News Release

Filed by Inpixon

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: XTI Aircraft Company

Inpixon SEC File No.: 001-36404

Date: August 4, 2023

Inpixon Schedules Business Update Conference

Call

and Presentation by XTI Aircraft Management

PALO ALTO, Calif., August 4, 2023 /PRNewswire/ -- Inpixon®

(Nasdaq: INPX), a leading provider of real-time location systems (RTLS), today announced it will host a conference call presentation

at 4:30 p.m. Eastern Time on Monday, August 14, 2023 to provide a business update as well as a presentation by the management of XTI

Aircraft Company (“XTI”) following the recently announced definitive merger agreement between Inpixon and XTI. Inpixon plans

to release its financial results for the second quarter of 2023 after market close the same day.

Interested parties may access the conference call presentation at https://www.webcaster4.com/Webcast/Page/2235/48894

or at the link on Inpixon’s Investor Relations section of the website, ir.inpixon.com/ir-news-events/ir-calendar. A webcast replay

will be available on Inpixon’s Investor Relations section of the website (ir.inpixon.com/ir-news-events/ir-calendar).

Shareholders and other interested parties are invited to submit questions

to Inpixon management prior to the beginning of the call via email to inpx@crescendo-ir.com.

About Inpixon

Inpixon® (Nasdaq: INPX) is the innovator of Indoor

Intelligence®, delivering actionable insights for people, places and things. Combining the power of mapping, positioning

and analytics, Inpixon helps to create smarter, safer, and more secure environments. The company’s Indoor Intelligence and industrial

real-time location system (RTLS) solutions are leveraged by a multitude of industries to optimize operations, increase productivity, and

enhance safety. Inpixon customers can take advantage of industry leading location awareness, analytics, sensor fusion, IIoT and the IoT

to create exceptional experiences and to do good with indoor data. For the latest insights, follow Inpixon on LinkedIn, Twitter,

and visit inpixon.com.

About XTI

XTI Aircraft Company is an aviation business based near Denver, Colorado.

XTI is guided by a leadership team with decades of experience, deep expertise, and success bringing new aircraft to market, including

more than 40 FAA-certified new aircraft configurations. XTI is founded on a culture of customer-focused problem solving to meet the evolving

needs of modern travelers. For information and updates about XTI Aircraft Company and the TriFan 600, visit xtiaircraft.com. For information

on reserving a priority position for the TriFan under the company’s pre-sales program, contact Mr. Saleem Zaheer at +1-720-900-6928 or

szaheer@xtiaircraft.com.

Contacts

Inpixon Contacts

General inquiries:

Email: marketing@inpixon.com

Web: inpixon.com/contact-us

Investor relations:

Crescendo Communications, LLC

Tel: +1 212-671-1020

Email: INPX@crescendo-ir.com

XTI Aircraft Contacts

General inquiries:

Email: liftup@xtiaircraft.com

Web: xtiaircraft.com/cm/get-involved

Investor relations:

Crescendo Communications for XTI

Tel: +1 212-671-1020

Email: XTI@crescendo-ir.com

Important Information About the Proposed Transaction and Where to

Find It

This press release relates to a proposed transaction between XTI Aircraft

Company, a Delaware corporation (“XTI”), and Inpixon, a Nevada corporation (“Inpixon”), pursuant to an agreement

and plan of merger, dated as of July 24, 2023, by and among Inpixon, Superfly Merger Sub Inc. and XTI (the “proposed transaction”).

Inpixon intends to file a registration statement on Form S-4 (the “Form S-4”) with the U.S. Securities and Exchange Commission

(“SEC”), which will include a preliminary prospectus and proxy statement of Inpixon in connection with the proposed transaction,

referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all Inpixon stockholders as of a record date

to be established for voting on the transaction and to the stockholders of XTI. Inpixon also will file other documents regarding the proposed

transaction with the SEC.

