0001512922

false

0001512922

2023-07-27

2023-07-27

0001512922

petv:CommonStockParValue0.001Member

2023-07-27

2023-07-27

0001512922

petv:WarrantsToPurchaseCommonStockMember

2023-07-27

2023-07-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

July

27, 2023

Date

of Report (Date of earliest event reported)

PETVIVO

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40715 |

|

99-0363559 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5251

Edina Industrial Blvd.

Edina,

Minnesota |

|

55439 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(952)

405-6216

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

PETV |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Common Stock |

|

PETVW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

On

July 27, 2023, PetVivo Holdings, Inc. (the “Company”) issued convertible promissory notes (“Convertible Notes”)

in the aggregate amount of $550,000 to three accredited investors pursuant to debenture subscription agreements (“Debenture

Subscription Agreement”). The Convertible Notes mature on January 26, 2024 (the “Maturity Date”), bear interest at

a rate of 10% per annum and automatically convert into shares of the Company’s common stock which are restricted under Rule

144 of the Securities Act of 1933, as amended, on the earlier of (i) the Maturity Date or (ii) upon the occurrence of certain events

prior to the Maturity Date, including, without limitation, a Qualified Financing, Sale or Public Offering (as such terms are defined

in the Convertible Notes).

If

the Company raises at least $2 million in a sale of its securities to investors who are not affiliated with the Company (a “Qualified

Financing”) prior to the Maturity Date, the Convertible Notes will be automatically converted into restricted shares of

the Company’s common stock at a conversion price equal to the greater of (i) the per share price at which the Company sells Shares

in the Qualified Financing or (ii) $1.60 per share. If the Convertible Notes are converted at the Maturity Date, the conversion price

is equal to $1.60 per share. If the Company completes a Public Offering or Sale (as such terms are defined in the Convertible Notes),

the Convertible Notes will be automatically converted into restricted shares of the Company’s common stock at a price equal

to the offering price of the Company’s common stock in the Public Offering or the fair market value of the Company’s common

stock at the time of the Sale, respectively.

The

Company may prepay the Convertible Notes at any time. The Convertible Notes contain a number of customary events of default. The Convertible

Notes are unsecured and are subordinated to the Company’s current outstanding liabilities.

The

Convertible Note Offering was completed pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act

of 1933, as amended (“Securities Act”). The issuance of restricted shares of the Company’s common stock upon

conversion of the Convertible Notes will be exempt from registration under Section 4(a)(2) of the Securities Act. Each investor is sophisticated

and represented in writing that he, she, or it is an accredited investor and acquired the securities for their own account for investment

purposes. A legend will be placed on the Convertible Notes and the stock certificates issued upon conversion of the Convertible Notes

stating that the securities are “restricted securities” under Rule 144 of the Securities Act, have not been registered

under the Securities Act and cannot be sold or otherwise transferred without registration or an exemption therefrom.

The

foregoing is only a summary of the material terms of the Debenture Subscription Agreements and the Convertible Notes and does not purport

to be a complete description of the rights and obligations of the parties thereunder. The summary of the Convertible Notes and the

Debenture Subscription Agreements is qualified in its entirety by reference to the forms of such agreements,

which are filed as Exhibits 10.1 and 10.2 to this Current Report and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

PETVIVO

HOLDINGS, INC. |

| |

|

|

| Date:

July 31, 2023 |

By:

|

/s/

John Lai |

| |

Name:

|

John

Lai |

| |

Title: |

Chief

Executive Officer

|

Exhibit

10.1

Maturity

Date: January 26, 2024

THE

DEBENTURE REPRESENTED BY THIS CERTIFICATE AND THE COMMON STOCK UNDERLYING SUCH DEBENTURE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES

ACT OF 1933 AND MAY NOT BE SOLD OR TRANSFERRED IN THE ABSENCE OF (a) AN EFFECTIVE REGISTRATION STATEMENT FOR THE DEBENTURE AND/OR COMMON

STOCK UNDER THE SECURITIES ACT OF 1933 OR (b) AN OPINION REASONABLY SATISFACTORY TO PETVIVO HOLDINGS, INC., FROM COUNSEL FOR PETVIVO

HOLDINGS, INC., OR FROM COUNSEL FOR THE PROPOSED TRANSFEROR REASONABLY SATISFACTORY TO PETVIVO HOLDINGS, INC., TO THE EFFECT THAT THE

TRANSFER MAY BE EFFECTED WITHOUT SUCH REGISTRATION.

