– On track to report initial data from

approximately 20 patients in SELECT-AML-1 trial in early December

2023 –

– Expect to report pivotal CR data from

SELECT-MDS-1 by mid-4Q 2024 –

– Founding CEO, Nancy Simonian, M.D. to retire

as CEO effective December 1, 2023; Conley Chee, CCO and CBO, to

succeed as CEO –

– Management to host a conference call at 8:30

a.m. ET today –

Syros Pharmaceuticals (NASDAQ: SYRS), a biopharmaceutical

company committed to advancing new standards of care for the

frontline treatment of hematologic malignancies, today reported

financial results for the quarter ended September 30, 2023 and

provided a corporate update.

“Syros is entering the fourth quarter well-positioned for its

next phase of growth. We are laser-focused on advancing

tamibarotene for the frontline treatment of hematologic

malignancies and look forward to reporting initial data from the

randomized portion of SELECT-AML-1 in early December, as well as

pivotal data from SELECT-MDS-1 next year,” said Nancy Simonian,

M.D., Chief Executive Officer of Syros. “This is precisely the

moment we hoped for when we started Syros over a decade ago: our

aim has always been to deliver profound benefit to people living

with serious diseases. In transitioning leadership to Conley, Syros

is taking a meaningful step toward achieving this vision,

installing a CEO with extensive commercial expertise and the skill

set necessary to effectively build and implement a successful

pre-launch and launch strategy. I look forward to continuing to

support Syros as a member of the Board of Directors, and to

partnering with Conley and our dedicated team as we progress our

clinical trials and, ultimately, work to establish tamibarotene as

the standard of care for HR-MDS and AML patients with RARA

overexpression.”

UPCOMING MILESTONES

Tamibarotene: Higher-Risk Myelodysplastic Syndrome

(HR-MDS)

- Complete enrollment of 190 patients necessary to support the

complete response (CR) primary endpoint analysis in the

SELECT-MDS-1 Phase 3 trial in newly diagnosed HR-MDS patients with

RARA gene overexpression in Q1 2024.

- Report pivotal complete response (CR) data from the

SELECT-MDS-1 Phase 3 trial in newly diagnosed HR-MDS patients with

RARA gene overexpression by mid-Q4 2024.

Tamibarotene: Acute Myeloid Leukemia (AML)

- Report initial data from approximately 20 patients from the

randomized portion of the SELECT-AML-1 Phase 2 trial in newly

diagnosed unfit AML patients with RARA overexpression. Syros plans

to share these data in a company-sponsored conference call and

webcast in early December 2023.

- Report additional data from SELECT-AML-1 in 2024.

RECENT PIPELINE HIGHLIGHTS

- In October 2023, Syros announced a strategic realignment to

prioritize key development and pre-launch activities to advance

tamibarotene for the frontline treatment of HR-MDS and AML. As a

result, Syros stopped further investment in the clinical

development of SY-2101, its novel, oral form of arsenic trioxide

(ATO) for the treatment of newly diagnosed acute promyelocytic

leukemia (APL), as well as in its preclinical and discovery-stage

programs. Syros may pursue further development of SY-2101 subject

to additional capital availability.

CORPORATE

- In October 2023, Syros announced the retirement as Chief

Executive Officer (CEO) of Nancy Simonian, M.D., effective December

1, 2023. Conley Chee, Syros's current Chief Commercial Officer and

Chief Business Officer, has been appointed to serve as Syros's next

CEO following Dr. Simonian's retirement.

Third Quarter 2023 Financial Results

- Revenues were $3.8 million for the third quarter of 2023,

consisting entirely of revenue recognized under our sickle cell

disease collaboration with Pfizer that ended in October. Syros

recognized $3.9 million in revenue in the third quarter of 2022,

consisting of $3.7 million in revenue recognized under its

collaboration with Global Blood Therapeutics, now a subsidiary of

Pfizer, and $0.2 million recognized under its collaboration with

Incyte.

- Research and development expenses were $28.3 million for the

third quarter of 2023, as compared to $25.8 million for the third

quarter of 2022. This increase was primarily due to the increase in

costs associated with our existing clinical trials of

tamibarotene.

- General and administrative expenses were $7.8 million for the

third quarter of 2023, as compared to $8.1 million for the third

quarter of 2022. This decrease was primarily due to a decrease in

consulting and professional fees, partially offset by an increase

in stock-based compensation.

- Restructuring costs were $2.4 million for the third quarter of

2023. Restructuring costs were comprised of $2.0 million of

severance, post-employment benefits, stock-based compensation, and

outplacement services, and $0.4 million of asset impairment charges

related to the laboratory equipment that is classified as assets

held for sale.

- For the third quarter of 2023, Syros reported a net loss of

$40.1 million, or $1.43 per share, compared to a net loss of $30.3

million, or $3.21 per share, for the same period in 2022.

Cash and Financial Guidance

Cash, cash equivalents and marketable securities as of September

30, 2023 were $112 million, as compared with $144 million on June

30, 2023.

