Perdoceo Education Corporation (NASDAQ: PRDO) today reported

operating and financial results for the quarter and year ended

December 31, 2023.

Full Year 2023 Results

as Compared to Prior Year

- Revenue increased 2.1% to $710.0 million, supported by an 11.8%

increase at CTU.

- Operating income increased 16.1% to $150.4 million, while

adjusted operating income increased 6.7% to $174.9 million.*

- Earnings per diluted share were $2.18 as compared to $1.39,

while adjusted earnings per diluted share were $2.10 as compared to

$1.63.*

- Total student enrollments at December 31, 2023 increased 3.2%

at CTU while AIUS decreased 39.3%.

- Ended the year with $604.2 million in cash, cash equivalents,

restricted cash and available-for-sale-short-term investments.

Fourth Quarter 2023

Results as Compared to Prior Year Quarter

- Revenue decreased 16.0% to $147.9 million, primarily driven by

the enrollment reduction at AIUS.

- Operating income decreased 29.7% to $15.9 million, while

adjusted operating income decreased 40.2% to $19.4 million.*

- Earnings per diluted share were $0.26 as compared to $0.23,

while adjusted earnings per diluted share were $0.27 as compared to

$0.31.*

- On February 5, 2024 the Board of Directors declared a dividend

for the fourth quarter of $0.11 per share payable on March 15,

2024.

*See GAAP (U.S. generally accepted accounting principles)

to non-GAAP reconciliation attached to this press release

"We delivered strong results for the full year 2023, supported

by ongoing improvements in student retention and engagement across

both our academic institutions,” said Todd Nelson, President and

Chief Executive Officer. “We remain committed to making investments

in our student support teams and technology that we believe will

further enhance student retention and academic outcomes across both

our academic institutions.”

REVENUE

- For the quarter ended December 31, 2023, revenue of $147.9

million decreased 16.0% compared to revenue of $176.1 million for

the prior year quarter.

- For the year ended December 31, 2023, revenue of $710.0 million

increased 2.1% compared to revenue of $695.2 million for the prior

year.

For the Quarter Ended December

31,

For the Year Ended December

31,

Revenue ($ in

thousands)

2023

2022

% Change

2023

2022

% Change

CTU

$

104,590

$

108,446

-3.6

%

$

468,926

$

419,617

11.8

%

AIUS

43,172

67,445

-36.0

%

240,300

274,479

-12.5

%

Corporate and Other

157

254

NM

778

1,112

NM

Total

$

147,919

$

176,145

-16.0

%

$

710,004

$

695,208

2.1

%

TOTAL STUDENT ENROLLMENTS

- As of December 31, 2023, CTU’s total student enrollments

increased 3.2%, while AIUS’ total student enrollments decreased

39.3% as compared to the prior year end.

- After some necessary short-term operational changes at AIUS

that impacted year-end total student enrollments, marketing and

student enrollment operations have mostly reverted to normalized

levels of operations during the fourth quarter of 2023.

At December 31,

Total Student

Enrollments(1)

2023

2022

% Change

CTU

26,000

25,200

3.2

%

AIUS

8,500

14,000

-39.3

%

Total

34,500

39,200

-12.0

%

(1)

Total student enrollments do not include

learners pursuing: a) non-degree seeking and professional

development programs, and b) degree seeking, non-Title IV,

self-paced programs at the Company's universities.

OPERATING INCOME

- For the quarter ended December 31, 2023, operating income

decreased by 29.7% to $15.9 million as compared to the prior year

quarter.

- For the year ended December 31, 2023, operating income

increased by 16.1% to $150.4 million as compared to the prior

year.

For the Quarter Ended December

31,

For the Year Ended December

31,

Operating Income

($ in thousands)

2023

2022

% Change

2023

2022

% Change

CTU

$

25,376

$

34,082

-25.5

%

$

144,008

$

141,622

1.7

%

AIUS

600

3,469

-82.7

%

45,283

33,315

35.9

%

Corporate and Other

(10,033

)

(14,877

)

NM

(38,845

)

(45,300

)

NM

Total

$

15,943

$

22,674

-29.7

%

$

150,446

$

129,637

16.1

%

ADJUSTED OPERATING INCOME

The Company believes it is useful to present non-GAAP financial

measures, which exclude certain significant and non-cash items, as

a means to understand the performance of its operations. (See table

below and the GAAP to non-GAAP reconciliation attached to this

press release for further details.)

