HighPeak Energy, Inc. (“HighPeak” or the “Company”) (NASDAQ: HPK)

today announced financial and operating results for the quarter and

nine months ended September 30, 2024, and provided updated 2024

production guidance.

Highlights Third Quarter 2024

- Sales volumes averaged 51,346 barrels of crude oil equivalent

per day (“Boe/d”), consisting of 88% liquids (crude oil and NGL),

representing a 6% increase over the second quarter 2024.

- Net income was $49.9 million, or $0.35 per diluted share, and

EBITDAX (a non-GAAP financial measure defined and reconciled below)

was $214.3 million, or $1.51 per diluted share.

- Generated free cash flow (a non-GAAP financial measure defined

and reconciled below) of $36.1 million, which marks the fifth

consecutive quarter of positive free cash flow generation.

- The Company reduced long-term debt by $30 million during the

third quarter and has reduced long-term debt by $90 million

year-to-date, paid a quarterly dividend of $0.04 per share and

continued to execute its share buyback plan by repurchasing over

870,000 shares during the third quarter.

Recent Events

- Increased 2024 average production guidance by more than 5% from

the second quarter guidance revision and 10% from our original 2024

guidance to a range of 48,000 to 51,000 Boe/d expected for the full

year 2024.

- On November 4, 2024, the Company’s

Board of Directors declared a quarterly dividend of $0.04 per

common share outstanding payable in December 2024.

Statement from HighPeak Chairman and CEO, Jack

Hightower:

“We promised this would be a year marked by steady

and reliable achievements, and I am proud we have continued to

demonstrate that commitment. There are three main takeaways from

our third quarter results. First, our current well performance has

led us to increase our full year production guidance 10% higher

than originally projected. Second, our operations team continues to

tighten costs, resulting in more capital and operating efficiencies

across the corporate structure. Third, we continue to generate free

cash flow, more than $200 million over the last five quarters,

which in turn has strengthened our balance sheet and positioned us

to take advantage of opportunities that increase shareholder

value.

“With HighPeak’s core values of maintaining

disciplined operations, strengthening our balance sheet and

maximizing value for our shareholders, we will finish strong in

2024 and set the course for continued momentum in 2025.

Concurrently, we will remain diligent in our strategic alternatives

process, with the goal of identifying a line of sight that will

realize optimal value of this high quality asset.”

Third Quarter 2024 Operational

Update

HighPeak’s sales volumes during the third

quarter of 2024 averaged 51,346 Boe/d, a 6% increase over second

quarter of 2024. Third quarter sales volumes consisted of

approximately 88% liquids (crude oil and NGL).

The Company ran two drilling rigs and one frac

crew during the third quarter, drilled 17 gross (16.9 net)

horizontal wells and completed 14 gross (10.5 net) producing

horizontal wells. At September 30, 2024, the Company had 24 gross

(23.9 net) horizontal wells and 1 gross (1.0 net) salt-water

disposal well in various stages of drilling and completion.

HighPeak President, Michael Hollis,

commented,

“The third quarter was another operationally

disciplined, beat-and-raise quarter for HighPeak Energy. We

increased the midpoint of our yearly production guide by an

additional 5%, which is up 10% from our original guide. We also

have exciting results both in our northern extension areas and our

first well in the Middle Spraberry zone. The results of these

successful wells bolster our massive runway of over 1,150 sub $50

oil breakeven drilling location inventory. At our current

development cadence, that is over two decades of highly economic

inventory.

“As most are aware, there are structural

differences between the Delaware and the Midland Basins that

results in the D,C&E cost to be less in the Midland Basin.

These structural differences of depth, pressure and horse-power

requirements for stimulation can lead to over $3 million of savings

per well. HighPeak’s acreage enjoys similar structural differences

compared with the more central portions of the Midland Basin.

HighPeak’s D,C&E costs are roughly $2 million dollars cheaper

per well than average Midland Basin wells. Generating similar oil

recoveries for roughly 25% less cost per foot, generates superior

returns. Sustaining this for decades will drive significant

shareholder value.

“The HighPeak team continues to be focused on

reducing operational and capital costs. All the hard work and

effort over the last few years is now paying off. HighPeak lowered

the midpoint of its 2024 LOE guide by 12.5% last quarter and we

reaffirm our LOE range and tightened capital expenditure range for

2024. As continuous improvement is in our DNA, we look forward to

achieving additional efficiency gains in 2025.”

