OneWater Marine Inc. (NASDAQ: ONEW) (“OneWater” or the “Company”)

today announced results for its fiscal third quarter ended June 30,

2022.

"The business is firing on all cylinders,

significantly exceeding our expectations. We delivered record

results in the fiscal third quarter, with revenues increasing 41%

and Adjusted EBITDA1 rising 45%. Our performance was bolstered by

strength across the business, diversity in our model, and a

powerful, multi-faceted acquisition engine,” commented Austin

Singleton, Chief Executive Officer at OneWater. “Through a broad

network of high-caliber stores, our dealers are leveraging

OneWater’s scale, inventory and expanded offerings, while

mitigating challenges presented by a constrained production

environment. At the same time, we are rapidly growing the business

and further positioning OneWater as a leader in the industry. Our

announced acquisition of Ocean Bio-Chem, Inc. late in the quarter

provides yet another example of our M&A prowess to support

long-term profitable growth.”

“As we enter the final quarter of our fiscal

year, we have maintained our momentum and the consumer demand has

been robust,” continued Mr. Singleton. “Since entering the

public markets more than two years ago, we have delivered strong

earnings results for our shareholders quarter after quarter, and we

believe we have strategies in place for long-term value creation.

Through our expanded footprint, diversified business model and

best-in-class integration playbook, we believe we are

well-positioned for outperformance throughout the coming

years.”

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June

30 |

|

|

2022 |

|

|

2021 |

|

$ Change |

|

% Change |

|

|

|

(unaudited, $ in thousands) |

|

Revenues |

|

|

|

|

|

|

|

|

|

New boat |

|

$ |

376,886 |

|

$ |

288,222 |

|

$ |

88,664 |

|

30.8 |

% |

|

Pre-owned boat |

|

|

98,181 |

|

|

71,116 |

|

|

27,065 |

|

38.1 |

% |

|

Finance & insurance income |

|

|

18,979 |

|

|

15,238 |

|

|

3,741 |

|

24.6 |

% |

|

Service, parts & other |

|

|

74,854 |

|

|

29,631 |

|

|

45,223 |

|

152.6 |

% |

|

Total revenues |

|

$ |

568,900 |

|

$ |

404,207 |

|

$ |

164,693 |

|

40.7 |

% |

|

|

|

|

|

|

|

|

|

|

Fiscal Third Quarter 2022

Results

Record revenue for fiscal third quarter 2022 was

$568.9 million, an increase of 40.7% compared to $404.2 million in

fiscal third quarter 2021 and was primarily due to our increase in

same-store sales and revenue from acquired businesses, with strong

contribution from acquired revenues related to service, parts and

other sales. During fiscal third quarter 2022 same-store sales

increased 12% compared to fiscal third quarter 2021, primarily as a

result of the continued strong demand environment.

New and pre-owned boat revenue increased 30.8%

and 38.1%, respectively, compared to the prior year, driven by a

significant increase in the average unit price of new boats and a

significant increase in the unit sales of pre-owned boats. Finance

& insurance income was up 24.6% and service, parts and other

sales was up 152.6%, both compared to the prior year, as a result

of the Company’s acquisition activity to expand the higher margin,

less cyclical service, parts & other revenues.

Gross profit totaled $183.9 million for fiscal

third quarter 2022, up $57.0 million from $127.0 million for fiscal

third quarter 2021. Gross profit margin of 32.3% increased 90 basis

points compared to the prior year period driven by our strategic

acquisitions of companies focused on higher margin, less cyclical

service, parts & other revenues and brokerage revenues, as well

as the shift in the mix and size of boats sold and local pricing

strategies.

Fiscal third quarter 2022 selling, general and

administrative expenses totaled $87.9 million, or 15.4% of revenue,

compared to $60.5 million, or 15.0% of revenue, in fiscal third

quarter 2021. The increase in selling, general and administrative

expenses as a percentage of revenue was due mainly to higher

marketing expenses, as well as higher administrative costs.

Net income for fiscal third quarter 2022 totaled

$64.5 million, compared to $51.6 million in fiscal third quarter

2021. The increase was primarily due to the elevated gross profit

and significant increase in service, parts and other sales during

the period.

Earnings per diluted share for fiscal third

quarter 2022 was $3.86 per diluted share, compared to $3.04 per

diluted share in 2021. For fiscal third quarter 2022, charges

related to transaction costs and contingent consideration adversely

impacted diluted earnings per share. This amount, tax effected at

25%, was $0.20 per diluted share.

Fiscal third quarter 2022 Adjusted EBITDA1

increased 45.2% to $95.1 million, compared to $65.5 million for

fiscal third quarter 2021.

