false0001289636--12-312024Q1http://www.profireenergy.com/20240331#LeaseRightOfUseAssethttp://www.profireenergy.com/20240331#LeaseRightOfUseAssethttp://www.profireenergy.com/20240331#LeaseRightOfUseAssethttp://www.profireenergy.com/20240331#LeaseRightOfUseAssethttp://www.profireenergy.com/20240331#LeaseLiabilityCurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityCurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityCurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityCurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityNoncurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityNoncurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityNoncurrenthttp://www.profireenergy.com/20240331#LeaseLiabilityNoncurrent33.3333.3375502533.3333.3333.3375502533.3333.3333.3375502533.3333.3333.3375502533.33xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purepfie:leasepfie:agreementpfie:numberOfSharepfie:installmentpfie:performanceMetricpfie:baypfie:segment00012896362024-01-012024-03-3100012896362024-05-0700012896362024-03-3100012896362023-12-310001289636us-gaap:ProductMember2024-01-012024-03-310001289636us-gaap:ProductMember2023-01-012023-03-310001289636us-gaap:ServiceMember2024-01-012024-03-310001289636us-gaap:ServiceMember2023-01-012023-03-3100012896362023-01-012023-03-310001289636us-gaap:CommonStockMember2023-12-310001289636us-gaap:AdditionalPaidInCapitalMember2023-12-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001289636us-gaap:TreasuryStockCommonMember2023-12-310001289636us-gaap:RetainedEarningsMember2023-12-310001289636us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001289636us-gaap:CommonStockMember2024-01-012024-03-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001289636us-gaap:RetainedEarningsMember2024-01-012024-03-310001289636us-gaap:CommonStockMember2024-03-310001289636us-gaap:AdditionalPaidInCapitalMember2024-03-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001289636us-gaap:TreasuryStockCommonMember2024-03-310001289636us-gaap:RetainedEarningsMember2024-03-310001289636us-gaap:CommonStockMember2022-12-310001289636us-gaap:AdditionalPaidInCapitalMember2022-12-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001289636us-gaap:TreasuryStockCommonMember2022-12-310001289636us-gaap:RetainedEarningsMember2022-12-3100012896362022-12-310001289636us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001289636us-gaap:CommonStockMember2023-01-012023-03-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001289636us-gaap:RetainedEarningsMember2023-01-012023-03-310001289636us-gaap:CommonStockMember2023-03-310001289636us-gaap:AdditionalPaidInCapitalMember2023-03-310001289636us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001289636us-gaap:TreasuryStockCommonMember2023-03-310001289636us-gaap:RetainedEarningsMember2023-03-3100012896362023-03-310001289636srt:MinimumMember2024-03-310001289636srt:MaximumMember2024-03-310001289636pfie:WarehouseSpaceOneMember2024-03-310001289636pfie:WarehouseSpaceTwoMember2024-03-3100012896362023-05-090001289636us-gaap:RestrictedStockUnitsRSUMember2024-03-310001289636us-gaap:PerformanceSharesMember2024-03-310001289636us-gaap:EmployeeStockOptionMember2024-03-310001289636us-gaap:RestrictedStockUnitsRSUMember2023-06-292023-06-290001289636us-gaap:RestrictedStockUnitsRSUMember2023-06-290001289636pfie:TwoThousandTwentyThreeEIPMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeEIPMember2023-04-250001289636pfie:TwoThousandTwentyThreeEIPMember2024-03-062024-03-060001289636pfie:TwoThousandTwentyThreeLTIPMembersrt:ChiefFinancialOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:VicePresidentOfProductionDevelopmentMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-250001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyThreeLTIPMember2023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-04-250001289636pfie:TwoThousandTwentyTwoLTIPMember2023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:TimeBasedUnitsMembersrt:ChiefFinancialOfficerMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TimeBasedUnitsMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:TimeBasedUnitsMemberpfie:VicePresidentOfProductionDevelopmentMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:TimeBasedUnitsMemberpfie:VicePresidentOfProductionDevelopmentMember2022-04-062022-04-060001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMembersrt:ChiefFinancialOfficerMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMemberpfie:VicePresidentOfProductionDevelopmentMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:TargetMember2023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:AboveTargetMember2023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:OutstandingMember2023-04-250001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMembersrt:ChiefFinancialOfficerMember2023-04-252023-04-250001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMember2023-04-252023-04-250001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyThreeLTIPMemberus-gaap:PerformanceSharesMemberpfie:VicePresidentOfProductionDevelopmentMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMember2023-04-252023-04-250001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:BelowTargetMember2023-04-250001289636srt:ChiefFinancialOfficerMemberpfie:TwoThousandTwentyTwoLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-062022-04-060001289636pfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyTwoLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-062022-04-060001289636pfie:TwoThousandTwentyTwoLTIPMemberpfie:VicePresidentOfProductionDevelopmentMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-062022-04-060001289636pfie:TwoThousandTwentyTwoLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2022-04-060001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:TimeBasedUnitsMembersrt:ChiefFinancialOfficerMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636pfie:ChiefBusinessDevelopmentOfficerMemberpfie:TimeBasedUnitsMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636pfie:TimeBasedUnitsMemberpfie:TwoThousandTwentyTwoLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2022-04-062022-04-060001289636us-gaap:PerformanceSharesMembersrt:ChiefFinancialOfficerMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636us-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyTwoLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2022-04-062022-04-060001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636pfie:TargetMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:AboveTargetMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:OutstandingMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMembersrt:ChiefFinancialOfficerMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyTwoLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2022-04-062022-04-060001289636pfie:TwoThousandTwentyTwoLTIPMember2022-04-062022-04-060001289636pfie:BelowTargetMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:TwoThousandTwentyOneLTIPMembersrt:ChiefFinancialOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-282021-05-280001289636pfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyOneLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-282021-05-280001289636pfie:VicePresidentOfOperationsMemberpfie:TwoThousandTwentyOneLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-282021-05-280001289636pfie:TwoThousandTwentyOneLTIPMemberpfie:VicePresidentOfProductionDevelopmentMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-282021-05-280001289636pfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyOneLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheTwoMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-280001289636pfie:TwoThousandTwentyOneLTIPMember2021-05-280001289636pfie:TimeBasedUnitsMemberpfie:TwoThousandTwentyOneLTIPMembersrt:ChiefFinancialOfficerMember2021-05-282021-05-280001289636pfie:ChiefBusinessDevelopmentOfficerMemberpfie:TimeBasedUnitsMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636pfie:TimeBasedUnitsMemberpfie:VicePresidentOfOperationsMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636pfie:TimeBasedUnitsMemberpfie:TwoThousandTwentyOneLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2021-05-282021-05-280001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMembersrt:ChiefFinancialOfficerMember2021-05-282021-05-280001289636us-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636us-gaap:PerformanceSharesMemberpfie:VicePresidentOfOperationsMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2021-05-282021-05-280001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636pfie:TargetMember2021-05-280001289636pfie:AboveTargetMember2021-05-280001289636pfie:OutstandingMember2021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMembersrt:ChiefFinancialOfficerMember2021-05-282021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:VicePresidentOfOperationsMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2021-05-282021-05-280001289636pfie:TwoThousandTwentyOneLTIPMember2021-05-282021-05-280001289636pfie:TwoThousandTwentyOneLTIPMemberpfie:BelowTargetMember2021-05-280001289636pfie:TargetMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-280001289636pfie:AboveTargetMemberpfie:TwoThousandTwentyOneLTIPMember2021-05-280001289636pfie:TwoThousandTwentyOneLTIPMemberpfie:OutstandingMember2021-05-280001289636us-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyOneLTIPMember2024-03-062024-03-060001289636pfie:TwoThousandTwentyThreeLTIPMemberpfie:WeightMember2023-04-250001289636pfie:WeightMemberpfie:TwoThousandTwentyTwoLTIPMember2022-04-060001289636pfie:TwoThousandTwentyOneLTIPMemberpfie:WeightMember2021-05-280001289636srt:MinimumMember2024-01-012024-03-310001289636srt:MaximumMember2024-01-012024-03-310001289636pfie:ElectronicsMember2024-01-012024-03-310001289636pfie:ElectronicsMember2023-01-012023-03-310001289636pfie:ManufacturedMember2024-01-012024-03-310001289636pfie:ManufacturedMember2023-01-012023-03-310001289636pfie:ReSellMember2024-01-012024-03-310001289636pfie:ReSellMember2023-01-012023-03-310001289636us-gaap:OperatingSegmentsMembercountry:CA2024-01-012024-03-310001289636us-gaap:OperatingSegmentsMembercountry:CA2023-01-012023-03-310001289636us-gaap:OperatingSegmentsMembercountry:US2024-01-012024-03-310001289636us-gaap:OperatingSegmentsMembercountry:US2023-01-012023-03-310001289636country:CAus-gaap:IntersegmentEliminationMember2024-01-012024-03-310001289636country:CAus-gaap:IntersegmentEliminationMember2023-01-012023-03-310001289636country:USus-gaap:IntersegmentEliminationMember2024-01-012024-03-310001289636country:USus-gaap:IntersegmentEliminationMember2023-01-012023-03-310001289636us-gaap:IntersegmentEliminationMember2024-01-012024-03-310001289636us-gaap:IntersegmentEliminationMember2023-01-012023-03-310001289636country:CA2024-01-012024-03-310001289636country:CA2023-01-012023-03-310001289636country:US2024-01-012024-03-310001289636country:US2023-01-012023-03-310001289636country:CA2024-03-310001289636country:CA2023-03-310001289636country:US2024-03-310001289636country:US2023-03-310001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourEIPMembersrt:ChiefFinancialOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourEIPMemberpfie:ChiefBusinessDevelopmentOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourEIPMemberpfie:VicePresidentOfProductionDevelopmentMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourEIPMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourEIPMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMembersrt:ChiefFinancialOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMemberus-gaap:RestrictedStockUnitsRSUMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:VicePresidentOfProductionDevelopmentMemberus-gaap:RestrictedStockUnitsRSUMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberus-gaap:RestrictedStockUnitsRSUMember2024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberpfie:TwoThousandTwentyFourLTIPMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:TimeBasedUnitsMembersrt:ChiefFinancialOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMemberpfie:TimeBasedUnitsMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:TimeBasedUnitsMemberpfie:VicePresidentOfProductionDevelopmentMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMembersrt:ChiefFinancialOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:TargetMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:AboveTargetMemberpfie:TwoThousandTwentyFourLTIPMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:OutstandingMember2024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMembersrt:ChiefFinancialOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:ChiefBusinessDevelopmentOfficerMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:VicePresidentOfProductionDevelopmentMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMember2024-04-092024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:BelowTargetMember2024-04-090001289636us-gaap:SubsequentEventMemberpfie:TwoThousandTwentyFourLTIPMemberpfie:WeightMember2024-04-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| | | | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended | March 31, 2024 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Transition Period From ________ to _________ |