Third Quarter 2024 Financial

Results

HighPeak reported net income of $49.9 million

for the third quarter of 2024, or $0.35 per diluted share. The

Company reported EBITDAX of $214.3 million, or $1.51 per diluted

share.

Third quarter average realized prices were

$75.99 per barrel (“$/Bbl”) of crude oil, $21.14 per barrel of NGL

and $0.42 per Mcf of natural gas, resulting in an overall realized

price of $57.49 per Boe, or 76.3% of the weighted average of NYMEX

crude oil prices, excluding the effects of

derivatives. HighPeak’s cash costs for the third quarter were

$11.81 per Boe, including lease operating expenses of $7.12 per

Boe, workover expenses of $0.38 per Boe, production and ad valorem

taxes of $3.26 per Boe and G&A expenses of $1.05 per Boe. As a

result, the Company’s unhedged EBITDAX per Boe was $45.68, or 79.5%

of the overall realized price per Boe for the quarter, excluding

the effects of derivatives.

HighPeak’s third quarter 2024 capital

expenditures to drill, complete, equip, provide facilities and for

infrastructure were $140.0 million.

Dividends

During the third quarter of 2024, HighPeak’s

Board of Directors approved a quarterly dividend of $0.04 per

share, or $5.0 million in dividends paid to stockholders during the

quarter. In addition, in November 2024, the Company’s Board of

Directors declared a quarterly dividend of $0.04 per share, or

approximately $5.0 million in dividends, to be paid on December 23,

2024 to stockholders of record on December 2, 2024.

Conference Call

HighPeak will host a conference call and webcast

on Tuesday, November 5, 2024, at 10:00 a.m. Central Time for

investors and analysts to discuss its results for the third quarter

of 2024. Conference call participants may register for the

call here. Access to the live audio-only webcast and replay of

the earnings release conference call may be found here. A live

broadcast of the earnings conference call will also be available on

the HighPeak Energy website at www.highpeakenergy.com under the

“Investors” section of the website. A replay will also be available

on the website following the call.

When available, a copy of the Company’s earnings

release, investor presentation and Quarterly Report on Form 10-Q

may be found on its website at www.highpeakenergy.com.

About HighPeak Energy, Inc.

HighPeak Energy, Inc. is a publicly traded

independent crude oil and natural gas company, headquartered in

Fort Worth, Texas, focused on the acquisition, development,

exploration and exploitation of unconventional crude oil and

natural gas reserves in the Midland Basin in West Texas. For more

information, please visit our website

at www.highpeakenergy.com.

Cautionary Note Regarding

Forward-Looking Statements

The information in this press release contains

forward-looking statements that involve risks and uncertainties.

When used in this document, the words “believes,” “plans,”

“expects,” “anticipates,” “forecasts,” “intends,” “continue,”

“may,” “will,” “could,” “should,” “future,” “potential,” “estimate”

or the negative of such terms and similar expressions as they

relate to HighPeak Energy, Inc. (“HighPeak Energy,” the “Company”

or the “Successor”) are intended to identify forward-looking

statements, which are generally not historical in nature. The

forward-looking statements are based on the Company's current

expectations, assumptions, estimates and projections about the

Company and the industry in which the Company operates. Although

the Company believes that the expectations and assumptions

reflected in the forward-looking statements are reasonable as and

when made, they involve risks and uncertainties that are difficult

to predict and, in many cases, beyond the Company's control. For

example, the Company’s review of strategic alternatives may not

result in a sale of the Company, a recommendation that a

transaction occur or result in a completed transaction, and any

transaction that occurs may not increase shareholder value, in each

case as a result of such risks and uncertainties.

