Current Report Filing (8-k)

May 05 2021 - 4:41PM

Edgar (US Regulatory)

false000171218900017121892021-05-042021-05-040001712189us-gaap:CommonStockMember2021-05-042021-05-040001712189th:WarrantsToPurchaseCommonStockMember2021-05-042021-05-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 5, 2021 (May 4, 2021)

TARGET HOSPITALITY CORP.

(Exact Name of Registrant as Specified in Its Charter)

001-38343

(Commission File Number)

|

Delaware

|

98-1378631

|

|

(State or Other Jurisdiction of Incorporation)

|

(I.R.S. Employer Identification No.)

|

2170 Buckthorne Place, Suite 440

The Woodlands, Texas 77380

(Address of principal executive offices, including zip code)

(800) 832-4242

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share

|

|

TH

|

|

The Nasdaq Stock Market LLC

|

Warrants to purchase common stock

|

|

THWWW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 4, 2021, the board of directors (the “Board”) of Target

Hospitality Corp. (the “Company”) approved the promotion of J. Travis Kelley from Senior Vice President – Operations to Executive Vice President –

Operations (“EVP”). As EVP, Mr. Kelley will continue to report directly to the Company’s Chief Executive Officer, will act as the Company’s principal

operating officer and will accordingly lead all operations including construction and catering/food services. In connection with such promotion, Mr. Kelley entered into an employment agreement with the Company, dated May 4, 2021(the “Kelley Agreement”), as approved by the Compensation Committee of the Board on May 4, 2021.

The Kelley Agreement provides for an initial employment term of 36 months, with automatic successive one year extensions after the end of the initial

term, unless either party provides a non-renewal notice to the other party at least 120 days before the expiration of the initial term or the renewal term, as applicable. Mr. Kelley’s agreement provides for an annual base salary of $250,000,

which he may elect to receive in whole in the form of restricted stock units. Mr. Kelley’s agreement provides for an annual cash performance bonus target of 65% of annual base salary and a long term incentive annual equity award with a target

grant value of $250,000. Mr. Kelley’s agreement also includes a 12 month non-competition and non-solicitation provision.

If Mr. Kelley’s employment is terminated other than for cause or good reason, he will be entitled to 12 months base salary plus a pro-rata bonus for the

year of termination, based on actual performance plus accrued and unpaid benefits and health insurance continuation for the severance period. In the event of a change in control, if Mr. Kelley is terminated other than for cause or with good

reason within 12 months of a change in control, he will be entitled to 100% of his base salary and his target annual bonus, as well as a lump sum payment of the costs that would be incurred by him for continued health insurance coverage during

the severance period, and vesting of any unvested time-based equity awards.

The foregoing description of the Kelley Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the

employment agreement with Mr. Kelley, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Biographical Information for J. Travis Kelley

Mr. Kelley, 45, has been with the Company since 2009. Prior to his promotion to EVP of Operations on May 4, 2021, Mr. Kelley served as the Company’s

Senior Vice President of Operations since 2017. In this role, he has overseen the management and operations of all of the Company’s communities across North America. Mr. Kelley began his time at the Company as Project Manager for the Bakken

region. From 2009 to 2017, Mr. Kelley served as Regional Vice President for the Rockies region during which time he oversaw the operations and management of 11 facilities and over 5,000 rooms. Mr. Kelley has over 20 years of experience in the

modular building industry. Mr. Kelley served as a member of the Williston, ND Chamber of Commerce for six years (three as Chairman) and on the board of the Greater North Dakota Chamber of Commerce for three years.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be

signed on its behalf by the undersigned, hereunto duly authorized.

3

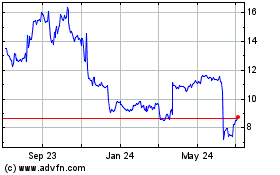

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Target Hospitality (NASDAQ:TH)

Historical Stock Chart

From Sep 2023 to Sep 2024