| Prospectus Supplement |

|

Filed pursuant to Rule 424(b)(5) |

| (To Prospectus dated December 6, 2022) |

|

Registration No. 333-268560 |

13,939,331

Shares

Lucid

Diagnostics Inc.

Common

Stock

Lucid

Diagnostics Inc. is offering directly to investors an aggregate of up to 13,939,331 shares of its common stock, at a public offering

price of $1.10 per share, pursuant to this prospectus supplement and the accompanying base prospectus.

We

have retained Canaccord Genuity LLC, or “Canaccord,” to act as our exclusive placement agent, or “Placement

Agent,” in connection with this offering. The Placement Agent is not purchasing or selling any securities offered by this prospectus

supplement and the accompanying base prospectus, nor is it required to arrange the purchase or sale of any specific number or dollar

amount of the securities, but it has agreed to use its commercially reasonable “best efforts” to arrange for the sale of

all of the securities offered by this prospectus supplement and the accompanying base prospectus. We have agreed to pay the Placement

Agent certain fees on the aggregate gross proceeds from the sale of shares in this offering to investors introduced to us by the Placement

Agent. We will pay no fee on the aggregate gross proceeds from the sale of shares to other investors. See “Plan of Distribution”

beginning on page S-14 of this prospectus supplement for more information regarding these arrangements.

Our

common stock is listed for trading on the Capital Market of The Nasdaq Stock Market LLC, or “Nasdaq,” under the symbol

“LUCD.” On March 3, 2025, the last reported sale price of our common stock $1.34.

The

aggregate market value of our outstanding voting and nonvoting common equity held by non-affiliates is $52,296,248, based on a last sale

price of $1.59 per share of our common stock on February 19, 2025 and 32,890,722 outstanding shares of our common stock held by non-affiliates.

As of the date hereof, excluding the securities offered hereby, none of our securities have been sold pursuant to General Instruction

I.B.6 of Form S-3 during the preceding 12 months.

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and have elected to comply

with certain reduced public company reporting requirements for this prospectus supplement and the accompanying base prospectus and for

future filings.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page S-7 of

this prospectus supplement and in the documents incorporated by reference herein and in the accompanying base prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus supplement or the accompanying base prospectus. Any representation to the contrary is

a criminal offense.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 1.100 | | |

$ | 15,333,254 | |

| Placement Agent fees(1) | |

$ | 0.026 | | |

$ | 398,528 | |

| Proceeds to us, before expenses | |

$ | 1.074 | | |

$ | 14,934,726 | |

| (1) | Consists

of a cash fee of 7.0% of the aggregate gross proceeds of from the sale of our securities

in the offering to investors introduced to us by the Placement Agent. The cash fee set forth

above assumes the sale of 5,175,685 shares in the offering to such investors. We have also

agreed to reimburse the Placement Agent for certain expenses incurred in connection with

this offering. In addition, we have agreed to pay a fee to a financial advisor of ours. See

“Plan of Distribution” beginning on page S-14 of this prospectus

supplement for additional information regarding the compensation to be paid to the Placement

Agent. |

Delivery

of the shares of common stock is expected to be made on or about March 5, 2025.

Canaccord

Genuity

The

date of this prospectus supplement is March 4, 2025.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

BASE PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus are part of a registration statement under the Securities Act on Form S-3

that we filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration

process. Under this shelf process, we may, from time to time, sell or issue any of the combination of securities described in the accompanying

base prospectus in one or more offerings with a maximum aggregate offering price of up to $125,000,000.

The

base prospectus provides you with a general description of the securities we may offer under the registration statement. This prospectus

supplement provides specific details regarding this offering of 13,939,331 shares of our common stock. This prospectus supplement contains

specific information about the terms of this offering. This prospectus supplement may also add, update or change information contained

in the accompanying base prospectus. If there is any inconsistency between the information in this prospectus supplement and the accompanying

base prospectus, you should rely on the information in this prospectus supplement. You should read both this prospectus supplement and

the accompanying base prospectus, together with the additional information described below under the heading “Where You Can

Find More Information” and “Information Incorporated by Reference.”

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus

and in any issuer free writing prospectus relating to this offering. We have not authorized anyone to provide you with different information

and, if provided, such information or representations must not be relied upon as having been authorized by us. Neither this prospectus

supplement nor the accompanying base prospectus nor any issuer free writing prospectus shall constitute an offer to sell or a solicitation

of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation.

This prospectus supplement and the accompanying base prospectus and any issuer free writing prospectus do not contain all of the information

included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the

registration statement, including its exhibits.

You

should not assume that the information appearing in this prospectus supplement or the information appearing in the accompanying base

prospectus is accurate as of any date other than the date on the front cover of this prospectus supplement or the accompanying base prospectus,

respectively. You should not assume that the information contained in the documents incorporated by reference in this prospectus supplement

or the accompanying base prospectus, or in any issuer free writing prospectus, is accurate as of any date other than the respective dates

of those documents. Our business, financial condition, results of operations, and prospects may have changed since that date.

Unless

otherwise indicated or unless the context otherwise requires, all references in this prospectus supplement to “Lucid Diagnostics,”

the “Company,” and “we,” “us” and “our” refer to Lucid Diagnostics

Inc., a Delaware corporation, and its subsidiaries.

MARKET

AND INDUSTRY DATA

We

obtained the market, industry and competitive position data used throughout this prospectus supplement and the accompanying base prospectus

and the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus from our own internal

estimates and research, as well as from independent market research, industry and general publications and surveys, governmental agencies

and publicly available information in addition to research, surveys and studies conducted by third parties. Internal estimates are derived

from publicly available information released by industry analysts and third-party sources, our internal research and our industry experience,

and are based on assumptions made by us based on such data and our knowledge of our industry and market, which we believe to be reasonable.

In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more

sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived

from the same sources, unless otherwise expressly stated or the context otherwise requires. In addition, while we believe the industry,

market and competitive position data included or incorporated by reference in this prospectus supplement and the accompanying base prospectus

are reliable and based on reasonable assumptions, such data involve risks and uncertainties and are subject to change based on various

factors, including those discussed in the section titled “Risk Factors.” These and other factors could cause results

to differ materially from those expressed in the estimates made by the independent parties or by us.

TRADEMARKS

We

have proprietary rights to trademarks used in this prospectus supplement and the accompanying base prospectus and in the documents incorporated

by reference in this prospectus supplement and the accompanying base prospectus, including Lucid Diagnostics™, EsoGuard®, EsoCheck®

and Collect+Protect™. Solely for our convenience, trademarks and trade names referred to in this prospectus supplement and the

accompanying base prospectus, and in the documents incorporated by reference in this prospectus supplement and the accompanying base

prospectus, may appear without the “®” or “™” symbols, but such references are not intended to indicate,

in any way, that we will not assert, to the fullest extent possible under applicable law, our rights or the rights to these trademarks

and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship

with, or endorsement or sponsorship of us by, any other companies. Each trademark, trade name, or service mark of any other company appearing

in this prospectus supplement and the accompanying base prospectus, and in the documents incorporated by reference in this prospectus

supplement and the accompanying base prospectus, is the property of its respective holder.

