Form POS 8C - Post-effective amendments filed by certain investment companies [Section 8(c)]

June 03 2024 - 4:59PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on June 3, 2024

Registration No. 333-277325

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective

Amendment ¨

Post-Effective

Amendment No. 1 x

(Check appropriate box or boxes)

Golub

Capital BDC, Inc.

(Exact Name of Registrant as Specified in Charter)

200 Park Avenue

25th Floor

New

York, NY 10166 (Address of Principal Executive Offices)

(212) 750-6060

(Area Code and Telephone Number)

David B. Golub

Golub Capital BDC, Inc.

200 Park Avenue

25th Floor

New York, NY 10166

(212)

750-6060 (Name and Address of Agent for Service)

Copies to:

Thomas J. Friedmann, Esq.

Eric S. Siegel, Esq.

Matthew J. Carter, Esq.

Dechert LLP

1900 K St. NW

Washington, DC 20006

Telephone: (202) 261-3395 Fax: (202) 261-3395

Approximate

Date of Proposed Public Offering: As soon as practicable after this registration statement becomes effective and upon completion

of the merger described in the enclosed document.

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Post-Effective

Amendment No. 1 to the Registration Statement on Form N-14 (File No. 333-277325) of Golub Capital BDC, Inc. (as amended,

the “Registration Statement”) is being filed solely for the purpose of updating certain exhibits to the Registration Statement.

Other than Item 16 of Part C of the Registration Statement, no changes have been made to the Registration Statement. Accordingly,

this Post-Effective Amendment No. 1 consists only of the facing page, this explanatory note and Part C of the Registration Statement.

The other contents of the Registration Statement are hereby incorporated by reference.

PART C

OTHER INFORMATION

Item 15. Indemnification.

As permitted by Section 102 of the DGCL, GBDC

has adopted provisions in its certificate of incorporation, as amended, that limit or eliminate the personal liability of its directors

for a breach of their fiduciary duty of care as a director. The duty of care generally requires that, when acting on behalf of the corporation,

directors exercise an informed business judgment based on all material information reasonably available to them. Consequently, a director

will not be personally liable to GBDC or its stockholders for monetary damages or breach of fiduciary duty as a director, except for

liability for: any breach of the director’s duty of loyalty to GBDC or its stockholders; any act or omission not in good faith

or that involves intentional misconduct or a knowing violation of law; any act related to unlawful stock repurchases, redemptions or

other distributions or payment of dividends; or any transaction from which the director derived an improper personal benefit. These limitations

of liability do not affect the availability of equitable remedies such as injunctive relief or rescission.

GBDC’s certificate of incorporation and bylaws

provide that all directors, officers, employees and agents of the registrant shall be entitled to be indemnified by GBDC to the fullest

extent permitted by the DGCL, subject to the requirements of the 1940 Act. Under Section 145 of the DGCL, GBDC is permitted to offer

indemnification to its directors, officers, employees and agents.

Section 145(a) of the DGCL provides, in general,

that a corporation shall have the power to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or

in the right of the corporation), because the person is or was a director, officer, employee or agent of the corporation or is or was

serving at the request of the corporation as a director, officer, employee or agent of any other enterprise. Such indemnity may be against

expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person

in connection with such action, suit or proceeding, if the person acted in good faith and in a manner the person reasonably believed

to be in or not opposed to the best interests of the corporation and if, with respect to any criminal action or proceeding, the person

did not have reasonable cause to believe the person’s conduct was unlawful.

