UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14C

(RULE 14c−101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ¨ |

Preliminary Information Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14c−5(d)(2)) |

| |

|

| x |

Definitive Information Statement |

Hycroft

Mining Holding Corporation

(Name Of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check

the appropriate box):

| x |

No fee required. |

| |

|

| ¨ |

Fee computed on table below per Exchange Act Rules 14c−5(g) and 0−11. |

| |

|

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0−11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0−11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

Payment of Filing Fee (Check

all boxes that apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11. |

NOTICE OF ACTION BY WRITTEN CONSENT OF MAJORITY

STOCKHOLDERS OF AND INFORMATION STATEMENT FOR

Hycroft Mining Holding Corporation

4300 Water Canyon Road, Unit 1

Winnemucca, Nevada 89445

(775) 304-0260

TO BE EFFECTIVE ON OR AFTER April 22, 2022

DATE FIRST MAILED TO STOCKHOLDERS: On or about

April 1, 2022

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

To Hycroft

Mining Holding Corporation Stockholders:

Hycroft

Mining Holding Corporation, a Delaware corporation (“Hycroft”), hereby gives notice to its stockholders of, and this information

statement is being distributed in connection with, an action by written consent (the “Written Consent”) of the majority stockholders

of Hycroft taken on March 15, 2022.

The

matter upon which action by written consent of the majority stockholders of Hycroft (the “Proposal”) was taken is an

amendment to Hycroft’s Second Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”)

to increase the number of authorized shares of Hycroft’s Class A common stock, par value $0.0001 per share (“Hycroft common

stock”), by 1,000,000,000 to 1,400,000,000, as reflected in Annex A to this information statement.

This

information statement is being furnished pursuant to the requirements of Rule 14c-2 of the Securities Exchange Act of 1934, as amended,

to Hycroft’s stockholders entitled to vote or give an authorization or consent in regard to the Proposal and from whom proxy authorization

or consent is not solicited. Hycroft’s Board of Directors (the “Board”) has fixed the close of business on March 15,

2022 as the record date (the “Record Date”) for the determination of holders of Hycroft’s common stock entitled to notice

of the action by written consent. Your consent is not required and is not being solicited in connection with this action. This information

statement is being furnished to Hycroft’s stockholders as of the Record Date for informational purposes only. This information statement

also constitutes notice of corporate action without a meeting by less than unanimous written consent of our stockholders pursuant to Section

228(e) of the Delaware General Corporation Law (the “DGCL”) and Section 2.9 of our Amended and Restated Bylaws.

Hycroft’s

majority stockholders are American Multi-Cinema, Inc., 2176423 Ontario Limited, Mudrick Distressed Opportunity Fund Global LP, Mudrick

Distressed Opportunity Drawdown Fund, L.P., Mudrick Distressed Opportunity Drawdown Fund II, L.P., Mudrick Distressed Opportunity Drawdown

Fund II SC, L.P., Boston Patriot Batterymarch St LLC, Boston Patriot Newbury St LLC, Mercer QIF Fund PLC, and Blackwell Partners LLC –

Series A (collectively, the “Majority Holders”).

Hycroft’s

principal executive offices are located at 4300 Water Canyon Road, Unit 1, Winnemucca, Nevada 89445, and Hycroft’s telephone number

is (775) 304-0260.

We

urge you to read this information statement carefully.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Diane R. Garrett, Ph.D. |

| |

Diane R. Garrett, Ph.D.

President and Chief Executive Officer and Director |

| March 30, 2022 |

CORPORATE ACTION TAKEN

Approval by Hycroft’s Board of Directors

The Board has determined that the Proposal is

advisable. On March 11, 2022, the Board authorized an amendment to the Certificate of Incorporation, subject to stockholder approval,

to increase the number of authorized shares of Hycroft common stock by 1,000,000,000 to 1,400,000,000, as reflected in Annex A

to this information statement.

