PDF Solutions, Inc. (Nasdaq: PDFS), a leading provider of

unified data and cloud analytics for the semiconductor ecosystem,

today announced financial results for its first quarter ended March

31, 2023.

Highlights of First Quarter 2023

Financial Results

- Record quarterly revenues

of $40.8 million for the first quarter of 2023, up 22% over last

year’s comparable quarter

- GAAP gross margin of 71%

and Non-GAAP gross margin of 75% for the first quarter of

2023

- GAAP diluted earnings per

share (EPS) of $0.01 and non-GAAP diluted EPS of $0.19 for the

first quarter of 2023

Total revenues for the first quarter of 2023

were $40.8 million, compared to $40.5 million for the fourth

quarter of 2022 and $33.5 million for the first quarter of 2022.

Analytics revenue for the first quarter of 2023 was $36.3 million,

compared to $36.0 million for the fourth quarter of 2022 and $30.4

million for the first quarter of 2022. Integrated Yield Ramp

revenue for the first quarter of 2023 was $4.4 million, compared to

$4.5 million for the fourth quarter of 2022 and $3.1 million for

the first quarter of 2022.

GAAP gross margin for the first quarter of 2023

was 71%, compared to 71% for the fourth quarter of 2022 and 66% for

the first quarter of 2022.

Non-GAAP gross margin for the first quarter of

2023 was 75%, compared to 74% for the fourth quarter of 2022 and

69% for the first quarter of 2022.

On a GAAP basis, net income for the first

quarter of 2023 was $0.4 million, or $0.01 per diluted share,

compared to a net income of $0.5 million, or $0.01 per diluted

share, for the fourth quarter of 2022, and net loss of $4.2

million, or ($0.11) per diluted share, for the first quarter of

2022.

Non-GAAP net income for the first quarter of

2023 was $7.3 million, or $0.19 per diluted share, compared to a

non-GAAP net income of $7.4 million, or $0.19 per diluted share,

for the fourth quarter of 2022, and non-GAAP net income of $3.7

million, or $0.09 per diluted share, for the first quarter of

2022.

Cash, cash equivalents and short-term

investments at March 31, 2023 were $133.5 million.

Financial Outlook and Recent

Accomplishments

In spite of macroenvironment headwinds and a

high revenue base from the strong performance in 2022, we expect

2023 revenue growth rate to approach mid-teens percent on a

year-over-year basis.

“Thanks to all our employees, contractors, and

customers for our continued performance. We are pleased with how we

are positioned for 2023 and look forward to serving our customers,”

said John Kibarian, CEO and President.

Conference Call

As previously announced, PDF Solutions will

discuss these results on a live conference call beginning at 2:00

p.m. Pacific Time / 5:00 p.m. Eastern Time today. To participate on

the live call, analysts and investors should pre-register at:

https://register.vevent.com/register/BId7bcb15025e048339c411669c6a1c0e1.

Registrants will receive dial-in information and a unique passcode

to access the call. We encourage participants to dial-in into the

call ten minutes ahead of scheduled time. The teleconference will

also be webcast simultaneously on the Company’s website at

https://ir.pdf.com/webcasts. A replay of the conference call

webcast will be available after the call on the Company’s investor

relations website. A copy of this press release, including the

disclosure and reconciliation of certain non-GAAP financial

measures to the comparable GAAP measures, which non-GAAP measures

may be used periodically by PDF Solutions’ management when

discussing financial results with investors and analysts, will also

be available on PDF Solutions’ website at

http://www.pdf.com/press-releases following the date of this

release.

First Quarter 2023 Financial Commentary

Available Online

A Management Report reviewing the Company’s

first quarter 2023 financial results will be furnished to the

Securities and Exchange Commission on Form 8-K and published on the

Company’s website at http://ir.pdf.com/financial-reports. Analysts

and investors are encouraged to review this commentary prior to

participating in the conference call.

