Current Report Filing (8-k)

January 06 2022 - 8:46AM

Edgar (US Regulatory)

0000876883

false

0000876883

2021-12-30

2021-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 30, 2021

STAGWELL

INC.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-13718

|

|

86-1390679

|

|

|

|

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

One

World Trade Center, Floor 65, New York, NY 10007

(Address of

principal executive offices and zip code)

(646)

429-1800

(Registrant’s Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title

of each class

|

Trading

symbol(s)

|

Name

of each exchange on which registered

|

|

Class

A Common Stock, $0.001 par value

|

STGW

|

NASDAQ

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On December 30, 2021, Stagwell Inc. (the “Company’)

entered into an agreement (the “Agreement”) to purchase the remaining 49% interest in Instrument LLC not previously owned

by the Company from Instrument Holdings Inc. (“Instrument Holdings”) and Instrument Leadership LLC (“Instrument Leadership”

and, together with Instrument Holdings, the “Sellers”) for an aggregate purchase price of $160 million. The Agreement replaces

the previous agreement between the Company and the Sellers, which obligated the Company to an uncapped future earn out payment that management

believes would have exceeded the $160 million purchase price. The purchase price is comprised of $86,078,627 in cash and $73,921,373 in

Class A common stock of the Company (“Stagwell Stock”) and payable in three installments. At closing of the transaction on

December 31, 2021, the Company paid the first installment of $75 million, comprised of $37.5 million in cash and $37.5 million, or 4,475,653

shares, in Stagwell Stock. The number of shares was calculated based on the average closing price of the Stagwell Stock for the 30 trading

days immediately prior to the date of the Agreement. The second and third installments of $42.5 million, each comprised of $24,289,313.50

in cash and $18,210,686.50 in Stagwell Stock, are payable on April 3, 2023 and April 1, 2024, respectively. The number of shares issued

in each installment will be calculated based on the average closing price of the Stagwell Stock for the 30 trading days immediately prior

to the payment date. Under the terms of the Agreement, the aggregate number of shares of Stagwell Stock issued in the transaction may

not exceed 10% of the Company’s outstanding Class A common stock.

The issuance of Stagwell Stock to the Sellers is

exempt from registration under Section 4(a)(2) of the Securities Act, as amended. The Company will receive no cash proceeds and no commissions

will be paid to any person in connection with the issuance.

|

|

Item 7.01

|

Regulation FD Disclosure.

|

On January 6, 2022, the Company issued a press

release announcing its acquisition of the remaining 49% interest in Instrument LLC. A copy of the press release is furnished as Exhibit

99.1 to this Current Report on Form 8-K.

The foregoing

information (including Exhibit 99.1 hereto) is being furnished under Item 7.01. Such information (including Exhibit 99.1 hereto) shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific

reference in such filing.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 6, 2022

|

|

STAGWELL INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Frank Lanuto

|

|

|

|

Frank Lanuto

|

|

|

|

Chief Financial Officer

|

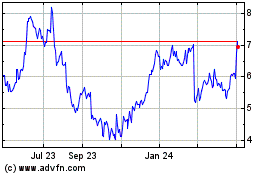

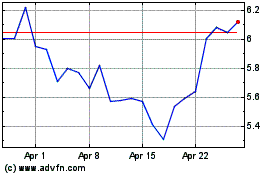

Stagwell (NASDAQ:STGW)

Historical Stock Chart

From Aug 2024 to Sep 2024

Stagwell (NASDAQ:STGW)

Historical Stock Chart

From Sep 2023 to Sep 2024