Action by Written Consent

On March 15, 2022, the Majority Holders delivered

to Hycroft the Written Consent approving the Proposal, in accordance with Section 228 of the DGCL. As of the Record Date, the Majority

Holders owned in the aggregate approximately 66% of the issued and outstanding shares of Hycroft common stock.

ACTION BY WRITTEN CONSENT; NO VOTE REQUIRED

As the Proposal has been duly authorized and

approved by the written consent of holders of a majority of issued and outstanding Hycroft common stock, we are not seeking any consent,

authorization or proxy from you. Section 228 of the DGCL provides that the written consent of the stockholders, having the minimum

number of votes that would be necessary to take such action at a meeting at which all shares entitled to vote thereon were present and

voted, may be substituted for a meeting. Approval by a majority of the outstanding Hycroft common stock would be required to approve the

Proposal, which approval has been duly secured by written consent executed and delivered to us by the Majority Holders, as noted above.

As of the Record Date, there were issued and outstanding

107,249,875 shares of Hycroft common stock, entitled to one vote per share. As of the Record Date, the Majority Holders owned, in the

aggregate, 71,211,326 shares, or approximately 66%, of the issued and outstanding Hycroft common stock. Accordingly, the Written Consent

executed by the Majority Holders pursuant to DGCL Section 228 and delivered to Hycroft is sufficient to approve the Proposal and no further

stockholder vote or other action is required.

The DGCL does not provide for dissenters’

rights of appraisal in connection with the Proposal.

NOTICE OF ACTION BY WRITTEN CONSENT

Pursuant to Section 228(e) of the DGCL, Hycroft

is required to provide prompt notice of the taking of corporate action without a meeting by less than unanimous written consent to those

stockholders who have not consented in writing to such action. This information statement serves as the notice required by Section 228(e)

of the DGCL.

PROPOSAL — APPROVAL OF THE AMENDMENT OF

HYCROFT’S SECOND AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

Hycroft is amending its Certificate of Incorporation

to increase the number of authorized shares of Hycroft common stock by 1,000,000,000 to 1,400,000,000. This amendment to the Certificate

of Incorporation is reflected in Annex A to this information statement. The amendment to the Certificate of Incorporation will

become effective on or after April 22, 2022.

As of the Record Date, there were 107,249,875 shares

of Hycroft common stock issued and outstanding.

The Board believes it to be in Hycroft’s

best interests to increase the number of authorized shares of Hycroft common stock. The availability of additional authorized shares

of Hycroft common stock will provide Hycroft with greater flexibility to issue common stock for a variety of corporate purposes, without

the delay and expense associated with convening a special stockholders’ meeting. These purposes may include financing transactions

as well as adopting additional stock plans or reserving additional shares for issuance under existing plans. The amendment to the Certificate

of Incorporation will make available the additional authorized shares of Hycroft common stock for issuance from time to time at the discretion

of the Board without further action by the stockholders, except where stockholder approval is required by law or Nasdaq requirement or

to obtain favorable tax treatment for certain employee benefit plans.

Except as described in this information statement

(including the information incorporated by reference), Hycroft has no current plans to issue any of the additional authorized but unissued

shares of Hycroft common stock being authorized by the amendment to the Certificate of Incorporation. Hycroft has not made the Proposal

in this information statement in response to any effort to accumulate Hycroft’s stock or to obtain control of Hycroft by means of

a tender offer, merger or solicitation in opposition to management.

INTERESTS OF CERTAIN

PARTIES IN THE MATTERS TO BE ACTED UPON

None of the directors

or executive officers of the Company have any substantial interest resulting from the Proposal that is not shared by all other stockholders,

pro rata, and in accordance with their respective interests.

