Instacart Confirms Raises IPO Pricing Target to $28-$30 a Share

September 15 2023 - 7:20AM

Dow Jones News

By Colin Kellaher

The parent of grocery-delivery app Instacart on Friday raised

the proposed price range for its planned initial public offering of

22 million shares to $28 to $30 apiece from a prior target of $26

to $28.

The Wall Street Journal reported late Thursday that the move,

which would value Instacart at nearly $10 billion on a fully

diluted basis at the high end, was coming following the successful

IPO of British chip designer Arm Holding.

Maplebear, as the Instacart parent is formally known, said in a

filing with the Securities and Exchange Commission that it would

sell 14.1 million shares in the offering, while current investors

plan to unload 7.9 million shares.

The offering, coupled with PepsiCo's planned purchase of $175

million of preferred stock, would yield net proceeds of about

$550.5 million at the $29-a-share pricing midpoint, or roughly

$640.9 million if the underwriters exercise their option to buy an

additional 3 million shares, the company said.

Maplebear has applied to list its shares on the Nasdaq Global

Select Market under the symbol CART.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 15, 2023 07:05 ET (11:05 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

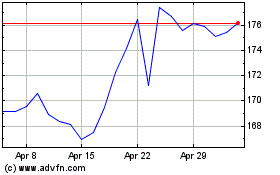

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Jun 2024 to Jul 2024

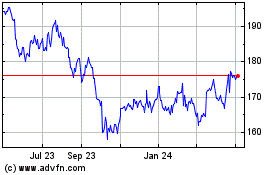

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Jul 2023 to Jul 2024