Rover Group, Inc. (Nasdaq: ROVR) (“Rover” or the “Company”), the

world’s largest online marketplace for pet care, today announced

that it has entered into a definitive agreement to be acquired by

private equity funds managed by Blackstone (“Blackstone”) in an

all-cash transaction valued at approximately $2.3 billion.

Under the terms of the agreement, Rover stockholders will

receive $11.00 per share in cash, representing a premium of

approximately 61% to the volume weighted average share price of

Rover’s Class A common stock over the 90 trading days ending on

November 28, 2023.

“We are thrilled for this next chapter in the Rover story and

look forward to the partnership with the Blackstone team, who share

our conviction, excitement and strategic vision,” said Aaron

Easterly, co-founder and CEO of Rover. “Blackstone brings deep

expertise in partnering with innovative technology companies, and

with their support and collaboration, we plan to continue investing

in our business in service of our mission to make it possible for

everyone to experience the unconditional love of a pet in their

lives. This transaction delivers immediate and compelling value to

Rover stockholders, and is a testament to the commitment and hard

work of our team and an exciting milestone for Rover.”

Sachin Bavishi, a Senior Managing Director at Blackstone, said,

“We are excited to partner with Aaron and the exceptional Rover

team, whose vision, creativity and data-driven approach have built

the Company into an industry leader. Our investment highlights

Blackstone’s high-conviction focus on backing rapidly growing

digital businesses and supporting talented entrepreneurs with

extensive resources to take advantage of transformational growth

opportunities. We look forward to working with Rover as they

continue working to drive innovation for pet owners and

providers.”

Tushar Gupta, a Principal at Blackstone, added, “We believe

Rover has a significant runway for growth as pet owners

increasingly place a premium on high-quality care, flexibility and

convenience. We look forward to partnering with management to build

upon their leading online marketplace and leveraging Blackstone’s

extensive expertise and resources to support the Company’s

continued expansion as a private company.”

Rover was created to provide an alternative to relying on

friends, family, neighbors, and/or boarding facilities for pet care

when traveling away from home. Over the years, offerings on Rover

have grown to include five core services addressing daytime and

overnight needs. From its inception through September 30, 2023,

over 93 million services have been booked by more than 4 million

pet parents on Rover with more than 1 million pet care providers

paid across North America and Europe. Through its platform and

mobile app, pet parents can easily discover, book, re-book, pay,

and review loving pet care providers online. Rover eliminates many

of the barriers of pet ownership, enabling the Company’s mission to

make it possible for everyone to experience the unconditional love

of pets.

Rover’s partnership with Blackstone reflects a shared belief in

the future growth potential of the industry and long-term vision to

build on Rover’s leadership position in the market. Blackstone’s

investment aims to help enable Rover to further accelerate

investment priorities, expand its global footprint, and fuel

expansion initiatives.

Transaction Terms

The merger agreement includes a customary 30-day “go-shop”

period expiring on December 29, 2023. During this period, Rover and

its advisors will be permitted to solicit, consider and negotiate

alternative acquisition proposals from third parties. The Rover

board of directors will have the right to terminate the merger

agreement to enter into a superior proposal, subject to the terms

and conditions of the merger agreement. There can be no assurance

that this “go-shop” process will or will not result in a superior

proposal, and Rover does not intend to disclose related

developments unless and until it determines that such disclosure is

appropriate or otherwise required.

The transaction is currently expected to close in the first

quarter of 2024, subject to the approval of Rover’s stockholders

and the satisfaction of required regulatory clearances and other

customary closing conditions. The Rover board of directors approved

the merger agreement and recommended that Rover stockholders

approve the transaction and adopt the merger agreement. Closing of

the transaction is not subject to a financing condition.

Upon completion of the transaction, Rover’s Class A common stock

will no longer be publicly-listed and Rover will become a privately

held company. The Company will continue to operate under the Rover

name and brand.

Advisors

Goldman Sachs & Co. LLC is acting as lead financial advisor

to Rover, and Centerview Partners LLC is also acting as a financial

advisor to Rover and delivered a fairness opinion to Rover’s Board

of Directors with respect to the proposed transaction. Wilson

Sonsini Goodrich & Rosati, Professional Corporation is acting

as legal counsel to Rover.

Evercore is acting as lead financial advisor and Moelis &

Company LLC is also acting as a financial advisor to Blackstone,

and Kirkland & Ellis LLP is acting as legal counsel to

Blackstone.

About Rover Group, Inc.

Founded in 2011 and based in Seattle, Rover

(Nasdaq: ROVR) is the world’s largest online marketplace for pet

care. Rover connects pet parents with pet providers who offer

overnight services, including boarding and in-home pet sitting, as

well as daytime services, including doggy daycare, dog walking, and

drop-in visits. To learn more about Rover, please visit

www.rover.com.