These risks and uncertainties include, among

other things, the results of the strategic review being undertaken

by the Company’s Board and the interest of prospective

counterparties, the Company’s ability to realize the results

contemplated by its 2024 guidance, volatility of commodity prices,

product supply and demand, the impact of a widespread outbreak of

an illness, such as the coronavirus disease pandemic, on global and

U.S. economic activity, competition, the ability to obtain

environmental and other permits and the timing thereof, other

government regulation or action, the ability to obtain approvals

from third parties and negotiate agreements with third parties on

mutually acceptable terms, litigation, the costs and results of

drilling and operations, availability of equipment, services,

resources and personnel required to perform the Company's drilling

and operating activities, access to and availability of

transportation, processing, fractionation, refining and storage

facilities, HighPeak Energy's ability to replace reserves,

implement its business plans or complete its development activities

as scheduled, access to and cost of capital, the financial strength

of counterparties to any credit facility and derivative contracts

entered into by HighPeak Energy, if any, and purchasers of HighPeak

Energy's oil, natural gas liquids and natural gas production,

uncertainties about estimates of reserves, identification of

drilling locations and the ability to add proved reserves in the

future, the assumptions underlying forecasts, including forecasts

of production, expenses, cash flow from sales of oil and gas and

tax rates, quality of technical data, environmental and weather

risks, including the possible impacts of climate change,

cybersecurity risks and acts of war or terrorism. These and other

risks are described in the Company's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K and

other filings with the SEC. The Company undertakes no duty to

publicly update these statements except as required by law.

Reserve engineering is a process of estimating

underground accumulations of hydrocarbons that cannot be measured

in an exact way. The accuracy of any reserve estimate depends on

the quality of available data, the interpretation of such data and

price and cost assumptions made by reserve engineers. Reserves

estimates included herein may not be indicative of the level of

reserves or PV-10 value of oil and natural gas production in the

future. In addition, the results of drilling, testing and

production activities may justify revisions of estimates that were

made previously. If significant, such revisions could impact

HighPeak’s strategy and change the schedule of any further

production and development drilling. Accordingly, reserve estimates

may differ significantly from the quantities of oil and natural gas

that are ultimately recovered.

Use of Projections

The financial, operational, industry and market

projections, estimates and targets in this press release and in the

Company’s guidance (including production, operating expenses and

capital expenditures in future periods) are based on assumptions

that are inherently subject to significant uncertainties and

contingencies, many of which are beyond the Company’s control. The

assumptions and estimates underlying the projected, expected or

target results are inherently uncertain and are subject to a wide

variety of significant business, economic, regulatory and

competitive risks and uncertainties that could cause actual results

to differ materially from those contained in the financial,

operational, industry and market projections, estimates and

targets, including assumptions, risks and uncertainties described

in “Cautionary Note Regarding Forward-Looking Statements” above.

These projections are speculative by their nature and, accordingly,

are subject to significant risk of not being actually realized by

the Company. Projected results of the Company for 2024 are

particularly speculative and subject to change. Actual results may

vary materially from the current projections, including for reasons

beyond the Company’s control. The projections are based on current

expectations and available information as of the date of this

release. The Company undertakes no duty to publicly update these

projections except as required by law.

Drilling Locations

The Company has estimated its drilling locations

based on well spacing assumptions and upon the evaluation of its

drilling results and those of other operators in its area, combined

with its interpretation of available geologic and engineering data.

The drilling locations actually drilled on the Company’s properties

will depend on the availability of capital, regulatory approvals,

commodity prices, costs, actual drilling results and other factors.

Any drilling activities conducted on these identified locations may

not be successful and may not result in additional proved reserves.

Further, to the extent the drilling locations are associated with

acreage that expires, the Company would lose its right to develop

the related locations.

