false

0000868278

0000868278

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 28, 2023

PROPHASE

LABS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-21617 |

|

23-2577138

|

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

711

Stewart Avenue, Suite 200

Garden

City, New York |

|

11530 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (215) 345-0919

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any

of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered Pursuant to Section 12(b) of the Exchange Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.0005 |

|

PRPH |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Chief

Operating Officer

On

January 4, 2024, ProPhase Labs, Inc. (the “Company”) announced that Jed A. Latkin has been appointed to serve as Chief Operating

Officer of the Company, effective on January 1, 2024.

Jed

A. Latkin served as a director and Chief Executive Officer of Navidea Biopharmaceuticals, Inc. (“Navidea”) from October 2018

until October 2021 and as Chief Operating Officer and Chief Financial Officer of Navidea from May 2017 to October 2018.

Mr. Latkin also served as Interim Chief Operating Officer of Navidea from April 2016 to April 2017. Mr. Latkin has more than twenty eight

years of experience in the financial industry supporting many investments in major markets. including biotechnology and pharmaceuticals.

He most recently was employed by Nagel Avenue Capital, LLC since 2010, and in that capacity he provided contracted services as a Turnaround

Specialist for numerous companies and asset management firms. Mr. Latkin was responsible for a large diversified portfolio

of asset-based investments in varying industries, including product manufacturing, agriculture, energy, and healthcare. In connection

with this role, he served as Chief Executive Officer of End of Life Petroleum Holdings, LLC and Black Elk Energy, LLC, Chief Financial

Officer of Viper Powersports, Inc. and West Ventures, LLC, and Portfolio Manager of Precious Capital, LLC. Mr. Latkin previously

served on the Board of Directors for Navidea from October 2018 until October 2021, CORAR from October 2018 until October 2021, Viper

Powersports, Inc. from 2012 to 2013, and the Renewable Fuels Association and Buffalo Lake Advanced Biofuels. Mr. Latkin worked

for over ten years in Investment Banking at Citigroup, Morgan Stanley, and Fleet Boston Robertson Stephens. He also spent five

years as a Co-Portfolio Manager for ING Investment Management. Mr. Latkin earned a B.A. from Rutgers University and a M.B.A. from Columbia

Business School.

On

December 28, 2023, Mr. Latkin accepted the Company’s Offer and Terms of Employment (the “Latkin Offer Letter”), which

provides that Mr. Latkin’s annual base compensation in connection with his service as Chief Operating Officer of the Company will

be $350,000. He will also be entitled to a sign-on bonus in the amount of $80,000. In addition, as an inducement to his employment as

Chief Operating Officer of the Company, the Company granted Mr. Latkin stock options (the “Options”) to purchase up to 500,000

shares of the Company’s common stock, with an exercise price of $6.00 per share and will be exercisable for a period

of seven years, pursuant to an inducement option award agreement to be entered into between the Company and Mr. Latkin. This award

was made in accordance with the employment inducement award exemption provided by Nasdaq Rule 5635(c)(4) and was therefore not awarded

under the Company’s stockholder approved equity plan. The Options will vest over a three-year period, with 25% of the Options vested

at the time of grant and the remainder of the Options vesting ratably on each of the first three anniversaries of the commencement date

of his employment and subject to continued service on each vesting date. Mr. Latkin will be eligible for an annual discretionary bonus

based on both the performance of the Company and of Mr. Latkin, individually. Mr. Latkin will also be eligible to participate in any

and all benefit plans of the Company that are made generally available to similarly-situated employees of the Company.

In

connection with Mr. Latkin’s appointment as Chief Operating Officer the Company, Mr. Latkin will enter into the Company’s

standard form of indemnification agreement, a copy of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K

filed with the Securities and Exchange Commission on August 19, 2009 and is incorporated herein by reference. Pursuant to the terms of

this agreement, the Company may be required, among other things, to indemnify Mr. Latkin for certain expenses, including attorneys’

fees, judgments, fines and settlement amounts incurred by him in any action or proceeding arising out of his service as principal accounting

officer.

There

are no family relationships between Mr. Latkin and any of the officers or directors of the Company, and there are no related party transactions

with Mr. Latkin that are reportable under Item 404(a) of Regulation S-K.

Chief

Financial Officer and Controller

On

December 28, 2023, the Company and Robert A. Morse mutually agreed that Mr. Morse would cease to be Chief Financial Officer of the Company and resume his

role as Controller of the Company, effective January 1, 2024, reporting to the Chief Operating Officer of the Company.

The

foregoing summary of the Latkin Offer Letter does not purport to be a complete description and is qualified

in its entirety by reference to the full text of the Latkin Offer Letter, which is included as Exhibit 10.1 hereto

and incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

A

copy of the Company’s press release dated January 4, 2024, relating to the announcement described in Item 5.02, is furnished as

Exhibit 99.1 to this Form 8-K.

