Novavax Announces Reverse Stock Split of Common Stock

May 08 2019 - 4:05PM

Novavax, Inc. (Nasdaq: NVAX) today announced it will effect a

one-for-twenty reverse stock split of its issued and outstanding

common stock. Stockholders of Novavax approved an amendment to

Novavax’ Second Amended and Restated Certificate of Incorporation

(the Amended Certificate) to effect the reverse stock split at a

Special Meeting of Stockholders held on May 8, 2019. The reverse

stock split is intended to give Novavax greater flexibility in

considering and planning for future potential business needs and to

increase the per share trading price of the Novavax’ common stock

to enable Novavax to satisfy the minimum price requirement for

continued listing on the Nasdaq Global Select Market. Pursuant to

the Amended Certificate, the reverse stock split will be effective

at 12:01 a.m., Eastern Time, on May 10, 2019. Novavax expects that

upon the opening of trading on May 10, 2019, its common stock will

trade on the Nasdaq Global Select Market on a split-adjusted basis

under the current trading symbol “NVAX” and the new CUSIP number

670002 401.

The reverse stock split affects all issued and

outstanding shares of Novavax’ common stock. The par value of the

Novavax’ common stock will remain unchanged at $0.01 per share

after the reverse stock split. The reverse stock split affects all

stockholders uniformly and will not alter any stockholder’s

percentage interest in the Novavax’ equity, except to the extent

that the reverse stock split results in some stockholders receiving

cash in lieu of any fractional shares as described below.

No fractional shares will be issued in

connection with the reverse split. Stockholders who would otherwise

be entitled to receive a fractional share will instead receive a

cash payment in lieu of such fractional shares equal to the fair

market value of such fractional shares, as determined in good faith

by Novavax’ Board of Directors.

Computershare Trust Company, N.A. is acting as

the exchange agent and transfer agent for the reverse stock split.

Stockholders holding their shares electronically in book-entry form

are not required to take any action to receive post-split shares.

Computershare will provide instructions to stockholders with

physical certificates regarding the process for exchanging their

pre-split stock certificates for book entry of the appropriate

number of post-split shares and receiving payment for any

fractional shares. Stockholders owning shares through a bank,

broker or other nominee will have their positions adjusted to

reflect the reverse stock split and will receive payment for any

fractional shares in accordance with their respective bank’s,

broker’s, or nominee’s particular processes. Additional information

regarding the reverse stock split can be found in the Novavax’

definitive proxy statement filed with the Securities and Exchange

Commission on April 1, 2019.

About Novavax

Novavax, Inc. (Nasdaq: NVAX) is a late-stage

biotechnology company that drives improved health globally through

the discovery, development, and commercialization of innovative

vaccines to prevent serious infectious diseases. Its two priority

programs are ResVax™, its RSV vaccine for infants via maternal

immunization, and NanoFlu™, its quadrivalent influenza nanoparticle

vaccine. Novavax’ proprietary recombinant technology platform

combines the power and speed of genetic engineering to efficiently

produce a new class of highly immunogenic nanoparticles addressing

urgent global health needs.

For more information, visit www.novavax.com and

connect with us on Twitter and LinkedIn.

Forward-Looking Statements

Statements contained in this press release,

including those relating to the sale of common stock, and those

statements using words such as “expects” and “intends” are

forward-looking statements that involve a number of risks and

uncertainties that could cause actual results to differ materially

from those in the forward-looking statements. These risks and

uncertainties include, but are not limited to: capital market

risks; our ability to raise additional capital when needed; and

other risk factors identified in Part I, Item 1A “Risk Factors,” of

the Novavax Annual Report on Form 10-K for the year ended December

31, 2018, and Quarterly Report on Form 10-Q for the period ended

March 31, 2019, as filed with the Securities and Exchange

Commission (SEC) and in other reports filed from time to time with

the SEC, including our Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, which are all available at www.sec.gov. We

caution investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC, available at sec.gov,

for a discussion of these and other risks and uncertainties. The

forward-looking statements in this press release speak only as of

the date of this document, and we undertake no obligation to update

or revise any of the statements. Our business is subject to

substantial risks and uncertainties, including those referenced

above. Investors, potential investors, and others should give

careful consideration to these risks and uncertainties.

Contacts:

Investors:Novavax, Inc.Erika TrahanSenior Manager, Investor

& Public Relationsir@novavax.com240-268-2000

Westwicke PartnersJohn

WoolfordJohn.woolford@westwicke.com443-213-0506

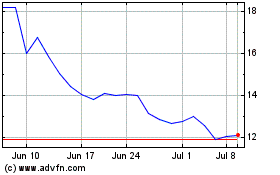

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Aug 2024 to Sep 2024

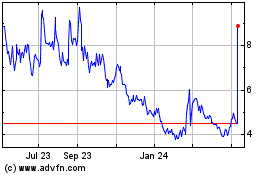

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Sep 2023 to Sep 2024