HINGHAM INSTITUTION FOR SAVINGS (NASDAQ: HIFS), Hingham,

Massachusetts announced results for the quarter ended March 31,

2023.

Earnings

Net income for the quarter ended March 31, 2023

was $8,510,000 or $3.96 per share basic and $3.87 per share

diluted, as compared to $11,864,000 or $5.54 per share basic and

$5.38 per share diluted for the same period last year. The Bank’s

annualized return on average equity for the first quarter of 2023

was 8.67%, and the annualized return on average assets was 0.82%,

as compared to 13.10% and 1.37% for the same period last year. Net

income per share (diluted) for the first quarter of 2023 decreased

by 28% compared to the same period in 2022.

Core net income for the quarter ended March 31,

2023, which represents net income excluding the after-tax gains and

losses on equity securities, both realized and unrealized, was

$5,744,000 or $2.67 per share basic and $2.61 per share diluted, as

compared to $15,105,000 or $7.05 per share basic and $6.85 per

share diluted for the same period last year. The Bank’s annualized

core return on average equity for the first quarter of 2023 was

5.85% and the annualized core return on average assets was 0.56%,

as compared to 16.68% and 1.74% for the same period last year. Core

net income per share (diluted) for the first quarter of 2023

decreased by 62% over the same period in 2022.

See Page 9 for a Non-GAAP reconciliation between

net income and core net income. In calculating core net income, the

Bank did not make any adjustments other than those relating to

after-tax gains and losses on equity securities, realized and

unrealized.

Balance Sheet

Total assets increased to $4.206 billion at

March 31, 2023, representing 1% annualized growth year-to-date and

15% growth from March 31, 2022.

Net loans increased to $3.672 billion at March

31, 2023, representing 2% annualized growth year-to-date and 16%

growth from March 31, 2022. Origination activity was concentrated

in the Boston and Washington D.C. markets and remained focused on

multifamily commercial real estate.

Retail and business deposits increased to $1.988

billion at March 31, 2023, representing 20% annualized growth

year-to-date and 11% growth from March 31, 2022.

Non-interest-bearing deposits, included in retail and business

deposits, decreased to $375.9 million at March 31, 2023,

representing a 12% annualized decline year-to-date and a 7% decline

from March 31, 2022. The Bank worked to capitalize on the market

disruption generated by the failure or instability of larger

regional banks to develop new relationships with commercial,

non-profit, and existing customers. These shifts reflect

significant new commercial relationships, offset by the flow of

funds into higher yielding interest-bearing accounts at the Bank.

The stability of the Bank’s balance sheet, as well as full and

unlimited deposit insurance through the Bank’s participation in the

Massachusetts Depositors Insurance Fund, has historically been

appealing to customers in times of uncertainty.

Wholesale deposits, which include brokered and

listing service time deposits, decreased to $531.9 million at March

31, 2023, representing a 53% annualized decline year-to-date and an

11% decline from March 31, 2022, as the Bank continued to manage

its wholesale funding mix between wholesale time deposits and

Federal Home Loan Bank advances in order mitigate the negative

impact of increasing short term rates in the cost of funds.

Borrowings from the Federal Home Loan Bank

totaled $1.265 billion at March 31, 2023, a 1% decline from

December 31, 2022, and a 46% increase from March 31, 2022. As of

March 31, 2023, the Bank maintained an additional $739.7 million in

immediately available borrowing capacity at the Federal Home Loan

Bank of Boston and the Federal Reserve Bank.

Book value per share was $182.89 as of March 31,

2023, representing both a 7% annualized growth year-to-date and

growth from March 31, 2022. In addition to the increase in book

value per share, the Bank declared $3.09 in dividends per share

since March 31, 2022, including a special dividend of $0.63 per

share declared during the fourth quarter of 2022.

On March 29, 2023, the Bank declared a regular

cash dividend of $0.63 per share. This dividend will be paid on May

10, 2023 to stockholders of record as of May 1, 2023. This was the

Bank’s 117th consecutive quarterly dividend and the Bank has

consistently increased regular quarterly cash dividends over the

last twenty-eight years. The Bank has also declared special cash

dividends in each of the last twenty-eight years, typically in the

fourth quarter.

The Bank sets the level of the special dividend

based on the Bank’s capital requirements and the prospective return

on other capital allocation options. This may result in special

dividends, if any, significantly above or below the regular

quarterly dividend. Future regular and special dividends will be

considered by the Board of Directors on a quarterly basis.

