UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-40752

RENEW ENERGY GLOBAL PLC

(Translation of registrant’s name into English)

C/O Vistra (UK) Ltd, Suite 3, 7th Floor

50, Broadway, London, England, SW1H 0DB, United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Other events

Earnings Release

On August 15, 2024, ReNew issued an earnings release announcing its unaudited financial results for the three months ended June 30, 2024, as well as certain other business updates. A copy of the earnings release dated August 15, 2024, is attached hereto as exhibit 99.1.

The contents of this Report of Foreign Private Issuer on Form 6-K (this “Form 6-K”), including Exhibit 99.1 hereto, are incorporated by reference into the Registrant’s registration statement on Form F-3, SEC file number 333-259706, filed by the Registrant on October 13, 2022 (as supplemented by any prospectus supplements filed on or prior to the date of this Form 6-K), and shall be a part thereof from the date on which this Form 6-K is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Dated: August 15, 2024 |

RENEW ENERGY GLOBAL PLC |

|

|

|

|

By: |

/s/ Kailash Vaswani |

|

Name: |

Kailash Vaswani |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

ReNew Announces Results for the First Quarter

of Fiscal 2025 (Q1 FY25), ended June 30, 2024

August 15, 2024: ReNew Energy Global Plc (“ReNew” or “the Company”) (Nasdaq: RNW, RNWWW), a leading decarbonization solutions company, today announced its unaudited consolidated IFRS results for Q1 FY25.

Operating Highlights:

•As of June 30, 2024, the Company’s portfolio consisted of ~15.6 GWs, of which ~9.6 GWs are commissioned and ~6.0 GWs are committed, compared to ~13.7 GWs as of June 30, 2023.

•The Company’s commissioned capacity has increased 14.0% year-over-year to ~9.6 GWs as of June 30, 2024. Subsequent to the end of the quarter, the Company commissioned 400 MWs of solar and 14 MWs of wind capacity, taking the total commissioned capacity to ~10 GWs as of August 15, 2024.

•Revenue for Q1 FY25 was INR 22,811 million (US$ 274 million), compared to INR 21,250 million (US$ 255 million) for Q1 FY24. Net profit for Q1 FY25 was INR 394 million (US$ 5 million) compared to INR 2,983 million (US$ 36 million) for Q1 FY24. Adjusted EBITDA for Q1 FY25 was INR 18,979 million (US$ 228 million), as against INR 18,599 million (US$ 223 million) for Q1 FY24.

Note: the translation of Indian rupees into U.S. dollars has been made at INR 83.33 to US$ 1.00. See note 1 for more information.

Key Operating Metrics

As of June 30, 2024, our total portfolio consisted of ~15.6 GWs and commissioned capacity was ~9.6 GWs, of which ~4.8 GWs were wind, ~4.7 GWs were solar and ~0.1 GWs were hydro. Commissioned capacity increased 14.0% year-over-year. In Q1 FY25, we commissioned 17 MWs of wind and 35 MWs of solar capacity. In addition, we received commissioning certificates during Q1 FY25 for 270 MWs of wind capacity and 380 MWs of solar capacity which was operationalized and generating pre-commissioning revenue as of Q4 FY24.

Electricity Sold

Total electricity sold in Q1 FY25 was 5,815 million kWh, an increase of 13.7% over Q1 FY24.

Electricity sold in Q1 FY25 from wind assets was 2,955 million kWh, an increase of 12.1% over Q1 FY24. Electricity sold in Q1 FY25 from solar assets was 2,764 million kWh, an increase of 16.3% over Q1 FY24. Electricity sold in Q1 FY25 from hydro assets was 96 million kWh, a decrease of 6.9% over Q1 FY24.

Plant Load Factor

Our weighted average Plant Load Factor (“PLF”) for Q1 FY25 for wind assets was 28.4%, compared to 29.9% for Q1 FY24. The PLF for Q1 FY25 for solar assets was 27.2%, compared to 27.5% for Q1 FY24.

Total Income

Total Income for Q1 FY25 was INR 24,903 million (US$ 299 million), similar to Q1 FY24. Total income benefitted from higher revenue owing to the increase in operational capacity but was offset by revenue loss from 400 MW assets sold in FY24 as part of our capital recycling strategy, lower wind PLF, lower late payment surcharge from customers and lower finance income and fair value change in derivatives & share warrants. Q1 FY25 Total Income includes finance income and fair value change in derivative instruments of INR 1,154 million (US$ 14 million).