DELIVERY OF DOCUMENTS

In some instances, we may deliver only one copy

of this information statement to multiple stockholders sharing a common address. If requested by phone or in writing, we will promptly

provide a separate copy to a stockholder sharing an address with another stockholder. Requests by phone should be directed to (775) 304-0260,

and requests in writing should be mailed to Hycroft Mining Holding Corporation, Attention: Investor Relations, 4300 Water Canyon Road,

Unit 1, Winnemucca, NV 89445. Stockholders sharing an address who currently receive multiple copies and wish to receive only a single

copy should contact their broker or send a signed, written request to us at the above address.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information

regarding beneficial ownership of Hycroft common stock, as of the Record Date, by (i) each person known by Hycroft to be the beneficial

owner of more than 5% of outstanding Hycroft common stock, (ii) each of our “named executive officers” and directors and (iii)

all of our executive officers and directors, as a group.

The number of shares of Hycroft common stock beneficially

owned by each entity, person, director or executive officer is determined in accordance with the rules of the Securities and Exchange

Commission (the “SEC”), and the information is not necessarily indicative of beneficial ownership for any other purpose. The

percentage ownership of Hycroft common stock is based on 107,249,875 shares of Hycroft common stock issued and outstanding as of the Record

Date. Under such rules, beneficial ownership generally includes any shares of Hycroft common stock over which the individual has sole

or shared voting power or investment power as well as any shares of Hycroft common stock that the individual has the right to acquire

within 60 days of the Record Date, through the exercise of warrants or other rights. Unless otherwise indicated in the footnotes to this

table, we believe each of the stockholders named in this table has sole voting and investment power with respect to the shares of Hycroft

common stock indicated as beneficially owned.

Hycroft common stock Beneficially Owned

| | |

Shares | | |

Percentage of | |

| Name of Beneficial Owner | |

| Beneficially Owned | | |

| Beneficial Ownership | |

| 5% or Greater Stockholders | |

| | | |

| | |

| American Multi-Cinema, Inc.(1) | |

| 46,816,480 | | |

| 35.8% | |

| 2176423 Ontario Ltd(2) | |

| 46,816,480 | | |

| 35.8% | |

| Mudrick Capital Management, L.P. and affiliated entities(3) | |

| 37,703,375 | | |

| 31.3% | |

| Highbridge Capital Management, LLC(4) | |

| 6,078,220 | | |

| 5.6% | |

| Named Executive Officers and Directors(5) | |

| | | |

| | |

| Diane R. Garrett, Ph.D.(6) | |

| 151,522 | | |

| *% | |

| Stanton K. Rideout(7) | |

| 102,377 | | |

| *% | |

| John Henris(8) | |

| - | | |

| -% | |

| Jeffrey Stieber(9) | |

| - | | |

| -% | |

| Michael Harrison(10) | |

| 29,973 | | |

| *% | |

| Stephen Lang | |

| - | | |

| -% | |

| David Naccarati | |

| 14,640 | | |

| *% | |

| Thomas Weng | |

| 10,095 | | |

| *% | |

| Marni Wieshofer | |

| 22,473 | | |

| *% | |

| All executive officers and directors as a group (7 individuals)(11) | |

| 331,080 | | |

| *% | |

| (1) | This includes 23,408,240 shares of Hycroft common stock underlying warrants held by American Multi-Cinema, Inc. The business address

of American Multi-Cinema, Inc. is One AMC Way, 11500 Ash Street, Leawood, Kansas 66211. |

| (2) | This includes 23,408,240 shares of Hycroft common stock underlying warrants held by 2176423 Ontario Ltd. The business address of 2176423

Ontario Ltd is 200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1. |

| (3) | Based on a Schedule 13D filed with the SEC on March 15, 2022 and other information provided to the Company. This includes

13,308,529 shares of Hycroft common stock underlying warrants held by the Mudrick Funds (as defined below). Mudrick Capital

Management, L.P. is the investment manager of Mudrick Distressed Opportunity Drawdown Fund, L.P., Mudrick Distressed Opportunity

Fund Global L.P., Mudrick Distressed Opportunity Drawdown Fund II, L.P., Mudrick Distressed Opportunity Drawdown Fund II SC, L.P.