Section 145(b) of the DGCL provides, in general,

that a corporation shall have the power to indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor because the person is or

was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer,

employee or agent of any other enterprise, against any expenses (including attorneys’ fees) actually and reasonably incurred by

the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the

person reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be

made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless

and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application

that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled

to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145(g) of the DGCL provides, in

general, that a corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a

director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director,

officer, employee or agent of any other enterprise, against any liability asserted against the person in any such capacity, or

arising out of the person’s status as such, regardless of whether the corporation would have the power to indemnify the person

against such liability under the provisions of the law. GBDC has obtained liability insurance for the benefit of its directors and

officers. Each of the Current GBDC Investment Advisory Agreement and the New Investment Advisory Agreement provides that, absent

willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its

duties and obligations, GC Advisors and its officers, managers, agents, employees, controlling persons, members and any other person

or entity affiliated with it are entitled to indemnification from GBDC for any damages, liabilities, costs and expenses (including

reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of GC Advisors’

services under the Current GBDC Investment Advisory Agreement, the New Investment Advisory Agreement or otherwise as an investment

adviser of GBDC.

The Administration Agreement, as assigned, provides

that, absent willful misfeasance, bad faith or negligence in the performance of its duties or by reason of the reckless disregard of

its duties and obligations, the Administrator and its officers, managers, agents, employees, controlling persons, members and any other

person or entity affiliated with it are entitled to indemnification from GBDC for any damages, liabilities, costs and expenses (including

reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Administrator’s services

under the Administration Agreement or otherwise as administrator for GBDC.

Insofar as indemnification for liability arising

under the Securities Act may be permitted to directors, officers and controlling persons of GBDC pursuant to the foregoing provisions,

or otherwise, GBDC has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such

liabilities (other than the payment by GBDC of expenses incurred or paid by a director, officer or controlling person of GBDC in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with

the securities being registered, GBDC will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits.

| (1) |

Form

of Certificate of Incorporation (Incorporated by reference to Exhibit (a)(2) to the Registrant’s Pre-effective Amendment

No. 3 to the Registration Statement on Form N-2 (File No. 333-163279), filed on March 24, 2010). |

| |

|

| (1)(a) |

Certificate

of Amendment to Certificate of Incorporation of Golub Capital BDC, Inc. (Incorporated by reference to Exhibit 3.1 to the Registrant's

Current Report on Form 8-K (File No. 814-00794), filed on September 4, 2019). |

| |

|

| (1)(b) |

Certificate

of Amendment to Certificate of Incorporation of Golub Capital BDC, Inc. (Incorporated by reference to Exhibit 3.1 to the Registrant's

Current Report on Form 8-K (File No. 814-00794), filed on February 18, 2022). |

| |

|

| (2)(a) |

Amended

and Restated Bylaws (Incorporated by reference to Exhibit 3.3 to the Registrant's Form 10-K (File No. 814-00794), filed November

21, 2022). |

| |

|

| (3) |

Not applicable. |

| |

|

| (4)(a) |

Agreement

and Plan of Merger by and among Golub Capital BDC, Inc., Golub Capital BDC 3, Inc., Park Avenue Subsidiary, Inc., GC Advisors, LLC,

and solely for purposes of Section 1.9, Golub Capital LLC, dated as of January 16, 2024 (Incorporated by reference to Exhibit

2.1 to the Registrant’s Current Report on Form 8-K (File No. 814-00794), filed on January 17, 2024). |

| |

|

| (4)(b) |

Amendment

No. 1 to Agreement and Plan of Merger by and among Golub Capital BDC, Inc., Golub Capital BDC 3, Inc., Park Avenue Subsidiary, Inc.,

GC Advisors, LLC, and solely for purposes of Section 1.9, Golub Capital LLC, dated as of April 11, 2024 (Incorporated by reference

to Exhibit 4(b) filed with Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed

on April 12, 2024).. |

| |

|

| (5)(a) |

Form

of Stock Certificate (Incorporated by reference to Exhibit (d) to the Registrant’s Pre-effective Amendment No. 3 to the

Registration Statement on Form N-2 (File No. 333-163279), filed on March 24, 2010). |

| |

|

| (5)(b) |

Form

of Subscription Certificate (Incorporated by reference to Exhibit (d)(2) to the Registrant’s Registration Statement on Form

N-2 (File No. 333-174756), filed on June 7, 2011). |

| |

|

| (5)(c) |

Form

of Indenture (Incorporated by reference to Exhibit (d)(3) to the Registrant’s Registration Statement on Form N-2 (File No.

