false

0001905956

0001905956

2024-11-27

2024-11-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 27, 2024

TREASURE GLOBAL INC

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41476 |

|

36-4965082 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

276 5th Avenue, Suite 704 #739

New York, New York |

|

10001 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

+6012 643 7688

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 per share |

|

TGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On November 27, 2024, Treasure Global Inc (the

“Company”) entered into a subscription agreement (the “Subscription Agreement”) with certain investors (the “Investors”).

Pursuant to the Subscription Agreement, the Investors agreed to invest an aggregate amount of $1,177,000.00 (the “Investment Amount”)

into the Company for 3,566,668 shares of the Company’s common stock (the “Offered Shares”), par value $0.00001 at a

negotiated purchase price of $0.33 (the “Offering”).The Investment Amount shall become due and payable when Offered Shares

are registered under an effective Registration Statement filed by the Company with the Securities Exchange Commission. Investors shall

make the payment within seven (7) days from the date of the Subscription Agreement. The Offering is expected to close on November 29,

2024, subject to the satisfaction of customary closing conditions.

All amounts payable by the Investor under this

Subscription Agreement shall be paid in full, and in the currency mutually agreed upon, and free of and without any deduction or withholding

for any current or future taxes, levies, duties, charges or other deductions or withholdings levied in any jurisdiction from or through

which payment is made. The Company intends to use the net proceeds from this Offering for working capital and general corporate purposes.

The Subscription Agreements contain representations,

warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company, other obligations

of the parties and termination provisions. The representations, warranties and covenants contained in the Subscription Agreements were

made only for the purposes of such agreements and as of the specific dates, were solely for the benefit of the parties to such agreements

and may be subject to limitations agreed upon by the contracting parties.

The Offered Shares are being sold pursuant to

a prospectus supplement dated November 27, 2024 and accompanying base prospectus dated March 29, 2024. The prospectus supplement and accompanying

base prospectus are related to the Company’s effective registration statement on Form S-3 (Registration Statement No. 333-278171)

that was originally filed with the Securities and Exchange Commission on March 22, 2024, and which was declared effective on March 29,

2024.

Capitalized terms used herein and not otherwise

defined are defined as set forth in the Subscription Agreement. The description of the Subscription Agreement contained in this Current

Report on Form 8-K does not purport to be complete and is qualified by reference to the copy of the Subscription Agreement filed as Exhibit

10.1 to this Current Report on Form 8-K.

Item 8.01. Other Events

On November 27, 2024, we filed the Prospectus

Supplement, dated as of November 27, 2024 under the registration statement on Form S-3 (File No. 333-278171), in respect of the financing

with the Investors. The Prospectus Supplement included certain updated disclosures regarding the Company, in particular, in the sections

captioned “Prospectus Supplement Summary-Recent Developments”. In addition, the Company is filing, as exhibits hereto, an

opinion of Sichenzia Ross Ference Carmel LLP as Exhibit 5.1 and the consent of WWC, P.C., as Exhibit 5.1 and Exhibit 23.1, respectively.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 27, 2024 |

TREASURE GLOBAL INC. |

| |

|

|

| |

By: |

/s/ Carlson Thow |

| |

Name: |

Carlson Thow |

| |

Title: |

Chief Executive Officer |

2

Exhibit 5.1

November 27, 2024

Treasure Global Inc

276 5th Avenue, Suite 704 #739

New York, New York

Re: TREASURE GLOBAL INC

Ladies and Gentlemen,

We have acted as counsel to Treasure Global Inc, a Delaware corporation

(the “Company”), in connection with the issuance of this opinion that relates to the a prospectus supplement dated November

27, 2024 and the accompanying base prospectus dated March 29, 2024 (together, the “Prospectus”) filed by the Company with

the Securities and Exchange Commission pursuant to Rule 424(b)5) under the Securities Act of 1933, as amended (the “Securities Act”).

The Prospectus is related to the Company’s Registration Statement on Form S-3 (No. 333-278171). The Prospectus covers the sale,

by the Company to certain investors of 3,566,668 shares (the “Shares”) of common stock, par value $0.00001 per share, of the

Company (“Common Stock”) at a negotiated purchase price of $0.33 per share of Common Stock, pursuant to a subscription agreement

(the “Subscription Agreement”) among the Company and certain Investors, dated as of November 27, 2024.

