This prospectus and any accompanying prospectus supplement and the documents incorporated herein or therein by reference include forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact contained in this prospectus, including statements regarding our future results of operations and financial position, strategy and plans and our expectations for future operations, are forward-looking statements. The words “anticipate,” “contemplate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “might,” “will,” “would,” “could,” “should,” “can have,” “likely,” “continue,” “design” and other words and terms of similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives and financial needs.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual results could differ from those expressed in our forward-looking statements. Our future financial position and results of operations, as well as any forward-looking statements are subject to change and inherent risks and uncertainties, including those described in the section entitled “Risk Factors” herein and in our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q. You should consider our forward-looking statements in light of a number of factors that may cause actual results to vary from our forward-looking statements including, but not limited to:

Should one or more of the foregoing risks or uncertainties materialize in a way that negatively impacts us, or should the underlying assumptions prove incorrect, our actual results may vary materially from those anticipated in our forward-looking statements, and our business, financial condition and results of operations could be materially and adversely affected.

The forward-looking statements contained in this prospectus are made as of the date of this prospectus or, in the case of any accompanying prospectus supplement or documents incorporated by reference, the date of any such document. You should not rely upon forward-looking statements as predictions of future events. In addition, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements.

Except as required by applicable law, we do not undertake any obligation to publicly correct or update any forward-looking statements. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements as well as others made in this prospectus, our most recent Annual Report on Form 10-K and any subsequently filed Quarterly Reports on Form 10-Q, and in our other Commission filings and public communications. You should evaluate all forward-looking statements made by us in the context of these risks and uncertainties.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere or incorporated by reference into this prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus, including all documents incorporated by reference, carefully, especially the “Risk Factors” section beginning on page 9 of this prospectus and the sections of our Annual Report on Form 10-K for the year ended December 31, 2020 and subsequently filed Quarterly Reports on Form 10-Q titled “Risk Factors”, which are incorporated herein by reference, and our financial statements and related notes incorporated by reference in this prospectus before making an investment decision with respect to our securities. Please see the sections of this prospectus titled “Where You Can Find More Information” and “Incorporation of Certain Information by Reference”.

Our Company

We engage in development activities related to the liquefaction and sale of LNG and the reduction of CO2 emissions, in part, through the CCS project. We have focused and continue to focus our development activities on the Terminal and recently announced our planned development of the CCS project (described further under “Recent Developments”). We have undertaken and continue to undertake various initiatives to evaluate, design and engineer the Terminal and the CCS project that we expect will result in demand for LNG supply at the Terminal, which would enable us to seek construction financing to develop the Terminal and the CCS project. We believe the Terminal possesses competitive advantages in several important areas, including, engineering, design, commercial, regulatory, emission reductions, and gas supply. We submitted a pre-filing request for the Terminal to the Federal Energy Regulatory Commission (the “FERC”) in March 2015 and filed a formal application with the FERC in May 2016. In November 2019, the FERC issued an order authorizing the siting, construction and operation of the Terminal. We also believe we have robust commercial offtake and gas supply strategies.

Recent Developments

COVID-19 Pandemic and its Effect on our Business

The business environment in which we operate has been impacted by the recent downturn in the energy market as well as the outbreak of COVID-19 and its progression into a pandemic in March 2020. We have modified and may continue to modify certain business and workforce practices to protect the safety and welfare of our employees. Furthermore, we have implemented and may continue to implement certain mitigation efforts to ensure business continuity. We will continue to actively monitor the situation and may take further actions altering our business operations that we determine are in the best interests of our employees, customers, partners, suppliers, and stakeholders, or as required by federal, state, or local authorities. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers, employees, and prospects, or on our financial results for fiscal year 2021 or beyond.

NEXT Carbon Solutions

On March 18, 2021, we announced the formation of NEXT Carbon Solutions that is expected to (i) develop one of the largest CCS projects in North America at the Terminal, (ii) advance proprietary processes to lower the cost of utilizing CCS technology, (iii) help other energy companies to reduce their greenhouse gas (“GHG”) emissions associated with the production, transportation, and use of natural gas and, (iv) generate high-quality, verifiable carbon offsets to support companies in their efforts to achieve net-zero emissions. NEXT Carbon Solutions’ CCS project is expected to reduce permitted CO2 emissions at the Terminal by more than 90 percent without major design changes to the Terminal.

Series C Convertible Preferred Stock Offering

In March 2021, we sold an aggregate of 24,500 shares of Series C Preferred Stock at $1,000 per share for an aggregate purchase price of $24.5 million and issued an additional 490 shares of Series C Preferred Stock in aggregate as origination fees to (i) York Capital Management, L.P. and certain of its affiliates (“York”), (ii) certain affiliates of Bardin Hill Investment Partners LP (“Bardin Hill”), and (iii) Avenue Energy Opportunities Fund II, L.P. (“Avenue” and together with York and Bardin Hill, the “Purchasers”). In April 2021, we sold 10,000 shares of Series C Preferred Stock at $1,000 per share for an aggregate purchase price of $10.0 million and issued an additional 200 shares of Series C Preferred Stock as an origination fee to OGCI Climate Investments Holdings LLP (“OGCI” and together with York, Bardin Hill, and Avenue, the “Series C Preferred Stock Purchasers”). Common Stock warrants (the “Series C Warrants”) were issued together with the issuances of the Series C Preferred Stock. York and Bardin Hill, or their affiliates, are each stockholders of the Company and are affiliated with certain members of the Company’s board of directors.