As of June 30, 2022, the Company’s cash and cash

equivalents balance was $95.7 million and total liquidity,

including cash and availability under credit facilities, was in

excess of $125.0 million. Total inventory as of June 30, 2022,

decreased sequentially to $269.4 million compared to $293.2 million

on March 31, 2022. As expected, inventories declined as the summer

selling season ramped up during the quarter.

Total long-term debt as of June 30, 2022, was

$335.8 million, and adjusted long-term net debt (net of $95.7

million cash)1 is 1.0 times trailing twelve-month Adjusted

EBITDA1.

Fiscal Year 2022 Guidance

The Company is raising its fiscal full year 2022

outlook for Adjusted EBITDA2 to be in the range of $240 million to

$250 million and earnings per diluted share to be in the range of

$9.20 to $9.60, both of which include previously completed

acquisitions but excludes any other acquisitions that may be

completed during the remainder of the year. For the fiscal year

2022, OneWater now anticipates that same store sales will be up

low-double digits, despite an expected challenging inventory

environment.

Conference Call and Webcast

OneWater will host a conference call to discuss

its fiscal third quarter earnings on Thursday, August 4, 2022, at

8:30 am Eastern time. To access the conference call via phone,

participants will need to register using the following link where

they will be provided a phone number and access

code: https://register.vevent.com/register/BI090ad2b5267948ff8f51a123d06a4699 Alternatively,

a live webcast of the conference call can be accessed through the

“Events” section of the Company’s website at

https://investor.onewatermarine.com/ where it will be archived for

one year.