Commission File Number 001-36378

PROFIRE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Nevada | 20-0019425 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

321 South 1250 West, Suite 1 | |

Lindon, Utah | 84042 |

(Address of principal executive offices) | (Zip Code) |

(801) 796-5127

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common, $0.001 Par Value | | PFIE | | NASDAQ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | |

Large accelerated filer ☐ | Accelerated Filer ☐ | |

Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☒

As of May 7, 2024, the registrant had 53,344,595 shares of common stock issued and 47,101,232 shares of common stock outstanding, par value $0.001.

PROFIRE ENERGY, INC.

FORM 10-Q

TABLE OF CONTENTS | | | | | | | | |

| Page |

| |

| PART I — FINANCIAL INFORMATION | |

| |

| Item 1. Financial Statements | |

| | |

| Condensed Consolidated Balance Sheets | |

| | |

| Condensed Consolidated Statements of Income and Comprehensive Income (Unaudited) | |

| | |

| Condensed Consolidated Statements of Stockholders' Equity (Unaudited) | |

| | |

| Condensed Consolidated Statements of Cash Flows (Unaudited) | |

| | |

| Notes to the Condensed Consolidated Financial Statements (Unaudited) | |

| |

| Item 2. Management's Discussion and Analysis of Financial Condition And Results of Operations | |

| |

| Item 3. Quantitative and Qualitative Disclosure about Market Risk | |

| |

| Item 4. Controls and Procedures | |

| |

| PART II — OTHER INFORMATION | |

| |

| Item 1. Legal Proceedings | |

| |

| Item 1A. Risk Factors | |

| |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| |

| Item 3. Defaults Upon Senior Securities | |

| |

| Item 4. Mine Safety Disclosures | |

| |

| Item 5. Other Information | |

| |

| Item 6. Exhibits | |

| |

| Signatures | |

PART I. FINANCIAL INFORMATION

Item 1 Financial Information

| | | | | | | | | | | | | | |

| PROFIRE ENERGY, INC. AND SUBSIDIARIES |

| Condensed Consolidated Balance Sheets |

| | As of |

| | March 31, 2024 | | December 31, 2023 |

| ASSETS | | (Unaudited) | | |

| CURRENT ASSETS | | | | |

| Cash and cash equivalents | | $ | 7,196,424 | | | $ | 10,767,519 | |

| Short-term investments | | 2,750,324 | | | 2,799,539 | |

| | | | |

| Accounts receivable, net | | 14,226,321 | | | 14,013,740 | |

| Inventories, net (note 3) | | 15,747,817 | | | 14,059,656 | |

| Prepaid expenses and other current assets (note 4) | | 3,357,009 | | | 2,832,262 | |

| | | | |

| Total Current Assets | | 43,277,895 | | | 44,472,716 | |

| LONG-TERM ASSETS | | | | |

| Net deferred tax asset | | 497,263 | | | 496,785 | |

| Long-term investments | | 6,286,599 | | | 6,425,582 | |

| | | | |

| Lease right-of-use asset (note 6) | | 395,267 | | | 432,907 | |

| Property and equipment, net | | 11,233,795 | | | 10,782,372 | |

| Intangible assets, net | | 1,064,724 | | | 1,104,102 | |

| Goodwill | | 2,579,381 | | | 2,579,381 | |

| Total Long-Term Assets | | 22,057,029 | | | 21,821,129 | |

| TOTAL ASSETS | | $ | 65,334,924 | | | $ | 66,293,845 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| CURRENT LIABILITIES | | | | |

| Accounts payable | | $ | 2,985,177 | | | $ | 2,699,556 | |

| Accrued liabilities (note 5) | | 2,733,161 | | | 4,541,820 | |

| Current lease liability (note 6) | | 121,386 | | | 130,184 | |

| Income taxes payable | | 916,469 | | | 1,723,910 | |

| Total Current Liabilities | | 6,756,193 | | | 9,095,470 | |

| LONG-TERM LIABILITIES | | | | |

| Net deferred income tax liability | | 44,876 | | | 52,621 | |

| Long-term lease liability (note 6) | | 280,371 | | | 307,528 | |

| TOTAL LIABILITIES | | 7,081,440 | | | 9,455,619 | |

| | | | |

| STOCKHOLDERS' EQUITY (note 7) | | | | |

Preferred stock: $0.001 par value, 10,000,000 shares authorized: no shares issued or outstanding | | — | | | — | |

Common stock: $0.001 par value, 100,000,000 shares authorized: 53,337,589 issued and 47,094,226 outstanding at March 31, 2024, and 53,047,231 issued and 46,803,868 outstanding at December 31, 2023 | | 53,340 | | | 53,048 | |

| Treasury stock, at cost | | (9,324,272) | | | (9,324,272) | |

| Additional paid-in capital | | 32,966,075 | | | 32,751,749 | |

| Accumulated other comprehensive loss | | (3,078,437) | | | (2,844,702) | |

| Retained earnings | | 37,636,778 | | | 36,202,403 | |

| TOTAL STOCKHOLDERS' EQUITY | | 58,253,484 | | | 56,838,226 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 65,334,924 | | | $ | 66,293,845 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

| | | | | | | | | | | | | | | | | | |

PROFIRE ENERGY, INC. AND SUBSIDIARIES |

Condensed Consolidated Statements of Income and Comprehensive Income |

(Unaudited) |

| | For the Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| | | | (See Note 1) | | | | |

| REVENUES (note 8) | | | | | | | | |

| Sales of products, net | | $ | 12,691,804 | | | $ | 13,759,679 | | | | | |

| Sales of services, net | | 949,336 | | | 924,949 | | | | | |

| Total Revenues | | 13,641,140 | | | 14,684,628 | | | | | |

| | | | | | | | |

| COST OF SALES | | | | | | | | |

| Cost of sales - products | | 6,095,004 | | | 6,105,506 | | | | | |

| Cost of sales - services | | 789,364 | | | 746,014 | | | | | |

| Total Cost of Sales | | 6,884,368 | | | 6,851,520 | | | | | |

| | | | | | | | |

| GROSS PROFIT | | 6,756,772 | | | 7,833,108 | | | | | |

| | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| General and administrative | | 4,604,766 | | | 4,110,032 | | | | | |

| Research and development | | 265,058 | | | 274,389 | | | | | |

| Depreciation and amortization | | 149,859 | | | 142,887 | | | | | |

| Total Operating Expenses | | 5,019,683 | | | 4,527,308 | | | | | |

| | | | | | | | |

| INCOME FROM OPERATIONS | | 1,737,089 | | | 3,305,800 | | | | | |

| | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Gain on sale of assets | | 44,821 | | | 53,075 | | | | | |