Information Regarding Use of Non-GAAP Financial

Measures

In addition to providing results that are

determined in accordance with Accounting Principles Generally

Accepted in the United States of America (GAAP), PDF Solutions also

provides certain non-GAAP financial measures. Non-GAAP gross profit

and margin exclude stock-based compensation expense and the

amortization of acquired technology. Non-GAAP net income excludes

the effects of certain non-recurring items, expenses related to an

arbitration proceeding for a disputed contract with a customer,

stock-based compensation expense, amortization of acquired

technology and other acquired intangible assets, and their related

income tax effects, as applicable, as well as adjustments for the

valuation allowance for deferred tax assets. These non-GAAP

financial measures are used by management internally to measure the

Company’s profitability and performance. PDF Solutions’ management

believes that these non-GAAP measures provide useful supplemental

information to investors regarding the Company’s ongoing operations

in light of the fact that none of these categories of expense has a

current effect on the future uses of cash (with the exception of

expenses related to an arbitration proceeding for a disputed

contract with a customer and acquisition-related costs) nor do they

impact the generation of current or future revenues. These non-GAAP

results should not be considered an alternative to, or a substitute

for, GAAP financial information, and may differ from similarly

titled non-GAAP measures used by other companies. In particular,

these non-GAAP financial measures are not a substitute for GAAP

measures of income or loss as a measure of performance, or to cash

flows from operating, investing and financing activities as a

measure of liquidity. Since management uses these non-GAAP

financial measures internally to measure profitability and

performance, PDF Solutions has included these non-GAAP measures to

give investors an opportunity to see the Company’s financial

results as viewed by management. A reconciliation of the comparable

GAAP financial measures to the non-GAAP financial measures is

provided at the end of the Company’s condensed consolidated

financial statements presented below.

Forward-Looking Statements

The press release and the planned conference

call include forward-looking statements regarding the Company’s

future expected business performance and financial results,

including expectations about total revenue growth that are subject

to future events and circumstances. Actual results could differ

materially from those expressed in these forward-looking

statements. Risks and uncertainties that could cause results to

differ materially include, but are not limited to, risks associated

with: expectations about the effectiveness of our business and

technology strategies; expectations regarding recent and future

acquisitions; current semiconductor industry trends; expectations

of continued adoption of the Company’s solutions by new and

existing customers; project milestones or delays and performance

criteria achieved; cost and schedule of new product development;

the impact of global economic trends and rising inflation and

interest rates; the provision of technology and services prior to

the execution of a final contract; the continuing impact of the

coronavirus (COVID-19) on the semiconductor industry and on the

Company’s operations or supply and demand for the Company’s

products; supply chain disruptions; the success of the Company’s

strategic growth opportunities and partnerships; the Company’s

ability to successfully integrate acquired businesses and

technologies; whether the Company can successfully convert backlog

into revenue; customers’ production volumes under contracts that

provide Gainshare royalties; possible impacts from the evolving

trade regulatory environment and geopolitical tensions; our ability

to obtain additional financing if needed; and other risks set forth

in PDF Solutions’ periodic public filings with the Securities and

Exchange Commission, including, without limitation, its Annual

Report on Form 10-K for the year ended December 31, 2022, Quarterly

Reports on Form 10-Q, and Current Reports on Form 8-K and

amendments to such reports. The forward-looking statements made in

the conference call are made as of the date hereof, and PDF

Solutions does not assume any obligation to update such statements

nor the reasons why actual results could differ materially from

those projected in such statements.

About PDF Solutions

PDF Solutions (NASDAQ: PDFS) provides

comprehensive data solutions designed to empower organizations

across the semiconductor ecosystem to improve the yield and quality

of their products and operational efficiency for increased

profitability. The Company’s products and services are used by

Fortune 500 companies across the semiconductor ecosystem to achieve

smart manufacturing goals by connecting and controlling equipment,

collecting data generated during manufacturing and test operations,

and performing advanced analytics and machine learning to enable

profitable, high-volume manufacturing.

Founded in 1991, PDF Solutions is headquartered

in Santa Clara, California, with operations across North America,

Europe, and Asia. The Company (directly or through one or more

subsidiaries) is an active member of SEMI, INEMI, TPCA, IPC, the

OPC Foundation, and DMDII. For the latest news and information

about PDF Solutions or to find office locations, visit

https://www.pdf.com.

PDF Solutions and the PDF Solutions logo are

trademarks or registered trademarks of PDF Solutions, Inc. or its

subsidiaries.