Under the Certificate of Designations of Series C Convertible Preferred Stock (the “Series C Certificate of Designations”), holders of Series C Preferred Stock have the following rights, preferences, and privileges:

Ranking: The Series C Preferred Stock ranks senior in preference and priority to the Common Stock and each other class or series of capital stock of the Company, except for the Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”), Series B Convertible Preferred Stock, par value $0.0001 per share (the “Series B Preferred Stock”), with respect to which it ranks pari passu, and any class or series of capital stock issued in compliance with the terms of the Series C Certificate of Designations.

Dividends: The holders of Series C Preferred Stock are entitled to receive, out of funds legally available for the payment of dividends under Delaware law, cumulative dividends that accrue daily at an annual rate of 12%, payable quarterly in cash or in-kind. The holders of Series C Preferred Stock are also entitled to participate in dividends (payable in cash, securities or otherwise) made on shares of Common Stock.

Liquidation Preference: Upon a defined liquidation, the holders of Series C Preferred Stock will be entitled to be paid first out of any proceeds in an amount per share equal to the greater of (i) an amount equal to (a) $1,000 per share of Series C Preferred Stock plus (b) any accrued but unpaid dividends on such share of Series C Preferred Stock as of immediately prior to such liquidation, and (ii) such amounts as would have been payable had all shares of Series C Preferred Stock been converted into Common Stock (without regard to any of the limitations on convertibility contained in the Series C Certificate of Designations and plus any payment in respect of any fractional interest pursuant to the Series C Certificate of Designations) immediately prior to such liquidation, and prior to payment of any amounts on Common Stock.

Conversion: The Company has the option to convert all, but not less than all, of the Series C Preferred Stock into shares of Common Stock at the conversion prices set forth in the Series C Convertible Preferred Stock Purchase Agreements (each a “Conversion Price”) on any date on which the volume weighted average trading price of shares of Common Stock for each trading day during any 60 of the prior 90 trading days is equal to or greater than 175% of the conversion price of the Series A Preferred Stock and the Series B Preferred Stock, in each case subject to certain terms and conditions. The current Conversion Price for the shares of Series C Preferred Stock issued to the Series C Preferred Stock Purchasers is $2.9632. Furthermore, the Company must convert all of the Series C Preferred Stock into shares of Common Stock at the Conversion Price on the earlier of (i) ten (10) business days following a FID Event (as defined in the Series C Certificate of Designations) and (ii) the date that is the tenth (10th) anniversary of the date of the Series C Certificate of Designations.

Anti-dilution Protection: The Conversion Price is subject to proportional adjustment for certain transactions relating to the Company’s capital stock, including stock splits, stock dividends and similar transactions. In addition, the Conversion Price will be subject to anti-dilution protections with respect to certain Common Stock issuances, subject to certain exceptions.

Voting Rights: Holders of Series C Preferred Stock will be entitled to vote with the holders of the Common Stock on an as-converted basis. In addition, prior to the conversion of the Series C Preferred Stock, the consent of the holders of at least a majority of the Series C Preferred Stock then outstanding, voting together as a single class, will be required for the Company to take certain actions, including, among others, (i) authorizing, creating or approving the issuance of any shares of, or of any security convertible into, or convertible or exchangeable for shares of, senior to the Series C Preferred Stock; (ii) adversely affecting the rights, preferences or privileges of the Series C Preferred Stock, subject to certain exceptions; (iii) amending, altering or repealing any of the provisions of the Company’s Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) in a manner that would adversely affect the powers, designations, preferences or rights of the Series C Preferred Stock; or (iv) amending, altering or repealing any of the provisions of the Series C Certificate of Designations.

Series C Warrants

The Series C Warrants issued to the Series C Preferred Stock Purchasers represent the right to acquire in the aggregate a number of shares of Common Stock equal to approximately 49 basis points (0.49%) of all outstanding shares of Common Stock, measured on a fully diluted basis, on the exercise date for an exercise price of $0.01 per share. The Series C Warrants have a fixed three-year term commencing on the closing date of the corresponding issuance of the Series C Preferred Stock. The Series C Warrants may only be exercised by holders of the Series C Warrants at the expiration of such three-year term, except that the Company can force exercise of the Series C Warrants prior to expiration of such term if (i) the volume weighted average trading price of shares of Common Stock for each trading day during any sixty (60) of the prior ninety (90) trading days is equal to or greater than 175% of the conversion price of the Series A Preferred Stock and the Series B Preferred Stock and (ii) the Company simultaneously elects to force a mandatory exercise of all other warrants then-outstanding and unexercised and held by any holder of Parity Stock (as defined in the Series C Certificate of Designations).