NOTE

ON FORWARD-LOOKING STATEMENTS AND RISK FACTOR SUMMARY

This

prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E

of the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” The statements contained in this prospectus

and in the documents incorporated by reference in this prospectus that are not purely historical are forward-looking statements. Forward-looking

statements include, but are not limited to, statements regarding expectations, hopes, beliefs, intentions or strategies regarding the

future, such as our estimates regarding expenses, future revenue, capital requirements and needs for additional financing and our expectations

regarding the time during which we will be an emerging growth company under the JOBS Act. In addition, any statements that refer to projections,

forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements.

The words “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,”

“intends,” “may,” “might,” “plans,” “possible,” “potential,”

“predicts,” “projects,” “should,” “would” and the negative of these terms and similar

expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus are based on

our current expectations and beliefs concerning future developments and their potential effects on us and on a number of assumptions.

Although we believe that our current expectations, beliefs and assumptions are reasonable, there can be no assurance that they will prove

correct. The forward-looking statements involve a number of risks and uncertainties (some of which are beyond our control) that may cause

actual developments and their effects on us to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those factors incorporated by reference or described in “Risk

Factors,” including the following:

| ● | our

limited operating history; |

| | | |

| ● | our

financial performance, including our ability to generate revenue; |

| | | |

| ● | our

ability to obtain regulatory approval for the commercialization of our products; |

| | | |

| ● | our

ability of our products to achieve market acceptance; |

| | | |

| ● | our

success in retaining or recruiting, or changes required in, our officers, key employees or

directors; |

| | | |

| ● | our

potential ability to obtain additional financing when and if needed; |

| | | |

| ● | our

ability to protect our intellectual property; |

| | | |

| ● | our

ability to complete strategic acquisitions; |

| | | |

| ● | our

ability to manage growth and integrate acquired operations; |

| | | |

| ● | the

potential liquidity and trading of our securities; |

| | | |

| ● | regulatory

and operational risks; |

| | | |

| ● | cybersecurity

risks; |

| | | |

| ● | risks

related to COVID-19 pandemic; |

| | | |

| ● | risks

related to our relationship with PAVmed; and |

| | | |

| ● | our

estimates regarding expenses, future revenue, capital requirements and needs for additional

financing. |

Should

one or more of these risks or uncertainties materialize, or should any of our expectations, beliefs and assumptions otherwise prove incorrect,

actual developments and their effects on us, including our financial results, may vary in material respects from those expressed or implied

in these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements, whether as

a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You

should not rely on our forward-looking statements. You should read prospectus, and the documents incorporated herein by reference, completely

and with the understanding actual developments and their effects on us may be materially different from what we expect.

GLOSSARY

Unless

otherwise stated in this prospectus supplement:

| ● | “510(k)”

refers to a premarket notification, submitted to the FDA by a manufacturer pursuant to section

510(k) of the FDCA and 21 CFR § 807 subpart E, of its intent to market a non-exempt

Class I or Class II medical device intended for human use, for which a PMA application is

not required, to demonstrate that the device to be marketed is as safe and effective, that

is, substantially equivalent to, a legally marketed device, commonly known as a “predicate”;

and “510(k) clearance” refers to a determination by FDA under 21 CFR § 807.100

that a medical device has been found to be substantially equivalent to a legally marketed

predicate device and can be marketed in the U.S. |

| | | |

| ● | “BE”

refers to Barrett’s Esophagus, an esophageal precancer and complication of GERD in

which surface cells lining the lower esophagus undergo precancerous metaplastic or dysplastic

transformation from repeated exposure to stomach fluid, including acid, refluxing into the

lower esophagus. BE can be nondysplastic or dysplastic. In nondysplastic BE, or “NDBE,”

there is no dysplasia. In dysplastic BE, there is dysplasia, which can be early, low-grade

dysplasia, or “LGD,” or advanced, high-grade dysplasia, or “HGD.” |

| | | |

| ● | “CE

Mark” refers to “Conformité Européenne” Mark, a mark

indicating that a product such as a medical device conforms to the essential requirements

of the relevant European directive and may be marketed in European Economic Area (the European

Union, Norway, Iceland, and Lichtenstein), Switzerland, and, until July 1, 2023, the United

Kingdom; for medical devices and in vitro devices the relevant directives had been Medical

Device Directive 93/42/EEC and In-Vitro Diagnostic Medical Devices Directive 98/79/EC, respectively,

but have been or will soon be replaced by Regulation (EU) 2017/745 and Regulation (EU) 2017/746,

respectively. |

| | | |

| ● | “CLIA”

refers to the Clinical Laboratory Improvement Amendments of 1988 and associated regulations

set forth in 42 CFR § 493, through which CMS regulates all non-research laboratory testing

performed on humans in the U.S., including LDTs. |

| | | |

| ● | “CMS”

refers to the U.S. Center for Medicare and Medicaid Services. |

| | | |

| ● | “EAC”

refers to esophageal adenocarcinoma, the most common and highly lethal form of esophageal

cancer which universally arises from BE. |

| | | |

| ● | “FDA”

refers to the U.S. Food and Drug Administration. |

| | | |

| ● | “FDCA”

refers to the U.S. Food, Drug, and Cosmetic Act as codified in 21 CFR. |

| | | |

| ● | “GERD”

refers to gastroesophageal reflux disease, commonly known as chronic heart burn, acid reflux,

or just reflux, a symptomatic or asymptomatic pathologic condition where dysfunction of the

muscular valve between the stomach and esophagus allows stomach fluid, including acid, to

inappropriately reflux into the lower esophagus. |

| | | |

| ● | “IVD”

refers to an in vitro diagnostic product, defined by FDA as a reagent, instrument, or system

intended for use in diagnosis of disease or other conditions; such a product is intended

for use in the collection, preparation, and examination of specimens take from the human

body and is a device as defined in the FDCA. |

| | | |

| ● | “LDT”

or “laboratory developed test” refers to a diagnostic test, defined by FDA as

“an IVD that is intended for clinical use and designed, manufactured and used within

a single laboratory,” which is generally subject only to self-certification of analytical

validity under the CMS CLIA program; FDA had historically exercised enforcement discretion

with regard to premarket review of LDTs but intends to phase out this approach as described

in “Prospectus Summary—Recent Developments” below. |

| | | |

| ● | “PAVmed”

refers to PAVmed Inc., our parent company. |

| | | |

| ● | “PMA”

refers to premarket approval, the most stringent FDA premarket medical device scientific

and regulatory review process, codified in 21 CFR § 814, which, due to the risk associated

with Class III devices, requires sufficient valid scientific evidence in addition to general

and special controls to assure that it is safe and effective for its intended use(s). |

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary contains basic information about us and our business but does not contain all of the information that is important to your investment

decision. You should read this summary together with the more detailed information contained elsewhere in this prospectus supplement

and the accompanying base prospectus and the documents incorporated herein and therein by reference before making an investment decision.

