As filed with the Securities and Exchange Commission on October 25, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Organovo Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

2836 |

27-1488943 |

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Classification Code Number) |

(I.R.S. Employer

Identification Number) |

11555 Sorrento Valley Road, Suite 100

San Diego, CA 92121

(858) 224-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Keith Murphy

Executive Chairman

Organovo Holdings, Inc.

11555 Sorrento Valley Road, Suite 100

San Diego, CA 92121

(858) 224-1000

(Name, address including zip code, and telephone number, including area code, of agent for service)

With copies to:

Jeffrey T. Hartlin, Esq. M. Ali Panjwani, Esq.

Samantha H. Eldredge, Esq. Pryor Cashman LLP

Paul Hastings LLP 7 Times Square

1117 S. California Avenue New York, NY 10036

Palo Alto, CA 94304 (212) 421-4100

(650) 320-1800

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 25, 2024

PRELIMINARY PROSPECTUS

Up to [_____] Shares of Common Stock

Pre-Funded Warrants to Purchase up to [_____] Shares of Common Stock

Common Warrants to Purchase up to [______] Shares of Common Stock

Up to [_____] Shares of Common Stock Underlying the Pre-Funded Warrants and Common Warrants

We are offering up to [_____] shares of common stock together with common warrants to purchase up to [_____] shares of common stock, based on assumed public offering price for each share of common stock and accompanying common warrant of $[_____], the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024. Each share of common stock, or pre-funded warrant in lieu thereof, is being sold together with a common warrant to purchase one share of common stock. The shares of common stock, or pre-funded warrants in lieu thereof, and common warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. Each common warrant will have an exercise price of $[_____], will be immediately exercisable and will expire on the fifth anniversary of the original issuance date.

We are also offering to certain purchasers, if any, whose purchase of shares of common stock in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The public offering price of each pre-funded warrant to purchase one share of common stock and accompanying common warrant to purchase one share of common stock will be equal to the price at which one share of common stock and accompanying common warrant to purchase one share of common stock is sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis.

There is no established public trading market for the common warrants or pre-funded warrants and we do not expect a market to develop. Without an active trading market, the liquidity of the common warrants and pre-funded warrants will be limited. In addition, we do not intend to list the common warrants or pre-funded warrants on the Nasdaq Capital Market, any other national securities exchange or any other trading system.

We have engaged Roth Capital Partners, LLC (the “placement agent”) to act as our lead placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum number of securities or minimum aggregate amount of proceeds that is a condition for this offering to close. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund if we do not sell all of the securities offered hereby. Because there is no escrow account and no minimum number of securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus. We will bear all costs associated with the offering. See “Plan of Distribution” on page 31 of this prospectus for more information regarding these arrangements. This offering will end no later than [_____], 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date.

Our shares of common stock are listed on the Nasdaq Capital Market under the symbol “ONVO.” On [_____], 2024, the last reported sale price of our common stock was $[_____]. The public offering price per share of common stock and per pre-funded warrant, each together with the accompanying common warrant, will be determined between us and the investors based on market conditions at the time of pricing, and may be at a discount to the then current market price of our common stock. The recent market price used throughout this prospectus may not be indicative of the actual offering price. The actual public offering price may be based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information By Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of this prospectus and under similar headings in documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share and Common Warrant |

|

|

Per Pre-Funded Warrant and Common Warrant |

|

|

Total |

|

Public offering price |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

Placement agent fees(1) |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

Proceeds, before expenses, to us(2) |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

(1)Represents a cash fee equal to 7.0% of the aggregate purchase price paid by investors in this offering, including proceeds received from the exercise of pre-funded warrants and common warrants offered hereby. We have also agreed to reimburse the placement agent for certain of its offering-related expenses. See “Plan of Distribution” beginning on page 31 of this prospectus for a description of the compensation to be received by the placement agent.

(2)Does not include proceeds from the exercise of the warrants and pre-funded warrants in cash, if any.

Delivery of the shares of common stock, pre-funded warrants and common warrants offered hereby is expected to be made on or about [_______], 2024, subject to the satisfaction of customary closing conditions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus is [_______], 2024

Organovo Holdings, Inc.

Table of Contents

About this Prospectus

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information other than the information that we have provided or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is at your own risk. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. You should assume that the information appearing in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our securities. Our business, financial condition and results of operations may have changed since those dates.

The information appearing in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of its respective date, regardless of the time of delivery of the respective document or of any sale of securities covered by this prospectus. You should not assume that the information contained in this prospectus, or in any free writing prospectus that we have authorized for use in connection with this offering, is accurate as of any date other than the respective dates thereof.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the U.S. Securities and Exchange Commission (the “SEC”) before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

Neither we nor the placement agent have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus and any free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any free writing prospectus applicable to that jurisdiction.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Industry publications and third-party research, surveys and studies often indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information and such information is inherently imprecise.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the sections of this prospectus titled “Risk Factors,” and “Special Note Regarding Forward-Looking Statements” “and under similar captions in the documents incorporated by reference into this prospectus, before making an investment decision. Unless otherwise indicated, all references in this prospectus to “Organovo,” the “company,” “we,” “our,” “us” or similar terms refer to Organovo Holdings, Inc. and its wholly owned subsidiaries, including Organovo, Inc. and Opal Merger Sub, Inc.