- For the quarter ended December 31, 2023, adjusted operating

income of $19.4 million decreased 40.2% compared to adjusted

operating income of $32.4 million for the prior year quarter.

- For the year ended December 31, 2023, adjusted operating income

of $174.9 million increased 6.7% compared to adjusted operating

income of $164.0 million for the prior year.

For the Quarter Ended December

31,

For the Year Ended December

31,

Adjusted

Operating Income ($ in thousands)

2023

2022

2023

2022

Operating income

$

15,943

$

22,674

$

150,446

$

129,637

Depreciation and amortization (1)

3,449

4,878

16,887

19,734

Legal fee expense related to certain

matters (2)

5

4,869

7,579

14,597

Adjusted Operating Income

$

19,397

$

32,421

$

174,912

$

163,968

Increase (Decrease)

-40.2

%

6.7

%

(1)

Amortization relates to definite-lived

intangible assets associated with acquisitions.

(2)

Legal fee expense associated with (i)

responses to the Department of Education (the “Department”)

relating to borrower defense to repayment applications from former

students, and (ii) acquisition efforts.

NET INCOME AND EARNINGS PER DILUTED SHARE

For the quarter ended December 31, 2023, the Company

recorded:

- Net income of $17.2 million compared to $16.0 million for the

prior year quarter.

- Earnings per diluted share of $0.26 increased 13.0% as compared

to $0.23 for the prior year quarter.

- Adjusted earnings per diluted share of $0.27 decreased 12.9% as

compared to $0.31 for the prior year quarter. (See table below and

the GAAP to non-GAAP reconciliation attached to this press release

for further details.)

For the year ended December 31, 2023, the Company recorded:

- Net income of $147.7 million compared to $95.9 million for the

prior year.

- Earnings per diluted share of $2.18 increased 56.8% as compared

to $1.39 for the prior year.

- Adjusted earnings per diluted share of $2.10 increased 28.8% as

compared to $1.63 for the prior year. (See table below and the GAAP

to non-GAAP reconciliation attached to this press release for

further details.)

For the Quarter Ended December

31,

For the Year Ended December

31,

2023

2022

2023

2022

Reported Earnings Per Diluted

Share

$

0.26

$

0.23

$

2.18

$

1.39

Pre-tax adjustments included in

operating expenses:

Amortization for acquired intangible

assets (1)

0.02

0.03

0.11

0.11

Legal fee expense related to certain

matters (2)

-

0.07

0.11

0.21

Gain on sale of intangible asset (3)

-

-

(0.32

)

-

Tax effect of adjustments (4)

(0.01

)

(0.02

)

0.02

(0.08

)

Adjusted Earnings Per Diluted

Share

$

0.27

$

0.31

$

2.10

$

1.63

(1)

Amortization relates to definite-lived

intangible assets associated with acquisitions.

(2)

Legal fee expense associated with (i)

responses to the Department relating to borrower defense to

repayment applications from former students, and (ii) acquisition

efforts.

(3)

Non-cash gain associated with the sale of

the LCB tradename in exchange for outstanding shares of Perdoceo's

stock.

(4)

The tax effect of adjustments was

calculated by multiplying the pre-tax adjustments with a tax rate

of 25.0%. This tax rate is intended to reflect federal and state

taxable jurisdictions as well as the nature of the adjustments.

DIVIDEND PAYMENT

The board of directors declared a quarterly dividend as part of

the Company’s dividend policy of $0.11 per share, which will be

paid on March 15, 2024 for holders of record of common stock as of

March 1, 2024. Any decision to pay future cash dividends, however,

will be made by the board of directors and depend on the Company’s

available retained earnings, financial condition and other relevant

factors. The Company expects quarterly dividend payments to be an

integral and growing part of its balanced capital allocation

strategy that also prioritizes investments in student support and

technology projects, while also evaluating acquisitions and share

repurchases.