Operational Performance

Metrics

The net interest margin for the quarter ended

March 31, 2023 decreased 184 basis points to 1.46%, as compared to

3.30% for the same period last year. The Bank experienced a

substantial increase in the cost of interest-bearing liabilities

when compared to the prior year. This was driven primarily by the

repricing of the Bank’s wholesale borrowings, wholesale deposits

and higher rates on the Bank’s retail and commercial deposits.

During this period, the increase in the cost of funds was partially

offset by a higher yield on interest-earning assets, driven

primarily by an increase in the interest on reserves held at the

Federal Reserve Bank of Boston, a higher Federal Home Loan Bank of

Boston stock dividend and to a lesser extent, an increase in the

yield on loans.

In a linked quarter comparison, the net interest

margin for the quarter ended March 31, 2023 decreased 63 basis

points to 1.46%, as compared to 2.09% in the quarter ended December

31, 2022. This was primarily the result of the continued and

significant increase in the cost of interest-bearing liabilities,

driven primarily by an increase in the cost of the Bank’s wholesale

funding sources, partially offset by an increase in the interest on

reserve balances held at the Federal Reserve Bank of Boston and an

increase in the yield on loans from the prior quarter. The increase

in the yield on loans was driven by both new loan originations at

higher rates and the repricing of existing adjustable rate

loans.

Key credit and operational metrics remained

strong in the first quarter. At March 31, 2023, non-performing

assets totaled 0.01% of total assets, compared to 0.03% at December

31, 2022 and 0.00% at March 31, 2022. Non-performing loans as a

percentage of the total loan portfolio totaled 0.01% at March 31,

2023, compared to 0.03% at December 31, 2022 and 0.00% at March 31,

2022. The Bank did not record any charge-offs in the first three

months of 2023 or 2022.

The Bank did not own any foreclosed property at

March 31, 2023, December 31, 2022 and March 31, 2022. In the first

quarter of 2023, the Bank foreclosed on a small commercial property

in Massachusetts and purchased the property at auction. The Bank

subsequently sold the property within the quarter and recovered all

principal, interest, and expenses. The Bank also recognized an

additional $85,000 gain on sale, reflected as a contra expense in

foreclosure and related expense in the Consolidated Statement of

Net Income.

The efficiency ratio, as defined on page 5

below, increased to 45.96% for the first quarter of 2023, as

compared to 21.82% for the same period last year. Operating

expenses as a percentage of average assets fell to 0.68% for the

first quarter of 2023, as compared to 0.72% for the same period

last year. As the efficiency ratio can be significantly influenced

by the level of net interest income, the Bank utilizes these paired

figures together to assess its operational efficiency over time.

During periods of significant net interest income volatility, the

efficiency ratio in isolation may over or understate the underlying

operational efficiency of the Bank. The Bank remains focused on

reducing waste through an ongoing process of continuous improvement

and standard work that supports operational leverage.

Chairman Robert H. Gaughen Jr. stated, “Returns

on equity and assets in the first quarter were significantly lower

than our long-term performance, reflecting the challenge from the

increase in short-term interest rates over the last twelve months.

The Bank’s business model has been built over time to compound

shareholder capital through all stages of the economic cycle.

During all such periods, we remain focused on careful capital

allocation, defensive underwriting and disciplined cost control -

the building blocks for compounding shareholder capital through all

stages of the economic cycle. These remain constant, regardless of

the macroeconomic environment in which we operate.

During material yield curve inversions, it is

important that we prioritize long-term investments, despite the

temporary pressure on margins and lower net income. This means

capitalizing on current market conditions to attract new deposit

and loan customers, as well as talented staff that can help us

continue to build our business well into the future.”

The Bank’s quarterly financial results are

summarized in this earnings release, but shareholders are

encouraged to read the Bank’s quarterly report on Form 10-Q, which

is generally available several weeks after the earnings release.

The Bank expects to file Form 10-Q for the quarter ended March 31,

2023 with the Federal Deposit Insurance Corporation (FDIC) on or

about May 5, 2023.

Incorporated in 1834, Hingham Institution for

Savings is one of America’s oldest banks. The Bank maintains

offices in Boston, Nantucket, and Washington, D.C., and provides

commercial mortgage and banking services in the San Francisco Bay

Area.

The Bank’s shares of common stock are listed and

traded on The NASDAQ Stock Market under the symbol HIFS.

