Post-effective Amendment to an Automatic Shelf Registration Statement on Form N-2 for Well-known Seasoned Issuers (n-2 Posasr)

June 25 2021 - 2:41PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on June 24, 2021

Securities Act File No. 333-255662

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ☒

(Check appropriate box or boxes)

|

|

|

|

|

|

|

|

|

Pre-Effective Amendment No.

|

|

☐

|

|

|

|

Post-Effective Amendment No. 1

|

|

☒

|

SLR INVESTMENT CORP.

(Exact name of Registrant as specified in charter)

500 Park Avenue

New York, NY 10022

(Address of Principal Executive Offices)

Registrant’s telephone number, including Area Code: (212) 993-1670

Michael S. Gross

Bruce J.

Spohler

Co-Chief Executive Officers

SLR Investment Corp.

500

Park Avenue

New York, NY 10022

(Name and address of agent for service)

COPIES TO:

Vlad M. Bulkin

Katten Muchin Rosenman LLP

2900 K Street NW, Suite 200

Washington, DC 20007

(202)

625-3838

Approximate date of proposed public offering: From time to time after the effective date of this Registration

Statement.

|

☐

|

Check box if the only securities being registered on this Form are being offered pursuant to dividend or

interest reinvestment plans.

|

|

☒

|

Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in

reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan.

|

|

☐

|

Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective

amendment thereto.

|

|

☒

|

Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective

amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act.

|

|

☐

|

Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General

Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act.

|

It is proposed that this filing will become effective (check appropriate box):

☐ when declared effective pursuant to Section 8(c) of the Securities Act.

If appropriate, check the following box:

|

☐

|

This [post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement].

|

|

☐

|

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

|

☐

|

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

|

☐

|

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

Check each box that appropriately characterizes the Registrant:

|

☐

|

Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940

(“Investment Company Act”)).

|

|

☒

|

Business Development Company (closed-end company that intends or has elected to be regulated as a business

development company under the Investment Company Act).

|

|

☐

|

Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase

offers under Rule 23c-3 under the Investment Company Act).

|

|

☒

|

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

|

☒

|

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

|

|

☐

|

Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange

Act”).

|

|

☐

|

If an Emerging Growth Company, indicate by check mark if the Registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

|

|

☐

|

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing).

|

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

Title of Securities Being Registered

|

|

Proposed

Maximum

Aggregate

Offering Price(1)

|

|

Amount of

Registration Fee

|

|

Common Stock, $0.01 par value per share(3)

|

|

|

|

|

|

Preferred Stock, $0.01 par value per share(3)

|

|

|

|

|

|

Subscription Rights(3)

|

|

|

|

|

|

Debt Securities(4)

|

|

|

|

|

|

Warrants(5)

|

|

|

|

|

|

Total(6)

|

|

$1,000,000,000

|

|

$0(2)

|

|

|

|

|

|

(1)

|

Estimated pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”),

solely for the purpose of determining the registration fee. The proposed maximum offering price per security will be determined, from time to time, by SLR Investment Corp. (the “Company” or “Registrant”) in connection with the

sale of the securities registered under this Registration Statement.

|

|

(2)

|

Pursuant to Rule 415(a)(6) under the Securities Act, in connection with the initial filing of this Registration

Statement on April 30, 2021, the Registrant carried forward to this Registration Statement $1,000,000,000 in aggregate offering price of unsold securities that the Registrant previously registered on its registration statement on Form N-2 (File

No. 333-223663) initially filed on March 14, 2018 (the “Prior Registration Statement”). In accordance with Rule 415(a)(6) under the Securities Act, the filing fee previously paid with respect to the unsold securities that are being carried

forward to this Registration Statement will continue to be applied to such unsold securities. Pursuant to Rule 415(a)(6) under the Securities Act, the offering of unsold securities under the Prior Registration Statement was deemed terminated as of

the date of the effectiveness of this Registration Statement.

|

|

(3)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate principal amount of common stock,

preferred stock, or subscription rights, from time to time.