This opinion letter is being

delivered in accordance with the requirements of Item 601(b)(5)(i) of Regulation S-K under the Securities Act, and no opinion is expressed

herein as to any matter pertaining to the contents of the Registration Statement.

In connection with the issuance

of this opinion letter, we have examined originals or copies, certified or otherwise identified to our satisfaction, of such records of

the Company and such agreements, certificates and receipts of public officials, certificates of officers or other representatives of the

Company and others, and such other documents as we have deemed necessary or appropriate as a basis for the opinions stated below. As to

any facts relevant to the opinions stated herein that we did not independently establish or verify, we have relied upon statements and

representations of officers and other representatives of the Company and of public officials.

In our examination, we have

assumed (i) the genuineness of all signatures, including endorsements, (ii) the legal capacity and competency of all natural persons,

(iii) the authenticity of all documents submitted to us as originals, (iv) the conformity to original documents of all documents submitted

to us as facsimile, electronic, certified or photostatic copies, and the authenticity of the originals of such copies and (v) the accuracy,

completeness and authenticity of certificates of public officials.

Based upon the foregoing and

subject to the qualifications and assumptions stated herein, we are of the opinion that the Shares have been duly authorized by all requisite

corporate action on the part of the Company under the Delaware General Corporation Law (“DGCL”) and, when the Shares are delivered

and paid for in accordance with the terms of the Purchase Agreement and when evidence of the issuance thereof is duly recorded in the

Company’s books and records, the Shares will be validly issued, fully paid and non-assessable.

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Our opinion is expressly limited

to the matters set forth above, and we render no opinion, whether by implication or otherwise, as to any other matters relating to the

Company, the Shares, the Purchase Agreement or any other agreements or transactions that may be related thereto or contemplated thereby.

We are expressing no opinion as to any obligations that parties other than the Company may have under or in respect of the Shares or as

to the effect that their performance of such obligations may have upon any of the matters referred to above. No opinion may be implied

or inferred beyond the opinion expressly stated above.

The opinion we render herein

is limited to those matters governed by the DGCL as of the date hereof and we disclaim any obligation to revise or supplement the opinion

rendered herein should the above-referenced laws be changed by legislative or regulatory action, judicial decision or otherwise. We express

no opinion as to whether, or the extent to which, the laws of any particular jurisdiction apply to the subject matter hereof.

This opinion letter is rendered

as of the date first written above, and we disclaim any obligation to advise you of facts, circumstances, events or developments that

hereafter may be brought to our attention or that may alter, affect or modify the opinion expressed herein.

We hereby consent to the filing

of this opinion as an exhibit to the Registration Statement. We also hereby consent to the reference to our firm under the heading “Legal

Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons

whose consent is required under Section 7 of the Securities Act or the General Rules and Regulations under the Securities Act. It is understood

that this opinion is to be used only in connection with the offer and sale of the Shares being registered while the Registration Statement

is effective under the Securities Act.

| Very truly yours, |

|

| |

|

| |

/s/ Sichenzia Ross Ference Carmel LLP |

| |

|

| |

Sichenzia Ross Ference Carmel LLP |

1185 AVENUE OF THE AMERICAS

| 31ST FLOOR | NEW YORK, NY | 10036

T (212) 930-9700 | F (212) 930-9725 | WWW.SRFC.LAW

Exhibit

10.1

Subscription Agreement

Dated

27 November 2024

(1)

TREASURE GLOBAL INC

(Registration

No. 790821)

(“Company” or “TGL”)

AND

(2)

V INVESCO FUND (L) LIMITED

(Registration

No: LL17636)

(“VIFL”)

AND

(3)

CHAI JIA MIN

(NRIC

No: 960730-13-5184)

(“CJM”)

SUBSCRIPTION

AGREEMENT

THIS

SUBSCRIPTION AGREEMENT is made on 27 November 2024.