PETVIVO

HOLDINGS, INC.

10%

CONVERTIBLE DEBENTURE

July

27, 2023

$___________

PetVivo

Holdings, Inc., a Nevada corporation (the “Company”), for value received, hereby promises to pay to the order of ___________

(the “Holder”) or the Holder’s registered assigns, the sum of ________________ ($____), or such lesser amount as shall

then equal the outstanding principal amount hereof and any unpaid accrued interest hereon, as set forth below, on January 26, 2024 (“Maturity

Date”), which is six months from the date of issuance of this Convertible Debenture (the “Debenture”), unless this

Debenture has been converted prior thereto pursuant to the terms hereof.

The

following is a statement of the rights of the Holder and the conditions to which this Debenture is subject, and to which the Holder hereof,

by the acceptance of this Debenture, agrees:

1.

Interest.

(a)

Interest Rate. The unpaid principal balance of this Debenture shall bear simple interest at a rate equal to ten percent (10%)

per annum from the date hereof until paid in full or converted pursuant to Section 3 hereof.

(b)

Maximum Rate Permitted by Law. In the event that any interest rate provided for in this Section 1 shall be determined to be unlawful,

such interest rate shall be computed at the highest rate permitted by applicable law. Any payment by the Company of any interest amount

in excess of that permitted by law shall be considered a mistake, with the excess being applied to the principal amount of this Debenture

without prepayment premium or penalty.

2.

Voluntary Prepayment. The Company may, at its option, prepay, in whole or in part, the outstanding principal and accrued interest

under this Debenture immediately prior to the conversion of this Debenture pursuant to the terms hereof. In the event of prepayment,

the Company shall tender to the Holder funds in the amount of the principal and accrued interest being paid by check or wire transfer.

In the event that less than all of the principal and accrued interest is paid, such payment shall be allocated first to accrued interest

and second to principal. Prior to making any prepayment of the Note hereunder, the Company shall provide the Holder with notice of its

intention to do so not less than ten (10) days prior to the date on which it intends to make such prepayment, in order to give the Holder

an opportunity to elect to make a voluntary conversion of the Note pursuant to Section 3 below. If, after giving notice of an intention

to make a prepayment under the Note, Company shall determine not to make such prepayment, or to change the anticipated date of such prepayment

to a further date, then it shall notify the Payee thereof in writing at least three (3) days prior to the previously scheduled payment

date.

3.

Conversion.

(a)

Mandatory Conversion.

(i)

Qualified Financing. Upon the consummation of a sale or sales of shares of capital stock or securities convertible into shares of capital

stock for cash in an equity financing to a third party or parties who are unaffiliated with the Company (“Qualified Investors”),

with aggregate gross proceeds to the Company of at least Two Million Dollars ($2,000,000) (a “Qualified Financing”), this

Debenture shall be automatically converted into fully paid and nonassessable shares of Common Stock of the Company (the “Common

Stock”), at the Conversion Price specified in Section 3(b) below and in the manner specified in Section 3(d) below.

(ii)

Maturity. Immediately prior to the Maturity Date of this Debenture as set forth on the first page hereof (“Maturity”), this

Debenture shall, at the Company’s election, be automatically converted into fully paid and nonassessable shares of Common Stock

of the Company, at the Conversion Price specified in Section 3(b) below and in the manner specified in Section 3(d) below.

(iii)

Profitability. If one or more events occur prior to Maturity which renders or will likely render the Company profitable (“Profitability”),

which determination shall be made solely by the Board of Directors of the Company, this Debenture shall, at the Company’s election,

be automatically converted into fully paid and nonassessable shares of Common Stock of the Company at the Conversion Price specified

in Section 3(b) below and in the manner specified in Section 3(d) below.

(iv)

Public Offering. Immediately prior to the consummation of any underwritten public offering by the Company of its equity securities pursuant

to an effective registration statement filed under the Securities Act of 1933, as amended (a “Public Offering”), this Debenture

shall be automatically converted into fully paid and nonassessable shares of Common Stock, at the Conversion Price specified in Section

3(b) below and in the manner specified in Section 3(d) below.