Before making any voting decision, investors and security holders

are urged to read the registration statement, the proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus

in connection with Inpixon’s solicitation of proxies for its stockholders’ meeting to be held to approve the transaction,

and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available

because they will contain important information about Inpixon, XTI and the proposed transaction.

Investors and securityholders will be able to obtain free copies of

the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will

be filed with the SEC by Inpixon through the website maintained by the SEC at www.sec.gov.

The documents filed by Inpixon with the SEC also may be obtained free

of charge at Inpixon’s website at www.inpixon.com or upon written request to: Inpixon, 2479 E. Bayshore Road, Suite 195, Palo Alto,

CA 94303.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED

OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS COMMUNICATION, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTION OR RELATED TRANSACTIONS

OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS COMMUNICATION. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL

OFFENSE.

Forward-Looking Statements

This communication contains certain “forward-looking statements”

within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than

statements of historical fact contained in this communication, including statements regarding the benefits of the proposed transaction,

the anticipated timing of the completion of the proposed transaction, the products under development by XTI and the markets in which it

plans to operate, the advantages of XTI’s technology, XTI’s competitive landscape and positioning, and XTI’s growth

plans and strategies, are forward-looking statements.

Some of these forward-looking statements can be identified by the

use of forwardlooking words, including “may,” “should,” “expect,” “intend,”

“will,” “estimate,” “anticipate,” “believe,” “predict,”

“plan,” “targets,” “projects,” “could,” “would,” “continue,”

“forecast” or the negatives of these terms or variations of them or similar expressions. All forward-looking statements

are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or

implied by such forward-looking statements. All forward-looking statements are based upon estimates, forecasts and assumptions that,

while considered reasonable by Inpixon and its management, and XTI and its management, as the case may be, are inherently uncertain

and many factors may cause the actual results to differ materially from current expectations which include, but are not limited

to:

| ● | the risk that the proposed transaction may not be completed in a timely manner

or at all, which may adversely affect the price of Inpixon’s securities; |

| | | |

| ● | the failure to satisfy the conditions to the consummation of the proposed

transaction, including the adoption of the merger agreement by the shareholders of Inpixon; |

| | | |

| ● | the occurrence of any event, change or other circumstance that could give

rise to the termination of the merger agreement; |

| | | |

| ● | the adjustments permitted under the merger agreement to the exchange ratio

that could result in XTI shareholders or Inpixon shareholders owning less of the post-combination company than expected; |

| | | |

| ● | the effect of the announcement or pendency of the proposed transaction on

Inpixon’s and XTI’s business relationships, performance, and business generally; |

| | | |

| ● | risks that the proposed transaction disrupts current plans of Inpixon and

XTI and potential difficulties in Inpixon’s and XTI’s employee retention as a result of the proposed transaction; |

| | | |

| ● | the outcome of any legal proceedings that may be instituted against XTI or

against Inpixon related to the merger agreement or the proposed transaction; |

| | | |

| ● | failure to realize the anticipated benefits of the proposed transaction; |

| | | |

| ● | the inability to meet and maintain the listing of Inpixon’s securities (or the securities of the post-combination company) on

Nasdaq; |

| | | |

| ● | the risk that the price of Inpixon’s securities (or the securities of the postcombination company) may be volatile due to a

variety of factors, including changes in the highly competitive industries in which Inpixon and XTI operate, |

| | | |

| ● | the inability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and

identify and realize additional opportunities; |

| ● | variations in performance across competitors, changes in laws, regulations, technologies that may impose additional costs and compliance

burdens on Inpixon and XTI’s operations, global supply chain disruptions and shortages, |

| | | |

| ● | national security tensions, and macro-economic and social environments affecting Inpixon and XTI’s business and changes in the

combined capital structure; |

| | | |

| ● | the risk that XTI has a limited operating history, has not yet manufactured any non-prototype aircraft or delivered any aircraft to

a customer, and XTI and its current and future collaborators may be unable to successfully develop and market XTI’s aircraft or

