Kubient, Inc. (NasdaqCM: KBNT, KBNTW)

(“Kubient '' or the “Company”), a cloud-based software

platform for digital advertising, and Adomni Inc. (“Adomni”) today

announced they have entered into a definitive merger agreement,

pursuant to which Adomni will merge with and into a wholly-owned

subsidiary of Kubient (the “Merger”). The combined company will

focus on growing and developing Adomni’s pre-existing programmatic

advertising service and platform that delivers high-impact

advertising campaigns via 725,000+ connected digital out of home

screens across the world. Following the closing of the Merger, the

combined company is expected to operate under the name “Adomni,

Inc.”

The Merger is intended to allow Adomni to

strengthen and diversify its advertising technology platform while

also expanding its scope to address a much larger, growing digital

ad market. Adomni is also poised to expand its product offering

with enhanced features around artificial intelligence (“AI”)

technology. Kubient’s AI product KAI will be harnessed to deliver

better advertising campaigns via Adomni’s platforms. These include

enhanced accuracy of fraud prevention via AI-powered algorithms,

real-time data monitoring and analysis of incoming data, advanced

pattern recognition within the data, brand protection from

fraudulent media, and more.

About the Proposed MergerUnder

the terms of the merger agreement, pending approval of the

transaction by Kubient’s stockholders and Adomni’s stockholders and

subject to customary closing conditions, Kubient will acquire 100%

of the outstanding equity interests in Adomni, by means of a

reverse triangular merger of a wholly-owned subsidiary of Kubient

with and into Adomni, with Adomni surviving as a wholly-owned

subsidiary of Kubient. In connection with the closing of the

Merger, Kubient is expected to change its name to “Adomni,

Inc.”

Immediately following the closing of the Merger,

the equity holders of Adomni are expected to own approximately 74%

of the outstanding common stock of the combined company, and the

equity holders of Kubient are expected to own approximately 26% of

the outstanding common stock of the combined company. The merger

agreement also provides that the equity holders of Adomni may

receive additional shares of Kubient equal to 1%, 2% or 5% of the

outstanding shares of Kubient on a fully diluted basis following

the filing of Kubient’s annual report on Form 10-K for the 2023

fiscal year upon the achievement certain audited net revenue

thresholds of Kubient for the 2023 fiscal year.

The Merger has been unanimously approved by the

board of directors of each company and is expected to close in the

second half of 2023.

Lake Street Capital Markets LLC is acting as the

exclusive financial advisor and Akerman LLP is serving as legal

counsel to Kubient. Perkins Coie LLP is serving as legal counsel to

Adomni.

Management Commentary“We are

proud to merge the Kubient and Adomni teams, and look forward to

rolling out our growth strategy as a combined entity,” said

Jonathan Gudai, Adomni’s Chief Executive Officer. “Kubient’s team

and tech stack is an excellent fit with our business and we believe

it will play an important role in our overall growth strategy to

broaden market diversification and extend the development of our

platforms. By combining our platform for Digital-Out-Of-Home with

Kubient’s leadership team and knowledge in the realms of online

digital advertising and connected television, we believe we can

bring these elements together and deliver a truly omni-channel

advertising and content experience. We believe the synergies

between our companies will advance our strategic mission to deliver

higher levels of ad-tech service globally.”

Paul Roberts, Kubient’s Founder and Chief

Executive Officer, added: “We are very excited about what the

combined strength of Kubient and Adomni will bring to the ad-tech

industry, including both advertisers, and publishers. Following an

extensive process of searching for the best possible partner, we

are very encouraged to have arrived at this proposed merger with

Adomni; we believe that Kubient has delivered its promise of

providing stockholders with an initiative that brings our

proprietary technology further to the forefront of the advertising

market. We believe Kubient’s proprietary technology will provide

Adomni’s customers with the benefit of enhanced product

performance, and advanced solution capability as the company

broadens its reach further into global markets. Together, we will

build upon our core competencies and advance forward-thinking

initiatives that play to our combined strengths. I’d like to take

the chance to extend our gratitude and appreciation to our

extraordinary employees, who’s hard work and commitment have

brought Kubient to this point in our journey.”

