First Quarter Sales Volume Increased 24.5% and Net Sales

Increased 18.0% to $276.2M Driven by Snack Bar Sales from the

Lakeville Acquisition1

John B. Sanfilippo & Son, Inc. (NASDAQ: JBSS) (the

“Company”) today announced financial results for its fiscal 2025

first quarter ended September 26, 2024.

First Quarter Summary1

- Sales volume increased 18.0 million pounds, or 24.5%, to 91.2

million pounds

- Net sales increased $42.1 million, or 18.0%, to $276.2

million

- Gross profit decreased 18.4% to $46.5 million

- Diluted EPS decreased 33.8% to $1.00 per share

CEO Commentary

“We were encouraged by sales volume increases across all three

of our distribution channels in the first quarter. The consumer

distribution channel delivered its strongest quarterly sales volume

growth (excluding the impact from the Lakeville Acquisition) in the

past eight quarters, as the overall core nut and trail mix category

continues to stabilize and recover. We remain optimistic that the

strategic pricing actions we initiated last quarter will continue

to drive positive momentum in our consumer distribution channel.

However, the category may be challenged by increasing commodity

costs and corresponding selling price increases in the next few

quarters,” stated Jeffrey T. Sanfilippo, Chief Executive

Officer.

“In addition to the impact from our strategic pricing actions,

our profitability in the quarter was impacted by a one-time

concession to a snack bar customer due to capacity constraints at

our Lakeville facility. We believe these capacity constraints have

been resolved. However, we continue to focus on identifying and

implementing cost savings and operational efficiencies to enhance

our future profitability,” Mr. Sanfilippo concluded.

_____________________________

1

Results include the impact of the

acquisition of the TreeHouse Foods snack bar business (the

“Lakeville Acquisition”) which was completed on September 29, 2023,

the first day of our second fiscal quarter of fiscal 2024.

First Quarter Results

Net Sales

Net sales for the first quarter of fiscal 2025 increased $42.1

million, or 18.0%, to $276.2 million, including approximately $40.5

million of net sales from the Lakeville Acquisition. Excluding the

Lakeville Acquisition, net sales increased $1.6 million, or 0.7%.

This increase was driven by slight increases in sales volume,

defined as pounds sold to customers, and the weighted average sales

price per pound.

Sales Volume

Consumer Distribution Channel + 30.8% (+3.4% excluding the

impact of the Lakeville Acquisition)

The increase in sales volume was primarily

driven by the Lakeville Acquisition, which predominantly consists

of private brand snack bars. Excluding the impact of the Lakeville

Acquisition, sales volume grew by 3.9%. This growth was mainly due

to new peanut butter and nutrition bar distribution, as well as

increased volumes of mixed nuts and snack and trail mix at a mass

merchandising retailer, which resulted mainly from retail pricing

adjustments and rotational distributions. Private brand sales

volume, including the Lakeville Acquisition, represented

approximately 88% of total sales volume in this channel.

The increase in sales volume was mainly due

to higher sales volume of Southern Style Nuts at a club store, as

they returned to normalized inventory levels compared to the same

quarter last year.

Commercial Ingredients Distribution Channel + 1.2% (- 0.6%

excluding the impact of the Lakeville Acquisition)

The sales volume increase was mainly driven by the Lakeville

Acquisition. Excluding the Lakeville Acquisition, sales volume

remained relatively unchanged, decreasing by less than one

percent.

Contract Manufacturing Distribution Channel + 13.3% (-19.8%

excluding the impact of the Lakeville Acquisition)

The increase in sales volume was driven by the increased granola

volume processed in our Lakeville facility for a major customer in

this channel. Excluding this granola volume, sales volume decreased

by 19.8%. This decrease was mainly due to reduced peanut

distribution by a major customer, resulting from soft consumer

demand. Additionally, the prior year’s comparable quarter was

positively impacted by a rotational distribution for a club

customer, which did not reoccur in the current quarter.

_____________________________

2

Includes Fisher recipe nuts, Fisher snack

nuts, Orchard Valley Harvest and Southern Style Nuts.

Gross Profit

Gross profit decreased by $10.5 million to $46.5 million, which

includes the $0.4 million positive impact from the Lakeville

Acquisition. This decrease was mainly due to lower selling prices

caused by competitive pricing pressures and strategic pricing

decisions, as well as higher commodity acquisition costs for

peanuts and most tree nuts. Additionally, a one-time price

concession to a snack bar customer and increased manufacturing

spending due to capacity constraints at our Lakeville facility

contributed to the overall decrease in gross profit. These factors

were partially offset by increased manufacturing efficiencies at

our other facilities. Gross profit margin decreased to 16.9% of net

sales from 24.4% in the comparable quarter of the previous year.