Investors should carefully consider the information set forth under the caption “Risk Factors” appearing elsewhere in this

prospectus supplement, including those incorporated by reference herein.

Our

Company

We

are a commercial-stage, cancer prevention medical diagnostics technology company focused on the millions of patients who are at risk

of developing esophageal precancer and cancer, specifically highly lethal EAC.

We

believe that our flagship product, the EsoGuard Esophageal DNA Test, performed on samples collected with the EsoCheck Esophageal Cell

Collection Device, constitutes the first and only commercially available diagnostic test capable of serving as a widespread tool for

the early detection of esophageal precancer, including BE, in at-risk patients. Early detection of esophageal precancer allows patients

to undergo appropriate monitoring and treatment, as indicated by clinical practice guidelines, in an effort to prevent progression to

esophageal cancer.

EsoGuard

is a bisulfite-converted targeted next-generation sequencing (NGS) DNA assay performed on surface esophageal cells collected with EsoCheck.

It quantifies methylation at 31 sites on two genes, Vimentin (VIM) and Cyclin A1 (CCNA1). The assay has been evaluated in multiple studies,

demonstrating sensitivity of ~90% for detecting disease along the full esophageal precancer to cancer spectrum, with a negative predictive

value (NPV) of ~99%. Sensitivity and NPV remain very high even for detecting early precancer, which is unprecedented for a molecular

diagnostic test.

EsoCheck

is an FDA 510(k) and CE Mark cleared non-invasive swallowable balloon capsule catheter device capable of sampling surface esophageal

cells in a less than five-minute office procedure. It consists of a vitamin pill-sized rigid plastic capsule tethered to a thin silicone

catheter from which a soft silicone balloon with textured ridges emerges to gently swab surface esophageal cells. When vacuum suction

is applied, the balloon and sampled cells are pulled into the capsule, protecting them from contamination and dilution by cells outside

of the targeted region during device withdrawal. We believe this proprietary Collect+Protect™ technology makes EsoCheck the only

non-invasive esophageal cell collection device capable of such anatomically targeted and protected sampling.

EsoGuard

and EsoCheck are based on patented technology licensed by Lucid from Case Western Reserve University, or “CWRU.” EsoGuard

and EsoCheck have been developed to provide an accurate, non-invasive, patient-friendly test for the early detection of EAC and BE, including

dysplastic BE and related precursors to EAC in patients with GERD, commonly known as chronic heartburn, acid reflux, or just reflux.

Recent

Developments

Business

Medicare

Coverage

In

November 2024, we submitted to Molecular Diagnostics Program, or “MolDX,” our complete clinical evidence package in

support of a request for reconsideration of the non-coverage language in the previously-published final Local Coverage Determination,

or “LCD,” L39256, entitled “Molecular Testing for Detection of Upper Gastrointestinal Metaplasia, Dysplasia,

and Neoplasia” to secure Medicare coverage for EsoGuard. The EsoGuard clinical evidence package included six new peer-reviewed

publications: three clinical validation studies (two in the intended use population, one case control), two clinical utility studies,

and one analytical validation study. The current LCD provides clear coverage criteria consistent with the American College of Gastroenterology

(ACG) guidelines for esophageal precancer testing. The package was submitted as part of a request for reconsideration of the non-coverage

language in the LCD to secure Medicare coverage for EsoGuard.

American

Journal of Gastroenterology Publication

On

November 7, 2024, we announced that our manuscript for our multi-center ESOGUARD BE-1 study had been accepted for publication in The

American Journal of Gastroenterology, the official journal of the American College of Gastroenterology (ACG). This is the fourth publication

presenting clinical validation data for our EsoGuard Esophageal DNA Test, and the second to demonstrate its performance in an intended-use

screening population. Consistent with previous studies, EsoGuard showed high sensitivity and negative predictive value in detecting esophageal

precancer (BE). With the acceptance for publication, we believe we now have a complete clinical evidence package to submit our data to

the MolDX program and formally seek Medicare coverage.

The

prospective, multi-center study presented data from a cohort of patients who met ACG guideline criteria for esophageal precancer screening

and underwent non-endoscopic EsoGuard testing followed by traditional upper endoscopy. EsoGuard sensitivity and negative predictive value

for detecting BE were approximately 88% and 99%, respectively. Specificity and positive predictive value were approximately 81% and 30%,

respectively. No serious adverse events were reported.

NASDAQ

Notice

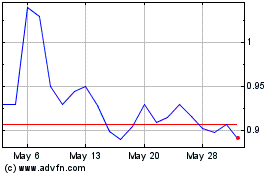

On

February 24, 2025, we received a notice from the Listing Qualifications Department of Nasdaq stating that the closing bid price of our

common stock had been above the minimum of $1 per share for continued listing on the Nasdaq Capital Market under Nasdaq Listing Rule

5550(a)(2) for ten consecutive trading days (through February 21, 2025) and accordingly, the Company had regained compliance with this

listing requirement.

As

previously disclosed, on June 21, 2024, we received a notice from the Listing Qualifications Department of Nasdaq stating that, for the

prior 30 consecutive business days (through June 20, 2024), the closing bid price of our common stock had been below the minimum of $1

per share required for continued listing. The notification letter stated that we would be afforded 180 calendar days (until December

18, 2024) to regain compliance, which grace period was extended by an additional 180 calendar days (until June 16, 2025).

Financing

2024

Convertible Notes

On

November 22, 2024, we closed on the sale of $21.975 million in principal amount of Senior Secured Convertible Notes, or the “2024

Convertible Notes,” in a private placement, to certain accredited investors, or the “2024 Note Investors.”

The sale of the 2024 Convertible Notes was completed pursuant to the terms of a Securities Purchase Agreement, dated as of November 12,

2024, or the “2024 Note SPA,” between us and the 2024 Note Investors. We used a portion of the proceeds from the sale

of the 2024 Convertible Notes to repay the then-outstanding Senior Convertible Note issued pursuant to that certain Securities Purchase

Agreement, dated as of March 13, 2023, or the “2023 Convertible Note.” We realized gross proceeds of $21.975

million and, after giving effect to the repayment in full of the 2023 Convertible Note, net proceeds of $18.3 million, from the sale

of the 2024 Convertible Notes.

