UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December 2022

Commission File Number: 001-36622

PROQR THERAPEUTICS N.V.

Zernikedreef 9

2333 CK Leiden

The Netherlands

Tel: +31 88 166 7000

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Entry into a Material Definitive Agreement

Collaboration Agreement

On December 21, 2022,

ProQR Therapeutics N.V. (“ProQR”), acting through ProQR Therapeutics VIII B.V. (“ProQR VIII” and together

with ProQR, the “Company”), entered into an Amended and Restated Research and Collaboration Agreement (as amended and

restated, the “Collaboration Agreement”) with Eli Lilly and Company (“Lilly”). This agreement amended and

restated the Company’s existing collaboration agreement with Lilly that was entered into in September 2021, to allow the

parties to continue and expand their work on the discovery, development and commercialization of potential new medicines for genetic

disorders in the liver and nervous system. Under the terms of the Collaboration Agreement, the Company and Lilly will seek to

continue to use the Company’s proprietary Axiomer® RNA editing platform to progress new drug targets toward clinical

development and commercialization. Through the expanded collaboration, the parties intend to explore further applications of the

Axiomer platform and progress additional drug targets, and Lilly grants the Company access to approved uses of

certain Lilly technology.

Under the Collaboration Agreement,

the Company will grant Lilly certain exclusive and non-exclusive licenses, with the right to grant sublicenses through multiple tiers

during a specified time period, to support the parties’ activities and to enable Lilly to develop, manufacture and commercialize

products derived from or containing compounds developed pursuant to such agreement. The Collaboration Agreement contemplates collaboration on an increased number of targets, and Lilly can exercise an option to further

increase the total number of targets. The Company retains all rights not granted to Lilly.

Under the Collaboration Agreement, Lilly will grant the Company certain non-exclusive licenses, with the right to grant approved sublicenses

through multiple tiers during a specified time period, to certain Lilly technology to enable the Company to develop, manufacture and commercialize

products approved by Lilly using such Lilly technology. Lilly has rights during a specified time period to engage in exclusive negotiations

with the Company with respect to certain Company products. Under the Collaboration Agreement, Lilly is eligible to receive tiered royalties

of up to low-single digit percentage on product sales for products covering licensed Lilly technology on a country-by-country and product-by-product

basis until the latest to occur of: (i) the expiration or abandonment of the last-to-expire valid claim in such country covering such

product, (ii) the expiration of all data or regulatory exclusivity periods for such product in such country, or (iii) a specified anniversary

of the first commercial sale of such product in such country.

Pursuant to the terms of the

Collaboration Agreement, Lilly will pay the Company a one-time,

non-refundable, non-creditable upfront payment of $50.0 million as consideration for the rights granted by the Company and $10.0 million for the options granted by the Company (in addition to the $20.0 million upfront fee paid under the original

collaboration), with Lilly also making an additional $15.0 million equity investment in the Company pursuant to a share purchase agreement

between the parties (the “Share Purchase Agreement”). Lilly will have the ability to exercise an option to further expand

the partnership for a consideration of $50.0 million. Under the Collaboration Agreement, the Company is also eligible to receive up to

approximately $3.75 billion for development, regulatory and commercialization milestones, as well as tiered royalties of up to mid-single

digit percentage on product sales on a country-by-country and product-by-product basis until the latest to occur of: (i) the expiration

or abandonment of the last-to-expire valid claim in such country covering such product, (ii) the expiration of all data or regulatory

exclusivity periods for such product in such country, or (iii) a specified anniversary of the first commercial sale of such product in

such country, subject to certain royalty step-down provisions set forth in the Collaboration Agreement.

The Collaboration

Agreement includes a specified research term for the parties to perform research and development activities, subject to a one-time

option, exercisable by Lilly at its sole discretion, to extend the term. Unless terminated earlier, the Collaboration Agreement will

continue on a product-by-product basis until Lilly or the Company has no royalty payment obligations with respect to such product,

and, with respect to certain sublicenses granted by the Company until the sublicense expires or terminates. The Collaboration

Agreement may be terminated in its entirety or on a program-by-program basis at any time without cause by Lilly following a

specified notice period (except with respect to Company products). The Collaboration Agreement may also be terminated by either

party under certain other circumstances, including an uncured material breach of the other party or if a party challenges or opposes

any patent owned by the other party and covered by the Collaboration Agreement. If the Collaboration Agreement is terminated with

respect to one or more programs, depending on the stage of development, certain rights in the terminated programs revert to the

Company, in accordance with the terms of the Collaboration Agreement. The Collaboration Agreement includes various representations,

warranties, covenants, indemnities and other customary provisions.

Share Purchase Agreement

In connection with the Collaboration

Agreement, ProQR and Lilly entered into the Share Purchase Agreement on December 21, 2022, pursuant to which the Company agreed to issue

and sell to Lilly 9,381,586 shares (the “Lilly Shares”) of the Company’s ordinary shares, nominal value €0.04

per share (“Ordinary Shares”), for an aggregate purchase price of $15,000,000.29. The issuance of the Lilly Shares occurred

concurrently with the entry by the parties into the Collaboration Agreement. The Share Purchase Agreement contains customary representations,

warranties, and covenants of each party.

