Methanex Corporation (“Methanex” or the “Company”) (TSX:MX)

(NASDAQ:MEOH) announced today that it has entered into a definitive

agreement to acquire OCI Global’s (“OCI”) international methanol

business for $2.05 billion. The transaction includes OCI’s interest

in two world-scale methanol facilities in Beaumont, Texas, one of

which also produces ammonia. The transaction also includes a

low-carbon methanol production and marketing business and a

currently idled methanol facility in the Netherlands.

“This is a unique opportunity to create value by

acquiring two highly attractive North American methanol assets that

will further strengthen our global production base and we expect it

will be immediately accretive to free cash flow per share,” said

Rich Sumner, President and Chief Executive Officer of Methanex.

“The Beaumont plants benefit from access to North America’s

abundant and favourably-priced supply of natural gas feedstock, and

are expected to increase our global methanol production by over 20

percent.”

“We believe the transaction will provide

significant long-term value to Methanex shareholders while aligning

with our strategic objectives of industry leadership, operational

excellence, and financial resiliency,” said Mr. Sumner. “From an

operating perspective, we have a shared culture of safety and

operational excellence, and we expect the OCI team will help us

build new skills in ammonia while enhancing our capabilities in the

evolving business of low carbon methanol production and

marketing.”

Nassef Sawiris, Executive Chairman of OCI,

added, “We are pleased with the opportunity to achieve a

significant ownership position and are highly confident in

Methanex’s ability to create enduring value for shareholders. As

the global leader committed to safety and operational excellence,

we identified Methanex as the natural owner of OCI Methanol at the

outset of our strategic process, which we initiated in the spring

of 2023.”

Strategic fit that enhances Methanex’s

asset portfolio

OCI’s methanol business enhances Methanex’s

asset portfolio with highly attractive assets in a low-risk

jurisdiction that has an ample and economic supply of feedstock

natural gas.

As part of the transaction, Methanex expects to

achieve approximately $30 million of annual cost synergies from

lower logistics costs and lower selling, general and administrative

expenses. Methanex anticipates low integration costs because of

OCI’s similar operating model and expects that additional value can

be obtained by applying its global expertise and extensive

operational experience to the OCI assets. Methanex plans to

integrate key operational practices at the facilities and will

incorporate the OCI assets into its global risk-based management

processes including turnaround and capital planning

post-closing.

OCI’s ammonia production, while modest compared

with its methanol production, provides Methanex with a low-risk

entry into a new and synergistic commodity in an adjacent and

complementary segment to methanol with similar feedstock-based

advantages. In addition to industrial and agricultural uses,

ammonia has low-carbon alternative fuel capabilities for power

generation and as a marine fuel and is a revenue diversification

opportunity for Methanex.

Dean Richardson, Senior Vice President, Finance

& Chief Financial Officer of Methanex, said, “We expect the

acquisition to add incremental annual Adjusted EBITDA of $275

million to our expected run-rate Adjusted EBITDA of $850 million at

a $350/MT realized methanol price1. We remain firmly committed to

maintaining financial flexibility and have in place a robust

financing plan that will support de-levering to our target range of

2.5 to 3.0 times debt/Adjusted EBITDA within approximately 18

months from closing, assuming an average realized price of $350/MT.

The plan includes the repayment of our $300 million bond as

scheduled in December 2024.”

Ahmed El Hoshy, CEO of OCI, said, “This is an

outstanding strategic fit for Methanex. We look forward to working

closely with Methanex’s management to fully integrate the business

after closing, and to ensure continuity and successful stewardship

of the business.”

As part of the transaction, Methanex will

acquire the following:

- A methanol facility in Beaumont,

Texas with an annual production capacity of 910,000 tonnes of

methanol and 340,000 tonnes of ammonia. This plant was restarted in

2011 and since that time the plant has been upgraded with $800

million of capital for full site refurbishment and

debottlenecking.

- A 50 percent interest in a second

methanol facility also in Beaumont, Texas, operated by the joint

venture Natgasoline LLC (“Natgasoline”). The Natgasoline plant was

commissioned in 2018 and has an annual capacity of 1.7 million

tonnes of methanol, of which Methanex’s share will be 850,000

tonnes.

- OCI HyFuels, which produces

low-carbon methanol and sells industry-leading volumes with trading

and distribution capabilities for renewable natural gas (RNG). With

nine years of experience in the low-carbon methanol business and

with an array of blue-chip customers, this will enhance Methanex’s

existing Low Carbon Solutions function with additional expertise in

this developing segment.

- A methanol facility in Delfzijl,

Netherlands with an annual capacity to produce 1 million tonnes of

methanol. This facility is not currently in production due to

unfavourable pricing for natural gas feedstock.