Overview

Organovo Holdings, Inc. (Nasdaq: ONVO), together with its wholly owned subsidiaries (collectively, “Organovo”, “we”, “us” and “our”), is a clinical stage biotechnology company that is focused on developing FXR314 in inflammatory bowel disease (“IBD”), including ulcerative colitis (“UC”), based on demonstration of clinical promise in three-dimensional (“3D”) human tissues as well as strong preclinical data. FXR is a mediator of gastrointestinal and liver diseases. FXR agonism has been tested in a variety of preclinical models of IBD. FXR314 is the lead compound in our established FXR program containing two clinically tested compounds (including FXR314) and over 2,000 discovery or preclinical compounds. FXR314 is a drug with safety and tolerability after daily oral dosing in Phase 1 and Phase 2 trials. Further, FXR314 has FDA clinical trial authorization for a Phase 2 trial in UC.

Our current clinical focus is in advancing FXR314 in IBD, including UC and Crohn’s disease (“CD”). We plan to start a Phase 2a clinical trial in UC in the calendar year 2025. We released Phase 2 data for FXR314 for the treatment of metabolic function-associated steatohepatitis ("MASH") in April 2024 that are supportive of ongoing development, and we believe FXR314 has a commercial opportunity in MASH, most likely in combination therapy. We are exploring the potential for combination therapies using FXR314 and currently approved mechanisms in preclinical animal studies and our IBD disease models.

Our second focus is building high fidelity, 3D tissues that recapitulate key aspects of human disease. We use our proprietary technology to build functional 3D human tissues that mimic key aspects of native human tissue composition, architecture, function and disease. We believe these attributes can enable critical complex, multicellular disease models that can be used to develop clinically effective drugs across multiple therapeutic areas.

As with the clinical development program, we are initially focusing on the intestine and have ongoing 3D tissue development efforts in human tissue models of UC and CD. We use these models to identify new molecular targets responsible for driving the disease and to explore the mechanism of action of known drugs including FXR314 and related molecules. We intend to initiate drug discovery programs around these new validated targets to identify drug candidates for partnering and/or internal clinical development.

Our current understanding of intestinal tissue models and IBD disease models leads us to believe that we can create models that provide greater insight into the biology of these diseases than are generally currently available. We are creating high fidelity disease models, leveraging our prior work including the work found in our peer-reviewed publication on bioprinted intestinal tissues (Madden et al. Bioprinted 3D Primary Human Intestinal Tissues Model Aspects of Native Physiology and ADME/Tox Functions. iScience. 2018 Apr 27;2:156-167. doi: 10.1016/j.isci.2018.03.015.) Our advances include cell type-specific compartments, prevalent intercellular tight junctions, and the formation of microvascular structures.

Using these disease models, we intend to identify and validate novel therapeutic targets. After finding therapeutic drug targets, we intend to focus on developing novel small molecule, antibody, or other therapeutic drug candidates to treat the disease, and advance these novel drug candidates towards an Investigational New Drug filing and potential future clinical trials.

We expect to broaden our work into additional therapeutic areas over time and are currently exploring specific tissues for development. In our work to identify the areas of interest, we evaluate areas that might be better served with 3D disease models than currently available models as well as the potential commercial opportunity. In line with these plans, we are building upon both our external and in house scientific expertise, which will be essential to our drug development effort.

Recent Developments

Mosaic Cell Sciences Division

In February 2024, we formed our Mosaic Cell Sciences division (“Mosaic”) to serve as a key source of certain of the primary human cells we utilize in our research and development efforts. We believe Mosaic can help us optimize our supply chain, reduce operating expenses related to cell sourcing and procurement and ensure that the cellular raw materials we use are of the highest quality and are derived from tissues that are ethically sourced in full compliance with state and federal guidelines. Mosaic provides us with qualified human cells for use in our clinical research and development programs. In addition to supplying us with primary human cells, Mosaic offers human cells for sale to life science customers, both directly and through distribution partners, which we expect to offset costs and over time become a profit center that offsets overall R&D spending by Organovo.

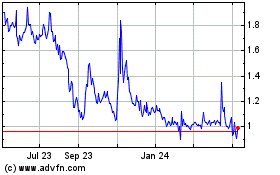

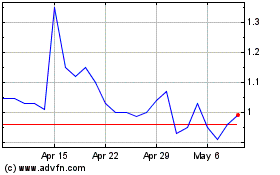

Nasdaq Minimum Bid Notice

On July 18, 2024, we received a written notice (the “Notice”) from the Listing Qualifications Staff of the Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of our common stock for the last 30 consecutive business days, we no longer meet the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have been provided with an initial period of 180 calendar days, or until January 14, 2025, to regain compliance. In order to regain compliance with the minimum bid price requirement, the closing bid price of our common stock must be at least $1 per share for a minimum of ten consecutive business days during this 180-day period. The Notice provides that the Nasdaq staff will provide written confirmation to us if we regain compliance with Rule 5550(a)(2).

