Company Reiterates Full-year 2023 Financial

Guidance as Turnaround Efforts Progress and MAGIC: THE GATHERING

Growth Continues

Hasbro, Inc. (NASDAQ: HAS), a global branded entertainment

leader, today reported financial results for the first quarter

2023.

- First quarter revenues of $1.00 billion declined 14%

year-over-year, or 13% on a constant currency basis.

- MAGIC: THE GATHERING revenue increases 16% Year-Over-Year

- First quarter operating profit of $17.9 million and adjusted

operating profit of $47.2 million.

- First quarter net loss of $22.1 million, or a net loss of $0.16

per share, and adjusted net income of $1.0 million, or $0.01 per

diluted share.

- Company realizes $35 million in Operational Excellence program

cost savings year-to-date. Reaffirms guidance for $150 million

run-rate savings for full-year 2023.

"First quarter results came in ahead of our expectations and

position Hasbro to meet our full-year financial targets," said

Chris Cocks, Hasbro chief executive officer. "Wizards of the Coast

and Digital Gaming delivered strong fan engagement. Segment

revenues increased 12%, including a 16% revenue increase in MAGIC:

THE GATHERING, behind the successful release of Phyrexia: All Will

Be One. Dungeons and Dragons: Honor Among Thieves delivered strong

critical and audience reviews pointing to a promising long life

including home entertainment and streaming, while also introducing

our newest Franchise Brand to tens of millions of new fans around

the world and positioning DUNGEONS & DRAGONS for robust

full-year growth.

"We've made significant progress in implementing our Blueprint

2.0 strategy, including heightening our focus on high-growth,

high-profit categories; improving our cost structure; and adding

talented executives to our leadership team. The sale process for

the eOne TV and film assets is ongoing and we expect to provide an

update during the second quarter," said Cocks. "The global Hasbro

team continues to execute our strategy to unlock the value of our

rich IP library across our growth priorities including in gaming,

direct-to-consumer and licensing."

"The year has started on plan as we reduce retail inventory

levels and remain positioned to drive continued margin expansion.

As we work through our inventory, we continue to invest in our

growth priorities, reduce costs, and return cash to shareholders,"

said Deborah Thomas, Hasbro chief financial officer. "The first

quarter is the smallest quarter of the year, and there is a lot of

the year ahead of us. The team is advancing our cost savings and

taking strategic steps to drive long-term shareholder value. With

my upcoming retirement and transition on May 18, I believe Hasbro

is well positioned with an experienced leadership team and a strong

strategic and financial plan for the future."

First Quarter 2023 Financial

Results

$ Millions, except earnings per

share

Q1 2023

Q1 2022

% Change

Net Revenues1

$

1,001.0

$

1,163.1

-14

%

Operating Profit

$

17.9

$

120.0

-85

%

Adjusted Operating Profit2

$

47.2

$

141.8

-67

%

Net Earnings (Loss)

$

(22.1

)

$

61.2

>-100%

Net Earnings (Loss) per Diluted

Share

$

(0.16

)

$

0.44

>-100%

Adjusted Net Earnings2

$

1.0

$

79.4

-99

%

Adjusted Net Earnings per Diluted

Share2

$

0.01

$

0.57

-98

%

EBITDA2

$

72.4

$

174.0

-58

%

Adjusted EBITDA2

$

98.7

$

192.1

-49

%

1Foreign exchange had a negative $15.8

million impact, or 1%, on first quarter 2023 revenue.

2See the financial tables accompanying

this press release for a reconciliation of GAAP and non-GAAP

financial measures, namely, adjusted operating profit, adjusted net

earnings, adjusted net earnings per share and adjusted EBITDA.

First Quarter 2023 Brand

Portfolio

Brand Performance ($ Millions)

Net Revenues

Q1 2023

Q1 2022

% Change

Franchise Brands1

$

613.4

$

650.4

-6

%

Partner Brands

$

132.7

$

206.5

-36

%

Portfolio Brands

$

92.0

$

112.6

-18

%

Non-Hasbro Branded Film &

TV

$

162.9

$

193.6

-16

%

1Effective in the first quarter of 2023,

the Company realigned its Brand Portfolios to Franchise Brands,

Partner Brands, Portfolio Brands and Non-Hasbro Branded Film &

TV. Franchise Brands include DUNGEONS & DRAGONS, Hasbro Gaming,

MAGIC: THE GATHERING, NERF, PEPPA PIG, PLAY-DOH and TRANSFORMERS. A

schedule of historical quarterly revenue is available at

https://investor.hasbro.com/ under Financials & Filings.