(v)

Sale. Immediately prior to the consummation of any consolidation or merger of the Company with or into any other corporation or other

entity or person, or any other corporate reorganization in which the Company shall not be the continuing or surviving entity (other than

a reincorporation in another state); any transaction or series of related transactions by the Company in which in excess of fifty percent

(50%) of the Company’s voting power is issued for the purpose of combining with or an acquisition by one or more corporations or

other entities or persons; or a sale, conveyance or disposition of all or substantially all of the assets of the Company (a “Sale”),

this Debenture shall be automatically converted into fully paid and nonassessable shares of Common Stock, at the Conversion Price specified

in Section 3(b) below and in the manner specified in Section 3(d) below.

(b)

A Qualified Financing, an election by the Company to convert this Debenture upon Maturity, Profitability, a Public Offering, and a Sale

shall occasionally be referred to herein collectively as “Conversion Events” and individually as the “Conversion Event.”

Upon any Conversion Event, the number of shares of Common Stock into which this Debenture shall be converted shall equal the product

of: (x) the sum of the principal amount of the Debenture being converted and the unpaid accrued interest thereon; (y) divided by the

applicable “Conversion Price” (as hereinafter defined).

(1)

Conversion Price Upon Qualified Financing, Maturity, or Profitability. In the event of a conversion of this Debenture pursuant

to either Section 3(a)(i), 3(a)(ii), or 3(a)(iii) the applicable “Conversion Price” shall be the greater of either i) the

per share price at which the Company sells shares of the Company Common Stock in the Qualified Financing (e.g. $2.10); or ii) One Dollar

and Sixty Cents ($1.60).

(2)

Conversion Price Upon Public Offering or Sale. In the event of conversion of this Debenture pursuant to either Section (3)(a)(iv)

or 3(a)(v), respectively, the applicable Conversion Price shall be the offering price of the Common Stock in the Public Offering, or

the Fair Market Value of the Common Stock at the time of the Sale (the “Fair Market Value” of a share of Common Stock shall

mean the per share value of the consideration received by the holders of the Common Stock in the Sale), as applicable.

(c)

No Impairment. The Company will not, by amendment of its Articles of Incorporation or through any reorganization, recapitalization,

transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid

the observance or performance of any of the terms to be observed or performed hereunder by the Company but will at all times in good

faith assist in the carrying out of all the provisions of this Section 3 and in the taking of all such action as may be necessary or

appropriate in order to protect the conversion rights of the holders of the Debentures against impairment.

(d)

Taxes on Conversion. The issue of share certificates on conversion of this Debenture shall be made without charge to the converting

Holder for any tax in respect of the issue thereof. The Company shall not, however, be required to pay any tax which may be payable in

respect of any transfer involved in the issue and delivery of shares in any name other than that of the Holder, and the Company shall

not be required to issue or deliver any certificate in respect of such shares unless and until the person or persons requesting the issuance

thereof shall have paid to the Company the amount of such tax or shall have established to the satisfaction of the Company that such

tax has been paid.

(e)

Reservation of Conversion Securities. The Company agrees that the Company will at all times have authorized and reserved, and

will keep available, solely for issuance or delivery upon the conversion of this Debenture, the shares of Common Stock and other securities

and properties as from time to time shall be receivable upon the conversion of this Debenture.

(f)

No Rights as Shareholders. Prior to the conversion of this Debenture, the Holder of this Debenture shall not be entitled to any

rights of a shareholder of the Company, including, without limitation, the right to vote, to receive dividends or other distributions,

or to exercise any pre-emptive rights, and shall not be entitled to receive any notice of any proceedings of the Company, except as provided

herein or in the Subscription Agreement or as otherwise agreed.

(g)

No Fractional Shares. The Company shall not be required to issue certificates representing fractional shares of Common Stock,

but will make a payment in cash based on the offering price of one share of Common Stock in the Qualified Financing, Public Offering,

or upon Maturity, as applicable, and based on the Fair Market Value of one share of Common Stock at the time of the Sale, for any fractional

share.

4.

Notices. The Company shall give the Holder written notice of a Conversion Event transaction not later than ten (10) days prior to

the shareholders’ meeting called to approve such transaction, or, if approved by the written consent of the shareholders, ten (10)

days prior to the closing of such transaction. The first of such notices shall describe the material terms and conditions of the impending

transaction and the provisions of this Section 4 and the Company shall thereafter give such holders prompt notice of any material changes.

