24,752

25,508

25,538

25,673

Total securities

2,616,609

2,482,683

2,497,116

2,414,770

2,362,891

PPP loans

598,139

875,098

941,456

764,416

—

Loans (includes loans held for sale)

10,316,319

10,231,671

10,162,379

9,908,132

9,678,174

Fed funds sold and reverse repurchases

136

303

301

113

164

Other earning assets

1,667,906

860,540

722,917

854,642

187,327

Total earning assets

15,199,109

14,450,295

14,324,169

13,942,073

12,228,556

ACL LHFI

(119,557

)

(124,088

)

(121,842

)

(103,006

)

(85,015

)

Other assets

1,601,250

1,620,694

1,564,825

1,685,317

1,498,725

Total assets

$

16,680,802

$

15,946,901

$

15,767,152

$

15,524,384

$

13,642,266

Interest-bearing demand deposits

$

3,743,651

$

3,649,590

$

3,669,249

$

3,832,372

$

3,184,134

Savings deposits

4,659,037

4,350,783

4,416,046

4,180,540

3,646,936

Time deposits

1,371,830

1,436,677

1,507,348

1,578,737

1,617,307

Total interest-bearing deposits

9,774,518

9,437,050

9,592,643

9,591,649

8,448,377

Fed funds purchased and repurchases

166,909

170,474

84,077

105,696

247,513

Other borrowings

166,926

173,525

167,262

107,533

85,279

Subordinated notes

122,875

42,828

—

—

—

Junior subordinated debt securities

61,856

61,856

61,856

61,856

61,856

Total interest-bearing liabilities

10,293,084

9,885,733

9,905,838

9,866,734

8,843,025

Noninterest-bearing deposits

4,363,559

4,100,849

3,921,867

3,645,761

2,910,951

Other liabilities

264,808

235,284

244,544

346,173

248,220

Total liabilities

14,921,451

14,221,866

14,072,249

13,858,668

12,002,196

Shareholders' equity

1,759,351

1,725,035

1,694,903

1,665,716

1,640,070

Total liabilities and equity

$

16,680,802

$

15,946,901

$

15,767,152

$

15,524,384

$

13,642,266

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION March 31, 2021 ($ in

thousands) (unaudited) PERIOD END BALANCES 3/31/2021

12/31/2020 9/30/2020 6/30/2020

3/31/2020 Cash and due from banks

$

1,774,541

$

1,952,504

$

564,588

$

1,026,640

$

404,341

Fed funds sold and reverse repurchases

—

50

50

—

2,000

Securities available for sale

2,337,676

1,991,815

1,922,728

1,884,153

1,833,779

Securities held to maturity

493,738

538,072

611,280

660,048

704,276

PPP loans

679,725

610,134

944,270

939,783

—

LHFS

412,999

446,951

485,103

355,089

325,389

LHFI

9,983,704

9,824,524

9,847,728

9,659,806

9,567,920

ACL LHFI

(109,191

)

(117,306

)

(122,010

)

(119,188

)

(100,564

)