Annual Meeting

The Bank will hold its Annual Meeting of

Stockholders (the “Meeting”) at 2:00PM EST on Thursday, April 27,

2023 at the Old Derby Academy, located at 34 Main Street, Hingham,

Massachusetts. Stockholders may also attend the Meeting by means of

remote communication via a video conference. Immediately following

the business meeting, the Bank will hold an informal meeting to

discuss the results of the prior year and the operations of the

Bank, as well as a question and answers session. We strongly

encourage all shareholders to vote by proxy. Electronic voting will

not be available. Registration for the meeting is available on the

Bank’s website (click here). In addition to participating in the

meeting itself, we also encourage shareholders to submit questions

in writing in advance using the form on the Bank’s website.

Current Expected Credit Losses

(“CECL”)

On January 1, 2023, the Bank adopted ASU 2016-13

- Measurement of Credit Losses on Financial Instruments, and

recorded a one-time transition amount of $545,000, net of taxes, as

a decrease to retained earnings. This amount represents additional

reserves for loans that existed upon adopting the new guidance. No

reserves were recorded for unfunded commitments. The adoption of

CECL did not have a material impact on the Bank’s regulatory

capital ratios.

HINGHAM INSTITUTION FOR

SAVINGSSelected Financial Ratios

| |

Three Months EndedMarch 31, |

| |

2022 |

|

2023 |

|

(Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| Key Performance

Ratios |

|

|

|

|

|

| Return on average assets

(1) |

1.37 |

% |

|

0.82 |

% |

| Return on average equity

(1) |

13.10 |

|

|

8.67 |

|

| Core return on average assets

(1) (5) |

1.74 |

|

|

0.56 |

|

| Core return on average equity

(1) (5) |

16.68 |

|

|

5.85 |

|

| Interest rate spread (1)

(2) |

3.24 |

|

|

0.92 |

|

| Net interest margin (1) (3) |

3.30 |

|

|

1.46 |

|

| Operating expenses to average

assets (1) |

0.72 |

|

|

0.68 |

|

| Efficiency ratio (4) |

21.82 |

|

|

45.96 |

|

| Average equity to average

assets |

10.45 |

|

|

9.51 |

|

| Average interest-earning

assets to average interest bearing liabilities |

125.86 |

|

|

121.68 |

|

| |

|

|

|

|

|

|

|

March 31,2022 |

|

December 31, 2022 |

|

March 31,2023 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

| Allowance for credit losses/total

loans |

|

0.68 |

% |

|

0.68 |

% |

|

0.69 |

% |

| Allowance for credit

losses/non-performing loans |

|

16,606.92 |

|

|

2,139.39 |

|

|

5,169.01 |

|

| |

|

|

|

|

|

|

|

|

|

| Non-performing loans/total

loans |

|

— |

|

|

0.03 |

|

|

0.01 |

|

| Non-performing loans/total

assets |

|

— |

|

|

0.03 |

|

|

0.01 |

|

| Non-performing assets/total

assets |

|

— |

|

|

0.03 |

|

|

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

| Share

Related |

|

|

|

|

|

|

|

|

|

| Book value per share |

$ |

170.49 |

|

|

$ |

179.74 |

|

$ |

182.89 |

|

| Market value per share |

$ |

343.20 |

|

|

$ |

275.96 |

|

$ |

233.44 |

|

| Shares outstanding at end of

period |

|

2,142,400 |

|

|

|

2,147,400 |

|

|

2,147,400 |

|

(1) Annualized.

(2) Interest rate spread represents the

difference between the yield on interest-earning assets and the

cost of interest-bearing liabilities.

(3) Net interest margin represents net interest

income divided by average interest-earning assets.

(4) The efficiency ratio represents total

operating expenses, divided by the sum of net interest income and

total other income (loss), excluding gain (loss) on equity

securities, net.

(5) Non-GAAP measurements that represent return

on average assets and return on average equity, excluding the

after-tax gain (loss) on equity securities, net.