| Other expense | | (23,339) | | | (9,553) | | | | | |

| Interest income | | 71,897 | | | 58,047 | | | | | |

| Interest expense | | (2,945) | | | (933) | | | | | |

| Total Other Income | | 90,434 | | | 100,636 | | | | | |

| | | | | | | | |

| INCOME BEFORE INCOME TAXES | | 1,827,523 | | | 3,406,436 | | | | | |

| | | | | | | | |

| INCOME TAX EXPENSE | | (393,148) | | | (816,815) | | | | | |

| | | | | | | | |

| NET INCOME | | $ | 1,434,375 | | | $ | 2,589,621 | | | | | |

| | | | | | | | |

| OTHER COMPREHENSIVE INCOME (LOSS) | | | | | | | | |

| Foreign currency translation loss | | $ | (244,801) | | | $ | (5,524) | | | | | |

| Unrealized gains on investments | | 11,066 | | | 76,287 | | | | | |

| Total Other Comprehensive Income (Loss) | | (233,735) | | | 70,763 | | | | | |

| | | | | | | | |

| COMPREHENSIVE INCOME | | $ | 1,200,640 | | | $ | 2,660,384 | | | | | |

| | | | | | | | |

| BASIC EARNINGS PER SHARE | | $ | 0.03 | | | $ | 0.05 | | | | | |

| FULLY DILUTED EARNINGS PER SHARE | | $ | 0.03 | | | $ | 0.05 | | | | | |

| | | | | | | | |

| BASIC WEIGHTED AVG NUMBER OF SHARES OUTSTANDING | | 46,884,875 | | | 47,174,518 | | | | | |

| FULLY DILUTED WEIGHTED AVG NUMBER OF SHARES OUTSTANDING | | 48,482,704 | | | 48,612,833 | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

PROFIRE ENERGY, INC. AND SUBSIDIARIES |

Condensed Consolidated Statements of Stockholders' Equity |

(Unaudited) |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Retained Earnings | | Total Stockholders' Equity |

| | Shares | | Amount | | | | | |

| Balance, December 31, 2023 | | 46,803,868 | | | $ | 53,048 | | | $ | 32,751,749 | | | $ | (2,844,702) | | | $ | (9,324,272) | | | $ | 36,202,403 | | | $ | 56,838,226 | |

| Stock based compensation | | — | | | — | | | 197,443 | | — | | | — | | | — | | | 197,443 |

| Stock issued in exercise of stock options | | 3,869 | | | 4 | | | 846 | | | — | | | — | | | — | | | 850 | |

| Stock issued in settlement of RSUs and accrued bonuses | | 286,489 | | | 288 | | | 324,127 | | | — | | | — | | | — | | | 324,415 | |

| Tax withholdings paid related to stock based compensation | | — | | | — | | | (308,090) | | | — | | | — | | | — | | | (308,090) | |

| | | | | | | | | | | | | | |

| Foreign currency translation | | — | | | — | | | — | | | (244,801) | | | — | | | — | | | (244,801) | |

| Unrealized gains on investments | | — | | | — | | | — | | | 11,066 | | | — | | | — | | | 11,066 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | 1,434,375 | | | 1,434,375 | |

| Balance, March 31, 2024 | | 47,094,226 | | | $ | 53,340 | | | $ | 32,966,075 | | | $ | (3,078,437) | | | $ | (9,324,272) | | | $ | 37,636,778 | | | $ | 58,253,484 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Retained Earnings | | Total Stockholders' Equity |

| | Shares | | Amount | | | | | |

| Balance, December 31, 2022 | | 47,105,771 | | | $ | 52,144 | | | $ | 31,737,843 | | | $ | (3,294,873) | | | $ | (7,336,323) | | | $ | 25,425,689 | | | $ | 46,584,480 | |

| Stock based compensation | | — | | | — | | | 223,047 | | — | | | — | | | — | | | 223,047 |

| | | | | | | | | | | | | | |

| Stock issued in settlement of RSUs and accrued bonuses | | 246,116 | | | 247 | | | 378,279 | | | — | | | — | | | — | | | 378,526 | |

| Tax withholdings paid related to stock based compensation | | — | | | — | | | (242,506) | | | — | | | — | | | — | | | (242,506) | |

| | | | | | | | | | | | | | |

| Foreign currency translation | | — | | | — | | | — | | | (5,524) | | | — | | | — | | | (5,524) | |

| Unrealized gains on investments | | — | | | — | | | — | | | 76,287 | | | — | | | — | | | 76,287 | |

| Net income | | — | | | — | | | — | | | — | | | — | | | 2,589,621 | | | 2,589,621 | |

| Balance, March 31, 2023 | | 47,351,887 | | | $ | 52,391 | | | $ | 32,096,662 | | | $ | (3,224,110) | | | $ | (7,336,323) | | | $ | 28,015,310 | | | $ | 49,603,930 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

| | | | | | | | | | | |

PROFIRE ENERGY, INC. AND SUBSIDIARIES |

Condensed Consolidated Statements of Cash Flows |

(Unaudited) |

| For the Three Months Ended March 31, |

| 2024 | | 2023 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 1,434,375 | | | $ | 2,589,621 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization expense | 267,654 | | | 262,039 | |

| Gain on sale of property and equipment | (44,821) | | | (53,075) | |

| Bad debt expense | 61,684 | | | 41,792 | |

| Stock awards issued for services | 197,443 | | | 223,047 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (23,969) | | | (1,108,889) | |

| Income taxes receivable/payable | (804,057) | | | 629,371 | |

| Inventories | (1,741,768) | | | (292,119) | |

| Prepaid expenses and other current assets | (564,253) | | | (335,832) | |

| Deferred tax asset/liability | (7,112) | | | 212,548 | |

| Accounts payable and accrued liabilities | (1,467,314) | | | (1,646,723) | |

| Net Cash Provided by (Used in) Operating Activities | (2,692,138) | | | 521,780 | |

| | | |

| INVESTING ACTIVITIES | | | |

| Proceeds from sale of property and equipment | 46,097 | | | 97,886 | |

| Sale (purchase) of investments | 199,357 | | | (390,548) | |

| Purchase of property and equipment | (776,721) | | | (153,755) | |

| | | |

| Net Cash Used in Investing Activities | (531,267) | | | (446,417) | |

| | | |

| FINANCING ACTIVITIES | | | |

| Value of equity awards surrendered by employees for tax liability | (307,933) | | | (242,506) | |

| | | |

| | | |

| Principal paid toward lease liability | (10,875) | | | (6,947) | |

| Net Cash Used in Financing Activities | (318,808) | | | (249,453) | |

| | | |

| Effect of exchange rate changes on cash | (28,882) | | | 8,868 | |

| | | |

| NET DECREASE IN CASH | (3,571,095) | | | (165,222) | |

| CASH AT BEGINNING OF PERIOD | 10,767,519 | | | 7,384,578 | |

| CASH AT END OF PERIOD | $ | 7,196,424 | | | $ | 7,219,356 | |

| | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | |

| | | |

| CASH PAID FOR: | | | |

| Interest | $ | 2,945 | | | $ | 933 | |

| Income taxes | $ | 1,056,844 | | | $ | — | |

| NON-CASH FINANCING AND INVESTING ACTIVITIES | | | |

| Common stock issued in settlement of accrued bonuses | $ | 324,415 | | | $ | 378,526 | |

| Common stock issued for stock options | $ | 850 | | | $ | — | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements (Unaudited)

For the Three Months Ended March 31, 2024 and 2023

NOTE 1 - CONDENSED FINANCIAL STATEMENTS

Except where the context otherwise requires, all references herein to the "Company," "Profire," "we," "us," "our," or similar words and phrases are to Profire Energy, Inc. and its wholly owned subsidiaries, taken together.

The accompanying condensed consolidated financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments have been made (which include only normal recurring adjustments) which are necessary to present fairly the financial position, results of operations, stockholders' equity, and cash flows at March 31, 2024 and for all periods presented herein.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("US GAAP") have been condensed or omitted. These condensed consolidated financial statements should be read in conjunction with the Company's audited financial statements contained in its annual report on Form 10-K for the year ended December 31, 2023 ("Form 10-K"). The results of operations for the three-month periods ended March 31, 2024 and 2023 are not necessarily indicative of the operating results for the full years. Certain amounts in the accompanying March 31, 2023 condensed consolidated statement of income and comprehensive income (loss) and footnotes have been reclassified to conform to the March 31, 2024 presentation.

NOTE 2 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Line of Business

This Organization and Summary of Significant Accounting Policies of the Company is presented to assist in understanding the Company's condensed consolidated financial statements. The Company's accounting policies conform to "US GAAP."

The Company provides burner-management products, solutions and services primarily for the oil and gas industry within the US and Canadian markets. The Company has made progress in expansion efforts outside of these markets into other industries with combustion and burner management requirements as well as into other international locations.