STOCK REPURCHASE PROGRAM

The board of directors approved a new stock repurchase program

commencing March 1, 2024 which authorizes the Company to repurchase

up to $50.0 million of the Company’s outstanding common stock. The

program expires September 30, 2025 and replaces the existing stock

repurchase program that expires on September 30, 2024.

BALANCE SHEET AND CASH FLOW

- For the quarter ended December 31, 2023, net cash provided by

operating activities was $13.2 million, compared to net cash

provided by operating activities of $40.5 million for the prior

year quarter.

- For the year ended December 31, 2023, net cash provided by

operating activities was $112.0 million, compared to net cash

provided by operating activities of $148.2 million for the prior

year.

- As of December 31, 2023 and December 31, 2022, cash, cash

equivalents, restricted cash and available-for-sale short-term

investments totaled $604.2 million and $518.2 million,

respectively.

For the Quarter Ended December

31,

For the Year Ended December

31,

Selected Cash

Flow Items ($ in thousands)

2023

2022

% Change

2023

2022

% Change

Net cash provided by operating

activities

$

13,192

$

40,546

-67.5

%

$

112,025

$

148,186

-24.4

%

Capital expenditures

$

1,610

$

3,515

-54.2

%

$

6,411

$

12,620

-49.2

%

2024 FINANCIAL OUTLOOK

The Company is providing the following 2024 outlook, subject to

the key assumptions identified below. Please see the GAAP to

non-GAAP reconciliation for adjusted operating income and adjusted

earnings per diluted share attached to this press release for

further details.

Total Company Outlook

For Quarter Ending March

31,

For the Year Ending December

31,

OUTLOOK

ACTUAL

OUTLOOK

ACTUAL

2024

2023

2024

2023

Operating Income

$40.1M - $42.1M

$43.3M

$154.6M - $174.6M

$150.4M

Depreciation and amortization

$2.9M

$5.2M

$12.4M

$16.9M

Legal fee expense related to certain

matters (1)

-

$4.6M

$3.0M

$7.6M

Adjusted Operating Income

$43.0M - $45.0M

$53.1M

$170.0M - $190.0M

$174.9M

Earnings Per Diluted Share

$0.52 - $0.54

$0.50

$1.96 - $2.18

$2.18

Amortization of acquired intangible

assets

$0.02

$0.04

$0.07

$0.11

Legal fee expense related to certain

matters (1)

-

$0.07

$0.04

$0.11

Gain on sale of intangible asset

-

-

-

($0.32)

Tax effect of adjustments

($0.01)

($0.03)

($0.03)

$0.02

Adjusted Earnings Per Diluted

Share

$0.53 - $0.55

$0.58

$2.04 - $2.26

$2.10

(1)

Legal fee expense associated with (i)

responses to the Department relating to borrower defense to

repayment applications from former students, and (ii) acquisition

efforts.