Employee Benefits Expense

Employee benefits expense for Q1 FY25 was INR 1,437 million (US$ 17 million), an increase of 25.3% over Q1 FY24, driven by higher employee share-based payments (INR 463 million in Q1 FY25 compared to INR 314 million in Q1 FY24) and an increase in headcount.

Other Expenses

Other Expenses for Q1 FY25 were INR 3,559 million (US$ 43 million), an increase of 16.8% over Q1 FY24. The increase was primarily driven by an increase in operating activities.

Finance Costs and Fair Value Change in Derivative Instruments

Finance costs and fair value change in derivative instruments for Q1 FY25 was INR 12,215 million (US$ 147 million), an increase of 10.3% over Q1 FY24. The increase in finance costs was primarily due to an increase in operational assets from the previous year, partially offset by lower unwinding cost of related derivative instruments and lower other ancillary borrowing costs.

Net Profit/ Loss

The net profit for Q1 FY25 was INR 394 million (US$ 5 million) compared to INR 2,983 million (US$ 36 million) for Q1 FY24. The decrease was primarily due to revenue loss from 400 MW assets sold in FY24 as part of our capital recycling strategy, lower wind PLF, lower late payment surcharge from customers and lower finance income and fair value change in derivatives & share warrants, and an increase in finance cost & operational expenses, in line with the increase in operational capacity.

Adjusted EBITDA

Adjusted EBITDA for Q1 FY25 was INR 18,979 million (US$ 228 million) compared to INR 18,599 million (US$ 223 million) for Q1 FY24.

Adjusted EBITDA is a non-IFRS measure. For more information, see “Use of Non-IFRS Measures” elsewhere in this release. IFRS refers to International Financial Reporting Standards as issued by the International Accounting Standards Board. In addition, reconciliations of non-IFRS measures to IFRS financial measures, and operating results are included at the end of this release.

FY 25 Guidance

The Company reiterates its FY25 guidance and expects to complete construction of between 1,900 to 2,400 MWs by the end of Fiscal Year 2025. The Company’s Adjusted EBITDA and Cash Flow to Equity guidance for FY25 are subject to weather being similar to FY24. The Company anticipates continued net gains on sales of assets, which is part of ReNew’s capital recycling strategy, and has included INR 1-2 billion of gains in the guidance below:

|

|

|

|

|

Financial Year |

|

Adjusted EBITDA |

|

Cash Flow to equity (CFe) |

FY25 |

|

INR 76 – INR 82 billion |

|

INR 12 – INR 14 billion |

The Company also reiterates its long-term and run rate guidance provided in Q4 FY24 results.

Cash Flow

Cash generated from operating activities for Q1 FY25 was INR 9,913 million (US$ 119 million), compared to INR 13,473 million (US$ 162 million) for Q1 FY24. The decrease was driven by higher working capital deployment, partially offset by income tax refund in Q1 FY25.

Cash used in investing activities for Q1 FY25 was INR 40,455 million (US$ 485 million), compared to INR 45,356 million (US$ 544 million) for Q1 FY24. Cash was primarily used for investment in renewable energy projects.

Cash generated from financing activities for Q1 FY25 was INR 20,079 million (US$ 241 million), compared to INR 13,799 million (US$ 166 million) in Q1 FY24. The increase was primarily on account of higher proceeds (net of repayments) from project financing, partially offset by higher interest paid during Q1 FY25.

Capital Expenditure

In Q1 FY25, we commissioned 17 MWs of wind and 35 MWs of solar projects for which our capex was INR 3,201 million (US$ 38 million).

Liquidity Position

As of June 30, 2024, we had INR 76,635 million (US$ 920 million) of cash and bank balances. This included an aggregate of cash and cash equivalents of INR 16,558 million (US$ 199 million), bank balances other than cash and cash equivalents of INR 57,152 million (US$ 686 million) and deposits with maturities of more than twelve months (forming part of other financial assets) of INR 2,925 million (US$ 35 million).