If we do not regain compliance with Rule 5550(a)(2) by January 14, 2025, we may be eligible for an additional compliance period of 180 calendar days. To qualify, we would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and would need to provide written notice to Nasdaq of our intention to cure the bid price deficiency during the second compliance period. However, if it appears to the Nasdaq staff that we will not be able to cure the deficiency, or we are otherwise not eligible, Nasdaq would notify us that our securities will be subject to delisting. In the event of such a notification, we may appeal the Nasdaq staff’s determination to delist our securities, but there can be no assurance the Nasdaq staff would grant any request for continued listing.

The Notice had no immediate effect on the listing or trading of our common stock and our common stock will continue to trade on the Nasdaq Capital Market under the symbol “ONVO”. We intend to monitor the closing bid price of our common stock and consider our available options if our common stock does not trade at a level likely to result in us regaining compliance with Rule 5550(a)(2) by January 14, 2025, including effecting a reverse stock split, which would be subject to the prior approval of our stockholders.

At our 2024 annual meeting of our stockholders to be held on November 20, 2024, we are asking our stockholders to approve an amendment to our Certificate of Incorporation, as amended, to effect, in the sole discretion of our Board of Directors (our “Board”) at any time on or before November 20, 2024, a reverse split of our common stock at a ratio to be determined by the Board within a range of 1-to-5 to 1-to-20 (or any number in between).

There can be no assurance that we will be able to regain compliance with Nasdaq’s minimum bid price requirement or that we will maintain our compliance with the other listing requirements necessary for us to maintain the listing of our common stock on the Nasdaq Capital Market.

Legal Proceeding

On August 27, 2023, H.C. Wainwright & Co., LLC (“H.C. Wainwright”) filed a complaint against us in the State of New York alleging that we breached a tail financing provision included in an engagement agreement we entered into with H.C. Wainwright in May 2023. In its complaint, H.C. Wainwright is seeking compensatory and consequential damages and attorneys’ fees. On October 18, 2024, we filed an answer to the complaint. We are defending these claims vigorously, but there is no guarantee that we will be successful in these efforts.

Corporate Information

We were incorporated in Delaware under the name Organovo Holdings, Inc. in January 2012. We are operating the business of our subsidiaries, including Organovo, Inc., our wholly-owned subsidiary, which we acquired in February 2012. Organovo, Inc. was incorporated in Delaware in April 2007. Our common stock has traded on the Nasdaq Capital Market under the symbol “ONVO” since December 27, 2019. Prior to that time, it had traded on the Nasdaq Global Market under the symbol “ONVO” since August 8, 2016 and prior to that it traded on the NYSE MKT under the symbol “ONVO”.

Our principal executive offices are located at 11555 Sorrento Valley Road, Suite 100, San Diego, CA 92121, and our telephone number is (858) 224-1000. Our website address is www.organovo.com. Any information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way part of this prospectus and should not be relied upon in connection with making any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may obtain any of the documents filed by us with the SEC at no cost from the SEC’s website at http://www.sec.gov.

We are a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

The Offering

|

|

Common stock offered by us |

Up to [_____] shares of common stock assuming no sale of any pre-funded warrants to purchase shares of common stock. |

Pre-funded warrants offered by us |

Each purchaser whose purchase of shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, has the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (each pre-funded warrant to purchase one share of our common stock) in lieu of shares that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock (or, at the election of the purchaser, 9.99%). The purchase price of each pre-funded warrant will equal the price at which one share of common stock is being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant we sell, the number of shares we are offering will be decreased on a one-for-one basis. We are also registering the shares of common stock issuable upon the exercise of the pre-funded warrants. |

Common warrants offered by us |

Common warrants to purchase up to [_____] shares of common stock. Each share of common stock or pre-funded warrant to purchase one share of common stock is being sold together with a common warrant to purchase one share of common stock. Each common warrant has an exercise price of $[__] per share, will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. The exercise price is subject to customary adjustments for stock splits and similar recapitalization transactions. The shares of common stock or the pre-funded warrants, as the case may be, and the accompanying common warrants can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. See “Description of Securities We Are Offering” on page 23 for more information. |

Term of the offering |

This offering will terminate on [_____], 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. |

Common stock to be outstanding immediately after this offering |

[_____] shares, assuming no sale of pre-funded warrants, which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one basis, and further assuming no exercise of any common warrants. |

Use of proceeds |

We expect to receive net proceeds, after deducting estimated placement agent fees and estimated expenses payable by us, of approximately $[_____] million, assuming a public offering price of $[_____] per share and common warrant, the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024, after deducting commissions and estimated offering expenses payable by us, and assuming no sale of any pre-funded warrants and no exercise of common warrants. We intend to use the net proceeds from this offering for working capital and general |

|

|

|

corporate purposes, which could include capital expenditures, research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, legal expenditures, including intellectual property protection and maintenance expenditures, acquisitions of new technologies and investments, business combinations and the repurchase of capital stock. See “Use of Proceeds” on page 14 for more information. |

Risk factors |

Investing in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 9 of this prospectus and the other information included and incorporated by reference in this prospectus. |

Nasdaq Capital Market trading symbol |

Our common stock is listed on the Nasdaq Capital Market under the symbol “ONVO.” There is no established trading market for the common warrants or the pre-funded warrants, and we do not expect a trading market to develop. We do not intend to list the common warrants or pre-funded warrants on any securities exchange or other trading market. Without a trading market, the liquidity of the common warrants and pre-funded warrants will be extremely limited. |