The transaction shall in no event take place sooner than ten (10) days after the Company has given the first notice provided for herein

or sooner than five (5) days after the Company has given the notice provided for herein of any material changes, provided, however, that

such periods may be shortened upon the written consent of the holders of the majority of the principal amount of Debentures then outstanding.

5.

Debenture Register. This Debenture is transferable only upon the books of the Company which it shall cause to be maintained for

such purpose. The Company may treat the registered holder of this Debenture as he or it appears on the Company’s books at any time

as the Holder for all purposes.

6.

Subordination. The indebtedness, including interest, principal, and default interest, if any, evidenced by this Debenture is hereby

expressly subordinated, to the extent and in the manner set forth in this Section 6, in right of payment to the prior payment in full

of all the Company’s Senior Indebtedness (as hereinafter defined) whether now outstanding or hereafter obtained. Notwithstanding

the foregoing, for so long as there is no event of default under the Senior Indebtedness, the Company may pay, and the Holder may receive

for its own account, all regular installments of interest hereunder.

(a)

Senior Indebtedness. As used in this Note, the term “Senior Indebtedness” shall mean, unless expressly subordinated

to or made on a parity with the amounts due under this Note, the principal of (and premium, if any), unpaid interest on and amounts reimbursable,

fees, expenses, costs of enforcement and other amounts due in connection with, (i) indebtedness of the Company to banks, commercial finance

lenders, insurance companies, leasing or equipment financing institutions or other lending institutions regularly engaged in the business

of lending money (excluding venture capital, investment banking or similar institutions which sometimes engage in lending activities

but which are primarily engaged in investments in equity securities), which is for money borrowed, or purchase or leasing of equipment

in the case of lease or other equipment financing, whether or not secured, (ii) any such indebtedness or any debentures, notes or other

evidence of indebtedness issued in exchange for such Senior Indebtedness, or any indebtedness arising from the satisfaction of such Senior

Indebtedness by a guarantor; and (iii) indebtedness of the Company to any third party which is for money borrowed, or purchase or leasing

of equipment in the case of lease or other equipment financing, whether or not secured, in which the Board of Directors of the Company

specifically deems Senior Indebtedness.

(b)

Default on Senior Indebtedness. If there should occur any receivership, insolvency, assignment for the benefit of creditors, bankruptcy,

reorganization or arrangements with creditors (whether or not pursuant to bankruptcy or other insolvency laws), sale of all or substantially

all of the assets, dissolution, liquidation or any other marshaling of the assets and liabilities of the Company, or if this Debenture

shall be declared due and payable upon the occurrence of an Event of Default as a result of a default under any Senior Indebtedness,

then (i) no amount shall be paid by the Company in respect of the principal of or interest on this Debenture at the time outstanding,

unless and until the principal of and interest on the Senior Indebtedness then outstanding shall be paid in full, and (ii) no claim or

proof of claim shall be filed with the Company by or on behalf of the Holder that shall assert any right to receive any payments in respect

of the principal of and interest on this Debenture, except subject to the payment in full of the principal of and interest on all of

the Senior Indebtedness then outstanding. If there occurs an event of default that has been declared in writing with respect to any Senior

Indebtedness, or in the instrument under which any Senior Indebtedness is outstanding, permitting the holder of such Senior Indebtedness

to accelerate the maturity thereof, then, unless and until such event of default shall have been cured or waived or shall have ceased

to exist, or all Senior Indebtedness shall have been paid in full, no payment shall be made in respect of the principal of or interest

on this Debenture.

(c)

Effect of Subordination. Subject to the rights, if any, of the holders of Senior Indebtedness under this Section 6 to receive

cash, securities, or other properties otherwise payable or deliverable to the Holder, nothing contained in this Section 6 shall impair,

as between the Company and the Holder, the obligation of the Company, subject to the terms and conditions hereof, to pay to the Holder

the principal hereof and interest hereon as and when the same become due and payable, or shall prevent the Holder, upon default hereunder,

from exercising all rights, powers, and remedies otherwise provided herein or by applicable law.