Net Debt

Net debt as of June 30, 2024, was INR 594,109 million (US$ 7,130 million). Net debt as of June 30, 2024 also includes investment from JV partners for renewable energy projects in the form of convertible debentures amounting to INR 21,454 (US$ 257 million) and net debt for solar module manufacturing amounting to INR 13,559 million (US$ 163 million).

Receivables

Total receivables as of June 30, 2024, were INR 25,160 million (US$ 257 million), of which INR 6,402 million (US$ 77 million) was unbilled and others. The Days Sales Outstanding were 83 days as on June 30, 2024, as compared to 114 days as of June 30, 2023, an improvement of 31 days year-on-year.

Cash Flow to Equity (CFe)

Cash Flow to Equity for Q1 FY25 was INR 9,703 million (US$ 116 million), compared to INR 9,584 million (US$ 115 million) for Q1 FY24. The CFe was similar to the prior period on account of limited growth in Adjusted EBITDA, higher normalized loan repayment, partially offset by an income tax refund received in Q1 FY25.

Use of Non-IFRS Financial Measures

Adjusted EBITDA

Adjusted EBITDA is a non-IFRS financial measure. We present Adjusted EBITDA as a supplemental measure of its performance. This measurement is not recognized in accordance with IFRS and should not be viewed as an alternative to IFRS measures of performance. The presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

The Company defines Adjusted EBITDA as Profit/(loss) for the period plus (a) current and deferred tax, (b) finance costs and FV changes on derivative instruments, (c) change in fair value of warrants (if recorded as expense) (d) depreciation and amortization, (e) listing expenses, (f) share based payment and other expense related to listing, less (g) share in profit/(loss) of jointly controlled entities (h) finance income and FV change in derivative instruments, (i) change in fair value of warrants (if recorded as income). We believe Adjusted EBITDA is useful to investors in assessing our ongoing financial performance and provides improved comparability on a like to like basis between periods through the exclusion of certain items that management believes are not indicative of our operational profitability and that may obscure underlying business results and trends. However, this measure should not be considered in isolation or viewed as a substitute for net income or other measures of performance determined in accordance with IFRS. Moreover, Adjusted EBITDA as used herein is not necessarily comparable to other similarly titled measures of other companies due to potential inconsistencies in the methods of calculation.

Our management believes this measure is useful to compare general operating performance from period to period and to make certain related management decisions. Adjusted EBITDA is also used by securities analysts, lenders and others in their evaluation of different companies because it excludes certain items that can vary widely across different industries or among companies within the same industry. For example, interest expense can be highly dependent on our capital structure, debt levels and credit ratings. Therefore, the impact of interest expense on earnings can vary significantly among companies. In addition, the tax positions of companies can vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the various jurisdictions in which they operate. As a result, effective tax rates and tax expenses can vary considerably among companies.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under IFRS. Some of these limitations include:

•it does not reflect cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss;

•it does not reflect changes in, or cash requirements for, working capital;

•it does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on outstanding debt;

•it does not reflect payments made or future requirements for income taxes; and

•although depreciation, amortization and impairment are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA does not reflect cash requirements for such replacements or payments.

Investors are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis. For more information, please see the Reconciliations of Net loss to Adjusted EBITDA towards the end of this earnings release.

Cash Flow to Equity (CFe)

CFe is a Non-IFRS financial measure. We present CFe as a supplemental measure of our performance. This measurement is not recognized in accordance with IFRS and should not be viewed as an alternative to IFRS measures of performance. The presentation of CFe should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

We define CFe as Adjusted EBITDA add non-cash expense and finance income and fair value change in derivative, less interest expense paid, tax paid/(refund) and normalized loan repayments. Normalized loan repayments are repayment of scheduled payments as per the loan agreement. Ad Hoc payments and refinancing (including planned arrangements/ borrowings in previous periods) are not included in normalized loan repayments. The definition also excludes changes in net working capital and investing activities.

We believe IFRS metrics, such as net income (loss) and cash from operating activities, do not provide the same level of visibility into the performance and prospects of our operating business as a result of the long-term capital-intensive nature of our businesses, non-cash depreciation and amortization, cash used for debt servicing as well as investments and costs related to the growth of our business.