This decrease was primarily due to the reasons noted above and the

higher net sales base as a result of the Lakeville Acquisition.

Operating Expenses

Total operating expenses decreased by $2.9 million compared to

the prior comparable quarter. Excluding the Lakeville Acquisition,

total operating expenses decreased by $4.9 million. This decrease

was primarily due to lower advertising expenses and incentive

compensation expenses, which was partially offset by an increase in

rent expense related to our new distribution center. Total

operating expenses, as a percentage of net sales, decreased to

10.7% from 13.9% in the prior comparable quarter, due to the higher

net sales base as a result of the Lakeville Acquisition. Excluding

the impact of the Lakeville Acquisition, total operating expenses,

as a percentage of net sales, decreased to 11.7% from 13.9%, due to

the reasons noted above.

Inventory

The value of total inventories on hand at the end of the current

first quarter increased by $19.8 million, or 11.3%. This increase

was mainly due to $21.1 million of additional inventory associated

with the Lakeville Acquisition. Excluding the Lakeville

Acquisition, the value of total inventories on hand decreased $1.4

million, or 0.8%, year over year. The weighted average cost per

pound of raw nut and dried fruit input stock on hand, excluding the

impact of the Lakeville Acquisition, did not change

significantly.

In closing, Mr. Sanfilippo commented, “We will continue to

execute on our strategic plan as we navigate through the upcoming

fiscal quarters. Moving forward, our main priorities will be to

optimize commodity acquisition costs and selling price alignment,

drive category growth for snack and trail mix, increase our snack

and nutrition bar distribution, and identify additional operational

efficiencies. I believe we have the right strategy and a

best-in-class team to create long-term shareholder value.”

Conference Call

The Company will host an investor conference call and webcast on

Thursday, October 31, 2024, at 10:00 a.m. Eastern (9:00 a.m.

Central) to discuss these results. To participate in the call via

telephone, please register using the following Participant

Registration link:

https://register.vevent.com/register/BIdf4da70deef84255952fdc65da1fbc41

Once registered, attendees will receive a dial-in number and

their own unique PIN number. This call is also being webcast by

Notified and can be accessed at the Company’s website at

www.jbssinc.com.

About John B. Sanfilippo & Son, Inc.

Based in Elgin, Illinois, John B. Sanfilippo & Son, Inc. is

a processor, packager, marketer and distributor of nut and dried

fruit products, snack bars, and dried cheese snacks, that are sold

under the Company’s Fisher ®, Orchard Valley Harvest ®, Squirrel

Brand ®, Southern Style Nuts ® and Just the Cheese ® brand names

and under a variety of private brands.

Upcoming Event

The Company will be presenting at the Southwest IDEAS conference

in Dallas, Texas on November 20, 2024. Qualified investors that

would like to schedule a meeting with management should contact

Three Part Advisors at the phone number below.

Forward-Looking Statements

Some of the statements in this release are forward-looking.

These forward-looking statements may be generally identified by the

use of forward-looking words and phrases such as “will”, “intends”,

“may”, “believes”, “anticipates”, “should” and “expects” and are

based on the Company’s current expectations or beliefs concerning

future events and involve risks and uncertainties. Consequently,

the Company’s actual results could differ materially. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements, whether as a result of new information,

future events or other factors that affect the subject of these

statements, except where expressly required to do so by law. Among

the factors that could cause results to differ materially from

current expectations are: (i) sales activity for the Company’s

products, such as a decline in sales to one or more key customers,

or to customers or in the nut or snack bar categories generally, in

some or all channels, a change in product mix to lower price

products, a decline in sales of private brand products or changing

consumer preferences, including a shift from higher margin products

to lower margin products; (ii) changes in the availability and

costs of raw materials and ingredients; (iii) the impact of any

fixed price commitments with customers; (iv) the ability to pass on

price increases to customers if and when commodity costs rise and

the potential for a negative impact on demand for, and sales of,

our products from price increases; (v) the ability to accurately

measure and estimate bulk inventory, fluctuations in the value and

quantity of the Company’s nut inventories due to fluctuations in

the market prices of nuts and bulk inventory adjustments,

respectively; (vi) losses associated with product recalls, product

contamination, food labeling or other food safety issues, or the

potential for lost sales or product liability if customers lose

confidence in the safety of the Company’s products or in nuts or

nut products in general, or are harmed as a result of using the

Company’s products; (vii) the ability of the Company to control

costs (including inflationary costs) and manage shortages in areas

such as inputs, transportation and labor; (viii) uncertainty in

economic conditions, including the potential for inflation or

economic downturn leading to decreased consumer demand; (ix) the

adverse effect of work slowdowns or stoppages, strikes, boycotts or

other types of labor unrest; (x) the adverse effect of litigation

and/or legal settlements, including potential unfavorable outcomes

exceeding any amounts accrued; (xi) losses due to significant

disruptions at any of our production, processing or warehouse

facilities; (xii) the ability to implement our Long-Range Plan,

including growing our branded and private brand product sales,

diversifying our product offerings (including by the launch of new

products) and expanding into alternative sales channels; (xiii)