(d)

Undertaking. By its acceptance of this Debenture, the Holder agrees to execute and deliver such documents as may be reasonably

requested from time to time by the Company or the lender of any Senior Indebtedness in order to implement the foregoing provisions of

this Section 6. If the Holder receives any payment on this Debenture which is prohibited by this Section 6, such payment shall be held

in trust by the Holder for the benefit of, and shall be paid and delivered upon written request to, the holders of Senior Indebtedness

or their agent, for application to the payment on such Senior Indebtedness.

7.

Defaults and Remedies.

(a)

Events of Default. An “Event of Default” shall occur if:

(i)

the Company shall default in the payment of the principal and interest of this Debenture, when and as the same shall become due and payable;

(ii)

the Company shall default in the due observance or performance of any material covenant, condition, or agreement on the part of the Company

to be observed or performed pursuant to the terms hereof or pursuant to the terms of the Subscription Agreement, and such default shall

continue for thirty (30) days after the date of written notice thereof, specifying such default and, if such default is capable of being

remedied, requesting that the same be remedied, shall have been given to the Company by the Holder;

(iii)

any event or condition shall occur that results in the acceleration of the maturity of any indebtedness of the Company or any subsidiary

in a principal amount aggregating $500,000 or more;

(iv)

an involuntary proceeding shall be commenced or an involuntary petition shall be filed in a court of competent jurisdiction seeking (a)

relief in respect of the Company, or of a substantial part of its property or assets, under Title 11 of the United States Code, as now

constituted or hereafter amended, or any other Federal or state bankruptcy, insolvency, receivership or similar law, (b) the appointment

of a receiver, trustee, custodian, sequestrator, conservator or similar official for the Company, or for a substantial part of its property

or assets, or (c) the winding up or liquidation of the Company; and such proceeding or petition shall continue undismissed for ninety

(90) days, or an order or decree approving or ordering any of the foregoing shall be entered; or

(v)

the Company shall (a) voluntarily commence any proceeding or file any petition seeking relief under Title 11 of the United States Code,

as now constituted or hereafter amended, or any other Federal or state bankruptcy, insolvency, receivership or similar law, (b) consent

to the institution of, or fail to contest in a timely and appropriate manner, any proceeding or the filing of any petition described

in paragraph (iv) of this Section 7(a), (c) apply for or consent to the appointment of a receiver, trustee, custodian, sequestrator,

conservator or similar official for the Company or any subsidiary, or for a substantial part of its property or assets, (d) file an answer

admitting the material allegations of a petition filed against it in any such proceeding, (e) make a general assignment for the benefit

of creditors, (f) become unable, admit in writing its inability or fail generally to pay its debts as they become due or (g) take any

action for the purpose of effecting any of the foregoing.

(b)

Acceleration. If an Event of Default occurs under Section 7(a)(iv) or (v), then, subject to Section 6 above, the outstanding principal

of and all accrued interest on this Debenture shall automatically become immediately due and payable, without presentment, demand, protest

or notice of any kind, all of which are expressly waived in Section 9 below. If any other Event of Default occurs and is continuing the

Holder, by written notice to the Company, may declare the principal of and accrued interest on this Debenture to be immediately due and

payable.

8.

Loss, Etc., of Debenture. Upon receipt of evidence satisfactory to the Company of the loss, theft, destruction, or mutilation

of this Debenture, and of indemnity reasonably satisfactory to the Company if lost, stolen, or destroyed, and upon surrender and cancellation

of this Debenture if mutilated, and upon reimbursement of the Company’s reasonable incidental expenses, the Company shall execute

and deliver to the Holder a new Debenture of like date, tenor, and denomination.

9.

Waiver. The Company hereby waives presentment, demand, notice of nonpayment, protest, and all other demands and notices in connection

with the delivery, acceptance, performance, or enforcement of this Debenture. If an action is brought for collection under this Debenture,

the Holder shall be entitled to receive all costs of collection, including, but not limited to, its reasonable attorneys’ fees.

10.

Notices. Any notice, approval, request, authorization, direction, or other communication under this Debenture shall be given in

writing and shall be deemed to have been delivered and given for all purposes (i) on the delivery date if delivered personally to the

party to whom the same is directed or transmitted by facsimile to the facsimile number set forth on the signature page of this Debenture

(or to such other facsimile number as may be communicated to the notifying party in writing) with confirmation of receipt, (ii) one (1)

business day after deposit with a commercial overnight carrier, with written verification of receipt, or (iii) three (3) business days

after the mailing date, whether or not actually received, if sent by U.S. mail, return receipt requested, postage and charges prepaid,

at the address of the party set forth on the signature page of this Debenture (or at such other address as may be communicated to the

notifying party in writing).