Suspension

of At-The-Market Program

We

are party to a Controlled Equity Offering℠ Sales Agreement, or “sales agreement,” with Cantor Fitzgerald &

Co., or “Cantor.” Pursuant to the sales agreement, from time to time, we may offer and sell shares of our common stock

to or through Cantor, acting as sales agent or principal. Sales of our common stock by Cantor, if any, under the sales agreement, or

the “ATM Offering,” may be made by any method permitted by law and deemed to be an “at the market offering”

as defined in Rule 415(a)(4) promulgated under the Securities Act. We filed a prospectus supplement dated December 6, 2022, or the “ATM

Prospectus Supplement,” for the offer and sale of shares of our common stock having an aggregate offering price of up to $6,500,000

in the ATM Offering.

Effective

as of March 4, 2025, we terminated the ATM Prospectus Supplement. We will not make any sales of common stock in the ATM Offering unless

and until a new prospectus or prospectus supplement is filed. Other than the termination of the Prospectus Supplement, the sales agreement

remains in full force and effect.

Corporate

Information

We

were incorporated in Delaware on May 8, 2018. Our corporate offices are located at 360 Madison Avenue, 25th Floor, New York, NY 10017,

and our telephone number is (917) 813-1828. Our corporate website is www.luciddx.com. The information contained on or that can be accessed

through our website is not incorporated by reference into this prospectus and you should not consider information on our website to be

part of this prospectus or in deciding whether to purchase our securities.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth

company, we will not be required to comply with certain disclosure and other obligations that are applicable to public companies that

are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of

the Sarbanes-Oxley Act of 2002, as amended, or the “Sarbanes-Oxley Act,” being able to take advantage of reduced disclosure

obligations regarding executive compensation in our periodic reports and proxy statements, and being exempt from the requirements of

holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously

approved. We intend to take advantage of these reduced disclosure and other obligations until we are no longer an emerging growth company.

In

addition, Section 107 of the Jumpstart Our Business Startups Act, or the “JOBS Act,” provides that an emerging growth

company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised

accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards

would otherwise apply to private companies. We have elected to use this extended transition period for complying with new or revised

financial accounting standards.

We

may remain an emerging growth company for up to five years, although we will lose that status as of the last day of the fiscal year in

which we have more than $1.235 billion of revenues, have more than $700.0 million in market value of our common stock held by non-affiliates

(assessed as of the most recently completed second quarter), or if we issue more than $1.0 billion of non-convertible debt over a three-year

period.

Risk

Factor Summary

Our

business is subject to numerous risks and uncertainties, as more fully described in “Risk Factors” beginning on page

S-7 and in Item 1A, “Risk Factors,” in our most recent annual report on Form 10-K, which is incorporated herein by

reference. As a result, we may be unable, for many reasons, including those that are beyond our control, to implement our current business

strategy and to become profitable. Those risks and uncertainties include the following:

Risks

Associated with Our Financial Condition

| ● | We

have incurred operating losses since our inception and may not be able to achieve profitability. |

| | | |

| ● | We

have concluded there is substantial doubt of our ability to continue as a going concern and

our independent registered public accounting firm’s report on our financial statements

contains an explanatory paragraph describing our ability to continue as a going concern. |

| | | |

| ● | To

raise capital, we have issued a significant amount of convertible securities under which

we expect to issue a correspondingly significant amount of shares of our common stock upon

conversion thereof. In addition, we may issue shares of our capital stock or debt securities

in the future in order to raise capital to fund our operations. All of the foregoing would

dilute the equity interest of our stockholders and might cause a change in control of our

ownership. |

| | | |

| ● | We

expect to need additional capital funding, which may be compounded by our obligations to

our parent company, PAVmed, which requires its own additional capital funding. |

| | | |

| ● | Our

quarterly operating results could be subject to significant fluctuation, which could increase

the volatility of our stock price and cause losses to our stockholders. |

| | | |

| ● | Servicing

our indebtedness may require a significant amount of cash, and the restrictive covenants

contained in our indebtedness could adversely affect our business plan, liquidity, financial

condition, and results of operations. |

Risks

Associated with Our Business

| ● | Since

we have a limited operating history, and have not generated any significant revenues to date,

you will have little basis upon which to evaluate our ability to achieve our business objective. |

| | | |

| ● | The

markets in which we operate are attractive and other companies or institutions may develop

and market novel or improved technologies, which may make the EsoGuard or EsoCheck technologies

less competitive or obsolete. |

| | | |

| ● | We

expect to derive substantially all of our revenues from the EsoGuard and EsoCheck products. |

| | | |

| ● | We

are highly dependent on our license agreement with CWRU, the termination of which would prevent

us from commercializing our products, and which imposes significant obligations on us. |

| ● | Our

products may never achieve market acceptance. |

| | | |

| ● | Recommendations

in published clinical practice guidelines issued by various organizations, including professional

societies and federal agencies may significantly affect payors’ willingness to cover,

and physicians’ willingness to prescribe, our products and services. |

Risks

Associated with Healthcare Regulation, Billing and Reimbursement, and Product Safety and Effectiveness

| ● | If

private or governmental third-party payors do not maintain reimbursement for our products

at adequate reimbursement rates, we may be unable to successfully commercialize our products

which would limit or slow our revenue generation and likely have a material adverse effect

on our business. |

| | | |

| ● | The

results of our clinical trials may not support our product candidate claims or may result

in the discovery of adverse side effects. |

| | | |

| ● | If

our clinical studies do not satisfy providers, payors, patients and others as to the reliability

and performance of our EsoGuard test and the EsoCheck device, or any other product or service

we may develop and seek to commercialize, we may experience reluctance or refusal on the

part of physicians to order, and third-party payors to pay for, such test. |

| | | |

| ● | Clinical

laboratories and medical diagnostic companies are subject to extensive and frequently changing

federal, state, and local laws. We could be subject to significant fines and penalties if

we fail (or if our prior unrelated third-party laboratory partner previously failed) to comply

with these laws and regulations. |

| | | |

| ● | Many

aspects of our business, beyond the specific elements described above, are subject to complex,

intertwined, costly and/or burdensome federal health care laws and regulations which may

open to interpretation and be subject to varying levels of discretionary enforcement. If

we fail to comply with these laws and regulations, we could face substantial penalties and

our business, operations and financial condition could be adversely affected. |

| | | |

| ● | Due

to billing complexities in the diagnostic and laboratory service industry, we may not be

able to collect payment for the EsoGuard tests we perform. |

Risks

Associated with Our Intellectual Property and Technology Infrastructure

| ● | We

may not be able to protect or enforce the intellectual property rights for the technology

used in, or expected to be used in, our products, which could impair our competitive position. |

| | | |

| ● | We

may be subject to intellectual property infringement claims by third parties which could

be costly to defend, divert management’s attention and resources, and may result in

liability. |

| | | |

| ● | Competitors

may violate the intellectual property rights for the technology used in, or expected to be

used in, our products, and we may bring litigation to protect and enforce our intellectual

property rights, which may result in substantial expense and may divert our attention from

implementing our business strategy. |

Risks

Associated with Our Relationship with PAVmed

| ● | PAVmed

owns a substantial portion of our voting stock and thus it (or any successor to its stake

in us), may exert significant influence over certain actions requiring a stockholder vote. |

| | | |

| ● | If

PAVmed’s debt is accelerated due to its default under the terms thereof, or the holder

of such debt elects to exchange those notes for shares of our common stock held by PAVmed

in accordance with the terms of such debt, PAVmed could cease to exert significant influence

over us. |

| | | |

| ● | Certain

conflicts of interest may arise between us and our affiliated companies, including PAVmed,

and in some cases we have waived certain rights with respect thereto. |

Risks

Associated with Ownership of Our Common Stock

| ● | Nasdaq

may in the future delist our common stock, which could limit investors’ ability to

make transactions in our securities and subject us to additional trading restrictions. |