BETWEEN

| (1) | TREASURE

GLOBAL INC (Registration No. 790821), a company incorporated in Delaware and having an

address for service at 276, 5th Avenue Suite, 704 #739 New York, NY 10001, United States

(“Company” or “TGL”) of the first part; |

AND

| (2) | V

INVESCO FUND (L) LIMITED (Registration No: LL17636), a company incorporated in the Federal

Territory of Labuan Malaysia and having its registered office at Lot A020, Level 1, Podium

Level, Financial Park, Jalan Merdeka, 87000 Labuan, Wilayah Persekutuan, Malaysia (“VIFL”)

of the second part; and |

AND

| (3) | CHAI

JIA MIN (NRIC No: 960730-13-5184), a Malaysian citizen having an address for service

at No. 19, Jalan SP 6/7, Taman Segar Perdana, 56100 Cheras, Kuala Lumpur, Wilayah Persekutuan,

Malaysia (“CJM”) of the third part. |

(VIFL

and CJM shall hereinafter be referred to each as an “Investor” and collectively, as “Investors”.

TGL and the Investors shall hereinafter be referred to each as “Party” and collectively as “Parties”.)

RECITALS

| (A) | The

Company is a Malaysian solutions provider developing innovative technology platforms. |

| (B) | The

Parties hereby agree that the Investors shall invest an aggregate amount of USD 1,177,000.00

(United States Dollar One Million One Hundred and Seventy-Seven Thousand) (“Investment

Amount”) into the Company for the Sale Shares which will be issued to the Investors

and that the Investment Amount shall be payable to the Company subject to and upon the terms

and conditions of this Agreement. |

OPERATIVE

PROVISIONS

In

this Agreement unless there is something in the subject or context inconsistent with such construction or unless it is otherwise expressly provided:-

| Agreement | means

this Agreement concerning the Sale Shares of TGL, in which includes all schedules and appendices

hereunder; |

| | | |

| | Business

Day | means

a day, excluding Saturday, Sunday or public holiday (gazetted or ungazetted and whether scheduled

or unscheduled) on which banks and financial institutions are open for business in Kuala

Lumpur; |

| Claim | Includes,

amongst others, any notice, demand, assessment, letter or other document issued or action

taken by the fiscal authorities in Malaysia or other statutory or governmental authority,

body or official whatsoever whereby the Company is or may be placed or sought to be placed

under a liability to make payment or deprived of any relief, allowance, credit or repayment

otherwise available; |

| Completion | means

the completion of the subscription of Sale Shares by the Investor, and allotment and issuance

of the Sale Shares in accordance with Clause 5 of this Agreement; |

| | | |

| | Completion

Date | means

within fourteen (14) days from the Unconditional Date or such other date the Parties may agree in writing; |

| | | |

| | Investment

Amount | has

the meaning as ascribed thereto in Recital (B); |

| | | |

| | Material Adverse

Change | means

an event or circumstance that constitutes a material adverse change in the business, assets,

financial or operation position or prospects of TGL and its group of companies; |

| Parties | means

collectively, the Investor and the Company and the expression “Party”

shall refer to any one of them as the context may require; |

| | | |

| | Registration

Statement | means

a registration statement on Form S-1 or Form S-3 covering the resale by the Investor of the

Sale Shares; |

| | | |

| | Sale

Shares | means

3,566,668 TGL Shares at a determined issuance price of USD0.33 (United States Dollar Thirty-Three

Cents) per TGL Share; |

| SEC | means

the United States Securities and Exchange Commission; |

| | | |

| | Unconditional

Date | has

the meaning as ascribed thereto in Clause 4; and |

| Warranties | means

the representations and warranties of the Company as set out in this Agreement, including

but not limited to the representations and warranties set out in Clause 6. |

| 2.1 | In

this Agreement, words importing the singular or the masculine gender will include the plural

or the feminine/neuter genders or vice versa and references to persons include any individual,

company, corporation, firm, partnership, joint venture, association, organisation, trust,

state or agency of a state. |

| 2.2 | The

headings and sub-headings in this Agreement are inserted for convenience only and are to

be ignored when construing the provisions of this Agreement. |

| 2.3 | Any

reference to statutes and rules made include any amendment, modification, consolidation or

re-enactment in force from time to time and any statutory instrument or regulations made

under it. |

| 2.4 | Any

reference to “law” includes common law and any constitution, decree, judgment,

legislation, order, ordinance, regulation, statute, treaty or other legislative measure in

any jurisdiction or any present or future directive, regulation, request or requirement (in

each case, whether or not having the force of law, the compliance with which is in accordance

with the general practice of person to whom the directive, regulation, request or requirement

is addressed). |

| 2.5 | A

period of days from the occurrence of any event or the performance of any act or thing shall

be deemed to exclude the day on which the event happens or the act or thing is done or to

be done (and will be reckoned from the day immediately following such event or act or thing),

and if the last day of the period is not a Business Day, then the period shall include the

next following day which is a Business Day. |

The

Investors hereby agrees to subscribe USD1,177,000.00 (United States Dollar One Million One Hundred and Seventy-Seven Thousand) worth

of Sale Shares, to be allocated in the following portion:

| Name

of Investor | |

Amount

(USD) | | |

No.