Within Franchise Brands, NERF, Hasbro Gaming, PLAY-DOH and PEPPA

PIG declined in the quarter as retailers focused on reducing

inventory levels.

First Quarter 2023 MAGIC: THE GATHERING

and Gaming Portfolio

Net Revenues

$ Millions

Q1 2023

Q1 2022

% Change

MAGIC: THE GATHERING

$

229.1

$

197.2

16

%

Hasbro Total Gaming1

386.5

378.8

2

%

1Hasbro’s Total Gaming Category includes

all gaming revenue, most notably MAGIC: THE GATHERING, Hasbro

Gaming and DUNGEONS & DRAGONS.

MAGIC: THE GATHERING's first quarter revenues increased 16%.

Strong player demand led to higher-than-expected performance for

the first quarter release of Phyrexia: All Will Be One. Back

catalog sales of previously released sets continue to perform.

Modern Horizons 2, released in June 2021, officially became the

game's first $200 million set in the first quarter. Universes

Beyond Warhammer 40K hit its fourth reprint on strong continuing

demand and the newest Universes Beyond set, The Lord of the Rings:

Tales of Middle-Earth, debuted with record pre-orders in March for

a late second quarter release. As previously communicated, we

expect MAGIC: THE GATHERING revenue to decline in the second

quarter based on year-over-year release timing. Third quarter

revenue is expected to increase on a strong release slate and

robust ongoing demand for the game. Organized play, i.e., in person

tournaments, also continues to build with the second MagicCon of

the year slated for May 5-7 in Minneapolis following a successful

event in Philadelphia in February.

Company Outlook

Reflecting on the current environment and an expected flat to

declining toy and game market in 2023, the Company's full-year 2023

guidance remains:

- Revenue down low-single digits

- Adjusted operating profit margin expansion of 50 to 70 basis

points, excluding Operational Excellence charges and other non-GAAP

items1

- Adjusted earnings per diluted share in the range of $4.45 to

$4.55

- Adjusted EBITDA approximately flat with 2022 Adjusted

EBITDA

- Operating cash flow in the range of $600 to $700 million

1The Company is not able to reconcile its forward-looking

non-GAAP adjusted operating profit margin, adjusted earnings per

diluted share and adjusted EBITDA measures because the Company

cannot predict with certainty the timing and amounts of discrete

items such as charges associated with its cost-savings program,

which could impact GAAP results. Guidance does not reflect the

potential sale of select entertainment assets. The Company plans to

update its outlook upon completion of this process if it results in

the sale of non-core entertainment assets.

Operational Excellence Program In support of Blueprint

2.0, Hasbro implemented an Operational Excellence program to

deliver $250-300 million in annualized run-rate cost savings by

year-end 2025. In the first quarter 2023, the Company realized an

additional $35 million of savings and still expects to achieve $150

million in run-rate cost savings for the full-year 2023. Expected

cash costs to implement the program are approximately $200 million,

of which $17.1 million was spent in the first quarter and

approximately $167 million remains to be spent. An $8.1 million

after-tax charge was recorded in first quarter 2023 associated with

the execution of the Blueprint 2.0 strategy.

First Quarter 2023 Major Segment

Performance

Q1 2023 Major Segments ($

Millions)

Net Revenues

Operating Profit

(Loss)

Adjusted Operating Profit

(Loss)1

Q1 2023

Q1 2022

% Change

Q1 2023

Q1 2022

Q1 2023

Q1 2022

Consumer Products

$

520.4

$

672.8

-23

%

$

(46.0

)

$

8.6

$

(35.4

)

$

18.9

Wizards of the Coast and Digital

Gaming

$

295.2

$

262.8

12

%

$

76.8

$

106.4

$

76.8

$

106.4

Entertainment

$

185.4

$

227.5

-19

%

$

(8.7

)

$

12.2

$

(2.5

)

$

21.0

Q1 2023 Major Segments ($

Millions)

EBITDA

Adjusted EBITDA1

Q1 2023

Q1 2022

Q1 2023

Q1 2022

Consumer Products

$

(11.5

)

$

41.3

$

(4.6

)

$

48.8

Wizards of the Coast and Digital

Gaming

$

81.2

$

107.6

$

86.4

$

112.2

Entertainment

$

3.5

$

25.9

$

8.1

$

31.4

1Reconciliations are included in the

attached schedules under the heading "Reconciliation of Adjusted

Operating Profit" and “Reconciliation of EBITDA and Adjusted

EBITDA.”

First Quarter 2023 Segment Commentary & 2023

Outlook

Consumer Products segment revenues decreased 23%.