CCS project

On March 25, 2021, we announced the execution of a term sheet with Oxy Low Carbon Ventures (“OLCV”), a subsidiary of Occidental Petroleum Corporation, for the offtake and storage of CO2 captured from the Terminal. Under the terms of the agreement, OLCV will offtake and transport CO2 from the Terminal and permanently sequester it in an underground geologic formation in the Rio Grande Valley, where there is believed to be vast CO2 storage capacity, pursuant to a CO2 Offtake Agreement and a Sequestration and Monitoring Agreement to be negotiated by the parties.

We have partnered with Mitsubishi Heavy Industries, an experienced developer of post-combustion carbon capture technology to assist with the planned CCS project at the Terminal.

Terminal

In April 2021, we announced a joint pilot project with Project Canary for the monitoring, reporting, and independent third-party measurement and certification of the GHG intensity of LNG to be sold from the Terminal.

Corporate Information

The mailing address of our principal executive office is 1000 Louisiana Street, Suite 3900, Houston, Texas 77002 and our telephone number is (713) 574-1880. We maintain a website at www.next-decade.com. The information contained on our website is not intended to form a part of, or be incorporated by reference into, this prospectus.

THE OFFERING

|

Common Stock offered by the selling stockholders

|

Up to 14,594,379 shares of Common Stock, which include:

|

|

|

|

|

|

● 11,875,669 shares that are issuable upon conversion of the Series C Preferred Stock;

|

|

|

● an estimated 814,692 shares that are issuable upon exercise of the Series C Warrants; and

|

|

|

● an estimated 1,904,018 shares that may be issuable upon conversion of the shares of Series C Preferred Stock issued as dividend payments.

|

|

|

|

|

Use of proceeds

|

We are not selling any shares of Common Stock under this prospectus and will not receive any of the proceeds from the sale of shares of Common Stock by the selling stockholders. To the extent Series C Warrants are exercised for cash, we will receive the exercise price thereof. We currently expect to use such net proceeds of any such exercise for working capital and general corporate purposes.

|

|

|

|

|

Risk factors

|

An investment in shares of Common Stock involves a high degree of risk. Please refer to the sections titled “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before investing in shares of Common Stock.

|

|

|

|

|

Nasdaq Capital Market symbol

|

NEXT

|

|

|

|

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. Before you decide to invest in shares of our Common Stock, you should consider carefully all of the information in this prospectus and the documents incorporated by reference herein and, in particular, the risks described below and the Risk Factors included in any prospectus supplement or amendment, our Annual Report on Form 10-K for the year ended December 31, 2020, subsequently filed Quarterly Reports on Form 10-Q, and our other filings with the Commission that are incorporated by reference into this prospectus. In addition, please read “Cautionary Note Regarding Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus. In addition, please read “Cautionary Note Regarding Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus. The risks described in this prospectus or in any document incorporated by reference are not the only ones we face. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our business, prospects, financial condition and results of operations. In any such case, the trading price of shares of our common stock could decline materially and you could lose all or part of your investment. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

USE OF PROCEEDS

All of the shares of Common Stock covered by this prospectus will be sold by the selling stockholders. See the section titled “Selling Stockholders.” We will, however, receive nominal proceeds, if any, from Series C Warrants exercised for cash in the future. We currently expect to use such net proceeds, if any, for working capital and general corporate purposes. We will bear all of the expenses incurred in connection with the registration of the shares of Common Stock covered by this prospectus other than those expenses related to transfer taxes, underwriting or brokerage commissions or discounts associated with the sale of shares of Common Stock pursuant to this prospectus.

SELLING STOCKHOLDERS

This prospectus covers the offering for resale of up to an aggregate of 14,594,379 shares of Common Stock that may be offered and sold from time to time under this prospectus by the selling stockholders identified below, subject to any appropriate adjustment as a result of any stock dividend, stock split or distribution, or in connection with a combination of shares. Of these shares, (i) 11,875,669 shares are issuable upon conversion of the Series C Preferred Stock; (ii) an estimated 814,692 shares are issuable upon exercise of the Series C Warrants; and (iii) an estimated 1,904,018 shares may be issuable upon conversion of the shares of Series C Preferred Stock issued as dividend payments. We entered into Series C Convertible Preferred Stock Purchase Agreements with the York, Bardin Hill, and Avenue on March 17, 2021 pursuant to which we sold an aggregate of 24,500 shares of Series C Preferred Stock at $1,000 per share for an aggregate purchase price of $24.5 million, issued an additional 490 shares of Series C Preferred Stock in aggregate as origination fees and issued Series C Warrants. We entered into a Series C Convertible Preferred Stock Purchase Agreement with OGCI on March 26, 2021 pursuant to which we sold an additional 10,000 shares of Series C Preferred Stock at $1,000 per share for an aggregate purchase price of $10.0 million, issued an additional 200 shares of Series C Preferred Stock as origination fees and issued Series C Warrants.