of TGL Shares | |

| VIFL | |

| 921,212 | | |

| 2,791,552 | |

| CJM | |

| 255,788 | | |

| 775,116 | |

| Total | |

| 1,177,000 | | |

| 3,566,668 | |

The

Company agrees to allot and issue the Sale Shares to the Investors in accordance with the terms and conditions as set out in this Agreement.

Unless

otherwise provided, Investment Amount shall become due and payable upon the effectiveness of a Registration Statement filed by the Company

with the SEC. The Company shall notify the Investors once the Registration Statement becomes effective, and the Investors shall make

the payment within Seven (7) days from the date of this Agreement.

Upon

the payment being made, the date shall be considered the “Unconditional Date”. Any indulgence granted by the Company

in respect of the amounts payable herein should not constitute a waiver of or prejudice the Company’s rights thereto.

All

amounts payable by the Investor under this engagement shall be paid in full, and in the currency mutually agreed upon, and free of and

without any deduction or withholding for any current or future taxes, levies, duties, charges or other deductions or withholdings levied

in any jurisdiction from or through which payment is made.

All

amounts payable by the Investors to the Company shall be deposited into the designated bank account.

| 5.1 | Completion

Arrangement |

| 5.1.1 | Completion

for the Sale Shares shall take place on the Completion Date. |

| 5.1.2 | On

or before the Completion Date, the Investors shall pay the Investment Amount for the Sale

Shares to the Company or such other person as may be nominated and/or authorised by the Company

in writing and, in exchange thereof, TGL shall deliver to each Investor on the Completion

Date the below including that:- |

| (a) | the

relevant book-entry transfer or the electronic record representing the Sale Shares, which

will be deposited into an account held by the Investor and/or its nominees; and |

| (b) | the

registration of the Investor as the holder of the Sale Shares, which will be reflected through

the Investor’s brokerage account or an account specified by the Investor. |

| 5.2 | Breach

of Completion Obligations |

If

the foregoing provisions of Clause 5.1 are not fully complied with by the Investor by or on the Completion Date, the Company shall be

entitled (in addition to and without prejudice to all other rights or remedies available, including the right to claim damages) by written

notice to the Investor served on such date:

| 5.2.1 | to

terminate this Agreement (other than the surviving provisions) without liability on its part; |

| 5.2.2 | to

effect Completion so far as practicable having regard to the defaults which have occurred;

or |

| 5.2.3 | to

fix a new date for Completion in which case the provisions of this Clause 5.2 shall apply

to Completion as so deferred but provided such deferral may only occur once. |

| 6.1 | Warranties

of the Company |

| 6.1.1 | The

Company warrants and represents to the Investors:- |

| (a) | that

the statements contained in this Agreement are true and accurate in all respects; |

| (b) | that

no order has been made or petition has been presented for the winding-up of TGL; |

| (c) | that

the Company is duly incorporated under the laws of the State of Delaware and has the power

and capacity to enter into and to execute all relevant documents pertaining to this Agreement

and all necessary corporate, governmental and other approvals have been obtained to enable

the Company to perform the terms and conditions as set out in this Agreement; |

| (d) | that

the Sale Shares are free from encumbrances; |

| (e) | that

the Sale Shares will be validly issued; |

| (f) | that

all actions, conditions and things required to be taken, fulfilled and done (including without

limitation the obtaining of any necessary consents or license or the making of any filing

or registration) (i) in order to enable them to lawfully enter into, exercise its rights

and perform and comply with their obligations under this Agreement and to ensure that those

obligations are legally binding and enforceable and (ii) for the issuance of the Sale Shares,

are fulfilled and done; and |

| (g) | that

there are no current or pending legal proceedings against the Company or any of their directors

or shareholders. |

| 6.2 | Warranties

of the Investor |

Each

Investor warrants and represents to the Company:

| 6.2.1 | that

the Investor has full knowledge of and undertakes that:- |

| (a) | the

Sale Shares involves risks as the return to the Investors is depending upon the performance

of TGL and that the Investor shall take full cognizance of all risks in connection with the