Significant Accounting Policies

There have been no changes to the significant accounting policies of the Company from the information provided in Note 1 of the notes to the consolidated financial statements in the Company's most recent Form 10-K.

Recent Accounting Pronouncements

Accounting Standards Update No. 2023-07 —Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures The update is intended to improve reportable segment disclosure requirements through enhanced disclosures about significant segment expenses. The amendments require disclosure of significant segment expenses regularly provided to the chief operating decision maker (CODM) as well as other segment items, extend certain annual disclosures to interim periods, clarify the applicability to single reportable segment entities, permit more than one measure of profit or loss to be reported under certain conditions, and require disclosure of the title and position of the CODM. The new disclosures have been adopted in this report. See NOTE 10 – SEGMENT INFORMATION.

Accounting Standards Update No. 2023-09 —Income Taxes (Topic 740): Improvements to Income Tax Disclosures The update requires the annual financial statements to include consistent categories and greater disaggregation of information in the rate reconciliation, and income taxes paid disaggregated by jurisdiction. ASU 2023-09 is effective for the Company’s annual reporting periods beginning after December 15, 2024, with early adoption permitted, and should be applied on a prospective basis, with a retrospective option. We are currently evaluating the effect that adoption of ASU 2023-09 will have on our disclosures.

The Company has evaluated all other recent accounting pronouncements and determined that the adoption of other pronouncements applicable to the Company has not had, nor is expected to have, a material impact on the Company's financial position, results of operations, or cash flows.

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

NOTE 3 – INVENTORIES

Inventories consisted of the following at each balance sheet date:

| | | | | | | | | | | |

| As of |

| March 31, 2024 | | December 31, 2023 |

| Raw materials | $ | 398,568 | | | $ | 338,539 | |

| Finished goods | 15,802,905 | | | 14,171,616 | |

| | | |

| Subtotal | 16,201,473 | | | 14,510,155 | |

| Reserve for obsolescence | (453,656) | | | (450,499) | |

| Total | $ | 15,747,817 | | | $ | 14,059,656 | |

NOTE 4 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consisted of the following at each balance sheet date: | | | | | | | | | | | |

| | As of |

| | March 31, 2024 | | December 31, 2023 |

| | | |

| Prepaid inventory | $ | 2,558,024 | | | $ | 1,944,942 | |

| Accrued receivables | 149,924 | | | 119,035 | |

| Prepaid insurance | 237,970 | | | 351,273 | |

| Interest receivables | 71,200 | | | 81,868 | |

| Other | 339,891 | | | 335,144 | |

| Total | $ | 3,357,009 | | | $ | 2,832,262 | |

NOTE 5 – ACCRUED LIABILITIES

Accrued liabilities consisted of the following at each balance sheet date: | | | | | | | | | | | | |

| | As of | |

| | March 31, 2024 | | December 31, 2023 | |

| Employee-related payables | $ | 1,397,167 | | | $ | 2,910,801 | | |

| Deferred revenue | 756,049 | | | 780,428 | | |

| Inventory-related payables | 215,696 | | | 400,701 | | |

| Tax-related payables | 75,420 | | | 119,188 | | |

| Warranty liabilities | 86,260 | | | 108,930 | | |

| Other | 202,569 | | | 221,772 | | |

| Total | $ | 2,733,161 | | | $ | 4,541,820 | | |

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

NOTE 6 – LEASES

| | | | | | | | | | | | | | |

| | As of |

| Components of lease right-of-use assets and liabilities | | March 31, 2024 | | December 31, 2023 |

| Financing lease right-of-use assets | | $ | 93,843 | | | $ | 106,402 | |

| Operating lease right-of-use assets | | 301,424 | | 326,505 |

| Total Lease right-of-use assets | | $ | 395,267 | | | $ | 432,907 | |

| | | | |

| Financing current lease liability | | $ | 43,775 | | | $ | 47,492 | |

| Operating current lease liability | | 77,611 | | 82,692 |

| Total Current lease liability | | $ | 121,386 | | | $ | 130,184 | |

| | | | |

| Financing long-term lease liability | | $ | 55,273 | | | $ | 63,393 | |

| Operating long-term lease liability | | 225,098 | | 244,135 |

| Total Long-term lease liability | | $ | 280,371 | | | $ | 307,528 | |

We have leases for office equipment and office space. The leases for office equipment are classified as financing leases, and the typical term is between 36 and 60 months. We have the option to extend most office equipment leases, but we do not intend to do so. Accordingly, no extensions have been recognized in the right-of-use asset or lease liability. The office equipment lease payments are not variable, and the lease agreements do not include any non-lease components, residual value guarantees, or restrictions. There are no interest rates implicit in the office equipment lease agreements, so we have used our incremental borrowing rate to determine the discount rate to be applied to our financing leases for the purpose of determining our lease liabilities. The weighted average discount rate applied to our financing leases is 4.50% and the weighted average remaining lease term is 2.4 years.

The following table shows the components of financing lease cost:

| | | | | | | | | | | | | |

| For the Three Months Ended March 31, | | |

| Financing Lease Cost | 2024 | 2023 | | | |

| Amortization of right-of-use assets | $ | 12,559 | | $ | 7,240 | | | | |

| Interest on lease liabilities | 2,945 | | 933 | | | | |

| Total financing lease cost | $ | 15,504 | | $ | 8,173 | | | | |

We lease two warehouse spaces, one with a two-year lease, and another with a four-year lease, both of which are recorded as operating leases. The weighted average discount rate applied to our financing leases is 4.5% and the weighted average remaining lease term is 3.7 years. The remainder of our office space leases are considered to be short-term, and we have elected not to recognize those on our balance sheet under the short-term recognition exemption. Operating lease expense recognized during the three-months ended March 31, 2024 and March 31, 2023 was $38,665 and $18,852, respectively.

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

As of March 31, 2024, maturities of lease liabilities are as follows:

| | | | | | | | |

| Years ending December 31, | | Amount |

| 2024 | | $ | 110,327 | |

| 2025 | | 126,278 | |

| 2026 | | 112,768 | |

| 2027 | | 91,097 | |

| 2028 | | — | |

| Thereafter | | — | |

| Total future minimum lease payments | | $ | 440,470 | |

| Less: Amount representing interest | | 38,713 | |

| Present value of future payments | | $ | 401,757 | |

| Current portion | | $ | 121,386 | |

| Long-term portion | | $ | 280,371 | |

NOTE 7 – STOCKHOLDERS' EQUITY

As of both March 31, 2024 and December 31, 2023, the Company held 6,243,363 shares of its common stock in treasury at a total cost of $9,324,272.

On May 9, 2023, the Company announced that its Board of Directors (the "Board") had authorized a share repurchase program allowing the Company to repurchase up to $2,000,000 worth of the Company’s common stock from time to time through April 30, 2024. Purchases under the program were made at the discretion of management pursuant to a Rule 10b5-1 plan. The size and timing of any purchases were dependent on price, market and business conditions and other factors. As of December 2023, the Company had spent the full allotment under the program.

As of March 31, 2024, the Company had 742,855 restricted stock units ("RSUs"), 752,338 performance-based RSUs, and 204,000 stock options outstanding with $1,289,440 in remaining compensation expense to be recognized over the next 1.9 years. See further details below about certain subsets of these outstanding equity-based awards.

On June 29, 2023, pursuant to the annual renewal of director compensation, the Board approved a grant of 195,966 RSUs to the Company's independent directors. Half of the RSUs vested immediately on the date of grant and the remaining 50% of the RSUs will vest on the first anniversary of the grant date or at the Company's next annual meeting of stockholders, whichever is earlier. The awards will result in total compensation expense of approximately $243,000 to be recognized over the vesting period.

2023 EIP and LTIP

On April 25, 2023, the Compensation Committee of the Board (the "Compensation Committee") approved the 2023 Executive Incentive Plan (the “2023 EIP”) for Ryan W. Oviatt, the Company's Co-CEO, Co-President, and CFO, Cameron M. Tidball, the Company's Co-CEO and Co-President, and Patrick D. Fisher, the Company's Vice President of Product Development. The 2023 EIP provided for the potential award of incentive compensation to the participants based on the Company’s financial performance in fiscal 2023. The incentive compensation was payable in cash and stock, and the stock portion of the incentive compensation constituted an award under the Company’s 2023 Equity Incentive Plan (the “2023 Plan”).

Participants were eligible to receive incentive compensation based upon reaching or exceeding performance goals established by the Compensation Committee for fiscal 2023. The performance goals in the 2023 EIP were based on the Company’s total revenue, EBITDA, and two non-financial factors including revenue source diversification and safety and environmental

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

performance. Each of the revenue, EBITDA, and revenue diversification performance goals will be weighted 30% while the safety and environment goal will be weighted 10% in calculating incentive compensation amounts.