Risks

Associated with the Offering

| ● | This

is a reasonable best efforts offering, with no minimum amount of securities required to be

sold, and we may sell fewer than all of the securities offered hereby. |

| | | |

| ● | Our

management will have broad discretion in the use of the net proceeds from this offering and

may not use them effectively. |

| | | |

| ● | You

will experience immediate and substantial dilution in the net tangible book value per share

of the common stock you purchase. |

| | | |

| ● | Even

after giving effect to this offering, we expect to require additional capital funding, which

may not be available on acceptable terms, or at all, or if available, may result in substantial

dilution to our stockholders or otherwise impair the value of our common stock. |

| | | |

| ● | A

substantial number of the shares of sold in this offering may be resold in the public market,

which could cause the price of our common stock to decline. |

| | | |

| ● | Our

outstanding options, convertible preferred stock and convertible notes, along with the potential

issuance of shares under our equity compensation plans and other arrangements, may have an

adverse effect on the market price of our common stock. |

| | | |

| ● | Our

stock price may be volatile, and purchasers of our securities could incur substantial losses. |

THE

OFFERING

The

following summary contains basic terms about this offering and the common stock and is not intended to be complete. It may not contain

all of the information that is important to you. You should read the more detailed information contained in this prospectus supplement,

including but not limited to, the risk factors beginning on page S-7 and the other risks described in this prospectus supplement, the

accompanying base prospectus and the documents incorporated by reference herein and therein.

| Issuer |

|

Lucid Diagnostics

Inc. |

| |

|

|

| Securities offered |

|

13,939,331 shares of common

stock |

| |

|

|

| Offering price |

|

$1.10 per share |

| |

|

|

| Common stock outstanding prior to this offering |

|

69,697,057(1) |

| |

|

|

| Common stock to be outstanding after this offering |

|

83,636,388( (1) |

| |

|

|

| Plan of distribution |

|

The Placement Agent has

agreed to use its commercially reasonable “best efforts” to sell the securities offered by this prospectus supplement

and the accompanying base prospectus. See “Plan of Distribution” on page S-14. |

| |

|

|

| Use of proceeds |

|

We intend to use the net

proceeds from the sale of our common stock in this offering for working capital and general corporate purposes. See “Use

of Proceeds” on page S-11. |

| |

|

|

| Risk Factors |

|

See the section entitled

“Risk Factors” on page S-7 and in the documents incorporated by reference herein for a discussion of factors you

should consider carefully before deciding to invest in our common stock. |

| |

|

|

| Nasdaq Global Market Symbol |

|

LUCD |

| (1) | Based

on the number of shares of our common stock outstanding as of February 28, 2025. This amount

does not include, as of February 28, 2025: |

| ● | 10,020,258

shares of our common stock issuable upon exercise of our outstanding stock options, at a

weighted average exercise price of $1.65 per share; |

| | | |

| ● | an

estimated 69,449,961 shares of our common stock issuable upon conversion of, and in payment

of dividends on, our outstanding Series B Convertible Preferred Stock, par value $0.001 per

share, or the “Series B Preferred Stock,” and our outstanding Series B-1

Convertible Preferred Stock, par value $0.001 per share, or the “Series B-1 Preferred

Stock,” and together with the Series B Preferred Stock, the “Preferred

Stock,” assuming that the Preferred Stock remains outstanding until its automatic

conversion date and all dividends on the Preferred Stock payable in shares of our common

stock are paid in full (without taking into account the limitations on conversion set forth

therein); and |

| | | |

| ● | an

estimated 36,934,233 shares of our common stock issuable upon conversion of, and in payment

of interest on, the 2024 Convertible Notes, assuming that the notes are converted in full

on their maturity date and the maximum number of shares permitted under the notes to be issued

in payment of interest are so issued (without taking into account the limitations on conversion

set forth therein). |

In

addition, as of February 28, 2025, 824,326 shares of our common stock were reserved for issuance, but not subject to outstanding stock-based

equity awards, under our Amended and Restated 2018 Long-Term Incentive Equity Plan, or the “2018 Plan,” and 1,259,830

shares of our common stock were reserved for issuance, but not yet issued, under our Employee Stock Purchase Plan, or the “ESPP.”

The number of shares available under the 2018 Plan will automatically increase on January 1st of each year, through (and including) January

1, 2032, in an amount equal to 6% of the total number of shares of our common stock outstanding on December 31st of the preceding calendar

year, unless our board of directors provides for a lesser amount. Similarly, the number of shares available for issuance under the ESPP

will automatically increase on January 1st of each year, through (and including) January 1, 2032, in an amount equal to the lesser of

(a) 2% of the total number of shares of our common stock outstanding on December 31st of the preceding calendar year, and (b) 1,000,000

shares, unless our board of directors provides for a lesser amount.

Furthermore,

(i) we are party to a committed equity facility with an affiliate of Cantor Fitzgerald & Co., pursuant to which the affiliate committed

to purchase up to $50 million in shares of our common stock (of which $48.2 million remains as of February 28, 2025), from time to time

at our request, at prices based on the current market price; (ii) we are party to a controlled equity offering agreement with Cantor

Fitzgerald & Co., pursuant to which, if we file a prospectus supplement related thereto, we may offer and sell shares of our common

stock in an “at the market offering” program, (iii) we are party to a management services agreement with PAVmed, pursuant

to which PAVmed may elect to receive payment of the monthly fee under the management services agreement in cash or in shares of our common

stock, with such shares valued at a price based on the current market price (although currently, under the terms of PAVmed’s convertible

debt, it is required to elect to receive such payment in cash); and (iv) we are party to a payroll and benefits expense reimbursement

agreement with PAVmed, pursuant to which PAVmed will pay certain payroll and benefit-related expenses on our behalf and we will reimburse

PAVmed on a quarterly basis or at such other frequency as the parties may determine, in cash or, subject to approval by our board of

directors and the board of directors of PAVmed, in shares of our common stock, or in a combination of cash and shares, with any such

shares valued at a price based on the current market price.