About Blackstone

Blackstone is the world’s largest alternative

asset manager. We seek to create positive economic impact and

long-term value for our investors. We do this by relying on

extraordinary people and flexible capital to help strengthen the

companies we invest in. Our over $1 trillion in assets under

management include investment vehicles focused on private equity,

real estate, public debt and equity, infrastructure, life sciences,

growth equity, opportunistic, non-investment grade credit, real

assets and secondary funds, all on a global basis. Further

information is available at www.blackstone.com. Follow @blackstone

on LinkedIn, X (Twitter), and Instagram.

Cautionary Statement Regarding

Forward-Looking Statements

This communication may contain forward-looking

statements, which include all statements that do not relate solely

to historical or current facts, such as statements regarding the

pending acquisition of the Company by private equity funds managed

by Blackstone (the “Merger”) and the expected timing of the closing

of the Merger and other statements that concern the Company’s

expectations, intentions or strategies regarding the future. In

some cases, you can identify forward-looking statements by the

following words: “may,” “will,” “could,” “would,” “should,”

“expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “project,” “aim,” “potential,” “continue,” “ongoing,”

“goal,” “can,” “seek,” “target” or the negative of these terms or

other similar expressions, although not all forward-looking

statements contain these words. These forward-looking statements

are based on the Company’s beliefs, as well as assumptions made by,

and information currently available to, the Company. Because such

statements are based on expectations as to future financial and

operating results and are not statements of fact, actual results

may differ materially from those projected and are subject to a

number of known and unknown risks and uncertainties, including, but

not limited to: (i) the risk that the Merger may not be completed

on the anticipated timeline or at all; (ii) the failure to satisfy

any of the conditions to the consummation of the Merger, including

the receipt of required approval from the Company’s stockholders

and required regulatory approval; (iii) the occurrence of any

event, change or other circumstance or condition that could give

rise to the termination of the merger agreement with private equity

funds managed by Blackstone, including in circumstances requiring

the Company to pay a termination fee; (iv) the effect of the

announcement or pendency of the Merger on the Company’s business

relationships, operating results and business generally; (v) risks

that the Merger disrupts the Company’s current plans and

operations; (vi) the Company’s ability to retain and hire key

personnel and maintain relationships with key business partners and

customers, and others with whom it does business; (vii) risks

related to diverting management’s or employees’ attention during

the pendency of the Merger from the Company’s ongoing business

operations; (viii) the amount of costs, fees, charges or expenses

resulting from the Merger; (ix) potential litigation relating to

the Merger; (x) uncertainty as to timing of completion of the

Merger and the ability of each party to consummate the Merger; (xi)

risks that the benefits of the Merger are not realized when or as

expected; (xii) the risk that the price of the Company’s Class A

common stock may fluctuate during the pendency of the Merger and

may decline significantly if the Merger is not completed; and

(xiii) other risks described in the Company’s filings with the U.S.

Securities and Exchange Commission (the “SEC”), such as the risks

and uncertainties described under the headings “Cautionary Note

Regarding Forward-Looking Statements,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and other sections of the Company’s Annual

Report on Form 10-K, the Company’s Quarterly Reports on Form 10-Q,

and in the Company’s other filings with the SEC. While the list of

risks and uncertainties presented here is, and the discussion of

risks and uncertainties to be presented in the proxy statement on

Schedule 14A that the Company will file with the SEC relating to

its special meeting of stockholders will be, considered

representative, no such list or discussion should be considered a

complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward-looking statements. Consequences of

material differences in results as compared with those anticipated

in the forward-looking statements could include, among other

things, business disruption, operational problems, financial loss,

legal liability to third parties and/or similar risks, any of which

could have a material adverse effect on the completion of the

Merger and/or the Company’s consolidated financial condition. The

forward-looking statements speak only as of the date they are made.

Except as required by applicable law or regulation, the Company

undertakes no obligation to update any forward-looking statements,

whether as a result of new information, future events or

otherwise.

The information that can be accessed through

hyperlinks or website addresses included in this communication is

deemed not to be incorporated in or part of this communication.

Additional Information and Where to Find

It

This communication is being made in respect of

the Merger. In connection with the proposed Merger, the Company

will file with the SEC a proxy statement on Schedule 14A relating

to its special meeting of stockholders and may file or furnish

other documents with the SEC regarding the Merger. When completed,

a definitive proxy statement will be mailed to the Company’s

stockholders. STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY

STATEMENT REGARDING THE MERGER (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN) AND ANY OTHER RELEVANT DOCUMENTS FILED OR FURNISHED WITH

THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The Company’s

stockholders may obtain free copies of the documents the Company

files with the SEC from the SEC’s website at www.sec.gov or through

the Company’s website at investors.rover.com under the link

“Financials” and then under the link “SEC Filings” or by contacting

the Company’s Investor Relations department via e-mail at

investorrelations@rover.com.