solutions, or may experience significant delays in doing so; |

| | | |

| ● | the risk that XTI is subject to the uncertainties associated with the regulatory approvals of its aircraft including the certification

by the Federal Aviation Administration, which is a lengthy and costly process; |

| | | |

| ● | the risk that the post-combination company may never achieve or sustain profitability; |

| | | |

| ● | the risk that XTI, Inpixon and the post-combination company may be unable to raise additional capital on acceptable terms to finance

its operations and remain a going concern; |

| | | |

| ● | the risk that the post-combination company experiences difficulties in managing its growth and expanding operations; |

| | | |

| ● | the risk that XTI’s conditional pre orders (which include conditional aircraft purchase agreements, non-binding reservations,

and options) are canceled, modified, delayed or not placed and that XTI must return the refundable deposits; |

| | | |

| ● | the risks relating to long development and sales cycles, XTI’s ability to satisfy the conditions and deliver on the orders and

reservations, its ability to maintain quality control of its aircraft, and XTI’s dependence on third parties for supplying components

and potentially manufacturing the aircraft; |

| | | |

| ● | the risk that other aircraft manufacturers develop competitive VTOL aircraft or other competitive aircraft that adversely affect XTI’s

market position; |

| | | |

| ● | the risk that XTI’s future patent applications may not be approved or may take longer than expected, and XTI may incur substantial

costs in enforcing and protecting its intellectual property; |

| | | |

| ● | the risk that XTI’s estimates of market demand may be inaccurate; |

| | | |

| ● | the risk that XTI’s ability to sell its aircraft may be limited by circumstances beyond its control, such as a shortage of pilots

and mechanics who meet the training standards, high maintenance frequencies and costs for the sold aircraft, and any accidents or incidents

involving VTOL aircraft that may harm customer confidence; |

| | | |

| ● | other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in Inpixon’s Annual Report on Form 10-K for the year ended December, 31, 2022, which was filed with the SEC on

April 17, 2023 (the “2022 Form 10-K”) and Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 filed

on May 16, 2023, and in the section entitled “Risk Factors” in XTI’s periodic reports filed pursuant to Regulation A

of the Securities Act including XTI’s Annual Report on Form 1-K for the year ended December 31, 2022, which was filed with the SEC

on July 13, 2023 (the “2022 Form 1-K”), as such factors may be updated from time to time in Inpixon’s and XTI’s

filings with the SEC, the registration statement on Form S-4 and the proxy statement/prospectus contained therein. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. |

Nothing in this press release should be regarded as a representation

by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking

statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are

made. Neither Inpixon nor XTI gives any assurance that either Inpixon or XTI or the post-combination company will achieve its expected

results. Neither Inpixon nor XTI undertakes any duty to update these forward-looking statements, except as otherwise required by law.

Participants in the Solicitation

XTI and Inpixon and their respective directors and officers and other

members of management may, under SEC rules, be deemed to be participants in the solicitation of proxies from Inpixon’s stockholders

with the proposed transaction and the other matters set forth in the registration statement. Information about Inpixon’s and XTI’s

directors and executive officers is set forth in Inpixon’s filings and XTI’s filings with the SEC, including Inpixon’s

2022 Form 10-K and XTI’s 2022 Form 1-K. Additional information regarding the direct and indirect interests, by security holdings

or otherwise, of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading

the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents

as described above under “Important Information About the Proposed Transaction and Where to Find It.”

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the proposed transaction and is not intended to and does not

constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any proxy, vote or approval, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be deemed to be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act.

###

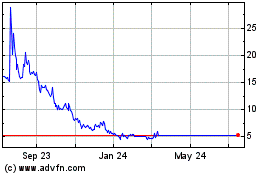

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

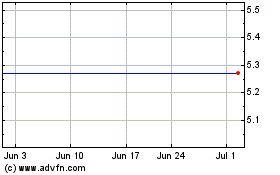

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Dec 2023 to Dec 2024