Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-257363

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the short form base shelf prospectus to which it relates dated August 30, 2021, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference in this prospectus supplement and the short form base shelf prospectus, as amended or supplemented, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this prospectus supplement and the short form base shelf prospectus to which it relates dated August 30, 2021, as amended or supplemented, from documents filed with securities commissions or similar authorities in Canada and with the United States Securities and Exchange Commission. Copies of the documents incorporated herein by reference may be obtained on request without charge from the secretary of Organigram Holdings Inc. at 1250-333 Bay Street, Toronto, ON, Canada, M5H 2R2, Telephone (855) 961-9420, and are also available electronically at www.sedar.com and www.sec.gov.

PROSPECTUS SUPPLEMENT

(to the Short Form Base Shelf Prospectus dated August 30, 2021)

|

NEW ISSUE

|

December 19, 2022

|

ORGANIGRAM HOLDINGS INC.

16,943,650 Common Shares

This prospectus supplement (the "Prospectus Supplement"), together with the short form base shelf prospectus to which it relates dated August 30, 2021, as amended or supplemented (the "Prospectus"), qualifies the distribution of: (i) up to 16,943,650 common shares (the "Common Shares") of Organigram Holdings Inc. (the "Corporation") issuable from time to time upon the exercise of up to 16,943,650 Warrants (as defined herein) issued by us on November 10, 2020 pursuant to the Unit Offering (as defined herein); and (ii) such indeterminate number of additional common shares that may be issuable by reason of the adjustment provisions contained in the Warrant Indenture (as defined herein). The Common Shares issuable upon exercise of Warrants are referred to herein as "Warrant Shares".

The Corporation has filed the Prospectus with the securities commissions in all of the provinces and territories of Canada, and a registration statement on Form F-10 (File No. 333-257363) (the "Registration Statement") with the United States Securities and Exchange Commission (the "SEC") under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"). The Prospectus forms part of the Registration Statement, which was principally filed with the SEC on June 24, 2021 and amended August 31, 2021. Previously, on November 10, 2020, the Corporation filed a prospectus supplement with the securities commissions in all of the provinces and territories of Canada pursuant to a short form base shelf prospectus dated November 22, 2019 (the "2019 Prospectus"), and a registration statement on Form F-10 (File No. 333-234564) (the "2019 Registration Statement") filed with the SEC under the U.S. Securities Act, relating to the offering (the "Unit Offering") by the Corporation of up to 32,500,000 units of the Corporation (collectively, the "Units", and each, a "Unit") at a price of $1.85 per Unit. Each Unit consisted of one Common Share and one-half of one Common Share purchase warrant (each whole warrant, a "Warrant"). Pursuant to the warrant indenture entered into between the Corporation and TSX Trust Company (the "Warrant Agent") on November 10, 2020 in connection with the Unit Offering (the "Warrant Indenture") each Warrant entitles the holder thereof to acquire one Warrant Share at an exercise price of $2.50 per Warrant Share, until 5:00 p.m. (Eastern Time) on November 12, 2023.

The exercise price of the Warrants was determined by negotiation between the Corporation and the underwriters for the Unit Offering. See "Plan of Distribution".

The Corporation's issued and outstanding Common Shares are listed on the Toronto Stock Exchange (the "TSX") and the Nasdaq Global Select Market (the "NASDAQ") under the symbol "OGI". On December 16, 2022, the closing prices of the Common Shares on such exchanges were $1.24 and US$0.89, respectively.

The Corporation has received approval from the TSX and the NASDAQ to list the Warrant Shares on the TSX and NASDAQ, as applicable.

Any investment in the Warrant Shares involves significant risks that should be carefully considered by prospective investors. The risks outlined in this Prospectus Supplement, the Prospectus, and in the documents incorporated by reference herein and therein, should be carefully reviewed and considered by prospective investors. See the "Risk Factors" section of this Prospectus Supplement and the Prospectus.

The Corporation is permitted, under a multi-jurisdictional disclosure system (the "MJDS") adopted by the securities regulatory authorities in Canada and the United States, to prepare the Prospectus and this Prospectus Supplement in accordance with Canadian disclosure requirements, which are different from those of the United States. Financial statements incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and may not be comparable to financial statements of United States companies. The Corporation's financial statements are subject to audit in accordance with the standards of the Public Corporation Accounting Oversight Board (United States) ("PCAOB") and its auditor is subject to both Canadian auditor independence standards and the auditor independence standards of the PCAOB and the SEC.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely because the Corporation is a corporation existing under the laws of Canada. The Corporation exists under the laws of Canada, and all of its executive offices, administrative activities and assets are located outside the United States. In addition, all of the directors and officers of the Corporation are residents of jurisdictions other than the United States and all or a substantial portion of the assets of those persons are or may be located outside the United States. See the "Enforceability of Civil Liabilities by U.S. Investors" section of this Prospectus Supplement.

THE WARRANT SHARES ISSUABLE UPON EXERCISE OF THE WARRANTS HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY NOR HAS THE SEC OR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT OR THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

You should be aware that the acquisition of the Warrant Shares described herein may have tax consequences both in the United States and in Canada. Such consequences may not be described fully in this Prospectus Supplement or the Prospectus. Investors should read the tax discussion in this Prospectus Supplement and consult their own tax advisors with respect to their particular circumstances. See "Certain Canadian Federal Income Tax Considerations", "Certain U.S. Federal Income Tax Considerations" and "Risk Factors".

The Corporation is continued under the Canada Business Corporations Act and its head office is located at 1250-333 Bay Street, Toronto, ON, Canada M5H 2R2 and its registered office is located at 35 English Drive, Moncton, NB, Canada E1E 3X3.

TABLE OF CONTENTS

(i)

IMPORTANT INFORMATION ABOUT THE PROSPECTUS

AND THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the Warrant Shares and also adds to and updates certain information contained in the Prospectus and the documents incorporated by reference herein and therein. The second part is the Prospectus, which gives more general information, some of which may not apply to the Warrant Shares. This Prospectus Supplement is deemed to be incorporated by reference in the Prospectus solely for the purpose of the offering of Warrant Shares issuable from time to time on the exercise of the Warrants.

If the description of the Warrant Shares varies between this Prospectus Supplement and the Prospectus, you should rely on the information in this Prospectus Supplement.

No representation is made in respect of information that is not included in, or specifically incorporated by reference into, the Prospectus. We have not authorized anyone to provide you with different or additional information. The information contained in this Prospectus Supplement, the Prospectus and the documents incorporated by reference herein and therein is accurate only as of the respective dates of those documents, and you should not assume otherwise.

The Prospectus also forms part of the Registration Statement that we filed with the SEC under the U.S. Securities Act utilizing the MJDS. The Registration Statement was declared effective by the SEC under the U.S. Securities Act on November 17, 2021 (SEC File No. 333-357363). This Prospectus Supplement is being filed by us with the SEC pursuant to General Instruction II.L of Form F-10. The Registration Statement incorporates the Prospectus and the Prospectus Supplement with certain modifications and deletions permitted by Form F-10. This Prospectus Supplement does not qualify the distribution of the Warrant Shares in any province or territory of Canada.