In connection with the issuances of the Series C Preferred Stock and the Series C Warrants, we entered into registration rights agreements with the selling stockholders pursuant to which we were obligated to prepare and file a registration statement to permit the resale of shares of Common Stock underlying (i) the Series C Preferred Stock (including any Common Stock underlying the Series C Preferred Stock issued as payment-in-kind dividends) issued pursuant to the respective purchase agreements and (ii) the Series C Warrants, in each case as may be sold by the selling stockholders from time to time as permitted by Rule 415 promulgated under the Securities Act. We cannot predict when or whether any of the selling stockholders will sell their shares of Common Stock upon conversion of their shares of Series C Preferred Stock or exercise of their Series C Warrants. We currently have no agreements, arrangements or understandings with the selling stockholders regarding the sale or other disposition of any of the shares of Common Stock covered hereby. The shares of Common Stock covered hereby may be offered from time to time by the selling stockholders.

We have prepared the below table and the related notes as of July 7, 2021 based on publicly available information and information previously supplied to us by the selling stockholders. We have not sought to verify such information. We believe, based on information supplied by the selling stockholders, that except as may otherwise be indicated in the footnotes to the table below, the selling stockholders have sole voting and dispositive power with respect to the shares of Common Stock reported as beneficially owned by them. Because the selling stockholders identified in the table may sell some or all of the shares of Common Stock owned by them which are included in this prospectus, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares of Common Stock, no estimate can be given as to the number of the shares of Common Stock available for resale hereby that will be held by the selling stockholders upon termination of this offering. In addition, the selling stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Common Stock they hold in transactions exempt from the registration requirements of the Securities Act after the date on which the selling stockholders provided the information set forth on the table below. We have, therefore, assumed for the purposes of the following table, that the selling stockholders will sell all of the shares of Common Stock beneficially owned by them that are covered by this prospectus. The selling stockholders are not obligated to sell any of the shares of Common Stock offered by this prospectus. The percent of beneficial ownership for the selling stockholders is based on 122,513,653 shares of Common Stock outstanding as of July 7, 2021.

|

|

|

Shares of Common Stock

Beneficially Owned

Prior to the Offering**

|

|

|

|

Shares of Common Stock

Beneficially Owned

After Completion of

the Offering**

|

|

Selling Stockholders:

|

|

Number

|

|

Percentage

|

|

Shares of

Common Stock

Offered

Hereby

|

|

Number

|

|

Percentage***

|

|

Avenue Energy Opportunities Fund II, L.P.(1)

|

|

-

|

|

-

|

|

4,245,241(2)

|

|

-

|

|

-

|

|

HCN LP(3)

|

|

4,090,196

|

|

3.3%

|

|

961,745(4)

|

|

4,090,196

|

|

3.0%

|

|

Bardin Hill Event-Driven Master Fund LP(3)

|

|

436,910(5)

|

|

*

|

|

96,272(6)

|

|

436,910

|

|

*

|

|

York Tactical Energy Fund, L.P.(7)

|

|

-

|

|

-

|

|

706,463(8)

|

|

-

|

|

-

|

|

York Tactical Energy Fund PIV-AN, L.P.(7)

|

|

-

|

|

-

|

|

1,411,938(9)

|

|

-

|

|

-

|

|

York European Distressed Credit Fund II, L.P.(7)

|

|

2,522,723

|

|

2.1%

|

|

846,086(10)

|

|

2,522,723

|

|

1.8%

|

|

York Capital Management, L.P.(7)

|

|

5,705,260

|

|

4.7%

|

|

364,199(11)

|

|

5,705,260

|

|

4.2%

|

|

York Credit Opportunities Fund, L.P.(7)

|

|

11,751,923

|

|

9.6%

|

|

592,487(12)

|

|

11,751,923

|

|

8.6%

|

|

York Credit Opportunities Investment Master Fund, L.P.(7)

|

|

12,628,348

|

|

10.3%

|

|

667,462(13)

|

|

12,628,348

|

|

9.2%

|

|

York Multi-Strategy Master Fund, L.P.(7)

|

|

13,567,803

|

|

11.1%

|

|

480,873(14)

|

|

13,567,803

|

|

9.9%

|

|

OGCI Climate Investments Holdings LLP(15)

|

|

-

|

|

-

|

|

4,211,831(16)

|

|

-

|

|

-

|

* Indicates beneficial ownership of less than 1% of the total outstanding Common Stock.

** “Beneficial ownership” is a term broadly defined by the SEC in Rule 13d-3 under the Exchange Act and includes more than typical forms of stock ownership, that is, stock held in the person’s name. The term also includes what is referred to as “indirect ownership,” meaning ownership of shares as to which a person has or shares investment or voting power. For purposes of this table, shares not outstanding that are subject to options, warrants, rights or conversion privileges exercisable within 60 days of July 7, 2021 are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. Since the Series C Preferred Stock and the Series C Warrants are not convertible into, or exercisable for, Common Stock within 60 days of July 7, 2021, shares of Common Stock issuable upon such conversion or exercise are not reflected as beneficially owned by the respective selling stockholders in the table above, although the shares are reflected in the table as offered hereby.

*** Based on a denominator equal to the sum of (i) 122,513,653 shares of Common Stock outstanding on July 7, 2021 and (ii) the number of shares of Common Stock offered under this prospectus by the selling stockholders.

