Monster Beverage Corporation (“Monster”) (NASDAQ: MNST) announced

today the final results of its modified “Dutch auction” tender

offer, which expired at 11:59 p.m., New York City time, on June 5,

2024.

Based on the final count by Equiniti Trust Company, LLC, the

depositary for the tender offer, a total of 119,018,767 shares of

Monster’s common stock were validly tendered and not validly

withdrawn at the final purchase price of $53.00 per share or as

purchase price tenders, which includes shares that were tendered

through notice of guaranteed delivery at the final purchase price

of $53.00 per share or as purchase price tenders.

In accordance with the terms and conditions of the tender offer,

Monster accepted for purchase a total of 56,603,773 shares of its

common stock, representing approximately 5.4% of the shares issued

and outstanding immediately prior to the completion of the

purchase, at the final purchase price of $53.00 per share, for an

aggregate purchase price of approximately $3.0 billion, excluding

fees and expenses relating to the tender offer.

Because the number of shares tendered at the final purchase

price of $53.00 per share or as purchase price tenders would have

exceeded the aggregate purchase price of the tender offer, shares

were accepted for purchase on a pro rata basis, except for tenders

of “odd lots,” which will be accepted in full, and conditional

tenders that will automatically be regarded as withdrawn because

the condition was not satisfied. Monster has been informed by the

depositary that the final proration factor for the tender offer is

approximately 47.18%. The depositary will promptly pay for all the

shares accepted for purchase pursuant to the tender offer and will

return all other shares tendered and not purchased.

Rodney Sacks and Hilton Schlosberg, who are Monster’s Co-CEOs

and members of the Board of Directors, tendered 608,114 and 350,000

shares, respectively, that they beneficially own. Of these shares,

286,918 and 165,135, respectively, were accepted for purchase by

Monster in the tender offer.

Sterling Trustees LLC, which controls certain trusts and

entities for the benefit of certain family members of Messrs. Sacks

and Schlosberg, tendered 8,450,000 shares on behalf of such trusts

and entities. Of these shares, 3,986,853 were accepted for purchase

by Monster in the tender offer.

Monster may purchase additional shares in the future in the open

market subject to market conditions, or in private transactions,

exchange offers, tender offers or otherwise. Under applicable

securities laws, however, Monster may not repurchase any shares

until June 21, 2024. Whether Monster makes additional repurchases

in the future will depend on many factors, including the market

price of the shares, Monster’s business and financial condition and

general economic and market conditions.

Evercore Group L.L.C. and J.P. Morgan Securities LLC acted as

dealer managers for the tender offer. D.F. King served as the

information agent, and Equiniti Trust Company, LLC acted as the

depositary. Questions regarding the tender offer may be directed to

Evercore Group L.L.C. at (888) 474-0200 or J.P. Morgan Securities

LLC at (877) 371-5947.

Monster Beverage Corporation

Based in Corona, California, Monster Beverage Corporation is a

holding company and conducts no operating business except through

its consolidated subsidiaries. Monster’s subsidiaries develop and

market energy drinks, including Monster Energy® drinks, Monster

Energy Ultra® energy drinks, Juice Monster® Energy + Juice energy

drinks, Java Monster® non-carbonated coffee + energy drinks, Rehab®

Monster® non-carbonated energy drinks, Monster Energy® Nitro energy

drinks, Reign® Total Body Fuel high performance energy drinks,

Reign Inferno® thermogenic fuel high performance energy drinks,

Reign Storm® total wellness energy drinks, NOS® energy drinks, Full

Throttle® energy drinks, Bang Energy® drinks, BPM® energy drinks,

BU® energy drinks, Burn® energy drinks, Gladiator® energy drinks,

Live+® energy drinks, Mother® energy drinks, Nalu® energy drinks,

Play® and Power Play® (stylized) energy drinks, Relentless® energy

drinks, Samurai® energy drinks, Ultra Energy® drinks, Predator®

energy drinks and Fury® energy drinks. Monster’s subsidiaries also

develop and market still and sparkling waters under the Monster

Tour Water® brand name. Monster’s subsidiaries also develop and

market craft beers, hard seltzers and flavored malt beverages under

a number of brands, including Jai Alai® IPA, Dale’s Pale Ale®,

Dallas Blonde®, Wild Basin® hard seltzers, The Beast Unleashed® and

Nasty Beast™ Hard Tea. For more information visit

www.monsterbevcorp.com.

Caution Concerning Forward-Looking

Statements

Certain statements made in this announcement may constitute

“forward-looking statements.” Monster cautions that these

statements are based on management’s current knowledge and

expectations and are subject to certain risks and uncertainties,

many of which are outside of the control of Monster, that could

cause actual results and events to differ materially from the

statements made herein. For a more detailed discussion of the risks

that could affect Monster’s operating results, see Monster’s

reports filed with the Securities and Exchange Commission,

including Monster’s annual report on Form 10-K for the year ended

December 31, 2023 and subsequently filed reports. Monster’s actual

results could differ materially from those contained in the

forward-looking statements, including with respect to the tender

offer.

CONTACTS:Rodney C. Sacks Chairman and Co-Chief Executive Officer

(951) 739-6200

Hilton H. Schlosberg Vice Chairman and Co-Chief Executive

Officer (951) 739-6200

Roger S. Pondel / Judy LinPondelWilkinson Inc.(310) 279-5980

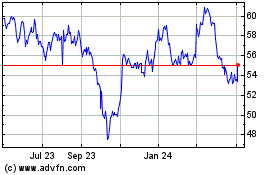

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Dec 2024 to Jan 2025

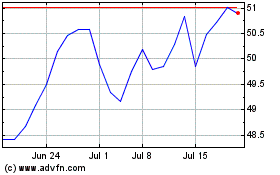

Monster Beverage (NASDAQ:MNST)

Historical Stock Chart

From Jan 2024 to Jan 2025