Unless the context otherwise permits, indicates or requires, all references in this Prospectus Supplement to the "Corporation", "we", "our", "us" and similar expressions are references to Organigram Holdings Inc. and the business carried on by it.

NOTE TO U.S. READERS REGARDING DIFFERENCES BETWEEN UNITED STATES AND

CANADIAN REPORTING PRACTICES

The Corporation prepares its financial statements in accordance with IFRS, as issued by the IASB, which differ from U.S. generally accepted accounting principles ("U.S. GAAP"). Accordingly, the Corporation's financial statements incorporated by references in the Prospectus Supplement, and in the documents incorporated by reference in this Prospectus Supplement, may not be comparable to financial statements of United States companies prepared in accordance with U.S. GAAP.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless otherwise noted herein and in the documents incorporated by reference, all dollar amounts refer to lawful currency of Canada. All references to "US$" or "U.S. dollars" are to the currency of the United States.

The following table sets forth, for the periods indicated, the high, low, average and period-end indicative rates of exchange for one U.S. dollar expressed in Canadian dollars, each based on the daily average rate of exchange published by the Bank of Canada for conversion of U.S. dollars into Canadian dollars.

|

|

Fiscal Year Ended

|

|

August 31, 2022

|

August 31, 2021

|

|

Low

|

1.2329

|

1.2040

|

|

High

|

1.3138

|

1.3396

|

|

Average

|

1.2720

|

1.2688

|

|

End

|

1.3111

|

1.2617

|

On December 16, 2022, the daily average rate of exchange posted by the Bank of Canada for conversion of U.S. dollars into Canadian dollars was US$1.00 = $1.3687. We make no representation that U.S. dollars could be converted into Canadian dollars at that rate or any other rate.

FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and the Prospectus, including the documents incorporated by reference herein and therein, contain "forward-looking statements" or "forward-looking information" within the meaning of applicable securities legislation (collectively referred to herein as "forward-looking information" or "forward-looking statements") which are based upon the Corporation's current internal expectations, estimates, projections, assumptions and beliefs. All statements other than statements of historical fact contained in this Prospectus Supplement, the Prospectus, or in the documents incorporated by reference herein and therein, are forward-looking statements, including, without limitation, the Corporation's statements regarding the impact of COVID-19 (as defined herein), the Corporation's business and the environment in which it operates, the Corporation's development and launch of new products, the Corporation's expectations regarding its production capacity and facility size, the Corporation's expectations regarding demand for cannabis and related products. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "projects", "believes", "pro forma" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will", "occur" or "be achieved" and similar words or the negative thereof. Although management of the Corporation believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct.

The forward-looking statements in this Prospectus Supplement and the Prospectus, including the documents incorporated by reference herein and therein, are based on certain assumptions, including construction, production, cultivation and distribution activities will proceed as planned and regulatory conditions will advance in the manner expected by management, that demand for cannabis and related products will change in the manner expected by management, in each case after taking into account any impacts related to COVID-19 that are currently known or predicted by management based on the limited information available and the fluidity and uncertainty of the crisis. They are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed under the heading "Risk Factors" in this Prospectus Supplement, the Annual Information Form (as defined below) and the Annual MD&A (as defined below) and the other factors referenced in the Annual MD&A, including those relating to general economic conditions and global events including COVID-19; potential supply chain and distribution disruptions; product development, facility and technological risks; changes to government laws, regulations or policy, including environmental or tax, or the enforcement thereof; agricultural risks; and the Corporation's ability to maintain any required licenses or certifications. The Annual Information Form has also been filed with the SEC through the Electronic Data Gathering, Analysis, and Retrieval system ("EDGAR") as an exhibit to the Corporation's annual report on Form 40-F, and may be accessed on the SEC's website at www.sec.gov.

There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this Prospectus Supplement and, except as expressly required by applicable law, the Corporation assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

ADDITIONAL INFORMATION

This Prospectus Supplement and the Prospectus, including the documents incorporated by reference into this Prospectus Supplement and the Prospectus, form part of the Registration Statement that we have filed with the SEC. This Prospectus Supplement and the Prospectus, together do not contain all of the information contained in the Registration Statement, certain items of which have been omitted or are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC. See "Documents Filed as Part of the Registration Statement". Statements included or incorporated by reference in this Prospectus Supplement about the contents of any contract, agreement or other documents referred to are not necessarily complete, and in each instance, you should refer to the exhibits for a complete description of the matter involved. Each such statement is qualified in its entirety by such reference.

The Corporation's Common Shares are registered under Section 12(b) of the United States Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act"), and accordingly, we are subject to informational requirements of the U.S. Exchange Act and applicable Canadian requirements. In accordance with these informational requirements, we file reports and other information with the SEC and with securities regulatory authorities in Canada. Under the MJDS adopted by the United States and Canada, documents and other information that we file with the SEC may be prepared in accordance with the disclosure requirements of Canada, which are different from those of the United States. As a foreign private issuer, we are exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. Reports and other information filed by us with, or furnished to, the SEC may be accessed on the SEC's website at www.sec.gov. You may read and download any public document that we have filed with the securities commission or similar regulatory authority in each of the provinces and territories of Canada on the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval, or SEDAR, at www.sedar.com.

ENFORCEABILITY OF CIVIL LIABILITIES BY U.S. INVESTORS

The Corporation exists under the laws of Canada, and all of its executive offices, administrative activities and assets are located outside the United States. In addition, with the exception of Marni Wieshofer, all of the directors and officers of the Corporation are residents of jurisdictions other than the United States and all or a substantial portion of the assets of those persons are or may be located outside the United States.

As a result, investors who reside in the United States may have difficulty serving legal process in the United States upon the Corporation or its directors or officers, as applicable, or enforcing judgments obtained in United States courts against any of them or the assets of any of them located outside the United States, or enforcing against them in the appropriate Canadian court judgments obtained in United States courts, including, but not limited to, judgments predicated upon the civil liability provisions of the federal securities laws of the United States, or bringing an original action in the appropriate Canadian courts to enforce liabilities against the Corporation or any of its directors or officers, as applicable, based upon United States federal securities laws.

In the United States, the Corporation has filed with the SEC, concurrently with the filing of its Registration Statement, an appointment of agent for service of process on Form F-X. Under such Form F-X, the Corporation has appointed Corporation Service Company of 1090 Vermont Avenue N.W., Washington, DC 20005, U.S.A., as its agent for service of process in the United States in connection with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against the Corporation in a United States court arising out of or related to or concerning the Warrants and/or Warrant Shares.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference in the Prospectus solely for the purpose of the offering of Warrant Shares issuable from time to time on the exercise of the Warrants.

Information has been incorporated by reference in the Prospectus from documents filed with securities commissions or similar regulatory authorities in each of the provinces and territories of Canada, which have also been filed with, or furnished to, the SEC. Copies of these documents may be obtained on request without charge from the Corporate Secretary of the Corporation at 1250-333 Bay Street, Toronto, ON, Canada M5H 2R2, Attention: Corporate Secretary (telephone (855) 961-9420), and are also available electronically under the Corporation's SEDAR profile at www.sedar.com. Documents filed with, or furnished to, the SEC are available through EDGAR at www.sec.gov.