333-174756), filed on June 7, 2011). |

| |

|

| (5)(d) |

Form

of Subscription Agent Agreement (Incorporated by reference to Exhibit (d)(4) to the Registrant’s Registration Statement

on Form N-2 (File No. 333-174756), filed on June 7, 2011). |

| |

|

| (5)(e) |

Form

of Warrant Agreement (Incorporated by reference to Exhibit (d)(5) to the Registrant’s Registration Statement on Form N-2

(File No. 333-174756), filed on June 7, 2011). |

| |

|

| (5)(f) |

Form

of Certificate of Designation for Preferred Stock (Incorporated by reference to Exhibit (d)(6) to the Registrant’s Pre-effective

Amendment No. 1 to the Registration Statement on Form N-2 (File No. 333-174756), filed on August 25, 2011). |

| |

|

| (5)(g) |

Form

T-1 Statement of Eligibility of U.S. Bank National Association, as Trustee, with respect to the Form of Indenture (Incorporated

by reference to Exhibit (d)(7) to the Registrant’s Pre-effective Amendment No. 1 to the Registration Statement on Form N-2

(File No. 333-174756), filed on August 25, 2011). |

| |

|

| (5)(h) |

Indenture,

dated as of October 2, 2020, by and between Golub Capital BDC, Inc. and U.S. Bank National Association, as trustee (Incorporated

by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K (File No. 814-00794), filed on October 5, 2020). |

| |

|

| (5)(i) |

First

Supplemental Indenture, dated as of October 2, 2020, relating to the 3.375% Notes due 2024, by and between Golub Capital BDC, Inc.

and U.S. Bank National Association, as trustee. (Incorporated by reference to Exhibit 4.2 to the Registrant's Current Report on

Form 8-K (File No. 814-00794), filed on October 5, 2020). |

| |

|

| (5)(j) |

Form

of 3.375% Notes due 2024. (Incorporated by reference to Exhibit 4.2 to the Registrant's Current Report on Form 8-K (File No. 814-00794),

filed on October 5, 2020). |

| (5)(k) |

Second

Supplemental Indenture, dated as of February 24, 2021, related to the 2.500% Notes due 2026, by and between Golub Capital BDC, Inc.

and U.S. Bank National Association, as trustee. (Incorporated by reference to Exhibit 4.1 to the Registrant's Current Report on

Form 8-K (File No. 814-00794), filed on February 24, 2021). |

| |

|

| (5)(l) |

Form

of 2.500% Notes due 2026. (Incorporated by reference to Exhibit 4.2 to the Registrant's Current Report on Form 8-K (File No. File

No. 814-00794), filed on February 24, 2021). |

| (5)(m) |

Third

Supplemental Indenture, dated as of August 3, 2021, relating to the 2.050% Notes due 2027, by and between Golub Capital BDC, Inc.

and U.S. Bank National Association, as trustee. (Incorporated by reference to Exhibit 4.2 to the Registrant's Current Report on

Form 8-K (File No. 814-00794), filed on August 3, 2021). |

| |

|

| (5)(n) |

Form

of 2.050% Notes due 2027. (Incorporated by reference to Exhibit 4.3 to the Registrant's Current Report on Form 8-K (File No. 814-00794),

filed on August 3, 2021). |

| |

|

| (5)(o) |

Notice

of Redemption of 3.375% Notes due 2024. (Incorporated by reference to Exhibit 99.1 to the Registrant’s Current Report on

Form 8-K (File No. 814-00794). |

| |

|

| (5)(p) |

Amendment

No. 7 to Loan Financing and Servicing Agreement, dated as of March 8, 2023, among GBDC 3 Funding LLC, as borrower, Golub Capital