Net LHFI

9,874,513

9,707,218

9,725,718

9,540,618

9,467,356

Premises and equipment, net

199,098

194,278

192,722

190,567

190,179

Mortgage servicing rights

83,035

66,464

61,613

57,811

56,437

Goodwill

384,237

385,270

385,270

385,270

381,717

Identifiable intangible assets

6,724

7,390

8,142

8,895

7,537

Other real estate

10,651

11,651

16,248

18,276

24,847

Operating lease right-of-use assets

33,704

30,901

30,508

29,819

30,839

Other assets

587,672

609,142

609,922

595,110

591,132

Total assets

$

16,878,313

$

16,551,840

$

15,558,162

$

15,692,079

$

14,019,829

Deposits: Noninterest-bearing

$

4,705,991

$

4,349,010

$

3,964,023

$

3,880,540

$

2,977,058

Interest-bearing

9,677,449

9,699,754

9,258,390

9,624,933

8,598,706

Total deposits

14,383,440

14,048,764

13,222,413

13,505,473

11,575,764

Fed funds purchased and repurchases

160,991

164,519

153,834

70,255

421,821

Other borrowings

145,994

168,252

178,599

152,860

84,230

Subordinated notes

122,877

122,921

—

—

—

Junior subordinated debt securities

61,856

61,856

61,856

61,856

61,856

ACL on off-balance sheet credit exposures

29,205

38,572

39,659

42,663

36,421

Operating lease liabilities

35,389

32,290

31,838

31,076

32,055

Other liabilities

178,856

173,549

159,922

153,952

155,283

Total liabilities

15,118,608

14,810,723

13,848,121

14,018,135

12,367,430

Common stock

13,209

13,215

13,215

13,214

13,209

Capital surplus

229,892

233,120

231,836

230,613

229,403

Retained earnings

1,533,110

1,495,833

1,459,306

1,419,552

1,402,089

Accum other comprehensive income (loss), net of tax

(16,506

)

(1,051

)

5,684

10,565

7,698

Total shareholders' equity

1,759,705

1,741,117

1,710,041

1,673,944

1,652,399

Total liabilities and equity

$

16,878,313

$

16,551,840

$

15,558,162

$

15,692,079

$

14,019,829

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION March 31, 2021 ($ in thousands

except per share data) (unaudited) Quarter

Ended INCOME STATEMENTS

3/31/2021 12/31/2020 9/30/2020

6/30/2020 3/31/2020 Interest and fees on LHFS &

LHFI-FTE

$

93,394

$

96,453

$

97,429

$

99,300

$

109,357

Interest and fees on PPP loans

9,241

14,870

6,729

5,044

—

Interest on securities-taxable

8,938

9,998

12,542

12,762

12,948

Interest on securities-tax exempt-FTE

290

293

301

315

457

Interest on fed funds sold and reverse repurchases

—

—

1

—

—

Other interest income

503

249

331

239

740

Total interest income-FTE

112,366

121,863

117,333

117,660

123,502

Interest on deposits

5,223

6,363

7,437

8,730

14,957

Interest on fed funds purchased and repurchases

56

56

32

42

625

Other interest expense

1,857

1,127

688

881

860

Total interest expense

7,136

7,546

8,157

9,653

16,442

Net interest income-FTE

105,230

114,317

109,176

108,007

107,060

Provision for credit losses, LHFI

(10,501

)

(4,413

)

1,760

18,185

20,581

Net interest income after provision-FTE

115,731

118,730

107,416

89,822

86,479

Service charges on deposit accounts

7,356

8,283

7,577

6,397

10,032

Bank card and other fees

9,472

9,107

8,843

7,717

5,355

Mortgage banking, net

20,804

28,155

36,439

33,745

27,483

Insurance commissions

12,445

10,196

11,562

11,868

11,550

Wealth management

8,416

7,838

7,679

7,571

8,537

Other, net

2,090

2,538

1,601

2,213

2,307

Total noninterest income

60,583

66,117

73,701

69,511

65,264

Salaries and employee benefits

71,162

69,660

67,342

66,107

69,148

Services and fees

22,484

22,327

20,992

20,567

19,930

Net occupancy-premises

6,795

6,616

7,000

6,587

6,286

Equipment expense

6,244

6,213

5,828

5,620

5,616

Other real estate expense, net

324

(812

)

1,203

271

1,294

Credit loss expense related to off-balance sheet credit exposures

(9,367

)

(1,087

)

(3,004

)