Pursuant to the terms of

the Share Purchase Agreement, Lilly may not, subject to certain limited exceptions, dispose of any of the Lilly Shares for a period

commencing on December 21, 2022 until the earlier of (i) June 21, 2023 and (ii) the date that the

Collaboration Agreement is terminated. Additionally, under the Share Purchase Agreement, Lilly may participate in some public

offerings and private placements of the Company, subject to share ownership requirements and other limitations set forth in the

Share Purchase Agreement. The Company has also granted Lilly certain customary registration rights with respect to the Lilly Shares,

including registering such shares for resale on or prior to the expiration of the lockup agreement described above. Lilly has also agreed to a standstill on acquiring additional shares of the Company and proposing certain

transactions to the Company or its shareholders, all on the terms, and subject to the exceptions, contained in the Share Purchase

Agreement.

The foregoing summaries of

the Collaboration Agreement and the Share Purchase Agreement do not purport to be complete and are qualified in their entirety by reference

to the respective agreements, copies of which are attached hereto as exhibits to this Report of Foreign Private Issuer on Form 6-K and

are incorporated herein by reference. The Company intends to seek confidential treatment from the Securities and Exchange Commission for

certain portions of the Collaboration Agreement.

On December 22, 2022, the

parties issued a joint press release announcing the above transactions, a copy of which is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

On December 22, 2022, the

Company hosted a webcasted conference call to discuss its Axiomer® RNA editing platform following its recently announced expanded

collaboration with Eli Lilly and Company. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by

reference.

The Company hereby incorporates

by reference the information contained herein into the Company’s registration statements on Form F-3 (File Nos. 333-248740; 333-260775;

333-260780; 333-263166).

Unregistered Sale of Equity Securities.

As described in the section

titled “Share Purchase Agreement” in this Report of Foreign Private Issuer on Form 6-K, which is incorporated in this

section by reference, the Company agreed to sell the Lilly Shares to Lilly on December 21, 2022 pursuant to the Share Purchase Agreement

and subject to the satisfaction of the closing conditions contained therein. The Lilly Shares were offered and issued in a private placement

exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), or

Regulation D promulgated thereunder, as a transaction by an issuer not involving a public offering. Lilly has represented that it acquired

the Lilly Shares for investment only and not with the intent to sell in connection with any distribution thereof, and an appropriate legend

was applied to the Lilly Shares.

Cautionary Note on Forward-Looking Statements

This Report of Foreign

Private Issuer on Form 6-K includes forward-looking statements. All statements other than statements of historical fact are

forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “goal,” “intend,” “look forward

to”, “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” and similar expressions. Such forward-looking statements include, but

are not limited to, statements regarding the collaboration with Lilly and the intended benefits thereof, including the upfront

payment, equity investment, and milestone and royalty payments from commercial product sales, if any, from the products covered by

the collaboration, as well as the potential of our technologies and product candidates. Forward-looking statements are based on

management’s beliefs and assumptions and on information available to management only as of the date of this report. Our actual

results could differ materially from those anticipated in these forward-looking statements for many reasons, including, without

limitation, the risks, uncertainties and other factors in our filings made with the Securities and Exchange Commission, including

certain sections of our annual report filed on Form 20-F. These risks and uncertainties include, among others, the cost, timing and

results of preclinical studies and other development activities by us and our collaborative partners whose

operations and activities may be slowed or halted by shortage and pressure on supply and logistics on the global market; our reliance on contract manufacturers or suppliers to supply materials

for research and development and the risk of supply interruption or delays from suppliers or contract manufacturers; the ability to secure, maintain and realize the intended benefits of collaborations with partners, including the

collaboration with Lilly; the possible impairment of, inability to obtain, and costs to obtain intellectual property rights;

possible safety or efficacy concerns that could emerge as new data are generated in research and development; and general business,

operational, financial and accounting risks, and risks related to litigation and disputes with third parties. Given these risks,

uncertainties and other factors, you should not place undue reliance on these forward-looking statements, and we assume no

obligation to update these forward-looking statements, even if new information becomes available in the future, except as required

by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

PROQR THERAPEUTICS N.V. |

| |

|

| Date: December 23, 2022 |

By: |

/s/ René Beukema |

| |

|

René Beukema |

| |

|

Chief Corporate Development Officer and General Counsel |

INDEX TO EXHIBITS

* Portions of this exhibit have been redacted

pursuant to a request for confidential treatment in accordance with the rules of the Securities and Exchange Commission.

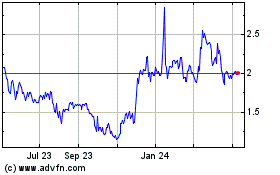

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Dec 2024 to Jan 2025

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Jan 2024 to Jan 2025