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Balance Sheets

| (In thousands, except share

amounts) |

March 31,2022 |

|

December 31,2022 |

|

March 31,2023 |

|

(Unaudited) |

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

5,371 |

|

$ |

7,936 |

|

$ |

5,727 |

| Federal Reserve and other

short-term investments |

|

291,497 |

|

|

354,097 |

|

|

346,713 |

|

Cash and cash equivalents |

|

296,868 |

|

|

362,033 |

|

|

352,440 |

| |

|

|

|

|

|

|

|

|

| CRA investment |

|

8,874 |

|

|

8,229 |

|

|

8,361 |

| Other marketable equity

securities |

|

83,190 |

|

|

54,967 |

|

|

59,115 |

|

Securities, at fair value |

|

92,064 |

|

|

63,196 |

|

|

67,476 |

| Securities held to maturity, at

amortized cost |

|

3,500 |

|

|

3,500 |

|

|

3,500 |

| Federal Home Loan Bank stock, at

cost |

|

35,508 |

|

|

52,606 |

|

|

52,316 |

| Loans, net of allowance for

credit losses of $21,589 at March 31, 2022, $24,989 at

December 31, 2022 and $25,690 at March 31, 2023 |

|

3,176,975 |

|

|

3,657,782 |

|

|

3,672,258 |

| Bank-owned life insurance |

|

13,073 |

|

|

13,312 |

|

|

13,395 |

| Premises and equipment, net |

|

16,210 |

|

|

17,859 |

|

|

18,056 |

| Accrued interest receivable |

|

5,887 |

|

|

7,122 |

|

|

7,161 |

| Deferred income tax asset,

net |

|

387 |

|

|

4,061 |

|

|

3,432 |

| Other assets |

|

6,394 |

|

|

12,328 |

|

|

15,901 |

|

Total assets |

$ |

3,646,866 |

|

$ |

4,193,799 |

|

$ |

4,205,935 |

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits |

$ |

1,990,848 |

|

$ |

2,118,045 |

|

$ |

2,144,387 |

| Non-interest-bearing

deposits |

|

404,045 |

|

|

387,244 |

|

|

375,887 |

|

Total deposits |

|

2,394,893 |

|

|

2,505,289 |

|

|

2,520,274 |

| Federal Home Loan Bank

advances |

|

865,000 |

|

|

1,276,000 |

|

|

1,265,000 |

| Mortgagors’ escrow accounts |

|

9,646 |

|

|

12,323 |

|

|

13,123 |

| Accrued interest payable |

|

298 |

|

|

4,527 |

|

|

5,713 |

| Other liabilities |

|

11,768 |

|

|

9,694 |

|

|

9,087 |

|

Total liabilities |

|

3,281,605 |

|

|

3,807,833 |

|

|

3,813,197 |

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value, 2,500,000 shares authorized, none

issued |

|

— |

|

|

— |

|

|

— |

|

Common stock, $1.00 par value, 5,000,000 shares authorized;