Except to the extent that their contents are modified or superseded by a statement contained in the Prospectus or in any other subsequently filed document that is also incorporated by reference in the Prospectus, the following documents of the Corporation filed with the securities commissions or similar regulatory authorities in each of the provinces and territories of Canada are specifically incorporated by reference into, and form an integral part of, the Prospectus:

(a) the annual information form of the Corporation for the year ended August 31, 2022, dated November 24, 2022 (the "Annual Information Form");

(b) the audited consolidated financial statements of the Corporation as of and for the years ended August 31, 2022 and 2021, and related notes thereto, (the"Annual Financial Statements"), together with the related management's report on internal control over financial reporting as of August 31, 2022, and the reports of the independent registered public accounting firm thereon;

(c) the management's discussion and analysis of financial condition and results of operations of the Corporation for the three months and year ended August 31, 2022 (the "Annual MD&A"); and

(d) the management information circular of the Corporation dated January 18, 2022 regarding the annual and special meeting of shareholders of the Corporation held on February 23, 2022;

Any documents of the type described in Item 11.1 of Form 44-101F1 - Short Form Prospectus Distributions subsequently filed by us with the securities commissions or regulatory authorities in Canada after the date of this Prospectus Supplement, and prior to the date on which the offering of Warrant Shares issuable from time to time on the exercise of the Warrants under this Prospectus Supplement ends, shall be deemed to be incorporated by reference into this Prospectus Supplement and the Prospectus.

Upon a new annual information form and annual consolidated financial statements being filed by the Corporation with the applicable Canadian securities commissions or similar regulatory authorities in Canada during the period that this Prospectus Supplement is effective, the previous annual information form, the previous annual consolidated financial statements and all interim consolidated financial statements and in each case the accompanying management's discussion and analysis, and material change reports, filed prior to the commencement of the financial year of the Corporation in which the new annual information form is filed shall be deemed to no longer be incorporated into this Prospectus Supplement for purpose of future offering of Warrant Shares issuable from time to time on the exercise of the Warrants under this Prospectus Supplement. Upon interim consolidated financial statements and the accompanying management's discussion and analysis being filed by the Corporation with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus Supplement is effective, all interim consolidated financial statements and the accompanying management's discussion and analysis filed prior to such new interim consolidated financial statements and management's discussion and analysis shall be deemed to no longer be incorporated into this Prospectus Supplement for purposes of future offering of Warrant Shares issuable from time to time on the exercise of the Warrants under this Prospectus Supplement. In addition, upon a new management information circular for an annual meeting of shareholders being filed by the Corporation with the applicable Canadian securities commissions or similar regulatory authorities during the period that this Prospectus Supplement is effective, the previous management information circular filed in respect of the prior annual meeting of shareholders shall no longer be deemed to be incorporated into this Prospectus Supplement for purposes of future offering of Warrant Shares issuable from time to time on the exercise of the Warrants under this Prospectus Supplement.

In addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement and the Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC after the date of this Prospectus Supplement, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus Supplement forms a part. In addition, the Corporation may incorporate by reference into this Prospectus Supplement, or the Registration Statement of which it forms a part, other information from documents that the Corporation will file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the U.S. Exchange Act, if and to the extent expressly provided therein.

Notwithstanding anything herein to the contrary, any statement contained in this Prospectus Supplement or the Prospectus or in a document incorporated or deemed to be incorporated by reference herein or therein shall be deemed to be modified or superseded, for the purposes of this Prospectus Supplement or the Prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or in the Prospectus modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document or statement which it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

THE CORPORATION

The Corporation was incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") on July 5, 2010 as Inform Resources Corp. and changed its name to Inform Exploration Corp. ("Inform") on February 16, 2011. On November 21, 2011, Inform completed its initial public offering and its common shares commenced trading on the TSX-Venture Exchange (the "TSX-V") on November 24, 2011. At that time, Inform was engaged in the acquisition, exploration and development of natural resource properties. Inform subsequently ceased all resource exploration activity.

In August 2014, pursuant to a reverse takeover transaction in accordance with Policy 5.2 of the TSX-V, Inform acquired all of the issued and outstanding shares of Organigram Inc. (the "RTO Transaction"). On or about the time of closing the RTO Transaction, Inform changed its name to Organigram Holdings Inc. On April 6, 2016, Organigram Holdings Inc. was continued from the BCBCA to the Canada Business Corporations Act. On February 25, 2020, the Corporation amended its articles to, among other things, clarify the rights, privileges, restrictions and conditions attaching to the Common Shares.

USE OF PROCEEDS

From time to time, when the Warrants are exercised, the Corporation may receive proceeds equal to the aggregate exercise price of such Warrants. Assuming that all of the Warrants are exercised prior to their expiry time, and that no adjustment based on the anti-dilution provisions contained in the Warrant Indenture have taken place, the gross proceeds to the Corporation from the exercise of the Warrants will be $42,359,125.

We intend to use the proceeds from the exercise of the Warrants, if any, for working capital and general corporate purposes.

The ultimate allocation of the net proceeds from exercise of the Warrants may vary depending on future developments in the Corporation's business operations or unforeseen events, including those listed under the "Risk Factors" section of this Prospectus Supplement. For example, the Corporation had negative operating cash flow for the year ended August 31, 2022. To the extent that the Corporation has negative cash flows in future periods, the Corporation may use a greater portion of its general working capital to fund such negative cash flow than it would use if it had positive cash flow. Investors are cautioned that, notwithstanding the Corporation's current intentions regarding the use of the net proceeds, there may be circumstances where a reallocation of the net proceeds may be advisable for reasons that management believes, in its discretion, are in the Corporation's best interests.

DESCRIPTION OF THE SECURITIES

Authorized Share Capital

The authorized capital of the Corporation consists of an unlimited number of Common Shares and an unlimited number of preferred shares (the "Preferred Shares"). As at the close of business on December 16, 2022, there were 313,856,912 Common Shares issued and outstanding; there are no Preferred Shares issued and outstanding.

Common Shares

The holders of the Common Shares are entitled to one vote per share at all meetings of the shareholders of the Corporation either in person or by proxy. The holders of Common Shares are also entitled to dividends, if and when declared by the directors of the Corporation and the distribution of the residual assets of the Corporation in the event of a liquidation, dissolution or winding up of the Corporation.

Dividends

As of the date of this Prospectus Supplement, the Corporation has not declared dividends and has no current intention to declare dividends on its Common Shares in the foreseeable future. Any decision to pay dividends on its Common Shares in the future will be at the discretion of the Corporation's board of directors ("Board") and will depend on, among other things, the Corporation's results of operations, current and anticipated cash requirements and surplus, financial condition, any future contractual restrictions and financing agreement covenants, solvency tests imposed by corporate law and other factors that the Board may deem relevant.