(1) Avenue Capital Management II, L.P., in its capacity as investment manager, trading advisor, and/or general partner, may be deemed the beneficial owner of the shares held by Avenue Energy Opportunities Fund II, L.P. Avenue Capital Management II GenPar, LLC is the general partner of Avenue Capital Management II, L.P. Marc Lasry is the managing member of Avenue Capital Management II GenPar, LLC. Mr. Lasry may be deemed to be the indirect beneficial owner of the securities reported by the Avenue Energy Opportunities Fund II, L.P. by reason of his ability to direct the vote and/or disposition of such securities. Mr. Lasry disclaims beneficial ownership of such shares. The address of Avenue Energy Opportunities Fund II, L.P. is 11 West 42nd Street, 9th Floor, New York, NY 10036

(2) Consists of (i) 3,442,224 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 236,337 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 566,617 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(3) Bardin Hill serves as the investment manager to such fund. Investment decisions of Bardin Hill are made by one or more of its portfolio managers, including Jason Dillow, John Greene, and Pratik Desai, each of whom has individual decision-making authority. Jason Dillow is the Chief Executive Officer and Chief Investment Officer of Bardin Hill. Each of Bardin Hill, HCN GP LLC (in the case of HCN LP), Bardin Hill Fund GP LLC (in the case of Bardin Hill Event-Driven Master Fund LP), Jason Dillow, John Greene, and Pratik Desai may be deemed to beneficially own the securities held by such fund and each of Bardin Hill, HCN GP LLC, Bardin Hill Fund GP LLC, Jason Dillow, John Greene, and Pratik Desai disclaims beneficial ownership of the reported securities, except to the extent of its or his pecuniary interest. Avinash Kripalani is a Partner at Bardin Hill and serves on the Board. The address of each of HCN LP, Bardin Hill, HCN GP LLC, Bardin Hill Fund GP LLC, Jason Dillow, John Greene, and Pratik Desai is 299 Park Ave., 24th Floor, New York, New York 10171.

(4) Consists of (i) 781,587 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 53,591 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 126,552 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(5) Includes 107,500 shares of Common Stock issuable upon exercise of warrants.

(6) Consists of (i) 78,968 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 5,492 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 11,811 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(7) York Capital Management Global Advisors, LLC (“YCMGA”) is the sole managing member of the general partner of such fund. James G. Dinan is the chairman of, and controls, YCMGA. Each of YCMGA and James G. Dinan has voting and investment power with respect to the shares of Common Stock owned by such fund and may be deemed to be beneficial owners thereof. Each of YCMGA and James G. Dinan disclaims beneficial ownership of such shares of Common Stock except to the extent of their pecuniary interests therein. William Vrattos, a Partner at York Capital Management, L.P., serves on the Board. The address of such fund, James G. Dinan and William Vrattos is 767 Fifth Avenue, 17th Floor, New York, New York 10153.

(8) Consists of (i) 573,704 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 39,944 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 92,805 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(9) Consists of (i) 1,147,408 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 78,224 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 186,285 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(10) Consists of (i) 688,444 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 46,601 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 111,028 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(11) Consists of (i) 296,976 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 19,972 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 47,246 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(12) Consists of (i) 481,911 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 33,286 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 77,281 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(13) Consists of (i) 550,755 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 38,279 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 88,417 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(14) Consists of (i) 391,468 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 26,629 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 62,769 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

(15) The registered holder of the referenced shares is OGCI. OGCI Climate Investments LLP, a limited liability partnership organized under the laws of England and Wales (“OGCI Parent”), controls OGCI by ownership of more than 99% of its equity and the ability to direct its management, including investment decisions. Pratima Rangarajan, in her capacity as CEO of OGCI and of OGCI Parent, exercises control over certain of their voting and investment decisions, including with respect to the referenced shares. Accordingly, OGCI Parent and Ms. Rangarajan may each be deemed to have shared voting and investment power over, and beneficial ownership (as defined by SEC Rule 13d–3 under the Exchange Act) of, the referenced shares held by OGCI. The address of each of OGCI, OGCI Parent and Ms. Rangarajan is 11-12 St. James’s Square, London SW1Y 4LB, United Kingdom.

(16) Consists of (i) 3,442,224 shares of Common Stock issuable upon the conversion of Series C Preferred Stock, (ii) an estimated 236,337 shares of Common Stock issuable upon the exercise of Series C Warrants and (iii) an estimated 533,207 shares of Common Stock issuable upon the conversion of shares of Series C Preferred Stock made as dividend payments.