|

|

|

|

|

|

HighPeak Energy, Inc. Unaudited Condensed

Consolidated Balance Sheet Data (In

thousands) |

|

|

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

135,573 |

|

|

$ |

194,515 |

|

|

Accounts receivable |

|

76,444 |

|

|

|

94,589 |

|

|

Derivative instruments |

|

24,843 |

|

|

|

31,480 |

|

|

Inventory |

|

7,966 |

|

|

|

7,254 |

|

|

Prepaid expenses |

|

3,921 |

|

|

|

995 |

|

|

Total current assets |

|

248,747 |

|

|

|

328,833 |

|

|

Crude oil and natural gas properties, using the successful efforts

method of accounting: |

|

|

|

|

|

|

Proved properties |

|

3,798,128 |

|

|

|

3,338,107 |

|

|

Unproved properties |

|

75,088 |

|

|

|

72,715 |

|

|

Accumulated depletion, depreciation and amortization |

|

(1,079,113 |

) |

|

|

(684,179 |

) |

|

Total crude oil and natural gas properties, net |

|

2,794,103 |

|

|

|

2,726,643 |

|

|

Other property and equipment, net |

|

3,483 |

|

|

|

3,572 |

|

|

Derivative instruments |

|

— |

|

|

|

16,059 |

|

|

Other noncurrent assets |

|

15,133 |

|

|

|

5,684 |

|

|

Total assets |

$ |

3,061,466 |

|

|

$ |

3,080,791 |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt, net |

$ |

120,000 |

|

|

$ |

120,000 |

|

|

Accounts payable – trade |

|

52,557 |

|

|

|

63,583 |

|

|

Accrued capital expenditures |

|

30,388 |

|

|

|

39,231 |

|

|

Revenues and royalties payable |

|

28,532 |

|

|

|

29,724 |

|

|

Other accrued liabilities |

|

25,499 |

|

|

|

19,613 |

|

|

Derivative instruments |

|

1,937 |

|

|

|

13,054 |

|

|

Advances from joint interest owners |

|

425 |

|

|

|

262 |

|

|

Operating leases |

|

290 |

|

|

|

528 |

|

|

Accrued interest |

|

— |

|

|

|

1,398 |

|

|

Total current liabilities |

|

259,628 |

|

|

|

287,393 |

|

|

Noncurrent liabilities: |

|

|

|

|

|

|

Long-term debt, net |

|

953,825 |

|

|

|

1,030,299 |

|

|

Deferred income taxes |

|

227,966 |

|

|

|

197,068 |

|

|

Asset retirement obligations |

|

14,231 |

|

|

|

13,245 |

|

|

Operating leases |

|

126 |

|

|

|

— |

|

|

Derivative instruments |

|

— |

|

|

|

65 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

Common stock |

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

1,173,231 |

|

|

|

1,189,424 |

|

|

Retained earnings |

|

432,446 |

|

|

|

363,284 |

|

|

Total stockholders' equity |

|

1,605,690 |

|

|

|

1,552,721 |

|

|

Total liabilities and stockholders' equity |

$ |

3,061,466 |

|

|

$ |

3,080,791 |

|

| |

|

|

|

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Condensed Consolidated Statements of

Operations |

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil sales |

$ |

270,636 |

|

|

$ |

338,372 |

|

|

$ |

827,595 |

|

|

$ |

790,458 |

|

|

NGL and natural gas sales |

|

942 |

|

|

|

7,214 |

|

|

|

7,013 |

|

|

|

19,682 |

|

|

Total operating revenues |

|

271,578 |

|

|

|

345,586 |

|

|

|

834,608 |

|

|

|

810,140 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil and natural gas production |

