Amended Statement of Beneficial Ownership (sc 13d/a)

December 28 2022 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)

_________________________________

LUCID GROUP, INC.

(Name of Issuer)

Class A Common Stock, par value $0.0001 per share

(Title of Class of Securities)

549498 103

(CUSIP Number)

Jonathan Butler, General Counsel

c/o Lucid Group, Inc.

7373 Gateway Boulevard

Newark, CA 94560

Telephone: (212) 380-7500

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 22, 2022

(Date of Event Which Requires Filing of This Statement)

_______________________________

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because off §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to

whom copies are to be sent.

|

* |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of

Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAME OF REPORTING PERSONS

The Public Investment Fund

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☒ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Kingdom of Saudi Arabia

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

8,041,393

|

|

8

|

SHARED VOTING POWER

1,100,965,202 (see Item 5 below)

|

|

9

|

SOLE DISPOSITIVE POWER

1,109,006,595 (see Item 5 below)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,109,006,595 (see Item 5 below)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.66% (see Item 5 below)

|

|

14

|

TYPE OF REPORTING PERSON

OO – Sovereign Wealth Fund of the Kingdom of Saudi Arabia

|

|

1

|

NAME OF REPORTING PERSONS

Ayar Third Investment Company

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☒ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Kingdom of Saudi Arabia

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,100,965,202 (see Item 5 below)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,100,965,202 (see Item 5 below)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.22% (see Item 5 below)

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

1

|

NAME OF REPORTING PERSONS

Yasir O. Al Rumayyan

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☒ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Kingdom of Saudi Arabia

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

4,654,595

|

|

8

|

SHARED VOTING POWER

1,100,965,202 (see Item 5 below)

|

|

9

|

SOLE DISPOSITIVE POWER

4,654,595

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,105,619,797 (see Item 5 below)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.47% (see Item 5 below)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

1

|

NAME OF REPORTING PERSONS

Turqi A. Alnowaiser

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☒ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Kingdom of Saudi Arabia

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

2,091,169 (see Item 5 below)

|

|

8

|

SHARED VOTING POWER

1,100,965,202 (see Item 5 below)

|

|

9

|

SOLE DISPOSITIVE POWER

2,091,169 (see Item 5 below)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,103,056,371 (see Item 5 below)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

60.33% (see Item 5 below)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

EXPLANATORY STATEMENT

The following constitutes Amendment No. 2 (“Amendment No. 2”) to the initial statement on Schedule 13D, filed on July 27, 2021 (the “Initial Schedule 13D”) by the undersigned, and

amendment No. 1 to the Initial Schedule 13D, filed on November 15, 2022 (“Amendment No. 1” collectively with the Initial Schedule 13D, referred to as the “Prior Schedule 13D”). This Amendment No. 2 amends the

Prior Schedule 13D as specifically set forth herein. Capitalized terms used in this Amendment No. 2 and not otherwise defined herein have the meanings given to them in the Prior Schedule 13D.

Item 4. Purpose of Transaction

Item 4 of the Prior Schedule 13D is hereby amended to add the following language:

On December 9, 2022, PIF purchased shares of Lucid Group, Inc. (the “Company”) Class A Common Stock in the open market. The reason for the purchase was made for

investment purpose.

Pursuant to that Subscription Agreement, dated November 8, 2022 (the “2022 Subscription Agreement”), between the Company and Ayar, Ayar has purchased 85,712,679

shares of Company’s Class A Common Stock.

Item 5. Interest in Securities of the Issuer

Item 5(a), (b) and (c) of the Prior Schedule 13D are hereby amended and replaced in their entirety with the following language:

(a)-(b)

As of the date hereof:

|

•

|

PIF directly owns 8,041,393 shares of Class A Common Stock and has sole voting and dispositive power of such shares. PIF may, pursuant to Rule 13d-3, be deemed to

beneficially own the 1,100,965,202 shares of Class A Common Stock directly owned by Ayar and aggregating to a beneficial ownership of 1,109,006,595 shares. The Ayar securities and the Class A Common held directly by PIF represent

approximately 60.66% of the Issuer’s issued and outstanding shares Class A Common Stock. PIF disclaims beneficial ownership of the Ayar securities except to the extent of its pecuniary interest therein.