11.

Transferability. This Debenture evidenced hereby may not be pledged, sold, assigned, or transferred except (i) to any subsidiary

wholly owned (directly or through intermediate wholly owned subsidiaries) by the Holder, (ii) to any director, shareholder, or executive

officer of the Holder, (iii) to any corporation, partnership or other entity resulting from any merger, consolidation or other reorganization

to which Holder is a party or any corporation, partnership or other person or entity to which Holder may transfer all or substantially

all of Holder’s assets and business, or (iv) with the express written consent of the Company, which may be withheld in its sole

discretion; provided, however, that any such transfer shall only be made in compliance with applicable federal and state securities laws.

Any pledge, sale, assignment, or transfer in violation of the foregoing shall be null and void.

12.

Headings; References. All headings used herein are used for convenience only and shall not be used to construe or interpret this

Debenture. Except where otherwise indicated, all references herein to Sections refer to Sections hereof.

13.

Successors and Assigns. All of the covenants, stipulations, promises, and agreements in this Debenture shall bind and inure to

the benefit of the parties’ respective successors and assigns, whether so expressed or not.

14.

Governing Law. This Debenture shall be governed by the laws of the State of Nevada, and the laws of such state (other than conflicts

of laws principles) shall govern the construction, validity, enforcement, and interpretation hereof, except to the extent federal laws

otherwise govern the validity, construction, enforcement, and interpretation hereof.

15.

Payments. Each payment on this Debenture shall be due and payable in lawful money of the United States of America, at the address

of the Holder as shown on the books of the Company, in funds which are or will be available for next business day use by the Holder.

In any case where the payment of principal and interest hereon is due on a non-business day, the Company shall be entitled to delay such

payment until the next succeeding business day, but interest shall continue to accrue until the payment is, in fact, made.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, the Company has caused this Debenture to be issued this 27 day of July 2023.

| Address: |

|

PETVIVO HOLDINGS, INC. |

| |

|

|

|

| 5151

Edina Industrial Blvd., |

|

By: |

|

| Suite

575 |

|

|

John

Lai |

| Edina,

MN 55439 |

|

Its: |

Chief

Executive Officer |

| |

|

|

|

| Name

and Address of Holder: |

|

|

|

| |

|

|

|

| Holder:

|

|

|

|

| |

|

|

|

| Address: |

|

|

|

| |

|

|

|

| Phone: |

|

|

|

Exhibit

10.2

PETVIVO

HOLDINGS, INC.

DEBENTURE

SUBSCRIPTION AGREEMENT

This

Debenture Subscription Agreement (this “Agreement”) is made as of the date of acceptance by PETVIVO HOLDINGS, Inc., a Nevada

corporation (the “Company”) of the terms hereof, by and between the Company, and the undersigned (“Purchaser”).

WHEREAS,

Purchaser wishes to subscribe for and purchase a Convertible Debenture of the Company upon the terms and subject to the conditions

of this Agreement, subject to acceptance of Purchaser’s subscription by the Company.

NOW

THEREFORE, in consideration of the premises and the mutual covenants contained herein and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.

PURCHASE OF CONVERTIBLE DEBENTURE

(a)

Subscription. Purchaser hereby subscribes for and agrees to purchase the Convertible Debenture of the Company in the aggregate

principal amount set forth on the signature page of this Agreement (the “Debenture”). The aggregate purchase price for the

Debenture shall be as set forth on the signature page hereto and shall be payable in United States Dollars.

(b)

Payment and Deliverables. Purchaser shall pay the purchase price for the Debenture by delivering good funds to the Company along

with a fully executed signature page to this Agreement. Such delivery of funds shall be made, assuming such subscription is accepted

by the Company, against delivery by the Company to Purchaser of an executed Debenture promptly following its acceptance of the funds.

2.