Sale Shares; and |

| (b) | any

projections, predictions, information and/or materials, made available to the Investor in

connection with the Sale Shares, are derived from TGL’s reasonable estimation, assumptions

and/or forecasts and, are made available without representations or warranties as to its

accuracy and or completeness. The Investor hereby expressly agrees that any reliance upon

or conclusions drawn therefrom shall be at such Investor’s own risk and shall not give

rise to any liability of or against the Company. |

| 6.2.2 | that

the Investor shall undertake to meet all the terms and conditions stipulated herein; |

| 6.2.3 | that

the Investor agrees to abide by and comply with all relevant anti-money laundering laws and

regulations that are in force and to ensure that by subscribing to the Sale Shares will not

be in breach of any laws and regulations that are in force from time to time; and |

| 6.2.4 | that

the Investor has read and fully understand the terms and conditions of this Agreement and

that the Investor has obtained advice from Investor’s advisors independent from the

Company and TGL, including but not limited to, the Investor’s personal investment,

tax and/or legal advisors prior to the subscription of the Sale Shares and the Investor did

not rely on any other representation(s) and/or information(s) that is/are inconsistent with

the terms and conditions herein. |

| 7.1 | Notwithstanding

any other provision of this Agreement, each Investor undertakes to indemnify and hold harmless

the Company, TGL and its Directors, officers, members, and advisors, whether individually

and/or collectively, from and against all losses, liabilities, obligations, damages, Claims,

proceedings, costs, expenses and/or whatsoever which may incur by reason of:- |

| (a) | the

failure of the Investor to fulfill any of the terms and conditions set out in this Agreement; |

| (b) | any

breach or inaccuracy in any of the representations, warranties and/or covenants made by the

Investor in connection with this Agreement; or |

| (c) | any

action, suit or proceeding based upon the fact that the Investor’s representations, warranties

and/or covenants were inaccurate or misleading or otherwise cause for obtaining damages or

redress from the Company or TGL. |

Save

as otherwise contemplated in this Agreement, the Company hereby undertakes to the Investors that:-

| (a) | it

will promptly furnish to the Investor such information as the Investor may reasonably require

from time to time of TGL; and |

| (b) | it

shall within a period of fourteen (14) Business Days report any Material Adverse Change of

which the Company (have constructive knowledge of) in the prospects, business, operations

or financial condition of TGL in writing to the Investor. |

A

notice or other communication required or permitted, under this Agreement, to be served on a person must be in writing and may be served:-

| (a) | by

way of personal service; |

| (b) | by

way of leaving it at the person’s current address for service; |

| (c) | by

way of post, postage prepaid; or |

| 9.2 | Particulars

for Service |

| 9.2.1 | The

particulars for service of the Investor and the Company are as stipulated above. |

| 9.2.2 | Any

Party may change its particulars for service by way of written notice to the other. |

A

notice or other communication is deemed served:

| 9.3.1 | if

given or made by facsimile immediately; or |

| 9.3.2 | if

given or made by hand when dleft at the address required by Clause 9.2 above; or |

| 9.3.3 | if

given by post, THREE (3) Business Days after posting and in proving the same it shall be

sufficient to show that the envelope containing the same was duly addressed, stamped and

posted. |

| 10.1 | Governing

Law and Jurisdiction |

This

Agreement is governed by and is to be construed in accordance with the laws of Malaysia. Each party irrevocably and unconditionally submits

to the non-exclusive jurisdiction of the courts of Malaysia and waives any right to object to proceedings being brought in those courts.

Time

is of the essence as regards all dates, periods of time and times specified in this Agreement.

| 10.3 | Waiver

and Exercise of Rights |

| 10.3.1 | Notwithstanding

any provisions stated herein, a single or partial exercise or waiver of a right relating

to this Agreement does not prevent any other exercise of that right or the exercise of any

other right. |

| 10.3.2 | No

party will be liable for any loss or expenses incurred by another party caused or contributed

to by the waiver, exercise, attempted exercise, failure to exercise or delay in the exercise

of a right. |

The

Parties covenant with each other that they will respectively sign execute and do and procure all other persons or companies, if necessary,

to execute and do all such further deeds, assurance, acts and things as may be necessary to give valid effect to the terms and conditions

of this Agreement.