PLAN OF DISTRIBUTION

The shares of Common Stock covered by this prospectus may be offered and sold from time to time by the selling stockholders. The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices related to the then-current market price or in negotiated transactions. The selling stockholders may sell their shares of Common Stock by one or more of, or a combination of, the following methods.

|

● privately negotiated transactions;

|

|

● underwritten transactions;

|

|

● exchange distributions and/or secondary distributions;

|

|

● sales in the over-the-counter market;

|

|

● ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

● sales by broker-dealers who agree with the selling stockholders to sell a specified number of such shares of Common Stock at a stipulated price per share;

|

|

● a block trade (which may involve crosses) in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

● purchases by a broker or dealer as principal and resale by such broker or dealer for its own account pursuant to this prospectus;

|

|

● short sales;

|

|

● through the writing of options on the shares, whether or not the options are listed on an options exchange;

|

|

● through the distributions of the shares of Common Stock by any selling stockholder to its partners, members or stockholders;

|

|

● a combination of any such methods of sale; and

|

|

● any other method permitted pursuant to applicable law.

|

In addition, the selling stockholders may from time to time sell shares of Common Stock in compliance with Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements under the Securities Act, rather than pursuant to this prospectus. In such event, the selling stockholders may be required by the securities laws of certain states to offer and sell the shares of Common Stock only through registered or licensed brokers or dealers.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of shares of Common Stock or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares of Common Stock may be underwriting discounts and commissions under the Securities Act. If any selling stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, then the selling stockholder will be subject to the prospectus delivery requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into with us and the selling stockholders, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act.

In connection with sales of shares of Common Stock under this prospectus, the selling stockholders may enter into hedging transactions with broker-dealers, who may in turn engage in short sales of shares of Common Stock in the course of hedging the positions they assume. The selling stockholders also may sell shares of Common Stock short and deliver them to close their short positions, or loan or pledge shares of Common Stock to broker-dealers that in turn may sell them. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction)

The selling stockholders may from time to time pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell such shares of Common Stock from time to time under this prospectus, or under an amendment to this prospectus under Rule 424 or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution, including the names of any underwriters, the purchase price and the proceeds the selling stockholders will receive from the sale of shares of Common Stock, any underwriting discounts and other items constituting underwriters’ compensation, any public offering price and any discounts or concessions allowed or reallowed or paid to dealers, and any other information we believe to be material.

The aggregate proceeds to the selling stockholders from the sale of shares of Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from any offering by the selling stockholders.

There can be no assurances that the selling stockholders will sell any or all of the shares of Common Stock offered under this prospectus.

Underwriters, dealers and agents may engage in transactions with, or perform services for, us in the ordinary course of our business.

DESCRIPTION OF COMMON STOCK TO BE REGISTERED

The following is a summary of our common stock and provisions of the Certificate of Incorporation and our Amended and Restated Bylaws, as amended (the “Bylaws”), and certain provisions of Delaware law. This summary does not purport to be complete and is qualified in its entirety by the provisions of the Certificate of Incorporation and the Bylaws. The Certificate of Incorporation and the Bylaws are incorporated by reference and filed as exhibits to the registration statement of which this prospectus forms a part.

Common Stock

Authorized and Outstanding Shares of Common Stock

The Certificate of Incorporation authorizes the issuance of 480,000,000 shares of Common Stock. As of July 7, 2021, there were 122,513,653 shares of Common Stock outstanding and held by 64 holders of record. The number of record holders is based upon the actual number of holders registered at such date and does not include holders of shares in “street name” or persons, partnerships, associated, corporations or entities in security position listings maintained by depositories.

Voting Power

Except as otherwise required by law or as otherwise provided in the certificates of designations for our series of preferred stock, including outstanding shares of our Series A Convertible Preferred Stock, Series B Convertible Preferred Stock and Series C Convertible Preferred Stock (collectively, the “Preferred Stock”), the holders of our Common Stock possess all voting power for the election of our directors and all other matters requiring stockholder action and will at all times vote together as one class on all matters submitted to a vote of our stockholders. The Bylaws provide that the voting standard for any matter (other than the election of directors) submitted to the Company’s stockholders is the affirmative vote of the holders of a majority of the stock present in person or represented by proxy and entitled to vote on such matter unless a different or minimum vote is required by law, the Certificate of Incorporation, the Bylaws, the rules and regulations of any stock exchange applicable to the Company, or any law or regulation applicable to the Company or its securities, in which case such different or minimum vote shall be the applicable vote on such matter. Holders of our shares of Common Stock are entitled to one vote per share on matters to be voted on by stockholders. Holders of shares of Preferred Stock vote on an as-converted basis with holders of our Common Stock.

Dividends

Subject to the prior rights of all classes or series of stock at the time outstanding having prior rights as to dividends or other distributions, including the Preferred Stock, the holders of our Common Stock are entitled to receive such dividends and other distributions, if any, as may be declared from time to time by the Board in its discretion out of funds legally available therefor and shall share equally on a per share basis in such dividends and distributions.

Liquidation, Dissolution and Winding Up

In the event of the voluntary or involuntary liquidation, dissolution, or winding-up of the Company, the holders of our Common Stock are entitled to receive their ratable and proportionate share of the remaining assets of the Company, after the rights of the holders of the Preferred Stock have been satisfied.

Election of Directors

The Board of Directors is currently divided into three classes, Class A, Class B and Class C, with only one class of directors being elected in each year and each class serving a three-year term. There is no cumulative voting with respect to the election of directors. Pursuant to the Bylaws, in uncontested elections, each director shall be elected by a majority of the votes cast with respect to such director, which means that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” such director. In contested elections, which are elections where the number of director nominees exceeds the number of directors to be elected, directors will be elected by a plurality of the votes cast at the meeting.