On March 6, 2024, the Compensation Committee approved the incentive compensation amounts based on achieving certain targets pursuant to the 2023 EIP. The incentive compensation amounts earned under the 2023 EIP were paid 50% in cash and 50% in shares of restricted stock under the 2023 Plan. In satisfaction of the 50% of the 2023 EIP plan that was payable in stock, the Compensation Committee approved a one-time bonus for Company executives that was settled by issuing a total of 225,698 shares of common stock, or 121,624 shares net of tax withholding. These shares were fully vested as of March 6, 2024.

In addition to the 2023 EIP, the Board also approved as a long-term incentive plan the grants of RSU awards to Messrs. Oviatt, Tidball, and Fisher pursuant to the 2023 Plan (the “2023 LTIP”). The 2023 LTIP consists of total awards of up to 287,076 RSUs (“Units”) to Mr. Oviatt, up to 287,076 Units to Mr. Tidball, and up to 50,868 Units to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the “2023 LTIP Restricted Stock Unit Award Agreements”) to be entered between the Company and each participant. One such agreement covers 33% of each award recipient’s Units that are subject to time-based vesting, and the other such agreement covers the remaining 67% of such award recipient’s Units that may vest based on performance metrics. Upon vesting, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested Unit. The vesting period of the 2023 LTIP began on January 1, 2023 and terminates on December 31, 2025 (the “2023 LTIP Performance Vesting Date”).

The Units subject to time-based vesting, including 95,692 Units to Mr. Oviatt, 95,692 Units for Mr. Tidball, and 16,956 Units to Mr. Fisher, will vest in three equal and annual installments beginning December 31, 2023 and ending on December 31, 2025 if the award recipients’ employment continues with the Company through such dates.

The performance-vesting Units, including up to 191,384 Units for Mr. Oviatt, 191,384 Units for Mr. Tidball, and 33,912 Units to Mr. Fisher, may vest over a three-year performance period beginning January 1, 2023 (the “2023 LTIP Performance Period”) based upon the following Company performance metrics:

| | | | | | | | | | | | | | |

| Performance Metrics | Weight | Target | Above Target | Outstanding |

| Total Shareholder Return (based on the Company’s closing price of its common stock at the end of the 2023 LTIP Performance Period relative to its closing price as of the last trading day in 2022) | 1/3 | 94.2% | 142.7% | 191.3% |

| Relative Total Shareholder Return (based on the Company’s ranked performance in closing stock price growth relative to a peer group of companies during the 2023 LTIP Performance Period) | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 15% | 17.5% | 20% |

| | | | |

One-third of such performance-vesting Units, consisting of 63,794 Units for Mr. Oviatt, 63,794 Units for Mr. Tidball, and 11,304 Units for Mr. Fisher, may vest for each of the three performance metrics identified in the table above. The number of Units that will vest for each performance metric on the 2023 LTIP Performance Vesting Date shall be determined as follows:

a.if the “Target” level for such performance metric is not achieved, none of the Units relating to such performance metric will vest;

b.if the “Target” level (but no higher level) for such performance metric is achieved, 50% of the Units relating to such performance metric will vest;

c.if the “Above Target” level (but no higher level) for such performance metric is achieved, 75% of the Units relating to such performance metric will vest; and

d.if the “Outstanding” level for such performance metric is achieved, 100% of the Units relating to such performance metric will vest.

The foregoing summary of the 2023 EIP and the 2023 LTIP Restricted Stock Unit Award Agreements relating to the 2023 LTIP is qualified in its entirety by the text of the 2023 EIP and each of the 2023 LTIP Restricted Stock Unit Award Agreements, which were filed as exhibits to the Quarterly Report on Form 10-Q for the quarter ending March 31, 2023.

2022 LTIP

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

On April 6, 2022, the Compenstion Committee approved as a long-term incentive plan the grants of restricted stock unit awards to Messrs. Oviatt, Tidball, and Fisher (the "2022 LTIP") pursuant to the Company's 2014 Equity Incentive Plan, as amended (the “2014 Plan”). The 2022 LTIP consists of total awards of up to 230,232 RSUs to Mr. Oviatt, up to 230,232 RSUs to Mr. Tidball, and up to 43,023 RSUs to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the “2022 LTIP Restricted Stock Unit Award Agreements”) entered into between the Company and each participant. One such agreement covers the 33% of each award recipient’s RSUs that are subject to time-based vesting, and the other such agreement covers the remaining 67% of such award recipient’s RSUs that may vest based on performance metrics. Upon vesting, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested unit. The vesting period of the 2022 LTIP began on January 1, 2022 and terminates on December 31, 2024 (the “2022 LTIP Performance Vesting Date”).

The RSUs subject to time-based vesting, including 76,744 RSUs to Mr. Oviatt, 76,744 RSUs for Mr. Tidball, and 14,341 RSUs to Mr. Fisher, will vest in three equal and annual installments beginning December 31, 2022 and ending on December 31, 2024 if the award recipients’ employment continues with the Company through such dates.

The performance-vesting RSUs, including up to 153,488 RSUs for Mr. Oviatt, 153,488 RSUs for Mr. Tidball, and 28,682 RSUs to Mr. Fisher, may vest at the end of the three-year performance period beginning January 1, 2022 (the "2022 LTIP Performance Period") based upon the following Company performance metrics:

| | | | | | | | | | | | | | |

| Performance Metric | Weight | Target | Above Target | Outstanding |

Total Shareholder Return (based on the Company’s closing price of its common stock at the end of the 2022 LTIP Performance Period relative to its closing price as of the last trading day in 2021) | 1/3 | 89% | 136% | 183% |

Relative Total Shareholder Return (based on the Company’s ranked performance in closing stock price growth relative to a peer group of companies during the 2022 LTIP Performance Period) | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 10% | 15% | 20% |

| | | | |

One-third of such performance-vesting RSUs, consisting of 51,163 RSUs for Mr. Oviatt, 51,163 RSUs for Mr. Tidball, and 9,561 RSUs for Mr. Fisher, may vest for each of the three performance metrics identified in the table above. The number of RSUs that will vest for each performance metric on the 2022 LTIP Performance Vesting Date shall be determined as follows:

a.if the “Target” level for such performance metric is not achieved, none of the RSUs relating to such performance metric will vest;

b.if the “Target” level (but no higher level) for such performance metric is achieved, 50% of the RSUs relating to such performance metric will vest;

c.if the “Above Target” level (but no higher level) for such performance metric is achieved, 75% of the RSUs relating to such performance metric will vest; and

d.if the “Outstanding” level for such performance metric is achieved, 100% of the RSUs relating to such performance metric will vest.

The foregoing summary of the 2022 LTIP Restricted Stock Unit Award Agreements is qualified in its entirety by the text of each of the 2022 LTIP Restricted Stock Unit Award Agreements, which were filed as exhibits to the Company's Form 10-Q for the quarter ending March 31, 2022.

2021 LTIP

On May 28, 2021, the Board approved as a long-term incentive plan, the grants of restricted stock unit awards to Messrs. Oviatt, Tidball, Fugal, and Fisher pursuant to the 2014 Plan (the “2021 LTIP”). The 2021 LTIP consists of total awards of up to 204,543 RSUs to Mr. Oviatt, up to 204,543 RSUs to Mr. Tidball, up to 85,908 RSUs to Mr. Fugal, and up to 47,973 RSUs to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the “2021 LTIP Restricted Stock Unit Award Agreements”) between the Company and each participant. One agreement covers the 33% of each award recipient’s RSUs that are subject to time-based vesting, and the other agreement covers the remaining 67% of such award recipient’s RSUs that may vest based on performance metrics. Upon vesting, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested RSU. The vesting period of the 2021 LTIP began on January 1, 2021 and terminated on December 31, 2023 (the “2021 LTIP Performance Vesting Date”).

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

The RSUs subject to time-based vesting, including 68,181 RSUs to Mr. Oviatt, 68,181 RSUs for Mr. Tidball, 28,636 RSUs to Mr. Fugal, and 15,991 RSUs to Mr. Fisher, vested in three equal annual installments that began on December 31, 2021 and ended on December 31, 2023.

The performance-vesting RSUs, including up to 136,362 RSUs for Mr. Oviatt, 136,362 RSUs for Mr. Tidball, 57,272 RSUs for Mr. Fugal, and 31,982 RSUs to Mr. Fisher, were eligible to vest over a three-year performance period beginning January 1, 2021 based upon the following Company performance metrics:

| | | | | | | | | | | | | | |

| Performance Metric | Weight | Target | Above Target | Outstanding |

Total Shareholder Return

| 1/3 | 135% | 194% | 253% |

| Relative Total Shareholder Return | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 10% | 15% | 20% |

| | | | |

One-third of such performance-vesting RSUs, consisting of 45,454 RSUs for Mr. Oviatt, 45,454 RSUs for Mr. Tidball, 19,091 RSUs for Mr. Jay Fugal, the Company's former Vice President of Operations, and 10,661 RSUs for Mr. Fisher, were eligible to vest for each of the three performance metrics identified in the table above. The number of RSUs that vested for each performance metric on the 2021 LTIP Performance Vesting Date was determined as follows:

•if the “Target” level for such performance metric is not achieved, none of the RSUs relating to such performance metric will vest;

•if the “Target” level (but no higher level) for such performance metric is achieved, 50% of the RSUs relating to such performance metric will vest;

•if the “Above Target” level (but no higher level) for such performance metric is achieved, 75% of the RSUs relating to such performance metric will vest; and

•if the “Outstanding” level for such performance metric is achieved, 100% of the RSUs relating to such performance metric will vest.