2,142,400 shares issued and outstanding at March 31, 2022,

2,147,400 shares issued and outstanding at December 31, 2022 and

March 31, 2023 |

|

2,142 |

|

|

2,147 |

|

|

2,147 |

|

Additional paid-in capital |

|

12,735 |

|

|

13,061 |

|

|

13,068 |

|

Undivided profits |

|

350,384 |

|

|

370,758 |

|

|

377,523 |

|

Accumulated other comprehensive income |

|

— |

|

|

— |

|

|

— |

|

Total stockholders’ equity |

|

365,261 |

|

|

385,966 |

|

|

392,738 |

|

Total liabilities and stockholders’ equity |

$ |

3,646,866 |

|

$ |

4,193,799 |

|

$ |

4,205,935 |

| |

|

|

|

|

|

|

|

|

HINGHAM INSTITUTION FOR

SAVINGSConsolidated Statements of

Income

| |

Three Months EndedMarch 31, |

| (In thousands, except per

share amounts) |

2022 |

|

|

2023 |

|

| (Unaudited) |

|

|

|

|

|

| |

|

|

|

|

|

| Interest and dividend

income: |

|

|

|

|

|

|

Loans |

$ |

29,760 |

|

|

$ |

36,416 |

|

|

Debt securities |

|

33 |

|

|

|

33 |

|

|

Equity securities |

|

258 |

|

|

|

903 |

|

|

Federal Reserve and other short-term investments |

|

110 |

|

|

|

3,374 |

|

|

Total interest and dividend income |

|

30,161 |

|

|

|

40,726 |

|

| |

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

Deposits |

|

1,504 |

|

|

|

13,800 |

|

|

Federal Home Loan Bank advances |

|

492 |

|

|

|

12,015 |

|

|

Total interest expense |

|

1,996 |

|

|

|

25,815 |

|

|

Net interest income |

|

28,165 |

|

|

|

14,911 |

|

| Provision for loan losses |

|

1,158 |

|

|

|

156 |

|

|

Net interest income, after provision for loan losses |

|

27,007 |

|

|

|

14,755 |

|

| Other income (loss): |

|

|

|

|

|

|

Customer service fees on deposits |

|

175 |

|

|

|

138 |

|

|

Increase in cash surrender value of bank-owned life insurance |

|

93 |

|

|

|

83 |

|

|

Gain (loss) on equity securities, net |

|

(4,157) |

|

|

|

3,548 |

|

|

Miscellaneous |

|

26 |

|

|

|

63 |

|

|

Total other income (loss) |

|

(3,863) |

|

|

|

3,832 |

|

| Operating expenses: |

|

|

|

|

|

|

Salaries and employee benefits |

|

3,644 |

|

|

|

4,306 |

|

|

Occupancy and equipment |

|

374 |

|

|

|

391 |

|

|

Data processing |

|

614 |

|

|

|

653 |

|

|

Deposit insurance |

|

283 |

|

|

|

650 |

|

|

Foreclosure and related |

|

(21) |

|

|

|

(74) |

|

|

Marketing |

|

191 |

|

|

|

212 |

|

|

Other general and administrative |

|

1,124 |

|

|

|

845 |

|

|

Total operating expenses |

|

6,209 |

|

|

|

6,983 |

|

| Income before income

taxes |

|

16,935 |

|

|

|

11,604 |

|

| Income tax provision |

|

5,071 |

|

|

|

3,094 |

|

|

Net income |

$ |

11,864 |

|

|

$ |

8,510 |

|

| |

|

|

|

|

|

| Cash dividends declared per

common share |

$ |

0.57 |

|

|

$ |

0.63 |

|

| |

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

Basic |

|

2,142 |

|

|

|

2,147 |

|

|

Diluted |

|

2,206 |

|

|

|

2,200 |

|

| |

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

Basic |

$ |

5.54 |

|

|

$ |

3.96 |

|

|

Diluted |

$ |

5.38 |

|

|

$ |

3.87 |

|

| |

|

|

|

|

|

HINGHAM INSTITUTION FOR

SAVINGSNet Interest Income Analysis

| |

Three months ended |

| |

March 31, 2022 |

|

December 31, 2022 |

|

March 31, 2023 |

|

| |

Average Balance (9) |

|

Interest |

Yield/ Rate (10) |

|

Average Balance (9) |

|

|

Interest |

Yield/ Rate (10) |

|

Average Balance (9) |

|

Interest |

Yield/ Rate (10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (1) (2) |

$ |

3,077,644 |

|

$ |

29,760 |

|

3.87 |

% |

|

$ |

3,624,745 |

|

$ |

35,714 |

|

3.94 |

% |

|

$ |

3,682,517 |

|

$ |

36,416 |

|

3.96 |

% |

| Securities (3) (4) |

|

94,899 |

|

|

291 |

|

1.23 |

|

|

|

103,033 |

|

|

749 |

|

2.91 |

|

|

|

99,693 |

|

|

936 |

|

3.76 |

|

| Short-term investments (5) |

|

240,755 |

|

|

110 |

|

0.18 |

|

|

|

287,286 |

|

|

2,766 |

|

3.85 |

|

|

|

294,513 |

|

|

3,374 |

|

4.58 |

|

|

Total interest-earning assets |

|

3,413,298 |

|

|

30,161 |

|

3.53 |

|

|

|

4,015,064 |

|