Operating income, which is the most directly comparable GAAP

measure to adjusted operating income, and earnings per diluted

share, which is the most directly comparable GAAP measure to

adjusted earnings per diluted share, may not follow the same trends

stated in the outlook above because of adjustments made for certain

significant and non-cash items. The operating income, adjusted

operating income, earnings per share and adjusted earnings per

share outlook provided above for 2024 are based on the following

key assumptions and factors, among others: (i) prospective student

interest in the Company’s programs and trends in student retention

and engagement remain consistent with management’s recent

experiences, (ii) no significant impact of new or proposed

regulations, or new interpretations of existing regulations,

including recent Department negotiated rulemaking initiatives, FTC

enforcement activity, FCC rulemaking or other adverse changes in

the legal or regulatory environment or our institutions

participation in Title IV programs, which may require further

operational changes in the way the Company’s academic institutions

market to, contact, enroll, support and educate current and

prospective students, among other impacts, (iii) no significant

operating impacts from the settlements with the U.S. Federal Trade

Commission and state attorneys general or other legal or regulatory

matters, (iv) the impact from federal student aid initiatives

implemented by the current administration remains consistent with

management's estimates, (v) no significant impact from the further

delays by the Department to its implementation of a simplified

FAFSA required by the FAFSA Simplification Act and the related

delay of providing institutions with students' relevant aid

eligibility and award information, (vi) earnings per diluted share

outlook assumes an effective income tax rate of approximately 25.5%

for the first quarter and approximately 26% for the full year, and

(vii) excludes any future impact from the Company’s stock

repurchase program. Although these estimates and assumptions are

based upon management’s good faith beliefs regarding current and

future circumstances and actions that may be undertaken, actual

results could differ materially from these estimates. In addition,

decisions the Company makes in the future as it continues to

evaluate diverse strategies to enhance stockholder value may impact

the outlook provided above.

CONFERENCE CALL INFORMATION

Perdoceo Education Corporation will host a conference call on

Wednesday, February 21, 2024 at 5:30 p.m. Eastern time to discuss

fourth quarter and full year 2023 results and 2024 outlook.

Interested parties can access the live webcast of the conference

call at www.perdoceoed.com in the Investor Relations section of the

website. Participants can also listen to the conference call by

dialing 1-888-596-4144 (domestic) or 1-646-968-2525

(international). Both dial-in numbers will use the access code

6410615. Viewers can also access the conference call by following

this link https://events.q4inc.com/attendee/980571149. Please

log-in or dial-in at least 10 minutes prior to the start time to

ensure a connection. An archived version of the webcast will be

accessible for 90 days at www.perdoceoed.com in the Investor

Relations section of the website.

ABOUT PERDOCEO EDUCATION CORPORATION

Perdoceo’s accredited academic institutions offer a quality

postsecondary education primarily online to a diverse student

population, along with campus-based and blended learning programs.

The Company’s academic institutions – Colorado Technical University

(“CTU”) and the American InterContinental University System (“AIUS”

or “AIU System”) – provide degree programs from the associate

through doctoral level as well as non-degree seeking and

professional development programs. Perdoceo’s academic institutions

offer students industry-relevant and career-focused academic

programs that are designed to meet the educational needs of today’s

busy adults. CTU and AIUS continue to show innovation in higher

education, advancing personalized learning technologies like their

intellipath® learning platform and using data analytics and

technology to serve and educate students while enhancing overall

learning and academic experiences. Perdoceo's institutions are

committed to providing quality education that closes the gap

between learners who seek to advance their careers and employers

needing a qualified workforce. For more information, please visit

www.perdoceoed.com.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “believe,” “will,” “expect,”

“continue,” “outlook,” “remain,” “focused on,” “should” and similar

expressions, are forward-looking statements as defined in Section

21E of the Securities Exchange Act of 1934, as amended. These

statements are based on information currently available to us and

are subject to various assumptions, risks, uncertainties and other

factors that could cause our results of operations, financial

condition, cash flows, performance, business prospects and

opportunities to differ materially from those expressed in, or

implied by, these statements. Except as expressly required by the

federal securities laws, we undertake no obligation to update or

revise such factors or any of the forward-looking statements

contained herein to reflect future events, developments or changed

circumstances, or for any other reason. These risks and

uncertainties, the outcomes of which could materially and adversely

affect our financial condition and operations, include, but are not

limited to, the following: declines in enrollment or interest in

our programs or our ability to market to and contact prospective

students; our continued compliance with and eligibility to

participate in Title IV Programs under the Higher Education Act of

1965, as amended, and the regulations thereunder (including the

terms of any potential changes to or conditions imposed on our

continued participation in the Title IV programs under new program

participation agreements, the new 90-10, financial responsibility

and administrative capability standards prescribed by the U.S.

Department of Education), as well as applicable accreditation

standards and state regulatory requirements; the impact of various

versions of “borrower defense to repayment” regulations; the final

outcome of various legal challenges to the Department's loan

discharge and forgiveness efforts; rulemaking or changing

interpretations of existing regulations, guidance or historical

practices by the U.S. Department of Education or any state or

accreditor and increased focus by Congress and governmental

agencies on, or increased negative publicity about, for-profit

education institutions; the success of our initiatives to improve

student experiences, retention and academic outcomes; our continued

ability to participate in educational assistance programs for key

employers, veterans or other military personnel; our ability to pay

dividends on our common stock and execute our stock repurchase

program; increased competition; the impact of management changes;

and changes in the overall U.S. economy. Further information about

these and other relevant risks and uncertainties may be found in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023 and its subsequent filings with the Securities

and Exchange Commission.

