false

--12-31

0001938046

0001938046

2025-01-09

2025-01-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 9, 2025

MANGOCEUTICALS,

INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

001-41615 |

|

87-3841292 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

15110

N. Dallas Parkway, Suite 600

Dallas,

Texas |

|

75248 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (214) 242-9619

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 Par Value Per Share |

|

MGRX |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.03 Material Modification to Rights of Security Holders.

The

information set forth in Item 5.03, below, is incorporated by reference into this Item 3.03 in its entirety.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

January 9, 2025, Mango & Peaches Corp. (“M&P”), the current wholly-owned subsidiary of Mangoceuticals, Inc.,

a Texas corporation (the “Company”, “we” and “us”), filed a Certificate of Designations

of Mango & Peaches Corp., establishing the designations, preferences, limitations, and relative rights of its Series A Super Majority

Voting Preferred Stock (the “Series A Preferred Stock”), with the Secretary of State of Texas, which was filed by

the Texas Secretary of State on January 15, 2025, effective January 9, 2025 (the “Series A Designation”). The Series

A Designation designated 100 shares of Series A Preferred Stock, the rights of which are discussed in greater detail below:

Series

A Super Majority Voting Preferred Stock

The

Series A Designation provides for the Series A Preferred Stock to have the following rights:

Dividend

Rights. The Series A Preferred Stock do not accrue dividends.

Liquidation

Preference. The Series A Preferred Stock have no liquidation preference.

Conversion

Rights. The Series A Preferred Stock have no conversion rights.

Voting

Rights. For so long as any shares of Series A Preferred Stock remain issued and outstanding, the holders thereof, voting separately

as a class, have the right to vote on all shareholder matters (including, but not limited to at every meeting of the stockholders of

M&P and upon any action taken by stockholders of M&P with or without a meeting) equal to fifty-one percent (51%) of the total

vote (the “Total Series A Vote” and the “Voting Rights”). For example, if there are 10,000 shares

of M&P’s common stock issued and outstanding at the time of a shareholder vote, the holders of the Series A Preferred Stock,

voting separately as a class, will have the right to vote an aggregate of 10,400 shares, out of a total number of 20,400 shares voting.

Additionally,

so long as Series A Preferred Stock is outstanding, M&P shall not, without the affirmative vote of the holders of at least 66-2/3%

of all outstanding shares of Series A Preferred Stock, voting separately as a class (i) amend, alter or repeal any provision of the Certificate

of Formation or the Bylaws of M&P so as to adversely affect the designations, preferences, limitations and relative rights of the

Series A Preferred Stock, (ii) effect any reclassification of the Series A Preferred Stock, (iii) designate any additional series of

preferred stock, the designation of which adversely effects the rights, privileges, preferences or limitations of the Series A Preferred

Stock; or (iv) amend, alter or repeal any provision of the Series A Designation (except in connection with certain non-material technical

amendments).

Redemption

Right. The Series A Preferred Stock has no redemption rights.

Protective

Provisions. Subject to the rights of series of preferred stock which may from time to time come into existence, so long as any

shares of Series A Preferred Stock are outstanding, M&P cannot without first obtaining the approval (by written consent, as provided

by law) of the holders of a majority of the then outstanding shares of Series A Preferred Stock, voting together as a class:

(a)

Issue any additional shares of Series A Preferred Stock after the original issuance of shares of Series A Preferred Stock;

(b)

Increase or decrease the total number of authorized or designated shares of Series A Preferred Stock;

(c)

Effect an exchange, reclassification, or cancellation of all or a part of the Series A Preferred Stock;

(d)

Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series A Preferred

Stock; or

(e)

Alter or change the rights, preferences or privileges of the shares of Series A Preferred Stock so as to affect adversely the shares

of such series, including the rights set forth in the Series A Designation.