Warrants

The Warrants are governed by the Warrant Indenture entered into on November 12, 2020 between the Corporation and the Warrant Agent. The Corporation appointed the principal transfer office of the Warrant Agent in Toronto, Ontario as the location at which the Warrants may be surrendered for exercise, transfer or exchange. A register of holders is maintained at the primary offices of the warrant agent in Toronto, Ontario. Under the Warrant Indenture, the Corporation may, subject to applicable law, purchase by private contract or otherwise, any of the Warrants then outstanding, and any Warrants so purchased will be cancelled.

Each Warrant is transferable and entitles the holder thereof to acquire one Warrant Share at an exercise price of $2.50 per Warrant Share, until 5:00 p.m. (Eastern time) on November 12, 2023, subject to adjustment in certain customary events, after which time the Warrants will expire and become null and void. The Warrant Indenture provides that, subject to compliance with applicable securities legislation and approval of applicable regulatory authorities, the Corporation is entitled to purchase in the market, by private contract or otherwise, all or any of the Warrants then outstanding, and any Warrants so purchased will be cancelled.

The Warrant Indenture provides for adjustment in the number of Warrant Shares issuable upon the exercise of the Warrants and/or the exercise price per Warrant Share upon the occurrence of certain events, including:

(a) the issuance of Common Shares or securities exchangeable for or convertible into Common Shares to all or substantially all of the holders of the Common Shares by way of a stock dividend or other distribution (other than a distribution of Warrant Shares upon the exercise of any Warrants);

(b) the subdivision, redivision or change of the Common Shares into a greater number of Common Shares;

(c) the consolidation, reduction or combination of the Common Shares into a lesser number of Common Shares;

(d) the issuance to all or substantially all of the holders of the Common Shares of rights, options or warrants under which such holders are entitled, during a period expiring not more than 45 days after the record date for such issuance, to subscribe for or purchase Common Shares, or securities exchangeable for or convertible into Common Shares; and

(e) the issuance or distribution to all or substantially all of the holders of the Common Shares of (i) securities of any class, whether of the Corporation or any other trust (other than Common Shares), (ii) rights, options or warrants to subscribe for or purchase Common Shares (or other securities convertible into or exchangeable for Common Shares), other than pursuant to a "Rights Offering" (as defined in the Warrant Indenture); (iii) evidences of its indebtedness or (iv) any property or other assets.

The Warrant Indenture also provides for adjustment in the class and/or number of securities issuable upon the exercise of the Warrants and/or exercise price per security in the event of the following additional events:

reclassifications of the Common Shares or a capital reorganization of the Corporation;

(f) consolidations, amalgamations, arrangements or mergers of the Corporation with or into any other corporation or other entity; or

(g) the transfer of the undertaking or assets of the Corporation as an entirety or substantially as an entirety to another corporation or other entity.

No adjustment in the exercise price or the number of Warrant Shares issuable upon the exercise of the Warrants is required to be made unless the cumulative effect of such adjustment or adjustments would result in a change of at least 1% in the exercise price or a change in the number of Warrant Shares issuable upon exercise by at least one one-hundredth of a Warrant Share, as the case may be. Furthermore, no adjustment will be made in the right to acquire Warrant Shares if an issue of Common Shares of the Corporation is being made in connection with a share incentive plan, restricted share plan or share purchase plan for the benefit of directors, officers, employees, consultants or other service providers, or the satisfaction of existing instruments issued as of the date of the Warrant Indenture.

The Corporation has covenanted in the Warrant Indenture that, during the period in which the Warrants are exercisable, it will give notice to the Warrant Agent and to the holders of the Warrants of certain stated events, including events that would result in an adjustment to the exercise price for the Warrants or the number of Warrant Shares issuable upon exercise of the Warrants, at least 14 days prior to the record date of such event, if any.

No fractional Warrant Shares are issuable upon the exercise of any Warrants and no cash or other consideration will be paid in lieu of fractional Warrant Shares. Holders of Warrants do not have any voting or pre-emptive rights or any other rights which a holder of Common Shares would have.

The Corporation may provide certain buy-in rights to a holder if it fails to cause the Warrant Agent to deliver the Warrant Shares by three trading days after the delivery to the Corporation of the notice of exercise and the aggregate exercise price (or notice of cashless exercise). The buy-in rights apply if after the trading day after the date of such delivery by the holder, the holder purchases (in an open market transaction or otherwise) Common Shares to deliver in satisfaction of a sale by the holder of the Warrant Shares that the holder anticipated receiving from the Corporation upon exercise of the Warrant. In this event, the Corporation will: (i) pay in cash to the holder the amount equal to the excess (if any) of the buy-in price over the product of (A) such number of Warrant Shares, times (B) the price at which the sell order giving rise to holder's purchase obligation was executed; and (ii) at the election of the holder, either (A) reinstate the portion of the Warrant as to such number of Warrant Shares, or (B) deliver to the holder a certificate or certificates representing such number of Warrant Shares that would have been issued to the holder had the Corporation complied with its delivery obligations under the Warrant Indenture.

The Warrant Indenture includes certain beneficial ownership limitations under which Warrants are not exercisable to the extent that, after giving effect to the issuance of the Warrant Shares issuable upon such exercise of the Warrants, the holder, together with its affiliates and other persons acting as a group with the holder or any of its affiliates, would beneficially own in excess of 4.99% of the number of Common Shares outstanding immediately after giving effect to such issuance. Such beneficial ownership limitation may be increased or decreased by the holder upon notice to the Corporation, to a maximum of 9.99%. Except as provided in the Warrant Indenture, beneficial ownership will be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. To the extent the beneficial ownership limitations apply, the determination of whether a Warrant is exercisable and of which portion of a Warrant is exercisable shall be in the sole discretion and at the sole responsibility of the holder, and the submission of an exercise notice in respect of any Warrants shall be deemed to be the holder's determination of whether the Warrants are exercisable, and neither the warrant agent nor the Corporation will have any obligation to verify or confirm the accuracy of such determination.

The Warrant Indenture provides that the Corporation will use its reasonable best efforts to maintain the Registration Statement or another registration statement relating to the Warrant Shares effective until the earlier of the expiration date of the Warrants and the date on which no Warrants remain outstanding (provided, however, that nothing shall prevent the Corporation's amalgamation, arrangement, merger or sale, including any take-over bid, and any associated delisting or deregistration or ceasing to be a reporting issuer, provided that, so long as the Warrants are still outstanding and represent a right to acquire securities of the acquiring Corporation, the acquiring Corporation shall assume the Corporation's obligations under the Warrant Indenture). If no such registration statement is effective, no person holding Warrants will be permitted to exercise Warrants, unless an exemption or a safe harbor from the registration requirements of the U.S. Securities Act and applicable state securities laws is available. During any such period, any person holding Warrants may give notice of their desire to exercise the Warrants, at which time the Corporation will permit the cashless exercise of the Warrants and issue such number of Warrant Shares calculated pursuant to the provisions of the Warrant Indenture, provided that such Warrant Shares shall not be subject to any transfer restrictions in the United States or Canada. If no such registration statement is effective, the Corporation will notify the holders of the Warrants in accordance with the provisions of the Warrant Indenture

The Warrant Indenture provides that, from time to time, the Corporation may amend or supplement the Warrant Indenture for certain purposes, without the consent of the holders of the Warrants, including curing defects or inconsistencies or making any change that does not prejudice the rights of any holder. Any amendment or supplement to the Warrant Indenture that would prejudice the interests of the holders of Warrants may only be made by "extraordinary resolution", which is defined in the Warrant Indenture as a resolution either: (i) passed at a meeting of the holders of Warrants at which there are holders of Warrants present in person or represented by proxy representing at least 20% of the aggregate number of the then outstanding Warrants by the affirmative vote of the holders of Warrants representing not less than 662/3% of the aggregate number of Warrants represented at the meeting and voted on the poll upon such resolution; or (ii) adopted by an instrument in writing signed by the holders of Warrants representing not less than 66 2/3% of the aggregate number of all the then outstanding Warrants.