|

|

|

|

|

|

|

|

|

|

ONEWATER MARINE INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

($ in thousands except per share data)(Unaudited) |

|

|

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

Revenues |

|

|

|

|

|

|

New boat |

$ |

376,886 |

|

$ |

288,222 |

|

$ |

903,104 |

|

$ |

679,704 |

|

Pre-owned boat |

|

98,181 |

|

|

71,116 |

|

|

227,484 |

|

|

165,778 |

|

Finance & insurance income |

|

18,979 |

|

|

15,238 |

|

|

43,234 |

|

|

32,990 |

|

Service, parts & other |

|

74,854 |

|

|

29,631 |

|

|

173,477 |

|

|

69,429 |

|

Total revenues |

|

568,900 |

|

|

404,207 |

|

|

1,347,299 |

|

|

947,901 |

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation andamortization shown

separately below) |

|

|

|

|

|

|

|

| New boat |

|

274,544 |

|

|

211,141 |

|

|

659,046 |

|

|

520,820 |

|

Pre-owned boat |

|

68,749 |

|

|

52,566 |

|

|

164,078 |

|

|

125,566 |

|

Service, parts & other |

|

41,668 |

|

|

13,548 |

|

|

96,729 |

|

|

33,341 |

|

Total cost of sales |

|

384,961 |

|

|

277,255 |

|

|

919,853 |

|

|

679,727 |

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

87,867 |

|

|

60,476 |

|

|

222,455 |

|

|

143,685 |

|

Depreciation and amortization |

|

4,073 |

|

|

1,475 |

|

|

10,549 |

|

|

3,816 |

|

Transaction costs |

|

1,337 |

|

|

65 |

|

|

5,158 |

|

|

633 |

|

Change in fair value of contingent consideration |

|

3,118 |

|

|

- |

|

|

11,022 |

|

|

377 |

|

Income from operations |

|

87,544 |

|

|

64,936 |

|

|

178,262 |

|

|

119,663 |

|

|

|

|

|

|

|

|

|

|

Other expense (income) |

|

|

|

|

|

|

|

|

Interest expense – floor plan |

|

1,131 |

|

|

956 |

|

|

3,056 |

|

|

2,206 |

|

Interest expense – other |

|

3,311 |

|

|

1,083 |

|

|

7,937 |

|

|

3,222 |

|

Other (income) expense, net |

|

(166) |

|

|

(158) |

|

|

491 |

|

|

(247) |

|

Total other expense, net |

|

4,276 |

|

|

1,881 |

|

|

11,484 |

|

|

5,181 |

|

Income before income tax expense |

|

83,268 |

|

|

63,055 |

|

|

166,778 |

|

|

114,482 |

|

Income tax expense |

|

18,785 |

|

|

11,498 |

|

|

36,455 |

|

|

20,559 |

|

Net income |

|

64,483 |

|

|

51,557 |

|

|

130,323 |

|

|

93,923 |

|

Less: Net income attributable to non-controllinginterests |

|

(959) |

|

|

- |

|

|

(1,970) |

|

|

- |

|

Less: Net income attributable to non-controlling interests of One

Water Marine Holdings, LLC |

|

(7,547) |

|

|

(17,054) |

|

|

(16,060) |

|

|

(31,158) |

|

Net income attributable to OneWater Marine Inc. |

$ |

55,977 |

|

$ |

34,503 |

|

$ |

112,293 |

|

$ |

62,765 |

|

|

|

|

|

|

|

|

|

|

Earnings per share of Class A commonstock – basic |

$ |

3.96 |

|

$ |

3.14 |

|

$ |

8.14 |

|

$ |

5.77 |

|

Earnings per share of Class A commonstock – diluted |

$ |

3.86 |

|

$ |

3.04 |

|

$ |

7.90 |

|

$ |

5.63 |

|

|

|

|

|

|

|

|

|

|

Basic weighted-average shares of Class Acommon stock

outstanding |

|

14,133 |

|

|

10,976 |

|

|

13,791 |

|

|

10,884 |

|

Diluted weighted-average shares of Class Acommon stock

outstanding |

|

14,512 |

|

|

11,341 |

|

|

14,205 |

|

|

11,143 |

|

|

|

|

|

|

|

|

|

|

ONEWATER MARINE INC.CONDENSED CONSOLIDATED BALANCE SHEETS |

|

($ in thousands, except par value and share data)(Unaudited) |

|

|

|

|

|

|

|

|

|

June 30,2022 |

|

June 30,2021 |

|

Cash |

|

$ |

95,690 |

|

$ |

113,249 |

|

Restricted cash |

|

|

16,209 |

|

|

7,437 |

|

Accounts receivable, net |

|

|

80,495 |

|

|

37,748 |

|

Inventories, net |

|

|

269,430 |

|

|

116,873 |

|

Prepaid expenses and other current assets |

|

|

57,389 |

|

|

32,311 |

|

Total current assets |

|

|

519,213 |

|

|

307,618 |

|

|

|

|

|

|

|

Property and equipment, net |

|

|

80,235 |

|

|

66,206 |

|

Operating lease right-of-use assets |

|

|

126,433 |

|

|

82,992 |

|

|

|

|

|

|

|

Other assets: |

|

|

|

|

|

Deposits |

|

|

823 |

|

|

504 |

|

Deferred tax assets |

|

|

32,585 |

|

|

18,620 |

|

Identifiable intangible assets, net |

|

|

245,659 |

|

|

74,004 |

|

Goodwill |

|

|

342,605 |

|

|

151,564 |

|

Total other assets |

|

|

621,672 |

|

|

244,692 |

|

Total assets |

|

$ |

1,347,553 |

|

$ |

701,508 |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

51,199 |

|

$ |

24,909 |

|

Other payables and accrued expenses |

|

|

54,725 |

|

|

55,688 |

|

Customer deposits |

|

|

65,520 |

|

|

43,114 |

|

Notes payable – floor plan |

|

|

217,338 |

|

|

108,160 |

|

Current operating lease liabilities |

|

|

12,788 |

|

|

8,253 |

|

Current portion of long-term debt |

|

|

19,450 |

|

|

11,858 |

|

Current portion of tax receivable agreement liability |

|

|

915 |

|

|

482 |

|

Total current liabilities |

|

|

421,935 |

|

|

252,464 |

|

|

|

|

|

|

|

Other long-term liabilities |

|

|

25,766 |

|

|

6,904 |

| Tax receivable agreement

liability, net of current portion |

|

|

45,290 |

|

|

25,594 |

| Noncurrent operating lease

liabilities |

|

|

114,545 |

|

|

75,184 |

|

Long-term debt, net of current portion and unamortized debt

issuance costs |

|

|

316,349 |

|

|

103,885 |

| Total liabilities |

|

|

923,885 |

|

|

464,031 |

|

|

|

|

|

|

| Preferred stock, $0.01 par

value, 1,000,000 shares authorized, noneissued and outstanding as

of June 30, 2022 and June 30, 2021 |

|

|

- |

|

|

- |

| Class A common stock, $0.01

par value, 40,000,000 shares authorized, 14,133,130 shares issued

and outstanding as of June 30, 2022 and 11,661,575 shares issued

and outstanding as of June 30, 2021 |

|

|

141 |

|

|

117 |

| Class B common stock, $0.01

par value, 10,000,000 shares authorized, 1,429,940 shares issued

and outstanding as of June 30, 2022 and 3,377,449 shares issued and

outstanding as of June 30, 2021 |

|

|

14 |

|

|

34 |

|

Additional paid-in capital |

|

|

178,347 |

|

|

123,643 |

|

Retained earnings |

|

|

186,536 |

|

|

60,029 |

|

Total stockholders’ equity attributable to OneWater Marine Inc |

|

|

365,038 |

|

|

183,823 |

|

Equity attributable to non-controlling interests |

|

|

58,630 |

|

|

53,654 |

|

Total stockholders’ equity |

|

|

423,668 |

|

|

237,477 |

|

Total liabilities and stockholders’ equity |

|

$ |

1,347,553 |

|

$ |

701,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ONEWATER MARINE INC.Reconciliation of Non-GAAP Financial