It

is anticipated that the 100 designated shares of Series A Preferred Stock of M&P will be issued to Jacob Cohen, the Chief Executive

Officer of the Company, pursuant to the terms of his Amended and Restated Executive Employment Agreement with the Company, entered into

on December 13, 2024, as described in greater detail in the Current Report on Form 8-K, filed by the Company with the Securities and

Exchange Commission on December 19, 2024

*

* * * *

The

description of the Series A Designation above is not complete and is qualified in its entirety by the full text of the Series A Designation,

filed herewith as Exhibit 3.1, which is incorporated by reference in this Item 5.03.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*

Filed herewith.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MANGOCEUTICALS,

INC. |

| |

|

|

| Date:

January 15, 2025 |

By: |

/s/

Jacob D. Cohen |

| |

|

Jacob

D. Cohen |

| |

|

Chief

Executive Officer |

Exhibit

3.1

CERTIFICATE

OF DESIGNATIONS

OF

MANGO

& PEACHES CORP.

ESTABLISHING

THE DESIGNATIONS, PREFERENCES,

LIMITATIONS,

AND RELATIVE RIGHTS OF ITS

SERIES

A SUPER MAJORITY VOTING PREFERRED STOCK

Pursuant

to Section 21.155 of the Texas Business Organizations Code (the “TBOC”), Mango & Peaches Corp.,

a corporation organized and existing under the TBOC (the “Company”),

DOES

HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Certificate of Formation of the Company

(the “Certificate”), as amended, and pursuant to Section 21.155 of the TBOC, the Board of Directors,

pursuant to Section 6.201 of the TBOC, the Board of Directors, by unanimous written consent of all members of the Board, on January

[ ], 2025, duly adopted a resolution providing for the issuance of a series of One Hundred (100) shares of Series A Super Majority Voting

Preferred Stock, which resolution is and reads as follows:

RESOLVED,

that pursuant to the authority expressly granted to and invested in the Board of Directors of the Company by the provisions of the

Certificate and Section 6.201 of the TBOC, a new series of the preferred stock, par value $0.0001 per share, of the Company be,

and it hereby is, established; and it is further

RESOLVED,

that the new series of preferred stock of the Company be, and it hereby is, given the distinctive designation of “Series

A Super Majority Voting Preferred Stock”; and it is further

RESOLVED,

that the Series A Super Majority Voting Preferred Stock shall consist of One Hundred (100) shares; and it is further

RESOLVED,

that the Series A Super Majority Voting Preferred Stock shall have the powers and preferences, and the relative, participating, optional

and other rights, and the qualifications, limitations, and restrictions thereon set forth below (the “Certificate of Designation”):

SECTION

1. DESIGNATION OF SERIES; RANK. The shares of such series of Series A Super Majority Voting Preferred Stock shall be designated as

the “Series A Preferred Stock” and the number of shares initially constituting such series shall be One Hundred

(100) shares.

SECTION

2. DIVIDENDS. The Holder(s) of the Series A Preferred Stock shall not be entitled to receive dividends paid on the Company’s

common stock (“Common Stock”). “Holder” shall mean the person or entity in which

the Series A Preferred Stock is registered on the books of the Company.

Page 1 of 5 Certificate of Designations of Series A Super Majority Voting Preferred Stock Mango & Peaches Corp. |

SECTION

3. LIQUIDATION PREFERENCE. The Holder(s) of the Series A Preferred Stock shall not be entitled to any liquidation preference.

SECTION

4. VOTING.

4.1

Voting Rights. The Holders of the Series A Preferred Stock will have the voting rights as described in this Section 4

or as required by law. For so long as any shares of the Series A Preferred Stock remain issued and outstanding, the Holders thereof,

voting separately as a class, shall have the right to vote on all shareholder matters (including, but not limited to at every meeting

of the stockholders of the Company and upon any action taken by stockholders of the Company with or without a meeting) equal to fifty-one

percent (51%) of the total vote (the “Total Series A Vote”). For example, if there are 10,000 shares of the

Company’s Common Stock issued and outstanding at the time of a shareholder vote, the Holders of the Series A Preferred Stock, voting

separately as a class, will have the right to vote an aggregate of 10,400 shares, out of a total number of 20,400 shares voting. For

the sake of clarity and in an abundance of caution, the total voting shares outstanding at the time of any and all shareholder votes

(i.e., the total shares eligible to vote on any and all shareholder matters) shall be deemed to include (a) the total Common Stock shares

outstanding; (A) the voting rights applicable to any outstanding shares of preferred stock, other than the Series A Preferred Stock,

if any; and (c) the voting rights attributable to the Series A Preferred Stock, as described herein, whether such Series A Preferred

Stock shares are voted or not.