Purchase price

Under a definitive agreement with OCI, the $2.05

billion purchase price will consist of $1.15 billion in cash, the

issuance of 9.9 million common shares of Methanex valued at $450

million (based on a $45 per share price) and the assumption of $450

million in debt and leases. The purchase price implies a multiple

of 7.5 times Adjusted EBITDA at a $350/MT realized methanol price,

including anticipated synergies. The world-scale North American

operating assets have been acquired below reinvestment economics of

brownfield or greenfield capacity.

After the transaction Methanex will have

approximately 77 million shares outstanding, of which OCI will own

approximately 13 percent. Methanex intends to fund the cash

consideration of the transaction through a combination of cash on

hand and new debt issuance. The Company has obtained a fully

committed debt financing package from Royal Bank of Canada to

support the transaction.

Next Steps

Closing of the transaction is expected in the

first half of 2025. The transaction has been approved by the boards

of directors of both companies and is subject to receipt of certain

regulatory approvals and other closing conditions including TSX

approval for the issuance of Methanex shares to OCI.

The transaction is also subject to approval by a

simple majority of the shareholders of OCI. The largest shareholder

of OCI, has signed an agreement to vote for the transaction.

There is currently a legal proceeding

between OCI and its Natgasoline joint venture partner over certain

shareholder rights. The obligation of Methanex to purchase OCI’s

50% stake in Natgasoline is subject to the resolution of this legal

proceeding. If it is not settled within a certain period, Methanex

has the option to carve out the purchase of the Natgasoline

joint venture and close only on the remainder of the transaction.

If Methanex elects to complete the transaction on a carved out

basis, it will retain the right to acquire OCI’s joint venture

interest for a specified period thereafter at its sole option.

Approximately 40% of the gross transaction and operating metrics

are attributable to Natgasoline. Substantially all the debt in the

total transaction is attributable to Natgasoline.

Advisors

Methanex’s financial advisors for the

transaction were Deutsche Bank and RBC Capital Markets. McCarthy

Tétrault LLP, Baker McKenzie LLP, Loyens & Loeff N.V. and Reed

Smith LLP acted as legal counsel for Methanex. Deutsche Bank and

RBC Capital Markets provided fairness opinions to Methanex’s Board

of Directors.

Conference call and webcast

A conference call for investors and analysts

will be hosted on September 9, 2024 at 6 am PST/ 9am EST. A

presentation outlining the transaction and details on how to access

the conference call will be available on the Investor Relations

page of our website.

About Methanex

Methanex is a Vancouver-based, publicly traded

company and is one of the world’s largest suppliers of methanol.

Methanex shares are listed for trading on the Toronto Stock

Exchange in Canada under the trading symbol “MX” and on the NASDAQ

Global Market in the United States under the trading symbol “MEOH”.

Methanex can be visited online at www.methanex.com.

Cautionary Statements Regarding

Forward-Looking Information

The information in this press release contains

certain forward-looking statements, including within the meaning of

applicable securities laws in Canada and the United States. These

statements relate to future events or our future intentions or

performance. All statements other than statements of historical

fact may be forward-looking statements. Forward-looking statements

are often, but not always, identified by the use of words such as

“anticipate”, “continue”, “demonstrate”, “expect”, “may”, "call

for", “can”, “will”, “believe”, “would” and similar expressions and

include statements relating to, among other things: the expected

benefits of the transaction, including benefits related to

anticipated synergies and commodity diversification; expected

increase and potential upside in our global methanol production;

our debt reduction and deleveraging plans; increased methanol

production and its anticipated impact on our financial profile;

integration costs; anticipated synergies and our ability to achieve

such synergies following closing of the transaction; integration

plans, including incorporating acquired assets into our global

risk-based management processes; near-term target markets; and the

anticipated closing date of the transaction.

Certain material factors or assumptions were

applied in drawing the conclusions or making the forecasts or

projections that are included in these forward-looking statements,

including future expectations and assumptions concerning the

receipt of all regulatory approvals required to complete the

transaction; our ability to realize the expected strategic,

financial and other benefits of the transaction in the timeframe

anticipated or at all; integration costs, logistics costs and

general and administrative expenses associated with the

transaction; the average realized price per metric ton of methanol;

our continued access to export shipping channels, the cost and

supply of natural gas feedstock in North America; production

capacity levels of acquired assets and facilities and subsequent

increase in our methanol production; the industrial and

agricultural uses of ammonia; the supply of, demand for and price

of methanol, methanol derivatives, natural gas, coal, oil and oil

derivatives; our ability to procure natural gas feedstock on

commercially acceptable terms; the availability of committed credit

facilities and other financing; absence of a material negative

impact from major natural disasters; absence of a material negative

impact from changes in laws or regulations; and absence of a

material negative impact from political instability in the

countries in which we operate. Readers are cautioned that the

foregoing lists of factors are not exhaustive.