The number of shares immediately outstanding following this offering is based on 14,373,076 shares of common stock outstanding as of June 30, 2024 and also gives effect to the issuance of 991,000 shares of common stock upon the partial exercise of a pre-funded warrant on July 31, 2024 and excludes the following as of June 30, 2024:

•835,322 shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of approximately $3.70 per share;

•121,392 shares of common stock issuable upon the vesting and settlement of outstanding restricted stock units;

•3,621,000 shares of common stock issuable upon the exercise of a pre-funded warrant, which is currently exercisable at an exercise price of $0.001, which number does not give effect to the issuance of 991,000 shares of common stock upon the partial exercise of the pre-funded warrant on July 31, 2024;

•6,562,500 shares of common stock issuable upon the exercise of warrants to purchase shares of our common stock, which are currently exercisable at an exercise price of $0.80;

•1,000 shares of common stock available for issuance pursuant to the 2021 Inducement Equity Plan;

•1,569,724 shares of common stock available for issuance pursuant to the 2022 Equity Incentive Plan; and

•45,000 shares of common stock available for issuance pursuant to the 2023 Employee Stock Purchase Plan.

Unless otherwise indicated, all information in this prospectus assumes no exercise of options under our equity incentive plans and no exercise of pre-funded warrants and common warrants.

In addition, the number of shares of our common stock outstanding immediately after this offering excludes additional shares of common stock that we may sell pursuant to a Sales Agreement that we entered into with JonesTrading Institutional Services LLC on March 16, 2018 (the “Sales Agreement”). As of the date of this prospectus, we may sell up to $1.3 million of shares of our common stock remaining available for sale by us under the Sales Agreement, provided no such sales shall be made for [___] days from the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to shelf registration statements with a value more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12 month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75 million.

Special Note Regarding Forward-Looking Statements

This prospectus and any accompanying prospectus supplement may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, about Organovo. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “projects”, “plans”, “goal”, “targets”, “potential”, “estimates”, “pro forma”, “seeks”, “intends” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future performance, operations, products and services of Organovo. We caution our stockholders and other readers not to place undue reliance on such statements.

You should read this prospectus, any accompanying prospectus supplement and the documents incorporated by reference completely and with the understanding that our actual future results may be materially different from what we currently expect. Our business and operations are and will be subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the risk factors described in the “Risk Factors” section beginning on page [•] of this prospectus.

You should assume that the information appearing in this prospectus, any accompanying prospectus supplement and any related free writing prospectus is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus are expressly qualified in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

Market, Industry and Other Data

Unless otherwise indicated, we have based the information concerning economic conditions, our industry and our market contained in this prospectus on a variety of sources, including information from third-party industry analysts and publications and our own estimates and research. This information involves a number of assumptions, estimates and limitations. The industry publications, surveys and forecasts and other public information generally indicate or suggest that their information has been obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industries in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, and are subject to change based on various factors, including those discussed in the “Risk Factors” section of this prospectus and in the other information contained in this prospectus. These and other factors could cause the information concerning our industry to differ materially from those expressed in this prospectus and incorporated by reference herein.

Dividend Policy

We have never declared or paid cash dividends on our common stock. We currently intend to retain our future earnings, if any, for use in our business and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including our financial condition, operating results, current and anticipated cash needs and plans for expansion.

RISK FACTORS

Investment in our securities involve a substantial degree of risk and should be regarded as speculative. As a result, the purchase of our securities should be considered only by persons who can reasonably afford to lose their entire investment. Before you elect to purchase our securities, you should carefully consider the risk and uncertainties described below in addition to the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024, any subsequent Quarterly Report on Form 10-Q and our other filings with the SEC, all of which are incorporated by reference herein. Additional risks and uncertainties of which we are unaware or which we currently believe are immaterial could also materially adversely affect our business, financial condition or results of operations. If any of the risks or uncertainties discussed in this prospectus occur, our business, prospects, liquidity, financial condition and results of operations could be materially and adversely affected, in which case the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks related to this Offering

We need to raise capital in this offering to support our operations. If we are unable to raise capital in this offering, our financial position will be materially adversely impacted.

We have incurred substantial losses since our inception, and we expect to continue to incur additional losses for the next several years. For the three months ended June 30, 2024, we had net losses of $3.3 million. From our inception through June 30, 2024, we had an accumulated deficit of $343.0 million. We believe that current cash on hand, prior to the receipt of any proceeds from this offering, is not sufficient to fund operations beyond January 2025. If we were to receive net proceeds of $[_____] million from this offering, we believe that the net proceeds from this offering, together with our existing cash and cash equivalents, will meet our capital needs into [_____]. If we receive the foregoing net proceeds of $[_____] million in this offering, and if we raise an additional $[_____] million in net proceeds through the sale of securities or otherwise throughout 2024, we believe that we will then meet our capital needs through the end of [_____]. In addition, the report of our independent registered public accounting firm on our financial statements for the year ended March 31, 2024 contains explanatory language that substantial doubt exists about our ability to continue as a going concern. If we do not have access to sufficient cash and liquidity to finance our business operations as currently contemplated, we would be compelled to reduce general and administrative expenses and delay research and development projects, including the purchase of scientific equipment and supplies, until we are able to obtain sufficient financing. We have no additional committed sources of capital and may find it difficult to raise money on terms favorable to us or at all. The failure to obtain sufficient capital to support our operations would have a material adverse effect on our business, financial condition and results of operations. If such sufficient financing is not received timely, we would then need to pursue a plan to license or sell assets, seek to be acquired by another entity, cease operations and/or seek bankruptcy protection.