4.2

Amendments to Articles of Incorporation and Bylaws. So long as the Series A Preferred Stock is outstanding, the Company shall

not, without the affirmative vote of the Holders of at least 66-2/3% of all outstanding shares of Series A Preferred Stock, voting separately

as a class (i) amend, alter or repeal any provision of the Articles of Incorporation or the Bylaws of the Company so as to adversely

affect the designations, preferences, limitations and relative rights of the Series A Preferred Stock, (ii) effect any reclassification

of the Series A Preferred Stock, or (iii) designate any additional series of preferred stock, the designation of which adversely effects

the rights, privileges, preferences or limitations of the Series A Preferred Stock set forth herein.

4.3

Amendment of Rights of Series A Preferred Stock. The Company shall not, without the affirmative vote of the Holders of at least

66-2/3% of all outstanding shares of the Series A Preferred Stock, amend, alter or repeal any provision of this Certificate of Designation;

provided, however, that the Company may, by any means authorized by law and without any vote of the Holders of shares of the Series A

Preferred Stock, make technical, corrective, administrative or similar changes in this Certificate of Designation that do not, individually

or in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Series A Preferred Stock.

Page 2 of 5 Certificate of Designations of Series A Super Majority Voting Preferred Stock Mango & Peaches Corp. |

SECTION

5. CONVERSION RIGHTS. The shares of the Series A Preferred Stock shall have no conversion rights.

SECTION

6. REDEMPTION RIGHTS. The shares of the Series A Preferred Stock shall have no redemption rights.

SECTION

7. NOTICES. Any notice required hereby to be given to the Holders of shares of the Series A Preferred Stock shall be deemed given

if deposited in the United States mail, postage prepaid, and addressed to each Holder of record at his, her or its address appearing

on the books of the Company.

SECTION

8. PROTECTIVE PROVISIONS. Subject to the rights of series of preferred stock which may from time to time come into existence, so

long as any shares of Series A Preferred Stock are outstanding, the Company shall not without first obtaining the approval (by written

consent, as provided by law) of the Holders of a majority of the then outstanding shares of Series A Preferred Stock, voting together

as a class:

(a)

Issue any additional shares of Series A Preferred Stock after the original issuance of shares of Series A Preferred Stock;

(b)

Increase or decrease the total number of authorized or designated shares of Series A Preferred Stock;

(c)

Effect an exchange, reclassification, or cancellation of all or a part of the Series A Preferred Stock;

(d)

Effect an exchange, or create a right of exchange, of all or part of the shares of another class of shares into shares of Series A Preferred

Stock; or

(e)

Alter or change the rights, preferences or privileges of the shares of Series A Preferred Stock so as to affect adversely the shares

of such series, including the rights set forth in this Certificate of Designations.

PROVIDED,

HOWEVER, that the Company may, by any means authorized by law and without any vote of the Holders of shares of the Series A Preferred

Stock, make technical, corrective, administrative or similar changes in this Certificate of Designation that do not, individually or

in the aggregate, adversely affect the rights or preferences of the Holders of shares of the Series A Preferred Stock.

SECTION

9. NO OTHER RIGHTS OR PRIVILEGES. Except as specifically set forth herein, the Holders of the Series A Preferred Stock shall have

no other rights, privileges, or preferences with respect to the Series A Preferred Stock.

Page 3 of 5 Certificate of Designations of Series A Super Majority Voting Preferred Stock Mango & Peaches Corp. |

SECTION

10. MISCELLANEOUS.

(a)

The headings of the various sections and subsections of this Certificate of Designation are for convenience of reference only and shall

not affect the interpretation of any of the provisions of this Certificate of Designation.

(b)

Whenever possible, each provision of this Certificate of Designation shall be interpreted in a manner as to be effective and valid under

applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful or incapable of being enforced by

reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity,

without invalidating or otherwise adversely affecting the remaining provisions of this Certificate of Designation. No provision herein

set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should

determine that a provision of this Certificate of Designation would be valid or enforceable if a period of time were extended or shortened,

then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

(c)

Except as may otherwise be required by law, the shares of the Series A Preferred Stock shall not have any powers, designations, preferences

or other special rights, other than those specifically set forth in this Certificate of Designations.

