RumbleOn, Inc. (NASDAQ: RMBL) (the “Company” or “RumbleOn”)

announced today the final results of its $100.0 million rights

offering (the “Rights Offering”). The subscription period of the

Rights Offering expired at 5:00 P.M. Eastern Time, on December 5,

2023. The Rights Offering resulted in subscriptions for

approximately 81.1% of the shares offered at an exercise price of

$5.50 per share. The shares of Class B common stock subscribed for

are expected to be issued to participating stockholders on or about

December 8, 2023.

Steve Pully, Executive Chairman of the Company, commented, “I

want to thank all of the stockholders that participated in the

Rights Offering, and especially the Standby Purchasers, Mark Tkach,

William Coulter, and Stone House Capital Management, LLC. The

successful Rights Offering is a transformative transaction for

RumbleOn.”

Mike Kennedy, Chief Executive Officer of the Company, added,

“the proceeds from the Rights Offering will both lower our debt

levels and also give us the ability to proactively grow our

business - this is a significant accomplishment for the Company. It

is an exciting time for me to lead RumbleOn.”

As previously disclosed, the Company entered into an agreement

with Mark Tkach, William Coulter, and Stone House Partners

(collectively, the “Standby Purchasers”) to backstop the Rights

Offering through a private placement of shares in the event that

the Rights Offering was not fully subscribed (the “Backstop Private

Placement”). Because the Rights Offering was not fully subscribed,

the Standby Purchasers will purchase the unsubscribed shares for an

aggregate amount of $18,938,090.

The Rights Offering and Backstop Private Placement are expected

to close on December 8, 2023.

The net proceeds to be received by the Company in the Rights

Offering and the Backstop Private Placement is expected to be

approximately $98.4 million. The Company will use $50.0 million of

the net proceeds to prepay a portion of the Company’s outstanding

debt under its Term Loan Credit Agreement, dated as of August 31,

2021, as amended, with Oaktree Fund Administration, LLC. The

remaining proceeds will be available to fund the growth and

development of the Company’s business, including for possible

acquisitions and other corporate purposes.

Following the completion of the Rights Offering and the Backstop

Private Placement, the Company expects to have approximately

35,015,190 million shares of its Class B common stock

outstanding.

A registration statement on Form S-3 (File No. 333-274859)

relating to the Rights Offering was filed with and declared

effective by the Securities and Exchange Commission (the “SEC”).

The Rights Offering was made only by means of a prospectus, copies

of which can be accessed through the SEC’s website at www.sec.gov.

Additional information regarding the Rights Offering is set forth

in the prospectus filed with the SEC.

About RumbleOn

RumbleOn, through its RideNow Powersports subsidiary, is the

largest powersports retailer in North America, operating over 55

locations representing 30 brands primarily in the Sun Belt. We

offer a wide selection of new and used motorcycles, all-terrain

vehicles, utility terrain vehicles, personal watercraft, and other

powersports products, including parts, apparel, accessories, and

aftermarket products from a wide range of manufacturers.

Additionally, we offer a full suite of financing, parts, repair,

and maintenance services. Our asset light logistics company,

Wholesale Express, provides freight brokerage services facilitating

transportation for dealers and consumers. To learn more please

visit us online at https://www.rumbleon.com/.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of

1995. Such forward-looking statements include, but are not limited

to, those regarding the closing of the Rights Offering and the

Backstop Private Placement, and the use of proceeds from the Rights

Offering and the Backstop Private Placement. Forward-looking

statements generally can be identified by words such as

“anticipates,” “believes,” “continues,” “could,” “estimates,”

“expects,” “intends,” “hopes,” “may,” “plan,” “possible,”

“potential,” “predicts,” “projects,” “should,” “targets,” “would”

and similar expressions, although not all forward-looking

statements contain these identifying words. Such statements are

subject to numerous important factors, risks and uncertainties that

may cause actual events or results to differ materially from

current expectations and beliefs, including, but not limited to

risks related to the diversion of management’s attention from

RumbleOn’s ongoing business operations; the impact of general

economic, industry or political conditions in the United States or

internationally, as well as the other risk factors set forth under

the caption “Risk Factors” in the Registration Statement, as

amended, and in RumbleOn’s Annual Report for the year ended

December 31, 2022 and Quarterly Reports on Form 10-Q for the

quarters ended March 30, 2023, June 30, 2023, and September 30,

2023 and in any subsequent filings made with the SEC by RumbleOn.

Any forward-looking statements contained in this press release

speak only as of the date hereof, and RumbleOn specifically

disclaims any obligation to update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231206631023/en/

Investor Inquiries: Will

Newell investors@rumbleon.com

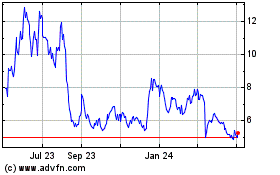

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Jan 2025 to Feb 2025

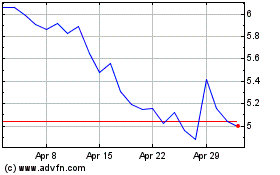

RumbleOn (NASDAQ:RMBL)

Historical Stock Chart

From Feb 2024 to Feb 2025