Our business owns high-value, long-lived assets capable of generating substantial Cash Flows to Equity over time. We believe that external consumers of our financial statements, including investors and research analysts, use CFe both to assess ReNew performance and as an indicator of its success in generating an attractive risk-adjusted total return, assess the value of the business and the platform. This has been a widely used metric by analysts to value our business, and hence we believe this will better help potential investors in analyzing the cash generation from our operating assets.

We have disclosed CFe for our operational assets on a consolidated basis, which is not our cash from operations on a consolidated basis. We believe CFe supplements IFRS results to provide a more complete understanding of the financial and operating performance of our businesses than would not otherwise be achieved using IFRS results alone. CFe should be used as a supplemental measure and not in lieu of our financial results reported under IFRS.

Webcast and Conference call information

A conference call has been scheduled to discuss the earnings results at 8:30 AM EST (6:00 PM IST) on August 16, 2024. The conference call can be accessed live at: https://edge.media-server.com/mmc/p/ucbu5ouj or by phone (toll-free) by dialing:

US/Canada: (+1) 855 881 1339

France: (+33) 0800 981 498

Germany: (+49) 0800 182 7617

Hong Kong: (+852) 800 966 806

India: (+91) 0008 0010 08443

Japan: (+81) 005 3116 1281

Singapore: (+65) 800 101 2785

Sweden: (+46) 020 791 959

UK: (+44) 0800 051 8245

Rest of the world: (+61) 7 3145 4010 (toll)

An audio replay will be available following the call on our investor relations website at https://investor.renew.com/news-events/events.

Notes:

(1)This press release contains translations of certain Indian rupee amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, the translation of Indian rupees into U.S. dollars has been made at INR 83.33 to US$ 1.00, which was the noon buying rate in New York City for cable transfer in non-U.S. currencies as certified for customs purposes by the Federal Reserve Bank of New York on June 28, 2024. We make no representation that the Indian rupee or U.S. dollar amounts referred to in this press release could have been converted into U.S. dollars or Indian rupees, as the case may be, at any particular rate or at all.

(2)The financial statements in this press release are not the Company’s statutory accounts as defined in section 434 of the UK Companies Act 2006. Statutory accounts for the Company’s financial year ended March 31, 2024, have not yet been delivered to the Registrar of Companies for England and Wales. Statutory accounts for the Company’s financial year ended March 31, 2023 have been delivered to the Registrar in accordance with section 441 of the Companies Act 2006 and an auditor’s report has been made on them and was unqualified, did not include any reference to any matters to which the auditor drew attention by way of emphasis without qualifying the report, and contained no statement under section 498(2) or (3) of the Companies Act 2006.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended and the Private Securities Litigation Reform Act of 1995, including statements regarding our future financial and operating guidance, operational and financial results such as estimates of nominal contracted payments remaining and portfolio run rate, and the assumptions related to the calculation of the foregoing metrics. The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include: the availability of additional financing on acceptable terms; changes in the commercial and retail prices of traditional utility generated electricity; changes in tariffs at which long-term PPAs are entered into; changes in policies and regulations including net metering and interconnection limits or caps; the availability of rebates, tax credits and other incentives; the availability of solar panels and other raw materials; our limited operating history, particularly as a relatively new public company; our ability to attract and retain relationships with third parties, including solar partners; our ability to meet the covenants in our debt facilities; meteorological conditions; supply disruptions; solar power curtailments by state electricity authorities and such other risks identified in the registration statements and reports that our Company has filed or furnished with the U.S. Securities and Exchange Commission, or SEC, from time to time. Portfolio represents the aggregate megawatts capacity of solar power plants pursuant to PPAs, signed or allotted or where we have received a letter of award. There is no assurance that we will be able to sign a PPA even though we have received a letter of award. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we assume no obligation to update these forward-looking statements.

About ReNew

Unless the context otherwise requires, all references in this press release to “we,” “us,” or “our” refers to ReNew and its subsidiaries.

ReNew is a leading decarbonization solutions company listed on Nasdaq (Nasdaq: RNW, RNWWW). ReNew's clean energy portfolio of ~15.6 GWs on a gross basis as of June 30, 2024, is one of the largest globally. In addition to being a major independent power producer in India, we provide end-to-end solutions in a just and inclusive manner in the areas of clean energy, value-added energy offerings through digitalization, storage, and carbon markets that increasingly are integral to addressing climate change. For more information, visit renew.com and follow us on LinkedIn, Facebook and Twitter.