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for [_____] days from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for [_____] days from closing; and (iv) indemnification for breach of contract.

This is a best efforts offering, no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans.

The placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth herein. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds to complete such short-term operations. Such additional fundraises may not be available or available on terms acceptable to us.

Our management has broad discretion as to the use of the net proceeds from this offering.

Our management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section titled “Use of Proceeds.” Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase the value of your investment, and the failure by our management to apply these funds effectively could harm our business. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected results, which could cause our common stock price to decline.

If you purchase securities in this offering, you will experience immediate and substantial dilution and may experience additional dilution in the future.

Investors purchasing shares of our common stock and accompanying common warrants in this offering will pay a price per share that substantially exceeds the pro forma as adjusted net tangible book value per share. As a result, investors purchasing our common stock and accompanying common warrants in this offering will incur immediate dilution of $[_____] per share, representing the difference between the assumed public offering price of $[_____] per share, which is the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024, and our as adjusted net tangible book value as of June 30, 2024. For more information on the dilution you may suffer as a result of investing in this offering, see “Dilution.”

Because there is no minimum required for the offering to close, investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus.

We have not specified a minimum offering amount nor have or will we establish an escrow account in connection with this offering. Because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds will not be returned under any circumstances whether during or after the offering.

We may issue additional equity or convertible debt securities in the future, which may result in additional dilution to you.

In order to raise additional capital, we expect to in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share and accompanying common warrant paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

Future sales of shares of our common stock in the public market, or the perception that such sales could occur, could cause our stock price to fall.

Sales of a substantial number of shares of our common stock in the public market, or the perception that these sales could occur, following this offering could cause the market price of our common stock to decline. A substantial majority of the outstanding shares of our common stock are, and the shares of common stock sold in this offering, as well as shares issuable upon exercise of common warrants or pre-funded warrants, upon issuance will be, freely tradable without restriction or further registration under the Securities Act. We may sell large quantities of our common stock at any time pursuant to one or more separate offerings in the future, including through “at the market offerings” pursuant the Sales Agreement. We cannot predict the effect that future sales of common stock or other equity-related securities would have on the market price of our common stock.

There is no public market for common warrants or the pre-funded warrants to purchase shares of our common stock being offered by us in this offering.

There is no established public trading market for the common warrants or pre-funded warrants to purchase shares of our common stock that are being offered as part of this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the common warrants or pre-funded warrants on any national securities exchange or other nationally recognized trading system, including the Nasdaq Capital Market. Without an active market, the liquidity of the common warrants and pre-funded warrants will be limited.

The common warrants and pre-funded warrants are speculative in nature.

The common warrants and pre-funded warrants do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price. Specifically, commencing on the date of issuance, holders of the common warrants may exercise their right to acquire common stock and pay an exercise price of $[__] per share, subject to certain adjustments, prior to five years from the date on which such warrants were issued, after which date any unexercised common warrants will expire and have no further value. Holders of pre-funded warrants have identical rights, except that the pre-funded warrants have an exercise price of $0.001 and do not expire until exercised in full. Moreover, following this offering, the market value of the common warrants and pre-funded warrants, if any, is uncertain and there can be no assurance that the market value of the common warrants or the pre-funded warrants will equal or exceed their imputed offering price.

Holders of the common warrants and pre-funded warrants offered hereby will have no rights as common stockholders with respect to the shares of our common stock underlying the common warrants and pre-funded warrants until such holders exercise their common warrants and pre-funded warrants and acquire our common stock, except as otherwise provided in the common warrants and pre-funded warrants.

Until holders of the common warrants and pre-funded warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the shares of our common stock underlying such warrants. Upon exercise of the common warrants and pre-funded warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Risks Related to Our Common Stock and Liquidity Risks

We could fail to maintain the listing of our common stock on the Nasdaq Capital Market, which could seriously harm the liquidity of our stock and our ability to raise capital or complete a strategic transaction.

The Nasdaq Stock Market LLC (“Nasdaq”) has established continued listing requirements, including a requirement to maintain a minimum closing bid price of at least $1 per share. If a company trades for 30 consecutive business days below such minimum closing bid price, it will receive a deficiency notice from Nasdaq. Assuming it is in compliance with the other continued listing requirements, Nasdaq would provide such company a period of 180 calendar days in which to regain compliance by maintaining a closing bid price at least $1 per share for a minimum of ten consecutive business days. There can be no assurance that we will continue to maintain compliance with the minimum bid price requirement or other listing requirements necessary for us to maintain the listing of our common stock on the Nasdaq Capital Market.