6,242

6,783

Other expense

14,539

15,890

14,598

13,265

14,753

Total noninterest expense

112,181

118,807

113,959

118,659

123,810

Income before income taxes and tax eq adj

64,133

66,040

67,158

40,674

27,933

Tax equivalent adjustment

2,894

2,939

2,969

3,007

3,108

Income before income taxes

61,239

63,101

64,189

37,667

24,825

Income taxes

9,277

11,884

9,749

5,517

2,607

Net income

$

51,962

$

51,217

$

54,440

$

32,150

$

22,218

Per share data Earnings per share - basic

$

0.82

$

0.81

$

0.86

$

0.51

$

0.35

Earnings per share - diluted

$

0.82

$

0.81

$

0.86

$

0.51

$

0.35

Dividends per share

$

0.23

$

0.23

$

0.23

$

0.23

$

0.23

Weighted average shares outstanding Basic

63,395,911

63,424,219

63,422,692

63,416,307

63,756,629

Diluted

63,562,503

63,616,767

63,581,964

63,555,065

63,913,603

Period end shares outstanding

63,394,522

63,424,526

63,423,820

63,422,439

63,396,912

See Notes to Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES CONSOLIDATED

FINANCIAL INFORMATION March 31, 2021 ($ in

thousands) (unaudited) Quarter Ended

NONPERFORMING ASSETS (1)

3/31/2021 12/31/2020 9/30/2020

6/30/2020 3/31/2020 Nonaccrual LHFI Alabama

$

9,161

$

9,221

$

3,860

$

4,392

$

4,769

Florida

607

572

617

687

254

Mississippi (2)

35,534

35,015

35,617

37,884

40,815

Tennessee (3)

12,451

12,572

13,041

6,125

6,153

Texas

5,761

5,748

721

906

1,001

Total nonaccrual LHFI

63,514

63,128

53,856

49,994

52,992

Other real estate Alabama

3,085

3,271

3,725

4,766

6,229

Florida

—

—

3,665

3,665

4,835

Mississippi (2)

7,566

8,330

8,718

9,408

13,296

Tennessee (3)

—

50

140

437

487

Texas

—

—

—

—

—

Total other real estate

10,651

11,651

16,248

18,276

24,847

Total nonperforming assets

$

74,165

$

74,779

$

70,104

$

68,270

$

77,839

LOANS PAST DUE OVER 90 DAYS

(1) LHFI

$

2,593

$

1,576

$

782

$

807

$

708

LHFS-Guaranteed GNMA serviced loans (no obligation to

repurchase)

$

109,566

$

119,409

$

121,281

$

56,269

$

43,564

Quarter Ended ACL

LHFI (1) 3/31/2021 12/31/2020

9/30/2020 6/30/2020 3/31/2020 Beginning

Balance

$

117,306

$

122,010

$

119,188

$

100,564

$

84,277

CECL adoption adjustments: LHFI

—

—

—

—

(3,039

)

Acquired loan transfers

—

—

—

—

1,822

Provision for credit losses

(10,501

)

(4,413

)

1,760

18,185

20,581

Charge-offs

(1,245

)

(2,797

)

(1,263

)

(1,870

)

(5,545

)

Recoveries

3,631

2,506

2,325

2,309

2,468

Net (charge-offs) recoveries

2,386

(291

)

1,062

439

(3,077

)

Ending Balance

$

109,191

$

117,306

$

122,010

$

119,188

$

100,564

NET (CHARGE-OFFS) RECOVERIES

(1) Alabama

$

102

$

(1,011

)

$

117

$

526

$

(1,080

)

Florida

30

66

387

(127

)

64

Mississippi (2)

2,207

332

442

(86

)

126

Tennessee (3)

47

303

42

66

(2,186

)

Texas

—

19

74

60

(1

)

Total net (charge-offs) recoveries

$

2,386

$

(291

)

$

1,062

$

439

$

(3,077

)

(1) Excludes PPP loans. (2) Mississippi includes Central and

Southern Mississippi Regions. (3) Tennessee includes Memphis,

Tennessee and Northern Mississippi Regions.