Press Enquiries

Shilpa Narani

Shilpa.narani@renew.com

+ 91 9999384233

Investor Enquiries

Anunay Shahi

Nitin Vaid

ir@renew.com

RENEW ENERGY GLOBAL PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(INR and US$ amounts in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

As at March 31, |

|

As at June 30, |

|

|

|

2024 |

|

2024 |

|

2024 |

|

|

|

(Audited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(INR) |

|

(INR) |

|

(USD) |

|

Assets |

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Property, plant and equipment |

|

|

678,600 |

|

|

698,269 |

|

|

8,380 |

|

Intangible assets |

|

|

37,883 |

|

|

37,500 |

|

|

450 |

|

Right of use assets |

|

|

12,898 |

|

|

13,218 |

|

|

159 |

|

Investment in jointly controlled entities |

|

|

2,862 |

|

|

2,818 |

|

|

34 |

|

Trade receivables |

|

|

8,087 |

|

|

7,738 |

|

|

93 |

|

Investments |

|

|

823 |

|

|

912 |

|

|

11 |

|

Other financial assets |

|

|

6,800 |

|

|

6,610 |

|

|

79 |

|

Deferred tax assets (net) |

|

|

5,556 |

|

|

6,017 |

|

|

72 |

|

Tax assets |

|

|

8,172 |

|

|

6,613 |

|

|

79 |

|

Contract assets |

|

|

1,500 |

|

|

1,679 |

|

|

20 |

|

Other non-financial assets |

|

|

6,317 |

|

|

9,763 |

|

|

117 |

|

Total non-current assets |

|

|

769,498 |

|

|

791,137 |

|

|

9,494 |

|

Current assets |

|

|

|

|

|

|

|

Inventories |

|

|

1,689 |

|

|

1,029 |

|

|

12 |

|

Trade receivables |

|

|

13,769 |

|

|

17,422 |

|

|

209 |

|

Investments |

|

|

1,502 |

|

|

0 |

|

|

0 |

|

Cash and cash equivalents |

|

|

27,021 |

|

|

16,558 |

|

|

199 |

|

Bank balances other than cash and cash equivalents |

|

|

50,706 |

|

|

57,152 |

|

|

686 |

|

Other financial assets |

|

|

4,671 |

|

|

5,688 |

|

|

68 |

|

Contract assets |

|

|

216 |

|

|

278 |

|

|

3 |

|

Other non-financial assets |

|

|

4,863 |

|

|

5,788 |

|

|

69 |

|

Total current assets |

|

|

104,437 |

|

|

103,915 |

|

|

1,247 |

|

Total assets |

|

|

873,935 |

|

|

895,052 |

|

|

10,741 |

|

Equity and liabilities |

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

Issued capital |

|

|

4,808 |

|

|

4,813 |

|

|

58 |

|

Share premium |

|

|

154,153 |

|

|

154,154 |

|

|

1,850 |

|

Retained losses |

|

|

(56,433 |

) |

|

(57,066 |

) |

|

(685 |

) |

Other components of equity |

|

|

2,689 |

|

|

3,539 |

|

|

42 |

|

Equity attributable to equity holders of the parent |

|

|

105,217 |

|

|

105,440 |

|

|

1,265 |

|

Non-controlling interests |

|

|

16,480 |

|

|

16,890 |

|

|

203 |

|

Total equity |

|

|

121,697 |

|

|

122,330 |

|

|

1,468 |

|

Non-current liabilities |

|

|

|

|

|

|

|

Interest-bearing loans and borrowings |

|

|

|

|

|

|

|

- Principal portion |

|

|

565,861 |

|

|

568,372 |

|

|

6,821 |

|

Lease liabilities |

|

|

7,477 |

|

|

7,874 |

|

|

94 |

|

Other financial liabilities |

|

|

7,011 |

|

|

7,498 |

|

|

90 |

|

Provisions |

|

|

10,508 |

|

|

11,143 |

|

|

134 |

|

Deferred tax liabilities (net) |

|

|

18,705 |

|

|

20,814 |

|

|

250 |

|

Other non-financial liabilities |

|

|

632 |

|

|

1,025 |

|

|

12 |

|

Total non-current liabilities |

|

|

610,194 |

|

|

616,726 |

|

|

7,401 |

|

Current liabilities |