Participants in the Solicitation

The Company and its directors and executive officers, which

consist of Adam Clammer, Jamie Cohen, Venky Ganesan, Greg

Gottesman, Kristine Leslie, Scott Jacobson, Erik Prusch, Megan

Siegler, who are the non-employee members of the Company’s Board of

Directors, Aaron Easterly, the Company’s Chief Executive Officer

and Chairperson of the Board, Brent Turner, the Company’s President

and Chief Operating Officer, and Charlie Wickers, the Company’s

Chief Financial Officer, are participants in the solicitation of

proxies from the Company’s stockholders in connection with the

Merger. Information regarding the Company’s directors and executive

officers (other than for Mr. Prusch), including a description of

their direct or indirect interests, by security holdings or

otherwise, can be found under the captions “Security Ownership of

Certain Beneficial Owners and Management,” “Board of Directors and

Corporate Governance—Director Compensation,” and “Executive

Compensation—Outstanding Equity Awards at Fiscal 2022 Year-End”

contained in the Company’s 2023 annual proxy statement filed with

the SEC on April 28, 2023 (the "2023 Proxy Statement"). To the

extent that the Company’s directors and executive officers and

their respective affiliates have acquired or disposed of security

holdings since the applicable “as of” date disclosed in the 2023

Proxy Statement, such transactions have been or will be reflected

on Statements of Change in Ownership on Form 4 or amendments to

beneficial ownership reports on Schedules 13D filed with the

SEC. Since the filing of the 2023 Proxy Statement, (1) Ms.

Cohen received a grant of 19,417 restricted stock units (“RSUs”)

and Mr. Gottesman, Ms. Leslie and Ms. Siegler each received a grant

of 33,273 RSUs, which will each vest in full on the earlier of June

16, 2024 or the date of the next annual meeting of the Company’s

stockholders, in each case subject to the applicable director

continuing to be a non-employee director through the applicable

vesting date, and (2) Mr. Prusch received a grant of 54,855 RSUs,

which will vest 1/3 on each of September 7, 2024, September 7, 2025

and September 7, 2026, subject to him continuing to be a

non-employee director through the applicable vesting dates.

In the Merger, outstanding equity awards held by each non-employee

director will fully vest immediately prior to the consummation of

the Merger provided that the non-employee director continues to be

a non-employee director through such date, and outstanding equity

awards held by Mr. Easterly, Mr. Turner and Mr. Wickers will be

treated in accordance with their respective severance and change in

control agreements and as described in the 2023 Proxy Statement

under the caption “Executive Compensation—Potential Payments Upon

Termination or Change in Control.” Additionally, pursuant to

the Business Combination Agreement, dated as of February 10, 2021,

by and among Nebula Caravel Acquisition Corp., Fetch Merger Sub,

Inc., and A Place for Rover, Inc., an affiliate of Mr. Clammer has

been issued restricted shares of the Company’s Class A common stock

that will fully vest immediately prior to the consummation of the

Merger and Mr. Easterly, Mr. Ganesan, Mr. Gottesman, Mr. Jacobson,

Mr. Turner and their respective affiliates will be issued

additional shares of the Company’s Class A common stock immediately

prior to the consummation of the Merger. Other information

regarding the participants in the proxy solicitation and a

description of their interests will be contained in the proxy

statement for the Company’s special meeting of stockholders and

other relevant materials to be filed with the SEC in respect of the

Merger when they become available. These documents can be obtained

free of charge from the sources indicated above.

Contacts

FOR ROVERInvestorsWalter

Ruddywalter.ruddy@rover.com(206) 715-2369

MediaKristin Sandbergpr@rover.com(360)

510-6365

OR

John Christiansen/Danya Al-QattanFGS

GlobalRover@FGSGlobal.com

FOR BLACKSTONEMediaMatt

Anderson(518) 248-7310Matthew.Anderson@blackstone.com

Mariel Seidman-Gati(646)

482-3712Mariel.SeidmanGati@blackstone.com

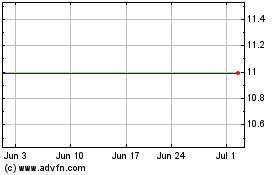

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

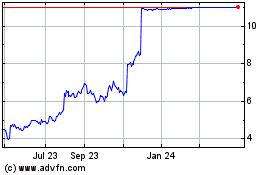

Rover (NASDAQ:ROVR)

Historical Stock Chart

From Feb 2024 to Feb 2025