On July 18, 2024, we received a written notice (the “Notice”) from the Listing Qualifications Staff of the Nasdaq Stock Market LLC (“Nasdaq”) indicating that, based upon the closing bid price of our common stock for the last 30 consecutive business days, we no longer meet the requirement to maintain a minimum bid price of $1 per share, as set forth in Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have been provided with an initial period of 180 calendar days, or until January 14, 2025, to regain compliance. In order to regain compliance with the minimum bid price requirement, the closing bid price of our common stock must be at least $1 per share for a minimum of ten consecutive business days during this 180-day period. The Notice provides that the Nasdaq staff will provide written confirmation to us if we regain compliance with Rule 5550(a)(2).

If we do not regain compliance with Rule 5550(a)(2) by January 14, 2025, we may be eligible for an additional compliance period of 180 calendar days. To qualify, we would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and would need to provide written notice to Nasdaq of our intention to cure the bid price deficiency during the second compliance period. However, if it appears to the Nasdaq staff that we will not be able to cure the deficiency, or we are otherwise not eligible, Nasdaq would notify us that our securities will be subject to delisting. In the event of such a notification, we may appeal the Nasdaq staff’s determination to delist our securities, but there can be no assurance the Nasdaq staff would grant any request for continued listing.

The Notice had no immediate effect on the listing or trading of our common stock and our common stock will continue to trade on the Nasdaq Capital Market under the symbol “ONVO”. We intend to monitor the closing bid price of our common stock and consider our available options if our common stock does not trade at a level likely to result in us regaining compliance with Rule 5550(a)(2) by January 14, 2025, including effecting a reverse stock split, which would be subject to the prior approval of our stockholders. At our 2024 annual meeting of our stockholders to be held on November 20, 2024, we are asking our stockholders to approve an amendment to our Certificate of Incorporation, as amended, to effect, in the sole discretion of our Board of Directors (our “Board”) at any time on

or before November 20, 2024, a reverse split of our common stock at a ratio to be determined by the Board within a range of 1-to-5 to 1-to-20 (or any number in between). However, there can be no assurances that our stockholders will approve this proposal.

There can be no assurance that we will be able to regain compliance with Nasdaq’s minimum bid price requirement or that we will maintain our compliance with the other listing requirements necessary for us to maintain the listing of our common stock on the Nasdaq Capital Market.

A delisting from the Nasdaq Capital Market and commencement of trading on the Over-the-Counter Bulletin Board would likely result in a reduction in some or all of the following, each of which could have a material adverse effect on stockholders:

•the liquidity of our common stock;

•the market price of our common stock (and the accompanying valuation of our Company);

•our ability to obtain financing or complete a strategic transaction;

•the number of institutional and other investors that will consider investing in shares of our common stock;

•the number of market markers or broker-dealers for our common stock; and

•the availability of information concerning the trading prices and volume of shares of our common stock.

There is no assurance that an active market in our common stock will continue at present levels or increase in the future.

Our common stock is currently traded on the Nasdaq Capital Market, but there is no assurance that an active market in our common stock will continue at present levels or increase in the future. As a result, an investor may find it difficult to dispose of our common stock on the timeline and at the volumes they desire. This factor limits the liquidity of our common stock and may have a material adverse effect on the market price of our common stock and on our ability to raise additional capital.

Risks Related to Our Capital Requirements, Finances and Operations

We may engage in strategic transactions, including acquisitions, investments, joint development agreements or divestitures that may have an adverse effect on our business.

We may pursue transactions, including acquisitions of complementary businesses, technology licensing arrangements, strategic relationships, and joint development agreements to expand our product offerings and geographic presence as part of our business strategy, which could be material to our financial condition and results of operations. We may also consider divesting programs or other assets or out-licensing our technology. We may not complete transactions in a timely manner, on a cost-effective basis, or at all, and we may not realize the expected benefits of any acquisition, license arrangement, strategic relationship, joint development agreement or divestiture. Other companies may compete with us for these strategic opportunities. We also could experience negative effects on our results of operations and financial condition from charges related to acquisitions and investments, amortization of intangible assets and asset impairment charges, and other issues that could arise in connection with, or as a result of, acquisitions or divestitures, including issues related to internal control over financial reporting, regulatory or compliance issues and potential adverse short-term effects on results of operations through increased costs or otherwise. Acquisitions involve numerous risks, including the following:

•difficulties in finding suitable partners or acquisition candidates or purchasers for programs or assets that we may seek to divest;

•difficulties in obtaining financing on favorable terms, if at all;

•difficulties in completing transactions on favorable terms, if at all;

•the possibility that we will pay more than the value we derive from the acquisition, which could result in future non-cash impairment charges and/or a dilution of future earnings per share;

•the assumption of certain known and unknown liabilities of acquired companies;

•the incurrence of debt, contingent liabilities, or future write-offs of intangible assets or goodwill;

•difficulties in retaining key relationships with employees, customers, partners and suppliers following any transaction; and

•difficulties in operating in different business markets where we may not have historical experience.

Any of these factors could have a negative impact on our business, results of operations or financial position. Further, past and potential acquisitions entail risks, uncertainties and potential disruptions to our business, especially where we have limited experience

as a company developing or marketing a particular product or technology. Following any acquisition, we must integrate the new business, which can be expensive, time-consuming and cause disruptions to our existing operations. Failure to timely and successfully integrate acquired businesses may result in non-compliance with regulatory or other requirements and may result in unexpected costs, including as a result of inadequate cost containment and failure to fully realize expected synergies. As a result of any of the foregoing, we may not realize the expected benefit from any acquisition or investment. If we cannot integrate acquired businesses, products or technologies, our business, financial conditions and results of operations could be materially and adversely affected.