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands)

December 31,

December 31,

2023

2022

ASSETS

CURRENT ASSETS:

Cash and cash equivalents,

unrestricted

$

118,009

$

109,408

Restricted cash

1,012

9,476

Short-term investments

485,135

399,315

Total cash and cash equivalents,

restricted cash and short-term investments

604,156

518,199

Student receivables, net

29,398

42,551

Receivables, other

4,539

3,457

Prepaid expenses

11,712

8,411

Inventories

5,004

1,904

Other current assets

155

597

Total current assets

654,964

575,119

NON-CURRENT ASSETS:

Property and equipment, net

21,371

26,038

Right of use asset, net

19,096

26,156

Goodwill

241,162

243,540

Intangible assets, net

36,219

53,564

Student receivables, net

3,859

1,850

Deferred income tax assets, net

23,804

24,613

Other assets

6,841

6,488

TOTAL ASSETS

$

1,007,316

$

957,368

LIABILITIES AND STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES:

Lease liability - operating

$

5,701

$

6,555

Accounts payable

10,766

13,518

Accrued expenses:

Payroll and related benefits

32,684

40,306

Advertising and marketing costs

7,196

8,977

Income taxes

3,974

7,814

Other

13,503

14,621

Deferred revenue

37,215

71,590

Total current liabilities

111,039

163,381

NON-CURRENT LIABILITIES:

Lease liability - operating

21,346

27,286

Other liabilities

33,510

40,856

Total non-current liabilities

54,856

68,142

STOCKHOLDERS' EQUITY:

Preferred stock

-

-

Common stock

903

894

Additional paid-in capital

694,798

684,183

Accumulated other comprehensive loss

(666

)

(5,447

)

Retained earnings

480,606

347,839

Treasury stock

(334,220

)

(301,624

)

Total stockholders' equity

841,421

725,845

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

1,007,316

$

957,368

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands, except per share

amounts and percentages)

For the Quarter Ended December

31,

2023

% of Total Revenue

2022

% of Total Revenue

REVENUE:

Tuition and fees, net

$

146,822

99.3

%

$

174,012

98.8

%

Other

1,097

0.7

%

2,133

1.2

%

Total revenue

147,919

176,145

OPERATING EXPENSES:

Educational services and facilities

30,223

20.4

%

31,217

17.7

%

General and administrative

92,756

62.7

%

114,610

65.1

%

Depreciation and amortization

3,449

2.3

%

4,878

2.8

%

Asset impairment

5,548

3.8

%

2,766

1.6

%

Total operating expenses

131,976

89.2

%

153,471

87.1

%

Operating income

15,943

10.8

%

22,674

12.9

%

OTHER INCOME:

Interest income

6,421

4.3

%

3,169

1.8

%

Interest expense

(116

)

-0.1

%

(102

)

-0.1

%

Miscellaneous income (expense)

129

0.1

%

(1,313

)

-0.7

%

Total other income

6,434

4.3

%

1,754

1.0

%

PRETAX INCOME

22,377

15.1

%

24,428

13.9

%

Provision for income taxes

5,189

3.5

%

8,473

4.8

%

NET INCOME

17,188

11.6

%

15,955

9.1

%

NET INCOME PER SHARE - BASIC:

$

0.26

$

0.24

NET INCOME PER SHARE -DILUTED:

$

0.26

$

0.23

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic

65,610

67,165

Diluted

67,185

68,423

UNAUDITED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME

For the Quarter Ended December

31,

(In Thousands)

2023

2022

NET INCOME

$

17,188

$

15,955

OTHER COMPREHENSIVE INCOME, net of

tax:

Foreign currency translation

adjustments

53

217

Unrealized gain on investments

4,280

653

Total other comprehensive income

4,333

870

COMPREHENSIVE INCOME

$

21,521

$

16,825

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per share

amounts and percentages)

For the Year Ended December

31,

2023

% of Total Revenue

2022

% of Total Revenue

REVENUE:

Tuition and fees, net

$

702,920

99.0

%

$

687,672

98.9

%

Other

7,084

1.0

%

7,536

1.1

%

Total revenue

710,004

695,208

OPERATING EXPENSES:

Educational services and facilities

130,324

18.4

%

116,723

16.8

%

General and administrative

398,084

56.1

%

426,120

61.3

%

Depreciation and amortization

16,887

2.4

%

19,734

2.8

%

Asset impairment

14,263

2.0

%

2,994

0.4

%

Total operating expenses

559,558

78.8

%

565,571

81.4

%

Operating income

150,446

21.2

%

129,637

18.6

%

OTHER INCOME:

Interest income

19,980

2.8

%

6,866

1.0

%

Interest expense

(404

)

-0.1

%

(400

)

-0.1

%

Miscellaneous income (expense)

22,099

3.1

%

(1,834

)

-0.3

%

Total other income

41,675

5.9

%

4,632

0.7

%

PRETAX INCOME

192,121

27.1

%

134,269

19.3

%

Provision for income taxes

44,469

6.3

%

38,402

5.5

%

NET INCOME

147,652

20.8

%

95,867

13.8

%

NET INCOME PER SHARE - BASIC:

$

2.22

$

1.41

NET INCOME PER SHARE -DILUTED:

$

2.18

$

1.39

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic

66,468

67,934

Diluted

67,826

69,031

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

For the Year Ended December

31,

(In Thousands)

2023

2022

NET INCOME

$

147,652

$

95,867

OTHER COMPREHENSIVE INCOME (LOSS), net

of tax:

Foreign currency translation

adjustments

45

(166

)

Unrealized gain (loss) on investments

4,736

(5,185

)

Total other comprehensive income

(loss)

4,781

(5,351

)

COMPREHENSIVE INCOME

$

152,433

$

90,516

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

For the Year Ended December

31,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net income

$

147,652

$

95,867

Adjustments to reconcile net income to net

cash provided by operating activities:

Asset impairment

14,263

2,994

Gain on sale of asset

(22,086

)

-

Depreciation and amortization expense

16,887

19,734

Bad debt expense

33,215

41,574

Compensation expense related to

share-based awards

8,078

8,751

Deferred income taxes

3,761

(720

)

Changes in operating assets and

liabilities:

Student receivables, gross

15,929

6,380

Allowance for credit losses

(38,573

)

(38,992

)

Receivables, other

(3,922

)

(1,670

)

Inventories, prepaid expenses, and other

current assets

(2,994

)

2,640

Other non-current assets

478

843

Accounts payable

(4,878

)

1,922

Accrued expenses and other non-current

liabilities

(19,235

)

22,332

Deferred revenue

(34,375

)

(11,767

)

Right of use asset and lease

liabilities

(2,175

)

(1,702

)

Net cash provided by operating

activities

112,025

148,186

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of available-for-sale

investments

(314,279

)

(492,100

)

Sales of available-for-sale

investments

238,184

262,277

Purchases of property and equipment

(6,411

)

(12,620

)

Business acquisitions, net of cash

acquired

-

(84,308

)

Earnout payment related to business

acquisition

(6,000

)

-

Net cash used in investing activities

(88,506

)

(326,751

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Purchase of treasury stock

(8,301

)

(23,117

)

Issuance of common stock

2,545

1,197

Payments of employee tax associated with

stock compensation

(2,209

)

(1,612

)

Payments of cash dividends

(14,417

)

-

Release of cash held in escrow

(1,000

)

(4,197

)

Net cash used in financing activities

(23,382

)

(27,729

)

NET INCREASE (DECREASE) IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH

137

(206,294

)

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, beginning of the period

118,884

325,178

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH, end of the period

$

119,021

$

118,884

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED SELECTED SEGMENT

INFORMATION

(In thousands, except

percentages)