Mr. Fugal resigned effective October 31, 2021 from his position as Vice President of Operations to pursue an opportunity as CEO of another company. Accordingly, Mr. Fugal did not receive incentive compensation under the 2021 LTIP, and his unvested RSUs have been forfeited.

On March 6, 2024, the Compensation Committee approved the incentive compensation amounts based on achieving certain targets pursuant to the 2021 LTIP. The performance vesting RSUs were settled by issuing a total of 152,354 shares of common stock, or 80,059 shares net of tax withholding.

The foregoing summary of the 2021 LTIP is qualified in its entirety by the text of each of the 2021 LTIP Restricted Stock Unit Award Agreements, which the Company filed as exhibits to its quarterly report on Form 10-Q for the quarter ended June 30, 2021.

NOTE 8 – REVENUE

Performance Obligations

Our performance obligations include providing product and servicing our product as well as other combustion related equipment. We recognize product revenue performance obligations in most cases when the product is delivered to the customer. Occasionally, if we are shipping the product on a customer’s account, we recognize revenue when the product has been shipped. At that point in time, the control of the product is transferred to the customer. When we perform service work, we apply the practical expedient that allows us to recognize service revenue when we have the right to invoice the customer for the work completed. We do not engage in transactions acting as an agent. The time needed to complete our performance obligations varies based on the size of the project; however, we typically satisfy our performance obligations within a few months of entering into the applicable sales contract or service contract.

Our customers have the right to return certain unused and unopened products within 90 days for a restocking fee. We provide a warranty on some of our products ranging from 90 days to 2 years, depending on the product. See Note 5 for the amount accrued for expected returns and warranty claims as of March 31, 2024.

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

Contract Balances

We have elected to use the practical expedient in ASC 340-40-25-4 (regarding recognition of the incremental costs of obtaining a contract) for costs related to contracts that are estimated to be completed within one year. All of our current sales contracts and service contracts are expected to be completed within one year, and as a result, we have not recognized a contract asset account. If we had chosen not to use this practical expedient, we would not expect a material difference in the contract balances. Occasionally, we collect milestone payments up front from customers on larger jobs. These payments are classified as deferred revenue until the deliverables have been met and revenue can be properly recognized in our financial statements. Each of the contracts related to these milestone payments is short-term in nature and we expect to recognize associated revenues within one year. As a result, we consider it appropriate to record deferred revenue for these transactions and do not have any other contract liability balances.

Disaggregation of Revenue

We consider all revenue recognized in the income statement to be revenue from contracts with customers. The table below shows revenue by category:

| | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, | | |

| | 2024 | | 2023 | | | | |

| Electronics | | $ | 5,334,008 | | | $ | 6,085,613 | | | | | |

| Manufactured | | 3,002,119 | | | 3,345,486 | | | | | |

| Re-Sell | | 4,355,677 | | | 4,328,580 | | | | | |

| Service | | 949,336 | | | 924,949 | | | | | |

| Total Revenue | | $ | 13,641,140 | | | $ | 14,684,628 | | | | | |

NOTE 9 – BASIC AND DILUTED EARNINGS PER SHARE

The following table is a reconciliation of the numerator and denominators used in the earnings per share calculation:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended March 31, |

| | 2024 | | 2023 |

| | Income (Numerator) | | Weighted Average Shares (Denominator) | | Per-Share

Amount | | Income (Numerator) | | Weighted Average Shares (Denominator) | | Per-Share

Amount |

| Basic EPS | | | | | | | | | | | | |

| Net income available to common stockholders | | $ | 1,434,375 | | | 46,884,875 | | | $ | 0.03 | | | $ | 2,589,621 | | | 47,174,518 | | | $ | 0.05 | |

| | | | | | | | | | | | |

| Effect of Dilutive Securities | | | | | | | | | | | | |

| Stock options & RSUs | | — | | | 1,597,829 | | | | | — | | | 1,438,315 | | | |

| | | | | | | | | | | | |

| Diluted EPS | | | | | | | | | | | | |

| Net income available to common stockholders + assumed conversions | | $ | 1,434,375 | | | 48,482,704 | | | $ | 0.03 | | | $ | 2,589,621 | | | 48,612,833 | | | $ | 0.05 | |

| | | | | | | | | | | | |

| | |

| | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

NOTE 10 – SEGMENT INFORMATION

We are required to report segment information in the same way that we internally organize our business for assessing performance and making decisions regarding allocation of resources. Our product and services lines are similar in their production processes, customers, and economic characteristics; and we do not manage the business or allocate costs based on individual product or service lines. Revenues are regularly reviewed on a disaggregated basis between our US and Canada subsidiaries; however, individual subsidiary operating performance is not reviewed regularly. Each subsidiary has a different purpose within the consolidated organization as a whole and they are not comparable to one another. As a result, we have concluded that we only have one operating segment, which is the consolidated company as a whole. We record inter-subsidiary revenues and costs for transfer pricing purposes related to income tax planning.

Segment information for these geographic areas is as follows:

| | | | | | | | | | | | | | | | | | |

| | | | For the Three Months Ended March 31, |

| Revenues | | | | | | 2024 | | 2023 |

| Revenue from external customers | | | | | | | | |

| Canada | | | | | | $ | 1,820,716 | | | $ | 2,136,204 | |

| United States | | | | | | 11,820,424 | | | 12,548,424 | |

| Inter-subsidiary revenue | | | | | | | | |

| Canada | | | | | | 3,657,599 | | | 1,908,921 | |

| United States | | | | | | 1,916 | | | 1,713 | |

| Inter-subsidiary eliminations | | | | | | (3,659,515) | | | (1,910,634) | |

| Total Revenue | | | | | | $ | 13,641,140 | | | $ | 14,684,628 | |

| | | | | | | | |

| | | | For the Three Months Ended March 31, |

| Income from Operations | | | | | | 2024 | | 2023 |

| Canada | | | | | | $ | 989,831 | | | $ | 716,764 | |

| United States | | | | | | 747,258 | | | 2,589,036 | |

| Total Income from Operations | | | | | | 1,737,089 | | | 3,305,800 | |

| Gain on sale of fixed assets | | | | | | 44,821 | | | 53,075 | |

| Other expense | | | | | | (23,339) | | | (9,553) | |

| Interest income | | | | | | 71,897 | | | 58,047 | |

| Interest expense | | | | | | (2,945) | | | (933) | |

| Income before income taxes | | | | | | $ | 1,827,523 | | | $ | 3,406,436 | |

| | | | | | | | |

| | | | | | As of |

| Long-Lived Assets | | | | | | March 31, 2024 | | December 31, 2023 |

| Canada | | | | | | $ | 4,858,130 | | | $ | 5,024,824 | |

| United States | | | | | | 6,770,932 | | | 6,190,455 | |

| Total Consolidated | | | | | | $ | 11,629,062 | | | $ | 11,215,279 | |

| | | | | | | | |

NOTE 11 – SUBSEQUENT EVENTS

In accordance with ASC 855 "Subsequent Events," Company management reviewed all material events through the date this report was issued.