Acquisition Conference Call InformationKubient

and Adomni will hold a conference call today at 4:30 p.m. Eastern

time (1:30 p.m. Pacific time) to discuss the details of the

Definitive Agreement.

Date: Wednesday, May 24, 2023Time: 4:30 p.m. Eastern time (1:30

p.m. Pacific time)U.S. dial-in: 1-888-506-0062International

dial-in: 1-973-528-0011Participant Access Code: 210517

Please call the conference telephone number 10 minutes prior to

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the Investor Relations section of Kubient’s

website.

A telephonic replay of the conference call will be available

after 7:30 p.m. Eastern time on the same day through June 7,

2023.

Toll-free replay number: 1-877-481-4010International replay

number: 1-919-882-2331Replay ID: 48481

About AdomniAdomni = advertise

everywhere. The company was founded in 2015 with the vision to

provide an online marketplace for brand marketers and ad agency

media specialists to easily and quickly launch digital advertising

campaigns in the real world. Today, Adomni’s connected screen

inventory reaches a monthly audience of over one billion people

across 37 digital screen types. Digital screen types range from

outdoor placements such as digital billboards, urban panels and

vehicle tops to indoor placements in high-traffic locations such as

airports, bars and restaurants, gas stations, gyms and shopping

malls.

Adomni’s ad planning and buying platform enables

media planners and buyers to view inventory availability,

transparently view pricing, target their ideal audience using its

proprietary Audience IQ technology, and measure the performance

impact of the ad campaign on the brand’s business goals via custom

reports. The simplicity and ease of Adomni’s platform enables

campaigns to be planned and launched in just minutes.

Adomni also owns and operates a consumer-facing

platform called Shoutable. Shoutable specializes in putting

user-generated-content (UGC) on digital billboards as the first

direct-to-consumer marketplace that bridges social media with the

physical world. In just minutes, anyone can choose a template, add

their photo and text and make a credit card purchase for small

amounts of space on digital billboards and other digital out of

home screens. Brands are also able to sponsor Shoutable campaigns

by providing custom templates for consumers to add their personal

content and place a free order which is subsidized by the

brand.

For additional information, please visit

www.adomni.com or www.shoutable.me.

About KubientKubient is a

technology company with a mission to transform the digital

advertising industry to audience-based marketing. Kubient’s next

generation cloud-based infrastructure enables efficient marketplace

liquidity for buyers and sellers of digital advertising. The

Kubient Audience Marketplace is a flexible open marketplace for

advertisers and publishers to reach, monetize and connect their

audiences. The Company’s platform provides a transparent

programmatic environment with proprietary artificial

intelligence-powered pre-bid ad fraud prevention, and proprietary

real-time bidding (RTB) marketplace automation for the digital out

of home industry. The Audience Marketplace is the solution for

brands and publishers that demand transparency and the ability to

reach audiences across all channels and ad formats. For additional

information, please visit https://kubient.com.

Additional Information about the

Proposed Merger and Where to Find ItThis communication

relates to the proposed merger transaction involving Kubient and

Adomni and may be deemed to be solicitation material in respect of

the proposed merger transaction. In connection with the proposed

merger transaction, Kubient will file relevant materials with the

United States Securities and Exchange Commission (the “SEC”),

including a registration statement on Form S-4 that will contain a

proxy statement (the “Proxy Statement”) and prospectus. This

communication is not a substitute for the Form S-4, the Proxy

Statement or for any other document that Kubient may file with the

SEC and or send to Kubient’s stockholders in connection with the

proposed merger transaction. BEFORE MAKING ANY VOTING DECISION,

INVESTORS AND SECURITY HOLDERS OF KUBIENT ARE URGED TO READ THE

FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE

SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KUBIENT, THE

PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Investors and

security holders will be able to obtain free copies of the Form

S-4, the Proxy Statement and other documents filed by Kubient with

the SEC through the website maintained by the SEC at

http://www.sec.gov. Copies of the documents filed by Kubient with

the SEC will also be available free of charge on Kubient’s website

at www.kubient.com, or by contacting Kubient Investor Relations at

kubient@gatewayir.com. Kubient, Adomni and their respective

directors and certain of their executive officers may be considered

participants in the solicitation of proxies from Kubient’s

stockholders with respect to the proposed merger transaction under

the rules of the SEC. Information about the directors and executive

officers of Kubient is set forth in its proxy statement on Schedule

14A for its 2023 annual meeting of stockholders, filed with the SEC

on April 26, 2023 and its Annual Report on Form 10-K for the year

ended December 31, 2022, which was filed with the SEC on March 30,

2023. Additional information regarding the persons who may be

deemed participants in the proxy solicitations and a description of

their direct and indirect interests, which may differ from the

interests of Kubient’s stockholders generally, will also be

included in the Form S-4, the Proxy Statement and other relevant

materials to be filed with the SEC when they become available.