RISK

FACTORS

Any

investment in our common stock involves a high degree of risk. Before you make a decision to invest in our common stock, you are urged

to read and carefully consider the risks and uncertainties relating to an investment in our company set forth below, together with all

of the other information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. You

should read and carefully consider the risks and uncertainties discussed under the item “Risk Factors” in our most recent

annual report on Form 10-K and in any of our subsequent quarterly reports on Form 10-Q, as well as the other information in such reports

and the risks, uncertainties and other information in the other documents we file with the SEC that are incorporated by reference in

this prospectus supplement and the accompanying base prospectus, as such reports and documents may be amended, supplemented or superseded

from time to time by documents we subsequently file with the SEC. Additional risks and uncertainties not presently known to us or that

we currently deem immaterial may also affect our business and results of operations. If any of these risks actually occur, our business,

financial condition or results of operations could be seriously harmed. In that event, the market price for our common stock could decline

and you may lose all or part of your investment.

Risks

Related to this Offering

This

is a commercially reasonable “best efforts” offering, with no minimum amount of securities required to be sold, and we may

sell fewer than all of the securities offered hereby.

The

Placement Agent has agreed to use its commercially reasonable “best efforts” to solicit offers to purchase the securities

in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of

any specific number or dollar amount of the securities. There is no required minimum number of securities that must be sold as a condition

to completion of this offering, and there can be no assurance that the offering contemplated hereby will ultimately be consummated. Even

if we sell securities offered hereby, because there is no minimum offering amount required as a condition to closing of this offering,

the actual offering amount is not presently determinable and may be substantially less than the maximum amount set forth on the cover

page of this prospectus supplement. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount

of proceeds received by us. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term

and may need to raise additional funds, which may not be available or available on terms acceptable to us.

Our

management will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not have the

opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. The failure by our management to apply these funds effectively could harm our business. See “Use

of Proceeds” on page S-11 for a description of our proposed use of proceeds from this offering.

You

will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

The

price per share of our common stock offered hereby is substantially higher than the pro forma net tangible book value per share of our

common stock. As a result, investors purchasing shares of our common stock in this offering will incur immediate dilution of approximately

$0.52 per share, after giving effect to the sale of all 13,939,331 shares of our common stock offered hereby at a public offering

price of $1.10 per share, and after deducting the estimated placement agent fees and offering expenses payable by us. See “Dilution”

on page S-12 of this prospectus supplement for a more detailed discussion of the dilution you will incur if you purchase shares in this

offering.

Even

after giving effect to this offering, we expect to require additional capital funding, which may not be available on acceptable terms,

or at all, or if available, may result in substantial dilution to our stockholders or otherwise impair the value of our common stock.

Even

after giving effect to this offering, as we have not generated significant revenue or cash flow to date, we expect to require additional

capital funding in order to make investments to support our business growth. We may seek to raise required additional capital through

public or private equity or debt offerings, through loans, through arrangements with strategic partners or through other sources. Such

capital may not be available on acceptable terms, or at all. If we do not have, or are not able to obtain, sufficient funds, we may have

to delay product development initiatives or reduce our research and development, clinical trial, marketing, customer support or other

commercial activities.

To

the extent we are successful in raising additional capital by issuing equity securities, our stockholders may experience substantial

dilution and the new equity securities may have greater rights, preferences or privileges than our existing common stock. Any additional

shares of our common stock or other securities convertible into or exchangeable for our common stock may be sold at prices lower (or

higher) than the price paid by purchasers in this offering. Furthermore, sales of a substantial number of shares of our common stock

in the public markets, or the perception that such sales could occur, could depress the market price of our common stock. In the case

of certain issuances of equity securities, if the effective sales price per share is less than the then-current conversion price under

the 2024 Convertible Notes, the conversion price of the 2024 Convertible Notes will be reduced to such lower sales price, which would

increase the number of shares of our common stock upon conversion of such notes, thereby further diluting our stockholders if the notes

are converted in accordance with their terms.

To

the extent we are successful in raising additional capital by issuing debt securities or incurring loans, the holders of such securities

or loans will have priority in payment over the holders of our equity securities. In addition, the terms of those debt securities or

loan arrangements may include negative covenants or other restrictions on our business that could impair our operational flexibility,

including restricting our ability to pursue our business strategy, and could also require us to incur substantial interest expense.

A

substantial number of the shares of sold in this offering may be resold in the public market, which could cause the price of our common

stock to decline.

The

sale of shares to be issued in this offering in the public market, or any future sales of a substantial number of shares of our common

stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock on the

Nasdaq Capital Market. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of

those shares of common stock for sale will have on the market price of our common stock.

Our

outstanding options, convertible preferred stock and convertible notes, along with the potential issuance of shares under our equity

compensation plans and other arrangements, may have an adverse effect on the market price of our common stock.

As

of February 28, 2025, in addition to our outstanding shares of common stock: (i) 10,020,258 shares of our common stock were issuable

upon exercise of our outstanding stock options, at a weighted average exercise price of $1.65 per share; (ii) an estimated 69,449,961

shares of our common stock were issuable upon conversion of, and in payment of dividends on, our outstanding Preferred Stock, assuming

that the Preferred Stock was to remain outstanding until its automatic conversion date and all dividends on the Preferred Stock were

to be paid in full (without taking into account the limitations on conversion set forth therein); and (iii) an estimated 36,934,233 shares

of our common stock issuable upon conversion of, and in payment of interest on, the 2024 Convertible Notes, assuming that the notes are

converted in full on their maturity date and the maximum number of shares permitted under the notes to be issued in payment of interest

are so issued (without taking into account the limitations on conversion set forth therein).

In

addition, as of February 28, 2025, 824,326 shares of our common stock were reserved for issuance, but not subject to outstanding stock-based

equity awards, under the 2018 Plan, and 1,259,830 shares of our common stock were reserved for issuance, but not yet issued, under the

ESPP. The number of shares available under the 2018 Plan will automatically increase on January 1st of each year, through (and including)

January 1, 2032, in an amount equal to 6% of the total number of shares of our common stock outstanding on December 31st of the preceding

calendar year, unless our board of directors provides for a lesser amount. Similarly, the number of shares available for issuance under

the ESPP will automatically increase on January 1st of each year, through (and including) January 1, 2032, in an amount equal to the

lesser of (a) 2% of the total number of shares of our common stock outstanding on December 31st of the preceding calendar year, and (b)

1,000,000 shares, unless our board of directors provides for a lesser amount.

Furthermore,

(i) we are party to a committed equity facility with an affiliate of Cantor Fitzgerald & Co., pursuant to which the affiliate committed

to purchase up to $50 million in shares of our common stock (of which $48.2 million remains as of February 28, 2025), from time to time

at our request, at prices based on the current market price; (ii) we are party to a controlled equity offering agreement with Cantor

Fitzgerald & Co., pursuant to which, if we file a prospectus supplement related thereto, we may offer and sell shares of our common

stock in an “at the market offering” program, (iii) we are party to a management services agreement with PAVmed, pursuant

to which PAVmed may elect to receive payment of the monthly fee under the management services agreement in cash or in shares of our common

stock, with such shares valued at a price based on the current market price (although currently, under the terms of PAVmed’s convertible

debt, it is required to elect to receive such payment in cash); and (iv) we are party to a payroll and benefits expense reimbursement

agreement with PAVmed, pursuant to which PAVmed will pay certain payroll and benefit-related expenses on our behalf and we will reimburse

PAVmed on a quarterly basis or at such other frequency as the parties may determine, in cash or, subject to approval by our board of

directors and the board of directors of PAVmed, in shares of our common stock, or in a combination of cash and shares, with any such

shares valued at a price based on the current market price.