|

|

(4)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate principal amount of debt

securities as may be sold, from time to time.

|

|

(5)

|

Subject to Note 6 below, there is being registered hereunder an indeterminate principal amount of warrants as

may be sold, from time to time, representing rights to purchase common stock, preferred stock or debt securities.

|

|

(6)

|

In no event will the aggregate offering price of all securities issued from time to time pursuant to this

registration statement exceed $1,000,000,000.

|

This Registration Statement shall become effective upon filing with the

Securities and Exchange Commission in accordance with Rule 462(e) under the Securities Act of 1933, as amended.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

This Post-Effective Amendment No. 1 to Registration Statement on Form N-2 is being filed by SLR Investment Corp. (the “Registrant”)

with the U.S. Securities and Exchange Commission (the “Commission”) to clarify that the maximum aggregate offering price of the securities registered hereunder is limited to $1,000,000,000. This Registration Statement incorporates by

reference the contents of the Registrant’s Registration Statement on Form N-2 (File No. 333-255662), initially filed with the Commission on April 30, 2021 (the “Original Registration Statement”), which became automatically effective,

including each of the documents filed by the Registrant with the Commission and all the exhibits thereto. The accountants’ consents are attached hereto and filed herewith. The contents of the Original Registration Statement, including the

exhibits thereto and incorporated by reference therein, are incorporated by reference into this Registration Statement.

OTHER

INFORMATION

ITEM 25. FINANCIAL STATEMENTS AND EXHIBITS

2. Exhibits

C-1

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant has duly caused this Post-Effective No. 1 to the

Registration Statement on Form N-2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, in the State of New York, on the 24th day of June, 2021.

SLR INVESTMENT CORP.

|

|

|

|

|

/s/ Michael S. Gross

|

|

/s/ Bruce J. Spohler

|

|

Michael S. Gross

Co-Chief Executive Officer, President, Chairman

of the Board and Director

|

|

Bruce J. Spohler

Co-Chief Executive Officer, Chief Operating

Officer and Director

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Michael S. Gross and Bruce

Spohler as true and lawful attorney-in-fact and agent with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities to sign any and all amendments to this Registration Statement (including

post-effective amendments, or any abbreviated registration statement and any amendments thereto filed pursuant to Rule 462(b) and otherwise), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the

Securities and Exchange Commission granting unto said attorney-in-fact and agent the full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the foregoing, as to all intents and

purposes as either of them might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Post-Effective No. 1 to the Registration Statement on

Form N-2 has been signed by the following persons on behalf of the Registrant, and in the capacities indicated, on the 24th day of June, 2021.

|

|

|

|

|

Signature

|

|

Title

|

|

|

|

|

/s/ Michael S. Gross

|

|

Co-Chief Executive Officer, President, Chairman of the Board and Director (Principal Executive Officer)

|

|

Michael S. Gross

|

|

|

|

|

|

|

/s/ Bruce Spohler

|

|

Co-Chief Executive Officer, Chief Operating Officer and Director

|

|

Bruce Spohler

|

|

|

|

|

|

|

/s/ Steven Hochberg

|

|

Director

|

|

Steven Hochberg

|

|

|

|

|

|

|

/s/ David S. Wachter

|

|

Director

|

|

David S. Wachter

|

|

|

|

|

|

|

/s/ Leonard A. Potter

|

|

Director

|

|

Leonard A. Potter

|

|

|

|

|

|

|

/s/ Richard L. Peteka

|

|

Chief Financial Officer (Principal Financial

|

|

Richard L. Peteka

|

|

Officer), Treasurer and Secretary

|

C-2

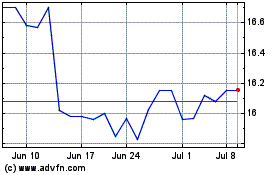

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

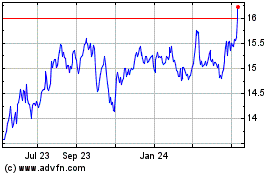

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jul 2023 to Jul 2024