and certain other funds managed by Mudrick Capital Management, L.P., and the managing member of Mudrick Capital Acquisition

Holdings, LLC (collectively, the “Mudrick Funds”) and holds voting and dispositive power over the shares of Hycroft

common stock held by the Mudrick Funds. Mudrick Capital Management, LLC is the general partner of Mudrick Capital Management, L.P.,

and Jason Mudrick is the sole member of Mudrick Capital Management, LLC. As such, Mudrick Capital Management, L.P., Mudrick Capital

Management, LLC and Jason Mudrick may be deemed to have beneficial ownership of the shares of Hycroft common stock held by the

Mudrick Funds. Each such entity or person disclaims any beneficial ownership of the reported shares other than to the extent of any

pecuniary interest they may have therein, directly or indirectly. The business address of such holders is 527 Madison Avenue, 6th

Floor, New York, New York 10022. David Kirsch, the Chairman of our Board, has no pecuniary interest in shares of Hycroft common

stock and disclaims any beneficial ownership of the shares of Hycroft common stock beneficially owned by Mudrick Capital Management,

L.P. and its affiliates. |

| (4) | Based on a Schedule 13G/A filed with the SEC on February 11, 2022. This includes 1,344,216 shares of Hycroft common stock underlying

warrants held by certain funds and accounts to which Highbridge Capital Management, LLC is the investment adviser. The business address

of Highbridge Capital Management, LLC is 277 Park Avenue, 23rd Floor, New York, New York 10172. |

| (5) | The business address of each of the listed individuals is 4300 Water Canyon Road, Unit 1, Winnemucca, Nevada 89445. |

| (6) | Includes (i) 8,000 shares of Hycroft common stock owned by Ms. Garrett’s spouse’s IRA and (ii) 51,498 shares of Hycroft

common stock to be converted from Restricted Stock Units on or about March 31, 2022. |

| (7) | Includes 26,334 shares of Hycroft common stock to be converted from Restricted Stock Units on or about March 31, 2022. |

| (8) | Mr. Henris retired from his positions as Executive Vice President and Chief Operating Officer effective December 31, 2021. |

| (9) | Mr. Stieber resigned from his position as Senior Vice President, Finance and Treasurer effective December 7, 2021. |

| (10) | Michael Harrison has an indirect pecuniary interest in shares of Hycroft common stock beneficially owned by Sprott Private Resource

Streaming and Royalty (Collector), LP and Sprott Private Resource Lending II (Collector), LP as chief executive officer of Sprott Resource

Streaming and Royalty Corp. and/or through his fiduciary role as a Managing Partner of Sprott Private Resource Streaming and Royalty (Collector)

LP. Mr. Harrison disclaims any beneficial ownership of the shares of Hycroft common stock beneficially owned by Sprott Private Resource

Streaming and Royalty (Collector), LP. and Sprott Private Resource Lending II (Collector), LP. |

| (11) | Includes directors and current executive officers. |

Where

You Can Find More Information; Incorporation By Reference

The SEC allows certain information

that Hycroft files with it to be “incorporated by reference” into this information statement, which means that Hycroft can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important part

of this information statement. The information incorporated by reference is considered to be a part of this information statement, and

information that Hycroft files later with the SEC will automatically update and supersede information contained in this information statement.

Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes

of this information statement to the extent that a statement contained in this information statement modifies or replaces that statement.

Hycroft incorporates by reference

the documents listed below and any future filings made by Hycroft with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange

Act in this information statement. Hycroft is not, however, incorporating by reference any documents or portions thereof, whether specifically

listed below or filed in the future, that are not deemed “filed” with the SEC, including our Compensation Committee report

and performance graph or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to

Item 9.01 of Form 8-K.