Any

issuance of these shares will dilute our other equity holders, which could cause the price of our common stock to decline. In addition,

the sale of these shares in the public market, or the perception that such sales may occur, could adversely affect the price of our common

stock.

Our

stock price may be volatile, and purchasers of our securities could incur substantial losses.

Our

stock price is likely to be volatile. The stock market in general, and the market for life science companies, and medical device companies

in particular, have experienced extreme volatility that has often been unrelated to the operating performance of particular companies.

As a result of this volatility, investors may experience losses on their investment in our common stock.

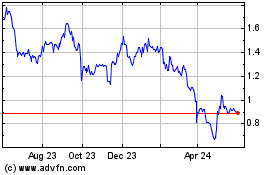

For

example, on March 3, 2025, the last reported sale price of our common stock $1.34. In the last six months, between September 4, 2024

and March 3, 2025, the intra-day sales price of our common stock fluctuated between a reported low sale price of $0.73 and a reported

high sales price of $1.633. We may incur rapid and substantial increases or decreases in our stock price in the foreseeable future that

do not coincide in timing with the disclosure of news or developments by us.

The

market price for our common stock may be influenced by many factors, including the following:

| ● | factors

in the public trading market for our stock that may produce price movements that may or may

not comport with macro, industry or company-specific fundamentals, including, without limitation,

the sentiment of retail investors (including as may be expressed on financial trading and

other social media sites and online forums), the direct access by retail investors to broadly

available trading platforms, the amount and status of short interest in our securities, access

to margin debt, trading in options and other derivatives on our common stock and any related

hedging and other trading factors; |

| | | |

| ● | speculation

in the press or investment community about our company or industry; |

| | | |

| ● | our

ability to successfully commercialize, and realize revenues from sales of, any products we

may develop; |

| | | |

| ● | the

performance, safety and side effects of any products we may develop; |

| | | |

| ● | the

success of competitive products or technologies; |

| | | |

| ● | results

of clinical studies of any products we may develop or those of our competitors; |

| | | |

| ● | regulatory

or legal developments in the U.S. and other countries, especially changes in laws or regulations

applicable to any products we may develop; |

| | | |

| ● | introductions

and announcements of new products by us, our commercialization partners, or our competitors,

and the timing of these introductions or announcements; |

| | | |

| ● | actions

taken by regulatory agencies with respect to our products, clinical studies, manufacturing

process or sales and marketing terms; |

| | | |

| ● | variations

in our financial results or those of companies that are perceived to be similar to us; |

| | | |

| ● | the

success of our efforts to acquire or in-license additional products or other products we

may develop; |

| | | |

| ● | developments

concerning our collaborations, including but not limited to those with our sources of manufacturing

supply and our commercialization partners; |

| | | |

| ● | developments

concerning our ability to bring our manufacturing processes to scale in a cost-effective

manner; |

| | | |

| ● | announcements

by us or our competitors of significant acquisitions, strategic partnerships, joint ventures

or capital commitments; |

| ● | developments

or disputes concerning patents or other proprietary rights, including patents, litigation

matters and our ability to obtain patent protection for our products; |

| | | |

| ● | our

ability or inability to raise additional capital and the terms on which we raise it; |

| | | |

| ● | the

recruitment or departure of key personnel; |

| | | |

| ● | changes

in the structure of healthcare payment systems; |

| | | |

| ● | market

conditions in the medical device, pharmaceutical and biotechnology sectors; |

| | | |

| ● | actual

or anticipated changes in earnings estimates or changes in stock market analyst recommendations

regarding our common stock, other comparable companies or our industry generally; |

| | | |

| ● | trading

volume of our common stock; |

| | | |

| ● | sales

of our common stock by us or our stockholders; |

| | | |

| ● | general

economic, industry and market conditions; and |

| | | |

| ● | the

other risks described and incorporated by reference in this “Risk Factors”

section. |

These

broad market and industry factors may seriously harm the market price of our common stock, regardless of our operating performance. In

the past, following periods of volatility in the market, securities class action litigation has often been instituted against companies.

Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources,

which could materially and adversely affect our business, financial condition, results of operations and growth prospects.

We

do not expect to pay any dividends in the foreseeable future.

We

have not paid any cash dividends on our shares of common stock to date. The payment of cash dividends on our common stock in the future

will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition and will be within the

discretion of our board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in

our business operations and, accordingly, our board of directors does not anticipate declaring any dividends on our common stock in the

foreseeable future. As a result, any gain you will realize on our common stock will result solely from the appreciation of such shares.

USE

OF PROCEEDS

We

estimate the net proceeds to us from this offering will be approximately $14.5 million, assuming we sell all of the shares offered hereby,

and after deducting the estimated placement agent fees and offering expenses payable by us. Because there is no minimum amount of shares

that must be sold as a condition to closing this offering, the actual number of shares of common stock sold and net proceeds to us are

not presently determinable and may be substantially less than the amounts set forth above.

We

intend to use the net proceeds from the sale of our common stock in this offering for working capital and general corporate purposes.

We have not identified the amounts we will spend on any specific purpose. The amounts actually expended for any purpose may vary significantly

depending upon numerous factors, including assessments of potential market opportunities, the results of clinical trials and regulatory

developments. In the event any net proceeds are not immediately applied, we may temporarily deposit them in our bank accounts as cash

and cash equivalents or purchase short-term investments.

DILUTION

If

you invest in our shares, your ownership interest will be diluted to the extent of the difference between the price you paid per share

of common stock in this offering and the net tangible book value per share of our common stock after this offering. Net tangible book

value per share represents total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding.

Our

net tangible book value as of September 30, 2024 was approximately $5.5 million, or approximately $0.11 per share of our

common stock issued and outstanding, on an unaudited historical basis as of such date.

Our

net tangible book value as of September 30, 2024 would have been approximately $23.8 million, or approximately $0.46 per

share of our common stock, after giving effect to the sale of $21.975 million in principal amount of 2024 Convertible Notes and the repayment

in full of the $3.6 million redemption price in respect of the 2023 Convertible Notes.

Our

net tangible book value as of September 30, 2024 would have been approximately $38.3 million, or approximately $0.58 per

share of our common stock issued and outstanding, on an unaudited pro forma basis as of such date, after giving further effect to the

sale by us of 13,939,331 shares of our common stock in this offering at an offering price of $1.10 per share, for aggregate gross proceeds

of approximately $15.3 million, and after deducting $0.8 million in estimated placement agent fees and offering expenses payable by us.