|

|

|

|

|

|

|

Interest-bearing loans and borrowings |

|

|

|

|

|

|

|

- Principal portion |

|

|

81,455 |

|

|

102,372 |

|

|

1,229 |

|

- Interest accrued |

|

|

2,957 |

|

|

5,780 |

|

|

69 |

|

Lease liabilities |

|

|

868 |

|

|

992 |

|

|

12 |

|

Trade payables |

|

|

9,094 |

|

|

6,058 |

|

|

73 |

|

Other financial liabilities |

|

|

42,571 |

|

|

38,972 |

|

|

468 |

|

Tax liabilities (net) |

|

|

429 |

|

|

807 |

|

|

10 |

|

Other non-financial liabilities |

|

|

4,670 |

|

|

1,015 |

|

|

12 |

|

Total current liabilities |

|

|

142,044 |

|

|

155,996 |

|

|

1,872 |

|

Total liabilities |

|

|

752,238 |

|

|

772,722 |

|

|

9,273 |

|

Total equity and liabilities |

|

|

873,935 |

|

|

895,052 |

|

|

10,741 |

|

RENEW ENERGY GLOBAL PLC

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

(INR and US$ amounts in millions, except share and par value data)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(INR) |

|

(INR) |

|

(USD) |

|

Income |

|

|

|

|

|

|

|

Revenue |

|

|

21,250 |

|

|

22,811 |

|

|

274 |

|

Other operating income |

|

|

109 |

|

|

177 |

|

|

2 |

|

Late payment surcharge from customers |

|

|

855 |

|

|

7 |

|

|

0 |

|

Finance income and fair value change in derivative instruments |

|

|

1,521 |

|

|

1,154 |

|

|

14 |

|

Other income |

|

|

830 |

|

|

754 |

|

|

9 |

|

Change in fair value of warrants |

|

|

94 |

|

|

— |

|

|

— |

|

Total income |

|

|

24,659 |

|

|

24,903 |

|

|

299 |

|

Expenses |

|

|

|

|

|

|

|

Raw materials and consumables used |

|

|

564 |

|

|

237 |

|

|

3 |

|

Employee benefits expense |

|

|

1,147 |

|

|

1,437 |

|

|

17 |

|

Depreciation and amortisation |

|

|

4,193 |

|

|

4,843 |

|

|

58 |

|

Other expenses |

|

|

3,048 |

|

|

3,559 |

|

|

43 |

|

Finance costs and fair value change in derivative instruments |

|

|

11,077 |

|

|

12,215 |

|

|

147 |

|

Change in fair value of warrants |

|

|

— |

|

|

77 |

|

|

1 |

|

Total expenses |

|

|

20,029 |

|

|

22,368 |

|

|

268 |

|

Profit before share of profit of jointly controlled entities and tax |

|

|

4,630 |

|

|

2,535 |

|

|

30 |

|

Share of loss of jointly controlled entities |

|

|

(36 |

) |

|

(45 |

) |

|

(1 |

) |

Profit before tax |

|

|

4,594 |

|

|

2,490 |

|

|

30 |

|

Income tax expense |

|

|

|

|

|

|

|

Current tax |

|

|

483 |

|

|

427 |

|

|

5 |

|

Deferred tax |

|

|

1,128 |

|

|

1,669 |

|

|

20 |

|

Profit for the period |

|

|

2,983 |

|

|

394 |

|

|

5 |

|

Weighted average number of equity shares in calculating basic EPS |

|

|

370,014,900 |

|

|

362,632,768 |

|

|

362,632,768 |

|

Weighted average number of equity shares in calculating diluted EPS |

|

|

370,014,900 |

|

|

363,037,886 |

|

|

363,037,886 |

|

(Loss) / earning per share |

|

|

|

|

|

|

|

Basic earning attributable to ordinary equity holders of the Parent (in INR) |

|

|

7.41 |

|

|

0.24 |

|

|

0.00 |

|

Diluted earning attributable to ordinary equity holders of the Parent (in INR) |

|

|

7.41 |

|

|

0.24 |

|

|

0.00 |

|

RENEW ENERGY GLOBAL PLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(INR and US$ amounts in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(INR) |