See Notes to

Consolidated Financials TRUSTMARK CORPORATION AND

SUBSIDIARIES CONSOLIDATED FINANCIAL INFORMATION March

31, 2021 (unaudited) Quarter Ended

FINANCIAL RATIOS AND OTHER DATA

3/31/2021 12/31/2020 9/30/2020

6/30/2020 3/31/2020 Return on average equity

11.98

%

11.81

%

12.78

%

7.76

%

5.45

%

Return on average tangible equity

15.56

%

15.47

%

16.82

%

10.32

%

7.34

%

Return on average assets

1.26

%

1.28

%

1.37

%

0.83

%

0.66

%

Interest margin - Yield - FTE

3.00

%

3.35

%

3.26

%

3.39

%

4.06

%

Interest margin - Cost

0.19

%

0.21

%

0.23

%

0.28

%

0.54

%

Net interest margin - FTE

2.81

%

3.15

%

3.03

%

3.12

%

3.52

%

Efficiency ratio (1)

71.84

%

65.59

%

62.19

%

62.13

%

63.50

%

Full-time equivalent employees

2,793

2,797

2,807

2,798

2,761

CREDIT QUALITY RATIOS

(2) Net (recoveries) charge-offs / average loans

-0.09

%

0.01

%

-0.04

%

-0.02

%

0.13

%

Provision for credit losses / average loans

-0.41

%

-0.17

%

0.07

%

0.74

%

0.86

%

Nonaccrual LHFI / (LHFI + LHFS)

0.61

%

0.61

%

0.52

%

0.50

%

0.54

%

Nonperforming assets / (LHFI + LHFS)

0.71

%

0.73

%

0.68

%

0.68

%

0.79

%

Nonperforming assets / (LHFI + LHFS + other real estate)

0.71

%

0.73

%

0.68

%

0.68

%

0.78

%

ACL LHFI / LHFI

1.09

%

1.19

%

1.24

%

1.23

%

1.05

%

ACL LHFI-commercial / commercial LHFI

1.13

%

1.20

%

1.20

%

1.15

%

0.97

%

ACL LHFI-consumer / consumer and home mortgage LHFI

0.95

%

1.16

%

1.41

%

1.56

%

1.35

%

ACL LHFI / nonaccrual LHFI

171.92

%

185.82

%

226.55

%

238.40

%

189.77

%

ACL LHFI / nonaccrual LHFI (excl individually evaluated loans)

437.08

%

572.69

%

593.72

%

561.04

%

468.84

%

CAPITAL RATIOS Total

equity / total assets

10.43

%

10.52

%

10.99

%

10.67

%

11.79

%

Tangible equity / tangible assets

8.30

%

8.34

%

8.68

%

8.37

%

9.27

%

Tangible equity / risk-weighted assets

11.23

%

11.22

%

11.01

%

11.09

%

11.05

%

Tier 1 leverage ratio

9.11

%

9.33

%

9.20

%

9.08

%

10.21

%

Common equity tier 1 capital ratio

11.71

%

11.62

%

11.36

%

11.42

%

11.35

%

Tier 1 risk-based capital ratio

12.20

%

12.11

%

11.86

%

11.94

%

11.88

%

Total risk-based capital ratio

14.07

%

14.12

%

12.88

%

13.00

%

12.78

%

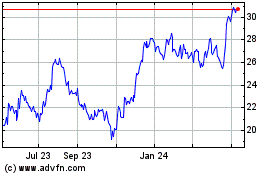

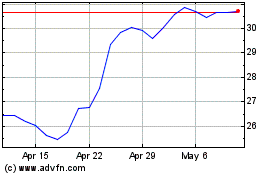

STOCK PERFORMANCE Market

value-Close

$

33.66

$

27.31

$

21.41

$

24.52

$

23.30

Book value

$

27.76

$

27.45

$

26.96

$

26.39

$

26.06

Tangible book value

$

21.59

$

21.26

$

20.76

$

20.18

$

19.92

(1) See Note 8 – Non-GAAP Financial Measures in the Notes to

Consolidated Financials for Trustmark’s efficiency ratio

calculation. (2) Excludes PPP loans.

