By Heather Haddon

Kraft Heinz Co. named a new chief executive, appointing a fellow

veteran manager of companies backed by investment firm 3G Capital

LLC to succeed Bernardo Hees amid weak sales and a federal

investigation into the food giant's procurement practices.

Miguel Patricio, the former chief marketing officer of brewer

Anheuser-Busch InBev SA, where 3G is also a top investor, will

succeed Mr. Hees as chief executive on July 1, Kraft said

Monday.

Kraft hadn't previously unveiled a planned executive change or a

succession plan. Kraft has yet to enter into compensation

agreements with Messrs. Hees or Patricio, the company said in a

filing Monday. Kraft board chairman Alexandre Behring approached

Mr. Patricio about taking the top spot a few months ago, and the

board unanimously voted for his appointment, a company spokesman

said.

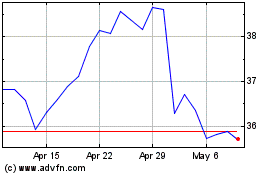

Shares in Kraft initially rose on Monday morning before edging

lower, and were off 0.4% at $32.83 by midafternoon. The company's

shares have fallen around 43% over the past year through Friday as

sales have stalled and the company has acknowledged its yearslong

cost-cutting drive undermined the value of some of its best-known

brands such as Oscar Mayer and Kraft cheese.

Kraft's problems are emblematic of troubles facing many of the

largest food companies as consumers migrate to new brands and

products perceived to fresher and more healthful. Many of Kraft's

competitors, such as Campbell Soup Co. and General Mills Inc. have

also struggled to maintain sales growth and keep their product

lines in step with current eating trends.

Mr. Patricio said he would shift Kraft's strategy to focus on

making the company's existing brands appeal more to consumers.

"Some are a little bit dusty and we have to rejuvenate them, Mr.

Patricio said in an interview.

He declined to discuss Kraft's plans to potentially divest

weaker brands, saying his job was to improve growth of the

company's existing products. He said he sees potential, in

particular, to boost sales of Planters nuts, Heinz products and

Philadelphia cream cheese.

"I'm not working to sell brands at this moment," he said. "I

just have plans to grow."

Kraft has recently divested some international brands such as

the Canadian natural cheese business it sold last year for around

$1.2 billion. The company has explored selling other brands. But in

recent months Kraft has focused on improving Oscar Mayer and other

brands, according to people familiar with the discussions.

Mr. Patricio has worked in the consumer-packaged goods industry

for more than 30 years, including stints at Coca-Cola Co. and

Johnson & Johnson.

At Anheuser-Busch, where he worked for more than two decades,

sales of its flagship Budweiser and Bud Light brands grew globally

but sank in the U.S. during Mr. Patricio's tenure. He spent years

focused on expanding the company's sales in China, but the brewer's

sales volumes fell overall in the U.S. as Anheuser-Busch faced the

same problems that have hurt Kraft: the growing preference among

many consumers for smaller, locally made beverage and food

brands.

"The growth of global brands is impressive but the U.S. has been

a point of pain," said Benj Steinman, president of the Beer

Marketer's Insights tracking firm. Mr. Patricio does bring more

outside brand-building expertise to Kraft than is common to other

3G executives, he said.

Mr. Patricio said his work promoting premium brands at

Anheuser-Busch will be relevant in helping Kraft improve. His most

recent work at the beer maker included oversight of its popular

"Dilly Dilly" ad campaign.

Mr. Patricio said the leadership change at Kraft, after Mr. Hees

led the company for six years, was a natural step in Kraft's

evolution under 3G, a Brazilian investment firm. 3G helped create

the firm through the 2015 merger of H.J. Heinz and Kraft Foods,

joining forces with Warren Buffett's Berkshire Hathaway Inc. to

form the fifth-largest food-and-beverage company in the world.

"He was the first one to admit that he was finishing this cycle

with the company and that the company would benefit from having a

person with a different background to lead it in the future," said

Mr. Patricio, who is 52 years old.

A Kraft spokesman said Mr. Hees decided to move back to 3G to

focus on other projects.

"I have confidence that Miguel and the team will take Kraft

Heinz to new heights," Mr. Hees, 49, said in a statement.

The firm's aggressive cost-cutting strategy, known as zero-base

budgeting, was emulated by many consumer-goods companies seeking to

boost profits before falling out of favor recently amid troubles at

Kraft and other proponents of the strategy.

Kraft's spending cuts left its brands in a weaker position to

compete on store shelves just as many consumers turned away from

many packaged goods. Sales fell, and Kraft cut some prices and

added salespeople to compete.

Since reporting in February that it had written down the value

of its Kraft and Oscar Mayer brands by some $15 billion, the

Chicago-based company has made some new investments in its

products.

Kraft earlier this month introduced a new variety of its

packaged meals called Brunchables. It also made an investment in

GrubMarket, a company focused on delivering locally grown foods,

and struck a deal with Farmstead, an online grocer.

Mr. Patricio declined to comment Monday on the Securities and

Exchange Commission's investigation into accounting practices in

Kraft's procurement division.

Kraft missed a February deadline to file its annual report with

securities regulators as it concludes an internal investigation

into those irregularities in its procurement department.

Kraft is also facing lawsuits in the wake of the write-downs,

including class-action suits from employees and shareholders

regarding losses related to the stock's drop. Kraft entered into an

agreement with its lenders to file its financial statements by May

14, it said in a filing last month.

--Jacob Bunge and Tripp Mickle contributed to this article.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

April 22, 2019 15:34 ET (19:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Aug 2024 to Sep 2024

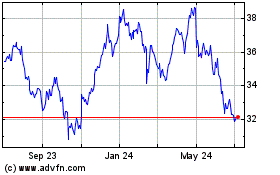

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Sep 2023 to Sep 2024