|

(INR) |

|

(USD) |

|

Cash flows from operating activities |

|

|

|

|

|

|

|

Profit before tax |

|

|

4,594 |

|

|

2,490 |

|

|

30 |

|

Adjustments to reconcile profit before tax to net cash flows: |

|

|

|

|

|

|

|

Finance costs |

|

|

10,793 |

|

|

12,021 |

|

|

144 |

|

Depreciation and amortisation |

|

|

4,193 |

|

|

4,843 |

|

|

58 |

|

Change in fair value of warrants |

|

|

(94 |

) |

|

77 |

|

|

1 |

|

Share based payments |

|

|

314 |

|

|

463 |

|

|

6 |

|

Interest income |

|

|

(1,271 |

) |

|

(1,147 |

) |

|

(14 |

) |

Others |

|

|

(101 |

) |

|

21 |

|

|

0 |

|

Working capital adjustments: |

|

|

|

|

|

|

|

(Increase) / decrease in trade receivables |

|

|

1,168 |

|

|

(3,210 |

) |

|

(39 |

) |

(Increase) / decrease in inventories |

|

|

(433 |

) |

|

639 |

|

|

8 |

|

(Increase) / decrease in other financial assets |

|

|

(7 |

) |

|

(613 |

) |

|

(7 |

) |

(Increase) / decrease in other non-financial assets |

|

|

(2,968 |

) |

|

(677 |

) |

|

(8 |

) |

(Increase) / decrease in contract assets |

|

|

(713 |

) |

|

(196 |

) |

|

(2 |

) |

Decrease / (increase) in other financial liabilities |

|

|

346 |

|

|

— |

|

|

— |

|

Decrease / (increase) in other non-financial liabilities |

|

|

(3,201 |

) |

|

(3,271 |

) |

|

(39 |

) |

Decrease / (increase) in in trade payables |

|

|

993 |

|

|

(3,037 |

) |

|

(36 |

) |

Cash generated from operations |

|

|

13,613 |

|

|

8,403 |

|

|

101 |

|

Income tax refund / (paid) (net) |

|

|

(140 |

) |

|

1,510 |

|

|

18 |

|

Net cash generated from operating activities (a) |

|

|

13,473 |

|

|

9,913 |

|

|

119 |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

Purchase of property, plant and equipment, intangible assets and right of use assets |

|

|

(34,917 |

) |

|

(36,306 |

) |

|

(436 |

) |

Sale of property, plant and equipment |

|

|

0 |

|

|

— |

|

|

— |

|

Investment in deposits having residual maturity more than 3 months and mutual funds |

|

|

(84,693 |

) |

|

(87,909 |

) |

|

(1,055 |

) |

Redemption of deposits having residual maturity more than 3 months and mutual funds |