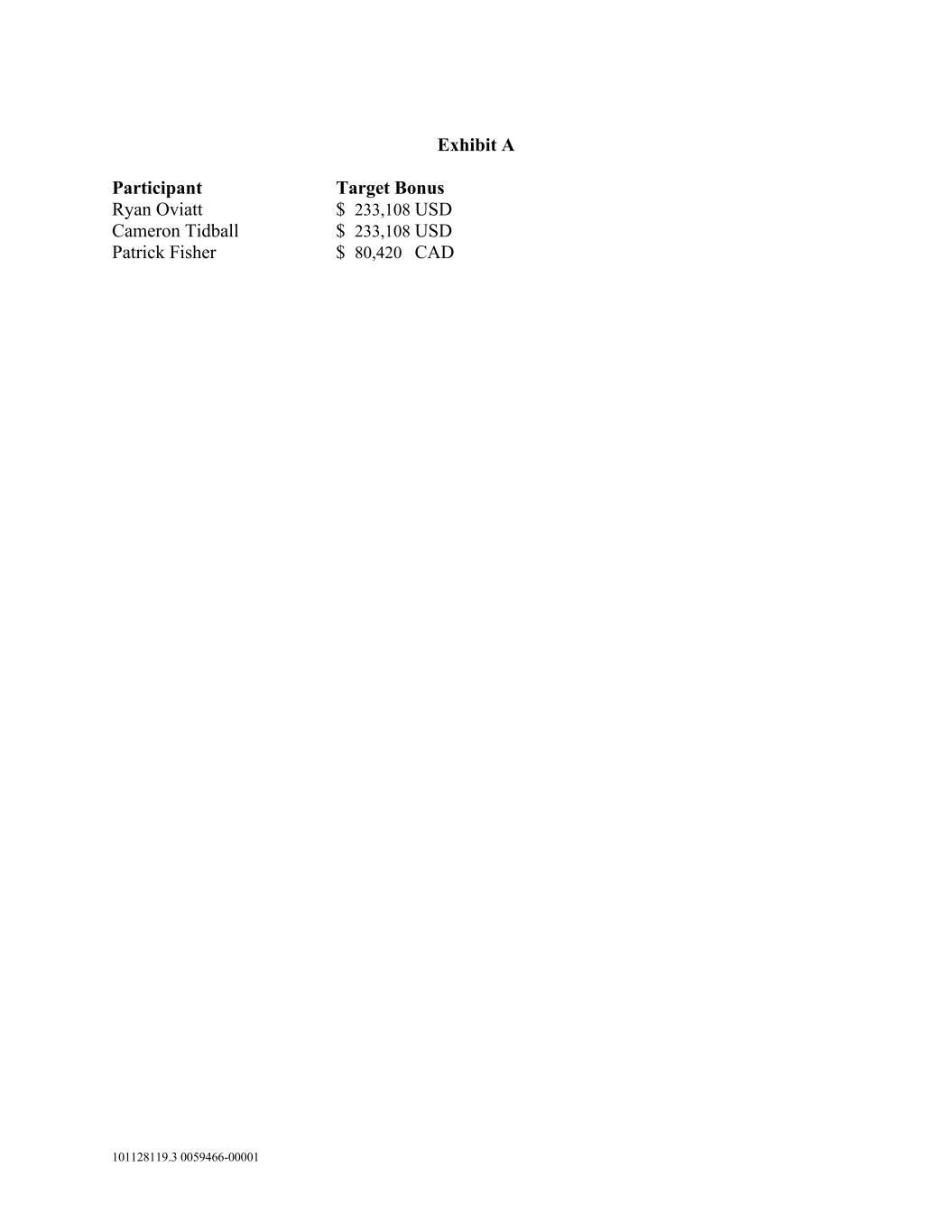

On April 9, 2024, the Compensation Committee approved the 2024 Executive Incentive Plan (the “2024 EIP”) for Messrs. Oviatt, Tidball, and Fisher. The 2024 EIP provides for the potential award of incentive compensation to the participants based on the Company’s financial performance in fiscal 2024. If earned, the incentive compensation will be payable in cash and stock, and the stock portion of the incentive compensation is intended to constitute an award under the 2023 Plan. In addition to the 2024 EIP, the Board also approved as a long-term incentive plan the grants of a restricted stock unit awards to Messrs. Oviatt, Tidball, and Fisher pursuant to the 2023 Plan (the “2024 LTIP”).

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

2024 EIP

Under the terms of the 2024 EIP, each participating executive officer has been assigned a target incentive compensation amount for fiscal 2024. The target incentive compensation amount for Mr. Oviatt is equal to 65% of his base salary as of December 31, 2024, the target incentive compensation amount for Mr. Tidball is equal to 65% of his base salary as of December 31, 2024, and the target incentive compensation for Mr. Fisher is equal to 40% of his base salary as of December 31, 2024. Under no circumstance can the participants receive more than two times the assigned target incentive compensation.

Participants will be eligible to receive incentive compensation based upon reaching or exceeding performance goals established by the Compensation Committee for fiscal 2024. The performance goals in the 2024 EIP are based on the Company’s total revenue, EBITDA, and two non-financial factors including strategic growth initiatives and safety and other. Each of the revenue, EBITDA, and strategic growth initiatives performance goals will be weighted 30% while the safety and other goal will be weighted 10% in calculating incentive compensation amounts.

The incentive compensation amounts earned under the 2024 EIP, if any, will be paid 50% in cash and 50% in shares of restricted stock under the 2023 Plan. In no event shall the total award exceed 200% of the target incentive compensation amount for each participant, or exceed any limitations otherwise set forth in the 2023 Plan. The actual incentive compensation amounts, if any, will be determined by the Compensation Committee upon the completion of fiscal 2024 reporting period and paid by March 15, 2025, subject to all applicable tax withholding.

2024 LTIP

The 2024 LTIP consists of total awards of up to 204,651 restricted stock units (“Units”) to Mr. Oviatt, up to 204,651 Units to Mr. Tidball, and up to 36,195 Units to Mr. Fisher, pursuant to two separate restricted stock unit award agreements (collectively, the “2024 LTIP Restricted Stock Unit Award Agreements”) entered between the Company and each participant. One such agreement covers 33% of each award recipient’s Units that are subject to time-based vesting, and the other such agreement covers the remaining 67% of such award recipient’s Units that may vest based on performance metrics. Upon vesting, the award agreements entitle the award recipients to receive one share of the Company’s common stock for each vested Unit. The vesting period of the 2024 LTIP began on January 1, 2024 and terminates on December 31, 2026 (the “2024 LTIP Performance Vesting Date”).

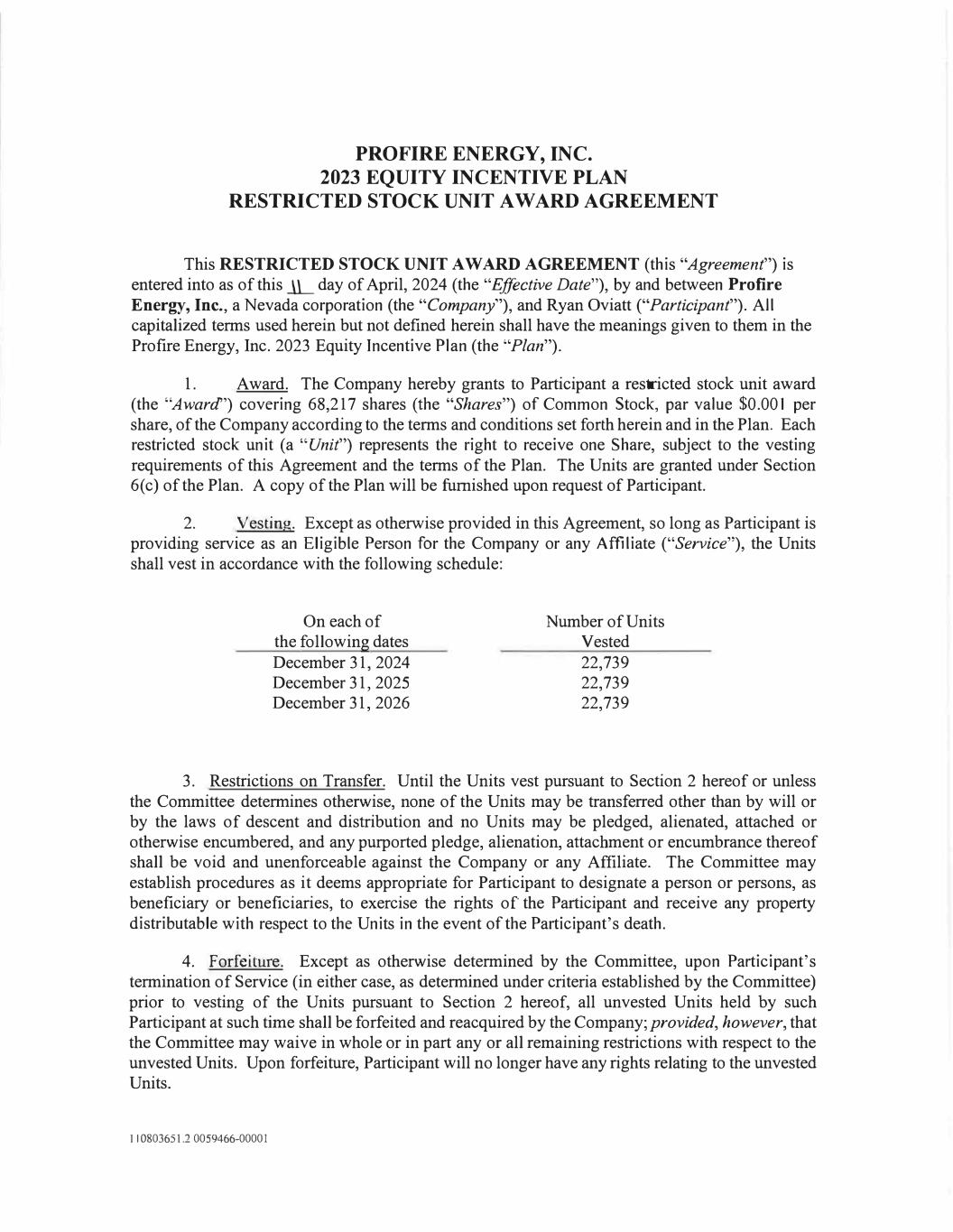

The Units subject to time-based vesting, including 68,217 Units to Mr. Oviatt, 68,217 Units for Mr. Tidball, and 12,065 Units to Mr. Fisher, will vest in three equal and annual installments beginning January 1, 2024 and ending on December 31, 2026 if the award recipients’ employment continues with the Company through such dates.

