false

0000278165

0000278165

2024-05-03

2024-05-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 3, 2024

OMNIQ

CORP.

(Exact

name of registrant as specified in charter)

| Delaware |

|

001-40768 |

|

20-3454263 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

1865

West 2100 South, Salt Lake City, UT 84119

(Address

of Principal Executive Offices) (Zip Code)

(714)

899-4800

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value

$0.001 |

|

OMQS |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard. |

On

May 3, 2024, The Nasdaq Stock Market LLC (“Nasdaq”) notified OMNIQ Corp. (the “Company”) that the Nasdaq Hearings

Panel (the “Panel”) has determined to delist the Company’s common stock and that trading of the Company’s securities

will be suspended at the open of trading on May 7, 2024. As previously reported, on August 9, 2023, Nasdaq Listing Qualifications Staff

(the “Staff”) notified the Company that it no longer complied with the minimum $35 million market value of listed securities

(“MVLS”) required for continued listing as set forth in Listing Rule 5550(b)(2). In accordance with Listing Rule 5810(c)(3)(A),

the Company was provided 180 calendar days, or until February 5, 2024, to regain compliance. On February 8, 2024, Staff notified the

Company that it had determined to delist the Company as it did not comply with the MVLS requirement for listing on the Exchange. On February

15, 2024, the Company requested a hearing, which was held on April 11, 2024.

In

connection with the Nasdaq delisting notice, Nasdaq will complete the delisting by filing a Form 25 Notification of Delisting with the

U.S. Securities and Exchange Commission (the “SEC”) after applicable appeal periods have lapsed. In the interim, the Company

expects its common stock will be eligible for quotation on the OTC Pink Market under its existing symbol, “OMQS.”

The

Company has 15 days after the date it received notice of the Panel’s decision to request that the Nasdaq Listing and Hearing Review

Council review the decision, or the Council may, on its own motion, determine to review the Panel’s decision within 45 calendar

days after the Company was notified of the decision.

The

Company has submitted an application to the OTCQX for quotation of its common stock, and plans

to continue to file its required periodic reports and other filings with the SEC.

Item

7.01 Regulation FD

On

May 8, 2024, Omniq Corp. (the “Company”) issued a press release. A copy of the press release is furnished hereto as Exhibit

99.1 and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

May 8, 2024

| OMNIQ Corp. |

|

| |

|

|

| By: |

/s/ Shai

S. Lustgarten |

|

| |

Shai S. Lustgarten |

|

| |

President and CEO |

|

Exhibit

99-1

OMNIQ

ANNOUNCES SUBMISSION OF APPLICATION TO OTCQX

SALT

LAKE CITY, May 8, 2024 (GLOBE NEWSWIRE) — OMNIQ Corp. (OTC Pink: OMQS) (“OMNIQ” or “the Company”),

a global leader in AI-based machine vision solutions for data processing and analytics, today announced that the Company has submitted

an application to list the trading of its common stock to the OTCQX marketplace from its current listing on the OTC PINK marketplace.

The listing of the Company’s common shares on OTCQX remains subject to the approval of OTCQX and the satisfaction of applicable

listing requirements.

The

Company meets several of the OTCQX listing requirements, and the Company confirms that the uplisting of the Company’s common stock

to the OTCQX will not change the trading symbol or cusip number. No action by the OMNIQ stockholders is required.

OTCQX

is the top tier of three markets organized by OTC Markets Group Inc. for trading over-the-counter securities and is designed for established,

investor-focused U.S. and international companies. To qualify for the OTCQX market, companies must meet high financial standards, follow

best practice corporate governance, demonstrate compliance with U.S. securities laws, and be current with their disclosure. Investors

can find current market information and real-time quotes for the Company on www.otcmarkets.com.

