Forget Treasury Bonds, Try This Top Corporate Bond ETF Instead - ETF News And Commentary

April 24 2014 - 10:00AM

Zacks

Thanks to rock-bottom interest rate of government

backed bonds which offer safe haven opportunities, the U.S.

corporate bond market has been on a rocky path as these normally

yield higher than their Fed cousins. Also, a slow-but-steady U.S.

market recovery and strengthening of corporate America have helped

the related high yield bond market to climb.

As per Wall Street Journal,

“purchasers of corporate debt are demanding the smallest

interest-rate premium to comparable government bonds since 2007”.

In general, a company needs to exhibit a steady earnings trend to be able to issue

debt securities to the public at a favorable coupon rate

(read: Time to Buy This Corporate Bond

ETF?).

When a company’s credit quality apparently improves,

it becomes easier for it to issue increased amounts of debt at low

rates. This is why default risk remains low if investors put their

money into investment-grade bonds of some well-established

companies.

Let’s come to the interest rate risk. While the bond

market saw a turbulent 2013 thanks to the initiation of taper talk

and the resultant rise in long-term interest rates, volatility in

rates have largely bottomed out this year. In 2014, rates have not

been rising as expected previously. The Fed has also pared down its

prior hints of short-term rate hike (possibly next year) thus

underpinning the low chances of interest rate rises this

year.

Even if long-term rates rise, inflation adjusted real

rates should not prevail at sky-high levels over the long term.

Notably, as the U.S. economy shifts to top gear, inflation will

also see an uptick. Investors should note that, the Fed’s decision

on further taper in 2014 will depend on whether inflation and

employment perk up at a desired pace.

This means that a gradual interest rate rise in a

modestly inflationary environment may not prove all that bad for

the long-term bond ETFs (read: Comprehensive

Guide to U.S. Junk Bond ETF Investing).

Thus, with each and every condition being fulfilled

for high-quality corporate bond markets, a look at the top ranked

ETF in the Corporate Bond space would be the best way to capture

the uptrend and cater to investors seeking higher yields without

too much extra risk:

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the

ETF in the context of our outlook for the underlying industry,

sector, style box or asset class (Read: Zacks

ETF Rank Guide). Our proprietary methodology

also takes into account the risk preferences of investors. ETFs are

ranked on a scale of 1 (Strong Buy) to 5 (Strong Sell) while they

also receive one of three risk ratings, namely Low, Medium or

High.

The aim of our models is to select the best ETFs

within each risk category. We assign each ETF one of the five ranks

within each risk bucket. Thus, the Zacks ETF Rank reflects the

expected return of an ETF relative to other products with a similar

level of risk.

For investors seeking to apply this methodology to their portfolio

in the corporate bond space, we have taken a closer look at the top

ranked LWC. This ETF has a Zacks ETF Rank of 2 or ‘Buy’

rating with a high risk outlook (see the full list of

top ranked ETFs) and is detailed

below:

SPDR Barclays Long Corp Term Bond ETF

(LWC)

This fund looks to track the Barclays Capital Long

U.S. Corporate Index. This Index intends to measure mainly the

performance of U.S. corporate bonds that have a maturity of greater

than or equal to 10 years. The corporate bonds have high investment

grade rating as well.

The ETF targets the longer end on the yield

curve with a weighted average maturity of 24.08 years. It is

subject to high levels of interest rate risk primarily due to its

long-term focus as indicated by a weighted average duration of

13.72 years. Also, in terms of credit risk, the ETF seems decently

placed with investment grade bonds occupying 80% of the

portfolio.

However, the ETF is an appropriate choice for

investors seeking high yield. The ETF’s yield-to-maturity hovers

around 4.58% (as of April 15, 2014) which is higher than the 3.46%

yield offered on 30-year treasury bonds.

Year-to-date, LWC has returned investors

8.64%. We currently give LWC a Zacks ETF Rank of 2 or ‘Buy’

rating along with a high risk outlook.

Bottom Line

In short, with corporate America definitely on a

roll, 2014 should be the year for corporate bonds, definitely the

ones with investment grade ratings. We at Zacks have plenty of

buy-rated corporate bonds while no government bonds are presently

top rated (read: Zacks Top Ranked Corporate

Bond ETF: LQD).

High quality corporate debt should outperform U.S.

government bonds this year thanks to their higher-yield nature even

if interest rates rise. This high yield nature of the corporate

bonds will likely make up for the erosion in capital appreciation

in a rising rate scenario, and especially if rates slowly move

higher over the course of the next few years.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30 Days.

Click to get this free report >>

SPDR-BC LT CR B (LWC): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

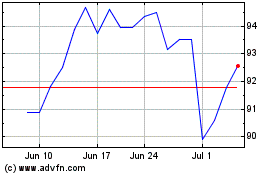

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Nov 2024 to Dec 2024

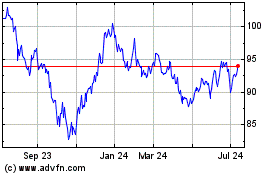

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Dec 2023 to Dec 2024