- Revenue decreased 21% excluding a negative $8.3 million impact

of foreign exchange, $6.2 million of which was in Europe.

- Revenue declines reflect the Company's efforts to lower retail

inventory levels.

- The segment's decline in adjusted operating profit is the

result of lower revenue, including higher allowances and close outs

to sell through inventory. These items were partially offset by

savings realized from the Company’s Operational Excellence program,

reflected primarily in cost of sales.

- For the full year 2023, revenue is expected to decline

mid-single digits from full-year 2022 with adjusted operating

profit margin improvement of 150 to 200 basis points from the

adjusted 7.6% in 2022.

Wizards of the Coast and Digital Gaming segment revenues

increased 12%.

- Revenues increased 14% excluding a negative $3.1 million impact

of foreign exchange.

- Tabletop gaming revenue increased 13%. Digital and licensed

gaming revenue increased 9%, bolstered by the addition of D&D

Beyond. Underlying demand for both MAGIC: THE GATHERING and

DUNGEONS & DRAGONS remains robust.

- Operating profit declined 28% due to investments in product

development and personnel, higher product cost, advertising expense

and costs supporting the return of organized play.

- Second quarter revenues are expected to decline year-over-year

for the segment based on MAGIC release timing which favors the

third quarter. Third quarter revenues are also expected to be

buoyed by the anticipated release of the D&D branded AAA video

game, Baldur’s Gate 3, in August on consoles and PC.

- For the full year 2023, we expect mid-single digit revenue

growth. Operating profit margin is expected to be in the high 30%

range as we continue to build on the Universes Beyond franchise and

invest for long-term growth in these valuable brands.

Entertainment segment revenue decreased 19%.

- Revenues declined 17% excluding a negative $4.3 million impact

of foreign exchange.

- Film & TV revenue declined 11% reflecting lower film

revenues with fewer new releases in 2023 vs. 2022 and lower

unscripted TV revenue. TV revenues increased behind continued

strong scripted TV deliveries, including the new series The Rookie:

Feds.

- Family Brands revenue declined 27% primarily due to content

sales timing year-over-year with several multi-year licensing deals

executed in Q1 2022.

- Music and Other declined as the Company exited these businesses

in late 2022.

- Adjusted operating loss was the result of lower revenues, as

well as higher advertising for Dungeons & Dragons: Honor Among

Thieves partially offset by lower royalty expense.

- For the full-year 2023, we expect revenue to increase

low-single digits and adjusted operating profit margin is expected

to increase slightly from 8.6% in 2022. Guidance will be updated

upon completion of the sale process of our non-core entertainment

assets.

Capital Priorities and

Dividend During the first quarter, Hasbro paid $96.7

million in cash dividends to shareholders. The next dividend of

$0.70 per common share was previously declared and will be payable

on May 15, 2023 to shareholders of record at the close of business

on May 1, 2023.

The Company continues to target Debt to EBITDA of 2.0 to 2.5

times. For 2023, progress is expected against this target. Pending

the outcome of the sale of non-core film and TV assets, the Company

anticipates prioritizing the sale proceeds toward paying down debt.

The Company remains committed to maintaining its investment grade

rating.

Conference Call Webcast

Hasbro will webcast its first quarter 2023 earnings conference call

at 8:30 a.m. Eastern Time today. To listen to the live webcast and

access the accompanying presentation slides, please go to

https://investor.hasbro.com. The replay of the call will be

available on Hasbro’s website approximately 2 hours following

completion of the call.

About Hasbro Hasbro is a global branded entertainment

leader whose mission is to entertain and connect generations of

fans through the wonder of storytelling and exhilaration of play.

Hasbro delivers engaging brand experiences for global audiences

through gaming, consumer products and entertainment, with a

portfolio of iconic brands including MAGIC: THE GATHERING, DUNGEONS

& DRAGONS, Hasbro Gaming, NERF, TRANSFORMERS, PLAY-DOH and

PEPPA PIG, as well as premier partner brands.

Hasbro is guided by our Purpose to create joy and community for

all people around the world, one game, one toy, one story at a

time. For more than a decade, Hasbro has been consistently

recognized for its corporate citizenship, including being named one

of the 100 Best Corporate Citizens by 3BL Media, one of the World’s

Most Ethical Companies by Ethisphere Institute and one of the 50

Most Community-Minded Companies in the U.S. by the Civic 50. For

more information, visit https://corporate.hasbro.com.

© 2023 Hasbro, Inc. All Rights Reserved.