PDF SOLUTIONS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS (UNAUDITED)(In

thousands)

| |

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

114,382 |

|

|

$ |

119,624 |

|

|

Short-term investments |

|

|

19,146 |

|

|

|

19,557 |

|

|

Accounts receivable, net |

|

|

47,048 |

|

|

|

42,164 |

|

|

Prepaid expenses and other current assets |

|

|

12,565 |

|

|

|

12,063 |

|

|

Total current assets |

|

|

193,141 |

|

|

|

193,408 |

|

| Property and equipment,

net |

|

|

41,723 |

|

|

|

40,174 |

|

| Operating lease right-of-use

assets, net |

|

|

5,712 |

|

|

|

6,002 |

|

| Goodwill |

|

|

14,123 |

|

|

|

14,123 |

|

| Intangible assets, net |

|

|

17,177 |

|

|

|

18,055 |

|

| Deferred tax assets, net |

|

|

90 |

|

|

|

64 |

|

| Other non-current assets |

|

|

7,322 |

|

|

|

6,845 |

|

|

Total assets |

|

$ |

279,288 |

|

|

$ |

278,671 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

6,289 |

|

|

$ |

6,388 |

|

|

Accrued compensation and related benefits |

|

|

13,869 |

|

|

|

16,948 |

|

|

Accrued and other current liabilities |

|

|

5,868 |

|

|

|

5,581 |

|

|

Operating lease liabilities ‒ current portion |

|

|

1,572 |

|

|

|

1,412 |

|

|

Deferred revenues ‒ current portion |

|

|

26,322 |

|

|

|

26,019 |

|

|

Billings in excess of recognized revenues |

|

|

342 |

|

|

|

1,852 |

|

|

Total current liabilities |

|

|

54,262 |

|

|

|

58,200 |

|

| Long-term income taxes

payable |

|

|

2,637 |

|

|

|

2,622 |

|

| Non-current operating lease

liabilities |

|

|

5,597 |

|

|

|

5,932 |

|

| Other non-current

liabilities |

|

|

3,367 |

|

|

|

1,905 |

|

|

Total liabilities |

|

|

65,863 |

|

|

|

68,659 |

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Common stock and additional

paid-in-capital |

|

|

454,313 |

|

|

|

447,421 |

|

| Treasury stock at cost |

|

|

(137,810 |

) |

|

|

(133,709 |

) |

| Accumulated deficit |

|

|

(100,795 |

) |

|

|

(101,150 |

) |

| Accumulated other

comprehensive loss |

|

|

(2,283 |

) |

|

|

(2,550 |

) |

|

Total stockholders’ equity |

|

|

213,425 |

|

|

|

210,012 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

279,288 |

|

|

$ |

278,671 |

|

PDF SOLUTIONS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)(In thousands, except per share

amounts)

| |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

March 31, |

|

December 31, |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

Analytics |

|

$ |

36,326 |

|

|

$ |

36,058 |

|

$ |

30,426 |

|

|

Integrated yield ramp |

|

|

4,433 |

|

|

|

4,465 |

|

|

3,072 |

|

|

Total revenues |

|

|

40,759 |

|

|

|

40,523 |

|

|

33,498 |

|

| |

|

|

|

|

|

|

|

|

|

| Costs and Expenses: |

|

|

|

|

|

|

|

|

|

|

Costs of revenues |

|

|

11,904 |

|

|

|

11,791 |

|

|

11,529 |

|

|

Research and development |

|

|

13,051 |

|

|

|

14,360 |

|

|

14,089 |

|

|

Selling, general, and administrative |

|

|

15,645 |

|

|

|

12,724 |

|

|

10,839 |

|

|

Amortization of acquired intangible assets |

|

|

325 |

|

|

|

324 |

|

|

314 |

|

|

Interest and other expense (income), net |

|

|

(911 |

) |

|

|

250 |

|

|

(310 |

) |

| Income (loss) before income tax

expense |

|

|

745 |

|

|

|

1,074 |

|

|

(2,963 |

) |

| Income tax expense |

|

|

390 |

|

|

|

591 |

|

|

1,187 |

|

| Net income (loss) |

|

$ |

355 |

|

|

$ |

483 |

|

$ |

(4,150 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

$ |

(0.11 |

) |

| Diluted |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

| Weighted average common shares

used to calculate net income (loss) per share: |

|

|

|

|

|

|

|

|

|

| Basic |

|

|

37,737 |

|

|

|

37,379 |

|

|

37,606 |

|

| Diluted |

|

|

38,859 |

|

|

|

38,276 |

|

|

37,606 |

|

PDF SOLUTIONS, INC.RECONCILIATION OF

GAAP GROSS MARGIN TO NON-GAAP GROSS MARGIN

(UNAUDITED)(In thousands)

