Current Report Filing (8-k)

December 01 2021 - 9:01AM

Edgar (US Regulatory)

false000093313600009331362021-12-012021-12-01

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 1, 2021

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-14667

|

|

91-1653725

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

COOP

|

The Nasdaq Stock Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 Regulation FD Disclosure.

On December 1, 2021, Mr. Cooper Group Inc. (the “Company”) disclosed an update to its 4Q’21 guidance, including the following:

|

●

|

The Company expects Originations pretax operating income at the high-end of the guidance range of $150-$175 million previously disclosed.

|

|

●

|

Servicing pretax operating income is expected to be higher than prior guidance of $10 million on higher EBO revenues.

|

|

●

|

Reverse sale is on track to close in December 2021.

|

The information furnished pursuant to this Item 7.01 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), nor will such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and

assumptions. Our actual results could differ materially from those predicted or implied. Undue reliance should not be placed on the forward-looking statements in this Current Report on Form 8-K. We assume no obligation to update such statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

Mr. Cooper Group Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: December 1, 2021

|

By:

|

/s/ Christopher G. Marshall

|

|

|

|

|

Christopher G. Marshall

|

|

|

|

|

Vice Chairman, President & Chief Financial

|

|

|

|

|

Officer

|

|

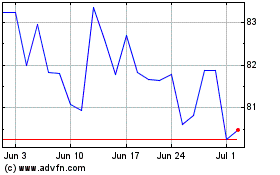

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Oct 2024 to Nov 2024

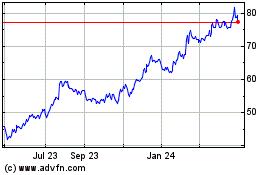

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Nov 2023 to Nov 2024