BDC 3, Inc., as servicer, and Deutsche Bank AG, New York Branch, as facility agent, as agent and as a committed lender. (Incorporated

by reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K (File No. 814-01244), filed on March 4, 2024. |

| |

|

| (6)(a) |

Fourth

Amended and Restated Investment Advisory Agreement, dated August 3, 2023, by and between the Registrant and GC Advisors LLC (Incorporated

by reference to Exhibit 10.3 to the Registrant’s Quarterly Report on Form 10-Q (File No. 814-00794), filed on August 7, 2023). |

| |

|

| (7)(a) |

Form

of Underwriting Agreement for equity securities (Incorporated by reference to Exhibit (h)(1) to the Registrant’s Registration

Statement on Form N-2 (File No. 333-174756), filed on June 7, 2011). |

| |

|

| (7)(b) |

Form

of Underwriting Agreement for debt securities (Incorporated by reference to Exhibit (h)(2) to the Registrant’s Registration

Statement on Form N-2 (File No. 333-174756), filed on June 7, 2011). |

| |

|

| (8) |

Not applicable. |

| |

|

| (9) |

Form

of Custody Agreement (Incorporated by reference to Exhibit (j) to the Registrant’s Pre-effective Amendment No. 5 to the

Registration Statement on Form N-2 (File No. 333-163279), filed on April 12, 2010). |

| |

|

| (10) |

Not applicable. |

| (13)(d) |

Amended

and Restated Dividend Reinvestment Plan (Incorporated by reference to Exhibit 10.1 to Registrant’s Current Report on Form

8-K (File No. 814-00794), filed on May 5, 2011). |

| |

|

| (13)(e) |

Master

Loan Sale Agreement, dated July 16, 2010, by and between the Registrant, Golub Capital BDC 2010-1 LLC and Golub Capital BDC 2010-1

Holdings LLC (Incorporated by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K (File No. 814-00794),

filed on July 16, 2010). |

| |

|

| (13)(f) |

Indenture,

dated as of November 16, 2018, by and between Golub Capital BDC CLO III LLC and US Bank National Association (Incorporated by

reference to Exhibit 10.1 to the Registrant’s Current Report on Form 8-K (File No. 814-00794), filed on November 21, 2018). |

| |

|

| (13)(g) |

First

Supplemental Indenture, dated as of June 30, 2023, by and between Golub Capital BDC CLO III LLC, as Issuer, and U.S. Bank Trust Company,

National Association, as Trustee, and consented to by GC Advisors LLC, as Collateral Manager (Incorporated by reference to Exhibit

10.1 to the Registrant's Current Report on Form 8-K (File No. 814-00794), filed on June 30, 2023). |

| |

|

| (13)(h) |

Collateral

Management Agreement, dated as of November 16, 2018, by and between Golub Capital BDC CLO III LLC and GC Advisors LLC (Incorporated

by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K (File No. 814-00794), filed on November 21, 2018). |

| |

|

| (13)(i) |

Amended

and Restated Revolving Loan Agreement, dated as of June 21, 2019, by and among the Registrant, as the borrower, and GC Advisors LLC,

as the lender (Incorporated by reference to Exhibit 10.1 to Registrant’s Current Report on Form 8-K (File No. 814-00794),

filed on June 25, 2019). |

| |

|

| (13)(j) |

First

Amendment to the Amended and Restated Revolving Loan Agreement, dated as of October 28, 2019, by and between Golub Capital BDC, Inc.

as the borrower and GC Advisors LLC as the lender (Incorporated by reference to Exhibit 10.1 to Registrant’s Current Report

on Form 8-K (File No. 814-00794), filed on October 31, 2019). |

| |

|

| (13)(k) |

Second

Amendment to Amended and Restated Revolving Loan Agreement, dated as of June 15, 2022, by and among Golub Capital BDC, Inc., as the

borrower, and GC Advisors LLC, as the lender. (Incorporated by reference to Exhibit 10.1 to the Registrant’s Current report

on Form 8-K (File No. 814-00794), filed on June 16, 2022). |

| |

|

| (13)(l) |

Note

Purchase Agreement, dated December 13, 2018, by and among GCIC CLO II LLC and Wells Fargo Securities, LLC (Incorporated by reference

to Exhibit 10.1 to Golub Capital Investment Corporation’s Current Report on Form 8-K (File No. 814-01128), filed on December