The foregoing summary of certain provisions of the Warrant Indenture does not purport to be complete and is qualified in its entirety by reference to the provisions of the Warrant Indenture in the form to be agreed upon by the parties. Reference should be made to the Warrant Indenture for the full text of attributes of the Warrants which has been filed by the Corporation under its corporate profile on SEDAR and EDGAR.

PLAN OF DISTRIBUTION

This Prospectus Supplement relates to the qualification for distribution of: (i) up to 16,943,650 Warrant Shares issuable from time to time upon exercise of up to 16,943,650 Warrants issued by us on November 12, 2020 pursuant to the Unit Offering; and (ii) such indeterminate number of additional Warrant Shares that may be issuable by reason of the anti-dilution provisions contained in the Warrant Indenture. See "Description of Securities - Warrants" for additional information on the terms of the Warrants.

On November 10, 2020, the Corporation filed a prospectus supplement with the securities commissions in all of the provinces and territories of Canada, except Québec, to the 2019 Prospectus, and filed the 2019 Registration Statement with the SEC relating to Unit Offering. Each Unit consisted of one Common Share, and one-half of a Warrant at a price of $1.85 per Unit. Each Warrant entitles the holder to acquire one Warrant Share at an exercise price of $2.50 per Warrant Share, until 5:00 p.m. (Eastern Time) on November 12, 2023. The exercise price of the Warrants was determined by negotiation between the Corporation and the underwriters for the Unit Offering.

The 2019 Prospectus has expired and the 2019 Registration Statement has ceased to be effective. Accordingly, this Prospectus Supplement supplements the Prospectus and Registration Statement, and registers the offering of the securities to which it relates under the U.S. Securities Act in accordance with MJDS. This Prospectus Supplement does not qualify the distribution of the Warrant Shares in any province or territory of Canada.

Holders of Warrants resident in the United States who acquire Warrant Shares pursuant to the exercise of Warrants in accordance with their terms and under the Prospectus and this Prospectus Supplement may have a right of action against us for any misrepresentation in the Prospectus and this Prospectus Supplement. However, the existence and enforceability of such a right of action is not without doubt.

The Warrant Shares to which this Prospectus Supplement relates will be sold directly by us to holders of Warrants, as the case may be, on the exercise of such Warrants. No underwriters, dealers or agents will be involved in these sales. No underwriter has been involved in the preparation of, or has performed any review of, this Prospectus Supplement.

It was a condition of closing of the Unit Offering that the shelf registration statement remain effective with the SEC and that we file with the SEC a prospectus supplement registering the offering of the Warrant Shares issuable from time to time on the exercise of the Warrants. No U.S. Person, person within the United States or person holding Warrants for the account or benefit of a U.S. Person or person within the United States may exercise the Warrants during any period of time when a registration statement covering such Warrant Shares is not effective or an exemption from such registration is not otherwise available. If a registration statement under the U.S. Securities Act is not effective, the Warrants may be exercised on a net cashless basis. See "See "Description of Securities - Warrants" for additional information of the terms of the Warrants.

PRIOR SALES

The following table summarizes our issuances of Common Shares and securities convertible into Common Shares during the 12 months prior to the date of this Prospectus Supplement:

| Date of Issuance |

Security Issued |

Reason for Issuance |

Number of

Securities

Issued |

Price per

Security

($) |

| December 21, 2021 |

Common Shares |

Consideration for the acquisition of Laurentian Organic Inc. |

10,896,422 |

2.53 |

| January 19, 2022 |

Common Shares |

Settlement of restricted share units |

25,143 |

4.29 |

| January 19, 2022 |

Common Shares |

Settlement of restricted share units |

13,837 |

2.15 |

| January 19, 2022 |

Common Shares |

Settlement of restricted share units |

50,000 |

4.75 |

| January 19, 2022 |

Common Shares |

Settlement of restricted share units |

63,158 |

4.75 |

| January 19, 2022 |

Common Shares |

Settlement of restricted share units |

45,732 |

6.59 |

| February 24, 2022 |

Common Shares |

Settlement of restricted share units |

4,051 |

4.29 |

| February 24, 2022 |

Common Shares |

Settlement of restricted share units |

3,309 |

2.15 |

| February 24, 2022 |

Common Shares |

Settlement of performance share units |

3,039 |

4.29 |

| February 24, 2022 |

Common Shares |

Settlement of performance share units |

4,181 |

2.15 |

| February 24, 2022 |

Common Shares |

Exercise of BT DE Investments Inc. top-up rights |

2,659,716 |

2.39 |

| March 30, 2022 |

Common Shares |

Exercise of stock options |

906 |

2.13 |

| April 14, 2022 |

Common Shares |

Settlement of performance share units |

1,133 |

4.29 |

| April 14, 2022 |

Common Shares |

Settlement of performance share units |

6,109 |

2.15 |

| April 14, 2022 |

Common Shares |

Settlement of restricted share units |

1,511 |

4.29 |

| April 14, 2022 |

Common Shares |

Settlement of restricted share units |

4,477 |

2.15 |

| April 18, 2022 |

Common Shares |

Settlement of restricted share units |

2,850 |

2.15 |

| April 18, 2022 |

Common Shares |

Settlement of performance share units |

966 |

2.15 |

| May 24, 2022 |

Restricted Share Units |

Grant under 2020 Incentive Plan |

18,430 |

1.61 |

| May 24, 2022 |

Performance Share Units |

Grant under 2020 Incentive Plan |

18,430 |

1.61 |

| May 24, 2022 |

Options |

Grant under 2020 Incentive Plan |

280,000 |

1.61 |

| July 21, 2022 |

Restricted Share Units |

Grant under 2020 Incentive Plan |

1,035,000 |

1.40 |

| July 21, 2022 |

Options |

Grant under 2020 Incentive Plan |

4,677,000 |

1.40 |

| July 22, 2022 |

Common Shares |

Settlement of restricted share units |

771 |

2.15 |

| July 22, 2022 |

Common Shares |

Settlement of performance share units |

1,735 |

2.15 |

| August 4, 2022 |

Common Shares |

Settlement of restricted share units |

1,345 |

4.29 |

| August 4, 2022 |

Common Shares |

Settlement of restricted share units |

726 |

2.15 |

| August 4, 2022 |

Common Shares |

Settlement of restricted share units |

1,829 |

6.59 |

| August 4, 2022 |

Common Shares |

Settlement of performance share units |

1,009 |

4.29 |

| August 4, 2022 |

Common Shares |

Settlement of performance share units |

1,633 |

2.15 |

| Date of Issuance |

Security Issued |

Reason for Issuance |

Number of

Securities

Issued |

Price per

Security

($) |

|

August 15, 2022

|

Common Shares

|

Settlement of restricted share units

|

3,771

|

4.29

|

|

August 15, 2022

|

Common Shares

|

Settlement of restricted share units

|

25,000

|

4.75

|

|

August 15, 2022

|

Common Shares

|

Settlement of restricted share units

|

7,088

|

6.59

|

|

August 15, 2022

|

Common Shares

|

Settlement of performance share units

|

2,829

|

4.29

|

|

August 15, 2022

|

Common Shares

|

Exercise of stock options

|

20,000

|

0.30

|

|

August 15, 2022

|

Common Shares

|

Exercise of stock options

|

40,000

|

0.58

|

|

September 29, 2022

|

Restricted Share Units

|

Grant under 2020 Incentive Plan

|

1,477,313

|

1.23

|

|

September 29, 2022

|

Performance Share Units

|

Grant under 2020 Incentive Plan

|

838,228

|

1.23

|

|

September 29, 2022

|

Options

|

Grant under 2020 Incentive Plan

|

880,000

|

1.23

|

|

September 29, 2022

|

Options

|

Grant under 2020 Incentive Plan

|

164,000

|

1.40

|

|

October 4, 2022

|

Common Shares

|

Exercise of stock options

|

10,000

|

0.40

|

|

October 4, 2022

|

Common Shares

|

Exercise of stock options

|

5,000

|

0.30

|

|

October 28, 2022

|

Common Shares

|

Settlement of restricted share units

|

12,572

|

4.29

|

|

October 28, 2022

|

Common Shares

|

Settlement of restricted share units

|

13,837

|

2.15

|

|

November 30, 2022

|

Restricted Share Units

|

Grant under 2020 Incentive Plan

|

7,926

|

1.36

|

|

November 30, 2022

|

Performance Share Units

|

Grant under 2020 Incentive Plan

|

7,926

|

1.36

|

|

November 30, 2022

|

Options

|

Grant under 2020 Incentive Plan

|

60,000

|

1.36

|

TRADING PRICES AND VOLUMES

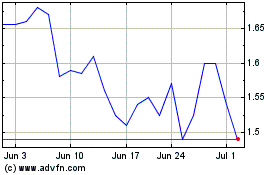

The Common Shares are listed on the TSX and the NASDAQ under the trading symbol "OGI". The following tables set forth the reported adjusted close high and low prices and monthly trading volumes of the Common Shares for the 12-month period prior to the date of this Prospectus Supplement.

|

|

Trading of Common Shares

|

Trading of Common Shares

|

|

|

TSX

|

NASDAQ

|

|

|

High

|

Low

|

Volume

|

High

|

Low

|

Volume

|

|

|

($)

|

($)

|

(#)

|

(US$)

|

(US$)

|

(#)

|

|

December 2021

|

2.69

|

2.19

|

40,496,474

|

2.13

|

1.71

|

139,115,746

|

|

January 2022

|

2.29

|

1.66

|

29,403,269

|

1.855

|

1.30

|

119,198,908

|

|

February 2022

|

2.21

|

1.69

|

26,381,293

|

1.74

|

1.30

|

84,071,766

|

|

March 2022

|

2.32

|

1.65

|

26,281,479

|

1.87

|

1.27

|

120,100,455

|

|

April 2022

|

2.29

|

1.74

|

19,339,219

|

1.82

|

1.35

|

112,695,827

|

|

May 2022

|

1.93

|

1.43

|

14,996,089

|

1.507

|

1.10

|

129,621,803

|

|

June 2022

|

1.48

|

1.17

|

10,354,813

|

1.18

|

0.91

|

47,679,999

|

|

July 2022

|

1.55

|

1.17

|

9,570,382

|

1.2

|

0.90

|

45,356,378

|

|

August 2022

|

1.63

|

1.30

|

13,572,697

|

1.27

|

1.00

|

45,861,583

|

|

September 2022

|

1.45

|

1.18

|

5,733,368

|

1.11

|

0.87

|

19,690,821

|

|

October 2022

|

1.46

|

1.17

|

8,237,676

|

1.08

|

0.84

|

23,784,021

|

|

November 2022

|

1.44

|

1.22

|

8,502,511

|

1.06

|

0.90

|

20,681,622

|

|

December 1 to December 16, 2022

|

1.71

|

1.17

|

8,214,801

|

1.27

|

0.86

|

21,757,239

|

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is, as of the date of this Prospectus Supplement, a general summary of the principal Canadian federal income tax considerations under the Income Tax Act (Canada) and the regulations thereunder (collectively, the "Tax Act") generally applicable to an investor who acquires as beneficial owner Warrant Shares upon exercise of the Warrants, and who, for the purposes of the Tax Act and at all relevant times, deals at arm's length with the Corporation, is not affiliated with the Corporation and who holds the Warrants pursuant to which their Warrant Shares are acquired, and acquires and holds the Warrant Shares as capital property (a "Holder"). Generally, the Warrants and Warrant Shares will be considered to be capital property to a Holder thereof provided that the Holder does not hold the Warrants or Warrant Shares in the course of carrying on a business of trading or dealing in securities and such Holder has not acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This summary does not apply to a Holder (i) that is a "financial institution" for the purposes of the mark-to-market rules contained in the Tax Act; (ii) that is a "specified financial institution" as defined in the Tax Act; (iii), an interest in which would be a "tax shelter investment" as defined in the Tax Act; (iv) that has made a functional currency reporting election under the Tax Act to report in a currency other than the Canadian dollar; (v) that has or will enter into a "derivative forward agreement", as that term is defined in the Tax Act, with respect to the Warrants or Warrant Shares. Such Holders should consult their own tax advisors with respect to an investment in the Warrant Shares; or (vi) that receives dividends on Warrant Shares under or as part of a "dividend rental arrangement" as defined in the Tax Act. This summary does not address (i) the deductibility of interest by a Holder who has borrowed money to acquire Warrants or Warrant Shares upon the exercise of such Warrants, (ii) the tax treatment of any payments made in connection with the buy-in rights, or (iii) the application of the "split income" rules in section 120.4 of the Tax Act.

Additional considerations, not discussed herein, may be applicable to a Holder that is a corporation resident in Canada, and that is or becomes, or does not deal at arm's length for purposes of the Tax Act with a corporation resident in Canada that is or becomes, as part of a transaction or event or series of transactions or events that includes the acquisition of the Warrant Shares, controlled by a non-resident corporation or other person, or a group of non-resident persons (including corporations) not dealing with each other at arm's length, for purposes of the "foreign affiliate dumping" rules in section 212.3 of the Tax Act. Such Holders should consult their tax advisors with respect to the consequences of acquiring Warrant Shares pursuant to the exercise of the Warrants.