—————————————————-

NOW

THEREFORE BE IT RESOLVED, that the Certificate of Designations is hereby approved, affirmed, confirmed, and ratified; and it is further

RESOLVED,

that each officer of the Company be and hereby is authorized, empowered and directed to execute and deliver, in the name of and on behalf

of the Company, any and all documents, and to perform any and all acts necessary to reflect the Directors’ approval and ratification

of the resolutions set forth above and this Certificate of Designations; and it is further

RESOLVED,

that in addition to and without limiting the foregoing, each officer of the Company and the Company’s attorney be and hereby is

authorized to take, or cause to be taken, such further action, and to execute and deliver, or cause to be delivered, for and in the name

and on behalf of the Company, all such instruments and documents as he may deem appropriate in order to effect the purpose or intent

of the foregoing resolutions (as conclusively evidenced by the taking of such action or the execution and delivery of such instruments,

as the case may be) and all action heretofore taken by such person in connection with the subject of the foregoing recitals and resolutions

be, and it hereby is approved, ratified and confirmed in all respects as the act and deed of the Company; and it is further

RESOLVED,

that this Certificate of Designations may be executed in one or more counterparts, each of which will be deemed to be an original, but

all of which taken together will constitute one and the same instrument. Any electronic signature of a signatory to this Certificate

of Designations is intended to authenticate such writing and shall be as valid, and have the same force and effect as a manual signature.

Any such electronically signed Certificate of Designations shall be deemed (i) an “electronic transmission”,

(ii) to be “written” or “in writing”; (ii) to have been signed; and (iii) to constitute

a record established and maintained in the ordinary course of business, and an original written record when printed from electronic files.

For purposes hereof, “electronic signature” includes, but is not limited to (i) a scanned copy (as a “pdf”

(portable document format) or other replicating image) of a manual ink signature, (ii) an electronic copy of a traditional signature

affixed to this Certificate of Designations, (iii) a signature incorporated into this Certificate of Designations utilizing touchscreen

capabilities, (iv) a signature incorporated into this Certificate of Designations as a (x) graphic, (y) image file or (z) manually typed

characters, added to such document with the intention of such characters representing the signatory’s execution of such Certificate

of Designations; or (v) a digital signature. A photocopy, facsimile, .pdf, .tif, .gif, .jpeg or similar electronic copy of this Certificate

of Designations (or any signature hereto) shall be effective as an original for all purposes.

[Remainder

of page left intentionally blank. Signature page follows.]

Page 4 of 5 Certificate of Designations of Series A Super Majority Voting Preferred Stock Mango & Peaches Corp. |

IN

WITNESS WHEREOF, the Board of Directors of the Company has unanimously approved and caused this “Certificate of Designations

of Mango & Peaches Corp. Establishing the Designations, Preferences, Limitations, and Relative Rights of its Series A Super Majority

Voting Preferred Stock” to be duly executed and approved this 8th day of January 2025.

DIRECTORS:

|

/s/ Jacob

Cohen |

| |

Jacob Cohen |

| |

Sole Director |

Page 5 of 5 Certificate of Designations of Series A Super Majority Voting Preferred Stock Mango & Peaches Corp. |

v3.24.4

Cover

|

Jan. 09, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 09, 2025

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41615

|

| Entity Registrant Name |

MANGOCEUTICALS,

INC.

|

| Entity Central Index Key |

0001938046

|

| Entity Tax Identification Number |

87-3841292

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

15110

N. Dallas Parkway

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75248

|

| City Area Code |

(214)

|

| Local Phone Number |

242-9619

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 Par Value Per Share

|

| Trading Symbol |

MGRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

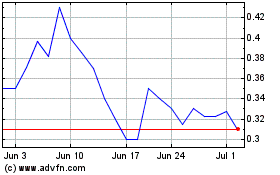

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mangoceuticals (NASDAQ:MGRX)

Historical Stock Chart

From Jan 2024 to Jan 2025