i3 Verticals, Inc. (“i3 Verticals” or the “Company”) (NASDAQ:

IIIV), and Payroc WorldAccess, LLC (“Payroc”), a leading

omni-channel payments provider, today announced that the companies

have entered into a definitive agreement whereby Payroc will

acquire i3 Verticals’ merchant of record payments business,

including its associated proprietary technology (the “divested

business”), in an all-cash transaction for $440 million, subject to

certain purchase price adjustments.

Greg Daily, Chairman and CEO of i3 Verticals stated, “i3 began

as a payments business, and we built a top-of-the-line merchant of

record payment platform bringing a wide variety of solutions to

third-party partners and software providers. We do not part with

this platform lightly and we believe that it has a bright future.

We are proud and appreciative of our team managing this business

and are confident we have found them the right home.

“This is a key strategic moment for our Company. After the

divestiture, we will be a pure vertical market software business

focused entirely on the Public Sector, Education and Healthcare

markets. Importantly, we have retained our payment facilitation

platform and our ability to attach payments to our vertical

software solutions. Upon the completion of this disposition, our

balance sheet will be stronger than ever, and we are excited to

begin our next chapter.”

“Payroc is excited about this combination,” said James Oberman,

Chief Executive Officer of Payroc. “The i3 merchant business is an

ideal fit for Payroc, and their values and goals align with ours.

Our ongoing commitment to combine a personal relationship with

payments technology will enhance growth for i3’s partners and

create opportunity for i3’s team members that join Payroc once the

transaction closes.”

The transaction is subject to closing conditions as set forth in

the definitive agreement, including the expiration or termination

of the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976. The closing is expected to occur sometime

in i3 Verticals’ fiscal fourth quarter.

Strategic Rationale and Benefits of the Transaction

- Selling the divested business will simplify i3’s business. The

remaining business consists of vertical market software solutions

that fit the Company's customers’ specific enterprise needs.

- The divested business includes two non-core assets from i3's

Software and Services segment related to the Non-profit and

Property Management vertical markets, representing approximately $4

million in annual adjusted EBITDA.

- The Company's customers will be narrowed to three strategic

verticals: Public Sector, Education and Healthcare.

- i3's ongoing business will be approximately 75% software and

related services revenue, and 25% payments and other.

- Proceeds from the transaction, after payment of transaction

expenses, will go towards paying down debt.

- After taxes, and in the absence of other acquisitions, the

Company expects to be able to pay down all, or nearly all, of its

2023 Senior Secured Credit Facility.

- i3's existing 2023 Senior Secured Credit Facility will remain

in place, which includes $450 million of aggregate commitments in

the form of a revolving credit facility.

- After reducing the Company's debt balance its applicable

borrowing rates under the facility will fall by 1% and remain there

until such time that Consolidated Total Net Leverage Ratio reaches

2x.

- The borrowing capacity generated will provide significant

capital for M&A.

For additional information regarding the terms of the definitive

agreement and the transactions contemplated thereby, see the

Company’s Current Report on Form 8-K to be filed in connection with

the execution of the definitive agreement.

Advisors

Raymond James & Associates, Inc. are serving as financial

advisors to i3 Verticals and Bass, Berry and Sims, LLP is serving

as the Company’s legal advisor.

Troutman Pepper Hamilton Sanders LLP is serving as Payroc’s

legal advisor.

About i3 Verticals

The Company delivers seamless integrated software and services

to customers in strategic vertical markets. Building on its

sophisticated and diverse platform of software and services

solutions, the Company creates and acquires software products to

serve the specific needs of public and private organizations in its

strategic verticals, including its Public Sector, Education and

Healthcare verticals.

About Payroc

Payroc WorldAccess, LLC is a high-growth merchant acquirer,

processor, and payment integrations powerhouse processing more than

$93 billion in annual transaction volume for more than 160,000

merchants. Payroc offers best-in-class sales enablement and payment

processing technology on a global scale, delivering proprietary,

innovative, and full-service merchant acquiring solutions together

with key card brand network payment sponsorship registrations.

Payroc (through its subsidiaries) is a registered Visa third party

processor, a Visa independent sales organization, a Mastercard

third-party service provider, a Mastercard member service provider,

a payment facilitator, an encryption support organization for Fifth

Third Bank, National Association ("Fifth Third"), and, in Canada is

registered with Peoples Trust Company, among many others.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995,

which involve risk and uncertainties.

You can identify forward-looking statements by the fact that

they do not relate strictly to historical or current facts. These

statements may include words such as “anticipate,” “estimate,”

“expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,”

“should,” “could have,” “exceed,” “significantly,” “likely” and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events.

These forward-looking statements are based on the Company’s

current beliefs, understandings and expectations. These

forward-looking statements are neither promises nor guarantees, but

are subject to a variety of risks and uncertainties, many of which

are beyond the Company’s control, which could cause actual results

to differ materially from those contemplated in these

forward-looking statements. Factors that could cause actual results

to differ materially from those expressed or implied include: (i)

the transactions contemplated by the definitive agreement (the

“Transactions”) may not be completed in a timely manner or at all,

because, among other reasons, conditions to the closing of the

Transactions set forth in the definitive agreement may not be

satisfied or waived; (ii) uncertainty as to the timing of

completion of the Transactions; (iii) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the definitive agreement; (iv) risks related to

disruption of management’s attention from ongoing business

operations; (v) post-closing risks related to the ancillary

agreements to be entered into upon the closing of Transactions in

accordance with the terms of the definitive agreement; and (vi) the

Company’s ability to execute on its strategy and achieve its goals

and other expectations after any completion of the Transactions, as

well as the risks set forth in the Company’s Annual Report on Form

10-K for the fiscal year ended September 30, 2023, filed with the

Securities and Exchange Commission on February 21, 2024, the

Company’s Quarterly Report on Form 10-Q for the fiscal quarter

ended March 31, 2024, filed with the Securities and Exchange

Commission on May 10, 2024, and the Company’s other filings with

the Securities and Exchange Commission.

Any forward-looking statement made by the Company in this press

release speaks only as of the date of this press release, and the

Company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626983858/en/

Clay Whitson Chief Financial Officer (888) 251-0987

investorrelations@i3verticals.com

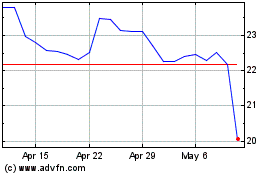

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

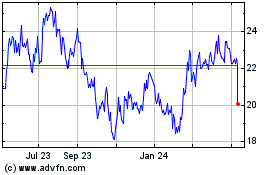

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Nov 2023 to Nov 2024