Dividends

We have not paid any cash dividends on shares of our Common Stock to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any dividends will be within the discretion of the Board of Directors.

Certain Anti-Takeover Provisions of Delaware Law

Staggered Board of Directors

The Certificate of Incorporation provides that the Board of Directors will be classified into three classes of directors of approximately equal size. As a result, in most circumstances, a person can gain control of the Board only by successfully engaging in a proxy contest at two or more annual meetings.

Special Meeting of Stockholders; Action by Written Consent

The Bylaws provide that special meetings of our stockholders may be called only by a majority vote of the Board of Directors. Additionally, the Certificate of Incorporation and Bylaws provide that stockholder action can be taken only at an annual or special meeting of stockholders and cannot be taken by written consent in lieu of a meeting.

Advance Notice Requirements for Stockholder Proposals and Director Nominations

The Bylaws provide that stockholders seeking to bring business before an annual meeting of stockholders or to nominate candidates for election as directors at an annual meeting of stockholders must provide timely notice of their intent in writing. To be timely, a stockholder’s notice must be delivered to or mailed and received at the Company’s principal executive offices not less than 60 days nor more than 90 days prior to the meeting. In the event that less than 70 days’ notice or prior public disclosure of the date of the annual meeting of stockholders is given or made to stockholders, a stockholder’s notice shall be timely if received at the Company’s principal executive offices no later than the close of business on the 10th day following the day on which such notice of the date of the annual meeting was mailed or such public was made, whichever first occurs. The Bylaws also specify certain requirements as to the form and content of a stockholders meeting. These provisions may preclude Company stockholders from bringing matters before an annual meeting of stockholders or from making nominations for directors at an annual meeting of stockholders.

Authorized but Unissued Shares

The Company’s authorized but unissued shares of Common Stock and Preferred Stock are available for future issuances without stockholder approval, subject to any limitations imposed by the Nasdaq Listing Rules. Such additional shares could be utilized for a variety of corporate purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Exclusive Forum Selection

The Certificate of Incorporation requires, to the fullest extent permitted by law, that derivative actions brought in Company’s name, actions against directors, officers and employees for breach of fiduciary duty and other certain actions be brought only in the Court of Chancery in the State of Delaware. Although Company believes this provision benefits it by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against Company’s directors and officers. However, the exclusive forum provision in the Certificate of Incorporation does not apply to suits brought to enforce any duty or liability created by the Exchange Act or the Securities Act or any claim with respect to which the federal courts have exclusive jurisdiction.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is Continental Stock Transfer & Trust Company, One State Street Plaza, 30th Floor, New York, NY 10004-1561.

Securities Exchange

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “NEXT.”

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of any securities to be offered will be passed upon for us by our counsel, K&L Gates LLP, Charlotte, North Carolina. Any underwriters will be represented by their own legal counsel.

EXPERTS

The audited financial statements incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

NextDecade Corporation

14,594,379 Shares of Common Stock

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the various expenses expected to be incurred by the Company in connection with the sale and distribution of the securities being registered hereby, other than underwriting discounts and commissions. All such expenses will be borne by the Company. All amounts are estimated except the Commission registration fee.

|

Commission registration fee

|

|

$

|

5,636.55

|

|

|

FINRA filing fee

|

|

$

|

(1)

|

|

|

Accounting fees and expenses

|

|

$

|

(1)

|

|

|

Legal fees and expenses

|

|

$

|

(1)

|

|

|

Printing expenses

|

|

$

|

(1)

|

|

|

Miscellaneous fees and expenses

|

|

$

|

(1)

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

(1)

|

|

|

(1)

|

Fees and expenses (other than the Commission registration fee to be paid upon the filing of this registration statement) will depend on the number and nature of the offerings of common stock and cannot be estimated at this time. An estimate of the aggregate expenses in connection with the issuance and distribution of the common stock being offered will be included in any applicable prospectus supplement.

|

Item 15. Indemnification of Directors and Officers

The Company is incorporated under the laws of the State of Delaware. Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”) allows a corporation to provide in its certificate of incorporation that a director of the corporation will not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except where the director breached the duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. The Certificate of Incorporation provides for this limitation of liability.

Section 145 of the DGCL provides that a Delaware corporation may indemnify any person who was, is or is threatened to be made party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was a director, an officer, an employee or an agent of such corporation or is or was serving at the request of such corporation as a director, an officer, an employee or an agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was illegal. A Delaware corporation may indemnify any persons who are, were or are threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason of the fact that such person is or was a director, an officer, an employee or an agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit, provided such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the corporation’s best interests, provided that no indemnification is permitted without judicial approval if the director, officer, employee or agent is adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him against the expenses which such officer or director has actually and reasonably incurred.