|

35,413 |

|

|

|

39,820 |

|

|

|

98,482 |

|

|

|

107,696 |

|

|

Production and ad valorem taxes |

|

15,412 |

|

|

|

18,839 |

|

|

|

46,410 |

|

|

|

44,395 |

|

|

Exploration and abandonments |

|

362 |

|

|

|

1,728 |

|

|

|

1,027 |

|

|

|

4,372 |

|

|

Depletion, depreciation and amortization |

|

136,578 |

|

|

|

117,420 |

|

|

|

395,121 |

|

|

|

291,562 |

|

|

Accretion of discount |

|

241 |

|

|

|

122 |

|

|

|

722 |

|

|

|

360 |

|

|

General and administrative |

|

4,971 |

|

|

|

6,934 |

|

|

|

14,391 |

|

|

|

11,952 |

|

|

Stock-based compensation |

|

3,753 |

|

|

|

14,057 |

|

|

|

11,326 |

|

|

|

22,095 |

|

|

Total operating costs and expenses |

|

196,730 |

|

|

|

198,920 |

|

|

|

567,479 |

|

|

|

482,432 |

|

|

Other expense |

|

1,404 |

|

|

|

540 |

|

|

|

3,405 |

|

|

|

8,042 |

|

|

Income from operations |

|

73,444 |

|

|

|

146,126 |

|

|

|

263,724 |

|

|

|

319,666 |

|

|

Interest income |

|

2,172 |

|

|

|

730 |

|

|

|

6,964 |

|

|

|

923 |

|

|

Interest expense |

|

(42,579 |

) |

|

|

(37,022 |

) |

|

|

(129,204 |

) |

|

|

(103,278 |

) |

|

Loss on derivative instruments, net |

|

32,334 |

|

|

|

(29,655 |

) |

|

|

(23,411 |

) |

|

|

(30,898 |

) |

|

Loss on extinguishment of debt |

|

— |

|

|

|

(27,300 |

) |

|

|

— |

|

|

|

(27,300 |

) |

|

Income before income taxes |

|

65,371 |

|

|

|

52,879 |

|

|

|

118,073 |

|

|

|

159,113 |

|

|

Income tax expense |

|

15,438 |

|

|

|

14,100 |

|

|

|

31,985 |

|

|

|

38,251 |

|

|

Net income |

$ |

49,933 |

|

|

$ |

38,779 |

|

|

$ |

86,088 |

|

|

$ |

120,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income |

$ |

0.36 |

|

|

$ |

0.28 |

|

|

$ |

0.62 |

|

|

$ |

0.94 |

|

|

Diluted net income |

$ |

0.35 |

|

|

$ |

0.28 |

|

|

$ |

0.60 |

|

|

$ |

0.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

124,988 |

|

|

|

123,159 |

|

|

|

125,595 |

|

|

|

115,164 |

|

|

Diluted |

|

129,094 |

|

|

|

127,006 |

|

|

|

129,581 |

|

|

|

120,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

$ |

0.04 |

|

|

$ |

0.025 |

|

|

$ |

0.12 |

|

|

$ |

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Condensed Consolidated Statements of Cash

Flows |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net income |

$ |

86,088 |

|

|

$ |

120,862 |

|

|

Adjustments to reconcile net income to net cash provided by

operations: |

|

|

|

|

|

|

Provision for deferred income taxes |

|

30,898 |

|

|

|

38,251 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

27,300 |

|

|

Loss on derivative instruments |

|

23,411 |

|

|

|

30,898 |

|

|

Cash paid on settlement of derivative instruments |

|

(11,897 |

) |

|

|

(21,032 |

) |

|

Amortization of debt issuance costs |

|

6,199 |

|

|

|

9,352 |

|

|

Amortization of original issue discounts on long-term debt |

|

7,385 |

|

|

|

12,660 |

|

|

Stock-based compensation expense |

|

11,326 |

|

|

|

22,095 |

|

|

Accretion expense |

|

722 |

|

|

|

360 |

|

|

Depletion, depreciation and amortization expense |

|

395,121 |

|

|

|

291,562 |

|

|

Exploration and abandonment expense |

|

386 |

|

|

|

3,747 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

18,145 |

|

|

|

(29,385 |

) |

|

Prepaid expenses, inventory and other assets |

|

(12,387 |

) |

|

|

(1,628 |

) |

|

Accounts payable, accrued liabilities and other current

liabilities |

|

(4,524 |

) |

|

|

16,700 |

|

|

Net cash provided by operating activities |

|

550,873 |

|

|

|

521,742 |

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Additions to crude oil and natural gas properties |

|

(452,148 |

) |

|

|

(840,663 |

) |

|

Changes in working capital associated with crude oil and natural

gas property additions |

|

(13,214 |

) |

|

|

(86,468 |

) |

|

Acquisitions of crude oil and natural gas properties |

|

(10,367 |

) |

|

|

(9,602 |

) |

|

Proceeds from sales of properties |

|

118 |

|

|

|

— |

|

|

Deposit and other costs related to pending acquisitions |

|

— |

|

|

|

(409 |

) |

|

Other property additions |

|

(216 |

) |

|

|

(103 |

) |

|

Net cash used in investing activities |

|

(475,827 |

) |

|

|

(937,245 |

) |

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Repayments under Term Loan Credit Agreement |