For the Quarter Ended December

31,

2023 (1)

2022

REVENUE:

CTU

$

104,590

$

108,446

AIUS

43,172

67,445

Corporate and Other

157

254

Total

$

147,919

$

176,145

OPERATING INCOME (LOSS):

CTU

$

25,376

$

34,082

AIUS

600

3,469

Corporate and Other

(10,033

)

(14,877

)

Total

$

15,943

$

22,674

OPERATING MARGIN (LOSS):

CTU

24.3

%

31.4

%

AIUS

1.4

%

5.1

%

Corporate and Other

NM

NM

Total

10.8

%

12.9

%

(1)

Results of operations include an

acquisition completed on December 1, 2022 within CTU.

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED SELECTED SEGMENT

INFORMATION

(In thousands, except

percentages)

For the Year Ended December

31,

2023 (1)

2022 (1)

REVENUE:

CTU

$

468,926

$

419,617

AIUS

240,300

274,479

Corporate and Other

778

1,112

Total

$

710,004

$

695,208

OPERATING INCOME (LOSS):

CTU

$

144,008

$

141,622

AIUS

45,283

33,315

Corporate and Other

(38,845

)

(45,300

)

Total

$

150,446

$

129,637

OPERATING MARGIN (LOSS):

CTU

30.7

%

33.8

%

AIUS

18.8

%

12.1

%

Corporate and Other

NM

NM

Total

21.2

%

18.6

%

(1)

Results of operations include an

acquisition completed on December 1, 2022 within CTU and an

acquisition completed on July 1, 2022 within AIUS.

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ITEMS (1)

(In thousands, unless otherwise

noted)

For the Quarter Ended December

31,

For the Year Ended December

31,

ACTUAL

ACTUAL

Adjusted

Operating Income

2023

2022

2023

2022

Operating income

$

15,943

$

22,674

$

150,446

$

129,637

Depreciation and amortization (2)

3,449

4,878

16,887

19,734

Legal fee expense related to certain

matters (3)

5

4,869

7,579

14,597

Adjusted Operating Income

$

19,397

$

32,421

$

174,912

$

163,968

For the Quarter Ending March

31,

For the Year Ending December

31,

OUTLOOK

ACTUAL

OUTLOOK

ACTUAL

2024

2023

2024

2023

Operating income

$40.1M - $42.1M

$

43,336

$154.6M - $174.6M

$

150,446

Depreciation and amortization (2)

$2.9M

5,155

$12.4M

16,887

Legal fee expense related to certain

matters (3)

-

4,619

$3.0M

7,579

Adjusted Operating Income

$43.0M - $45.0M

$

53,110

$170.0M - $190.0M

$

174,912

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ITEMS (1) (cont’d)

For the Quarter Ended December

31,

For the Year Ended December

31,

ACTUAL

ACTUAL

2023

2022

2023

2022

Reported Earnings Per Diluted

Share

$

0.26

$

0.23

$

2.18

$

1.39

Pre-tax adjustments included in

operating expenses:

Amortization for acquired intangible

assets (2)

0.02

0.03

0.11

0.11

Legal fee expense related to certain

matters (3)

-

0.07

0.11

0.21

Gain on sale of intangible asset (4)

-

-

(0.32

)

-

Total pre-tax adjustments

$

0.02

$

0.10

$

(0.10

)

$

0.32

Tax effect of adjustments (5)

(0.01

)

(0.02

)

0.02

(0.08

)

Total adjustments after tax

0.01

0.08

(0.08

)

0.24

Adjusted Earnings Per Diluted

Share

$

0.27

$

0.31

$

2.10

$

1.63

For the Quarter Ending March

31,

For the Year Ending December

31,

OUTLOOK

ACTUAL

OUTLOOK

ACTUAL

2024

2023

2024

2023

Reported Earnings Per Diluted

Share

$0.52 - $0.54

$

0.50

$1.96 - $2.18

$

2.18

Pre-tax adjustments included in

operating expenses:

Amortization for acquired intangible

assets (2)

$0.02

0.04

$0.07

0.11

Legal fee expense related to certain

matters (3)