Based on its current plans, Syros believes that its existing

cash, cash equivalents and marketable securities will be sufficient

to fund its anticipated operating expenses and capital expenditure

requirements into 2025, beyond pivotal Phase 3 data from the

SELECT-MDS-1 trial and additional data from the randomized portion

of the SELECT-AML-1 trial.

Conference Call and Webcast

Syros will host a conference call today at 8:30 a.m. ET to

discuss these third quarter 2023 financial results and provide a

corporate update.

To access the live conference call, please dial (888) 259-6580

(domestic) or (416) 764-8624 (international) and refer to

conference ID 83649711. A webcast of the call will also be

available on the Investors & Media section of the Syros website

at www.syros.com. An archived replay of the webcast will be

available for approximately 30 days following the presentation.

About Syros Pharmaceuticals

Syros is committed to developing new standards of care for the

frontline treatment of patients with hematologic malignancies.

Driven by the motivation to help patients with blood disorders that

have largely eluded other targeted approaches, Syros is developing

tamibarotene, an oral selective RARα agonist in frontline patients

with higher-risk myelodysplastic syndrome and acute myeloid

leukemia with RARA gene overexpression. For more information, visit

www.syros.com and follow us on Twitter (@SyrosPharma) and

LinkedIn.

Cautionary Note Regarding Forward-Looking

Statements This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995, including without limitation statements

regarding Syros’ clinical development plans, the progression of its

clinical trials, the timing and impact of enrolling study

participants and reporting clinical data, the ability to

commercialize tamibarotene and deliver benefit to patients, and the

sufficiency of Syros’ capital resources to fund its operating

expenses and capital expenditure requirements into 2025. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“hope,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“target,” “should,” “would,” and similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in these forward-looking

statements as a result of various important factors, including

Syros’ ability to: advance the development of its programs under

the timelines it projects in current and future clinical trials;

demonstrate in any current and future clinical trials the requisite

safety, efficacy and combinability of its drug candidates; sustain

the response rates and durability of response seen to date with its

drug candidates; successfully develop a companion diagnostic test

to identify patients with the RARA biomarker; obtain and maintain

patent protection for its drug candidates and the freedom to

operate under third party intellectual property; obtain and

maintain necessary regulatory approvals; identify, enter into and

maintain collaboration agreements with third parties; manage

competition; manage expenses; raise the substantial additional

capital needed to achieve its business objectives; attract and

retain qualified personnel; and successfully execute on its

business strategies; risks described under the caption “Risk

Factors” in Syros’ Annual Report on Form 10-K for the year ended

December 31, 2022 and Quarterly Report on Form 10-Q for the quarter

ended September 30, 2023, each which is on file with the Securities

and Exchange Commission; and risks described in other filings that

Syros makes with the Securities and Exchange Commission in the

future.

Financial Tables

Syros Pharmaceuticals,

Inc.

Selected Condensed

Consolidated Balance Sheet Data

(in thousands)

(unaudited)

September 30,

2023

December 31,

2022

Cash, cash equivalents and marketable

securities (current and noncurrent)

$

112,219

$

202,304

Working capital1

94,121

180,614

Total assets

147,795

244,486

Total stockholders’ equity

36,302

127,736

(1) The Company defines working capital as

current assets less current liabilities. See the Company’s

condensed consolidated financial statements for further details

regarding its current assets and current liabilities.

Syros Pharmaceuticals,

Inc.

Condensed Consolidated

Statement of Operations

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Revenue

$

3,762

$

3,891

$

9,550

$

15,634

Operating expenses:

Research and development

28,280

25,759

86,650

84,030

General and administrative

7,764

8,076

22,394

21,970

Transaction related expenses

—

9,510

—

9,510

Restructuring cost

2,354

—

2,354

—

Total operating expenses

38,398

43,345

111,398

115,510

Loss from operations

(34,636

)

(39,454

)

(101,848

)

(99,876

)

Interest income

1,633

392

5,533

539

Interest expense

(1,303

)

(1,051

)

(3,798

)

(3,008

)

Change in fair value of warrant

liabilities

(5,837

)

9,860

(77

)

12,465

Net loss applicable to common

stockholders

$

(40,143

)

$

(30,253

)

$

(100,190

)

$

(89,880

)

Net loss per share applicable to common

stockholders - basic and diluted

$

(1.43

)

$

(3.21

)

$

(3.59

)

$

(11.93

)

Weighted-average number of common shares

used in net loss per share applicable to common stockholders -

basic and diluted

27,990,558

9,417,069

27,915,951

7,536,149

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114402254/en/

Syros Contact Karen Hunady Director of Corporate

Communications & Investor Relations 1-857-327-7321

khunady@syros.com

Investor Relations Hannah Deresiewicz Stern Investor

Relations, Inc. 212-362-1200 hannah.deresiewicz@sternir.com

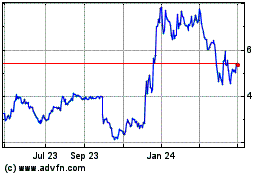

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

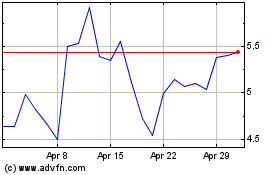

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Jan 2024 to Jan 2025