The

information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

|

* Certain portions

of this Exhibit have been omitted pursuant to Regulation S-K Item 601(a)(6) promulgated under the Exchange Act. The Company agrees

to furnish supplementally a copy of any omitted schedule to the Securities and Exchange Commission upon request. |

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

ProPhase

Labs, Inc. |

| |

|

|

| |

By: |

/s/

Ted Karkus |

| |

|

Ted

Karkus |

| |

|

Chairman

of the Board and Chief Executive Officer |

Date:

January 4, 2024

Exhibit

10.1

CERTAIN

PERSONALLY IDENTIFIABLE INFORMATION HAS BEEN OMITTED FROM THIS EXHIBIT PURSUANT TO ITEM 601(A)(6) OF REGULATION S-K. [***] INDICATES

THAT INFORMATION HAS BEEN REDACTED.

December

27, 2023

Jed

Latkin

[***]

Offer

and Terms of Employment

Dear

Jed:

It

is with great pleasure that I offer you a position with ProPhase Labs, Inc. (“ProPhase”) as Chief Operating Officer (“COO”).

You will be reporting directly to Ted Karkus, CEO of ProPhase. We at ProPhase work closely together in a hands-on, team oriented, collaborative

environment. We are developing a high energy environment for the quick thinking, skilled, and professional who are looking to expand

our genomics business, our biopharmaceuticals business, our Pharmaloz Lozenge manufacturing business, and our company as a whole.

Your

position will be, as with all Associates, on an “at will” basis. Assuming acceptance of the terms outlined below, I look

forward to your starting January 1, 2024. The following outlines the terms discussed:

| |

● |

Your

position will be considered a full-time position. |

| |

|

|

| |

● |

Your

compensation will be a base salary of $350,000 per annum. |

| |

|

|

| |

● |

Your

signing bonus will be $80,000 vesting upon the signing of this agreement and payable by January 31, 2024. |

| |

|

|

| |

● |

You

will receive a stock option grant to purchase 500,000 shares of ProPhase Labs common stock at $6 per share subject to Nasdaq rules

and upon executing our standard form of stock option agreement containing the specific terms and conditions of the stock option grant

(25% vested at grant date, 25% per year vesting thereafter over 3 years subject to continued service on each such vesting date). |

| |

|

|

| |

● |

You

will be eligible for an annual bonus based on both company and individual performance to be paid at the discretion of the compensation

committee of the board of directors. |

| |

|

|

| |

● |

You

will be eligible for additional stock options at the discretion of the compensation committee. |

711 Stewart

Ave, Suite 200 · Garden City, NY 11530

· U.S.A

Telephone:

516-464-6121 · Fax: 516-464-6132 ·

For information: www.ProPhaseLabs.com

| |

● |

You

will receive a $900 a month auto allowance. |

| |

|

|

| |

● |

You

will be paid the base salary every other Friday, 26 paychecks annually, subject to all Federal, State and Local tax, withholdings. |

| |

|

|

| |

● |

You

will be eligible for participation in our various employee benefit plans based upon the terms of each of the individual plan provisions. |

| |

|

|

| |

● |

You

will receive 3 paid weeks’ vacation for each 12 months employment in addition to all other scheduled holidays in accordance

with Prophase’s policy. |

| |

|

|

| |

● |

All

out of pocket expenses such as but not limited to business meals, travel and lodging, shall be reimbursed to you in a timely fashion

subject to company policy. |

| |

|

|

| |

● |

During

your employment with the Company, you shall at all times: (i) comply with the terms and conditions set forth in this letter; (ii)

perform and carry out such responsibilities, duties, and authorities as the company may direct, designate, request of, or assign

to you from time to time; (iii) devote sufficient time, attention, effort, and skill to your position with and the business of the

company; and (vi) comply with and abide by the company’s policies, practices, and procedures (as may be amended or otherwise

modified from time to time). |

On

behalf of the company, I am pleased to extend this offer to you. This offer will expire on December 31, 2023 and is conditioned on a

standard background check. I look forward to a long relationship and believe you can become an important component and member of our

team to achieve success. If you have any questions, please feel free to contact me at your earliest convenience.

I

look forward to your favored reply.

| Sincerely, |

|

| |

|

| /s/

Ted Karkus |

|

| |

|

| Ted

Karkus |

|

| Chief

Executive Officer |

|

| Offer

Accepted: |

/s/

Jed Latkin |

| |

|

| Date:

|

12/28/2023 |

Exhibit

99.1

ProPhase

poised to ramp up growth at Pharmaloz and Nebula Genomics in 2024

Company

also plans to commercialize its BE-Smart Esophageal Cancer Test in 2024

Company

announces the hiring of long-time industry veteran Jed Latkin as COO to help build and manage this growth

Garden

City, NY – January 04, 2024 (GLOBE NEWSWIRE) – ProPhase Labs, Inc. (NASDAQ: PRPH) (“ProPhase” or the

“Company”), a next generation biotech, genomics, therapeutics and diagnostics company, today reported that Jed Latkin, a

long-time operations and finance expert, has accepted the role as COO of the parent company.

Mr.

Latkin, a Columbia MBA, represented the seller in the Company’s acquisition of the BE-SMART Esophageal Cancer Test. He immediately

became a consultant to ProPhase to help develop its biotech assets including the BE-Smart test as the Company works toward its commercialization,

as well as work on the Company’s other subsidiaries.