19, 2018). |

| |

|

| (13)(m) |

Indenture,

dated December 13, 2018, by and between GCIC CLO II LLC and The Bank of New York Mellon Trust Company, N.A. (Incorporated by reference

to Exhibit 10.2 to Golub Capital Investment Corporation’s Current Report on Form 8-K (File No. 814-01128), filed on December

19, 2018). |

| |

|

| (13)(n) |

Collateral

Management Agreement, dated December 13, 2018, by and between GCIC CLO II LLC and GC Advisors LLC (Incorporated by reference to

Exhibit 10.3 to Golub Capital Investment Corporation’s Current Report on Form 8-K (File No. 814-01128), filed on December 19,

2018). |

| |

|

| (13)(o) |

Master

Loan Sale Agreement by and among Golub Capital Investment Corporation, as the seller, GC Advisors LLC, as the closing date seller,

GCIC CLO II LLC, as the buyer, and GCIC Funding LLC, as the warehouse borrower, dated as of December 13, 2018 (Incorporated by

reference to Exhibit 10.4 to Golub Capital Investment Corporation’s Current Report on Form 8-K (File No. 814-01128), filed

on December 19, 2018). |

| |

|

| (13)(p) |

Master

Loan Sale Agreement by and among Golub Capital Investment Corporation, as the seller, GCIC CLO II Depositor LLC, as the intermediate

seller, and GCIC CLO II LLC, as the buyer, dated as of December 13, 2018 (Incorporated by reference to Exhibit 10.5 to Golub Capital

Investment Corporation’s Current Report on Form 8-K (File No. 814-01128), filed on December 19, 2018). |

| (13)(q) |

First

Supplemental Indenture, dated as of December 21, 2020, by and between GCIC CLO II LLC, as Issuer, and The Bank of New York Mellon

Trust Company, National Association, as Trustee to the Indenture, dated as of December 13, 2018, among the Issuer and Trustee. (Incorporated

by reference to Exhibit 10.1 to the Registrant's Quarterly Report on Form 10-Q (File No. 814-00794), filed on February 8, 2021). |

| |

|

| (13)(r) |

Second

Supplemental Indenture, dated as of June 30, 2023, by and between GCIC CLO II LLC, as Issuer, and The Bank of New York Mellon Trust

Company, National Association, as Trustee, and consented to by GC Advisors LLC, as Collateral Manager and The Bank of New York Mellon

Trust Company, National Association, as Collateral Administrator. (Incorporated by reference to Exhibit 10.2 to the Registrant’s

Current report on Form 8-K (File No. 814-00794), filed on June 30, 2023). |

| |

|

| (13)(s) |

Senior

Secured Revolving Credit Agreement, dated as of February 11, 2021, by and among Golub Capital BDC, Inc., as borrower, JPMorgan Chase

Bank, N.A., as administrative agent and as collateral agent, and the lenders, syndication agents, joint bookrunners, and joint lead

arrangers party thereto. (Incorporated by reference to Exhibit 10.1 to the Registrant's Current Report on Form 8-K (File No. 814-00794),

filed on February 12, 2021). |

| |

|

| (13)(t) |

Commitment

Increase Agreement, dated as of October 14, 2021, by Signature Bank, as Increasing Lender, Wells Fargo Bank, National Association

and Regions Bank, each as an Assuming Lender, in favor of GBDC, as borrower, and JPMorgan Chase Bank, N.A., as administrative agent

under the Revolving Credit Facility. (Incorporated by reference to Exhibit 10.1 to the Registrant’s Current report on Form

8-K (File No. 814-00794), filed on October 18, 2021). |

| (13)(u) |

Commitment

Increase Agreement, dated as of November 23, 2021, by First National Bank of Pennsylvania, as Assuming Lender, JPMorgan Chase Bank,