No Offer or SolicitationThis

communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor a solicitation

of any vote or approval with respect to the proposed transaction or

otherwise. No offer of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, and otherwise in accordance

with applicable law.

Forward Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995, including but not

limited to, express or implied statements regarding the structure,

timing and completion of the proposed merger; the combined

company’s listing on The Nasdaq Capital Market after closing of the

proposed merger; expectations regarding the ownership structure of

the combined company; the expected executive officers and directors

of the combined company; each company’s and the combined company’s

expected cash position at the closing of the proposed merger and

cash runway of the combined company; the future operations of the

combined company; the nature, strategy and focus of the combined

company; the location of the combined company’s corporate

headquarters; and other statements that are not historical fact.

All statements other than statements of historical fact contained

in this press release are forward-looking statements. These

forward-looking statements are made as of the date they were first

issued, and were based on the then-current expectations, estimates,

forecasts, and projections, as well as the beliefs and assumptions

of management. Forward-looking statements are subject to a number

of risks and uncertainties, many of which involve factors or

circumstances that are beyond Kubient’s control. Kubient’s actual

results could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including

but not limited to (i) the risk that the conditions to the closing

of the proposed merger are not satisfied, including the failure to

timely obtain shareholder approval for the transaction, if at all;

(ii) uncertainties as to the timing of the consummation of the

proposed merger and the ability of each of Kubient and Adomni to

consummate the proposed merger; (iii) risks related to Kubient’s

ability to manage its operating expenses and its expenses

associated with the proposed merger pending closing; (iv) risks

related to the failure or delay in obtaining required approvals

from any governmental or quasi-governmental entity necessary to

consummate the proposed merger; (v) the risk that as a result of

adjustments to the exchange ratio, Kubient shareholders and Adomni

stockholders could own more or less of the combined company than is

currently anticipated; (vi) risks related to the market price of

Kubient’s stock relative to the exchange ratio; (vii) unexpected

costs, charges or expenses resulting from the transaction; (viii)

potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the proposed

merger; (ix) the uncertainties associated with Adomni’s platform

and technologies; (x) risks related to the inability of the

combined company to obtain sufficient additional capital to

continue to advance Adomni’s platform and technologies; and (xi)

risks associated with the possible failure to realize certain

anticipated benefits of the proposed merger, including with respect

to future financial and operating results, among others. Actual

results and the timing of events could differ materially from those

anticipated in such forward-looking statements as a result of these

risks and uncertainties. These and other risks and uncertainties

are more fully described in periodic filings with the SEC,

including the factors described in the section titled “Risk

Factors” in Kubient’s Registration Statement on Form S-1 filed with

the SEC on December 21, 2020, and in other filings that Kubient

makes and will make with the SEC in connection with the proposed

merger, including the Proxy Statement described above under

“Additional Information about the Proposed Merger and Where to Find

It.” You should not place undue reliance on these forward-looking

statements, which are made only as of the date hereof or as of the

dates indicated in the forward-looking statements. Kubient

expressly disclaims any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in its expectations with

regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

Kubient Investor RelationsGateway Investor

RelationsMatt Glover and John YiT:

1-949-574-3860Kubient@gatewayir.com

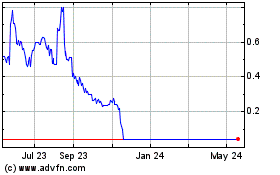

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

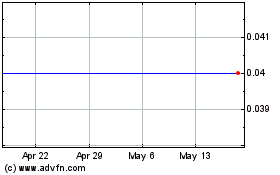

Kubient (NASDAQ:KBNT)

Historical Stock Chart

From Nov 2023 to Nov 2024