technology disruptions or failures or the occurrence of

cybersecurity incidents or breaches; (xiv) the inability to protect

the Company’s brand value, intellectual property or avoid

intellectual property disputes; (xv) our ability to manage the

impacts of changing weather patterns on raw material availability

due to climate change; and (xvi) our ability to operate and further

integrate the acquired snack bar related assets at our Lakeville

facility and realize efficiencies and synergies from such

acquisition.

JOHN B. SANFILIPPO & SON,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in thousands, except per

share amounts)

For the Quarter Ended

September 26, 2024

September 28, 2023

Net sales

$

276,196

$

234,105

Cost of sales

229,652

177,083

Gross profit

46,544

57,022

Operating expenses:

Selling expenses

19,839

21,992

Administrative expenses

9,698

10,453

Total operating expenses

29,537

32,445

Income from operations

17,007

24,577

Other expense:

Interest expense

516

227

Rental and miscellaneous expense, net

411

356

Pension expense (excluding service

costs)

361

350

Total other expense, net

1,288

933

Income before income taxes

15,719

23,644

Income tax expense

4,060

6,056

Net income

$

11,659

$

17,588

Basic earnings per common share

$

1.00

$

1.52

Diluted earnings per common share

$

1.00

$

1.51

Weighted average shares outstanding

— Basic

11,630,405

11,594,960

— Diluted

11,714,362

11,674,742

JOHN B. SANFILIPPO & SON,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Dollars in thousands)

September 26, 2024

June 27, 2024

September 28, 2023

ASSETS

CURRENT ASSETS:

Cash

$

442

$

484

$

838

Accounts receivable, net

83,787

84,960

68,363

Inventories

194,565

196,563

174,789

Prepaid expenses and other current

assets

8,695

12,078

7,603

287,489

294,085

251,593

PROPERTIES, NET:

175,377

165,094

137,993

OTHER LONG-TERM ASSETS:

Intangibles, net

17,191

17,572

17,966

Deferred income taxes

3,680

3,130

3,461

Operating lease right-of-use assets

28,034

27,404

6,845

Other assets

7,596

8,290

6,995

56,501

56,396

35,267

TOTAL ASSETS

$

519,367

$

515,575

$

424,853

LIABILITIES & STOCKHOLDERS'

EQUITY

CURRENT LIABILITIES:

Revolving credit facility borrowings

$

47,152

$

20,420

$

6,008

Current maturities of long-term debt

815

737

688

Accounts payable

59,575

53,436

51,922

Bank overdraft

1,315

545

669

Accrued expenses

30,976

50,802

30,014

139,833

125,940

89,301

LONG-TERM LIABILITIES:

Long-term debt, less current

maturities

6,169

6,365

6,924

Retirement plan

26,463

26,154

26,788

Long-term operating lease liabilities

25,167

24,877

5,136

Other

10,932

9,626

9,337

68,731

67,022

48,185

STOCKHOLDERS' EQUITY:

Class A Common Stock

26

26

26

Common Stock

91

91

91

Capital in excess of par value

136,626

135,691

132,733

Retained earnings

174,220

186,965

155,925

Accumulated other comprehensive income

(loss)

1,044

1,044

(204

)

Treasury stock

(1,204

)

(1,204

)

(1,204

)

TOTAL STOCKHOLDERS’ EQUITY

310,803

322,613

287,367

TOTAL LIABILITIES & STOCKHOLDERS’

EQUITY

$

519,367

$

515,575

$

424,853

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030677398/en/

Company: Frank S. Pellegrino Chief Financial

Officer 847-214-4138

Investor Relations: John Beisler or Steven Hooser

Three Part Advisors, LLC 817-310-8776

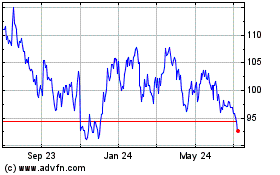

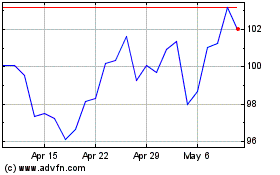

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

John B Sanfilippo and Son (NASDAQ:JBSS)

Historical Stock Chart

From Nov 2023 to Nov 2024