|

|

72,589 |

|

|

82,928 |

|

|

995 |

|

Deferred consideration received during the period |

|

|

1,115 |

|

|

227 |

|

|

3 |

|

Purchase consideration paid |

|

|

(223 |

) |

|

— |

|

|

— |

|

Proceeds from interest received |

|

|

773 |

|

|

703 |

|

|

8 |

|

Investment in energy funds |

|

|

— |

|

|

(76 |

) |

|

(1 |

) |

Loans given |

|

|

— |

|

|

(22 |

) |

|

(0 |

) |

Net cash used in investing activities (b) |

|

|

(45,356 |

) |

|

(40,455 |

) |

|

(485 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

|

Shares bought back, held as treasury stock |

|

|

(2,060 |

) |

|

— |

|

|

— |

|

Shares issued during the period |

|

|

0 |

|

|

1 |

|

|

0 |

|

Payment for acquisition of interest from non-controlling interest |

|

|

(137 |

) |

|

— |

|

|

— |

|

Payment of lease liabilities (including payment of interest expense) |

|

|

(123 |

) |

|

(66 |

) |

|

(1 |

) |

Proceeds from shares and debentures issued by subsidiaries |

|

|

4,411 |

|

|

96 |

|

|

1 |

|

Proceeds from interest-bearing loans and borrowings |

|

|

71,625 |

|

|

109,487 |

|

|

1,314 |

|

Repayment of interest-bearing loans and borrowings |

|

|

(50,042 |

) |

|

(78,108 |

) |

|

(937 |

) |

Interest paid (including settlement gain / loss on derivative instruments) |

|

|

(9,875 |

) |

|

(11,331 |

) |

|

(136 |

) |

Net cash generated from financing activities (c) |

|

|

13,799 |

|

|

20,079 |

|

|

241 |

|

Net decrease in cash and cash equivalents (a) + (b) + (c) |

|

|

(18,084 |

) |

|

(10,463 |

) |

|

(126 |

) |

Cash and cash equivalents at the beginning of the period |

|

|

38,182 |

|

|

27,021 |

|

|

324 |

|

Effects of exchange rate changes on cash and cash equivalents |

|

|

(4 |

) |

|

— |

|

|

— |

|

Cash and cash equivalents at the end of the period |

|

|

20,094 |

|

|

16,558 |

|

|

199 |

|

Components of cash and cash equivalents |

|

|

|

|

|

|

|

Cash and cheque on hand |

|

|

1 |

|

|

1 |

|

|

0 |

|

Balances with banks: |

|

|

|

|

|

|

|

- On current accounts |

|

|

13,286 |

|

|

10,118 |

|

|

121 |

|

- Deposits with original maturity of less than 3 months |

|

|

6,807 |

|

|

6,439 |

|

|

77 |

|

Total cash and cash equivalents |

|

|

20,094 |

|

|

16,558 |

|

|

199 |

|

RENEW ENERGY GLOBAL PLC

Unaudited Non-IFRS metrices

(INR and US$ amounts in millions)

Reconciliation of Net profit to Adjusted EBITDA for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(INR) |

|

(INR) |

|

(USD) |

|

Profit for the period |

|

|

2,983 |

|

|

394 |

|

|

5 |

|

Less: Finance income and fair value change in derivative instruments |

|

|

(1,521 |

) |

|

(1,154 |

) |

|

(14 |

) |

Add: Share in loss of jointly controlled entities |

|

|

36 |

|

|

45 |

|

|

1 |

|

Add: Depreciation and amortisation |

|

|

4,193 |

|

|

4,843 |

|

|

58 |

|

Add: Finance costs and fair value change in derivative instruments |

|

|

11,077 |

|

|

12,215 |

|

|

147 |

|

Add/ less: Change in fair value of warrants |

|

|

(94 |

) |

|

77 |

|

|

1 |

|

Add: Income tax expense |

|

|

1,611 |

|

|

2,096 |

|

|

25 |

|

Add: Share based payment expense and others related to listing |

|

|

314 |

|

|

463 |

|

|

6 |

|

Adjusted EBITDA |

|

|

18,599 |

|

|

18,979 |

|

|

228 |

|

Reconciliation of Cash flow to equity (CFe) to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(INR) |

|

(INR) |

|

(USD) |

|

Adjusted EBITDA |

|

|

18,599 |

|

|

18,979 |

|

|

228 |

|

Add: Finance income and fair value change in derivative instruments |

|

|

1,521 |

|

|

1,154 |

|

|

14 |

|

Less: Interest paid in cash |

|

|

(7,947 |

) |

|

(8,445 |

) |

|

(101 |

) |

Add/ less: Tax refund/ (paid) |

|

|

(140 |

) |

|

1,510 |

|

|

18 |

|

Less: Normalised loan repayment |

|

|

(2,573 |

) |

|

(3,550 |

) |

|

(43 |

) |

Add: Other non-cash items |

|

|

124 |

|

|

55 |

|

|

1 |

|

Total CFe |

|

|

9,584 |

|

|

9,703 |

|

|

116 |

|

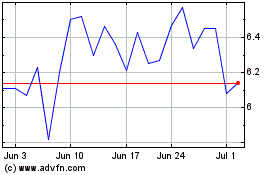

ReNew Energy Global (NASDAQ:RNW)

Historical Stock Chart

From Jul 2024 to Aug 2024

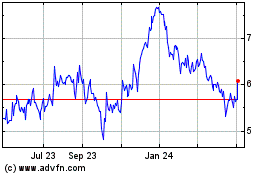

ReNew Energy Global (NASDAQ:RNW)

Historical Stock Chart

From Aug 2023 to Aug 2024