Measures |

|

(amounts in thousands, except per share data)(Unaudited) |

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Trailing twelve months ended June 30, |

|

Description |

|

2022 |

|

2021 |

|

2022 |

|

Net income |

|

$ |

64,483 |

|

$ |

51,557 |

|

$ |

152,813 |

|

Interest expense – other |

|

|

3,311 |

|

|

1,083 |

|

|

9,059 |

|

Income tax expense |

|

|

18,785 |

|

|

11,498 |

|

|

41,698 |

|

Depreciation and amortization |

|

|

4,274 |

|

|

1,475 |

|

|

12,409 |

|

Change in fair value of contingent consideration |

|

|

3,118 |

|

|

- |

|

|

13,894 |

|

Loss on extinguishment of debt |

|

|

- |

|

|

- |

|

|

- |

|

Transaction costs |

|

|

1,337 |

|

|

65 |

|

|

5,394 |

| Other (income) expense,

net |

|

|

(166) |

|

|

(158) |

|

|

490 |

|

Adjusted EBITDA |

|

$ |

95,142 |

|

$ |

65,520 |

|

$ |

235,757 |

|

|

|

|

|

|

|

|

|

Long-term debt (including current portion) |

|

|

|

|

|

$ |

335,799 |

|

Less: Cash |

|

|

|

|

|

|

(95,690) |

|

Adjusted long-term debt |

|

|

|

|

|

$ |

240,109 |

|

|

|

|

|

|

|

|

|

Adjusted net debt leverage ratio |

|

|

|

|

|

1.0x |

|

|

|

|

|

|

|

|

About OneWater Marine Inc.

OneWater Marine Inc. is one of the largest and

fastest-growing premium marine retailers in the United States.

OneWater operates a total of 96 retail locations, 10 distribution

centers/warehouses and multiple online marketplaces in 19 different

states, several of which are in the top twenty states for marine

retail expenditures. OneWater offers a broad range of products and

services and has diversified revenue streams, which include the

sale of new and pre-owned boats, finance and insurance products,

parts and accessories, maintenance, repair and other services.

Non-GAAP Financial Measures and Key

Performance Indicators

This press release and our related earnings call

contain certain non-GAAP financial measures, including Adjusted

EBITDA and adjusted long-term net debt, as measures of our

operating performance. Management believes these measures may be

useful in performing meaningful comparisons of past and present

operating results, to understand the performance of the Company’s

ongoing operations and how management views the business.

Reconciliations of reported GAAP measures to adjusted non-GAAP

measures are included in the financial schedules contained in this

press release. These measures, however, should not be construed as

an alternative to any other measure of performance determined in

accordance with GAAP. Because our non-GAAP financial measures may

be defined differently by other companies, our definition of these

non-GAAP financial measures may not be comparable to similarly

titled measures of other companies, thereby diminishing its

utility. We have not reconciled non‐GAAP forward-looking measures,

including Adjusted EBITDA guidance, to their corresponding GAAP

measures due to the high variability and difficulty in making

accurate forecasts and projections, particularly with respect to

acquisition contingent consideration and transaction costs.

Acquisition contingent consideration and transaction costs are

affected by the acquisition, integration and post-acquisition

performance of our acquirees which is difficult to predict and

subject to change. Accordingly, reconciliations of forward-looking

Adjusted EBITDA is not available without unreasonable effort.

Adjusted EBITDA

We define Adjusted EBITDA as net income (loss)

before interest expense – other, income tax expense, depreciation

and amortization and other (income) expense, further adjusted to

eliminate the effects of items such as the change in fair value of

contingent consideration, gain (loss) on extinguishment of debt and

transaction costs. See reconciliation above.

