Statement of Changes in Beneficial Ownership (4)

May 22 2020 - 6:26PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

LAMPROPOULOS FRED P |

2. Issuer Name and Ticker or Trading Symbol

MERIT MEDICAL SYSTEMS INC

[

MMSI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

PRESIDENT AND CEO |

|

(Last)

(First)

(Middle)

1600 WEST MERIT PARKWAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/20/2020 |

|

(Street)

SOUTH JORDAN, UT 84095

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, No Par Value | 5/20/2020 | | M | | 5000 | A | $12.06 | 6269 | I | By spouse |

| Common Stock, No Par Value | 5/20/2020 | | S | | 5000 | D | $44 (1) | 1269 | I | By spouse |

| Common Stock, No Par Value | | | | | | | | 95467 | I | By 401(k) Plan (2) |

| Common Stock, No Par Value | | | | | | | | 90 | I | By spouse as custodian for child |

| Common Stock, No Par Value | | | | | | | | 967916 | D |

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-qualified stock options (right to buy) | $12.06 | 5/20/2020 | | M | | | 5000 | 10/4/2015 (3) | 10/4/2021 | Common Stock | 5000 | $0 | 0 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $17.27 | | | | | | | 2/13/2016 (5) | 2/13/2022 | Common Stock | 5000 | | 5000 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $16.05 | | | | | | | 1/28/2017 (6) | 1/28/2023 | Common Stock | 50000 | | 50000 | D |

|

| Non-qualified stock options (right to buy) | $16.05 | | | | | | | 1/28/2017 (6) | 1/28/2023 | Common Stock | 7500 | | 7500 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $28.20 | | | | | | | 4/14/2018 (7) | 4/14/2024 | Common Stock | 200000 | | 200000 | D |

|

| Non-qualified stock options (right to buy) | $28.20 | | | | | | | 4/14/2018 (7) | 4/14/2024 | Common Stock | 10000 | | 10000 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $44.80 | | | | | | | 3/2/2019 (8) | 3/2/2025 | Common Stock | 38002 | | 38002 | D |

|

| Non-qualified stock options (right to buy) | $44.80 | | | | | | | 3/2/2019 (8) | 3/2/2025 | Common Stock | 10000 | | 10000 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $55.73 | | | | | | | 3/1/2020 (9) | 3/1/2026 | Common Stock | 159151 | | 159151 | D |

|

| Non-qualified stock options (right to buy) | $55.73 | | | | | | | 3/1/2020 (9) | 3/1/2026 | Common Stock | 10000 | | 10000 | I | See footnote (4) |

| Non-qualified stock options (right to buy) | $37.71 | | | | | | | 2/26/2021 (10) | 2/26/2027 | Common Stock | 100334 | | 100334 | D |

|

| Performance Stock Units | (11) | | | | | | | 3/15/2021 (12) | 3/15/2023 (11) | Common Stock | 21215 (13) | | 21215 | D |

|

| Explanation of Responses: |

| (1) | The price reported in Column 4 of Table 1 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $44.00 to $44.01, inclusive. The Reporting Person undertakes to provide to Merit Medical Systems, Inc., any security holder of Merit Medical Systems, Inc., or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the range set forth in this Form 4. |

| (2) | Represents plan holdings as of 5/20/2020. |

| (3) | Becomes exercisable in equal annual installments of 20% commencing 10/4/2015. |

| (4) | Represents derivative securities held by the spouse of the reporting person. The reporting person expressly disclaims beneficial ownership of the securities owned by his spouse. |

| (5) | Becomes exercisable in equal annual installments of 20% commencing 2/13/2016. |

| (6) | Becomes exercisable in equal annual installments of 20% commencing 1/28/2017. |

| (7) | Becomes exercisable in equal annual installments of 20% commencing 4/14/2018. |

| (8) | Becomes exercisable in equal annual installments of 20% commencing 3/2/2019. |

| (9) | Becomes exercisable in equal annual installments of 20% commencing 3/1/2020. |

| (10) | Becomes exercisable in equal annual installments of 25% commencing 2/26/2021. |

| (11) | Each performance share unit represents the Company's commitment to issue one share of Merit Medical Systems, Inc. common stock, subject to achievement of performance criteria. |

| (12) | If earned by the Reporting Person, the PSUs will be awarded not later than March 15 of the year following the Issuer's achievement of the target level of free cash flow, subject to conditions set forth in the Performance Stock Unit Award Agreement. |

| (13) | On February 26, 2020, the reporting person was awarded a target number of performance share units ("PSUs") pursuant to a Performance Stock Unit Award Agreement by and between the Reporting Person and the Issuer. The actual number of PSUs to be awarded to the Reporting Person will be based upon the Issuer's free cash flow measured against its 2020 financial plan over one, two and three-year periods ending December 31, 2020, 2021 and 2022, respectively, and subject to the Reporting Person's continued employment with the Issuer and the conditions set forth in the Stock Unit Award Agreement. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

LAMPROPOULOS FRED P

1600 WEST MERIT PARKWAY

SOUTH JORDAN, UT 84095 | X |

| PRESIDENT AND CEO |

|

Signatures

|

| /s/ Brian G. Lloyd, Attorney-in-Fact | | 5/22/2020 |

| **Signature of Reporting Person | Date |

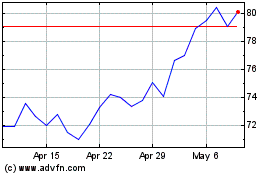

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Aug 2024 to Sep 2024

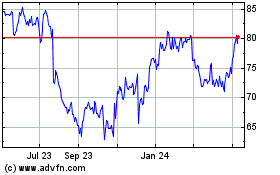

Merit Medical Systems (NASDAQ:MMSI)

Historical Stock Chart

From Sep 2023 to Sep 2024