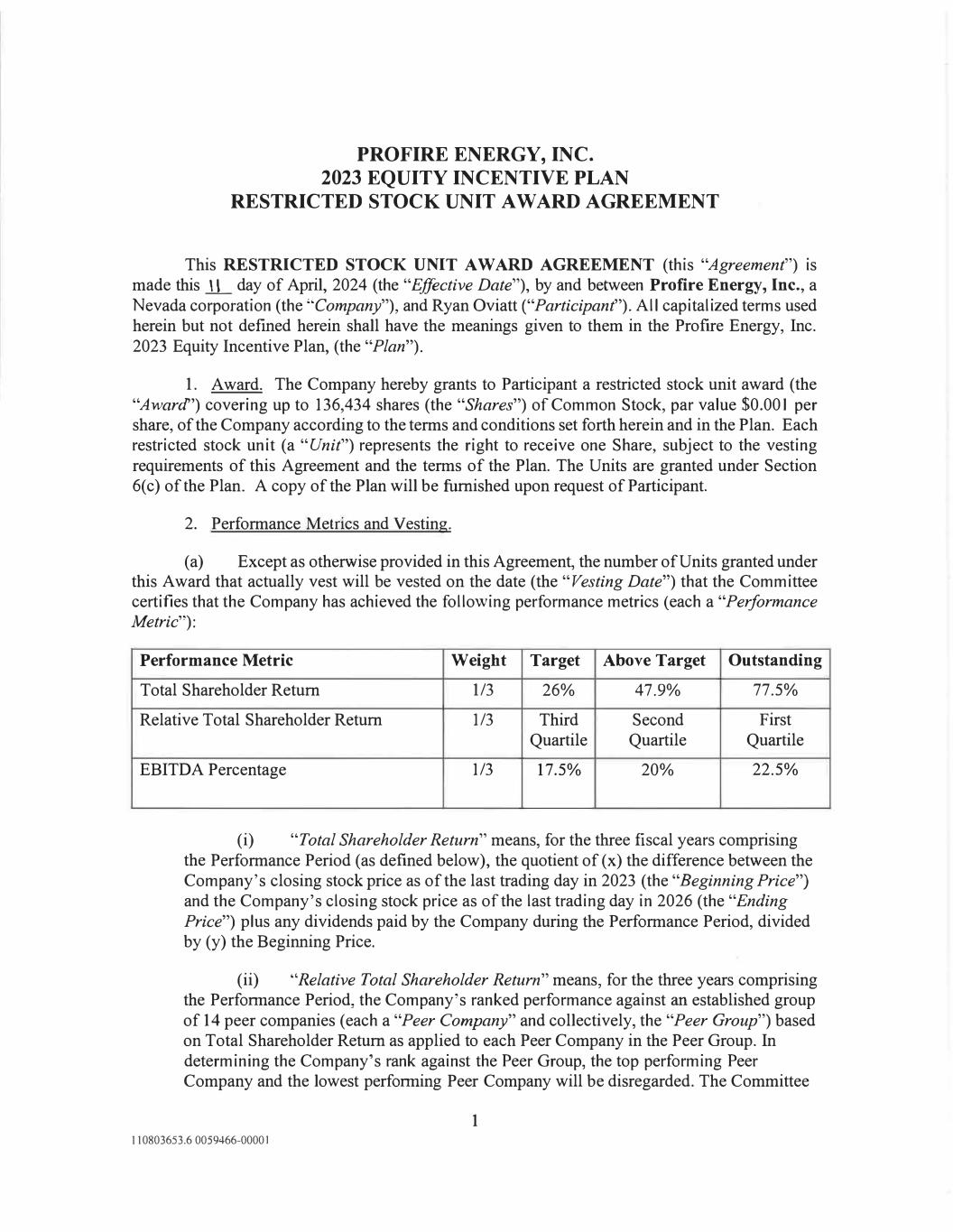

The performance-vesting Units, including up to 136,434 Units for Mr. Oviatt, 136,434 Units for Mr. Tidball, and 24,130 Units to Mr. Fisher, may vest over a three-year performance period beginning January 1, 2024 (the “2024 LTIP Performance Period”) based upon the following Company performance metrics:

| | | | | | | | | | | | | | |

| Performance Metrics | Weight | Target | Above Target | Outstanding |

| Total Shareholder Return (based on the Company’s closing price of its common stock at the end of the 2024 LTIP Performance Period relative to its closing price as of the last trading day in 2023) | 1/3 | 26.0% | 47.9% | 77.5% |

| Relative Total Shareholder Return (based on the Company’s ranked performance in closing stock price growth relative to a peer group of companies during the 2024 LTIP Performance Period) | 1/3 | Third Quartile | Second Quartile | First Quartile |

| EBITDA as a Percentage of Total Revenue | 1/3 | 17.5% | 20.0% | 22.5% |

| | | | |

One-third of such performance-vesting Units, consisting of 45,477 Units for Mr. Oviatt, 45,477 Units for Mr. Tidball, and 8,043 Units for Mr. Fisher, may vest for each of the three performance metrics identified in the table above. The number of Units that will vest for each performance metric on the 2024 LTIP Performance Vesting Date shall be determined as follows:

a.if the “Target” level for such performance metric is not achieved, none of the Units relating to such performance metric will vest;

PROFIRE ENERGY, INC. AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

For the Three Months Ended March 31, 2024 and 2023

b.if the “Target” level (but no higher level) for such performance metric is achieved, 50% of the Units relating to such performance metric will vest;

c.if the “Above Target” level (but no higher level) for such performance metric is achieved, 75% of the Units relating to such performance metric will vest; and

d.if the “Outstanding” level for such performance metric is achieved, 100% of the Units relating to such performance metric will vest.

The foregoing summary of the 2024 EIP and the 2024 LTIP Restricted Stock Unit Award Agreements relating to the 2024 LTIP is qualified in its entirety by the text of the 2024 EIP and each of the 2024 LTIP Restricted Stock Unit Award Agreements, which were filed as exhibits to this Quarterly Report on Form 10-Q for the quarter ending March 31, 2024.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

This discussion summarizes the significant factors affecting our consolidated operating results, financial condition, liquidity, and capital resources during the three-month periods ended March 31, 2024 and 2023. This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the financial statements and notes to the financial statements contained in this quarterly report on Form 10-Q and our annual report on Form 10-K for the year ended December 31, 2023.

Forward-Looking Statements

This quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that are based on management's beliefs and assumptions and on information currently available to management. For this purpose, any statement contained in this report that is not a statement of historical fact may be deemed to be forward-looking, including, but not limited to, statements relating to our future actions, intentions, plans, strategies, objectives, results of operations, cash flows and the adequacy of or need to seek additional capital resources and liquidity. Words such as "may," "should," "expect," "project," "plan," "anticipate," "believe," "estimate," "intend," "budget," "forecast," "predict," "potential," "continue," "should," "could," "will," or comparable terminology or the negative of such terms are intended to identify forward-looking statements; however, the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements by their nature involve known and unknown risks and uncertainties and other factors that may cause actual results and outcomes to differ materially depending on a variety of factors, many of which are not within our control. Such factors include, but are not limited to, economic conditions generally and in the oil and gas industry in which we and our customers participate; competition within our industry; legislative requirements or changes which could render our products or services less competitive or obsolete; our failure to successfully develop new products and/or services or to anticipate current or prospective customers' needs; price increases; limits to employee capabilities; delays, reductions, or cancellations of contracts we have previously entered into; sufficiency of working capital, capital resources and liquidity and other factors detailed herein and in our other filings with the United States Securities and Exchange Commission (the "SEC" or "Commission"). Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report. For a more detailed discussion of the principal factors that could cause actual results to be materially different, you should read our risk factors in Item 1A. Risk Factors, included elsewhere in this report.

Forward-looking statements are based on current industry, financial, and economic information which we have assessed but which by its nature is dynamic and subject to rapid and possibly abrupt changes. Due to risks and uncertainties associated with our business, our actual results could differ materially from those stated or implied by such forward-looking statements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements and we hereby qualify all of our forward-looking statements by these cautionary statements.