This summary is based upon the current provisions of the Tax Act in force as of the date hereof and counsel's understanding of the current published administrative and assessing practices of the Canada Revenue Agency (the "CRA"). This summary takes into account all specific proposals to amend the Tax Act publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the "Tax Proposals") and assumes that the Tax Proposals will be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be enacted in their current form or at all. This summary does not otherwise take into account any changes in law or in the administrative policies or assessing practices of the CRA, whether by legislative, governmental or judicial decision or action, nor does it take into account or consider any provincial, territorial or foreign income tax considerations, which considerations may differ significantly from the Canadian federal income tax considerations discussed in this summary.

This summary is of a general nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Holder. Holders should consult their own tax advisors with respect to their particular circumstances.

Acquisition of Warrant Shares

No gain or loss will be realized by a Holder on the exercise of a Warrant to acquire a Warrant Share. When a Warrant is exercised, the Holder's cost of the Warrant Share acquired thereby will be equal to the aggregate of the Holder's adjusted cost base of such Warrant and the exercise price paid for the Warrant Share. The Holder's adjusted cost base of the Warrant Share so acquired will be determined by averaging the cost of the Warrant Share with the adjusted cost base to the Holder of all Common Shares of the Corporation held as capital property immediately before the acquisition of the Warrant Share.

Residents of Canada

The following section of this summary applies to Holders who, for the purposes of the Tax Act, are or are deemed to be resident in Canada at all relevant times ("Resident Holders"). Certain Resident Holders whose Warrant Shares might not constitute capital property may make, in certain circumstances, an irrevocable election permitted by subsection 39(4) of the Tax Act to deem Warrant Shares, and every other "Canadian security" as defined in the Tax Act, held by such persons, in the taxation year of the election and each subsequent taxation year to be capital property. This election does not apply to Warrants. Resident Holders should consult their own tax advisors regarding this election.

Dividends

Dividends received or deemed to be received on the Warrant Shares are required to be included in computing a Resident Holder's income. In the case of a Resident Holder that is an individual (other than certain trusts), such dividends will be subject to the gross-up and dividend tax credit rules normally applicable in respect of "taxable dividends" received from "taxable Canadian corporations" (each as defined in the Tax Act). An enhanced dividend tax credit will be available to individuals in respect of "eligible dividends" designated by the Corporation to the Resident Holder in accordance with the provisions of the Tax Act. A dividend will be an eligible dividend if the recipient receives written notice (which may include a notice published on the Corporation's website) from the Corporation designating the dividend as an "eligible dividend". There may be limitation on the Corporation's ability to designate dividends as "eligible dividends".

Dividends received or deemed to be received by a corporation that is a Resident Holder on the Warrant Shares are required to be included in computing its income but generally will be deductible in computing its taxable income. In certain circumstances, section 55(2) of the Tax Act will treat a taxable dividend received (or deemed to be received) by a Resident Holder that is a corporation as proceeds of dispositions or a capital gain. Resident Holders that are corporations should consult their own tax advisors having regard to their own circumstances.

A Resident Holder that is a "private corporation" (as defined in the Tax Act) or a corporation controlled, whether because of a beneficial interest in one or more trusts, or otherwise, by or for the benefit of an individual (other than a trust) or related group of individuals (other than trusts) generally will be liable to pay an additional tax (refundable in certain circumstances) under Part IV of the Tax Act on dividends received or deemed to be received on the Warrant Shares to the extent such dividends are deductible in computing the Resident Holder's taxable income for the year.

Dispositions of Warrant Shares

Upon a disposition (or a deemed disposition) of a Warrant Share, a Resident Holder generally will realize a capital gain (or a capital loss) equal to the amount, if any, by which the proceeds of disposition of such Warrant Share, net of any reasonable costs of disposition, are greater (or are less) than the adjusted cost base of such Warrant Share to the Resident Holder. The tax treatment of capital gains and capital losses is discussed in greater detail below under the subheading "Capital Gains and Capital Losses".

Capital Gains and Capital Losses

Generally, a Resident Holder is required to include in computing its income for a taxation year one-half of the amount of any capital gain (a "taxable capital gain") realized in the year. Subject to and in accordance with the provisions of the Tax Act, a Resident Holder is required to deduct one-half of the amount of any capital loss (an "allowable capital loss") realized in a taxation year from taxable capital gains realized in the year by such Resident Holder. Allowable capital losses in excess of taxable capital gains may be carried back and deducted in any of the three preceding taxation years or carried forward and deducted in any following taxation year against net taxable capital gains realized in such year to the extent and under the circumstances described in the Tax Act.

The amount of any capital loss realized on the disposition or deemed disposition of Warrant Shares by a Resident Holder that is a corporation may be reduced by the amount of dividends received or deemed to have been received by it on such shares or shares substituted for such shares to the extent and in the circumstances specified by the Tax Act. Analogous rules apply to a partnership or trust of which a corporation, trust or partnership is a member or beneficiary. Resident Holders to whom these rules may be relevant should consult their own tax advisors.

A Resident Holder that is throughout the relevant taxation year a "Canadian-controlled private corporation" (as defined in the Tax Act) may be liable to pay an additional tax (refundable in certain circumstances) on its "aggregate investment income" for the year, including amounts in respect of net taxable capital gains. Proposed Amendments extend this additional tax and refund mechanism in respect of "aggregate investment income" to "substantive CCPCs" (as defined in the Proposed Amendments) and introduce anti-avoidance rules that could deem certain corporations resident in Canada that do not otherwise qualify as "substantive CCPCs" to so qualify. Resident Holders should consult their own advisors with respect to the application of the Proposed Amendments.

Minimum Tax

Capital gains realized and dividends received or deemed to be received by a Resident Holder that is an individual (other than certain trusts) may give rise to minimum tax under the Tax Act. Resident Holders should consult their own advisors with respect to the application of minimum tax.

Non-Residents of Canada

The following section of this summary is generally applicable to Holders who (i) for the purposes of the Tax Act, have not been and will not be deemed to be resident in Canada at any time while they hold the Warrants or Warrant Shares; and (ii) do not use or hold the Warrants or Warrant Shares in connection with carrying on a business in Canada ("Non-Resident Holders"). Special rules, which are not discussed in this summary, may apply to a Non-Resident Holder that is an insurer carrying on business in Canada and elsewhere. Such Holders should consult their own tax advisors.

Dividends

Dividends paid or credited or deemed to be paid or credited on the Warrant Shares to a Non-Resident Holder are subject to Canadian withholding tax at the rate of 25% on the gross amount of the dividend unless such rate is reduced by the terms of an applicable tax treaty. For example, under the Canada-United States Tax Convention (1980), as amended as of the date hereof (the "Treaty"), the rate of withholding tax on dividends paid or credited to a Non-Resident Holder who is resident in the U.S. for purposes of the Treaty and entitled to benefits under the Treaty (a "U.S. Holder") is generally limited to 15% of the gross amount of the dividend.

Dispositions of Warrants and Warrant Shares

A Non-Resident Holder generally will not be subject to tax under the Tax Act in respect of a capital gain realized on the disposition or deemed disposition of a Warrant Share nor will capital losses arising therefrom be recognized under the Tax Act, unless the Warrant Share constitutes "taxable Canadian property" to the Non-Resident Holder thereof for purposes of the Tax Act, and the gain is not exempt from tax pursuant to the terms of an applicable tax treaty.