See Notes to

Consolidated Financials

TRUSTMARK CORPORATION AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIALS March 31, 2021 ($ in

thousands) (unaudited)

Note 1 - Paycheck Protection Program

In January 2021, Trustmark began submitting applications to the

SBA on behalf of and originating loans to qualified small

businesses under the Coronavirus Aid, Relief, and Economic Security

Act (the CARES Act), as amended by the Consolidated Appropriations

Act, 2021. During the first quarter of 2021, Trustmark originated

4,774 PPP loans totaling $301.5 million (net of $16.5 million of

deferred fees and costs). At March 31, 2021, Trustmark had 7,456

PPP loans outstanding that totaled $679.7 million (net of $22.1

million of deferred fees and costs) under the CARES Act.

Due to amount and nature of the PPP loans, these loans were not

included in the LHFI portfolio and are presented separately in the

accompanying consolidated balance sheets. The PPP loans are fully

guaranteed by the SBA; therefore, no ACL was estimated for these

loans.

Note 2 - Securities Available for Sale and Held to

Maturity

The following table is a summary of the estimated fair value of

securities available for sale and the amortized cost of securities

held to maturity:

3/31/2021

12/31/2020

9/30/2020

6/30/2020

3/31/2020

SECURITIES

AVAILABLE FOR SALE

U.S. Government agency obligations

$

17,349

$

18,041

$

19,011

$

19,898

$

21,190

Obligations of states and political

subdivisions

5,798

5,835

8,315

11,176

23,572

Mortgage-backed securities

Residential mortgage pass-through

securities

Guaranteed by GNMA

52,406

56,862

62,156

69,637

71,971

Issued by FNMA and FHLMC

1,749,144

1,441,321

1,279,919

1,121,604

967,329

Other residential mortgage-backed

securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

345,869

419,437

500,858

574,940

634,075

Commercial mortgage-backed securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

167,110

50,319

52,469

86,898

115,642

Total securities available for sale

$

2,337,676

$

1,991,815

$

1,922,728

$

1,884,153

$

1,833,779

SECURITIES HELD

TO MATURITY

Obligations of states and political

subdivisions

$

26,554

$

26,584

$

31,605

$

31,629

$

31,758

Mortgage-backed securities

Residential mortgage pass-through

securities

Guaranteed by GNMA

7,268

7,598

8,244

10,306

10,492

Issued by FNMA and FHLMC

61,855

67,944

78,213

86,346

91,971

Other residential mortgage-backed

securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

324,360

360,361

399,400

435,333

463,175

Commercial mortgage-backed securities

Issued or guaranteed by FNMA, FHLMC, or

GNMA

73,701

75,585

93,818

96,434

106,880

Total securities held to maturity

$

493,738

$

538,072

$

611,280

$

660,048

$

704,276

At March 31, 2021, the net unamortized, unrealized loss included

in accumulated other comprehensive income (loss) in the

accompanying balance sheet for securities held to maturity

previously transferred from securities available for sale totaled

approximately $8.2 million ($6.2 million, net of tax).

Management continues to focus on asset quality as one of the

strategic goals of the securities portfolio, which is evidenced by

the investment of 98.0% of the portfolio in GSE-backed obligations

and other Aaa rated securities as determined by Moody’s. None of

the securities owned by Trustmark are collateralized by assets

which are considered sub-prime. Furthermore, outside of stock

ownership in the Federal Home Loan Bank of Dallas, Federal Home

Loan Bank of Atlanta and Federal Reserve Bank, Trustmark does not

hold any other equity investment in a GSE.