Any divestitures may result in a dilutive impact to our future earnings, as well as significant write-offs, including those related to goodwill and other intangible assets, which could have a material adverse effect on our results of operations and financial condition. Divestitures could involve additional risks, including difficulties in the separation of operations, services, products and personnel, the diversion of management’s attention from other business concerns, the disruption of our business and the potential loss of key employees. We may not be successful in managing these or any other significant risks that we encounter in divesting a product or technology.

Risks Related to Litigation

Claims, litigation, government investigations and other proceedings may adversely affect our business, operating results and financial condition.

We are, from time to time, involved in various claims, litigation matters and regulatory proceedings that could have a material adverse effect on us. These matters may include intellectual property disputes, contract disputes, employment and tax matters and other proceedings and litigation, including class action lawsuits. It is not possible to predict the outcome of pending or future litigation and any such claims, with or without merit, could be time consuming and expensive, and may require the Company to incur substantial costs and divert the resources of management.

For example, on August 27, 2023, H.C. Wainwright filed a complaint against us in the State of New York alleging that we breached a tail financing provision included in an engagement agreement we entered into with H.C. Wainwright in May 2023. In its complaint, H.C. Wainwright is seeking compensatory and consequential damages and attorneys’ fees. On October 18, 2024, we filed an answer to the complaint. We are defending these claims vigorously, but there is no guarantee that we will be successful in these efforts.

Determining legal reserves or possible losses from claims against us involves judgment and may not reflect the full range of uncertainties and unpredictable outcomes. Until the final resolution of such matters, we may be exposed to losses in excess of the amount recorded, and such excess amounts could have a material effect on our business, results of operations and financial condition. In addition, it is possible that a resolution of any claim, including as a result of a settlement, could require us to make substantial future payments or require us to change our business practices each of which could have a material adverse effect on our business, operating results and financial condition.

Use of Proceeds

We estimate that we will receive net proceeds of approximately $[_____] million, after deducting the estimated placement agent fees and estimated offering expenses payable by us (based on an assumed public offering price of $[_____] per share, which was the last reported sales price of our common stock on the Nasdaq Capital Market on [_____], 2024) and assuming no sale of any pre-funded warrants and no exercise of common warrants. However, because this is a best efforts offering and there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the placement agent’s fees and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth on the cover page of this prospectus.

We intend to use the proceeds of this offering for working capital and general corporate purposes, which could include capital expenditures, research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, legal expenditures, including intellectual property protection and maintenance expenditures, acquisitions of new technologies and investments, business combinations and the repurchase of capital stock. Pending these uses, we may invest the net proceeds in short- and intermediate-term interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the United States government.

This expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. We cannot currently allocate specific percentages of the net proceeds to us from this offering that we may use for the purposes specified above. Our management will have broad discretion in the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not result in our being profitable or increase our market value. See “Risk Factors—Risks Related to this Offering and the Ownership of Our Common Stock—Our management has broad discretion as to the use of the net proceeds from this offering.”

Capitalization

The following table sets forth our cash and cash equivalents and total capitalization as of June 30, 2024:

•a pro forma basis to reflect the issuance of 991,000 shares of common stock upon the partial exercise of a pre-funded warrant to purchase shares of common stock on July 31, 2024; and

•on a pro forma as adjusted basis, giving effect to the issuance and sale of [_____] shares of common stock and accompanying common warrants to purchase [_____] shares of common stock (excluding the shares of common stock issuable upon exercise of the common warrants being offered in this offering) in this offering at the assumed combined public offering price of $[_____] per share, which is the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024, and after deducting estimated placement agent fees and estimated offering expenses payable by us and assuming no sale of any pre-funded warrants in this offering and no exercise of any common warrants.

The as adjusted information below is illustrative only, and our capitalization following the closing of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

You should read this information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical financial statements and related notes in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and our Quarterly Report on Form 10-Q for the period ended June 30, 2024, incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

Actual (unaudited) |

|

Pro Forma |

|

|

Pro Forma As Adjusted |

|

|

|

(In thousands, except share and per share data) |

Cash and cash equivalents |

|

$ |

6,187 |

|

$ |

6,188 |

|

|

$ |

[_____] |

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share: 200,000,000 shares authorized, 14,373,076 shares issued and outstanding as of June 30, 2024, actual; 200,000,000 shares authorized, 15,364,076 shares issued and outstanding, pro forma; 200,000,000 shares authorized, [_____] shares issued and outstanding, pro forma as adjusted |

|

|

14 |

|

|

15 |

|

|

$ |

[_____] |

Additional paid-in capital |

|

|

349,662 |

|

|

349,662 |

|

|

|

[_____] |

Accumulated deficit |

|

|

(343,013) |

|

|

(343,013) |

|

|

|

[_____] |

Treasury stock, 46 shares at cost |

|

|

(1) |

|

|

(1) |

|

|

|

[_____] |

Total stockholders’ equity |

|

|

6,662 |

|

|

6,663 |

|

|

|

[_____] |

Total capitalization |

|

$ |

6,662 |

|

$ |

6,663 |

|

|

$ |

[_____] |

The number of shares immediately outstanding following this offering is based on 14,373,076 shares of common stock outstanding as of June 30, 2024 and also gives effect to the issuance of 991,000 shares of common stock upon the partial exercise of a pre-funded warrant on July 31, 2024 and excludes the following as of June 30, 2024:

•835,322 shares of common stock issuable upon the exercise of stock options outstanding at a weighted average exercise price of approximately $3.70 per share;

•121,392 shares of common stock issuable upon the vesting and settlement of outstanding restricted stock units;

•3,621,000 shares of common stock issuable upon the exercise of a pre-funded warrant, which is currently exercisable at an exercise price of $0.001, which number does not give effect to the issuance of 991,000 shares of common stock upon the partial exercise of the pre-funded warrant on July 31, 2024;

•6,562,500 shares of common stock issuable upon the exercise of warrants to purchase shares of our common stock, which are currently exercisable at an exercise price of $0.80;

•1,000 shares of common stock available for issuance pursuant to the 2021 Inducement Equity Plan;

•1,569,724 shares of common stock available for issuance pursuant to the 2022 Equity Incentive Plan; and

•45,000 shares of common stock available for issuance pursuant to the 2023 Employee Stock Purchase Plan.

In addition, the number of shares of our common stock outstanding immediately after this offering excludes additional shares of common stock that we may sell pursuant to the Sales Agreement. As of the date of this prospectus, we may sell up to $[____] million of shares of our common stock remaining available for sale by us under the Sales Agreement, provided no such sales shall be made for [___] days from the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities pursuant to shelf registration statements with a value more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12 month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75 million.

Dilution

If you purchase our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share of common stock and accompanying common warrant to purchase one share of common stock and the net tangible book value per share of our common stock after this offering (excluding the shares of common stock issuable upon exercise of the common warrants being offering in this offering and the payment of the exercise price therefor).

As of June 30, 2024, we had net tangible book value of approximately $4.6 million, or $0.32 per share. Net tangible book value per share represents the amount of total tangible assets less total liabilities divided by the number of shares of our common stock outstanding.

Our pro forma net tangible book value as of June 30, 2024, before giving effect to this offering, was approximately $4.6 million, or $0.30 per share of our common stock. Pro forma net tangible book value, before the issuance and sale of shares of common stock and accompanying common warrants in this offering, gives effect to the issuance of 991,000 shares of common stock upon the partial exercise of a pre-funded warrant on July 31, 2024.

After giving effect to (i) the pro forma adjustments set forth above and (ii) the issuance and sale of [_____] shares of our common stock in this offering [and accompanying common warrants to purchase [_____] shares of our common stock (excluding the shares of common stock issuable upon exercise of the common warrants being offered in this offering)] at an assumed combined public offering price of $[_____] per share, the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024, assuming no sale of pre-funded warrants in this offering and no exercise of common warrants and after deducting estimated placement agent fees and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of June 30, 2024 would have been approximately $[_____] million, or approximately $[_____] per share. This amount represents an immediate increase in net tangible book value of approximately $[_____] per share to our existing stockholders and an immediate dilution in pro forma net tangible book value of approximately $[_____] per share to new investors purchasing shares of common stock in this offering.

Dilution per share to new investors is determined by subtracting pro forma as adjusted net tangible book value per share after this offering from the offering price per share paid by new investors. The pro forma as adjusted information below is based on an assumed public offering price of $[_____] per share, the last reported sale price of our common stock on the Nasdaq Capital Market on [_____], 2024, and is illustrative only, and dilution following the closing of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

The following table illustrates this dilution, assuming the holders of the common warrants do not exercise any of the common warrants:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per share |

|

|

|

|

|

$ |

[__] |

|

Net tangible book value per share as of June 30, 2024 |

|

$ |

0.32 |

|

|

|

|

|

Decrease in net tangible book value per share attributable to the issuance of 991,000 shares of common stock upon the partial exercise of a pre-funded warrant on July 31, 2024 |

|

|

(0.02) |

|

|

|

|

|

Pro forma net tangible book value per share as of June 30, 2024 |

|

|

0.30 |

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering |

|

$ |

[__] |

|

|

|

|

|

Pro forma as adjusted net tangible book value per share, after giving effect to this offering |

|

|

|

|

|

$ |

[__] |

|

Dilution per share to investors purchasing shares in this offering |

|

|

|

|

|

$ |

[__] |

|

The dilution information discussed above is illustrative only and may change based on the actual public offering price, the actual number of shares of common stock, pre-funded warrants and accompanying common warrants we offer in this offering and other terms of this offering determined at pricing.

A $0.50 increase or decrease in the assumed public offering price of $[_____] per share of common stock and accompanying common warrant to purchase one share of common stock, based on the last reported sale price for our common stock as reported on the Nasdaq Capital Market on [_____], 2024, would decrease the number of shares of our common stock and accompanying common warrants offered in this offering by approximately [_____] million shares and accompanying common warrants to purchase [_____] million shares or increase the number of shares of our common stock and accompanying common warrants offered in this offering by approximately [_____] million shares and accompanying common warrants to purchase [_____] million shares.