SECURITIES LAW COMPLIANCE

(a)

Exemption from Registration. Purchaser acknowledges that the Debenture is not being registered under the Securities Act of 1933,

as amended (the “1933 Act”), based, in part, on reliance that the issuance of the Debenture is exempt from registration under

the 1933 Act. Purchaser further acknowledges that the Company’s reliance on such exemption is predicated, in part, on the representations

set forth below made by Purchaser to the Company:

(i)

Purchaser is acquiring the Debenture solely for Purchaser’s own account, for investment purposes only, and not with an intent to

sell, or for resale in connection with any distribution of all or any portion of the Debenture within the meaning of the 1933 Act;

(ii)

Purchaser is an “Accredited Investor” as that term is defined in Rule 501 of the General Rules and Regulations under the

1933 Act, a summary of the relevant portions of which is attached hereto as Exhibit A;

(iii)

In evaluating the merits and risks of an investment in the Debenture, Purchaser has relied upon the advice of Purchaser’s legal

counsel, tax advisors, and/or other investment advisors;

(iv)

Purchaser is experienced in evaluating and investing in companies such as the Company. Purchaser has been given access to all information

and has received a business summary and financials of the Company, which Purchaser has requested to review and analyze in connection

with Purchaser’s purchase of the Debenture hereunder;

(v)

Purchaser is aware that an investment in securities of a closely held corporation such as the Company is non-marketable, non-transferable,

and will require Purchaser’s capital to be invested for an indefinite period of time, possibly without return. Purchaser has no

need for liquidity in this investment, and has the ability to bear the economic risk of this investment;

(vi)

Purchaser understands that the Debenture being purchased hereunder and the shares of capital stock issued upon conversion thereof (the

“Conversion Shares”) are characterized as “restricted securities” under the federal securities laws since the

Debenture and the Conversion Shares are being acquired from the Company in a transaction not involving a public offering and that under

such laws and applicable regulations such securities may be resold without registration under the 1933 Act only in certain limited circumstances.

Purchaser understands that the Company has no obligation to file a registration statement under the 1933 Act for the Debenture and the

Conversion Shares or to otherwise assist Purchaser in complying with any exemption from registration. Purchaser represents that Purchaser

is familiar with Rule 144 promulgated under the 1933 Act, as presently in effect, and understands the resale limitations imposed thereby

and by the 1933 Act; and

(vii)

No oral representation of any kind and no written representation of any kind whatsoever other than as set forth in this Agreement is

being relied on by Purchaser in connection with his decision to enter into this Agreement. Purchaser acknowledges that he was not presented

with or solicited by any form of general advertising relating to the purchase of the Debenture.

(b)

Restrictive Legends. In order to reflect the restrictions on disposition of the Debenture and the Conversion Shares, the certificates

for the Debenture and the Conversion Shares will be endorsed with restrictive legends, including the following legends:

(i)

“THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT

BE SOLD, OFFERED FOR SALE, PLEDGED, HYPOTHECATED OR OTHERWISE TRANSFERRED UNLESS THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH

ACT COVERING SUCH SECURITIES OR THE ISSUER RECEIVES AN OPINION OF COUNSEL SATISFACTORY TO IT STATING THAT SUCH SALE OR TRANSFER IS EXEMPT

FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS OF SUCH ACT.”

(ii)

Any legends required by state securities laws.

3.

MISCELLANEOUS PROVISIONS

(a)

Market Stand-Off.

(i)

In connection with any underwritten public offering by the Company of its securities pursuant to an effective registration statement

filed under the 1933 Act, Purchaser hereby agrees that Purchaser shall not sell, make any short sale of, loan, hypothecate, pledge, grant

any option for the purchase of, or otherwise dispose or transfer for value or otherwise agree to engage in any of the foregoing transactions

with respect to, any Conversion Shares held by Purchaser without the prior written consent of the Company and its underwriters. Such

limitations shall be in effect for such period of time from and after the effective date of such registration statement as may be requested

by the Company or such underwriters; provided, however, that in no event shall such period exceed one hundred eighty (180) calendar days.

(ii)

In order to enforce the limitations of this Section 3, the Company may impose stop-transfer instructions with respect to the Conversion

Shares until the end of the applicable stand-off period.

(b)

Agreement is Entire Contract. This Agreement and the Debenture constitute the entire contract between the parties hereto with

regard to the subject matter hereof.

(c)

Governing Law. This Agreement shall be governed by the laws of the State of Minnesota, and the laws of such state (other than

conflicts of laws principles) shall govern the construction, validity, enforcement, and interpretation hereof, except to the extent federal

laws otherwise govern the validity, construction, enforcement, and interpretation hereof.

