Newtek Business Services Corp. Declares a Fourth Quarter 2022 Distribution of $0.70 per Share

November 17 2022 - 1:15PM

Newtek Business Services Corp., (NASDAQ: NEWT), an internally

managed business development company (“BDC”), today announced that

its Board of Directors declared a fourth quarter 2022 cash

distribution of $0.70 per share1, payable on December 30, 2022 to

shareholders of record as of December 20, 2022.

1Note regarding Dividend Payments: The Company's

Board of Directors expects to maintain a dividend policy with the

objective of distributing 90 – 100% of the Company’s 2022 taxable

income. This distribution includes a spillover dividend of the

Company’s retained earnings. The determination of the tax

attributes of the Company's distributions is made annually as of

the end of the Company's fiscal year based upon its taxable income

for the full year and distributions paid for the full year.

Newtek Business Services Corp., Your Business Solutions

Company®, is an internally managed BDC, which along with its

controlled portfolio companies, provides a wide range of business

and financial solutions under the Newtek® brand to the small- and

medium-sized business (“SMB”) market. Since 1999, Newtek has

provided state-of-the-art, cost-efficient products and services and

efficient business strategies to SMB relationships across all 50

states to help them grow their sales, control their expenses and

reduce their risk.

Newtek’s and its portfolio companies’ products and services

include: Business Lending, SBA Lending Solutions, Electronic

Payment Processing, Technology Solutions (Cloud Computing, Data

Backup, Storage and Retrieval, IT Consulting), eCommerce, Accounts

Receivable Financing & Inventory Financing, Insurance

Solutions, Web Services, and Payroll and Benefits Solutions.

Newtek® and Your Business Solutions Company® are

registered trademarks of Newtek Business Services Corp.

Note Regarding Forward Looking

Statements

This press release contains certain

forward-looking statements. Words such as “believes,” “intends,”

“expects,” “projects,” “anticipates,” “forecasts,” “goal” and

“future” or similar expressions are intended to identify

forward-looking statements. All forward-looking statements involve

a number of risks and uncertainties that could cause actual results

to differ materially from the plans, intentions and expectations

reflected in or suggested by the forward-looking statements. Such

risks and uncertainties include, among others, include our ability

to close the pending acquisition of the National Bank of New York

City (the “Transaction”), obtain required regulatory approvals for

the pending Transaction, the timing of the closing of the

Transaction, the timing of the Company’s discontinuance from

regulation as a BDC under the 1940 Act, projections concerning or

considering the pending Transaction, the timing of our ability to

originate new investments, achieve certain margins and levels of

profitability, the availability of additional capital and the

ability to maintain certain debt to asset ratios, intensified

competition, operating problems and their impact on revenues and

profit margins, anticipated future business strategies and

financial performance, anticipated future number of customers,

business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions, which

could cause Newtek’s actual results to differ from management’s

current expectations, are contained in Newtek’s filings with the

Securities and Exchange Commission and available through

http://www.sec.gov/. Newtek cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements.

SOURCE: Newtek Business Services Corp.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

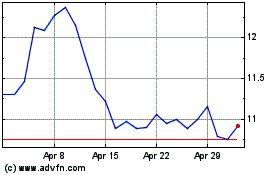

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Aug 2024 to Sep 2024

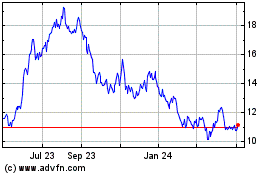

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Sep 2023 to Sep 2024