“We

view the current situation as a temporary phase in our ongoing strategy focused on growth and profitability. We are actively executing

our strategic plan and exploring every avenue to ensure a swift return to a national exchange listing. In the interim, OMNIQ will continue

trading on the OTC market and we have taken steps to be listed on the OTCQX, the premier tier of the OTC markets, reflecting our commitment

to high standards and transparency,” said Shai Lustgarten, CEO of OMNIQ, “Please be assured that OMNIQ remains

diligent in fulfilling all SEC requirements and filings. Our commitment to growth is unwavering, as evidenced by our consistent acquisition

of new customers and the expansion of our business with existing Fortune 100 customers. We are confident in the strength of our partnerships

and our proven business model, which will drive our return to profitability and sustain our long-term success.”

ABOUT

OMNIQ

OMNIQ

Corp. leads in technological innovation, offering advanced computerized and machine vision image processing solutions powered by its

unique AI technology. The Company’s extensive product range encompasses data collection, real-time surveillance, and monitoring

systems designed for industries including supply chain management, homeland security, public safety, and traffic & parking management.

The solutions are designed to enhance the secure and efficient flow of people, assets, and information. They also play a crucial role

in vital infrastructures such as airports, warehouses, and national borders.

OMNIQ’s

client base includes government agencies and prestigious Fortune 500 companies across various industries, including manufacturing, retail,

distribution, healthcare, transportation, logistics, food and beverage, and the oil, gas, and chemical sectors. By leveraging OMNIQ’s

innovative solutions, these organizations achieve enhanced operational capabilities, allowing them to adeptly manage the complexities

of their respective fields.

Financially,

OMNIQ is strategically positioned in rapidly expanding markets. The Company taps into the Global Safe City market, anticipated to grow

to $67.1 billion by 2028, the smart parking market expected to grow to $16.4 billion by 2030, and the quickly expanding fast-casual restaurant

sector, projected to hit $209 billion by 2027. These figures underscore OMNIQ’s pivotal role in sectors increasingly reliant on

sophisticated AI technology solutions.

For

more information, visit OMNIQ.com.

INFORMATION

ABOUT FORWARD-LOOKING STATEMENTS

“Safe

Harbor” Statement under the Private Securities Litigation Reform Act of 1995. Statements in this press release relating to plans,

strategies, economic performance and trends, projections of results of specific activities or investments, and other statements that

are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

This

release contains “forward-looking statements” that include information relating to future events and future financial and

operating performance. The words “anticipate,” “may,” “would,” “will,” “expect,”

“estimate,” “can,” “believe,” “potential” and similar expressions and variations thereof

are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance

or results and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved.

Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as

of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results

to differ materially from those expressed in or suggested by the forward-looking statements.

Examples

of forward-looking statements include, among others, statements made in this press release regarding the closing of the private placement

and the use of proceeds received in the private placement. Important factors that could cause these differences include, but are not

limited to: fluctuations in demand for the Company’s products particularly during the current health crisis, the introduction of

new products, the Company’s ability to maintain customer and strategic business relationships, the impact of competitive products

and pricing, growth in targeted markets, the adequacy of the Company’s liquidity and financial strength to support its growth,

the Company’s ability to manage credit and debt structures from vendors, debt holders and secured lenders, the Company’s

ability to successfully integrate its acquisitions, and other information that may be detailed from time-to-time in OMNIQ Corp.’s

filings with the United States Securities and Exchange Commission. Examples of such forward-looking statements in this release include,

among others, statements regarding revenue growth, driving sales, operational and financial initiatives, cost reduction and profitability,

and simplification of operations. For a more detailed description of the risk factors and uncertainties affecting OMNIQ Corp., please

refer to the Company’s recent Securities and Exchange Commission filings, which are available at SEC.gov. OMNIQ Corp. undertakes

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or

otherwise, unless otherwise required by law.

Contact

IR@omniq.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

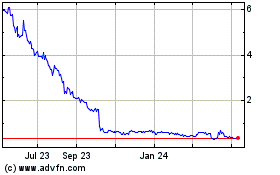

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

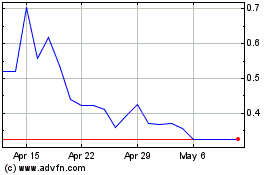

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Feb 2024 to Feb 2025