|

|

•

|

Ayar directly owns 1,100,965,202 shares of Class A Common Stock and has shared voting power over such shares which represent approximately 60.22% of the Issuer’s issued and

outstanding shares of Class A Common Stock.

|

|

•

|

H.E. Al Rumayyan as the sole manager of Ayar has shared voting power over 1,100,965,202 shares of Class A Common Stock held by Ayar. In addition, H.E. Al Rumayyan has sole

voting and dispositive power over 4,654,595 shares of Class A Common Stock held in his name, which do not include options to purchase 400,000 shares of Class A Common Stock that are not exercisable within 60 days from the date hereof.

Accordingly, H.E. Al Rumayyan may be deemed to beneficially own an aggregate of 1,105,619,797 shares of Class A Common Stock, representing approximately 60.47% of the Issuer’s issued and outstanding shares of Class A Common Stock. H.E. Al

Rumayyan disclaims beneficial ownership of any securities held by Ayar.

|

|

•

|

Mr. Alnowaiser, based on his authority delegated to him by H.E. Al Rumayyan, the sole manager of Ayar, has shared voting power over 1,100,965,202 shares of Class A Common

Stock held by Ayar. In addition, Mr. Alnowaiser has sole voting and dispositive power over 2,091,169 shares of Class A Common Stock held in his name, which includes 17,295 shares issuable pursuant to Restricted Stock Units that will not vest

for more than 60 days from the date hereof. Accordingly, Mr. Alnowaiser may be deemed the beneficial owner of an aggregate of 1,103,056,371 shares of Class A Common Stock, representing approximately

60.33% of the Issuer’s issued and outstanding shares of Class A Common Stock. Mr. Alnowaiser disclaims beneficial ownership of any securities held by Ayar.

|

Based on conversations with the Issuer, the percentages set forth in this Item 5(a) are based on 1,828,310,203 shares of Class A Common Stock issued and outstanding as of December 23,

2022, as reported by the Issuer in connection with the closing of a transaction dated December 22, 2022.

Each of the Reporting Persons may be deemed to be a member of a group with respect to the Issuer or securities of the Issuer for the purposes of Section 13(d) or 13(g) of the Act. Each

of the Reporting Persons disclaims beneficial ownership of all of the shares of Class A Common Stock included in this report, except to the extent of any pecuniary interests therein, and the filing of this report shall not be construed as an admission

that any such person or entity is the beneficial owner of any such securities for purposes of Section 13(d) or 13(g) of the Act, or for any other purpose.

(c) The Public Investment Fund engaged in an Open market purchase of 8,041,393 shares of Class A Common Stock on December 9, 2022, for an average price of $8.5241. Ayar Third

Investment Company engaged in a private placement with the issuer on December 23, 2022, purchasing 85,712,679 shares Class A Common Stock at a purchase price of $10.6752.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Item 6 of the Prior Schedule 13D is hereby amended to add the following language:

The response to Item 4 of this Schedule 13D is incorporated by reference herein.

[The remainder of this page intentionally left blank]

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 27, 2022

| |

THE PUBLIC INVESTMENT FUND

|

|

| |

|

|

| |

By:

|

The Public Investment Fund, /s/ H.E. Yasir O. Al Rumayyan, Governor

|

| |

Name:

|

His Excellency Yasir O. Al Rumayyan

|

| |

Title:

|

Governor

|

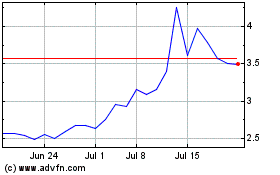

Lucid (NASDAQ:LCID)

Historical Stock Chart

From Apr 2024 to May 2024

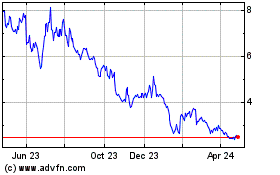

Lucid (NASDAQ:LCID)

Historical Stock Chart

From May 2023 to May 2024