Mr.

Latkin has been in the finance and management industry since 1996 and has worked with over 15 pharmaceutical companies over the last

ten years alone. He has served as CEO, CFO or COO of multiple companies in Biotech, manufacturing, and other verticals.

Mr.

Latkin has also served as a board member of several key industry groups that has allowed him to build a diverse network of contacts that

will help ProPhase find key partnerships over the next several years. In his role at ProPhase he will not only serve as COO of the Company

but also as the head of the newly restructured finance department.

“ProPhase

has successfully transformed itself once again from a company that was mainly focused on the covid testing lab business, into a diversified

manufacturing, biotech and genomics powerhouse that has multi-billion-dollar potential,” said Ted Karkus, CEO of ProPhase Labs.

“We

anticipate an acceleration in growth at both Nebula Genomics and Pharmaloz Manufacturing, as well as commercialization of our BE-SMART

esophageal cancer test, during 2024. Our entire senior team at ProPhase has worked very closely with Jed over the past year and our Board

of Directors has spent meaningful time with him as well. Given our multiple high growth prospects in 2024, we felt that it was the perfect

time to hire him as our COO, to help develop and grow these subsidiaries. With his diversified background at a multitude of companies

spanning from biotech to manufacturing, he is an ideal fit for this multi-faceted COO role,” Mr. Karkus concluded.

Inducement

Award

Mr.

Latkin was awarded a stock option to purchase up to 500,000 shares of the Company’s common stock as an inducement to his employment

as Chief Operating Officer of the Company. This award was made in accordance with the employment inducement award exemption provided

by Nasdaq Rule 5635(c)(4) and was therefore not awarded under the Company’s stockholder approved equity plan. The option award

will vest over a three-year period, with 25% vesting at the time of grant and 25% vesting every twelve months following the commencement

date of his employment, contingent upon his continued service through each vesting date. The options have an exercise price of $6.00

per share and will be exercisable for a period of seven years.

About

ProPhase Labs

ProPhase

Labs, Inc. (Nasdaq: PRPH) is a next-generation biotech, genomics, therapeutics and diagnostics company. Our goal is to create a healthier

world with bold action and the power of insight. We’re revolutionizing healthcare with industry-leading Whole Genome Sequencing

solutions, while developing potential game changer diagnostics and therapeutics in the fight against cancer. This includes a potentially

life-saving cancer test focused on early detection of esophageal cancer and potential breakthrough cancer therapeutics with novel mechanisms

of action. Our world-class CLIA labs and cutting-edge diagnostic technology provide wellness solutions for healthcare providers and consumers.

We develop, manufacture, and commercialize health and wellness solutions to enable people to live their best lives. We are committed

to executional excellence, smart diversification, and a synergistic, omni-channel approach. ProPhase Labs’ valuable subsidiaries,

their synergies, and significant growth underscores our multi-billion dollar potential.

Forward

Looking Statements

Except

for the historical information contained herein, this document contains forward looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements regarding our strategy, plans, objectives and initiatives, including our

plans to grow our subsidiaries and commercialize our BE-Smart Esophageal Cancer Test in 2024. Management believes that these forward-looking

statements are reasonable as and when made. However, such forward-looking statements involve known and unknown risks, uncertainties,

and other factors that may cause actual results to differ materially from those projected in the forward-looking statements. These risks

and uncertainties include but are not limited to our ability to obtain and maintain necessary regulatory approvals, general economic

conditions, consumer demand for our products and services, challenges relating to entering into and growing new business lines, the competitive

environment, and the risk factors listed from time to time in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and any

other SEC filings. The Company undertakes no obligation to update forward-looking statements except as required by applicable securities

laws. Readers are cautioned that forward-looking statements are not guarantees of future performance and are cautioned not to place undue

reliance on any forward-looking statements.

For

more information, visit www.ProPhaseLabs.com.

ProPhase

Media Relations and Institutional Investor Contact:

ProPhase

Labs, Inc.

267-880-1111

investorrelations@prophaselabs.com

ProPhase

Retail Investor Relations Contact:

Renmark

Financial Communications

John

Boidman

514-939-3989

Jboidman@renmarkfinancial.com

Source:

ProPhase Labs, Inc.

v3.23.4

Cover

|

Dec. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity File Number |

000-21617

|

| Entity Registrant Name |

PROPHASE

LABS, INC.

|

| Entity Central Index Key |

0000868278

|

| Entity Tax Identification Number |

23-2577138

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

711

Stewart Avenue

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, Address Line Three |

G

|

| Entity Address, City or Town |

arden

City

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11530

|

| City Area Code |

(215)

|

| Local Phone Number |

345-0919

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0005

|

| Trading Symbol |

PRPH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

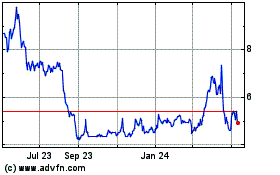

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

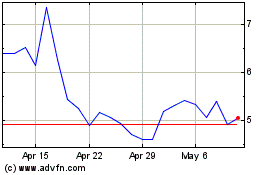

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Nov 2023 to Nov 2024