Provided the Warrant Shares are listed on a "designated stock exchange", as defined in the Tax Act (which currently includes the TSX and the NASDAQ), at the time of disposition, the Warrant Shares generally will not constitute taxable Canadian property of a Non-Resident Holder at that time, unless at any time during the 60-month period immediately preceding the disposition, the following two conditions are met: (i) 25% or more of the issued shares of any class or series of the share capital of the Corporation were owned by, or belonged to, one or any combination of (x) the Non-Resident Holder, (y) persons with whom the Non-Resident Holder did not deal at arm's length (within the meaning of the Tax Act), and (z) partnerships in which the Non-Resident Holder or a person referred to in (y) holds a membership interest directly or indirectly through one or more partnerships, and (ii) more than 50% of the fair market value of the Common Shares, was derived directly or indirectly from one or any combination of: (A) real or immovable property situated in Canada, (B) Canadian resource property (as defined in the Tax Act), (C) timber resource property (as defined in the Tax Act), and (D) options in respect of, or interests in, or for civil law rights in, property described in any of (A) through (C) above, whether or not such property exists.

A Non-Resident Holder's capital gain (or capital loss) in respect of Warrant Shares that constitute or are deemed to constitute taxable Canadian property (and are not "treaty-protected property" as defined in the Tax Act) will generally be computed in the manner described above under the subheading "Residents of Canada-Dispositions of Warrant Shares".

Non-Resident Holders whose Warrant Shares may be taxable Canadian property should consult their own tax advisors, including with respect to any notification or tax filing obligations under the Tax Act.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising from and relating to the acquisition, ownership, and disposition of Warrants, and Warrant Shares upon exercise of the Warrants that was prepared by Hodgson Russ LLP, counsel to the Corporation with respect to U.S. federal income tax matters.

This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax considerations that may apply to a U.S. Holder arising from and relating to the acquisition, ownership, and disposition of Warrants or Warrant Shares. In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the U.S. federal income tax consequences to such U.S. Holder, including, without limitation, specific tax consequences to a U.S. Holder under an applicable income tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any U.S. Holder. Except as specifically set forth below, this summary does not address the U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences to U.S. Holders of the acquisition, ownership, and disposition of Warrants or Warrant Shares. In addition, except as specifically set forth below, this summary does not discuss applicable tax reporting requirements. Each prospective U.S. Holder should consult its own tax advisors regarding the U.S. federal, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership, and disposition of Warrants or Warrant Shares.

No legal opinion from U.S. legal counsel or ruling from the Internal Revenue Service (the "IRS") has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Warrants or Warrant Shares. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. In addition, because the authorities on which this summary are based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the conclusions described in this summary.

Scope of this Summary

Authorities

This summary is based on the U.S. Internal Revenue Code of 1986, as amended (the "Code"), Treasury Regulations (whether final, temporary, or proposed), published rulings of the IRS, published administrative positions of the IRS, the Treaty, and U.S. court decisions that are applicable, and, in each case, as in effect and available, as of the date of this Prospectus Supplement. Any of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied retroactively or prospectively. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted, could be applied on a retroactive or prospective basis.

U.S. Holders

For purposes of this summary, the term "U.S. Holder" means a beneficial owner of Warrants or Warrant Shares that is for U.S. federal income tax purposes:

- an individual who is a citizen or resident of the United States;

- a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) organized in or under the laws of the United States, any state thereof or the District of Columbia;

- an estate whose income is subject to U.S. federal income taxation regardless of its source; or

- a trust that (1) is subject to the primary supervision of a court within the United States and is under the control of one or more U.S. persons for all substantial decisions or (2) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

Non-U.S. Holders

For purposes of this summary, a "non-U.S. Holder" is a beneficial owner of Warrants or Warrant Shares that is not a U.S. Holder. This summary does not address the U.S. federal income tax consequences applicable to non-U.S. Holders. Accordingly, a non-U.S. Holder should consult its own tax advisor regarding the tax consequences (including the potential application of and operation of any income tax treaties) related to the acquisition, ownership and disposition of Warrants or Warrant Shares.

In addition, this summary assumes that the Corporation is not a "controlled foreign corporation" for U.S. federal income tax purposes.

U.S. Holders Subject to Special U.S. Federal Income Tax Rules Not Addressed

This summary does not address the U.S. federal income tax considerations applicable to U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders that: (a) are tax-exempt organizations, qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; (b) are financial institutions, underwriters, insurance companies, real estate investment trusts, or regulated investment companies; (c) are broker-dealers, dealers, or traders in securities or currencies that elect to apply a mark-to-market accounting method; (d) have a "functional currency" other than the U.S. dollar; (e) own Warrants or Warrant Shares as part of a straddle, hedging transaction, conversion transaction, constructive sale, or other arrangement involving more than one position; (f) acquire Warrants or Warrant Shares in connection with the exercise of employee stock options or otherwise as compensation for services; (g) hold Warrants or Warrant Shares other than as a capital asset within the meaning of Section 1221 of the Code (generally, property held for investment purposes); (h) are required to accelerate the recognition of any item of gross income with respect to Warrants or Warrant Shares as a result of such income being recognized on an applicable financial statement; or (i) own, have owned or will own (directly, indirectly, or by attribution) 10% or more of the total combined voting power or value of the outstanding shares of the Corporation. This summary also does not address the U.S. federal income tax considerations applicable to U.S. Holders who are: (a) U.S. expatriates or former long-term residents of the U.S.; (b) persons that have been, are, or will be a resident or deemed to be a resident in Canada for purposes of the Tax Act; (c) persons that use or hold, will use or hold, or that are or will be deemed to use or hold Warrants or Warrant Shares in connection with carrying on a business in Canada; (d) persons whose Warrants or Warrant Shares constitute "taxable Canadian property" under the Tax Act; or (e) persons that have a permanent establishment in Canada for the purposes of the Treaty and that use or hold Warrants or Warrant Shares in connection with such permanent establishment. U.S. Holders that are subject to special provisions under the Code, including, but not limited to, U.S. Holders described immediately above, should consult their own tax advisors regarding the U.S. federal income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership and disposition of Warrants or Warrant Shares.

If an entity or arrangement that is classified as a partnership (or other "pass-through" entity) for U.S. federal income tax purposes holds Warrants or Warrant Shares, the U.S. federal income tax consequences to such entity and the partners (or other owners) of such entity generally will depend on the activities of the entity and the status of such partners (or owners). This summary does not address the tax consequences to any such partner (or owner). Partners (or other owners) of entities or arrangements that are classified as partnerships or as "pass-through" entities for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the acquisition, ownership, and disposition of Warrants or Warrant Shares.

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. PROSPECTIVE PURCHASERS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL TAX RULES TO THEIR PARTICULAR CIRCUMSTANCES AS WELL AS THE STATE, LOCAL, AND NON-U.S. TAX CONSEQUENCES TO THEM OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF WARRANTS OR WARRANT SHARES.

Exercise, Disposition or Expiration of Warrants

Exercise of Warrants