false

0001529113

0001529113

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 14, 2023

INPIXON

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-36404 |

|

88-0434915 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

2479 E. Bayshore Road, Suite 195

Palo Alto, CA |

|

94303 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (408) 702-2167

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously

satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock |

|

INPX |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 14, 2023, Inpixon (the “Company”)

issued a press release announcing that its board of directors set December 27, 2023 as the record date for determining the holders of

the Company’s outstanding capital stock and certain other securities entitled to the distribution of all the outstanding shares

of Grafiti Holding Inc. owned by Inpixon in connection with its previously announced spinoff, as reported on a current report on Form

8-K filed with the Securities and Exchange Commission on October 23, 2023. A copy of the press release, including additional details regarding

the distribution, is filed as Exhibit 99.1 hereto and is incorporated herein in its entirety by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INPIXON |

| |

|

| Date: December 15, 2023 |

By: |

/s/ Nadir Ali |

| |

Name: |

Nadir Ali |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Inpixon Announces Record Date and Details for Subsidiary Spin-off and

its Planned Business Combination with Damon Motors

Inpixon

Securityholders to Receive Shares of Spin-off Standalone Public Company

The Spin-off Advances

Progression of Planned Business Combination between Inpixon Subsidiary Grafiti Holding and Damon Motors

PALO ALTO, Calif., Dec. 14, 2023 /PRNewswire/

-- Inpixon® (Nasdaq: INPX) today announced that its board of directors has set December 27th, 2023 as the record

date (“Record Date”) for determining the holders of Inpixon’s outstanding capital stock and certain other securities

(the “Record Date Securityholders”) entitled to the distribution of all the outstanding shares of Grafiti Holding Inc. (“Grafiti”)

owned by Inpixon (the “Spin-off Shares”) in connection with its previously announced spinoff (“Spin-off”).

The Spin-off is required to be completed prior

to the planned business combination between Grafiti and Damon Motors, Inc. (“Damon”), the maker of the acclaimed HyperSport

electric motorcycle (“Business Combination”). The Damon HyperSport is expected to be one of the safest, smartest, and most powerful

motorcycles available in the market. Upon the completion of the Business Combination, the combined company will be listed on the Nasdaq

Capital Market (“Nasdaq”), subject to the approval of an initial listing application.

Nadir Ali, CEO of Inpixon said, “I’m

pleased to report we are making progress with the planned Spin-off and the anticipated business combination of Grafiti with Damon. This

transaction represents what we believe is a tremendous opportunity to maximize value for our shareholders. Importantly, Damon’s electric

motorcycles are poised to further innovate the transportation industry, incorporating cutting-edge technology designed to solve unaddressed

safety problems in motorcycling. Moreover, with an impressive 200 hp, 200 mph, 200 miles of range, and more than $85 million in non-binding

reservations in hand, Damon holds the potential to capture a meaningful share of the multi-billion global motorcycle market.”

On the Record Date, Inpixon plans to transfer

all of the Spin-off Shares to a liquidating trust for the benefit of the Record Date Securityholders, which will hold the Spin-off Shares

in trust until the effectiveness of a registration statement covering the Spin-off Shares (the “Registration Statement”), which

Grafiti has confidentially submitted with the Securities and Exchange Commission. Following the effectiveness of the Registration Statement,

the trust will distribute the Spin-off Shares to the Record Date Securityholders on a pro rata basis. During the period that the trust

remains in possession of the Spin-off Shares, and prior to their delivery to the Record Date Securityholders, the beneficial interests

in such shares will not be certificated or tradable, and will not be transferrable prior to consummation of the Business Combination.

After the consummation of the Business Combination, 80% of the Spin-off Shares will be subject to lock-up restrictions, subject to release

in two equal tranches at 90 days and 180 days after consummation of the Business Combination, subject to earlier release of all the locked-up

shares if the shares sustain a specified trading threshold on Nasdaq.

For U.S. federal and applicable state income

tax purposes, the Record Date Securityholders will be deemed to receive a distribution of the Spin-off Shares from Inpixon as of the Record

Date.

The Record Date Securityholders and management

holding Spin-off Shares immediately prior to the closing of the Business Combination are anticipated to retain approximately 18.75% of

the outstanding capital stock of the combined company determined on a fully diluted basis, which includes up to 5% in equity incentives

which may be issued to Inpixon management.

Inpixon will retain its Industrial Internet

of Things (IIOT) business line and continue to progress toward completion of the business combination transaction with XTI Aircraft Company.

Inpixon believes that these opportunities, when consummated, will offer multiple opportunities for its shareholders to maximize the value

of their investment in Inpixon.

The Record Date Securityholders do not need

to take any action. Following the closing of the Business Combination, Inpixon stockholders will continue to hold, along with their new

common shares of Grafiti, the same number of shares of Inpixon common stock that they held immediately prior to the closing of the Business

Combination.