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

March 31, |

|

December 31, |

|

March 31, |

|

| |

|

2023 |

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP |

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

40,759 |

|

$ |

40,523 |

|

$ |

33,498 |

|

| Costs of revenues |

|

|

11,904 |

|

|

11,791 |

|

|

11,529 |

|

| GAAP gross profit |

|

$ |

28,855 |

|

$ |

28,732 |

|

$ |

21,969 |

|

| GAAP gross margin |

|

|

71 |

% |

|

71 |

% |

|

66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

28,855 |

|

$ |

28,732 |

|

$ |

21,969 |

|

| Adjustments to reconcile GAAP

to non-GAAP gross margin: |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

964 |

|

|

737 |

|

|

728 |

|

|

Amortization of acquired technology |

|

|

553 |

|

|

553 |

|

|

553 |

|

| Non-GAAP gross profit |

|

$ |

30,372 |

|

$ |

30,022 |

|

$ |

23,250 |

|

| Non-GAAP gross margin |

|

|

75 |

% |

|

74 |

% |

|

69 |

% |

PDF SOLUTIONS, INC.RECONCILIATION OF

GAAP NET INCOME (LOSS) TO NON-GAAP NET INCOME

(UNAUDITED)(In thousands, except per share

amounts)

| |

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

| |

|

March 31, |

|

December 31, |

|

March 31, |

| |

|

2023 |

|

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

| GAAP net income (loss) |

|

$ |

355 |

|

|

$ |

483 |

|

$ |

(4,150 |

) |

| Adjustments to reconcile GAAP

net income (loss) to non-GAAP net income: |

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

4,884 |

|

|

|

5,088 |

|

|

5,553 |

|

|

Amortization of acquired technology under costs of revenues |

|

|

553 |

|

|

|

553 |

|

|

553 |

|

|

Amortization of other acquired intangible assets |

|

|

325 |

|

|

|

324 |

|

|

314 |

|

|

Expenses of arbitration (1) |

|

|

2,133 |

|

|

|

852 |

|

|

451 |

|

|

Tax impact of valuation allowance for deferred tax assets and

reconciling items (2) |

|

|

(980 |

) |

|

|

98 |

|

|

937 |

|

| Non-GAAP net income |

|

$ |

7,270 |

|

|

$ |

7,398 |

|

$ |

3,658 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP net income (loss) per

diluted share |

|

$ |

0.01 |

|

|

$ |

0.01 |

|

$ |

(0.11 |

) |

| Non-GAAP net income per

diluted share |

|

$ |

0.19 |

|

|

$ |

0.19 |

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average common shares

used in GAAP net income (loss) per diluted share calculation |

|

|

38,859 |

|

|

|

38,276 |

|

|

38,580 |

|

| Weighted average common shares

used in non-GAAP net income per diluted share calculation |

|

|

38,859 |

|

|

|

38,276 |

|

|

38,580 |

|

(1) Represents expenses related to an

arbitration proceeding over a disputed customer contract, which

expenses are expected to continue until the arbitration is

resolved.

(2) The difference between the

GAAP and non-GAAP income tax provisions is primarily due to the

valuation allowance on a GAAP basis and non-GAAP adjustments. For

example, on a GAAP basis, the Company does not receive a deferred

tax benefit for foreign tax credits or R&D credits after

valuation allowance. The Company’s non-GAAP tax rate and resulting

non-GAAP tax expense is not calculated with a full U.S. federal or

state valuation allowance due to the Company’s cumulative non-GAAP

income and management’s conclusion that it is more likely than not

to utilize its net deferred tax assets (DTAs). Each reporting

period, management evaluates the need for a valuation allowance and

may place a valuation allowance against its U.S. net DTAs on a

non-GAAP basis if it concludes it is more likely than not that it

will not be able to utilize some or all of its US DTAs on a

non-GAAP basis.

| |

|

|

|

Company Contacts: |

|

|

|

Adnan Raza |

|

Sonia Segovia |

|

Chief Financial Officer |

|

Investor Relations |

|

Tel: (408) 516-0237 |

|

Tel: (408) 938-6491 |

|

Email: adnan.raza@pdf.com |

|

Email: sonia.segovia@pdf.com |

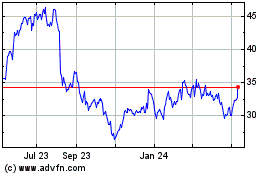

PDF Solutions (NASDAQ:PDFS)

Historical Stock Chart

From Jan 2025 to Feb 2025

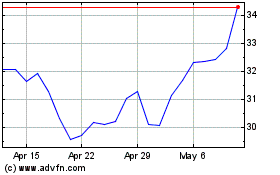

PDF Solutions (NASDAQ:PDFS)

Historical Stock Chart

From Feb 2024 to Feb 2025