Our board of directors, management team and

lenders use Adjusted EBITDA to assess our financial performance

because it allows them to compare our operating performance on a

consistent basis across periods by removing the effects of our

capital structure (such as varying levels of interest expense),

asset base (such as depreciation and amortization) and other items

(such as the change in fair value of contingent consideration, gain

or loss on extinguishment of debt and transaction costs) that

impact the comparability of financial results from period to

period. We present Adjusted EBITDA because we believe it provides

useful information regarding the factors and trends affecting our

business in addition to measures calculated under GAAP. Adjusted

EBITDA is not a financial measure presented in accordance with

GAAP. We believe that the presentation of this non-GAAP financial

measure will provide useful information to investors and analysts

in assessing our financial performance and results of operations

across reporting periods by excluding items we do not believe are

indicative of our core operating performance.

Adjusted Long-Term Net Debt

We defined adjusted long-term net debt as

long-term debt (including current portion) less cash. We consider,

and we believe certain investors and analysts consider, adjusted

long-term net debt, as well as adjusted long-term net debt divided

by trailing twelve-month Adjusted EBITDA, to be an indicator of our

financial leverage.

Same-Store Sales

We define same-store sales as sales from our

stores excluding new and acquired stores. New and acquired stores

become eligible for inclusion in the comparable store base at the

end of the store’s thirteenth month of operations under our

ownership and revenues are only included for identical months in

the same-store base periods. Stores relocated within an existing

market remain in the comparable store base for all periods.

Additionally, amounts related to closed stores are excluded from

each comparative base period. We use same-store sales to assess the

organic growth of our revenue on a same-store basis. We believe

that our assessment on a same-store basis represents an important

indicator of comparative financial results and provides relevant

information to assess our performance.

Cautionary Statement Concerning

Forward-Looking Statements

This press release and statements made during

the above referenced conference call may contain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, including regarding our strategy, future

operations, financial position, prospects, plans and objectives of

management, growth rate and its expectations regarding future

revenue, operating income or loss or earnings or loss per share. In

some cases, you can identify forward-looking statements because

they contain words such as “may,” “will,” “will be,” “will

likely result,” “should,” “expects,” “plans,” “anticipates,”

“could,” “would,” “foresees,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential,”

“outlook” or “continue” or the negative of these words or other

similar terms or expressions that concern our expectations,

strategy, plans or intentions. These forward-looking statements are

not guarantees of future performance, but are based on management's

current expectations, assumptions and beliefs concerning future

developments and their potential effect on us, which are inherently

subject to uncertainties, risks and changes in circumstances that

are difficult to predict. Our expectations expressed or implied in

these forward-looking statements may not turn out to be

correct.

Important factors, some of which are beyond our

control, that could cause actual results to differ materially from

our historical results or those expressed or implied by these

forward-looking statements include the following: effects of

industry wide supply chain challenges and our ability to maintain

adequate inventory, changes in demand for our products and

services, the seasonality and volatility of the boat industry, our

acquisition and business strategies, the inability to comply with

the financial and other covenants and metrics in our credit

facilities, cash flow and access to capital, effects of the

COVID-19 pandemic and related governmental actions or restrictions

on the Company’s business, risks related to the ability to realize

the anticipated benefits of any proposed acquisitions, including

the risk that proposed acquisitions will not be integrated

successfully, the timing of development expenditures, and other

risks. More information on these risks and other potential factors

that could affect our financial results is included in our filings

with the Securities and Exchange Commission, including in the “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” sections of our Annual Report

on Form 10-K for the fiscal year ended September 30, 2021 and in

our subsequently filed Quarterly Reports on Form 10-Q, each of

which is on file with the SEC and available from OneWater Marine’s

website at www.onewatermarine.com under the “Investors” tab, and in

other documents OneWater Marine files with the SEC. Any

forward-looking statement speaks only as of the date as of which

such statement is made, and, except as required by law, we

undertake no obligation to update or revise publicly any

forward-looking statements, whether because of new information,

future events, or otherwise.

Investor or Media Contact:Jack

EzzellChief Financial OfficerIR@OneWaterMarine.com

1 See reconciliation of Non-GAAP financial

measures below.

2 See reconciliation of non-GAAP financial

measures below for a discussion of why reconciliations of

forward-looking Adjusted EBITDA are not available without

unreasonable effort.

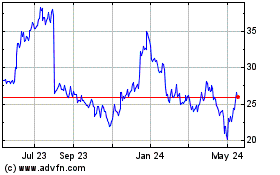

OneWater Marine (NASDAQ:ONEW)

Historical Stock Chart

From Jul 2024 to Jul 2024

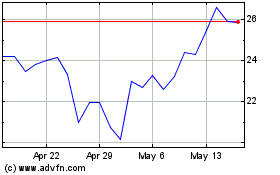

OneWater Marine (NASDAQ:ONEW)

Historical Stock Chart

From Jul 2023 to Jul 2024