Factors that May Affect the Distribution

and Spin-off

The distribution of the Spin-off Shares to

the Record Date Securityholders is conditioned upon the effectiveness of the Registration Statement. In addition, the Business Combination

is subject to the satisfaction or waiver of certain closing conditions, including approval of the Business Combination by Damon securityholders,

approval by the Supreme Court of British Columbia, and a Plan of Arrangement for purposes of compliance with the exemption from registration

provided by Section 3(a)(10) under the Securities Act of 1933, as amended, in connection with the issuance by Grafiti of the merger consideration

to Damon securityholders, as well as approval by Nasdaq to list the shares of the combined company. No assurance can be provided as to

the timing of the completion of the distribution and the Business Combination or that all conditions to the Spin-off or the Business Combination

will be satisfied. Inpixon expects that there will be no public trading market for the shares of Grafiti until or unless the Business

Combination is consummated.

Inpixon may elect to change the Record Date

for the Spin-off to a later date or to not proceed with the distribution.

About Inpixon

Inpixon® (Nasdaq: INPX)

is the innovator of Indoor Intelligence®, delivering actionable insights for people, places and things. Combining the

power of mapping, positioning and analytics, Inpixon helps to create smarter, safer, and more secure environments. The company’s

Indoor Intelligence and industrial real-time location system (RTLS) solutions are leveraged by a multitude of industries to optimize

operations, increase productivity, and enhance safety. Inpixon customers can take advantage of industry leading location awareness, analytics,

sensor fusion, IIoT and the IoT to create exceptional experiences and to do good with indoor data. For the latest insights, follow Inpixon

on LinkedIn, and X, and visit inpixon.com.

About Damon Motors

Damon is a global technology leader disrupting

urban mobility, led by entrepreneurs and executives from world-class EV and technology companies. With its offices in San Rafael,

California and headquartered in Vancouver, Canada, Damon is on a mission to cause a paradigm shift for safer, smarter motorcycling. Anchored

by its proprietary electric powertrain, HyperDrive™, Damon has captured the attention of the motorcycling world by delivering 200

hp, a top speed of 200 mph, 200 miles of range, innovative design, and new safety features, including CoPilot™ and Shift™,

which are attracting an entirely new generation of motorcycle riders. With strong consumer interest in the US and abroad, Damon aims

to set a new standard for motorcycle safety and sustainability worldwide. For more information on how Damon technology is defining the

new industry standard, please visit damon.com.

Important Information About the Proposed

Damon Transaction and Where to Find It

In connection with the Spin-off, Grafiti has

confidentially filed with the SEC a registration statement, registering Grafiti common shares. Grafiti will also file a preliminary and

final non-offering prospectus with the British Columbia Securities Commission relating to the Business Combination with Damon. This press

release does not contain all the information that should be considered concerning the Spin-off and the Business Combination with Damon

(the “Proposed Damon Transaction”) and is not a substitute for any other documents that Inpixon or Grafiti may file with the

SEC, or that Damon may send to stockholders in connection with the business combination. It is not intended to form the basis of any investment

decision or any other decision in respect to the Proposed Damon Transaction. Damon’s stockholders and Inpixon’s stockholders and other

interested persons are advised to read, when available, the registration statement of Grafiti together with its exhibits, as these materials

will contain important information about Inpixon, Grafiti, Damon, the Proposed Damon Transaction.

The registration statement, upon effectiveness,

and other documents to be filed by Grafiti with the SEC will also be available free of charge, at the SEC’s website at www.sec.gov, or

by directing a request to: Grafiti Holding Inc., 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303.

Forward-Looking Statements Regarding the

Proposed Damon Transaction

This press release contains certain “forward-looking

statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities

Act, and Section 21E of the Exchange Act. All statements other than statements of historical fact contained in this press release, including

statements regarding the benefits of the Proposed Damon Transaction, the anticipated timing of the completion of the Proposed Damon Transaction,

the products under development by Damon and the markets in which it plans to operate, the advantages of Damon’s technology, Damon’s competitive

landscape and positioning, and Damon’s growth plans and strategies, are forward-looking statements. Some of these forward-looking statements

can be identified by the use of forward-looking words, including “may,” “should,” “expect,” “intend,”

“will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,”

“projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms

or variations of them or similar expressions. All forward-looking statements are subject to risks, uncertainties, and other factors which

could cause actual results to differ materially from those expressed or implied by such forward-looking statements. All forward-looking

statements are based upon estimates, forecasts, and assumptions that, while considered reasonable by Inpixon and its management, and Damon

and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from

current expectations which include, but are not limited to:

| ● | the risk that the Proposed Damon Transaction may not be completed in a timely

manner or at all, which may adversely affect the price of Inpixon’s securities; |

| ● | the risk that the public market valuation of the combined company following

the consummation of the business combination may differ from the valuation range ascertained by the parties to the business combination

and their respective financial advisors, and that the valuation to be ascertained by an independent financial advisor to Damon in connection

with the business combination may differ from the valuation ascertained by Inpixon’s independent financial advisor; |

| ● | the failure to satisfy the conditions to the consummation of the Proposed

Damon Transaction, including receiving the necessary approvals from the Damon securityholders and the Supreme Court of British Columbia

with respect to the Plan of Arrangement; |

| ● | the occurrence of any event, change or other circumstance that could give

rise to the termination of the Proposed Damon Transaction; |

| ● | the effect of the announcement or pendency of the Proposed Damon Transaction

on Inpixon, Grafiti and Damon’s business relationships, performance, and business generally; |

| ● | risks that the Proposed Damon Transaction disrupts current plans of Inpixon,

Grafiti and Damon and potential difficulties in their employee retention as a result of the Proposed Damon Transaction; |

| ● | the outcome of any legal proceedings that may be instituted against Damon,

Grafiti or Inpixon related to the Proposed Damon Transaction; |

| ● | failure to realize the anticipated benefits of the Proposed Damon Transaction; |

| ● | the inability to satisfy the initial listing criteria of Nasdaq or obtain

Nasdaq approval of the initial listing of the combined company on Nasdaq; |

| ● | the risk that the price of the securities of the combined company may be

volatile due to a variety of factors, including changes in the highly competitive industries in which Grafiti and Damon operate, variations

in performance across competitors, changes in laws, regulations, technologies that may impose additional costs and compliance burdens

on Grafiti and Damon’s operations, global supply chain disruptions and shortages, and macro-economic and social environments affecting

Grafiti and Damon’s business and changes in the combined capital structure; |

| ● | the inability to implement business plans, forecasts, and other expectations

after the completion of the Proposed Damon Transaction, and identify and realize additional opportunities; |

| ● | the risk that Damon has a limited operating history, has not achieved sufficient

sales and production capacity at a mass-production facility, and Damon and its current and future collaborators may be unable to successfully

develop and market Damon’s motorcycles or solutions, or may experience significant delays in doing so; |

| ● | the risk that the combined company may never achieve or sustain profitability; |

| ● | the risk that Damon and the combined company may be unable to raise additional

capital on acceptable terms to finance its operations and remain a going concern; |

| ● | the risk that the combined company experiences difficulties in managing its

growth and expanding operations; |

| ● | the risk that Damon’s $85 million of non-binding reservations are canceled,

modified, delayed or not placed and that Damon must return the refundable deposits and such reservations are not converted to sales; |

| ● | the risks relating to Damon’s ability to satisfy the conditions and deliver

on the orders and reservations, its ability to maintain quality control of its motorcycles, and Damon’s dependence on third parties for

supplying components and manufacturing the motorcycles; |

| ● | the risk that other motorcycle manufacturers develop competitive electric

motorcycles or other competitive motorcycles that adversely affect Damon’s market position; |

| ● | the risk that Damon’s patent applications may not be approved or may take

longer than expected, and Damon may incur substantial costs in enforcing and protecting its intellectual property; |

| ● | the risk that Damon’s estimates of market demand may be inaccurate; and |

| ● | other risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Inpixon’s Annual Report on Form 10-K for the year

ended December, 31, 2022, which was filed with the SEC on April 17, 2023, and Quarterly Report on Form 10-Q for the quarterly period thereafter,

as such factors may be updated from time to time in Inpixon’s filings with the SEC, and the registration statement to be filed by Grafiti

in connection with the Spin-off. These filings identify and address other important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the forward-looking statements. |

Nothing in this press release should be regarded

as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which

speak only as of the date they are made. Neither Inpixon nor Damon gives any assurance that either Inpixon or Damon or the combined company

will achieve its expected results. Neither Inpixon nor Damon undertakes any duty to update these forward-looking statements, except as

otherwise required by law.

No Offer or Solicitation

This press release is not a proxy statement

or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transactions and is

not intended to and does not constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any

proxy, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

deemed to be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Contacts

Inpixon Contacts

General inquiries:

Email: marketing@inpixon.com

Web: inpixon.com/contact-us

Investor relations:

Crescendo Communications

for Inpixon

Tel: +1 212-671-1020

Email: INPX@crescendo-ir.com

5

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

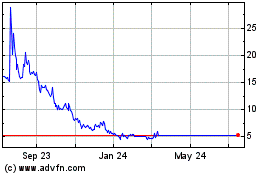

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

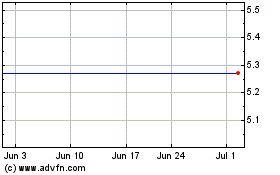

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Dec 2023 to Dec 2024