N.A., MUFG Union Bank, N.A., CIBC Bank USA, and Sumitomo Mitsui Banking Corporation, each as an Increasing Lender, in favor of Golub

Capital BDC, Inc., as borrower, and JPMorgan Chase Bank, N.A., as administrative agent under the Senior Secured Revolving Credit

Facility, dated as of February 11, 2021, as amended, among Golub Capital BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative

agent and as collateral agent, and the lenders, syndication agents, joint bookrunners, and joint lead arrangers party thereto. (Incorporated

by reference to Exhibit 10.2 to the Registrant’s Current report on Form 8-K (File No. 814-00794), filed on November 24, 2021). |

| |

|

| (13)(v) |

Amendment

No. 1, dated as of November 19, 2021, to Senior Secured Revolving Credit Agreement, dated as of February 11, 2021, by and among,

Golub Capital BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative agent and as collateral agent, and the lenders,

syndication agents, joint bookrunners, and joint lead arrangers party thereto. (Incorporated by reference to Exhibit 10.1 to the

Registrant’s Current report on Form 8-K/A (File No. 814-00794), filed on December 14, 2021). |

| |

|

| (13)(w) |

Amendment

No. 2, dated as of September 2, 2022, to Senior Secured Revolving Credit Agreement, dated as of February 11, 2021, as amended, by

and among, Golub Capital BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative agent and as collateral agent, and

the lenders, syndication agents, joint bookrunners, and joint lead arrangers party thereto. (Incorporated by reference to Exhibit

10.1 to the Registrant’s Current report on Form 8-K (File No. 814-00794), filed on September 8, 2022). |

| |

|

| (13)(x) |

Commitment

Increase Agreement, dated as of September 16, 2022, by Santander Bank, N.A., as an Assuming Lender, in favor of Golub Capital BDC,

Inc., as borrower, and JPMorgan Chase Bank, N.A., as administrative agent under the Senior Secured Revolving Credit Facility, dated

as of February 11, 2021, as amended, among Golub Capital BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative agent

and as collateral agent, and the lenders, syndication agents, joint bookrunners, and joint lead arrangers party thereto. (Incorporated

by reference to Exhibit 10.1 to the Registrant’s Current report on Form 8-K (File No. 814-00794), filed on September 20, 2022). |

| (13)(y) |

Amended

and Restated Senior Secured Revolving Credit Agreement, dated as of March 17, 2023, by and among Golub Capital BDC, Inc., as borrower,

and JPMorgan Chase Bank, N.A., as administrative agent under the Senior Secured Revolving Credit Facility, dated as of February 11,

2021, as amended, among Golub Capital BDC, Inc., as borrower, JPMorgan Chase Bank, N.A., as administrative agent and as collateral

agent, and the lenders, syndication agents, joint bookrunners, and joint lead arrangers party thereto. (Incorporated by reference

to Exhibit 10.1 to the Registrant’s Current report on Form 8-K (File No. 814-00794), filed on March 20, 2023). |

| |

|

| (13)(z) |

Equity

Distribution Agreement, dated as of October 6, 2023, by and among Golub Capital BDC, Inc. GC Advisors LLC, Golub Capital LLC, Keefe

Bruyette & Woods, Inc. and Regions Securities LLC (Incorporated by reference to Exhibit 1.1 to the Registrant’s Current

report on Form 8-K (File No. 814-00794), filed on October 10, 2023). |

| |

|

| 13(aa) |

Fourth

Supplemental Indenture, dated as of December 5, 2023, relating to the 7.050% Notes due 2028, by and between Golub Capital BDC, Inc.

and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association), as trustee (Incorporated

by reference to Exhibit 4.2 to Registrant's Current Report on 8-K (File No. 814-00794), filed on December 5, 2023). |

| |

|

| 13(bb) |

Waiver

Agreement to the Fourth Amended and Restated Investment Advisory Agreement by and Between Golub Capital BDC, Inc. and GC Advisors