Under Section 6.1 of the Bylaws, the Company shall indemnify and provide advancement to any current or former director or officer of the Company (the “Indemnitee”) against any threatened, pending or completed action, suit, arbitration, mediation, alternate dispute resolution mechanism, investigation, inquiry, administrative hearing or any other actual, threatened or completed proceeding (as such term is more specifically defined in Section 6.7(c) of our Bylaws, the “Proceeding”) to the fullest extent permitted by law, as such may be amended from time to time. The Company shall indemnify such Indemnitee against all expenses, judgments, penalties, fines and amounts paid in settlement actually and reasonably incurred by him or her, or on his or her behalf, in connection with such Proceeding or any claim, issue or matter therein, if Indemnitee acted in good faith and in a manner Indemnitee reasonably believed to be in or not opposed to the best interests of the Company, and with respect to any criminal Proceeding, had no reasonable cause to believe Indemnitee’s conduct was unlawful.

The indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation or the Bylaws, agreement, vote of stockholders or disinterested directors or otherwise.

We expect to maintain standard policies of insurance that provide coverage (i) to our directors and officers against loss rising from claims made by reason of breach of duty or other wrongful act and (ii) to us with respect to indemnification payments that we may make to such directors and officers.

Item 16. Exhibits and Financial Statement Schedules

(a) Exhibits.

The exhibits listed below in the “Exhibit Index” are part of this Registration Statement and are incorporated herein by reference.

Item 17. Undertakings

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

|

|

|

|

provided, however, that paragraphs (a)(1)(i), (ii) and (iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the Registration Statement;

|

|

|

(2)

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

|

|

|

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

(A)

|

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the Registration Statement as of the date the filed prospectus was deemed part of and included in the Registration Statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the Registration Statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the Registration Statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided, however, that no statement made in a Registration Statement or prospectus that is part of the Registration Statement or made in a document incorporated or deemed incorporated by reference into the Registration Statement or prospectus that is part of the Registration Statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the Registration Statement or prospectus that was part of the Registration Statement or made in any such document immediately prior to such effective date;

|

|

|

(5)

|

That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(A)

|

Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(B)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

|

|

|

(C)

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

|

|

|

(D)

|

Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

EXHIBIT INDEX

* To be filed, if necessary, after effectiveness of this registration statement by an amendment to the Registration Statement or incorporated by reference from documents filed or to be filed with the Commission under the Exchange Act.

(1) Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed July 28, 2017.

(2) Incorporated by reference to Exhibit 3.2 of the Registrant’s Current Report on Form 8-K, filed July 28, 2017.

(3) Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed March 4, 2021.

(4) Incorporated by reference to Exhibit 4.1 of the Registrant’s Annual Report on Form 10-K, filed March 3, 2020.

(5) Incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K, filed March 18, 2021.

(6) Incorporated by reference to Exhibit 4.1 of the Registrant’s Current Report on Form 10-K, filed March 18, 2021.

** Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on July 15, 2021.

|

|

NEXTDECADE CORPORATION

|

|

|

|

|

|

By:

|

/s/ Brent Wahl

|

|

|

|

Brent Wahl

|

|

|

|

Chief Financial Officer

|

POWER OF ATTORNEY

Each of the undersigned officers and directors of NextDecade Corporation hereby constitutes and appoints Brent Wahl and Vera de Gyarfas and each of them, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all (i) amendments (including post-effective amendments) and additions to this Registration Statement of NextDecade Corporation on Form S-3 and (ii) to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in connection therewith, as fully and to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities set forth opposite their names and on July 15, 2021.

|

Name

|

|

Title

|

|

|

|

|

|

/s/ Matthew Schatzman

|

|

Chairman of the Board and Chief Executive Officer

|

|

Matthew Schatzman

|

|

(Principal Executive Officer)

|

|

|

|

|

|

/s/ Brent Wahl

|

|

Chief Financial Officer

|

|

Brent Wahl

|

|

(Principal Financial Officer)

|

|

|

|

|

|

/s/ Eric Garcia

|

|

Vice President and Chief Accounting Officer

|

|

Eric Garcia

|

|

(Principal Accounting Officer)

|

|

|

|

|

|

/s/ Khalifa Abdulla Al Romaithi

|

|

Director

|

|

Khalifa Abdulla Al Romaithi

|

|

|

|

|

|

|

|

/s/ Brian Belke

|

|

Director

|

|

Brian Belke

|

|

|

|

|

|

|

|

/s/ Frank Chapman

|

|

Director

|

|

Frank Chapman

|

|

|

|

/s/ Taewon Jun

|

|

Director

|

|

Taewon Jun

|

|

|

|

|

|

|

|

/s/ Avinash Kripalani

|

|

Director

|

|

Avinash Kripalani

|

|

|

|

|

|

|

|

/s/ Edward Andrew Scoggins, Jr.

|

|

Director

|

|

Edward Andrew Scoggins, Jr.

|

|

|

|

|

|

|

|

/s/ William Vrattos

|

|

Director

|

|

William Vrattos

|

|

|

|

|

|

|

|

/s/ Spencer Wells

|

|

Director

|

|

Spencer Wells

|

|

|

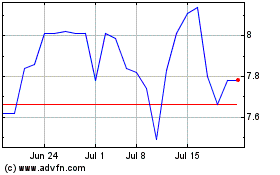

NextDecade (NASDAQ:NEXT)

Historical Stock Chart

From Aug 2024 to Sep 2024

NextDecade (NASDAQ:NEXT)

Historical Stock Chart

From Sep 2023 to Sep 2024