Forward Looking Statement Safe Harbor Certain statements

in this press release contain “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements, which may be identified by the use of

forward-looking words or phrases, include statements relating to:

our business strategies and plans for growth; expectations relating

to products, gaming and entertainment; anticipated cost savings;

financial targets; changes in leadership; and anticipated financial

performance for 2023. Our actual actions or results may differ

materially from those expected or anticipated in the

forward-looking statements due to both known and unknown risks and

uncertainties. Factors that might cause such a difference include,

but are not limited to:

- our ability to successfully execute on our Blueprint 2.0

strategy, including to focus on and scale select business

initiatives and brands to drive profitability;

- our ability to design, develop, manufacture, and ship products

on a timely, cost-effective and profitable basis;

- our ability to successfully compete in the global play and

entertainment industry;

- our ability to successfully evolve and transform our business

and capabilities to successfully address the global consumer

landscape;

- inflation and downturns in global and regional economic

conditions impacting one or more of the markets in which we sell

products, which can negatively impact our retail customers and

consumers, result in lower employment levels, consumer disposable

income, retailer inventories and spending, including lower spending

on purchases of our products;

- our dependence on third party relationships, including with

third party manufacturers, licensors of brands, studios, content

producers and entertainment distribution channels;

- risks relating to the concentration of manufacturing for many

of our products in the People’s Republic of China and our ability

to successfully diversify sourcing of our products to reduce

reliance on sources of supply in China;

- our ability to successfully develop and continue to execute

plans to mitigate the negative impact of the coronavirus on our

business;

- risks related to other economic and public health conditions or

regulatory changes in the markets in which we and our customers,

partners, licensees, suppliers and manufacturers operate, such as

inflation, rising interest rates, higher commodity prices, labor

costs or transportation costs, or outbreaks of disease, the

occurrence of which could create work slowdowns, delays or

shortages in production or shipment of products, increases in costs

or delays in revenue;

- risks associated with international operations, such as

currency conversion, currency fluctuations, the imposition of

tariffs, quotas, shipping delays or difficulties, border adjustment

taxes or other protectionist measures, and other challenges in the

territories in which we operate;

- the success of our key partner brands, including the ability to

secure, maintain and extend agreements with our key partners or the

risk of delays, increased costs or difficulties associated with any

of our or our partners’ planned digital applications or media

initiatives;

- risks related to our leadership changes;

- our ability to attract and retain talented and diverse

employees;

- our ability to realize the benefits of cost-savings and

efficiency and/or revenue and operating profit enhancing

initiatives;

- risks relating to the impairment and/or write-offs of products

and content we acquire and produce;

- risks relating to loss of data or security breaches;

- risks relating to investments, acquisitions and dispositions,

including the ability to realize the anticipated benefits of

acquired assets or businesses;

- fluctuations in our business due to seasonality;

- the concentration of our customers, potentially increasing the

negative impact to our business of difficulties experienced by any

of our customers or changes in their purchasing or selling

patterns;

- the bankruptcy or other lack of success of one or more of our

significant retailers, licensees and other partners; and

- other risks and uncertainties as may be detailed from time to

time in our public announcements and U.S. Securities and Exchange

Commission (“SEC”) filings.

The statements contained herein are based on our current beliefs

and expectations. We undertake no obligation to make any revisions

to the forward-looking statements contained in this press release

or to update them to reflect events or circumstances occurring

after the date of this press release.

Non-GAAP Financial Measures The financial tables

accompanying this press release include non-GAAP financial measures

as defined under SEC rules, specifically Adjusted operating profit,

Adjusted net earnings and Adjusted net earnings per diluted share,

which exclude, where applicable, acquisition and related costs,

acquired intangible amortization; and Operational Excellence

charges. Also included in this press release are the non-GAAP

financial measures of EBITDA and Adjusted EBITDA. EBITDA represents

net earnings attributable to Hasbro, Inc. excluding interest

expense, income tax expense, net earnings (loss) attributable to

noncontrolling interests, depreciation and amortization of

intangibles. Segment EBITDA represents segment operating profit

(loss) plus other income or expense, less depreciation and

amortization of intangibles. Adjusted EBITDA also excludes

Operational Excellence charges and the impact of stock compensation

(including acquisition-related stock expense). As required by SEC

rules, we have provided reconciliations on the attached schedules

of these measures to the most directly comparable GAAP measure.

