Immunovant Announces Pricing of $450 Million Common Stock Financing

September 27 2023 - 11:41PM

Immunovant, Inc. (Nasdaq: IMVT), a clinical-stage immunology

company dedicated to enabling normal lives for people with

autoimmune diseases, today announced the pricing of an underwritten

public offering and concurrent private placement, with anticipated

gross proceeds to Immunovant of approximately $450 million, before

deducting underwriting discounts and commissions and other expenses

payable by Immunovant in connection with the transactions. All of

the shares are to be sold by Immunovant.

Immunovant offered 7,370,000 shares of its common stock in the

public offering, at an offering price of $38.00 per share. In

addition, Immunovant has granted the underwriters for the public

offering a 30-day option to purchase up to an additional 1,105,500

shares of its common stock at the public offering price, less

underwriting discounts and commissions.

Concurrent with the public offering, Immunovant has agreed to

sell 4,473,684 shares of common stock to Roivant Sciences, Ltd. at

a price of $38.00 per share, in a private placement exempt from the

registration requirements of the Securities Act of 1933, as

amended, or the Securities Act, subject to the consummation of the

public offering and other customary conditions. However, the

consummation of the public offering is not contingent on the

consummation of this concurrent private placement.

The public offering and concurrent private placement are

expected to close on or about October 2, 2023, subject to

satisfaction of customary closing conditions.

Leerink Partners, Piper Sandler, Guggenheim Securities and Wells

Fargo Securities are acting as joint bookrunning managers for the

public offering. LifeSci Capital is acting as co-manager for the

public offering.

The shares in the public offering are being offered by

Immunovant pursuant to a Registration Statement on Form S-3

previously filed and declared effective by the SEC. A preliminary

prospectus supplement related to the public offering was filed with

the SEC on September 26, 2023. The final prospectus supplement

related to the public offering will be filed with the SEC and will

be available on the SEC’s website located at www.sec.gov.

When available, a copy of the final prospectus supplement and

the accompanying prospectus relating to the public offering may

also be obtained from: Leerink Partners LLC, Syndicate Department,

53 State Street, 40th Floor, Boston, MA 02109, or by telephone at

(800) 808-7525 ext. 6105, or by email at syndicate@leerink.com;

Piper Sandler & Co., Attention: Prospectus Department, 800

Nicollet Mall, J12S03, Minneapolis, Minnesota 55402, or by

telephone at (800) 747-3924, or by email at prospectus@psc.com;

Guggenheim Securities, LLC, Attention: Equity Syndicate Department,

330 Madison Avenue, 8th Floor, New York, NY 10017, or by telephone

at (212) 518-9544, or by email at

GSEquityProspectusDelivery@guggenheimpartners.com; and Wells Fargo

Securities, LLC, Attention: Equity Syndicate Department, 500 West

33rd Street - 14th Floor, New York, NY 10001, or by telephone at

(800) 645-3751, or by email at

WFScustomerservice@wellsfargo.com.

The shares of common stock to be sold in the concurrent private

placement have not been registered under the Securities Act or

under any state securities laws and, unless so registered may not

be offered or sold in the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and applicable

state securities laws.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor will there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation, or sale would be unlawful before registration

or qualification under the securities laws of that state or

jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

as contained in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements include, but are not

limited to, the uncertainties related to the completion of the

public offering and the concurrent private placement. There are

numerous risks and uncertainties that could cause actual results

and Immunovant’s plans and objectives to differ materially from

those expressed in the forward-looking information, such as those

risks discussed in the section entitled “Risk Factors” set forth in

Immunovant’s most recent Annual Report on Form 10-K filed with the

SEC on May 22, 2023, Immunovant’s Quarterly Report on Form 10-Q

filed with the SEC on August 23, 2023, and future reports to be

filed with the SEC. These documents contain and identify important

factors that could cause the actual results for Immunovant to

differ materially from those contained in Immunovant’s

forward-looking statements. Any forward-looking statements

contained in this press release speak only as of the date hereof,

and Immunovant’s specifically disclaims any obligation to update

any forward-looking statement, except as required by law. These

forward-looking statements should not be relied upon as

representing Immunovant’s views as of any date subsequent to the

date of this press release.

Contact:Chau Cheng, PhD MBAVice President,

Investor RelationsImmunovant, Inc.info@immunovant.com

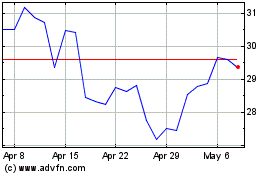

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Dec 2024 to Jan 2025

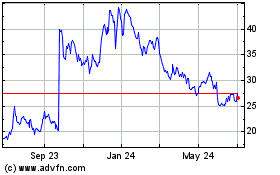

Immunovant (NASDAQ:IMVT)

Historical Stock Chart

From Jan 2024 to Jan 2025