LLC (Incorporated by reference to Exhibit 10.1 to Registrant's Current Report on 8-K (File No. 814-00794), filed on January 17,

2024). |

| |

|

| 13(cc) |

Fifth

Supplemental Indenture, dated as of February 1, 2024, relating to the 6.000% Notes due 2029, by and between Golub Capital BDC, Inc.

and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association), as trustee (Incorporated

by reference to Exhibit 4.2 to Registrant's Current Report on 8-K (File No. 814-00794), filed on February 1, 2024). |

| |

|

| (14)(a) |

Consent

of Ernst & Young LLP (Incorporated by reference to Exhibit 14(a) filed with Amendment

No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed on April 12, 2024). |

| |

|

| 14(b) |

Report

of Ernst & Young LLP on GBDC 3 Supplemental Information (Incorporated by reference to

Exhibit 14(b) filed with Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed

on April 12, 2024). |

| |

|

| 14(c) |

Report

of Ernst & Young LLP on GBDC Supplemental Information (Incorporated by reference to Exhibit

14(c) filed with Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed on April

12, 2024). |

| |

|

| (15) |

Not applicable. |

| |

|

| (16) |

Power

of Attorney (Included on and incorporated by reference to the signature page to the Pre-Effective Amendment No. 1 to the

Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed on April 12, 2024). |

| |

|

| (17)(a) |

Consent

of Keefe, Bruyette & Woods, Inc. (Incorporated by reference to Exhibit 17(a) filed with the Registrant’s Registration

Statement on Form N-14 (File No. 333-277325), filed on February 23, 2024). |

| |

|

| (17)(b) |

Consent

of Morgan Stanley & Co. LLC (Incorporated by reference to Exhibit 17(b) filed with the Registrant’s Registration Statement

on Form N-14 (File No. 333-277325), filed on February 23, 2024). |

| |

|

| (17)(c) |

Form

of Proxy Card of Golub Capital BDC, Inc. (Incorporated by reference to Exhibit 17(c)

filed with Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed on April 12,

2024). |

| |

|

| (17)(d) |

Form

of Proxy Card of Golub Capital BDC 3, Inc. (Incorporated by reference to Exhibit 17(d)

filed with Amendment No. 1 to the Registrant’s Registration Statement on Form N-14 (File No. 333-277325), filed on April 12,

2024). |

| |

|

| (18) |

Filing

Fee Table (Incorporated by reference to Exhibit 18 filed with Amendment No. 1 to the Registrant’s

Registration Statement on Form N-14 (File No. 333-277325), filed on April 12, 2024). |

Item 17. Undertakings.

(1) The undersigned registrant agrees that prior to any public reoffering

of the securities registered through the use of a prospectus which is a part of this registration statement by any person or party who

is deemed to be an underwriter within the meaning of Rule 145(c) of the Securities Act, the reoffering prospectus will contain the

information called for by the applicable registration form for the reofferings by persons who may be deemed underwriters, in addition

to the information called for by the other items of the applicable form.

(2) The undersigned registrant agrees that every prospectus that is

filed under paragraph (1) above will be filed as a part of an amendment to the registration statement and will not be used until

the amendment is effective, and that, in determining any liability under the 1933 Act, each post-effective amendment shall be deemed

to be a new registration statement for the securities offered therein, and the offering of the securities at that time shall be deemed

to be the initial bona fide offering of them.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed on behalf of the registrant, in New York, New York on the 3rd day

of June, 2024.