-

0.07

$0.04

0.11

Gain on sale of intangible asset (4)

-

-

-

(0.32

)

Total pre-tax adjustments

$0.02

$

0.11

$0.11

$

(0.10

)

Tax effect of adjustments (5)

($0.01)

(0.03

)

($0.03)

0.02

Total adjustments after tax

$0.01

0.08

$0.08

(0.08

)

Adjusted Earnings Per Diluted

Share

$0.53 - $0.55

$

0.58

$2.04 - $2.26

$

2.10

PERDOCEO EDUCATION CORPORATION

AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP ITEMS (1) (cont’d)

(1)

The Company believes it is useful to

present non-GAAP financial measures which exclude certain

significant and non-cash items as a means to understand the

performance of its operations. As a general matter, the Company

uses non-GAAP financial measures in conjunction with results

presented in accordance with GAAP to help analyze the performance

of its operations, assist with preparing the annual operating plan,

and measure performance for some forms of compensation. In

addition, the Company believes that non-GAAP financial information

is used by analysts and others in the investment community to

analyze the Company’s historical results and to provide estimates

of future performance.

The Company believes adjusted operating

income and adjusted earnings per diluted share allow it to analyze

and assess its operations and compare current operating results

with the operational performance of other companies in its industry

because it does not give effect to potential differences caused by

items it does not consider reflective of underlying operating

performance, such as amortization for acquired intangible assets,

significant legal settlements and legal fee expense related to

certain matters. The Company believes the items it is adjusting for

are not normal operating expenses reflective of its underlying

business. In evaluating adjusted operating income and adjusted

earnings per diluted share, investors should be aware that in the

future the Company may incur expenses similar to the adjustments

presented above. The presentation of adjusted operating income and

adjusted earnings per diluted share should not be construed as an

inference that the Company's future results will be unaffected by

expenses that are unusual, non-routine or non-recurring. Adjusted

operating income and adjusted earnings per diluted share have

limitations as an analytical tool, and should not be considered in

isolation, or as a substitute for net income, operating income,

earnings per diluted share, or any other performance measure

derived in accordance and reported under GAAP or as an alternative

to cash flow from operating activities or as a measure of

liquidity.

Non-GAAP financial measures, when viewed

in a reconciliation to corresponding GAAP financial measures,

provide an additional way of viewing the Company’s results of

operations and the factors and trends affecting the Company’s

business. Non-GAAP financial measures should be considered as a

supplement to, and not as a substitute for, or superior to, the

corresponding financial results presented in accordance with

GAAP.

Results of operations include the Coding

Dojo acquisition as of December 1, 2022 and the CalSouthern

acquisition as of July 1, 2022.

(2)

Amortization for acquired intangible

assets relate to definite-lived intangible assets associated with

acquisitions.

(3)

Legal fee expense associated with (i)

responses to the Department relating to borrower defense to

repayment applications from former students, and (ii) acquisition

efforts.

(4)

Non-cash gain associated with the sale of

the LCB tradename in exchange for outstanding shares of Perdoceo's

stock.

(5)

The tax effect of adjustments was

calculated by multiplying the pre-tax adjustments with a tax rate

of 25.0%. This tax rate is intended to reflect federal and state

taxable jurisdictions as well as the nature of the adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221341398/en/

Investors: Alpha IR Group Davis Snyder or Nick Nelson

(312) 445-2870 PRDO@alpha-ir.com Or Media: Perdoceo

Education Corporation (847) 585-2600 media@perdoceoed.com

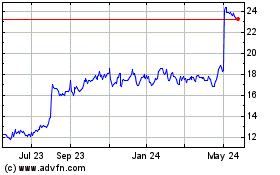

Perdoceo Education (NASDAQ:PRDO)

Historical Stock Chart

From Oct 2024 to Nov 2024

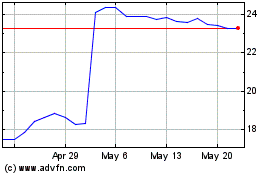

Perdoceo Education (NASDAQ:PRDO)

Historical Stock Chart

From Nov 2023 to Nov 2024