Management believes that Adjusted net earnings, Adjusted net

earnings per diluted share and Adjusted operating profit provide

investors with an understanding of the underlying performance of

our business absent unusual events. Management believes that EBITDA

and Adjusted EBITDA are appropriate measures for evaluating the

operating performance of our business because they reflect the

resources available for strategic opportunities including, among

others, to invest in the business, strengthen the balance sheet and

make strategic acquisitions. The impact of changes in foreign

currency exchange rates used to translate the consolidated

statements of operations is quantified by translating the current

period revenues at the prior period exchange rates and comparing

this amount to the prior period reported revenues. The Company

believes that the presentation of the impact of changes in exchange

rates, which are beyond the Company’s control, is helpful to an

investor’s understanding of the performance of the underlying

business. These non-GAAP measures should be considered in addition

to, not as a substitute for, or superior to, net earnings or other

measures of financial performance prepared in accordance with GAAP

as more fully discussed in our consolidated financial statements

and filings with the SEC. As used herein, "GAAP" refers to

accounting principles generally accepted in the United States of

America.

HAS-E

(Tables Attached)

HASBRO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(1)

(Unaudited)

(Millions of Dollars)

April 2, 2023

March 27, 2022

ASSETS

Cash and Cash Equivalents

$

386.2

$

1,057.9

Accounts Receivable, Net

685.2

931.7

Inventories

713.4

644.3

Prepaid Expenses and Other Current

Assets

754.4

621.4

Total Current Assets

2,539.2

3,255.3

Property, Plant and Equipment, Net

509.1

422.6

Goodwill

3,470.1

3,419.3

Other Intangible Assets, Net

801.0

1,136.6

Other Assets

1,604.3

1,284.9

Total Assets

$

8,923.7

$

9,518.7

LIABILITIES, NONCONTROLLING INTERESTS

AND SHAREHOLDERS' EQUITY

Short-Term Borrowings

$

134.5

$

104.1

Current Portion of Long-Term Debt

109.0

155.8

Accounts Payable and Accrued

Liabilities

1,653.9

1,783.1

Total Current Liabilities

1,897.4

2,043.0

Long-Term Debt

3,682.4

3,737.9

Other Liabilities

585.2

633.6

Total Liabilities

6,165.0

6,414.5

Redeemable Noncontrolling Interests

—

23.5

Total Shareholders' Equity

2,758.7

3,080.7

Total Liabilities, Noncontrolling

Interests and Shareholders' Equity

$

8,923.7

$

9,518.7

(1) Amounts may not sum due to

rounding

HASBRO, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(1)

(Unaudited)

(Millions of Dollars and Shares Except Per

Share Data)

Quarter Ended

April 2, 2023

% Net Revenues

March 27, 2022

% Net Revenues

Net Revenues

$

1,001.0

100.0

%

$

1,163.1

100.0

%

Costs and Expenses:

Cost of Sales

285.3

28.5

%

333.1

28.6

%

Program Cost Amortization

122.5

12.2

%

138.5

11.9

%

Royalties

69.0

6.9

%

90.1

7.7

%

Product Development

83.3

8.3

%

69.6

6.0

%

Advertising

82.8

8.3

%

77.6

6.7

%

Amortization of Intangibles

23.1

2.3

%

27.1

2.3

%

Selling, Distribution and

Administration

317.1

31.7

%

307.1

26.4

%

Operating Profit

17.9

1.8

%

120.0

10.3

%

Interest Expense

46.3

4.6

%

41.6

3.6

%

Other Expense (Income), Net

(7.4

)

-0.7

%

(1.8

)

-0.2

%

Earnings (Loss) before Income Taxes

(21.0

)

-2.1

%

80.2

6.9

%

Income Tax Expense

0.7

0.1

%

17.3

1.5

%

Net Earnings (Loss)

(21.7

)

-2.2

%

62.9

5.4

%

Net Earnings Attributable to

Noncontrolling Interests

0.4

0.0

%

1.7

0.1

%

Net Earnings (Loss) Attributable to

Hasbro, Inc.

$

(22.1

)

-2.2

%

$

61.2

5.3

%

Per Common Share

Net Earnings (Loss)

Basic

$

(0.16

)

$

0.44

Diluted

$

(0.16

)

$

0.44

Cash Dividends Declared

$

0.70

$

0.70

Weighted Average Number of Shares

Basic

138.6

139.3

Diluted

138.7

139.6

(1) Amounts may not sum due to

rounding

HASBRO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (1)

(Unaudited)

(Millions of Dollars)

Quarter Ended

April 2, 2023

March 27, 2022

Cash Flows from Operating Activities:

Net Earnings (Loss)

$

(21.7

)

$

62.9

Other Non-Cash Adjustments

181.9

179.3

Changes in Operating Assets and

Liabilities

(71.4

)

(107.5

)

Net Cash Provided by Operating

Activities

88.8

134.7

Cash Flows from Investing Activities:

Additions to Property, Plant and

Equipment

(53.2

)

(29.2

)

Other

(2.4

)

5.3

Net Cash Utilized by Investing

Activities

(55.6

)

(23.9

)

Cash Flows from Financing Activities:

Proceeds from Long-Term Debt

1.2

1.3

Repayments of Long-Term Debt

(35.5

)

(133.9

)

Net (Repayments of) Proceeds from

Short-Term Borrowings

(7.7

)

103.3

Stock-Based Compensation Transactions

—

70.2

Dividends Paid

(96.7

)

(94.5

)

Payments Related to Tax Withholding for

Share-Based Compensation

(14.0

)

(19.3

)

Other

(3.9

)

(4.6

)

Net Cash Utilized by Financing

Activities

(156.6

)

(77.5

)

Effect of Exchange Rate Changes on

Cash

(3.5

)

5.4

Net (Decrease) Increase in Cash and Cash

Equivalents

(126.9

)

38.7

Cash and Cash Equivalents at Beginning of

Year

513.1

1,019.2

Cash and Cash Equivalents at End of

Period

$

386.2

$

1,057.9

(1) Amounts may not sum due to

rounding

HASBRO, INC.

SUPPLEMENTAL FINANCIAL DATA

SEGMENT RESULTS - AS REPORTED AND AS

ADJUSTED (5)

(Unaudited)

(Millions of Dollars)

Operating

Results

Quarter Ended April 2,

2023

Quarter Ended March 27,

2022

As Reported

Non-GAAP Adjustments

Adjusted

As Reported

Non-GAAP Adjustments

Adjusted

% Change

Total Company

Results

External Net Revenues (1)

$

1,001.0

$

—

$

1,001.0

$

1,163.1

$

—

$

1,163.1

-14

%

Operating Profit (1)

17.9

29.3

47.2

120.0

21.8

141.8

-67

%

Operating Margin

1.8

%

2.9

%

4.7

%

10.3

%

1.9

%

12.2

%

EBITDA

72.4

26.3

98.7

174.0

18.1

192.1

-49

%

Segment

Results

Consumer

Products:

External Net Revenues (2)

$

520.4

$

—

$

520.4

$

672.8

$

—

$

672.8

-23

%

Operating Profit (Loss)

(46.0

)

10.6

(35.4

)

8.6

10.3

18.9

>-100%

Operating Margin

-8.8

%

2.0

%

-6.8

%

1.3

%

1.5

%

2.8

%

EBITDA

(11.5

)

6.9

(4.6

)

41.3

7.5

48.8

>-100%

Wizards of the Coast

and Digital Gaming:

External Net Revenues (3)

$

295.2

$

—

$

295.2

$

262.8

$

—

$

262.8

12

%

Operating Profit

76.8

—

76.8

106.4

—

106.4

-28

%

Operating Margin

26.0

%

—

26.0

%

40.5

%

—

40.5

%

EBITDA

81.2

5.2

86.4

107.6

4.6

112.2

-23

%

Entertainment:

External Net Revenues (4)

$

185.4

$

—

$

185.4

$

227.5

$

—

$

227.5

-19

%

Operating Profit (Loss)

(8.7

)

6.2

(2.5

)

12.2

8.8

21.0

>-100%

Operating Margin

-4.7

%

3.3

%

-1.3

%

5.4

%

3.9

%

9.2

%

EBITDA

3.5

4.6

8.1

25.9

5.5

31.4

-74

%

Corporate and

Other:

Operating Profit (Loss)

$

(4.2

)

$

12.5

$

8.3

$

(7.2

)

$

2.7

$

(4.5

)

>100%

EBITDA

(0.8

)

9.6

8.8

(0.8

)

0.5

(0.3

)

>100%

(1) Effective in the first quarter of

2023, the Company is realigning our brand portfolios to correspond

with the Blueprint 2.0 strategy. Net Revenues by Brand Portfolio

below have been restated to present net revenues and operating

profit under the realigned structure.

