Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 21 2022 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign

Private Issuer

Pursuant to Rule 13a-16

or 15d-16 of

the Securities

Exchange Act of 1934

For the month of September 2022

Commission File Number: 001-36622

PROQR THERAPEUTICS N.V.

Zernikedreef 9

2333 CK Leiden

The Netherlands

Tel: +31 88 166 7000

(Address, Including Zip Code, and Telephone

Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Termination of a Material Definitive Agreement

On September 19, 2022 (the

“Notice Date”), ProQR Therapeutics N.V. (the “Company") entered into a pay-off letter (the “Pay-Off

Letter”) with Pontifax Medison Finance (Israel) L.P., Pontifax Medison Finance (Cayman) L.P., Kreos Capital VI (UK) Limited,

Kreos Capital 2020 Opportunity (UK) Limited, Kreos Capital 2020 Opportunity Limited and Kreos Capital VI (Expert Fund) L.P. (each, a

“Lender” and collectively, the “Lenders”) and Pontifax Medison Finance GP, L.P., in its capacity

as administrative agent and collateral agent for itself and Lenders (in such capacity, including any successor thereto, the “Agent”

and, together with the Lenders, the “Lender Parties”). The Pay-Off Letter acknowledges and confirms that the Company

has previously delivered a written notice of prepayment notifying the Lender Parties that it intends to (i) prepay in full the entire

principal balance of the loans (the “Loans”) currently outstanding, including all accrued and unpaid interest thereon,

under that certain Loan and Security Agreement, dated as of July 14, 2020 (as amended by that certain Joinder and First Amendment to

Loan Agreement and Joinder to Registration Rights Agreement, dated as of August 4, 2020, that certain Second Amendment to Loan Agreement,

dated as of January 5, 2021, that certain Third Amendment to Loan and Security Agreement, dated as of December 29, 2021, and as further

amended, supplemented, modified and/or restated from time to time and in effect immediately prior to the Notice Date, the “Loan

and Security Agreement”; capitalized terms used but not otherwise defined herein shall have the respective meanings ascribed

to them in the Loan and Security Agreement) and (ii) pay and satisfy in full all other amounts and obligations outstanding under the

Loan and Security Agreement and the other Loan Documents (together with the Loans, collectively, the “Indebtedness”),

in each case, in accordance with the terms of the Loan and Security Agreement and the other Loan Documents, as applicable. The Pay-Off

Letter provides that (i) the aggregate prepayment amount in connection with the Indebtedness, together with a prepayment charge equal

to one percent (1%) of the principal amount being prepaid, will be approximately $42.7 million (the “Pay-Off Amount”)

and (ii) upon receipt by the Agent of payment in full of the Pay-Off Amount, all liens, encumbrances and security interests of the Lender

Parties will be automatically and irrevocably released and terminated, and all liabilities, obligations and indebtedness owed by the

Company to the Lender Parties will be satisfied and discharged in full.

The Company paid in full the

Pay-Off Amount to the Lender Parties on September 21, 2022. Following such payment and satisfaction, the Loan and Security Agreement and

all other Loan Documents were terminated, canceled and of no further force and effect in accordance with their terms (other than inchoate

indemnity obligations or other contingent obligations which, by their terms, survive termination), and no further borrowings may be made

thereunder.

The Company hereby incorporates

by reference the information contained herein into the Company’s registration statements on Form F-3 (File No. 333-260775,

File No. 333-260780 and File No. 333-248740).

Other Information

Following the payment in full

of the Pay-Off Amount, the Company expects that its cash, cash equivalents and marketable securities will enable it to fund its operating

expenses and capital expenditure requirements into 2026.

Forward-Looking Statements

This Report of Foreign

Private Issuer on Form 6-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995, as amended. All statements other than statements of historical fact are forward-looking statements, which are often indicated

by terms such as "anticipate," "believe," "could," "estimate," "expect,"

"goal," "intend," "look forward to", "may," "plan," "potential,"

"predict," "project," "should," "will," "would" and similar expressions. Such

forward-looking statements include, but are not limited to, statements regarding the Company’s business operations, financial

position and cash runway. Forward-looking statements are based on management's beliefs and assumptions and on information available

to management only as of the date of this Report of Foreign Private Issuer on Form 6-K. The Company’s actual results could

differ materially from those anticipated in these forward-looking statements for many reasons, including, without limitation, the

risks, uncertainties and other factors in the Company’s filings made with the Securities and Exchange Commission. These risks

and uncertainties are described in greater detail in the section entitled “Risk Factors” in the Company’s Annual

Report on Form 20-F for the year ended December 31, 2021 filed with the Securities and Exchange Commission. All forward-looking

statements contained in this Report of Foreign Private Issuer on Form 6-K speak only as of the date on

which they were made and should not be relied upon as representing its views as of any subsequent date. The Company undertakes no

obligation to update such forward-looking statements, even if new information becomes available in the future, except as required by

law. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking

statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PROQR THERAPEUTICS N.V. |

| |

|

|

| Date: September 21, 2022 |

By: |

/s/ René Beukema |

| |

|

René Beukema |

| |

|

Chief Corporate Development Officer and General Counsel |

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Dec 2024 to Jan 2025

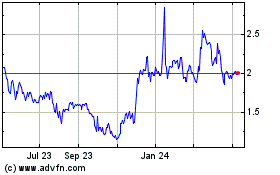

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Jan 2024 to Jan 2025