|

(90,000 |

) |

|

|

— |

|

|

Repurchased shares under buyback program |

|

(27,247 |

) |

|

|

— |

|

|

Dividends paid |

|

(15,082 |

) |

|

|

(8,706 |

) |

|

Dividend equivalents paid |

|

(1,602 |

) |

|

|

(903 |

) |

|

Debt issuance costs |

|

(58 |

) |

|

|

(26,401 |

) |

|

Proceeds from exercises of warrants |

|

1 |

|

|

|

1,728 |

|

|

Borrowings under Term Loan Credit Agreement |

|

— |

|

|

|

1,170,000 |

|

|

Repayments under Prior Credit Agreement |

|

— |

|

|

|

(525,000 |

) |

|

Repayments of 10.000% Senior Notes and 10.625% Senior Notes |

|

— |

|

|

|

(475,000 |

) |

|

Borrowings under Prior Credit Agreement |

|

— |

|

|

|

255,000 |

|

|

Proceeds from issuance of common stock |

|

— |

|

|

|

155,768 |

|

|

Stock offering costs |

|

— |

|

|

|

(5,371 |

) |

|

Premium on extinguishment of debt |

|

— |

|

|

|

(4,457 |

) |

|

Proceeds from exercises of stock options |

|

— |

|

|

|

148 |

|

|

Net cash (used in) provided by financing activities |

|

(133,988 |

) |

|

|

536,806 |

|

|

Net (decrease) increase in cash and cash equivalents |

|

(58,942 |

) |

|

|

121,303 |

|

|

Cash and cash equivalents, beginning of period |

|

194,515 |

|

|

|

30,504 |

|

|

Cash and cash equivalents, end of period |

$ |

135,573 |

|

|

$ |

151,807 |

|

|

|

|

|

|

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Summary Operating Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Average Daily Sales Volumes: |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (Bbls) |

|

38,710 |

|

|

|

44,381 |

|

|

|

38,581 |

|

|

|

37,171 |

|

|

NGLs (Bbls) |

|

6,497 |

|

|

|

4,708 |

|

|

|

5,890 |

|

|

|

3,895 |

|

|

Natural gas (Mcf) |

|

36,831 |

|

|

|

21,716 |

|

|

|

32,418 |

|

|

|

18,221 |

|

|

Total (Boe) |

|

51,346 |

|

|

|

52,708 |

|

|

|

49,874 |

|

|

|

44,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Realized Prices (excluding effects of

derivatives): |

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil per Bbl |

$ |

75.99 |

|

|

$ |

82.87 |

|

|

$ |

78.29 |

|

|

$ |

77.90 |

|

|

NGL per Bbl |

$ |

21.14 |

|

|

$ |

20.08 |

|

|

$ |

21.96 |

|

|

$ |

22.23 |

|

|

Natural gas per Mcf |

$ |

0.42 |

|

|

$ |

1.89 |

|

|

$ |

0.58 |

|

|

$ |

1.58 |

|

|

Total per Boe |

$ |

57.49 |

|

|

$ |

71.27 |

|

|

$ |

61.07 |

|

|

$ |

67.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Margin Data ($ per Boe): |

|

|

|

|

|

|

|

|

|

|

|

|

Average price, excluding effects of derivatives |

$ |

57.49 |

|

|

$ |

71.27 |

|

|

$ |

61.07 |

|

|

$ |

67.29 |

|

|

Lease operating expenses |

|

(7.12 |

) |

|

|

(7.87 |

) |

|

|

(6.74 |

) |

|

|

(8.23 |

) |

|

Expense workovers |

|

(0.38 |

) |

|

|

(0.34 |

) |

|

|

(0.47 |

) |

|

|

(0.71 |

) |

|

Production and ad valorem taxes |

|

(3.26 |

) |

|

|

(3.89 |

) |

|

|

(3.40 |

) |

|

|

(3.69 |

) |

|

General and administrative expenses |

|

(1.05 |

) |

|

|

(1.43 |

) |

|

|

(1.05 |

) |

|

|

(0.99 |

) |

|

|

$ |

45.68 |

|

|

$ |

57.74 |

|

|

$ |

49.41 |

|

|

$ |

53.67 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Earnings Per Share Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net income as reported |

$ |

49,933 |

|

|

$ |

38,779 |

|

|

$ |

86,088 |

|

|

$ |

120,862 |

|

|

Participating basic earnings |

|

(4,835 |

) |

|

|

(3,771 |

) |

|

|

(8,280 |

) |

|

|

(12,413 |

) |

|

Basic earnings attributable to common shareholders |

|

45,098 |

|

|

|

35,008 |

|

|

|

77,808 |

|

|

|

108,449 |

|

|

Reallocation of participating earnings |

|

66 |

|

|

|

54 |

|

|

|

102 |

|

|

|

192 |

|

|

Diluted net income attributable to common shareholders |

$ |

45,164 |

|

|

$ |

35,062 |

|

|

$ |

77,910 |

|

|

$ |

108,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

124,988 |

|

|

|

123,159 |

|

|

|

125,595 |

|

|

|

115,164 |

|

|

Dilutive warrants and unvested stock options |

|

1,952 |

|

|

|

1,688 |

|

|

|

1,832 |

|

|

|

3,208 |

|

|

Dilutive unvested restricted stock |

|

2,154 |

|

|

|

2,159 |

|

|

|

2,154 |

|

|

|

2,159 |

|

|

Diluted weighted average shares outstanding |

|

129,094 |

|

|

|

127,006 |

|

|

|

129,581 |

|

|

|

120,531 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.36 |

|

|

$ |

0.28 |

|

|

$ |

0.62 |

|

|

$ |

0.94 |

|

|

Diluted |

$ |

0.35 |

|

|

$ |

0.28 |

|

|

$ |

0.60 |

|

|

$ |

0.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Reconciliation of Net Income to EBITDAX,