The documents listed below

that have been previously filed with the SEC are hereby incorporated by reference:

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on March 24, 2021 and amended on April 9, 2021 and May 14, 2021; |

| |

|

|

| |

● |

the information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December, 2020 from our definitive proxy statement on Schedule 14A filed with the SEC on April 14, 2021; |

| |

|

|

| |

● |

our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2021, June 30, 2021 and September 30, 2021, filed with the SEC on May 17, 2021, August 4, 2021 and November 12, 2021, respectively; and |

| |

|

|

| |

● |

our Current Reports on Form 8-K filed with the SEC on January 12, 2021 (Item 5.02 and Exhibits 10.1 and 10.2 only), January 20, 2021 (Item 3.03 and Exhibits 4.1 only), March 24, 2021, April 15, 2021 (Item 5.02 only), May 6, 2021, May 24, 2021, October 7, 2021, November 10, 2021 (Items 1.01 and 5.02 and Exhibit 10.1 only), December 16, 2021 (Item 5.02 only), December 30, 2021, January 10, 2022, February 22, 2022 (Item 8.01 and Exhibit 96.1 only), March 1, 2022, March 15, 2022 and March 15, 2022 and our Current Report on Form 8-K/A filed on November 12, 2021. |

All reports and other documents

Hycroft subsequently files pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, including, but excluding any information

furnished to, rather than filed with, the SEC, will also be incorporated by reference into this information statement and deemed to be

part of this information statement from the date of the filing of such reports and documents.

Hycroft has not authorized

anyone to provide any information other than that contained or incorporated by reference in this information statement. Hycroft takes

no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information

contained in this information statement speaks only as of the date of this information statement unless the information specifically indicates

that another date applies.

A free copy of any of the

documents incorporated by reference in this information statement (other than exhibits, unless they are specifically incorporated by reference

in the documents) may be requested by writing or telephoning Hycroft at the following address:

Hycroft Mining Holding Corporation

Attention: Investor Relations

4300 Water Canyon Road, Unit 1

Winnemucca, NV 89445

(775) 304-0260

This information

statement and the documents incorporated by reference in this information statement are also accessible through Hycroft’s

website at www.hycroftmining.com. Except for the specific incorporated documents listed above, no information available on or

through Hycroft’s website shall be deemed to be incorporated in this information statement.

ANNEX A

CERTIFICATE OF AMENDMENT

TO THE

SECOND AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

HYCROFT MINING HOLDING

CORPORATION

Pursuant to Sections 242 of

the General

Corporation Law of the State

of Delaware

Hycroft Mining Holding Corporation,

a Delaware corporation (hereinafter called the “Corporation”), does hereby certify as follows:

FIRST: Article IV,

Section 1 of the Corporation’s Second Amended and Restated Certificate of Incorporation is hereby amended to read in its entirety

as set forth below:

Authorized

Capital Stock. The total number of shares of all classes of capital stock, each with a par value of $0.0001 per share, which the Corporation

is authorized to issue is 1,410,000,000 shares, consisting of (a) 1,400,000,000 shares of Class A common stock (the “Common Stock”)

and (b) 10,000,000 shares of preferred stock (the “Preferred Stock”).

SECOND: The foregoing

amendment was duly adopted in accordance with Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF,

Hycroft Mining Holding Corporation has caused this Certificate to be duly executed in its corporate name this 22nd day of April, 2022.

| |

HYCROFT MINING HOLDING CORPORATION |

| |

|

| |

By: |

|

| |

Name: |

Diane R. Garrett, Ph.D. |

| |

Title: |

President and Chief Executive Officer and Director |

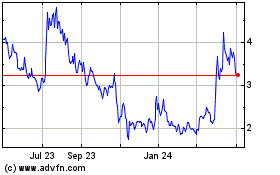

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Apr 2024 to May 2024

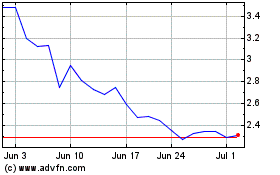

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From May 2023 to May 2024