(d)

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed to be an original, but all of which

together shall constitute one and the same instrument.

(e)

Successors and Assigns. The provisions of this Agreement shall inure to the benefit of, and be binding upon, the Company and its

successors and assigns and Purchaser and Purchaser’s legal representatives, heirs, legatees, distributees, assigns, and transferees

by operation of law, whether or not any such person shall have become a party to this Agreement and have agreed in writing to join herein

and be bound by the terms and conditions hereof.

[Remainder

of Page Intentionally Left Blank]

IN

WITNESS WHEREOF, Purchaser has executed this Debenture Subscription Agreement as of ______, 2023.

| |

COMPANY: |

| |

|

|

| |

PETVIVO

HOLDINGS, INC., |

| |

a

Nevada corporation |

| |

|

|

| |

By: |

|

| |

|

John

Lai |

| |

Its: |

Chief

Executive Officer |

| |

|

|

| |

Address: |

5151

Edina Industrial Blvd. |

| |

|

Suite

575 |

| |

|

Edina,

MN 55349 |

| |

|

|

| |

Date

Accepted: |

______________________ |

| |

|

|

| |

PURCHASER: |

| |

|

|

| |

|

| |

Signature: |

| |

|

|

| |

Address: |

| |

|

|

| |

Phone: |

| |

|

|

| |

Aggregate

principal amount: $ ________ |

EXHIBIT

A

“Accredited

investor” shall mean any person who comes within any of the following categories at the time of the sale of the securities to that

person:

| |

(1) |

Any

bank as defined in Section 3(a)(2) of the Securities Act of 1933 (the “1933 Act”) or any savings and loan association

or other institution as defined in Section 3(a)(5)(A) of the 1933 Act whether acting in its individual or fiduciary capacity; any

broker dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934; any insurance company as defined in Section

2(13) of the 1933 Act; any investment company registered under the Investment Company Act of 1940 or any business development company

as defined in Section 2(a)(48) of that Act; any Small Business Investment Company licensed by the U.S. Small Business Administration

under Section 301(c) or (d) of the Small Business Investment Act of 1958; any employee benefit plan within the meaning of Title I

of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section

3(21) of such Act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or

if the employee benefit plan has total assets in excess of $5,000,000, or, if a self-directed plan, with investment decisions made

solely by persons that are accredited investors; |

| |

|

|

| |

(2) |

Any

private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940; |

| |

|

|

| |

(3) |

Any

organization described in Section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or

partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000; |

| |

|

|

| |

(4) |

Any

director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive

officer, or general partner of a general partner of that issuer; |

| |

|

|

| |

(5) |

Any

natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of his purchase exceeds

one million dollars ($1,000,000); provided, however, that indebtedness secured by such person’s primary residence shall

be excluded from such person’s net-worth, up to the primary residence’s fair market value; provided, further, that

any mortgage indebtedness in excess of the primary residence value shall be considered a liability and deducted from such person’s

net worth; |

| |

|

|

| |

(6) |

Any

natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that

person’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level

in the current year; |

| |

|

|

| |

(7) |

Any

trust with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase

is directed by a sophisticated person as described in Rule 506(b)(2)(ii) promulgated under the 1933 Act; and |

| |

|

|

| |

(8) |

Any

entity in which all of the equity owners are accredited investors. |

v3.23.2

Cover

|

Jul. 27, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity File Number |

001-40715

|

| Entity Registrant Name |

PETVIVO

HOLDINGS, INC.

|

| Entity Central Index Key |

0001512922

|

| Entity Tax Identification Number |

99-0363559

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

5251

Edina Industrial Blvd.

|

| Entity Address, City or Town |

Edina

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55439

|

| City Area Code |

(952)

|

| Local Phone Number |

405-6216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.001 |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

PETV

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

PETVW

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=petv_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=petv_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

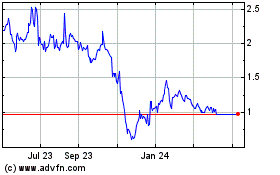

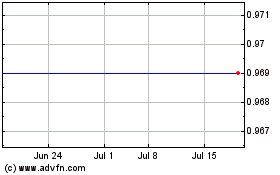

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jun 2024 to Jul 2024

PetVivo (NASDAQ:PETV)

Historical Stock Chart

From Jul 2023 to Jul 2024