Net Revenues

Quarter Ended

April 2, 2023

March 27, 2022

% Change

Net Revenues by

Brand Portfolio

Franchise Brands (a)

$

613.4

$

650.4

-6

%

Partner Brands

132.7

206.5

-36

%

Portfolio Brands

92.0

112.6

-18

%

Non-Hasbro Branded Film & TV

162.9

193.6

-16

%

Total

$

1,001.0

$

1,163.1

Operating Profit

(Loss)

Adjusted Operating Profit

(Loss)

Quarter Ended

Quarter Ended

April 2, 2023

March 27, 2022

% Change

April 2, 2023

March 27, 2022

% Change

Operating Profit

(Loss) and Adjusted Operating Profit (Loss) by Brand Portfolio

(i)

Franchise Brands (a)

$

61.6

$

142.5

-57

%

$

69.9

$

152.3

-54

%

Partner Brands

(13.2

)

(5.6

)

>-100%

(13.2

)

(5.6

)

>-100%

Portfolio Brands

(10.8

)

1.7

>-100%

(6.2

)

6.0

>-100%

Non-Hasbro Branded Film & TV

(15.5

)

(11.4

)

-36

%

(11.6

)

(6.4

)

-81

%

Total

$

22.1

$

127.2

$

38.9

$

146.3

(i) Operating Profit (Loss) by Brand

Portfolio excludes Corporate and Other. For the quarter ended April

2, 2023, and quarter ended March 27, 2022 there was an Operating

Loss of $4.2 and $7.2, respectively, relating to unallocated

Corporate and Other expenses. Adjusted Operating Profit (Loss) for

Corporate and Other was $8.3 for the quarter ended April 2, 2023

and ($4.5) for the quarter ended March 27, 2022, respectively.

Adjusted measures exclude certain non-GAAP adjustments. See

"Reconciliation of Non-GAAP Financial Measures" for Adjusted

Operating Profit.

(a) Franchise Brands include: DUNGEONS

& DRAGONS, Hasbro Gaming, MAGIC: THE GATHERING, NERF, PEPPA

PIG, PLAY-DOH and TRANSFORMERS.

Net Revenues

Quarter Ended

April 2, 2023

March 27, 2022

% Change

MAGIC: THE GATHERING

$

229.1

$

197.2

16

%

Hasbro Total Gaming (b)

386.5

378.8

2

%

(b) Hasbro Total Gaming includes all

gaming revenue, most notably DUNGEONS & DRAGONS, MAGIC: THE

GATHERING and Hasbro Gaming.

Net Revenues

Quarter Ended

April 2, 2023

March 27, 2022

% Change

(2)

Consumer Products Segment Net Revenues by

Major Geographic Region

North America

$

279.1

$

405.2

-31

%

Europe

131.6

176.7

-26

%

Asia Pacific

63.3

52.2

21

%

Latin America

46.4

38.7

20

%

Total

$

520.4

$

672.8

Quarter Ended

April 2, 2023

March 27, 2022

% Change

(3)

Wizards of the Coast and Digital Gaming Net

Revenues by Category

Tabletop Gaming

$

217.9

$

192.2

13

%

Digital and Licensed Gaming

77.3

70.6

9

%

Total

$

295.2

$

262.8

Quarter Ended

April 2, 2023

March 27, 2022

% Change

(4)

Entertainment Segment Net Revenues by

Category

Film and TV

$

168.4

$

190.2

-11

%

Family Brands

17.0

23.2

-27

%

Music and Other

—

14.1

-100

%

Total

$

185.4

$

227.5

(5) Amounts within this section may not

sum due to rounding

HASBRO, INC.

SUPPLEMENTAL FINANCIAL DATA

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(Unaudited)

(Millions of Dollars)

Reconciliation of

Adjusted Operating Profit (1)

Quarter Ended

April 2, 2023

March 27, 2022

Operating Profit (Loss)

$

17.9

$

120.0

Consumer Products

(46.0

)

8.6

Wizards of the Coast and Digital

Gaming

76.8

106.4

Entertainment

(8.7

)

12.2

Corporate and Other

(4.2

)

(7.2

)

Non-GAAP Adjustments (2)

$

29.3

$

21.8

Consumer Products

10.6

10.3

Entertainment

6.2

8.8

Corporate and Other

12.5

2.7

Adjusted Operating Profit

(Loss)

$

47.2

$

141.8

Consumer Products

(35.4

)

18.9

Wizards of the Coast and Digital

Gaming

76.8

106.4

Entertainment

(2.5

)

21.0

Corporate and Other

8.3

(4.5

)

(2) Non-GAAP Adjustments include the

following:

Acquisition-related costs (i)

$

1.9

$

2.7

Acquired intangible amortization (ii)

16.8

19.1

Operational Excellence charges (iii)

Transformation office and consultant

fees

10.6

—

Total

$

29.3

$

21.8

(1) Amounts may not sum due to

rounding

(i) In association with the Company's

acquisition of eOne, the Company incurred stock compensation

expenses of $1.9 ($1.7 after-tax) in the quarter ended April 2,

2023, and $2.7 ($2.3 after-tax) in the quarter ended March 27,

2022. The expense is included within Selling, Distribution and

Administration.