However, forward-looking statements, by their

nature, involve risks and uncertainties that could cause actual

results to differ materially from those contemplated by the

forward-looking statements. The risks and uncertainties primarily

include those that impact our ability to complete and generate the

expected benefits of the transaction and risks and uncertainties

attendant producing and marketing methanol and successfully

carrying out major capital expenditure projects in various

jurisdictions, including risks and uncertainties related to the

receipt of regulatory approvals; our ability to complete or

otherwise realize the anticipated benefits of the transaction

within the anticipated timeframe or at all; our ability to

successfully integrate the acquired business into our existing

business and the cost and timing of such integration;; changes in

future commodity prices relative to our anticipated forecasts;

conditions in the methanol and other industries, including

fluctuations in the supply, demand and price for methanol and its

derivatives, including demand for methanol for energy uses, the

price of natural gas, coal, oil and oil derivatives; our ability to

obtain natural gas feedstock on commercially acceptable terms to

underpin current operations; future production growth

opportunities; our ability to carry out corporate initiatives and

strategies; actions of competitors, suppliers and financial

institutions; conditions within the natural gas delivery systems

that may prevent delivery of our natural gas supply requirements;

competing demand for natural gas, especially with respect to any

domestic needs for gas and electricity; actions of governments and

governmental authorities, including, without limitation,

implementation of policies or other measures that could impact the

supply of or demand for methanol or its derivatives; changes in

laws and regulations including the adoption of new environmental

laws and regulations and changes in how they are interpreted and

enforced; ability to comply with current and future environmental

or other laws; import or export restrictions, anti-dumping

measures, increases in duties, taxes and government royalties and

other actions by governments that may adversely affect our

operations or existing contractual arrangements; other risks

identified in our Second Quarter 2024 MD&A.

Readers are cautioned that undue reliance should

not be placed on forward-looking information as actual results may

vary materially from the forward-looking information. Methanex does

not undertake to update, correct or revise any forward-looking

information as a result of any new information, future events or

otherwise, except as may be required by applicable law.

Footnote 1: Illustrative Adjusted EBITDA

capabilities assumptions (non-GAAP measures)

Note that Adjusted EBITDA is a forward-looking

non-GAAP measure that does not have any standardized meaning

prescribed by GAAP and therefore is unlikely to be comparable

to similar measures presented by other companies.

For a description and historical Adjusted EBITDA

for Methanex Corporation, refer to Additional Information

- Non-GAAP Measures in the Company’s 2023 Annual MD&A and

Second Quarter 2024 MD&A.

Adjusted EBITDA reflects Methanex’s

proportionate ownership interest. Methanex production is based on

plants operating at full capacity except for Chile (1.25 mmt), New

Zealand (1 mmt) and in Trinidad, Titan operating at full rates and

Atlas idled. We target to hedge ~70% of our existing North American

natural gas requirements. The unhedged portion of our North

American natural gas requirements are purchased under contracts at

spot prices. Estimates assume Henry Hub natural gas price of

~$3.50/mmbtu based on forward curve. Gas contracts outside of

North America are methanol sharing contracts with a base price for

natural gas plus sharing as methanol prices increase.

Adjusted EBITDA reflects OCI’s proportionate

ownership interest. OCI’s production is based on the Beaumont and

Natgasoline plants operating at 90% operating rates. This includes

ammonia production from Beaumont. Natural gas costs are assumed to

be 100% unhedged and assume Henry Hub natural gas price of

~$3.50/mmbtu based on the forward curve.

Run-rate Adjusted EBITDA figures include ~$30M of cost synergies

from logistics optimization and SG&A improvements including

from the expected optimization of methanol storage capacity.

For further information, contact:

Methanex Investor InquiriesSarah

HerriottDirector, Investor RelationsMethanex Corporation

604-661-2600 or Toll Free: 1-800-661-8851www.methanex.com

Methanex Media InquiriesJim

FitzpatrickDirector, CommunicationsMethanex

Corporation604-895-5359

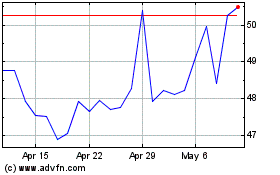

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Oct 2024 to Nov 2024

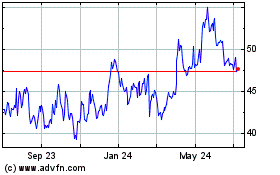

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Nov 2023 to Nov 2024