This

Agreement binds the heirs, personal representatives, successors- in-title, assigns or nominees, as the case may be, of the Parties and

may be signed in counterparts. If signed by the Parties in respective counterparts, this Agreement is deemed to have been duly executed

by relevant Parties and will come into full force and effect.

| 10.6 | Illegality

and Severability of Provisions |

| 10.6.1 | The

illegality, invalidity or unenforceability of any provision of this Agreement under the law

of any jurisdiction will not affect its legality, validity or enforceability under the law

of any other jurisdiction, nor the legality, validity or enforceability of any other provision. |

| 10.6.2 | If

a provision in this Agreement is held to be illegal, invalid, void, voidable or unenforceable,

that provision must be read down to the extent necessary to ensure that it is not illegal,

invalid, void, voidable or unenforceable. |

| 10.6.3 | If

it is not possible to read down the provision as required in this clause, that provision

is severable without affecting the validity or enforceability of the remaining part of that

provision or the other provisions in this Agreement. |

| 10.7.1 | The

Company shall bear all costs and expenses incurred in the preparation and execution of this

Agreement. |

| 10.7.2 | Notwithstanding

the Company’s foregoing obligation above, each Party shall bear its own costs and/or

expenses incurred from any disputes arising out of or in connection with this Agreement,

unless otherwise stipulated or agreed. |

This

Agreement constitute the entire agreement and understanding between the Parties with respect to the subject matter and supersedes all

previous term sheets, proposals, representations, warranties, agreements relating thereto whether oral, written or otherwise and no Party

shall modify this Agreement unless with the written consent of all Parties.

(The

remainder of this page is intentionally left blank)

| EXECUTED BY the Parties as an agreement on the date first stated hereof: |

| |

|

|

| Company |

|

|

| |

|

|

| Signed by |

) |

|

| for and on behalf of |

) |

|

| TREASURE GLOBAL INC |

) |

|

| (Registration No. 790821) |

) |

/s/ Carlson Thow |

| |

|

Name: Carlson Thow

Designation: CEO and Director |

| |

|

|

| Investor Subscribing to 2,791,552 TGL Shares |

| |

|

|

| Signed by |

) |

|

| For and on behalf of |

) |

|

| V INVESCO FUND (L) LIMITED |

) |

|

| (Registration No: LL17636) |

) |

/s/ Ang Zhi Feng |

| |

|

Name: Ang Zhi Feng

Designation: Director |

| |

|

|

| Investor Subscribing to 775,115 TGL Shares |

| |

|

|

| Signed by |

) |

|

| |

) |

|

| CHAI JIA MIN |

) |

|

| (NRIC No: 960730-13-5184) |

) |

/s/ CHAI JIA MIN |

11

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We hereby consent to incorporation by reference

in this Registration Statement on Form S-3 (No. 333-278171) of Treasure Global Inc and its subsidiaries (collectively the “Company”)

of our report dated September 30, 2024 included in this Company’s annual report on Form 10-K, relating to the audit of the consolidated

balance sheets of the Company as of June 30, 2024 and 2023, and the related consolidated statement of operations and comprehensive loss,

changes in stockholders’ deficiency, and cash flows in each of the year for the two years period ended June 30, 2024 and the related

notes included herein.

We also consent to the reference of WWC, P.C.

as an independent registered public accounting firm, as experts in matters of accounting and auditing.

| |

/s/ WWC, P.C. |

| San Mateo, California |

WWC, P.C. |

| November 27, 2024 |

Certified Public Accountants |

| |

PCAOB ID: 1171 |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

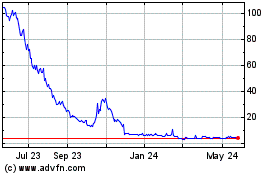

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

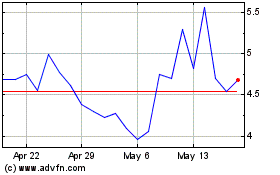

Treasure Global (NASDAQ:TGL)

Historical Stock Chart

From Feb 2024 to Feb 2025