| |

GOLUB CAPITAL

BDC, INC. |

| |

|

| |

By: |

/s/

David B. Golub |

| |

|

David B. Golub |

| |

|

Chief Executive Officer |

As required by the Securities Act of 1933, this

registration statement has been signed below by the following persons in the capacities and on the dates indicated:

| SIGNATURE |

|

TITLE |

|

DATE |

| |

|

|

|

|

| /s/

David B. Golub |

|

Chief Executive Officer and

Director

|

|

June 3,

2024 |

| David B. Golub |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Christopher C. Ericson |

|

Chief Financial Officer

|

|

June 3,

2024 |

| Christopher C. Ericson |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| * |

|

Chairman of the Board of Directors |

|

June 3,

2024 |

| Lawrence E. Golub |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

June 3,

2024 |

| John T. Baily |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

June 3,

2024 |

| Kenneth F. Bernstein |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

June 3,

2024 |

| Anita J. Rival |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

June 3,

2024 |

| William M. Webster IV |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

June 3,

2024 |

| Lofton P. Holder |

|

|

|

|

| *By: |

/s/ David B. Golub |

|

| |

Attorney-in-Fact |

|

Exhibit 12

June 3, 2024

|

Golub Capital BDC 3, Inc.

200 Park Avenue

New York, New York 10166

|

|

Golub Capital BDC, Inc.

200 Park Avenue

New York, New York 10166

|

Ladies and Gentlemen:

You have requested our opinion regarding certain

federal income tax consequences to Golub Capital BDC, Inc., a business development company organized as a Delaware corporation (the “Acquiring

Fund”), to Golub Capital BDC 3, Inc., a business development company organized as a Maryland corporation (the “Acquired

Fund”) and to Park Avenue Subsidiary Inc., a Maryland corporation and wholly-owned direct subsidiary of the Acquiring Fund (the

“Merger Sub”), in connection with the merger of the Merger Sub with and into the Acquired Fund, with the Acquired Fund

being the surviving entity, followed by the merger of the Acquired Fund with and into the Acquiring Fund, and holders of shares of common

stock of the Acquired Fund (the “Acquired Fund Shares”) receiving, in cancellation of their Acquired Fund Shares, shares

of common stock of the Acquiring Fund plus cash in lieu of fractional shares of the Acquiring Fund (collectively, the “Reorganization”),

pursuant to the Agreement and Plan of Merger, dated as of January 16, 2024, between the Acquiring Fund, the Acquired Fund the Merger Sub,

GC Advisors LLC and, for certain limited purposes, Golub Capital LLC (as amended, the “Plan”), specifically regarding

whether the Reorganization will be treated for U.S. federal income tax purposes as a reorganization qualifying under section 368(a)

of the Internal Revenue Code of 1986, as amended (the “Code”). Unless otherwise defined, capitalized terms used in

this opinion have the meanings assigned to them in the Plan.

For purposes of this opinion, we have examined

and relied upon (1) the Plan, (2) the Registration Statement (including the Joint Proxy Statement/Prospectus), (3) the facts and representations

contained in the letter dated on or about the date hereof addressed to us from the Acquiring Fund, (4) the facts and representations contained

in the letter dated on or about the date hereof addressed to us from the Acquired Fund, and (5) such other documents and instruments as

we have deemed necessary or appropriate for purposes of rendering this opinion. This opinion is based on the assumption that the Reorganization

will be consummated in accordance with the Plan, the Registration Statement (including the Joint Proxy Statement/Prospectus) and such

other documents, certificates and records. This opinion is based upon the Code, Treasury Regulations, judicial decisions, and administrative

rulings and pronouncements of the Internal Revenue Service, all as in effect on the date hereof.

Based upon and subject to the foregoing, we are

of the opinion that, for United States federal income tax purposes, the Reorganization will constitute a “reorganization”

within the meaning of Section 368(a) of the Code.

This opinion is expressly only as of the date

hereof. Except as set forth above, we express no other opinion.

| |

|

| |

Very truly yours, |

| |

|

| |

/s/ Dechert LLP |

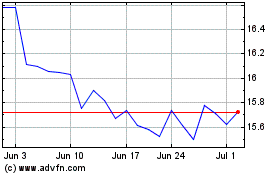

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Golub Capital BDC (NASDAQ:GBDC)

Historical Stock Chart

From Jul 2023 to Jul 2024