New York Mortgage Trust Declares Fourth Quarter 2023 Common Stock Dividend of $0.20 Per Share, and Preferred Stock Dividends

December 14 2023 - 5:08PM

New York Mortgage Trust, Inc. (Nasdaq: NYMT) (the “Company”)

announced today that its Board of Directors (the “Board”) declared

a regular quarterly cash dividend of $0.20 per share on shares of

its common stock for the quarter ending December 31, 2023. The

dividend will be payable on January 26, 2024 to common stockholders

of record as of the close of business on December 26, 2023.

In addition, the Board declared cash dividends

on the Company’s 8.000% Series D Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock (“Series D Preferred Stock”), 7.875%

Series E Fixed-to-Floating Rate Cumulative Redeemable Preferred

Stock (“Series E Preferred Stock”), 6.875% Series F

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

(“Series F Preferred Stock”) and 7.000% Series G Cumulative

Redeemable Preferred Stock (“Series G Preferred Stock”) as stated

below.

Quarterly Preferred Stock DividendsThe Board

declared cash dividends for the dividend period that began on

October 15, 2023 and ends on January 14, 2024 as follows:

|

Class of Preferred Stock |

|

Series D |

|

Series E |

|

Series F |

|

Series G |

|

Record Date |

|

January 1, 2024 |

|

January 1, 2024 |

|

January 1, 2024 |

|

January 1, 2024 |

|

Payment Date |

|

January 15, 2024 |

|

January 15, 2024 |

|

January 15, 2024 |

|

January 15, 2024 |

|

Cash Dividend Per Share |

|

$0.50 |

|

$0.4921875 |

|

$0.4296875 |

|

$0.4375 |

About New York Mortgage

TrustNew York Mortgage Trust, Inc. is a Maryland

corporation that has elected to be taxed as a real estate

investment trust (“REIT”) for federal income tax purposes. NYMT is

an internally managed REIT in the business of acquiring, investing

in, financing and managing primarily mortgage-related single-family

and multi-family residential assets.

Forward-Looking StatementsWhen

used in this press release, in future filings with the Securities

and Exchange Commission (the “SEC”) or in other written or oral

communications, statements which are not historical in nature,

including those containing words such as “will,” “believe,”

“expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,”

“could,” “would,” “should,” “may” or similar expressions, are

intended to identify “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and, as such, may involve known and unknown

risks, uncertainties and assumptions. Statements regarding the

following subject, among others, may be forward-looking: the

payment of dividends.

Forward-looking statements are based on

estimates, projections, beliefs and assumptions of management of

the Company at the time of such statements and are not guarantees

of future performance. Forward-looking statements involve risks and

uncertainties in predicting future results and conditions. Actual

results and outcomes could differ materially from those projected

in these forward-looking statements due to a variety of factors,

including, without limitation: changes in the Company’s business

and investment strategy; inflation and changes in interest rates

and the fair market value of the Company’s assets, including

negative changes resulting in margin calls relating to the

financing of the Company’s assets; changes in credit spreads;

changes in the long-term credit ratings of the U.S., Fannie Mae,

Freddie Mac, and Ginnie Mae; general volatility of the markets in

which the Company invests; changes in prepayment rates on the loans

the Company owns or that underlie the Company’s investment

securities; increased rates of default, delinquency or vacancy

and/or decreased recovery rates on or at the Company’s assets; the

Company’s ability to identify and acquire targeted assets,

including assets in its investment pipeline; the Company's ability

to dispose of assets from time to time on terms favorable to it,

including the disposition over time of its joint venture equity

investments; changes in relationships with the Company’s financing

counterparties and the Company’s ability to borrow to finance its

assets and the terms thereof; changes in the Company's

relationships with and/or the performance of its operating

partners; the Company’s ability to predict and control costs;

changes in laws, regulations or policies affecting the Company’s

business; the Company’s ability to make distributions to its

stockholders in the future; the Company’s ability to maintain its

qualification as a REIT for federal tax purposes; the Company’s

ability to maintain its exemption from registration under the

Investment Company Act of 1940, as amended; and risks associated

with investing in real estate assets, including changes in business

conditions and the general economy, the availability of investment

opportunities and the conditions in the market for Agency RMBS,

non-Agency RMBS, ABS and CMBS securities, residential loans,

structured multi-family investments and other mortgage-,

residential housing- and credit-related assets.

These and other risks, uncertainties and

factors, including the risk factors described in the Company’s

reports filed with the SEC pursuant to the Exchange Act, could

cause the Company’s actual results to differ materially from those

projected in any forward-looking statements the Company makes. All

forward-looking statements speak only as of the date on which they

are made. New risks and uncertainties arise over time and it is not

possible to predict those events or how they may affect the

Company. Except as required by law, the Company is not obligated

to, and does not intend to, update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

For Further Information

AT THE COMPANYInvestor RelationsPhone: 212-792-0107Email:

InvestorRelations@nymtrust.com

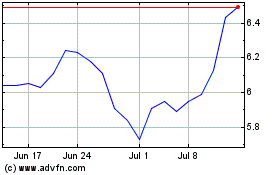

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

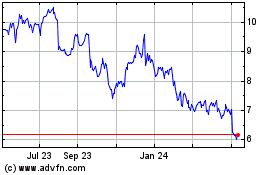

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Nov 2023 to Nov 2024