false

0001757499

0001757499

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 4, 2024

SHUTTLE

PHARMACEUTICALS HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41488 |

|

82-5089826 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

401

Professional Drive, Suite 260

Gaithersburg,

MD 20879

(Address

of principal executive offices) (Zip Code)

(240)

430-4212

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock $0.00001 per share |

|

SHPH |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

September 4, 2024, Shuttle Pharmaceuticals Holdings, Inc., a Delaware corporation (the “Company”),

issued a $250,000 promissory note (the “Promissory Note”) to the Company’s CEO, Dr. Anatoly Dritschilo, in exchange

for Dr. Dritschilo’s loan of $250,000 to the Company. The Promissory Note accrues interest at 12% per annum and is repayable in

12 substantially equal installments over a period of one year.

The

foregoing description of the Promissory Note does not purport to be complete and is qualified in its entirety by reference to the full

text of the agreement, which is filed herewith as Exhibit 10.1.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SHUTTLE

PHARMACEUTICALS HOLDINGS, INC. |

| |

|

|

| Dated:

September 10, 2024 |

|

|

| |

|

|

| |

By: |

/s/

Anatoly Dritschilo |

| |

Name: |

Anatoly

Dritschilo |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

PROMISSORY

NOTE

$250,000.00

September

4,2024

Maryland, United States

For

value received, Shuttle Pharmaceutical Holdings, Inc., a Delaware company (the “Company”), promises to pay to Anatoly

Dritschilo (the “Holder”), the principal sum of $250,000.00 (the “Principal”). Interest shall accrue

from the date of this Promissory Note (this “Note”) on the unpaid principal amount at a rate equal to 12.0% per annum,

computed as simple interest on the basis of a year of 365 days.

1.

Basic Terms.

(a)

Maturity. Principal, and interest accrued under this Note, shall be payable in 12 installments substantially equal installments,

as set forth on Schedule A attached hereto, with the final payment to be made on September 4, 2025 (the “Maturity

Date”). Notwithstanding the foregoing, the entire unpaid principal sum of this Note, together with accrued and unpaid interest

thereon, shall become immediately due and payable within ten (10) business days upon: (i) the commission of any act of bankruptcy by

the Company, (ii) the execution by the Company of a general assignment for the benefit of creditors, (iii) the filing by or against the

Company of a petition in bankruptcy or any petition for relief under the federal bankruptcy act or the continuation of such petition

without dismissal for a period of 90 days or more, or (iv) the appointment of a receiver or trustee to take possession of the property

or assets of the Company.

(b)

Payment. All payments shall be made in lawful money of the United States of America at such place as the Holder hereof

may from time to time designate in writing to the Company. Payment shall be credited first to the accrued interest then due and payable

and the remainder shall be applied to principal.

(c)

Default. In the event the Company fails to repay the Note in full on the Maturity Date, the Note shall accrue interest

at default interest rate of 20% per annum (the “Default Interest”). Such Default Interest shall accrue until such time as

the Loan and all interest thereon is paid in full.

2.

Action to Collect on Note. If action is instituted to collect on this Note, the Company promises to pay all of the Holder’s

costs and expenses, including reasonable attorney’s fees, incurred in connection with such action.

3.

Loss of Note. Upon receipt by the Company of evidence satisfactory to it of the loss, theft, destruction or mutilation

of this Note or any Note exchanged for it, and indemnity satisfactory to the Company (in case of loss, theft or destruction) or surrender

and cancellation of such Note (in the case of mutilation), the Company will make and deliver in lieu of such Note a new Note of like

tenor.

4.

Miscellaneous.

(a)

Governing Law. The validity, interpretation, construction and performance of this Note, and all acts and transactions pursuant

hereto and the rights and obligations of the Company and Holder shall be governed, construed and interpreted in accordance with the laws

of the State of Maryland, without giving effect to principles of conflicts of law.

(b)

Entire Agreement. This Note constitutes the entire agreement and understanding between the Company and the Holder relating

to the subject matter herein and supersedes all prior or contemporaneous discussions, understandings and agreements, whether oral or

written between them relating to the subject matter hereof.

(c)

Amendments and Waivers. Any term of this Note may be amended only with the written consent of the Company and the Holder.

Any amendment or waiver effected in accordance with this Section 4(c) shall be binding upon the Company, the Holder and each transferee

of this Note.

(d)

Successors and Assigns. The terms and conditions of this Note shall inure to the benefit of and be binding upon the respective

successors and assigns of the Company and the Holder. Notwithstanding the foregoing, the Holder may not assign, pledge, or otherwise

transfer this Note without the prior written consent of the Company. Subject to the preceding sentence, this Note may be transferred

only upon surrender of the original Note for registration of transfer, duly endorsed, or accompanied by a duly executed written instrument

of transfer in form satisfactory to the Company. Thereupon, a new note for the same principal amount and interest will be issued to,

and registered in the name of, the transferee. Interest and principal are payable only to the registered holder of this Note.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Company has executed this Promissory Note as of the date first set forth above.

| |

the

company: |

| |

|

|

| |

SHUTTLE

PHARMACEUTICALS HOLDINGS, INC. |

| |

|

| |

By: |

|

| |

|

(Signature) |

| |

Name: |

Anatoly

Dritschilo, M.D. |

| |

Title: |

Chief

Executive Officer |

| |

CFO

approval: |

| |

|

|

| |

By: |

|

| |

|

(Signature) |

| |

Name: |

Timothy

Lorber |

| |

Title: |

Chief

Financial Officer |

Schedule

A

[Repayment

Schedule]

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

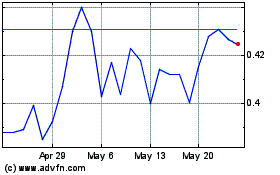

Shuttle Pharmaceuticals (NASDAQ:SHPH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shuttle Pharmaceuticals (NASDAQ:SHPH)

Historical Stock Chart

From Dec 2023 to Dec 2024