(ii) Represents intangible amortization

costs related to the intangible assets acquired in the eOne

acquisition. The Company has allocated certain of these intangible

amortization costs between the Consumer Products and Entertainment

segments, to match the revenue generated from such intangible

assets.

(iii) Program related transformation

office and consultant fees of $10.6 ($8.1 after-tax) for the

quarter ended April 2, 2023, are included within Selling,

Distribution and Administration within the Corporate and Other

segment.

HASBRO, INC.

SUPPLEMENTAL FINANCIAL DATA

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(Unaudited)

(Millions of Dollars)

Reconciliation of

EBITDA and Adjusted EBITDA (1)

Quarter Ended

April 2, 2023

March 27, 2022

Net Earnings (Loss) Attributable to

Hasbro, Inc.

$

(22.1

)

$

61.2

Interest Expense

46.3

41.6

Income Tax Expense

0.7

17.3

Net Earnings Attributable to

Noncontrolling Interests

0.4

1.7

Depreciation

24.0

25.1

Amortization of Intangibles

23.1

27.1

EBITDA

$

72.4

$

174.0

Non-GAAP Adjustments and Stock

Compensation (2)

26.3

18.1

Adjusted EBITDA

$

98.7

$

192.1

(2) Non-GAAP Adjustments and Stock

Compensation are comprised of the following:

Stock compensation

$

15.7

$

18.1

Operational Excellence charges

10.6

—

Total

$

26.3

$

18.1

Adjusted EBITDA by Segment:

Consumer Products

$

(4.6

)

$

48.8

Wizards of the Coast and Digital

Gaming

86.4

112.2

Entertainment

8.1

31.4

Corporate and Other

8.8

(0.3

)

Total Adjusted EBITDA

$

98.7

$

192.1

Consumer Products:

Operating Profit (Loss)

$

(46.0

)

$

8.6

Other Income

8.5

0.8

Depreciation

12.1

13.9

Amortization of Intangibles

13.9

18.0

EBITDA

$

(11.5

)

$

41.3

Non-GAAP Adjustments and Stock

Compensation

6.9

7.5

Adjusted EBITDA

$

(4.6

)

$

48.8

Wizards of the Coast and Digital

Gaming:

Operating Profit

$

76.8

$

106.4

Other Expense

(0.5

)

(0.7

)

Depreciation

3.0

1.9

Amortization of Intangibles

1.9

—

EBITDA

$

81.2

$

107.6

Non-GAAP Adjustments and Stock

Compensation

5.2

4.6

Adjusted EBITDA

$

86.4

$

112.2

Entertainment:

Operating Profit (Loss)

$

(8.7

)

$

12.2

Other Income

3.6

1.9

Depreciation

1.9

2.8

Amortization of Intangibles

6.7

9.0

EBITDA

$

3.5

$

25.9

Non-GAAP Adjustments and Stock

Compensation

4.6

5.5

Adjusted EBITDA

$

8.1

$

31.4

(1) Amounts may not sum due to

rounding

HASBRO, INC.

SUPPLEMENTAL FINANCIAL DATA

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(Unaudited)

(Millions of Dollars and Shares, Except

Per Share Data)

Reconciliation of

Net Earnings and Earnings per Share (1)

Quarter Ended

(all adjustments reported after-tax)

April 2, 2023

Diluted Per Share

Amount

March 27, 2022

Diluted Per Share

Amount

Net Earnings (Loss) Attributable to

Hasbro, Inc.

$

(22.1

)

$

(0.16

)

$

61.2

$

0.44

Acquisition and related costs

1.7

0.01

2.3

0.02

Acquired intangible amortization

13.3

0.10

15.9

0.11

Operational Excellence charges

8.1

0.06

—

—

Net Earnings Attributable to Hasbro, Inc.,

as Adjusted

$

1.0

$

0.01

$

79.4

$

0.57

(1) Amounts may not sum due to

rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230426005602/en/

Investors: Debbie Hancock | Hasbro, Inc. | (401) 727-5401 |

debbie.hancock@hasbro.com Media: Abby Hodes | Hasbro, Inc. | (646)

734-6426 | abby.hodes@hasbro.com

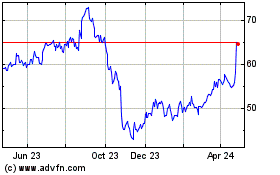

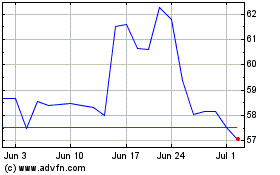

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Apr 2023 to Apr 2024