|

39,229 |

|

3.91 |

|

|

|

4,076,723 |

|

|

40,726 |

|

4.00 |

|

| Other assets |

|

52,987 |

|

|

|

|

|

|

|

|

47,959 |

|

|

|

|

|

|

|

|

53,809 |

|

|

|

|

|

|

|

Total assets |

$ |

3,466,285 |

|

|

|

|

|

|

|

$ |

4,063,023 |

|

|

|

|

|

|

|

$ |

4,130,532 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

stockholders’ equity: |

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits

(6) |

$ |

2,028,082 |

|

|

1,504 |

|

0.30 |

% |

|

$ |

2,221,963 |

|

|

8,793 |

|

1.58 |

% |

|

$ |

2,250,188 |

|

|

13,800 |

|

2.45 |

% |

| Borrowed funds |

|

683,920 |

|

|

492 |

|

0.29 |

|

|

|

1,036,944 |

|

|

9,481 |

|

3.66 |

|

|

|

1,100,156 |

|

|

12,015 |

|

4.37 |

|

|

Total interest-bearing liabilities |

|

2,712,002 |

|

|

1,996 |

|

0.29 |

|

|

|

3,258,907 |

|

|

18,274 |

|

2.24 |

|

|

|

3,350,344 |

|

|

25,815 |

|

3.08 |

|

| Non-interest-bearing

deposits |

|

383,816 |

|

|

|

|

|

|

|

|

408,951 |

|

|

|

|

|

|

|

|

378,089 |

|

|

|

|

|

|

| Other liabilities |

|

8,267 |

|

|

|

|

|

|

|

|

9,282 |

|

|

|

|

|

|

|

|

9,452 |

|

|

|

|

|

|

|

Total liabilities |

|

3,104,085 |

|

|

|

|

|

|

|

|

3,677,140 |

|

|

|

|

|

|

|

|

3,737,885 |

|

|

|

|

|

|

| Stockholders’ equity |

|

362,200 |

|

|

|

|

|

|

|

|

385,883 |

|

|

|

|

|

|

|

|

392,647 |

|

|

|

|

|

|

| Total liabilities and

stockholders’ equity |

$ |

3,466,285 |

|

|

|

|

|

|

|

$ |

4,063,023 |

|

|

|

|

|

|

|

$ |

4,130,532 |

|

|

|

|

|

|

| Net interest income |

|

|

|

$ |

28,165 |

|

|

|

|

|

|

|

$ |

20,955 |

|

|

|

|

|

|

|

$ |

14,911 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average interest rate

spread |

|

|

|

|

|

|

3.24 |

% |

|

|

|

|

|

|

|

1.67 |

% |

|

|

|

|

|

|

|

0.92 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (7) |

|

|

|

|

|

|

3.30 |

% |

|

|

|

|

|

|

|

2.09 |

% |

|

|

|

|

|

|

|

1.46 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average interest-earning assets

to average interest-bearing liabilities (8) |

|

125.86 |

% |

|

|

|

|

|

|

|

123.20 |

% |

|

|

|

|

|

|

|

121.68 |

% |

|

|

|

|

|

|

(1) |

|

Before allowance for loan losses. |

|

(2) |

|

Includes non-accrual loans. |

|

(3) |

|

Excludes the impact of the

average net unrealized gain or loss on securities. |

|

(4) |

|

Includes Federal Home Loan Bank

stock. |

|

(5) |

|

Includes cash held at the Federal

Reserve Bank. |

|

(6) |

|

Includes mortgagors' escrow

accounts. |

|

(7) |

|

Net interest income divided by

average total interest-earning assets. |

|

(8) |

|

Total interest-earning assets

divided by total interest-bearing liabilities. |

|

(9) |

|

Average balances are calculated

on a daily basis. |

|

(10) |

|

Annualized. |

HINGHAM INSTITUTION FOR

SAVINGS Non-GAAP Reconciliation

The table below presents the reconciliation between net income

and core net income, a non-GAAP measurement that represents net

income excluding the after-tax gain (loss) on equity

securities.

| |

Three Months EndedMarch 31, |

| (In thousands, unaudited) |

2022 |

|

|

2023 |

|

| |

|

|

|

|

|

| Non-GAAP reconciliation: |

|

|

|

|

|

|

Net Income |

$ |

11,864 |

|

|

$ |

8,510 |

|

|

(Gain) loss on equity securities, net |

|

4,157 |

|

|

|

(3,548 |

) |

|

Income tax expense (benefit) (1) |

|

(916 |

) |

|

|

782 |

|

| Core Net Income |

$ |

15,105 |

|

|

$ |

5,744 |

|

(1) The equity securities are held in a tax-advantaged

subsidiary corporation. The income tax effect of the (gain) loss on

equity securities, net, was calculated using the effective tax rate

applicable to the subsidiary.

CONTACT: Patrick R. Gaughen, President and Chief Operating

Officer (781) 783-1761

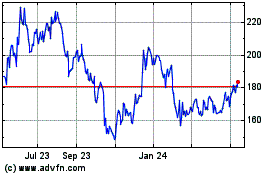

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Feb 2025 to Mar 2025

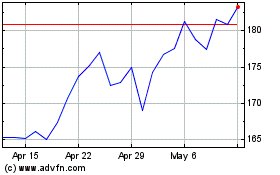

Hingham Institution for ... (NASDAQ:HIFS)

Historical Stock Chart

From Mar 2024 to Mar 2025