Form 8-K - Current report

November 14 2023 - 3:00PM

Edgar (US Regulatory)

false

0001337068

0001337068

2023-11-14

2023-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November

14, 2023

MAGYAR BANCORP, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

0-51726 |

20-4154978 |

| (State or Other Jurisdiction) |

(Commission File No.) |

(I.R.S. Employer |

| of Incorporation) |

|

Identification No.) |

| |

|

|

| |

|

|

| 400 Somerset Street, New Brunswick, New Jersey |

|

08901 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(732) 342-7600

Not Applicable

(Former name or former address, if changed since last

report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange

on Which Registered |

|

Common

Stock, par value $0.01 per share |

|

MGYR |

|

The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 14, 2023, Magyar Bancorp, Inc. (the “Company”)

announced that its Board of Directors has approved a special cash dividend of $0.07 per common share to shareholders of record at the

close of business on November 28, 2023, payable on December 12, 2023.

A copy of the news release, dated November 14, 2023,

announcing the dividend is included as Exhibit 99.1 to this report and is incorporated herein by reference.

|

Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

|

MAGYAR BANCORP, INC. |

| |

|

|

| |

|

|

| |

|

|

| DATE: November 14, 2023 |

By: |

/s/ John S. Fitzgerald |

| |

|

John S. Fitzgerald |

| |

|

President and Chief Executive Officer |

|

News |

400 Somerset St., New Brunswick, NJ 08901

732.342.7600

MAGYAR BANCORP, INC.

DECLARES SPECIAL CASH DIVIDEND

NEW BRUNSWICK, NEW JERSEY – November

14, 2023; Magyar Bancorp, Inc. (NASDAQ: MGYR) announced that its Board of Directors has declared a special cash dividend of $0.07,

payable December 12, 2023 to shareholders of record on November 28, 2023.

About Magyar Bancorp

Magyar Bancorp is the parent company of Magyar

Bank, a community bank headquartered in New Brunswick, New Jersey. Magyar Bank has been serving families and businesses in Central New

Jersey since 1922 with a complete line of financial products and services. Today, Magyar operates seven branch locations in New Brunswick,

North Brunswick, South Brunswick, Branchburg, Bridgewater and Edison (2). Please visit us online at www.magbank.com.

Forward Looking Statements

This press release contains statements about

future events that constitute forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference to a future period or periods,

or by the use of forward- looking terminology, such as “may,” “will,” “believe,” “expect,”

or similar terms or variations on those terms, or the negative of those terms. Forward-looking statements are subject to numerous risks

and uncertainties, including, but not limited to, those risks previously disclosed in the Company’s filings with the SEC, general

economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment

of qualified personnel, and market acceptance of the Company’s pricing, products and services, and with respect to the loans extended

by the Bank and real estate owned, the following: risks related to the economic environment in the market areas in which the Bank operates,

particularly with respect to the real estate market in New Jersey; the risk that the value of the real estate securing these loans may

decline in value; and the risk that significant expense may be incurred by the Company in connection with the resolution of these loans.

In addition, the COVID-19 pandemic continues to have an adverse impact on the Company, its customers and the communities it serves. Given

its ongoing and dynamic nature, it is difficult to predict the full impact of the pandemic on the Company’s business. The extent

of such impact will depend on future developments, which are highly uncertain, including when the coronavirus can be controlled and abated

and the extent to which the economy can open and remain open. The Company wishes to caution readers not to place undue reliance on any

such forward-looking statements, which speak only as of the date made. The Company does not undertake and specifically declines any obligation

to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Contact: John Reissner, 732.214.2083

v3.23.3

Cover

|

Nov. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 14, 2023

|

| Entity File Number |

0-51726

|

| Entity Registrant Name |

MAGYAR BANCORP, INC.

|

| Entity Central Index Key |

0001337068

|

| Entity Tax Identification Number |

20-4154978

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Somerset Street

|

| Entity Address, City or Town |

New Brunswick

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08901

|

| City Area Code |

(732)

|

| Local Phone Number |

342-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

MGYR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

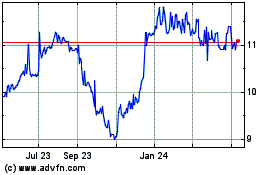

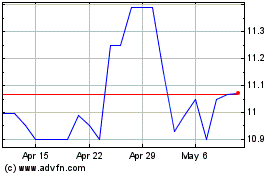

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Magyar Bancorp (NASDAQ:MGYR)

Historical Stock Chart

From Nov 2023 to Nov 2024