This represents an immediate increase in net tangible book value of $0.11 per share of our common stock to existing stockholders

and an immediate dilution of $0.52 per share of our common stock to new investors purchasing shares of our common stock in this

offering.

The

following table illustrates the dilution on a per share of common stock basis for investors purchasing shares of our common stock in

this offering:

| Public offering price per share in this offering | |

| | | |

$ | 1.10 | |

| Pro forma net tangible book value per share as of September 30, 2024 | |

$ | 0.46 | | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.12 | | |

| | |

| Pro forma as adjusted net tangible book value per share as of September 30, 2024 | |

| | | |

$ | 0.58 | |

| Dilution per share to new investors in this offering | |

| | | |

$ | 0.52 | |

The

per share calculations above are based on the number of shares of our common stock issued and outstanding as of September 30, 2024, as

follows: 51,597,718 shares on an unaudited historical basis and on an unaudited pro forma basis and 65,537,049 shares on an unaudited

pro forma as adjusted basis (in each case, excluding 6,584,240 shares of unvested restricted stock awards granted under our incentive

equity plan).

The

foregoing information does not take into account the exercise of our outstanding options, the conversion of our outstanding convertible

preferred stock or convertible notes, or the issuance of shares under our equity plans or other arrangements, as set forth in footnote

1 in “Prospectus Summary – The Offering.”

To

the extent that other shares are issued, investors purchasing shares in this offering could experience more or less dilution. In addition,

we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of those securities could result in more or less dilution to investors in this offering.

DESCRIPTION

OF COMMON STOCK

Upon

consummation of the offering, 83,636,388 shares of our common stock will be outstanding, assuming the sale of all the shares offered

by this prospectus supplement. This amount does not include the shares of our common stock issuable upon the exercise of our outstanding

options or the conversion of our outstanding convertible preferred stock and convertible notes, or the issuance of shares under our equity

plans or other arrangements, as set forth in footnote 1 in “Prospectus Summary – The Offering.” For a description

of our common stock, please see “Description of Capital Stock” in the accompanying base prospectus.

PLAN

OF DISTRIBUTION

Subject

to the terms and conditions of a placement agency agreement, Canaccord has agreed to act as our exclusive Placement Agent in connection

with this offering of our securities pursuant to this prospectus supplement and the accompanying base prospectus. The Placement

Agent is not purchasing or selling any securities offered by this prospectus supplement and the accompanying base prospectus, nor

is it required to arrange the purchase or sale of any specific number or dollar amount of the securities, but it has agreed to use its

commercially reasonable “best efforts” to arrange for the sale of all of the securities offered hereby. We will enter into

subscription agreements directly with the investors in this offering. Notwithstanding anything to the contrary herein, we have directly

solicited investments from certain investors, or the “Excluded Investors,” as agreed to among us and the Placement

Agent, and therefore the Placement Agent is not acting as placement agent with respect to the Excluded Investors.

We

expect to deliver the securities being offered pursuant to this prospectus supplement on or about March 5, 2025, subject to satisfaction

of customary closing conditions in the placement agency agreement.

The placement

agency agreement contains customary representations, warranties and agreements by us and customary conditions to closing. Under

the placement agency agreement, we have agreed to indemnify the Placement Agent against certain liabilities, including liabilities under

the Securities Act, and to contribute to payments the Placement Agent may be required to make in respect thereof.

The

Placement Agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions

received by it and any profit realized on the resale of the shares underlying the warrants sold by it while acting as principal might

be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the Placement Agent would be required

to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities

Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of

shares by the Placement Agent acting as principal. Under these rules and regulations, the Placement Agent:

| |

● |

may not engage in any stabilization activity in connection with our securities; and |

| |

|

|

| |

● |

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted

under the Exchange Act, until it has completed its participation in the distribution. |

Placement

Agent Fees and Expenses

We

have agreed to pay the Placement Agent a cash fee of 7.0% of the aggregate gross proceeds of from the sale of shares in this

offering to investors introduced to us by the Placement Agent. We will pay no fee on the aggregate gross proceeds from the sale of shares

to other investors. We have also agreed to reimburse the Placement Agent for certain expenses incurred in connection with this offering,

including its reasonable fees and expenses of legal counsel, up to $50,000.

The

following table shows the offering price, estimated placement agent fees and proceeds to us, before expenses, from the sale of our securities

offered hereby.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 1.100 | | |

$ | 15,333,254 | |

| Placement Agent fees(1) | |

$ | 0.026 | | |

$ | 398,528 | |

| Proceeds to us, before expenses | |

$ | 1.074 | | |

$ | 14,934,726 | |

| |

(1) |

Consists of a cash fee of 7.0% of the aggregate gross proceeds of from the sale of our securities in the offering to

investors introduced to us by the Placement Agent. The cash fee set forth above assumes the sale of 5,175,685 shares in the offering

to such investors. We have also agreed to reimburse the Placement Agent for certain expenses incurred in connection with this

offering. |

In

addition, we have agreed to pay a financial advisor of ours a fee of $300,000. We estimate that the expenses of this offering (excluding

the fees and expenses of the Placement Agent but including the fees and expenses of our financial advisor) will be approximately $0.4

million.

Lock-Up

Agreement

We,

our executive officers and directors have agreed, subject to certain exceptions, not to (i) directly or indirectly, offer, pledge, sell,

contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant

to purchase or otherwise transfer or dispose of any shares of our common stock or any securities convertible into or exercisable or exchangeable

for our common stock or file any registration statement under the Securities Act with respect to any of the foregoing or (ii) enter into

any swap or any other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence

of ownership of our common stock, whether any such swap or transaction described in clause (i) or (ii) above is to be settled by delivery

of our common stock or other securities, in cash or otherwise, without the prior written consent of the Placement Agent, for a period

ending on the date that is 90 days from the date of the placement agency agreement, or the “Lock-Up Period.”

The

Placement Agent, in its sole discretion, may release our common stock and other securities subject to the lock-up agreements described

above in whole or in part at any time. When determining whether or not to release our common stock and other securities from lock-up

agreements, the Placement Agent will consider, among other factors, the holder’s reasons for requesting the release, the number

of shares for which the release is being requested and market conditions at the time of the request.

Electronic

Offer, Sale and Distribution of Securities

A

prospectus in electronic format may be made available on the website maintained by the Placement Agent and the Placement Agent may distribute

prospectuses electronically. Other than the prospectus in electronic format, the information on these websites is not part of this prospectus

or the registration statement of which this prospectus forms a part, has not been approved or endorsed by us or the Placement Agent,

and should not be relied upon by investors.

Other

Relationships

From

time to time, the Placement Agent or its affiliates may in the future provide various advisory, investment and commercial banking and