Note 3 – Loan Composition

LHFI consisted of the following during the periods

presented:

LHFI BY

TYPE

3/31/2021

12/31/2020

9/30/2020

6/30/2020

3/31/2020

Loans secured by real estate:

Construction, land development and other

land loans

$

1,342,088

$

1,309,039

$

1,385,947

$

1,277,277

$

1,136,389

Secured by 1-4 family residential

properties

1,742,782

1,741,132

1,775,400

1,813,525

1,852,065

Secured by nonfarm, nonresidential

properties

2,799,195

2,709,026

2,707,627

2,610,392

2,575,422

Other real estate secured

1,135,005

1,065,964

887,792

884,815

838,573

Commercial and industrial loans

1,323,277

1,309,078

1,398,468

1,413,255

1,476,777

Consumer loans

153,267

161,174

160,960

161,620

170,678

State and other political subdivision

loans

1,036,694

1,000,776

935,349

931,536

938,637

Other loans

451,396

528,335

596,185

567,386

579,379

LHFI

9,983,704

9,824,524

9,847,728

9,659,806

9,567,920

ACL LHFI

(109,191

)

(117,306

)

(122,010

)

(119,188

)

(100,564

)

Net LHFI

$

9,874,513

$

9,707,218

$

9,725,718

$

9,540,618

$

9,467,356

TRUSTMARK CORPORATION AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIALS March 31, 2021 ($ in

thousands) (unaudited)

Note 3 – Loan Composition (continued)

The following table presents the LHFI composition by region at

March 31, 2021 and reflects each region’s diversified mix of

loans:

March 31, 2021

LHFI -

COMPOSITION BY REGION

Total

Alabama

Florida

Mississippi

(Central and

Southern

Regions)

Tennessee

(Memphis, TN and

Northern MS

Regions)

Texas

Loans secured by real estate:

Construction, land development and other

land loans

$

1,342,088

$

497,839

$

65,032

$

315,127

$

40,117

$

423,973

Secured by 1-4 family residential

properties

1,742,782

112,699

37,777

1,509,503

69,371

13,432

Secured by nonfarm, nonresidential

properties

2,799,195

765,496

263,877

976,949

181,688

611,185

Other real estate secured

1,135,005

325,951

6,139

418,988

19,910

364,017

Commercial and industrial loans

1,323,277

203,778

22,980

621,592

290,619

184,308

Consumer loans

153,267

22,501

7,755

100,323

19,232

3,456

State and other political subdivision

loans

1,036,694

95,707

35,179

684,640

45,335

175,833

Other loans

451,396

79,979

13,016

279,520

64,796

14,085

Loans

$

9,983,704

$

2,103,950

$

451,755

$

4,906,642

$

731,068

$

1,790,289

CONSTRUCTION,

LAND DEVELOPMENT AND OTHER LAND LOANS BY REGION

Lots

$

67,471

$

21,575

$

11,036

$

26,266

$

1,373

$

7,221

Development

110,837

42,509

610

42,838

13,709

11,171

Unimproved land

108,607

33,232

14,333

31,363

11,568

18,111

1-4 family construction

255,987

117,406

22,312

71,072

12,495

32,702

Other construction

799,186

283,117

16,741

143,588

972

354,768

Construction, land development and other

land loans

$

1,342,088

$

497,839

$

65,032

$

315,127

$

40,117

$

423,973

LOANS SECURED BY

NONFARM, NONRESIDENTIAL PROPERTIES BY REGION

Non-owner occupied:

Retail

$

400,595

$

162,007

$

31,393

$

106,249

$

25,339

$

75,607

Office

236,662

68,374

26,516

64,074

12,449

65,249

Hotel/motel

352,191

150,807

90,266

51,443

36,164

23,511

Mini-storage

135,538

23,176

2,392

62,461

390

47,119

Industrial

201,182

47,521

18,356

47,369

419

87,517

Health care

41,973

21,803

1,194

16,417

383

2,176

Convenience stores

16,773

3,289

200

3,134

373

9,777

Nursing homes/senior living

158,489

71,123

—

42,050

6,760

38,556

Other

78,407

10,075

7,261

25,585

8,846

26,640

Total non-owner occupied loans

1,621,810

558,175

177,578

418,782

91,123

376,152

Owner-occupied:

Office

163,874

40,240

44,295

37,566

8,662

33,111

Churches

102,001

21,454

6,586

50,270

10,030

13,661

Industrial warehouses

177,666

12,410

3,169

49,610

17,122

95,355

Health care

141,491

26,787

7,525

94,096

2,327

10,756

Convenience stores

136,175

17,369

9,348

65,479

531

43,448

Retail

69,585

14,050

6,670

23,696

10,512

14,657

Restaurants

56,319

4,267

4,394

32,341

15,025

292

Auto dealerships

56,449

7,033

274

23,599

25,543

—

Nursing homes/senior living

176,746

58,770

—

117,976

—

—

Other

97,079

4,941

4,038

63,534

813

23,753

Total owner-occupied loans

1,177,385

207,321

86,299

558,167

90,565

235,033

Loans secured by nonfarm, nonresidential

properties

$

2,799,195

$

765,496

$

263,877

$

976,949

$

181,688

$

611,185

TRUSTMARK CORPORATION AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIALS March 31, 2021 ($ in

thousands) (unaudited)

Note 4 – Subordinated Notes

During the fourth quarter of 2020, Trustmark agreed to issue and

sell $125.0 million aggregate principal amount of its 3.625%

Fixed-to-Floating Rate Subordinated Notes (the Notes) due December

1, 2030. At March 31, 2021, the carrying amount of the Notes was

$122.9 million. The Notes are unsecured obligations and are

subordinated in right of payment to all of Trustmark’s existing and

future senior indebtedness, whether secured or unsecured. The Notes

are obligations of Trustmark only and are not obligations of, and

are not guaranteed by, any of its subsidiaries, including TNB. From

the date of issuance until November 30, 2025, the Notes bear

interest at a fixed rate of 3.625% per year, payable semi-annually

in arrears on June 1 and December 1 of each year. Beginning

December 1, 2025, the Notes will bear interest at a floating rate

per year equal to the Benchmark rate, which is the Three-Month Term

Secured Overnight Financing Rate (SOFR), plus 338.7 basis points,

payable quarterly in arrears on March 1, June 1, September 1 and

December 1 of each year. The Notes qualify as Tier 2 capital for

Trustmark. The Notes may be redeemed at Trustmark’s option under

certain circumstances. Trustmark intends to use the net proceeds

for general corporate purposes.

Note 5 – Yields on Earning Assets and Interest-Bearing

Liabilities

The following table illustrates the yields on earning assets by

category as well as the rates paid on interest-bearing liabilities

on a tax equivalent basis:

Quarter Ended

3/31/2021

12/31/2020

9/30/2020

6/30/2020

3/31/2020

Securities – taxable

1.40

%

1.62

%

2.02

%

2.16

%

2.25

%

Securities – nontaxable

4.02

%

3.89

%

3.80

%

3.58

%

3.85

%

Securities – total

1.43

%

1.65

%

2.05

%

2.18

%

2.28

%

PPP loans

6.27

%

6.76

%

2.84

%

2.65

%

—

Loans - LHFI & LHFS

3.67

%

3.75

%

3.81

%

4.03

%

4.54

%

Loans - total

3.81

%

3.99

%

3.73

%

3.93

%

4.54

%

Fed funds sold & reverse

repurchases

—

—

1.32

%

—

—

Other earning assets

0.12

%

0.12

%

0.18

%

0.11

%

1.59

%

Total earning assets

3.00

%

3.35

%

3.26

%

3.39

%

4.06

%

Interest-bearing deposits

0.22

%

0.27

%

0.31

%

0.37

%

0.71

%

Fed funds purchased & repurchases

0.14

%

0.13

%

0.15

%

0.16

%

1.02

%

Other borrowings

2.14

%

1.61

%

1.19

%

2.09

%

2.35

%

Total interest-bearing liabilities

0.28

%

0.30

%

0.33

%

0.39

%

0.75

%

Net interest margin

2.81

%

3.15

%

3.03

%

3.12

%

3.52

%

Net interest margin excluding PPP loans

and the FRB balance

2.99

%

3.09

%

3.20

%

3.35

%

3.55

%

Reflected in the table above are yields on earning assets and

liabilities, along with the net interest margin which equals

reported net interest income-FTE, annualized, as a percent of

average earning assets. In addition, the table includes net

interest margin excluding PPP loans and the balance held at the

Federal Reserve Bank of Atlanta (FRB), which equals reported net

interest income-FTE excluding interest income on PPP loans and the

FRB balance, annualized, as a percent of average earning assets

excluding average PPP loans and the FRB balance.

At March 31, 2021 and December 31, 2020, the average FRB balance

totaled $1.618 billion and $814.2 million, respectively, and is

included in other earning assets in the accompanying average

consolidated balance sheets.

The net interest margin excluding PPP loans and the FRB balance

totaled 2.99% for the first quarter of 2021, a decrease of 10 basis

points when compared to the fourth quarter of 2020. Continued low

interest rates decreased the yield on the loans held for investment

and held for sale portfolio as well as the securities portfolio and

were partially offset by lower costs of interest-bearing

deposits.

Note 6 – Mortgage Banking

Trustmark utilizes a portfolio of exchange-traded derivative

instruments, such as Treasury note futures contracts and option

contracts, to achieve a fair value return that offsets the changes

in fair value of mortgage servicing rights (MSR) attributable to

interest rates. These transactions are considered freestanding

derivatives that do not otherwise qualify for hedge accounting

under generally accepted accounting principles (GAAP). Changes in

the fair value of these exchange-traded derivative instruments,

including administrative costs, are recorded in noninterest income

in mortgage banking, net and are offset by the changes in the fair

value of the MSR. The MSR fair value represents the present value

of future cash flows, which among other things includes decay and

the effect of changes in interest rates. Ineffectiveness of hedging

the MSR fair value is measured by comparing the change in value of

hedge instruments to the change in the fair value of the MSR asset

attributable to changes in interest rates and other market driven

changes in valuation inputs and assumptions. The impact of this

strategy resulted in a net positive ineffectiveness of $270

thousand during the first quarter of 2021.

TRUSTMARK CORPORATION AND SUBSIDIARIES NOTES TO

CONSOLIDATED FINANCIALS March 31, 2021 ($ in

thousands) (unaudited)

Note 6 – Mortgage Banking (continued)

The following table illustrates the components of mortgage

banking revenues included in noninterest income in the accompanying

income statements:

Quarter Ended

3/31/2021

12/31/2020

9/30/2020

6/30/2020

3/31/2020

Mortgage servicing income, net

$

6,181

$

6,227

$

5,742

$

5,893

$

5,819

Change in fair value-MSR from runoff

(5,103

)

(5,177

)

(4,590

)

(4,214

)

(2,607

)

Gain on sales of loans, net

19,456

28,014

34,472

34,078

14,339

Mortgage banking income before hedge

ineffectiveness

20,534

29,064

35,624

35,757

17,551

Change in fair value-MSR from market

changes

13,696

951

60

(3,159

)

(23,999

)

Change in fair value of derivatives

(13,426

)

(1,860

)

755

1,147

33,931

Net positive (negative) hedge

ineffectiveness

270

(909

)

815

(2,012

)

9,932

Mortgage banking, net

$

20,804

$

28,155

$

36,439

$

33,745

$

27,483

Note 7 – Other Noninterest Income and Expense

Other noninterest income consisted of the following for the