Discretionary Cash Flow and Net Cash Provided by

Operations |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net income |

$ |

49,933 |

|

|

$ |

38,779 |

|

|

$ |

86,088 |

|

|

$ |

120,862 |

|

|

Interest expense |

|

42,579 |

|

|

|

37,022 |

|

|

|

129,204 |

|

|

|

103,278 |

|

|

Interest income |

|

(2,172 |

) |

|

|

(730 |

) |

|

|

(6,964 |

) |

|

|

(923 |

) |

|

Income tax expense |

|

15,438 |

|

|

|

14,100 |

|

|

|

31,985 |

|

|

|

38,251 |

|

|

Depletion, depreciation and amortization |

|

136,578 |

|

|

|

117,420 |

|

|

|

395,121 |

|

|

|

291,562 |

|

|

Accretion of discount |

|

241 |

|

|

|

122 |

|

|

|

722 |

|

|

|

360 |

|

|

Exploration and abandonment expense |

|

362 |

|

|

|

1,728 |

|

|

|

1,027 |

|

|

|

4,372 |

|

|

Stock based compensation |

|

3,753 |

|

|

|

14,057 |

|

|

|

11,326 |

|

|

|

22,095 |

|

|

Derivative related noncash activity |

|

(33,775 |

) |

|

|

15,883 |

|

|

|

11,514 |

|

|

|

9,866 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

27,300 |

|

|

|

— |

|

|

|

27,300 |

|

|

Other expense |

|

1,404 |

|

|

|

540 |

|

|

|

3,405 |

|

|

|

8,042 |

|

|

EBITDAX |

|

214,341 |

|

|

|

266,221 |

|

|

|

663,428 |

|

|

|

625,065 |

|

|

Cash interest expense |

|

(38,020 |

) |

|

|

(33,798 |

) |

|

|

(115,620 |

) |

|

|

(85,723 |

) |

|

Other (a) |

|

53 |

|

|

|

4,480 |

|

|

|

1,831 |

|

|

|

(3,287 |

) |

|

Discretionary cash flow |

|

176,374 |

|

|

|

236,903 |

|

|

|

549,639 |

|

|

|

536,055 |

|

|

Changes in operating assets and liabilities |

|

729 |

|

|

|

(78,837 |

) |

|

|

1,234 |

|

|

|

(14,313 |

) |

|

Net cash provided by operating activities |

$ |

177,103 |

|

|

$ |

158,066 |

|

|

$ |

550,873 |

|

|

$ |

521,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) includes interest and other income net of current tax expense,

other expense and operating portion of exploration and abandonment

expenses. |

|

|

|

HighPeak Energy, Inc. |

|

Unaudited Free Cash Flow Reconciliation |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

|

Nine Months Ended September 30, 2024 |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

177,103 |

|

|

$ |

550,873 |

|

|

Changes in operating assets and liabilities |

|

(729 |

) |

|

|

(1,234 |

) |

|

Discretionary cash flow |

|

176,374 |

|

|

|

549,639 |

|

|

Less: Additions to crude oil and natural gas properties (excluding

acquisitions) |

|

(140,251 |

) |

|

|

(452,148 |

) |

|

Free cash flow |

$ |

36,123 |

|

|

$ |

97,491 |

|

|

|

|

|

|

|

|

Investor Contact:

Ryan Hightower Vice President, Business

Development 817.850.9204 rhightower@highpeakenergy.com

Source: HighPeak Energy, Inc.

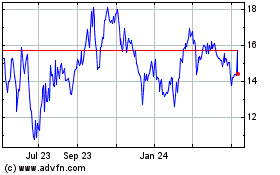

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

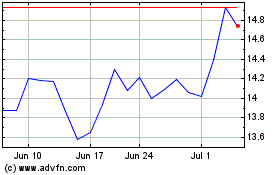

HighPeak Energy (NASDAQ:HPK)

Historical Stock Chart

From Dec 2023 to Dec 2024